High-frequency trading – what it is, how HFT works, the main strategies for high-frequency trading. If you have previously studied the features

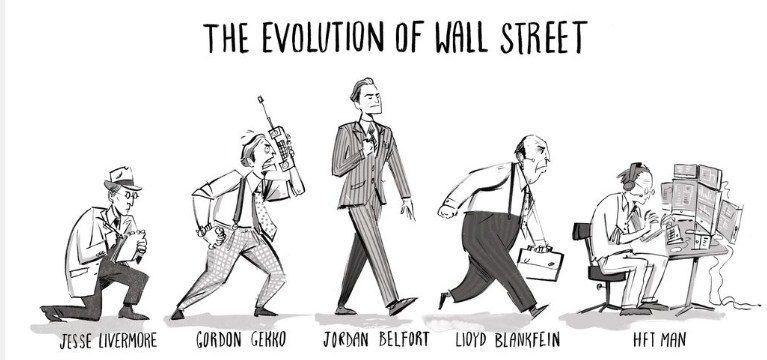

of algorithmic trading , then you have probably heard such a thing as HFT trading. Statics claims that half of all trading in the US market takes place through HFT. So what is high-frequency trading? Consider in this article.

HFT trading – what is it, general information

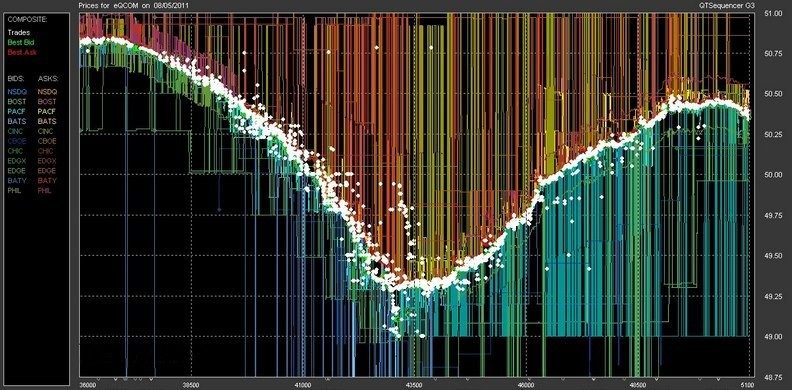

High Frequency Trading is a type of algorithmic trading characterized by short holding periods, high speed and capital turnover. Powerful computers are used for trading, which carry out a huge number of transactions every second. Usually these are small volumes that allow you to test the market. HFT trading is directly related to speed. The method allows you to track even minimal changes in prices, as well as discrepancies between prices on several exchanges. High-frequency trading is used in the stock, currency and other markets. But recently it has also been used in crypto trading, as it allows you to make several transactions in just one second, which gives you unlimited investment opportunities. There are special services that provide their HFT trading platforms to investors.

How the HFT system works

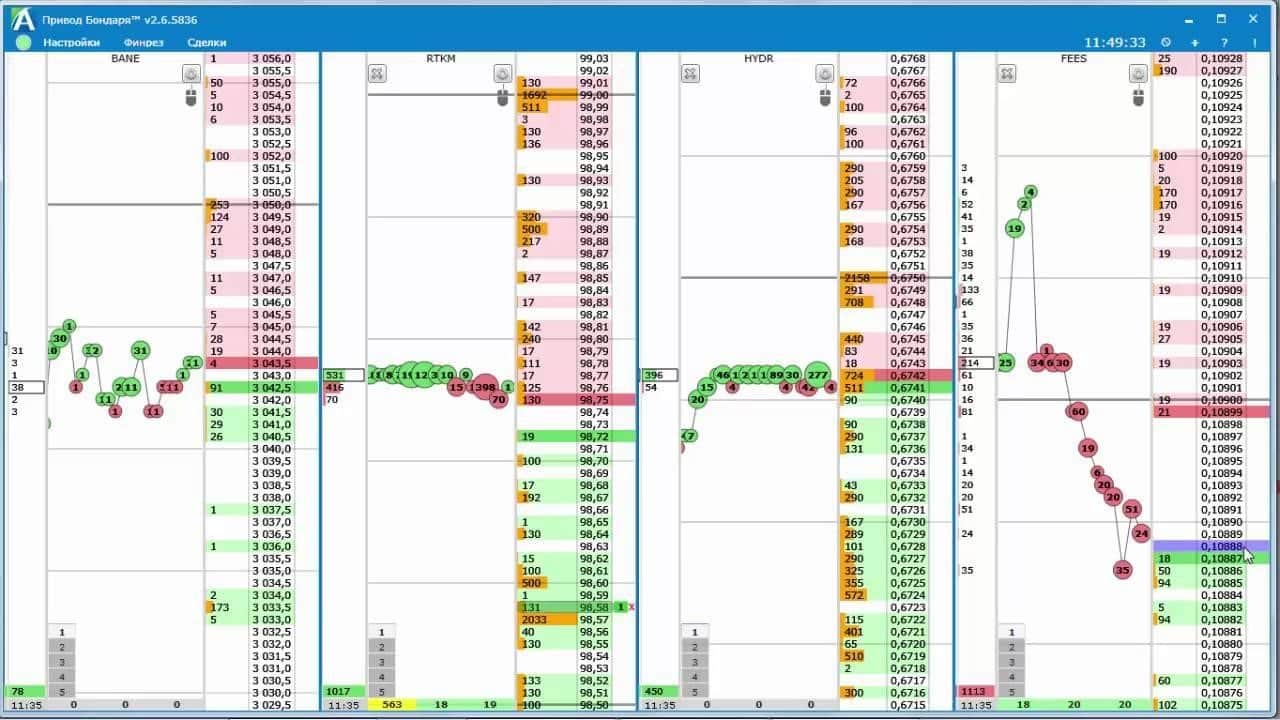

The key to high-quality HFT trading is full automation. However, this does not mean that this method is suitable for everyone. The computers that are used in the trading process are programmed to host complex algorithms. They constantly analyze price spikes down to milliseconds. Algorithms are created by specialists so that computers can detect triggers and trends of growth or decline in time. Usually such impulses are invisible to other traders, even those with extensive experience. Based on the analysis, the programs automatically open more positions at a high speed. The main goal of a trader is to be the first to profit from the trend detected by the algorithm.

Important! We are not talking about big jumps in prices, but rather short-term fluctuations that appear when large players enter the market.

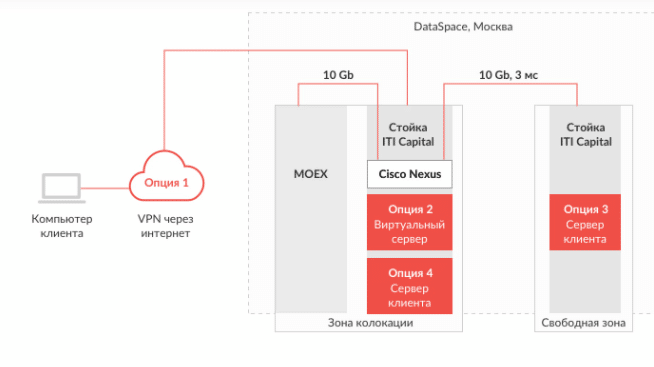

High-frequency trading on the exchange can be used not only in the ordinary stock market, but also in the cryptocurrency market. However, not everyone can use algorithms correctly. The possibilities of using NFT here are the same as in the regular market. But it is worth remembering that cryptocurrency prices are more volatile, so there are more risks in the crypto market. But, accordingly, there are also more chances to earn. Note! Collocation is one of the NFT methods that allows you to earn on cryptocurrency. It is used in cases where the trading server is located in close proximity to the data processing center. It’s good when the server is located in the same place as the exchange – this allows you to transfer data almost instantly. The delay in time for the average trader may not matter.

What strategies and algorithms are used in HFT trading

There are several methods that allow you to make money on quick deals. Let’s consider some of them.

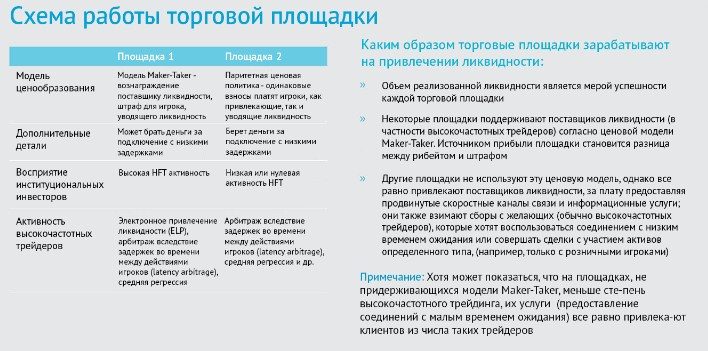

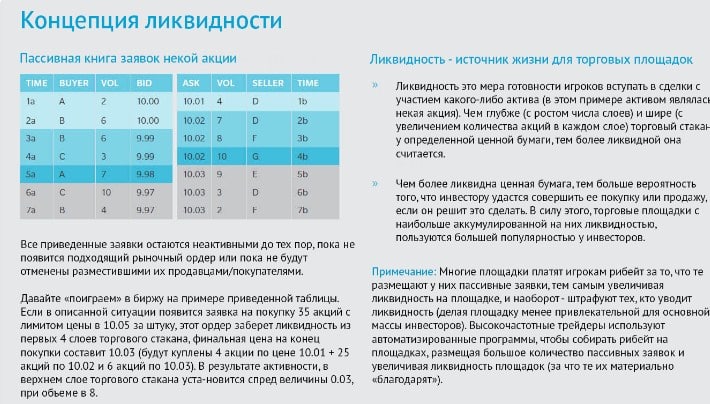

Marketmaking

The strategy proposes to generate many orders on both sides of the price – higher if the shares are sold, and lower if they are bought. Thanks to this, market liquidity appears, and private traders find “entry points” more easily. As for the NFT trader, in this case he earns on the supply and demand spread. If financial instruments are popular, then they already have high liquidity in the market. But with less liquidity, it is not so easy for a trader to find a buyer.

Arbitration

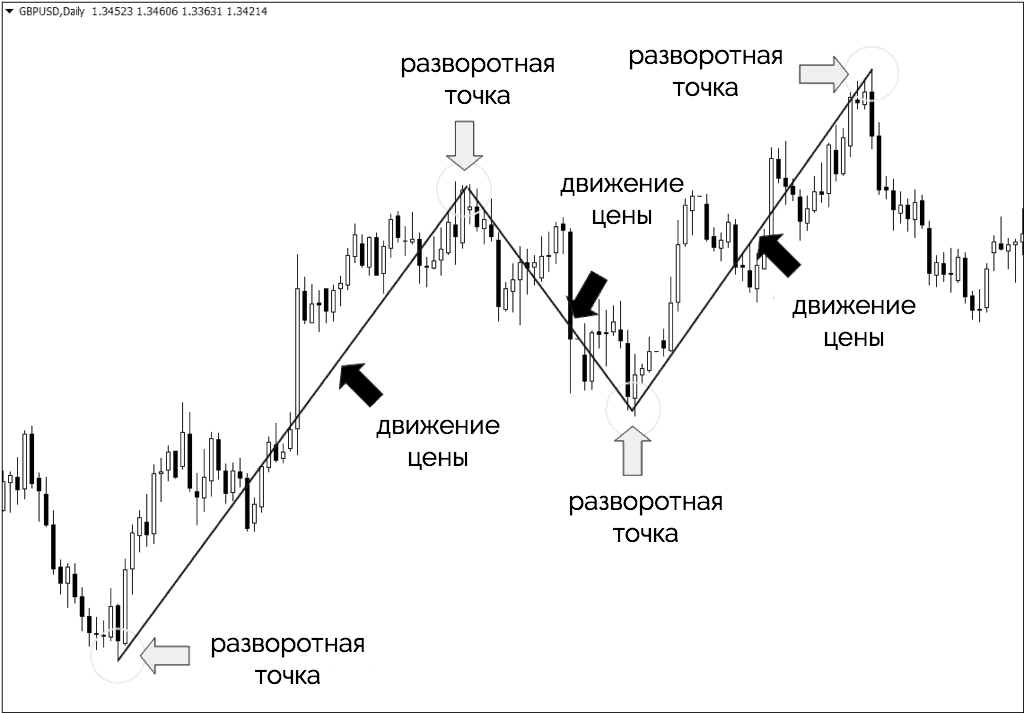

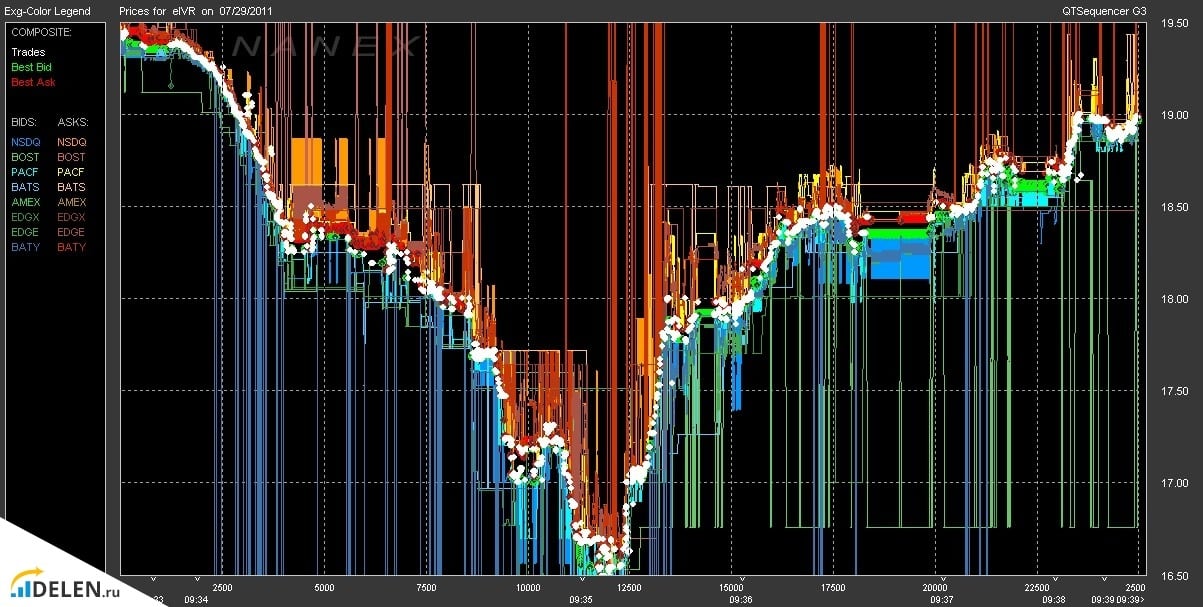

The meaning of this method is to find a discrepancy in prices at different sites. That is, a trader earns on price inequality between instruments or related markets. Algorithms allow you to find correlations between different financial instruments, and make money on it. A good example is a stock and a futures on it. Another strategy option is delay arbitrage. The merchant in this case earns on early access to information. Access to important information a moment earlier than other players and provides the trader with the main income. To access such information, the server is located in close proximity to the data centers of the exchanges.

Ignition impulse

In some cases, HFT investors provoke market participants into futures trading, which causes price spikes. A good example is the surge in large-scale manipulation that was observed in the stock market in 2012. Instruments traded on different platforms can be interconnected. This means that when the price on one exchange changes, the price on the other exchange also changes. However, information is not provided immediately. For example, there are more than 1200 km or 5 milliseconds between the Chicago and New York stock exchanges. This means that robots operating in New York won’t know what’s going on in Chicago for five milliseconds. https://articles.opexflow.com/stock-exchange/nasdaq.htm When there is a spike in market activity across exchanges, there is a temporary “out of sync” across exchanges. In this case, the price of futures may be different from the price of shares. Again, a trader can make good money on these fluctuations. What is HFT and what tasks do developers & engineers solve – high-frequency trading in modern realities: https://youtu.be/662q9FVqp50

What software is needed

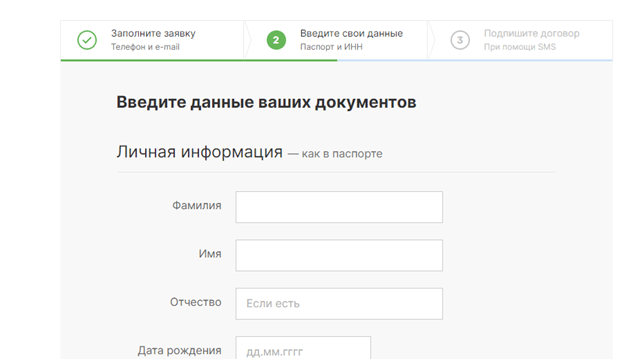

There are two ways to enter High Frequency Trading. And the first option is to find a dedicated broker. If this option is not suitable and the trader wants to master high-frequency trading on his own, you can purchase special equipment and install powerful software. There are several offers on the market in this direction.

- First, choose which strategy you will follow. The software developer will sell you only the program itself. But you will have to deal with signals, algorithms and strategies on your own.

- Be prepared for high costs. Most likely, you will have to pay for the services of a broker, stable Internet, collocation.

- Direct connection (DMA).

- SMARTgate.

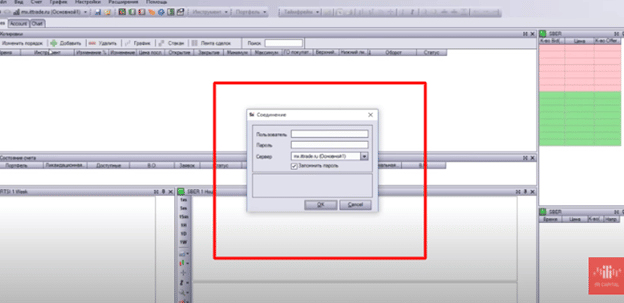

To use the first method, you need software that can connect to the exchange. It must have the appropriate hardware power. Hardware power can be seen on the screen.

- With a VPN.

- Rent a virtual server from ITI Capital.

- Placement of the server in the free zone. The client server is located in the same place in the DataSpace data center, but not in the place of collocation, but in a neighboring building. This option is much cheaper.

- Placement of the client’s server in the collocation zone.

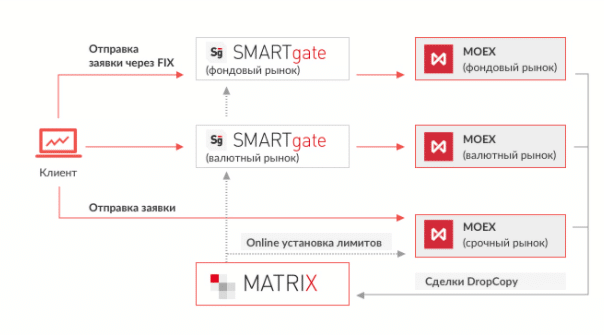

As for the second option, SMARTgate is a limiting proxy server that is installed between

the trading robot and the exchange gateway. Thanks to this method, the client can trade from a single account, through a connection on all markets of the Moscow Exchange.

Advantages and disadvantages of HFT trading

Despite the fact that high-frequency trading has been used on the world market for a long time, the attitude towards it is ambiguous. Therefore, we consider both the advantages and disadvantages of this method. The advantages include:

- Increasing liquidity in the process of making transactions.

- Increase in trading volume.

- Lowering the bid-ask spread.

- Increasing the efficiency of pricing.

But there are also disadvantages:

- Due to high-frequency trading, the volatility in the markets becomes somewhat greater, since it is thanks to it that many HFT traders earn.

- Investors working with high-frequency trading earn at the expense of small players.

- Sometimes this type of income is associated with prohibited trading – for example, layering or spoofing.

Prohibited trading involves automated market manipulation that allows you to overtake other players. Spoofers place lots of orders on one side of the order book, so it looks like there are a lot of investors in the market looking to buy or sell assets. Layering manipulators first create a large number of orders, and then cancel them – this leads to the fact that the price of the asset rises or falls sharply. High-frequency trading (from the English “HFT, High-frequency trading”) – what is it, algorithms and strategies used: https://youtu.be/Rc3GsNv1ffU

In what cases and who can use HF trading

Anyone can use this type of earnings, since algorithms have now appeared that anyone can buy. But beginners should be especially careful. This method is especially suitable for institutional investors who understand the market and are able to cope with unexpected price spikes. Before moving on to high-frequency trading, it is better to try your hand at ordinary trading and gain experience in order to begin to understand the market. It may be better to start with

intraday trading first , and only then move on to HFT.

Questions and answers

How can you become an HFT trader? You can conclude an agreement with a broker, or purchase your own software.

How does the Marketmaking strategy work? The investor creates order generation on both sides of the price. On the difference in these prices and there is earnings.

What is a collocation? This is one of the HFT methods, when the server is placed near the data center of the exchange. This allows you to minimize the time that is usually spent on data transfer. This method is used in many high-frequency trading strategies.