Portfolio diversification: how to secure investments. Today the world has entered the sphere of another destabilization, and this could not but affect the stock market. Just yesterday, seemingly reliable securities (stocks, bonds, etc.) that cost a lot of money and bring stable profits, today are falling sharply in price. Therefore, investors should be prepared for sharp changes in market conditions. And to do this, diversify your investment portfolio in order to minimize your financial risks. https://articles.opexflow.com/investicii/investicionnyj-portfel.htm

- Investment portfolio diversification – what is it in simple words

- What is the optimal investment portfolio

- Conservative investors

- Moderate Investors

- Aggressive investors

- How to build your investment portfolio

- By type of currency

- By state

- By asset class

- By economic sector

- By companies

- What is the essence of diversification when investing

- Diversifying an Inversion Portfolio – Pros and Cons

- Pros of Diversification

- Cons of Diversification

- Are there examples of fully balanced investment portfolios

- Type of investment portfolio – “perpetual portfolio”

- Type of investment portfolio – 50 to 50

- Investment portfolio type – “Advanced portfolio”

- Type of investment portfolio – “Currency portfolio”

- Rebalancing is a mechanism for preventing an increase in risks for an investment portfolio

Investment portfolio diversification – what is it in simple words

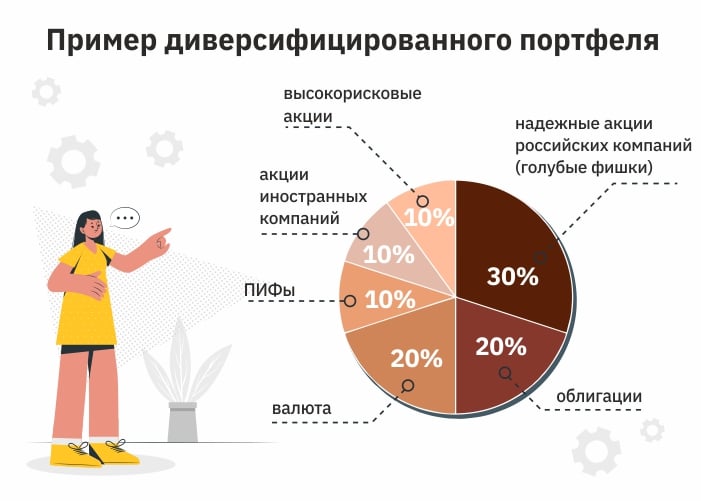

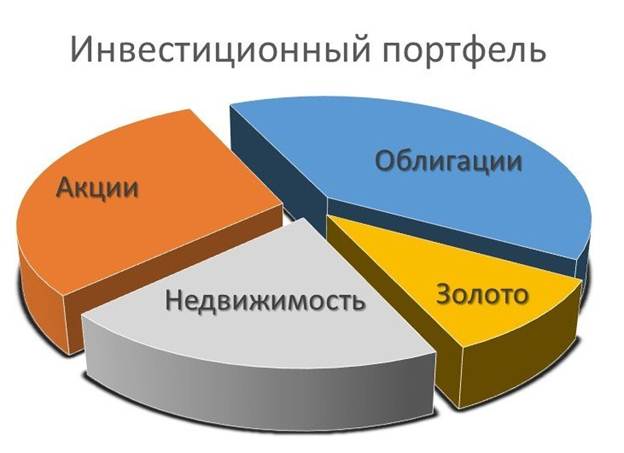

The concept of diversification is quite broad. It can mean the process of expanding the scope of the enterprise in order to increase profits. Diversification of the investment portfolio implies a strategy for managing possible risks when acquiring assets on the stock market. It provides for the distribution of assets (stocks, bonds, or other instruments) in such a way that the risks for the portfolio owner always remain as minimal as possible.

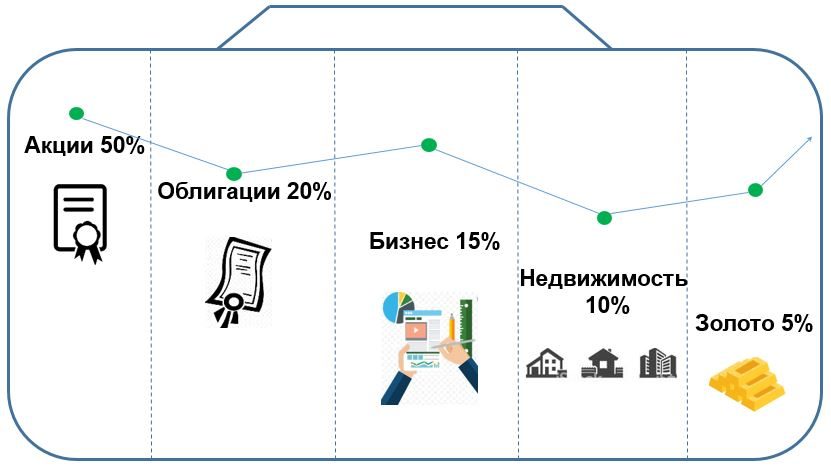

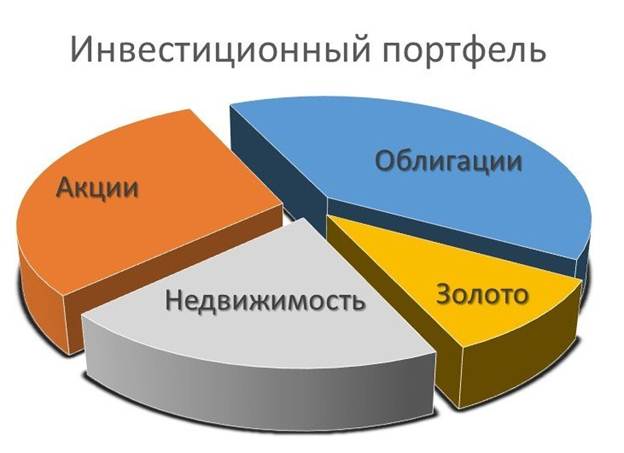

An investment portfolio is assets that are collected in such a way that their profitability meets the goals and objectives set by its owner as much as possible. Investment portfolios may include not only a set of instruments that are used in the stock market (shares of exchange-traded funds,

futures , stocks, bonds, etc.), but also currency, precious metals, real estate, deposits in various banks, and so on.

At the same time, the risk for the investor is a situation in which he does not receive the level of income that he planned when compiling the portfolio, or even the loss of part of the invested funds. Diversification of the investment portfolio allows and provides for the purchase by the investor not of any one instrument, but the purchase of assets in different categories that are little related to each other. This allows you to compensate for the drop in income in one area due to the profitability of other positions. At the same time, it should be borne in mind that the purchase of assets (shares) of various companies is not always diversification. For example, if an investor buys shares of Chevron, Gazprom and Total, then this will not be diversification, since all these companies, despite the fact that they are registered in different countries, operate in the common oil and gas market. And the reaction of the market to any events will necessarily affect each of them. If, however, a portfolio is formed from the shares of various companies that operate in unrelated areas, for example, oil and gas production, construction, IT technologies, etc., then the risks of negative market changes for them will simultaneously turn out to be minimal.

What is the optimal investment portfolio

There is no unequivocal answer to the question – what is the optimal investment portfolio? Each investor has his own requirements for the investment portfolio, which depend on a huge number of factors, such as the investment horizon, goals set, financial solvency, etc. Therefore, it is rather not about the optimal, but about a well-balanced investment portfolio. An investor can get such a portfolio if it is properly diversified. When the profitability and risks in it will meet the wishes of the investor as much as possible. At the same time, each of the investors will have their own expected income and acceptable risks. The above can be illustrated by the following conditional model. Let’s take three main “types of investors”:

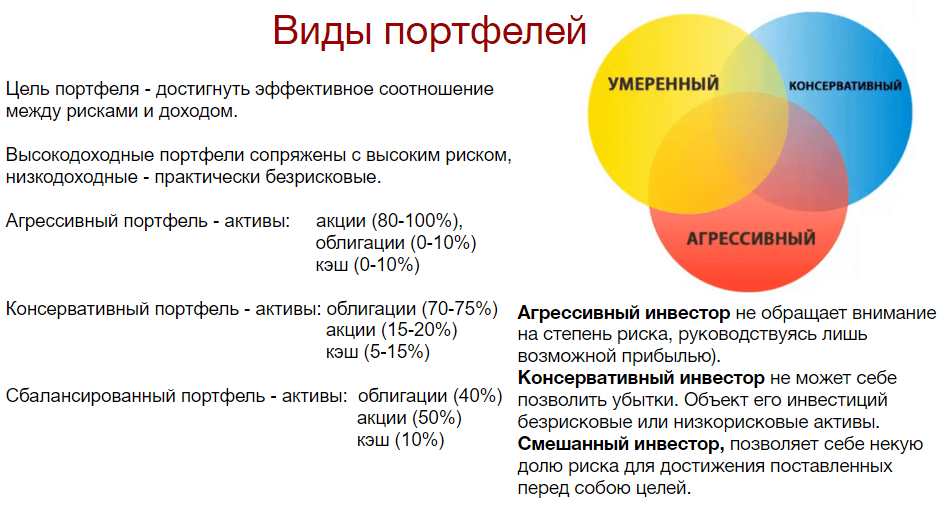

Conservative investors

Such investors, first of all, want to preserve their assets and protect them from inflationary processes. Therefore, for them, diversification will consist in acquiring the most reliable assets (bonds, stocks, etc.) of stable, large companies.

Moderate Investors

They are ready to start making risky investments to increase their income. But the main goal of such investors is still to accumulate capital (within the set goals) for 10-20 years. Therefore, their investment portfolios are dominated by stocks of the broad market, and almost all sectors of the economy are represented in it.

Aggressive investors

Such investors are trying to quickly get high returns, and therefore easily go to the drawdown of their investment portfolio. For such investors, diversification will be in venture investments.

Venture investment is an investment in which an investment is made in several promising (but rather risky) projects at the early stages of their formation.

With a high probability, 8 such projects out of 10 will fail. But the income received from successfully implemented projects will fully cover the losses and bring significant profits.

How to build your investment portfolio

Therefore, before starting to form your investment portfolio, the trader/investor must first of all decide on the goals he is pursuing and the strategy that he will use. The goals can be very diverse – from acquiring property (an apartment, a house, an expensive car, etc.), to paying for education for children or generating additional income after retirement. For example, an investor who is 25-30 years old decided to form a pension fund for himself. He has 30-40 years ahead of him. And therefore, he must form an investment portfolio of assets that have already shown good and stable returns over a long period of time. At the same time, even some drawdown of shares, for a short period, will not particularly affect such a portfolio, because there will be quite a sufficient period of time ahead, so that they stabilize and continue to grow. At the same time, if the investment period is relatively short, 2-4 years, then the portfolio for them is best formed from stocks with high stability, albeit with not the highest level of income (usually these are bonds ”

blue chips “). After the goals and methods have been determined, the investor begins to form a portfolio, selecting the assets he needs with the appropriate parameters. During this period, you can resort to several levels of diversification at once:

By type of currency

In this part of the portfolio, it is good to have securities that are traded in several of the most stable currencies (dollars, euros, yuan, etc.). In this case, any, even a very sharp fall in one of the currencies will not critically affect the value of the entire investment portfolio.

By state

Do not allow accumulation of assets of any one country in your portfolio, but distribute them at once among several leading countries of the world. This will avoid significant losses in the event of sudden changes in one of the countries, a fall in the level of its economy.

By asset class

First of all, these are stocks, bonds and other securities. By purchasing shares, the investor, first of all, plans that their quotes, and, accordingly, the price will increase. When buying bonds, he relies on, first of all, stable payments of coupon income on them. In addition, you can also invest in exchange-traded funds (BPIF,

ETF ), currency and gold. [caption id="attachment_11983" align="aligncenter" width="624"]

By economic sector

Which, in turn, although rather conditionally, are divided into established ones with stable returns. And new ones, with a high degree of innovation, which carry risks, but with successful investments, they can bring very high income to those who saw their potential in time.

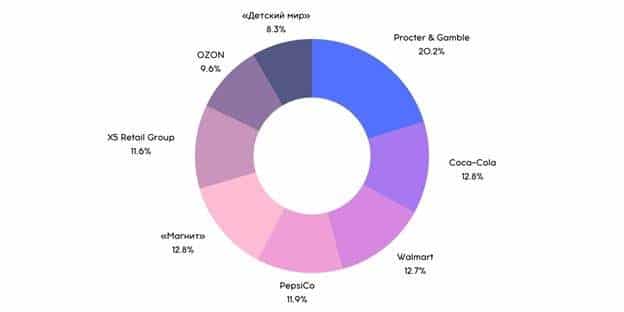

By companies

Acquisition of shares of specific companies. A choice that requires an investor to have deep knowledge of market conditions, the ability to navigate indicators and deep intuition. When purchasing securities, you should pay attention to the fact that one asset does not occupy more than 10% of the investment portfolio, and one sector of the economy does not exceed 20%. Diversifying your investment portfolio in simple terms: https://youtu.be/CA7d9VSi7NE

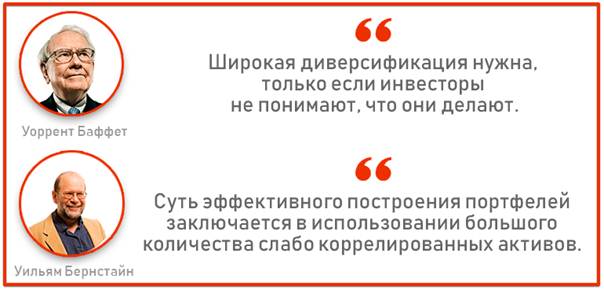

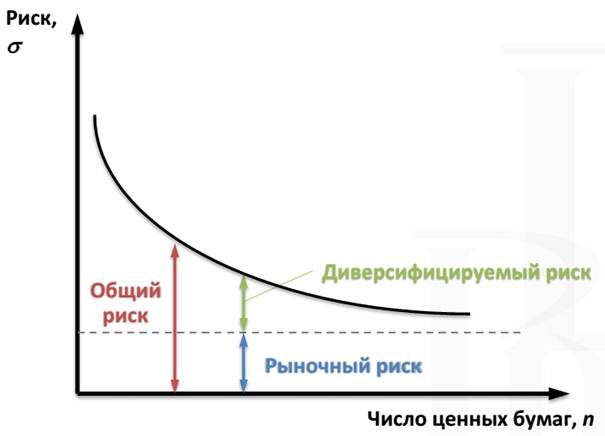

What is the essence of diversification when investing

The “portfolio” theory adopted today is a methodology that allows you to choose assets that bring the highest possible income with minimal risks. According to her, in order to successfully manage the risks in investments, one can invest through diversification. So, if you combine risky and stable assets, you can create a balanced portfolio. For example, along with shares, you can also buy bonds. At the same time, the overall risk of investments will be significantly lower than in the case of purchasing individual instruments. The theory also states that assets must be matched in sectors of the economy that are completely uncorrelated with each other. For example, let’s say the value of some securities falls sharply due to an increase in prices for certain raw materials, while others rise sharply.

Pros of Diversification

The undoubted advantages of diversification include:

- Reducing risks to an acceptable level . The likelihood that the investor will lose a significant amount of money is significantly reduced.

- An opportunity for an investor to invest part of the funds in risky, but highly profitable assets . In a diversified investment portfolio, such assets will not increase the overall level of risk.

- Protection against high market volatility.

- In the long term, it can increase the overall return on the investment portfolio .

Cons of Diversification

The disadvantages of diversification include:

- It will not protect against systemic risks that affect all securities in the market.

- Difficulties in managing an investment portfolio, because the more assets it contains, the more difficult it is to manage them.

- Increasing commissions, the more securities an investor purchases, the more commissions he has to pay.

- Excessive diversification can drastically reduce portfolio returns.

- Limited earning potential in the short term.

How diversification affects the reliability of an investment portfolio and how to make the right asset allocation: https://youtu.be/GH6e9aY2BOI

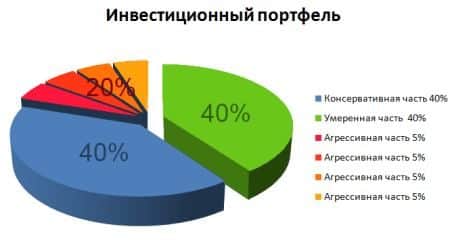

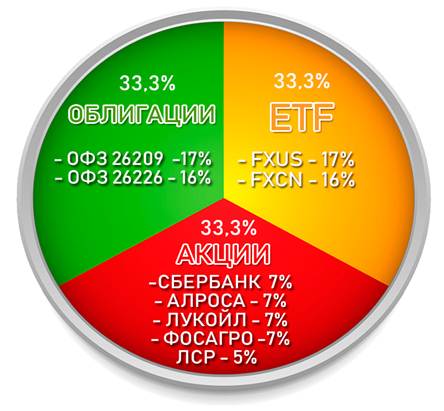

Are there examples of fully balanced investment portfolios

Scientists and investors have long been trying to create an “ideal” investment portfolio that is guaranteed to provide high returns while completely minimizing any risks. But such a portfolio is possible only in an “ideal” world, and since investors have to work with reality, it will be possible to find out which portfolio will be the most profitable in ten years only after ten years. The economy of the world is constantly changing and some of its changes are absolutely impossible to predict. Therefore, investors should hardly spend their time looking for the “ideal” investment portfolio. And it is worth collecting a portfolio that most fully meets exactly the current conditions in the stock markets, and start working with it. For a more accurate and complete understanding of landmarks, It is worth considering some of the most popular types of balanced investment portfolios. [caption id="attachment_12615" align="aligncenter" width="444"]

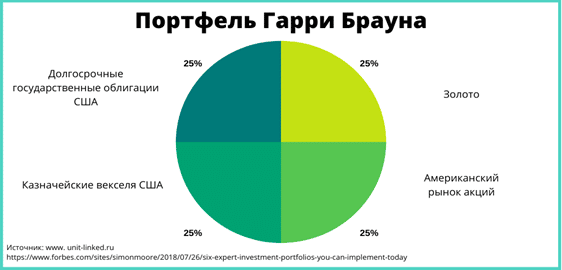

Type of investment portfolio – “perpetual portfolio”

This type appeared in the early 70s of the last century and is the simplest type of balanced investment portfolio

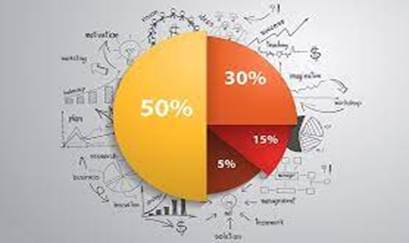

Type of investment portfolio – 50 to 50

In this portfolio, 50% of the invested funds are invested in the purchase of shares and 50% in bonds. At the same time, internally acquired assets are also diversified, so if most of the shares are owned by American companies, then in bonds the most significant part is owned by Chinese or Russian enterprises.

- TSPX (US blue chips) – 30%

- TMOS (Russian blue chips) – 5%

- VTBE (shares of companies in other countries) -15%

- Bonds in the amount of fifty percent of the portfolio:

- OFZ (bonds of the Ministry of Finance of the Russian Federation) – 30%

- FXRU (currency bonds of Russian companies) — 10%

- FXRB (currency bonds of a Russian company with protection against changes in the exchange rate) – 10%.

Investment portfolio type – “Advanced portfolio”

This type has a partial similarity with the “eternal portfolio”, but it also has significant differences from it. First of all, it includes investments in real estate and the so-called alternative ones – cryptocurrency, coins, stamps, works of art, antiques.

- Shareholding – 25%.

- Bond package – 25%.

- Precious metals – 20%.

- Real estate – 20%.

- Other alternative investments – 10%.

Type of investment portfolio – “Currency portfolio”

Such a portfolio of investments consists exclusively of currencies and is not suitable for generating real additional income or capital accumulation. But such a portfolio is great for saving invested funds. And, if the investor plans to make his future expenses from this portfolio, then there is no need to carry out currency conversion.

Rebalancing is a mechanism for preventing an increase in risks for an investment portfolio

In the process of work, the ratio of assets within the investment portfolio can change quite significantly. This happens because the value of the various assets in the portfolio varies unevenly. Some of them will rise in price much faster, and if no action is taken, then at some point it may happen that only one asset class will begin to account for most of the value of the investment portfolio. And naturally, as a result of such an imbalance in the investment portfolio, risks will increase. In order to avoid such a situation, the investor needs to periodically rebalance his investment portfolio. Why is it necessary to take profits from growing assets and use these amounts to acquire assets that are not growing so actively or even sag until the portfolio is balanced again. If the balance within the investment portfolio changes in a small range (1–3%), then nothing can be changed in the portfolio. If the balance is disturbed by more than 10%, then it is necessary to rebalance the portfolio and restore it to the original level of the asset ratio.

As an example:

Suppose an investor’s initial portfolio had a stock to bond ratio of 70/30. A separate part of the shares has grown in price, and now this ratio is already 80/20. In order to return the portfolio to its original balance, the investor must either buy more of the bonds or sell some of the shares. At the same time, it must be remembered that the purpose of rebalancing is not to increase the profitability of the investment portfolio, but to reduce its possible risks.