The article was created based on a series of posts from the OpexBot Telegram channel , supplemented by the author’s vision and the opinion of the AI. Opexbot provides lessons on financial literacy online, the best materials and advice for 2023, in an accessible and understandable language for children, students, and pensioners. Practical advice and a targeted approach to each situation.

- What is financial literacy in complex and simple words

- What issues does a person solve when learning financial literacy?

- How to become financially literate: a set of lessons from opexbot

- From childhood we are taught to live in the ass

- We also save through our ass

- Financial literacy questions about attitudes towards money

- Beggars pray that their poverty is guaranteed

- Five financial goals to set and achieve before age 40

- Increase financial stability

- Create a reserve fund/financial cushion

- Create a challenge for yourself and achieve results

- Get your own real estate, a car, visit distant islands, fly to a Sting concert, buy a pug

- Make a list of things that really make you happy

- They pay little – the wife nags, the mother-in-law presses, the bank calls, the child cries

- First side: increase active income

- The second side: generate passive income

- The 70/30 rule in finance

- Financial literacy questions about budgets and airbags

- Save, protect and increase your finances right now

- Get rid of “small” expenses

- Round up spending on cards

- Make a shopping list “on the shore”

- “Put the tariffs through the sieve”

- Don’t ignore bonus programs and cashback

- Start investing in the future now

- Start generating passive income

- Find out what a tax deduction is, maybe you are entitled to one?

- Improve financial literacy

- Financial literacy questions about investments and savings

- Investments should work for you, not you work for the sake of investments

- Countless diamonds in stone caves

- He ate, walked and had fun, but didn’t invest in himself

- Everyone has their own balance

- Where to invest wisely and without nerves in a crisis – interest will tell you

- Bonds

- ” Blue chips ” – shares of the first echelon of the Russian Federation

- Mutual funds and ETFs – ready-made portfolios

- Gold

- What I wouldn’t recommend

- Financial security in difficult conditions: an effective and understandable plan

- Financial literacy questions about loans

- IMPORTANT! Rules that I follow in any unclear situation!

- Cash reserve

- Supply of water and food for several days

- Full tank of gasoline, charged power bank – flashlight – phone…

- “Alarm suitcase”

- Collection point and telephones

- No supplies for a year

- Funda, crypto and other nonsense

What is financial literacy in complex and simple words

Let’s begin. Financial literacy is like the Amur tiger, many have heard, some have seen in pictures, and even fewer have met in person. So what is financial literacy? Here is the definition given by VIKI:

Financial literacy about planning, investing and growth.

What issues does a person solve when learning financial literacy?

A little boring but useful theory about financial literacy. If you’re too lazy to read, let’s go straight to practical advice, lessons and financial literacy training from opexbot. Financial literacy is one of the key skills needed in today’s world to successfully manage your finances and ensure long-term financial stability. This term refers to a person’s ability to understand and apply knowledge about financial instruments, investing, budgeting, debt management, and planning financial goals. One of the main components of financial literacy is the ability to effectively manage your income and expenses.. This includes developing and following a budget, analyzing the financial situation, planning and controlling expenses. Financially literate people clearly understand which expenses are necessary and which can be deferred for the future. An important part of financial literacy is also the ability to invest your money correctly . Financially literate people strive to understand various financial instruments, risks and investment returns in order to maximize their profits and minimize possible losses. They make informed financial decisions based on information and analysis.

Why are you poor – psychology, resources and habits

How to become financially literate: a set of lessons from opexbot

Financial literacy lessons available for children, schoolchildren, students and retirees. Let’s start the educational program with a letter from our regular reader.

From childhood we are taught to live in the ass

Good afternoon, admins. Let me start with the fact that many of us were not taught financial literacy. They taught a lot of things at school, but there was nothing about how not to become a beggar. It was about how everyone should be as one: study well, attend a macrame club and go to clean-up days. Have you ever wondered why there are so many future successful people among C students? Yes, from childhood they spit on frameworks and conventions. They take risks and go their own way. Parents dictate which university to enter and which profession to master. Mom is a doctor. That means you should go into medicine too. And it doesn’t matter that your interests lie on a different plane. They broke me, discouraged my desire for self-realization, and stole 5 years of my life. We are taught to be short-sighted.

The training system itself is inflexible

Unlike, for example, an Israeli school, where each student chooses subjects that interest him to master. And we suffer for the sake of a useless crust for 5 years. For example, I have no idea where my diploma is. Next – unloved work from paycheck to paycheck. No passive income. A vicious circle that is difficult to break: 5/8 work, loans, lack of energy and money, debts, work to pay off debts. The state is forcing loans on us in every possible way. The debt burden of the population of the Russian Federation is close to 50%. Every second person is trapped.

We also save through our ass

The apartment is cheaper – there is definitely construction outside the window. Nervous breakdown, sleepless nights, lack of energy to do anything in the morning. Cheap fast food – poisoning and pharmacy. Lost health, time, money.

Saving is not about taking the worst things out of life. It’s about denying yourself the worst today, so that in 5 years you don’t deny yourself the best.

Change jobs. Learn what you dreamed of as a child. Quit your second job, and there are up to 30% of them in the Russian Federation, in order to free up time to improve yourself. Invest 2k rubles in shares. Next month 4k. These are lifting amounts. And over time, a financial cushion will form. And what can give more confidence if not a solid account on a card or brokerage account? Don’t have a degraded holiday on the weekends. Make the most of your free time! Don’t give a damn about opportunities that come your way. Everyone has them.

The worst thing that can happen is to stay in the ass forever and send your children down the same path in life. Using the same settings and rules.

I’ll add on my own: We were really taught to live in the ass from childhood, but it’s not necessary to spend our whole lives in it. Demand from yourself as from a king, and from those around you as from slaves. I am glad that I am bringing enlightenment to the masses. The financial literacy of the population is decreasing from year to year, let’s correct this with the sword of knowledge opexbota. The result of the survey is whether you consider yourself a financially literate person as a percentage of the total:

Financial literacy questions about attitudes towards money

Beggars pray that their poverty is guaranteed

Have you ever wondered why the rich get richer, while the poor cannot escape the whirlpool of poverty? One of the reasons was explained by Richard Thaler and he called it the “initial wealth effect.” If you liked long stories at school, check out the book “Fundamental Ideas of the Financial World.” Evolution”: Peter Bernstein. For those who like short retellings, I will state the essence. Richard Thaler conducted an experiment to test the lack of invariant thinking in finance. He invited a group of students to imagine that each of them won $30. Then there are two options: toss a coin and, depending on whether it comes up heads or tails, get more or give 9.00. Or don’t flip the coin at all. 70% of the subjects decided to toss a coin.

Have you ever wondered why the rich get richer, while the poor cannot escape the whirlpool of poverty? One of the reasons was explained by Richard Thaler and he called it the “initial wealth effect.” If you liked long stories at school, check out the book “Fundamental Ideas of the Financial World.” Evolution”: Peter Bernstein. For those who like short retellings, I will state the essence. Richard Thaler conducted an experiment to test the lack of invariant thinking in finance. He invited a group of students to imagine that each of them won $30. Then there are two options: toss a coin and, depending on whether it comes up heads or tails, get more or give 9.00. Or don’t flip the coin at all. 70% of the subjects decided to toss a coin.

The next day, Thaler presented the students with this situation. Their initial capital is zero, and choose one of the following options: toss a coin and get $39 if it lands on heads, or $21 if it lands on tails. Or don’t give it up and you’re guaranteed to get $30. Only 43% of students agreed to risk throwing, the rest preferred a guaranteed win.

The next day, Thaler presented the students with this situation. Their initial capital is zero, and choose one of the following options: toss a coin and get $39 if it lands on heads, or $21 if it lands on tails. Or don’t give it up and you’re guaranteed to get $30. Only 43% of students agreed to risk throwing, the rest preferred a guaranteed win.

The point is that the end result is the SAME .Whether you start with $30 or from zero, the probable winnings are each time contrasted with the guaranteed amount. Students, however, exhibit different preferences, thereby demonstrating a lack of invariance. Thaler called this discrepancy the “initial wealth effect.” If you have money in your pocket, you tend to take risks. If it is empty, then you would prefer to take 30 USD with a guarantee, rather than play at the risk of getting 21 USD. And this is not an abstraction. In the real world, this effect is of no small importance. And not only in the financial sector.

The point is that the end result is the SAME .Whether you start with $30 or from zero, the probable winnings are each time contrasted with the guaranteed amount. Students, however, exhibit different preferences, thereby demonstrating a lack of invariance. Thaler called this discrepancy the “initial wealth effect.” If you have money in your pocket, you tend to take risks. If it is empty, then you would prefer to take 30 USD with a guarantee, rather than play at the risk of getting 21 USD. And this is not an abstraction. In the real world, this effect is of no small importance. And not only in the financial sector.

For the poor, stable long-term poverty is closer than the “risk” of becoming rich, but also the possibility of losing a penny. There is a stronger desire to preserve rather than increase, albeit with some risks. This is against logic, but fears do not sleep.

But not everything is so hopeless. Awareness of the problem is half of its solution. If you look at it soberly, this is not even a problem, but a feature of thinking. It is from these artificial frameworks that we need to break out.

Five financial goals to set and achieve before age 40

Increase financial stability

To avoid getting lost in debt and to make your money work for you and not the other way around, you should spend some time learning about financial literacy.

Create a reserve fund/financial cushion

Most financial experts suggest that your emergency fund should cover at least 3 months of living expenses. Black swans sometimes fly in pairs.

Create a challenge for yourself and achieve results

Have 1 million in pocket money. Read 1 book about finance per week for a year. Quit smoking…Yes, yes, it’s not only about health, but also about finances.

Get your own real estate, a car, visit distant islands, fly to a Sting concert, buy a pug

Having achieved financial well-being, realize your dream. Spend some of the savings you earn at work or trading. This is the only way the brain understands that everything is not in vain. Reinvesting everything in new projects, shares, business is good. But you also need to please yourself.

Make a list of things that really make you happy

Statistics show that not all multimillionaires are happy. Some ended very sadly. You can have all the money in the world and a successful career, but still be unhappy. Money is just a tool. And everyone has their own list of happiness. Write it down and hurry to it.

They pay little – the wife nags, the mother-in-law presses, the bank calls, the child cries

The majority of Russians (77% of respondents) are not satisfied with their current job precisely because of the low salary level. Not management, not growth prospects, but income. Let’s consider work like a medal, where on each side there are two approaches to solving the issue of low income.

First side: increase active income

Here are the following ways: – Increasing your salary through promotion, through additional tasks, or through results. Each of the approaches requires preparatory work. You don’t just get promoted to a position – you need to develop a skill, or be a relative. You need to take on additional tasks if they don’t finish you off. But not all bosses are interested in the result. — Looking for a job in a similar direction, but with more income. HeadHunter in hands/keys.

The second side: generate passive income

With the current salary and without total savings on everything. And it is possible. You just need to act gradually so as not to burn out and burn out. Haste is only good for catching fleas. Invest no more than 15% of your active income into investing and trading. Assemble a low-risk stock/bond portfolio. It is worth trading on a small deposit. Dave Ramsey: “Financial winners don’t run sprints, they run marathons. They are in no hurry. They do it gradually.”

The 70/30 rule in finance

The rich spend less on luxury (Bill Gates is an example of this). Rich people get richer and poor people get poorer. A rich person who wins the lottery invests; a poor person is likely to end up with nothing again. 70% of financial success depends on the right spending habits and only 30% on the right investing habits.Let’s compare two people who invest $500 per month and both receive an unexpected lump sum of $100,000 as an inheritance. The first one continues to invest $500 per month and takes a Land Cruiser for $100 thousand, while the second one invests $100 thousand and $500 monthly. After 30 years, the first one will have about $588,000. And the second one would have $1,350,000 in today’s money… a difference of 750k in real terms due to the correct consumption culture and more than 1 million if we do not take into account inflation!

Financial literacy questions about budgets and airbags

Save, protect and increase your finances right now

I came across statistics: in 2023, 75% of Russians began to save on expenses. 13% save on catering, 12% on vacation, on food – 9%, clothes, shoes – 9%, beauty salons – 8%. What else can you do quickly for financial well-being? Choose and act.

Get rid of “small” expenses

Coffee house? Taxi travel? Fast food? Each item has a profitable and useful alternative. A bicycle is an excellent form of transport. Fast, free, great! Calculate the cost of purchasing or renting a scooter/bicycle. And if on credit, how much will it pay off? Not necessarily new. Do you even think about this? Noticing such details will already bring you much closer to your financial goals.

Round up spending on cards

The balances are automatically transferred to a deposit at interest.

Make a shopping list “on the shore”

“Put the tariffs through the sieve”

Communication, Internet, paid subscriptions. Disable unnecessary subscriptions on your phone and TV.

Don’t ignore bonus programs and cashback

Almost every store offers discounts to customers. Don’t be lazy to find out about them.

Start investing in the future now

In education, knowledge, shares. Instead of social networks and TV, read a book, study useful information, open a brokerage account, learn a new skill.

Start generating passive income

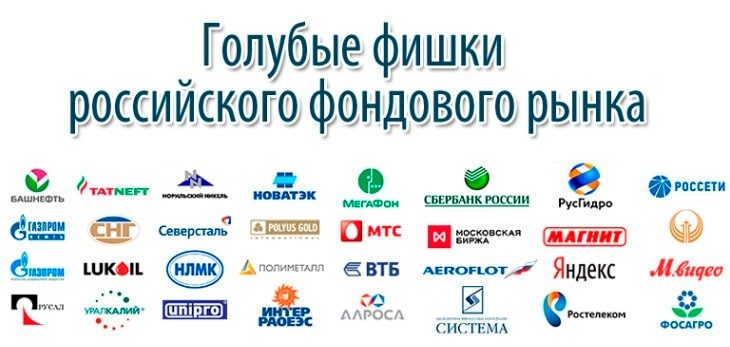

You can invest from 1-5k rubles in shares of some “ blue chips ” with good growth potential and dividends.

Find out what a tax deduction is, maybe you are entitled to one?

Improve financial literacy

Yours, your loved ones and your children.

There are two ways to improve your financial situation: spend less or earn more. And it’s even better to combine.

Financial literacy questions about investments and savings

Investments should work for you, not you work for the sake of investments

Why does a person need a personal investment plan? As I see it, in order to build an optimal balance between the financial situation today and in the future. And the investment plan needs to be built wisely and personally to suit your psychotype. To make you personally comfortable! Two extremes that you shouldn’t go to.

Countless diamonds in stone caves

Investing is not an end in itself, but a way to live the highest quality life at an age when the speed of thinking and physical capabilities do not allow you to earn money through active methods.

But this is not a reason to live poorly in the moment, postponing all the best for conditional old age. Investing should be comfortable and reasonable.

Otherwise it will be like in the story: “The apples have been harvested. The wife ordered that the apples that had begun to rot should be eaten so that they would not go to waste. While the rotten apples are eaten, the good ones begin to rot. In the end, they only ate the rotten ones.” You need to live here and now. But it’s to live, and not to burn madly.

He ate, walked and had fun, but didn’t invest in himself

But living one day at a time is madness. And we need to take care of the future today, while we still have the opportunity. Don’t drink 10 bottles of beer, don’t eat 10 hot dogs, don’t buy a fancy smartphone. This is not about restrictions. And about smart investments. There is Krylov’s fable “The Dragonfly and the Ant” about spenders and burners. I recommend reading it not only for children. “The Jumping Dragonfly sang red summer; I didn’t have time to look back as winter rolled into my eyes. The pure field has died; There are no more bright days, as under each leaf both a table and a house were ready. Everything has passed: with the cold winter, Need, hunger comes…”

Everyone has their own balance

There are people who enjoy hoarding. As a result, they can easily save and invest. There is a second category, those who enjoy what they spend. It’s difficult for them to save. They invest themselves in emotions and who has the right to blame them?

Financial literacy is 20% knowledge of tools and strategies and 80% the ability to understand yourself, your desires and needs now and in the long term.

Where to invest wisely and without nerves in a crisis – interest will tell you

How to beat inflation – a more advanced lesson on financial literacy from opexbota. It’s difficult to outpace inflation, but let’s try. Or at least break even. Yes, so that it is relatively safe. So, inflation at the end of 2022 was 12%.

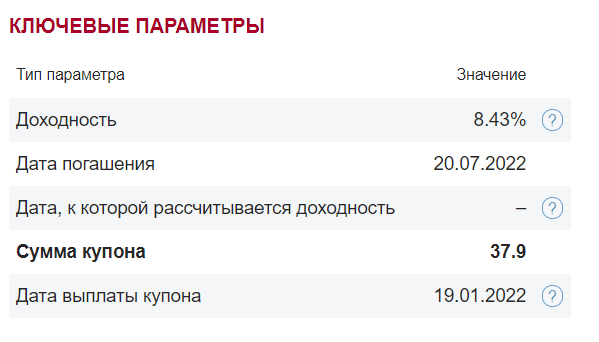

Bonds

10-14% yield. There are options where the risks will be moderate. He explained why investing in bonds is better than taking money to the bank. I won’t repeat myself.

” Blue chips ” – shares of the first echelon of the Russian Federation

Over the long term, many companies grow steadily. Growth leaders for the year Sber +92%; MTS +40%; NOVATEK + 25%; Tatneft +9%. More details here . And the tall divas pay. This year the divas have paid, or will pay, Sberbank, Beluga Group, NOVATEK and others. But there are also counterexamples: fall. Diversification is a must. Building a portfolio wisely is a difficult task for a beginner. If you don’t have time to figure it out, then:

Mutual funds and ETFs – ready-made portfolios

Allows you to invest small amounts. For example, by purchasing a share of a mutual investment fund linked to the Moscow Exchange index, you will immediately invest in all the shares of leading Russian companies. Bonuses: wide selection, reliability, tax deduction. Profitability can be up to 20-30% per annum. Information is publicly available.

Gold

13.26% return over the last year. A working option for long-term investments. Over the years, the price of the precious metal only increases, and during periods of crisis, growth accelerates. Well, selling/exchanging gold helps you survive in a critical situation.

What I wouldn’t recommend

- Deposit . 8-10% per annum. Inflation will win. There are currently no deposits in Russia that would outpace inflation in percentage terms. And the banking crisis has not been canceled. Dummy capsules can also be found in the Russian Federation.

- Cash . 0% per annum. Money must work. Under the mattress, cash is being devalued by inflation every day. And they can also be “gobbled up” by children, unexpected and much-needed “wants”, or thieves. There should be cash, but as a financial cushion that you can instantly access.

- Real estate is stability. Real estate investment is one of the safest instruments available today. But not for any capital.

https://youtu.be/0MRATvTlwPI?si=LQ2KHJyuHVkQwUuj

Financial security in difficult conditions: an effective and understandable plan

- Airbag . Security is not financial, but family. We don’t touch it, only in cases when we can’t not touch it.

- Financial safety net . Part of the money should always be in the cache in order to be able to buy back the drawdown.

- Prices can fall not only to zero, but also to minus . We use the pillow in parts so as not to bite our elbows when the shares fall by half, after they have already fallen by half.

- No sudden movements . Often all black swans arrive at non-trading times. And if it’s trading, then the auctions close very quickly. Therefore, if you are investing for the long term, you should only exit stocks as a last resort. You will understand when, but most likely you will prefer to buy more and average the position.

- There is such a strategy that the financial cushion lies in short bonds . And you only buy more once every 3-6 months. This makes it possible not to make unnecessary movements, or to enter on better terms.

- Don’t forget to use the statistics service for viewing commission expenses at Tinkoff . It is very sobering from unnecessary actions. Otherwise, use futures, close your trades at night and sleep well.

Where can you invest a small amount: invest 10,000, 20,000, 30,000 rubles

Financial literacy questions about loans

Before taking a loan: assess the risks, benefits and your capabilities

IMPORTANT! Rules that I follow in any unclear situation!

Stop and think about what actions you can take now to avoid getting into trouble in the near or distant future and improve your situation. Take care of your psyche, do not monitor Internet resources every minute. Information noise only clogs the brain and interferes with adequate thinking. Don’t cheat your children. The situation will end, the injury will remain.

Cash reserve

Twenty-first century, contactless payments – everything is great. But they won’t help you buy goods second-hand or pay for a taxi in an unfamiliar city at night when your card is suddenly not accepted. But don’t take everything off the cards either. Excess cash in your pockets in such a situation is also not good.

Supply of water and food for several days

Circumstances may arise when you don’t want to leave the house. And door-to-door delivery will not work. We take out cereals, canned goods, and prepared foods from the freezer and sit at home, safe.

Full tank of gasoline, charged power bank – flashlight – phone…

If there are places where you can accumulate energy, then it is better to do this in advance. And not because this energy will not be there later, but so that it will be there when everyone suddenly begins to accumulate it. Every area of our lives is based on balance. The slightest imbalance overloads the system, queues and excitement begin, and there is no longer enough for everyone. At this time, you just sit at home and watch what is happening until everything returns to normal.

“Alarm suitcase”

It must contain: documents, money, a first aid kit, a supply of water and food for three days, baby food, if required. If you urgently need to leave your home and you can grab one thing, what will it be?

Collection point and telephones

To be honest, I haven’t fully figured this out myself yet. But I know that my parents and wife know my phone number by heart. When the child grows up, he will also know exactly the address, phone number + a note with this in his clothes.

No supplies for a year

When the rush starts, everyone starts raking everything they see off the shelves. You can’t stock up for your entire life. The supply is needed for a maximum of a week, until the situation becomes clear and everything returns to normal. And it is important when the situation becomes clear, for example, it becomes clear that none of this was useful. There should be a thought: “it’s good that all this is not useful now, it won’t go to waste, I’m great,” and not: “Omg! Well, it was necessary to buy all this in a haze and where to put it all.”

Funda, crypto and other nonsense

The most valuable thing is the life and health of the family. Everything else is bait. Well, it’s clear that those who were in foreign currency are now calmer. If the market falls, then buy it back. If he grows up…why would he grow up now? Do not buy rubles for 120, do not update your brokerage account every minute. Drawing a conclusion from everything written: if a crowd is running somewhere, then it would be good to anticipate in advance and be there a day earlier. It’s like arriving at work fifteen minutes before traffic jams. Yes, this is about an hour earlier than everyone else, but this is a whole working hour of time, instead of standing in a traffic jam and burning nerves and gasoline. Take care of yourself!