Portfolio ƒe vovototodedeameme: alesi woawɔ akpɔ gadede asiwo tae. Egbea xexeame ge ɖe malike bubu ƒe nɔnɔme me, eye esia mate ŋu akpɔ ŋusẽ ɖe gaxɔmenuawo ƒe asitsatsa dzi o. Etsɔ ko la, gaxɔgbalẽvi siwo dze abe kakaɖedzi le wo ŋu ene (adzɔnuwo, gagbalẽwo, kple bubuawo) siwo xɔa ga geɖe eye wokpɔa viɖe siwo li ke la, egbea ƒe asi le ɖiɖim ŋutɔ. Eyata ele be gadelawo nadzra ɖo ɖe tɔtrɔ kpata siwo ava asitsatsa ƒe nɔnɔmewo me ŋu. Eye be nàwɔ esia la, trɔ asi le wò gadede asi ŋu le mɔ vovovowo nu be nàɖe wò ganyawo ƒe afɔkuwo dzi akpɔtɔ. https://nyatiwo.opexflow.com/investicii/investicionnyj-portfel.htm

- Investment portfolio diversification – nukae nye esia le nya bɔbɔewo me

- Nukae nye gadodo ƒe gaxɔgbalẽvi nyuitɔ kekeake

- Ame siwo dea ga asiwo me siwo léa blemakɔnuléleɖeasi me ɖe asi

- Ame siwo dea ga asi na amewo le ɖoɖo nu

- Ame siwo dea ga asi na amewo dzikutɔe

- Alesi nàtu wò gadodo ƒe agbalẽdzraɖoƒe ɖo

- Le ga ƒomevi si wozãna nu

- Le dukɔa nu

- Le nunɔamesiwo ƒe hatsotso nu

- Le ganyawo ƒe akpawo nu

- To dɔwɔƒewo dzi

- Nukae nye nu vevitɔ si le nu vovovowo wɔwɔ me ne wole ga dem eme

- Nu Vovovowo Wɔwɔ le Inversion Portfolio – Viɖewo kple Kuxiwo

- Viɖe Siwo Le Nu Vovovowo Ŋudɔwɔwɔ Ŋu

- Nusiwo gblẽ le Ame Vovovowo Ŋu

- Ðe gadodo ƒe gaxɔgbalẽvi siwo da sɔ bliboe ƒe kpɔɖeŋuwo li

- Gadede asi ƒe agbalẽdzraɖoƒe ƒomevi – “perpetual portfolio”.

- Gadede asi ƒe agbalẽdzraɖoƒe ƒomevi – 50 va ɖo 50

- Deme ƒe agbalẽdzraɖoƒe ƒomevi – “Advanced portfolio”.

- Gadede asi ƒe agbalẽdzraɖoƒe ƒomevi – “Ga ƒe agbalẽdzraɖoƒe”.

- Dadasɔ gbugbɔgawɔ nye mɔnu si dzi woato axe mɔ ɖe afɔku siwo le gadede asi me ƒe dzidziɖedzi nu

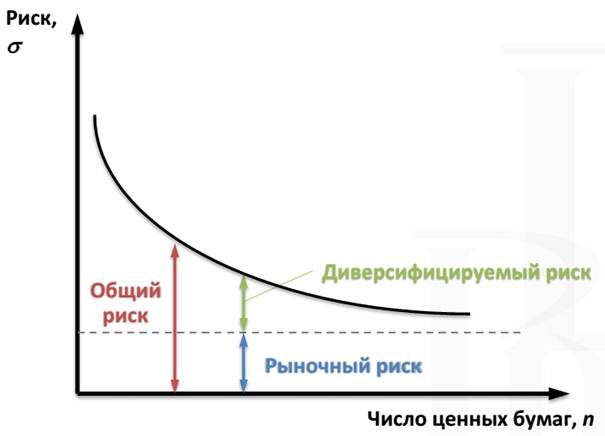

Investment portfolio diversification – nukae nye esia le nya bɔbɔewo me

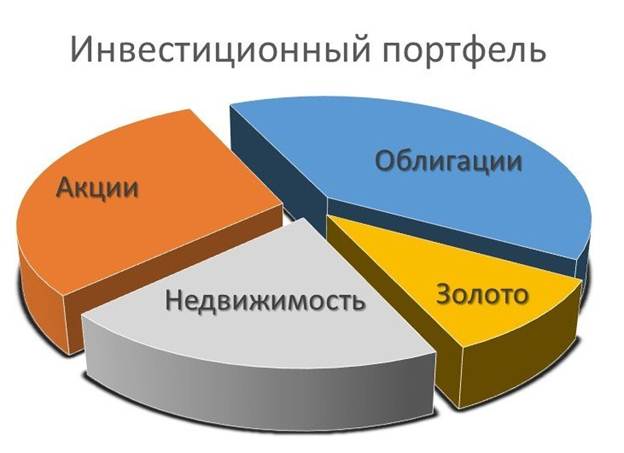

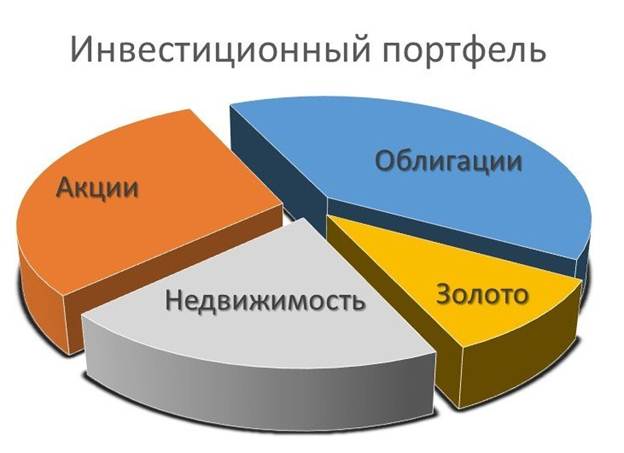

Nukpɔsusu si nye be woawɔ nu vovovowo la keke ta ŋutɔ. Ate ŋu afia ɖoɖo si woawɔ be woakeke dɔwɔƒea ƒe dɔwɔwɔ ɖe enu be woatsɔ adzi viɖewo ɖe edzi. Gadede asi ƒe akpa vovovowo wɔwɔ fia aɖaŋu aɖe si dzi woato akpɔ afɔku siwo ate ŋu ado mo ɖa ne wole nunɔamesiwo xɔm le gaxɔmenudzraƒewo. Ewɔ ɖoɖo be woama nunɔamesiwo (adzɔnuwo, gagbalẽwo, alo dɔwɔnu bubuwo) le mɔ aɖe nu be afɔku siwo le gaxɔgbalẽvia tɔ ŋu la nanɔ sue wu ɣesiaɣi alesi woate ŋui.

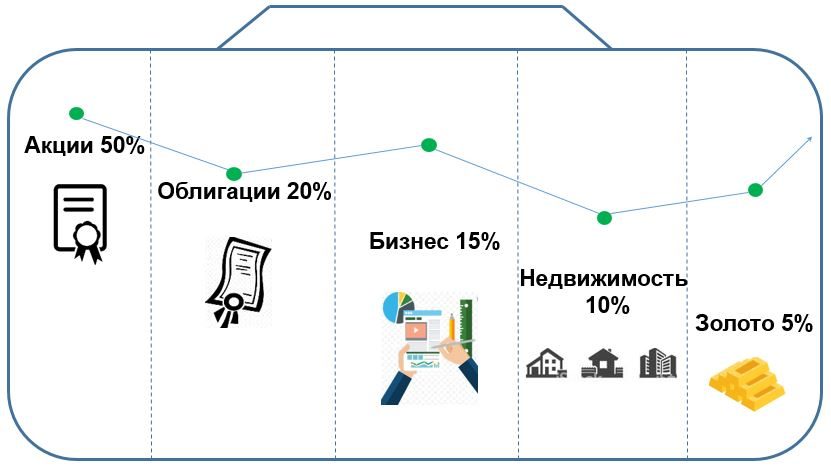

Gadede asi ƒe agbalẽdzraɖoƒe nye nunɔamesi siwo woƒo ƒu le mɔ si ana woƒe viɖekpɔkpɔ naɖo taɖodzinu kple taɖodzinu siwo eƒe aƒetɔ ɖo la gbɔ alesi wòanya wɔe nu. Menye dɔwɔnu siwo wozãna le gaxɔmenudzraƒewo ƒe ƒuƒoƒo aɖe koe ate ŋu anɔ gadodo ƒe agbalẽdzraɖoƒewo me (ga siwo wodzrana le gaxɔmenu me ƒe gomekpɔkpɔwo,

etsɔme , gaxɔgbalẽviwo, gaxɔgbalẽviwo, kple bubuawo), ke boŋ ga, ga xɔasiwo, anyigba kple xɔwo, ga siwo woda ɖe gadzraɖoƒe vovovowo me, hã ate ŋu anɔ eme. kple bubuawo.

Le ɣeyiɣi ma ke me la, afɔku si le gadelawo ŋu nye nɔnɔme si me mexɔa ga si wòɖo be wòakpɔ esime wònɔ gaxɔgbalẽvia nu ƒom ƒu o, alo ga si wode gae ƒe akpa aɖe gɔ̃ hã bu. Gadede asi ƒe agbalẽdzraɖoƒea ƒe vovototodedeameme ɖea mɔ eye wòwɔa ɖoɖo be gadelawo naƒle menye dɔwɔnu ɖeka aɖeke o, ke boŋ be wòaƒle nunɔamesi siwo le hatsotso vovovo siwo medo ƒome kple wo nɔewo boo o me. Esia wɔnɛ be nàte ŋu axe fe ɖe ga si nèkpɔna ƒe ɖiɖi le nuto aɖe me le viɖe si wokpɔna le ɖoƒe bubuwo ta la ta. Le ɣeyiɣi ma ke me la, ele be wòanɔ susu me na mí be menye ɣesiaɣie dɔwɔƒe vovovowo ƒe nunɔamesiwo (gawo) ƒeƒle nyea vovototodedeameme o. Le kpɔɖeŋu me, ne gadelawo ƒle Chevron, Gazprom kple Total ƒe akpa aɖewo la, ekema esia manye vovototodedeameme o, elabena dɔwɔƒe siawo katã, togbɔ be woŋlɔ wo ŋkɔ ɖe dukɔ vovovowo me hã la, wowɔa dɔ le ami kple gas ƒe asi ɖeka me. Eye alesi asitsalawo awɔ nui ɖe nudzɔdzɔ ɖesiaɖe ŋu akpɔ ŋusẽ ɖe wo dometɔ ɖesiaɖe dzi godoo. Gake ne wowɔ gaxɔgbalẽvi aɖe tso dɔwɔƒe vovovo siwo wɔa dɔ le nuto siwo meku ɖe wo nɔewo ŋu o me, le kpɔɖeŋu me, ami kple gas wɔwɔ, xɔtutu, IT mɔ̃ɖaŋunuwo, kple bubuawo me la, ekema afɔku siwo le asitsatsa ƒe tɔtrɔ gbegblẽwo me na wo la ava zu le ɣeyiɣi ɖeka me nye nu suetɔ kekeake.

Nukae nye gadodo ƒe gaxɔgbalẽvi nyuitɔ kekeake

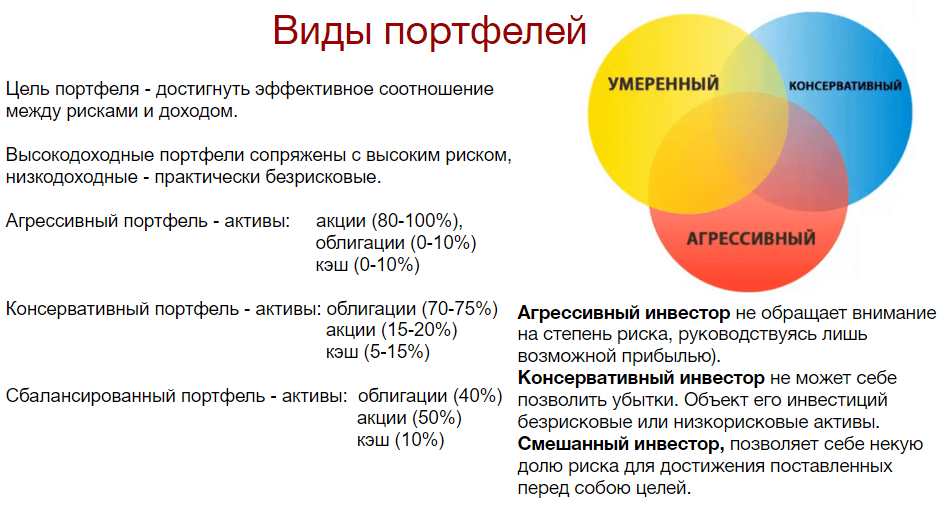

Ŋuɖoɖo aɖeke meli si ŋu ɖikeke mele o na biabia la – nukae nye gadodo ƒe gaxɔ nyuitɔ kekeake? Gadelawo dometɔ ɖesiaɖe kple eƒe nudidiwo le gadodo ƒe ɖoɖoa ŋu, siwo nɔ te ɖe nu gbogbo aɖewo dzi, abe gadede asi ƒe ɣeyiɣi ƒe didime, taɖodzinu siwo woɖo, gazazã ƒe ŋutete, kple bubuawo ene. Eyata menye nu nyuitɔ kekeake ŋue wòku ɖo boŋ o, ke boŋ gadede asi ƒe ɖoɖo si da sɔ nyuie ŋue wòku ɖo. Gadelawo ate ŋu axɔ gaxɔgbalẽvi ma tɔgbe ne wowɔe wòto vovo nyuie. Ne viɖe kple afɔku siwo le eme la awɔ ɖe gadelawo ƒe didiwo dzi alesi wòanya wɔe. Le ɣeyiɣi ma ke me la, ga si woakpɔ mɔ na kple afɔku siwo dzi woda asi ɖo anɔ gadelawo dometɔ ɖesiaɖe si. Woate ŋu atsɔ nɔnɔme ƒe kpɔɖeŋu si gbɔna la awɔ nusiwo le etame la ƒe kpɔɖeŋu. Mina míatsɔ “gadelawo ƒomevi” vevi etɔ̃:

Ame siwo dea ga asiwo me siwo léa blemakɔnuléleɖeasi me ɖe asi

Gbã la, gadelawo mawo dina be yewoakpɔ yewoƒe nunɔamesiwo ta ahakpɔ wo ta tso ga ƒe asixɔxɔ ƒe ɖoɖowo me. Eyata le woawo gome la, vovototodedeameme anye nunɔamesi siwo ŋu kakaɖedzi le wu (bonds, stocks, kple bubuawo) siwo li ke, gã siwo li ke la xɔxɔ.

Ame siwo dea ga asi na amewo le ɖoɖo nu

Wole klalo be yewoadze gadede asi siwo me afɔku le gɔme be yewoadzi yewoƒe gakpɔkpɔ ɖe edzi. Gake gadelawo mawo ƒe taɖodzinu vevitɔ gakpɔtɔ nye be woaƒo ga nu ƒu (le taɖodzinu siwo woɖo me) hena ƒe 10-20. Eyata asi gbadzaa ƒe adzɔnuwoe xɔ aƒe ɖe woƒe gadede dɔwɔƒewo me, eye ganyawo ƒe akpawo katã kloe le eme.

Ame siwo dea ga asi na amewo dzikutɔe

Gadelawo mawo le agbagba dzem be yewoakpɔ ga geɖe kaba, eye le esia ta woate ŋu ayi yewoƒe gadede asi ƒe gaxɔgbalẽviwo ɖeɖeɖa gbɔ bɔbɔe. Le gadelawo mawo gome la, nu vovovowo wɔwɔ anɔ gadede asi na amewo me.

Venture investment nye gadede asi si me wodoa ga le dɔ geɖe siwo ŋugbe wodo (gake afɔku le wo me boŋ) me le wo ɖoɖo ƒe gɔmedzedze.

Ne kakaɖedzi le eŋu ŋutɔ la, dɔ mawo tɔgbe 8 le 10 me ado kpo nu. Gake ga si woakpɔ tso dɔ siwo wowɔ dzidzedzetɔe me la axe nusiwo bu la bliboe eye wòahe viɖe geɖe vɛ.

Alesi nàtu wò gadodo ƒe agbalẽdzraɖoƒe ɖo

Eyata hafi nàdze wò gadodo ƒe agbalẽdzraɖoƒea ɖoɖo gɔme la, ele be asitsalawo/gadelawo natso nya me gbã le taɖodzinu siwo yome tim wòle kple aɖaŋu si wòazã ŋu. Taɖodzinuwo ate ŋu ato vovo ŋutɔ – tso nunɔamesiwo xɔxɔ dzi (xɔdɔme, aƒe, ʋu xɔasi aɖe, kple bubuawo), va ɖo sukudede ƒe fexexe na ɖeviwo alo gakpɔkpɔ bubuwo le dzudzɔxɔxɔledɔme megbe dzi. Le kpɔɖeŋu me, gadelawo dometɔ aɖe si xɔ ƒe 25-30 la ɖoe be yeaɖo dzudzɔxɔxɔledɔmegaxɔ aɖe na ye ɖokui. Ƒe 30-40 le eŋgɔ. Eye le esia ta ele be wòaɖo gadede asi ƒe agbalẽdzraɖoƒe si me nunɔamesi siwo ɖe gakpɔkpɔ nyui kple esiwo li ke fia xoxo le ɣeyiɣi didi aɖe me la le. Le ɣeyiɣi ma ke me la, gomekpɔkpɔ le eme aɖewo gɔ̃ hã, hena ɣeyiɣi kpui aɖe, makpɔ ŋusẽ ɖe gaxɔgbalẽvi ma tɔgbe dzi ŋutɔŋutɔ o, elabena ɣeyiɣi si sɔ gbɔ ŋutɔ anɔ ŋgɔ, . ale be woali ke eye woayi edzi anɔ tsitsim. Le ɣeyiɣi ma ke me la, ne gadede asi ƒe ɣeyiɣia le kpuie vie, ƒe 2-4 la, ekema wowɔ portfolio na wo nyuie wu tso adzɔnu siwo li ke ŋutɔ me, togbɔ be menye gakpɔkpɔ ƒe seƒe kɔkɔtɔ kekeake o hã (zi geɖe la, esiawo nyea gagbalẽwo “.

blue chips “). Ne wonya taɖodzinuwo kple mɔnuwo vɔ la, gadelawo dzea gaxɔgbalẽviwo ɖoɖo gɔme, eye wòtiaa nunɔamesi siwo wòhiã la kple nɔnɔme siwo sɔ. Le ɣeyiɣi sia me la, àteŋu ato vovototodedeameme ƒe ɖoɖo geɖewo dzi zi ɖeka:

Le ga ƒomevi si wozãna nu

Le gaxɔgbalẽvia ƒe akpa sia la, anyo be gagbalẽ siwo wodzrana le ga siwo li ke wu dometɔ geɖe me (dɔlar, euro, yuan, kple bubuawo) nanɔ asiwò. Le go sia me la, gaawo dometɔ ɖeka ƒe ɖiɖi sesẽ ŋutɔ gɔ̃ hã makpɔ ŋusẽ ɖe gadede asi bliboa ƒe asixɔxɔ dzi vevie o.

Le dukɔa nu

Mègaɖe mɔ be woaƒo dukɔ ɖeka aɖeke ƒe nunɔamesiwo nu ƒu ɖe wò gaxɔgbalẽvia me o, ke boŋ ma wo zi ɖeka ɖe xexeame ƒe dukɔ xɔŋkɔ geɖe dome. Esia aƒo asa na nusiwo bu vevie ne tɔtrɔ kpata va le dukɔawo dometɔ ɖeka me, si nye eƒe ganyawo ƒe ɖiɖi.

Le nunɔamesiwo ƒe hatsotso nu

Gbã la, esiawo nye gaxɔgbalẽviwo, gaxɔgbalẽviwo kple gaxɔgbalẽvi bubuwo. To gomewo ƒle me la, gadelawo, gbã la, wɔa ɖoɖo be yewoƒe asiwo, eye, le esia nu la, asixɔxɔa adzi ɖe edzi. Ne ele gagbalẽwo ƒlem la, gbã la, eɖoa ŋu ɖe ga si wòkpɔna le coupon me ƒe fexexe si li ke ŋu ɖe wo dzi. Tsɔ kpe ɖe eŋu la, àte ŋu ade ga ga siwo wodzrana le asitɔtrɔ me (BPIF,

ETF ), ga kple sika hã me. [caption id="attachment_11983" align="aligncenter" width="624"]

Le ganyawo ƒe akpawo nu

Wo dometɔ siwo hã, togbɔ be nɔnɔme aɖewo le wo ŋu boŋ hã la, woma wo ɖe esiwo woɖo anyi siwo ƒe viɖewo li ke me. Eye yeyewo, siwo me nu yeyewo dodo ɖe ŋgɔ le, siwo me afɔkuwo le, gake ne wodo ga ɖe eme dzidzedzetɔe la, woate ŋu ahe ga gbogbo aɖe ŋutɔ vɛ na amesiwo kpɔ woƒe ŋutete le ɣeyiɣi aɖe megbe.

To dɔwɔƒewo dzi

Dɔwɔƒe aɖewo koŋ ƒe gomenɔamesiwo xɔxɔ. Tiatia si bia be asitsatsa ƒe nɔnɔmewo ŋuti sidzedze deto nanɔ gadelawo si, ŋutete si le esi be wòazɔ mɔ ɖe dzesiwo ŋu eye wòanya nu tso eŋu nyuie. Ne èle gaxɔgbalẽviwo ƒlem la, ele be nàlé ŋku ɖe nyateƒe si wònye be nunɔamesi ɖeka mexɔ ga si wotsɔ de eme ƒe akpa si wu 10% o, eye ganyawo ƒe akpa ɖeka mewu 20% o la ŋu. Wò gadede agbalẽ me ƒe vovototodedeameme le nya bɔbɔewo me: https://youtu.be/CA7d9VSi7NE

Nukae nye nu vevitɔ si le nu vovovowo wɔwɔ me ne wole ga dem eme

“Adzɔnudzraɖoƒe” ƒe nufiafia si dzi woda asi ɖo egbea nye mɔnu si ana nàte ŋu atia nunɔamesi siwo ahe gakpɔkpɔ gãtɔ kekeake vɛ kple afɔku suetɔ kekeake. Le eƒe nya nu la, be ame nate ŋu akpɔ afɔku siwo le gadede asi me gbɔ dzidzedzetɔe la, ate ŋu ade gae to gadede asi na ame vovovowo me. Eyata ne èƒo nunɔamesi siwo me afɔku le kple esiwo li ke nu ƒu la, àte ŋu awɔ gaxɔgbalẽvi si da sɔ. Le kpɔɖeŋu me, àte ŋu aƒle gagbalẽwo hã tsɔ kpe ɖe gomenɔamesiwo ŋu. Le ɣeyiɣi ma ke me la, afɔku bliboa si le gadede asi me la aɖiɖi ŋutɔ wu esi le dɔwɔnu ɖekaɖekawo ƒle gome. Nufiafiaa gblɔ hã be ele be woatsɔ nunɔamesiwo asɔ kple wo nɔewo le ganyawo ƒe akpa siwo mewɔ ɖeka kple wo nɔewo kura o me. Le kpɔɖeŋu me, mina míagblɔ be gaxɔgbalẽvi aɖewo ƒe asixɔxɔ ɖiɖina ŋutɔ le esi nu xoxo aɖewo ƒe asi dzi ɖe edzi ta, evɔ bubuwo ya dzina ɖe edzi ŋutɔ.

Viɖe Siwo Le Nu Vovovowo Ŋudɔwɔwɔ Ŋu

Viɖe siwo ŋu ɖikeke mele o siwo le vovototodedeameme ŋu dometɔ aɖewoe nye:

- Afɔkuwo dzi ɖeɖe kpɔtɔ va ɖo afisi woate ŋu alɔ̃ ɖo . Ga gbogbo aɖe si ate ŋu adzɔ be gadelawo nabu la dzi ɖena kpɔtɔna ŋutɔ.

- Mɔnukpɔkpɔ na gadelawo be wòade ga la ƒe akpa aɖe nunɔamesi siwo me afɔku le, gake wokpɔa viɖe geɖe me . Le gadede asi na ame vovovowo me la, nunɔamesi mawo madzi afɔku ƒe agbɔsɔsɔ bliboa ɖe edzi o.

- Takpɔkpɔ tso asitsatsa ƒe tɔtrɔ gã me.

- Le ɣeyiɣi didi me la, ate ŋu ana ga si woakpɔ tso ga si wodo ɖe ga me la katã me nadzi ɖe edzi .

Nusiwo gblẽ le Ame Vovovowo Ŋu

Nusiwo gblẽ le nu vovovowo wɔwɔ ŋu dometɔ aɖewoe nye:

- Makpɔ ame ta tso ɖoɖowɔɖi ƒe afɔku siwo gblẽa nu le dedienɔnɔgbalẽ siwo katã le asi me ŋu la me o.

- Sesẽ siwo dona tso gadodo ƒe agbalẽdzraɖoƒe aɖe dzi kpɔkpɔ me, elabena zi alesi nunɔamesi geɖe le eme la, zi nenemae wo dzi kpɔkpɔ sesẽnae.

- Dɔdzikpɔfewo dzi ɖe edzi, zi alesi gadelawo ƒlea gaxɔgbalẽvi geɖe la, zi nenemae wòle be wòaxe dɔdzikpɔfe geɖee.

- Nu vovovowo wɔwɔ fũ ate ŋu aɖe ga si wokpɔna tso gaxɔmenuawo me dzi akpɔtɔ ŋutɔ.

- Gakpɔkpɔ ƒe ŋutete si seɖoƒe li na le ɣeyiɣi kpui aɖe me.

Alesi vovototodedeameme kpɔa ŋusẽ ɖe gadodo ƒe agbalẽdzraɖoƒe ƒe kakaɖedzi dzi kple alesi woawɔ nunɔamesiwo mama nyuie: https://youtu.be/GH6e9aY2BOI

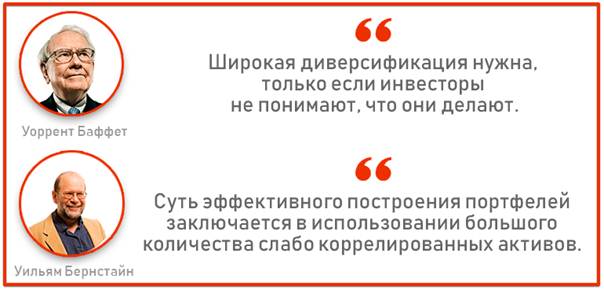

Ðe gadodo ƒe gaxɔgbalẽvi siwo da sɔ bliboe ƒe kpɔɖeŋuwo li

Dzɔdzɔmeŋutinunyalawo kple gadelawo le agbagba dzem tso gbaɖegbe ke be yewoawɔ gadodo ƒe ɖoɖo “si sɔ nyuie” si ŋu kakaɖedzi le be ana woakpɔ viɖe geɖe esime wòaɖe afɔku ɖesiaɖe dzi akpɔtɔ keŋkeŋ. Gake xexe “si sɔ nyuie” me koe gaxɔgbalẽvi sia tɔgbe ate ŋu adzɔ le, eye esi wònye be ele be gadelawo nawɔ dɔ kple nu ŋutɔŋutɔ ta la, ƒe ewo megbe koe wòanya wɔ be woanya gaxɔgbalẽvi si akpɔ viɖe geɖe wu le ƒe ewo me. Xexeame ƒe ganyawo le tɔtrɔm ɣesiaɣi eye womate ŋu agblɔ eƒe tɔtrɔ aɖewo ɖi kura o. Eyata mele be gadelawo nazã woƒe ɣeyiɣi atsɔ adi gadodo ƒe agbalẽdzraɖoƒe “si sɔ nyuie” kura o. Eye enyo be nàƒo gaxɔgbalẽvi si sɔ pɛpɛpɛ wu ɖe nɔnɔme siwo li fifia le gaxɔmenudzraƒewo nu la nu ƒu, eye nàdze dɔwɔwɔ gɔme kplii. Be nàse dzesiwo gɔme wòade pɛpɛpɛ wu eye wòade blibo wu la, . Anyo be míabu gadodo ƒe gaxɔgbalẽvi siwo da sɔ ƒomevi siwo ame geɖe lɔ̃a zazã wu la dometɔ aɖewo ŋu. [caption id = "attachment_12615" ɖoɖo = "ɖoɖo ƒe titina" kekeme = "444"].

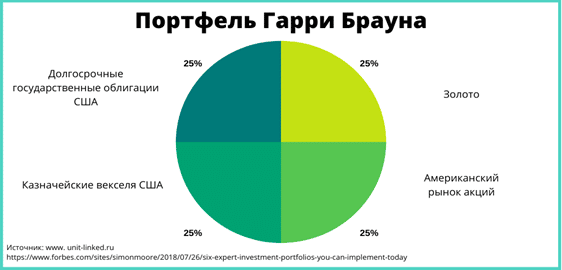

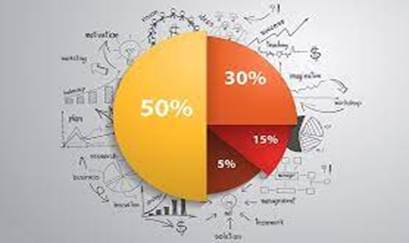

Gadede asi ƒe agbalẽdzraɖoƒe ƒomevi – “perpetual portfolio”.

Esia ƒomevi dze le ƒe alafa si va yi ƒe ƒe 70-awo ƒe gɔmedzedze eye wònye gadodo ƒe gaxɔgbalẽvi si da sɔ ƒe ƒomevi bɔbɔetɔ kekeake .Le gaxɔgbalẽvi

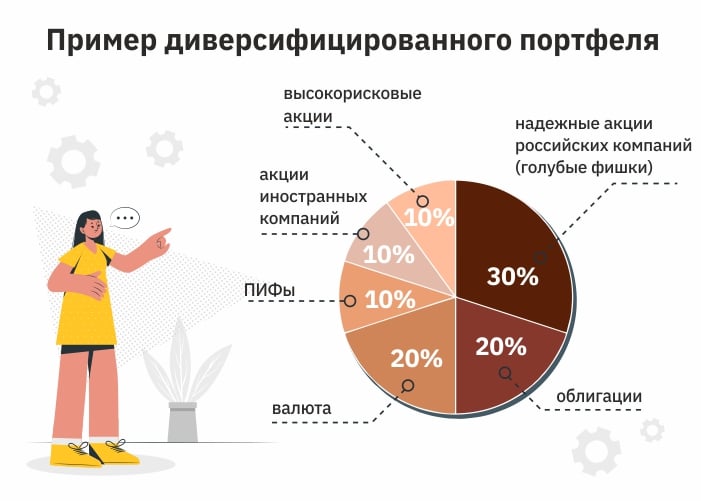

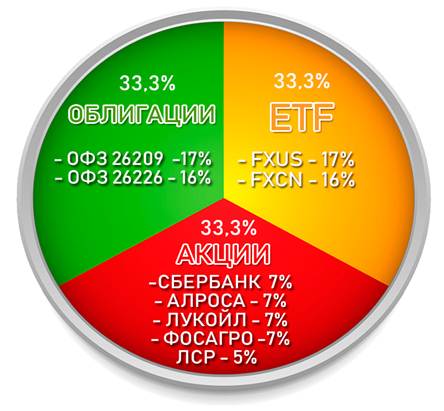

Gadede asi ƒe agbalẽdzraɖoƒe ƒomevi – 50 va ɖo 50

Le gaxɔ sia me la, wotsɔa ga si wode eme la ƒe 50% dea gomekpɔkpɔwo ƒeƒle me eye wotsɔa 50% dea gagbalẽwo me. Le ɣeyiɣi ma ke me la, nunɔamesi siwo woxɔ le dukɔa me hã le vovovo, eyata ne Amerika dɔwɔƒewo tɔe gome akpa gãtɔ nye la, ekema le gagbalẽwo me la, China alo Russia dɔwɔƒewo ƒe akpa si ɖe dzesi wue nye esi.

- TSPX (United States ƒe blue chips) – 30% .

- TMOS (Russiatɔwo ƒe blue chips) – 5% .

- VTBE (dɔwɔƒe siwo le dukɔ bubuwo me ƒe gomekpɔkpɔwo) -15% .

- Agbalẽvi siwo ƒe home nye gaxɔgbalẽvia ƒe alafa memama blaatɔ̃:

- OFZ (Russia Dukɔa ƒe Ganyawo Gbɔkpɔha ƒe gagbalẽwo) – 30% .

- FXRU (ga ƒe gagbalẽ siwo Russia dɔwɔƒewo wɔ) — 10% .

- FXRB (ga ƒe gagbalẽ siwo le Russia dɔwɔƒe aɖe si me wokpɔa ame ta tso tɔtrɔ siwo vaa ga ƒe asitɔtrɔ me la me) – 10%.

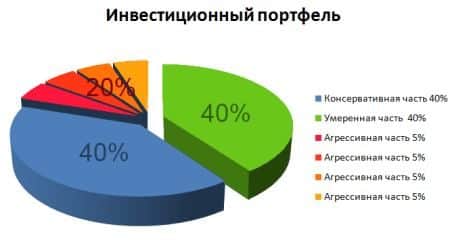

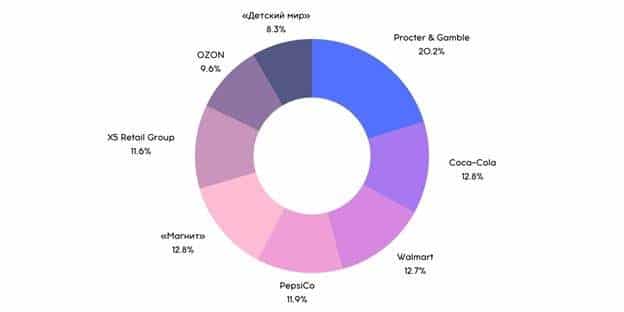

Deme ƒe agbalẽdzraɖoƒe ƒomevi – “Advanced portfolio”.

Esia ƒomevi ƒe akpa aɖe ɖi “eternal portfolio” la, gake vovototo gã aɖe hã le esi tso egbɔ. Gbã la, elɔ gadede anyigbawo kple esiwo woyɔna be bubuwo me ɖe eme – cryptocurrency, gaku, stamps, aɖaŋudɔwo, blemanuwo.

- Gomenɔamesiwo – 25%.

- Bond ƒe agbalẽvi – 25%.

- Ga xɔasiwo – 20%.

- Aƒewo kple anyigbawo – 20%.

- Gadede asi bubu siwo woate ŋu azã ɖe eteƒe – 10%.

Gadede asi ƒe agbalẽdzraɖoƒe ƒomevi – “Ga ƒe agbalẽdzraɖoƒe”.

Gawo ɖeɖekoe le gadede asi ƒe agbalẽdzraɖoƒe sia tɔgbe me eye mesɔ na gakpɔkpɔ ŋutɔŋutɔ kpee alo ga si woatsɔ aƒo ƒui o. Gake gaxɔgbalẽvi sia tɔgbe nyo ŋutɔ na ga si wode eme la dzadzraɖo. Eye, ne gadelawo ɖoe be yeawɔ yeƒe etsɔme gazazãwo tso gaxɔ sia me la, ekema mehiã be woawɔ ga ƒe tɔtrɔ o.

Dadasɔ gbugbɔgawɔ nye mɔnu si dzi woato axe mɔ ɖe afɔku siwo le gadede asi me ƒe dzidziɖedzi nu

Le dɔwɔwɔ me la, nunɔamesi siwo le gadodo ƒe agbalẽvia me ƒe xexlẽme ate ŋu atrɔ ŋutɔ. Esia dzɔna elabena nunɔamesi vovovo siwo le gaxɔa me ƒe asixɔxɔ toa vovo le mɔ si mesɔ o nu. Wo dometɔ aɖewo ƒe asi adzi ɖe edzi kabakaba wu, eye ne womewɔ naneke o la, ekema ate ŋu adzɔ le ɣeyiɣi aɖe me be nunɔamesiwo ƒe hatsotso ɖeka koe adze asixɔxɔ si le gadede asi me ƒe akpa gãtɔ xɔxɔ gɔme. Eye le dzɔdzɔme nu la, le gadede asi ƒe ɖoɖoa me ƒe dadasɔ ma tɔgbe ta la, afɔkuwo adzi ɖe edzi. Be woaƒo asa na nɔnɔme sia tɔgbe la, ele be gadelawo nagbugbɔ ada asɔ le eƒe gadede asi me tso ɣeyiɣi yi ɣeyiɣi. Nukatae wòhiã be woaxɔ viɖe tso nunɔamesi siwo le dzidzim ɖe edzi me eye woazã ga home siawo atsɔ axɔ nunɔamesi siwo mele dzidzim ɖe edzi vevie nenema o alo woaɖiɖi gɔ̃ hã vaseɖe esime woagada asɔ le gaxɔa me ake. Ne ga si susɔ le gadodo ƒe gaxɔa me trɔ le ɣeyiɣi sue aɖe me (1–3%) la, ekema womate ŋu atrɔ naneke le gaxɔgbalẽvia me o. Ne wogblẽ nu le ga si susɔ ŋu wu 10% la, ekema ehiã be woagbugbɔ ada asɔ le gaxɔgbalẽvia me eye woagbugbɔe aɖo afisi wònɔ le nunɔamesiwo ƒe xexlẽme nu.

Abe kpɔɖeŋu ene:

Tsɔe be gadelawo ƒe gaxɔgbalẽvi gbãtɔ ƒe ga si wotsɔ de gae me ƒe xexlẽme nye 70/30. Gomeawo ƒe akpa aɖe si to vovo ƒe asi dzi ɖe edzi, eye fifia xexlẽme sia nye 80/20 xoxo. Be ga si wotsɔ de gae la natrɔ ga si susɔ ɖe gaxɔa me la ɖe eƒe ga si susɔ gbã la, ele be gadelawo naƒle gagbalẽawo ƒe akpa geɖe alo adzra gaxɔgbalẽviawo dometɔ aɖewo. Le ɣeyiɣi ma ke me la, ele be míaɖo ŋku edzi be menye taɖodzinu si le dadasɔ ŋue nye be wòana viɖe si le gadede asi me nadzi ɖe edzi o, ke boŋ be woaɖe afɔku siwo ate ŋu ado tso eme dzi akpɔtɔ.