Portefeuille diversification : nafolodonniw lakanani cogo. Bi diɲɛ donna basigibaliya wɛrɛ la, wa o tun tɛ se ka nɔ bila bolomafara sugu la. Kunu dɔrɔn, a bɛ iko lakanafɛnw (aksidanw, bonw, a ɲɔgɔnnaw) minnu bɛ wari caman bɔ, ka tɔnɔ sabatilenw lase, bi, olu sɔngɔ bɛ ka jigin kosɛbɛ. O la, waridonnaw ka kan ka labɛn fɛn caman yeli kama suguya cogoyaw la. Wa walasa k’o kɛ, i ka i ka wari bilalenw caman kɛ walasa ka i ka wariko gɛlɛyaw dɔgɔya. https://articles.opexflow.com/investicii/investissementj-portfel.htm Bamako, Mali

- Investissement portfolio diversification – o ye mun ye daɲɛ nɔgɔmanw na

- Investissement portfolio min ka fisa ni tɔw bɛɛ ye, o ye mun ye

- Investisseurs conservateurs (Investisseurs conservateurs) ye

- Investisseurs (Investisseurs) minnu bɛ danma-danma

- Investisseurs aggressifs (waridonnaw) minnu bɛ kɛ ni fanga ye

- I bɛ se ka i ka wari bilalenw jɔ cogo min na

- Ka kɛɲɛ ni wari suguya ye

- Ka kɛɲɛ ni jamana ye

- Ka kɛɲɛ ni nafolo suguya ye

- Sɔrɔko siratigɛ la

- Ka kɛɲɛ ni sosiyetew ye

- Diversification (danfara) kunba ye mun ye n’i bɛ wari bila

- Diversifying an Inversion Portfolio – Nafa ni dɛsɛ

- Nafa minnu bɛ sɔrɔ fɛn caman na

- Nafa minnu bɛ sɔrɔ fɛn caman kɛli la

- Yala misaliw bɛ yen wariko bolofara minnu bɛ balansi dafalen na wa

- Investissement portfolio suguya – “portefeuille perpétuel”.

- Investissement portfolio suguya – 50 ka se 50 ma

- Investissement portfolio suguya – “Portfolio avancé”.

- Investissement portfolio suguya – “Wari portfolio”.

- Balancogo kura ye fɛɛrɛ ye min bɛ faratiw caya bali wariko bolofara dɔ la

Investissement portfolio diversification – o ye mun ye daɲɛ nɔgɔmanw na

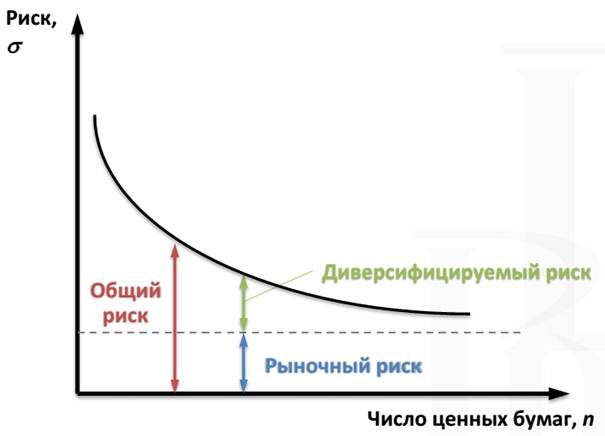

Fɛnɲɛnɛmako hakilina ka bon kosɛbɛ. A bɛ se ka kɛ sababu ye ka baarakɛda in ka baarakɛyɔrɔ bonya walasa ka dɔ fara tɔnɔ kan. Investissement portfolio caman-camanko b’a jira ko fɛɛrɛ dɔ bɛ yen min bɛ se ka kɛ ka faratiw ɲɛnabɔ ni nafolo bɛ sɔrɔ bolomafara sugu la. A b’a jira ko nafolo (stocks, bonds, walima minɛn wɛrɛw) ka tila-tila cogo la min b’a to farati minnu bɛ sɔrɔ portfolio tigi la, olu bɛ to ka dɔgɔya tuma bɛɛ ni a bɛ se ka kɛ.

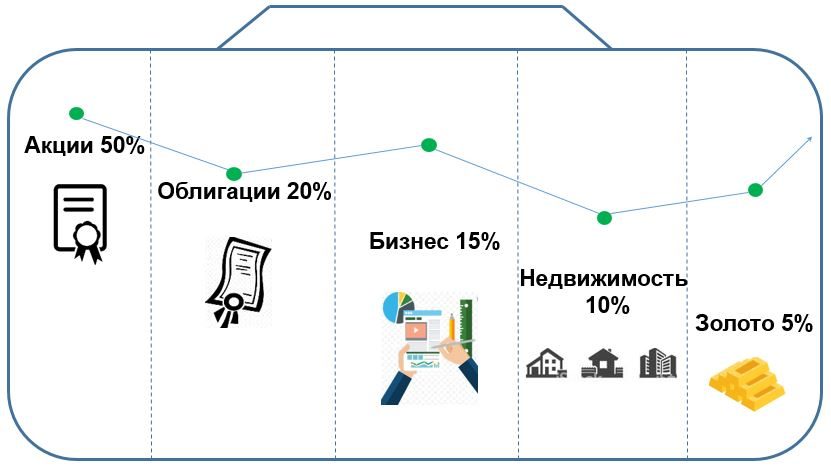

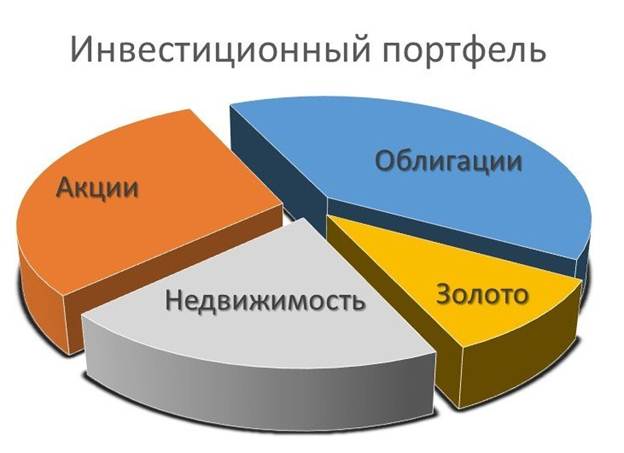

Investissement portfolio ye nafolo ye min bɛ lajɛ cogo la min b’a to u nafa bɛ se ka kuntilenna ni laɲiniw dafa a tigi ye minnu sigi senkan. Investissement portfolios bɛ se ka kɛ dɔrɔn tɛ minɛnw kulu ye minnu bɛ kɛ bolomafara sugu la (shares of exchange-traded funds,

futures , stocks, bonds, wdfl), nka wari, nɛgɛ nafamaw, dugukolow, wari bilalenw banki suguya caman na, ani a ɲɔgɔnnaw.

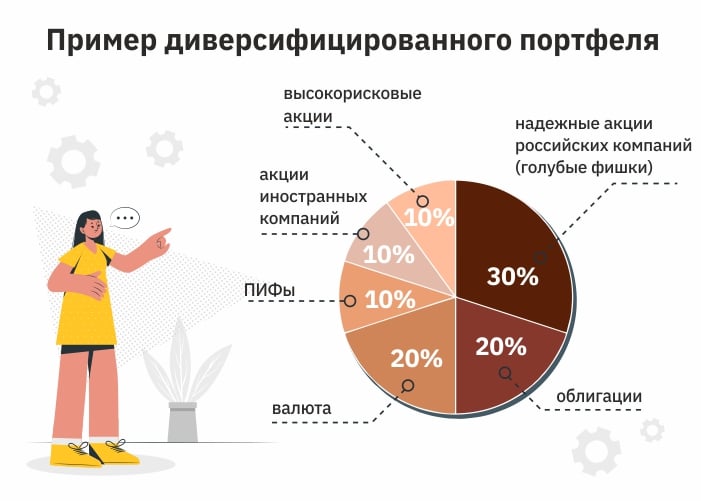

O waati kelen na, farati min bɛ waridonna bolo, o ye ko ye min kɔnɔ, a ye sɔrɔ hakɛ min boloda a ka bolomafara lajɛtuma na, a tɛ sɔrɔ min na, walima hali wari bilalen yɔrɔ dɔ bɔnɛna. Nafolodonna ka bolofara suguya caman b’a to ani ka a to waridonna ka sanni kɛ minɛn kelen si tɛ, nka a bɛ se ka nafolo san suguya wɛrɛw la minnu ni ɲɔgɔn cɛ tɛ kelen ye kosɛbɛ. O b’a to i bɛ se ka sɔrɔ dɔgɔyali musaka bɔ yɔrɔ dɔ la k’a sababu kɛ jɔyɔrɔ wɛrɛw nafa ye. O waati kelen na, a ka kan ka to an hakili la ko tɔn suguya caman ka nafolo (jatebɔ) sanni tɛ fɛn caman kɛli ye tuma bɛɛ. Misali la, ni waridonna dɔ ye Chevron, Gazprom ani Total ka jatew san, o tuma na, o tɛna kɛ fɛn caman sɛnɛni ye, bawo nin tɔn ninnu bɛɛ, hali n’u tɔgɔ sɛbɛnna jamana wɛrɛw la, u bɛ baara kɛ petoroli ni gazi suguya kelen na. Wa sugu bɛ min kɛ ko kɛlen o ko kɛlen na, o bɛna nɔ bila u kelen-kelen bɛɛ la wajibiya la. Nka, ni portfolio dɔ dabɔra ka bɔ tɔn suguya caman ka jatew la minnu bɛ baara kɛ yɔrɔw la minnu ni ɲɔgɔn cɛ tɛ kelen ye, misali la, petoroli ni gazi bɔli, jɔli, IT fɛɛrɛw, a ɲɔgɔnnaw, o tuma na, suguya caman yeli juguw faratiw bɛna kɛ u ye waati kelen na ka kɛ fɛn fitinin ye.

Investissement portfolio min ka fisa ni tɔw bɛɛ ye, o ye mun ye

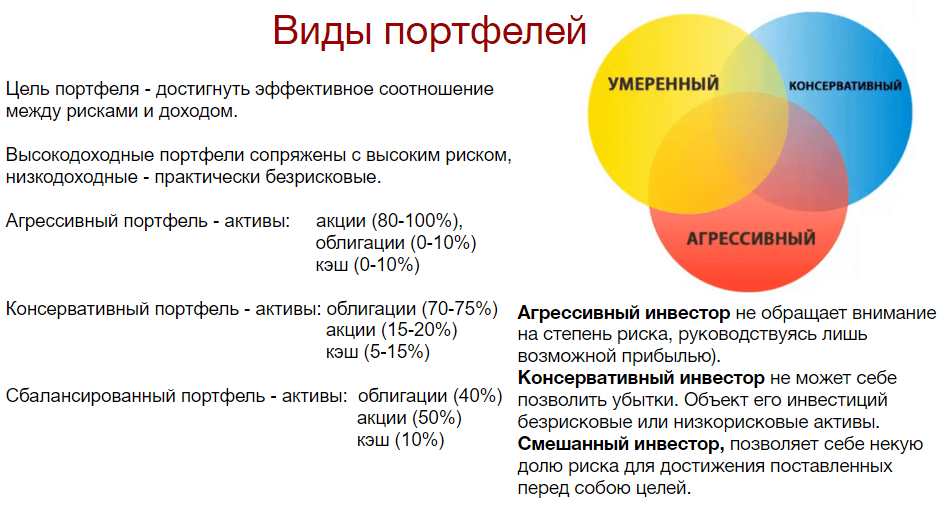

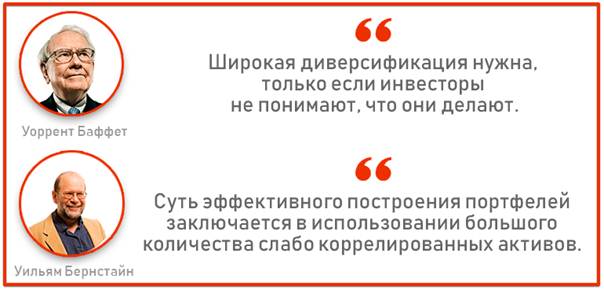

Ɲininkali jaabi jɛlen tɛ yen – wariko portfolio ɲuman ye mun ye ? Investisseur kelen-kelen bɛɛ n’a ka ɲininiw ye investissement portfolio la, minnu bɛ bɔ fɛn caman na, i n’a fɔ investissement horizon, laɲiniw sigilen, wariko ɲɛnabɔli, a ɲɔgɔnnaw. O la, a tɛ kɛ fɛn ɲuman ye, nka a bɛ kɛ wariko bolofara min bɛ balansi ɲuman na. Investisseur bɛ se ka o portfolio sugu sɔrɔ ni a kɛra fɛn caman ye ka ɲɛ. Ni nafa ni farati minnu bɛ a kɔnɔ, olu bɛna waridonna sago dafa ka se a dan na. O waati kelen na, waridonna kelen-kelen bɛɛ bɛna u yɛrɛ ka sɔrɔ makɔnɔnen sɔrɔ ani farati minnu bɛ se ka sɔn. Nin kuma fɔlen in bɛ se ka jira ni nin misali saratilen in ye. An ka “investisseur suguya” belebele saba ta:

Investisseurs conservateurs (Investisseurs conservateurs) ye

O waridonna suguw, fɔlɔ, u b’a fɛ k’u ka nafolo mara ani k’u lakana ka bɔ nafolosɔrɔbaliya taabolo la. O la, u fɛ, danfara bɛna kɛ ka nafolo sɔrɔ min bɛ se ka da a kan kosɛbɛ (bon, aksidanw, a ɲɔgɔnnaw) ka ɲɛsin tɔnba sabatilenw ma.

Investisseurs (Investisseurs) minnu bɛ danma-danma

U labɛnnen don ka daminɛ ka wari bila farati la walasa ka dɔ fara u ka sɔrɔ kan. Nka o waridonna suguw ka laɲini fɔlɔ ye hali bi ka waribonw lajɛ (laɲini latigɛlenw kɔnɔ) san 10-20 kɔnɔ. O de kama, u ka wariko bolofaraw bɛ fanga sɔrɔ suguba ka bolomafaraw fɛ, wa a bɛ se ka fɔ ko sɔrɔko bolofara bɛɛ bɛ jira a kɔnɔ.

Investisseurs aggressifs (waridonnaw) minnu bɛ kɛ ni fanga ye

O waridonna suguw b’a ɲini ka nafa caman sɔrɔ joona, wa o de kama u bɛ taa nɔgɔya la u ka waridonna ka bolomafara bɔli la. O waridonna suguw fɛ, fɛn caman bɛna kɛ fɛntigiw ka nafolodonniw na.

Venture investissement ye investissement ye min kɔnɔ investissement bɛ kɛ porozɛ caman na minnu bɛ layidu ta (nka farati bɛ u la) u sigili daminɛ na.

Ni a bɛ se ka kɛ kosɛbɛ, o porozɛ sugu 8 bɛna dɛsɛ 10 la. Nka sɔrɔ min bɛ sɔrɔ porozɛw la minnu kɛra ka ɲɛ, o bɛna bɔnɛw dafa bɛrɛbɛrɛ, ka tɔnɔba lase u ma.

I bɛ se ka i ka wari bilalenw jɔ cogo min na

O la, sanni i ka daminɛ k’i ka wariko bolofara sigi sen kan, jagokɛla/waridonbaga ka kan fɔlɔ ka a latigɛ a bɛ kuntilenna minnu na ani a bɛna baara kɛ ni fɛɛrɛ min ye. Laɲiniw bɛ se ka kɛ fɛn caman ye – k’a ta nafolo sɔrɔli la (so, so, mobili sɔngɔ gɛlɛn, a ɲɔgɔnnaw), ka se denmisɛnw ka kalan sarali ma walima ka sɔrɔ wɛrɛ sɔrɔ lakɔlibila kɔfɛ. Misali la, waridonna dɔ min si bɛ san 25-30 la, o y’a latigɛ ka pansiyɔn bolofara dɔ sigi sen kan a yɛrɛ ye. San 30-40 b’a ɲɛfɛ. Wa o de kama, a ka kan ka nafolodonni bolodalen dɔ sigi sen kan, nafolo minnu ye nafa ɲuman ni sabatilen jira kaban waati jan kɔnɔ. O waati kelen na, hali jatebɔ dɔw bɔli, waati kunkurunnin kɔnɔ, o tɛna nɔ bila kɛrɛnkɛrɛnnenya la o portfolio sugu la, bawo waati bɛrɛ bɛna kɛ ka kɔn o ɲɛ, walasa u ka sabati ani ka taa a fɛ ka bonya. O waati kelen na, ni waridon waati ka surun kosɛbɛ, san 2-4, o tuma na, u ka portfolio bɛ dilan ka ɲɛ ka bɔ aksidanw na minnu sabatili ka bon, hali ni sɔrɔ hakɛ tɛ minnu na (a ka c’a la, olu ye bonw ye

bulu buluw “). Laɲiniw ni fɛɛrɛw latigɛlen kɔfɛ, waridonna bɛ daminɛ ka portfolio dɔ sigi sen kan, a mago bɛ nafolo minnu na, a bɛ olu sugandi ni paramɛtiri bɛnnenw ye. O waati kɔnɔ, aw bɛ se ka taa ni danfara hakɛ caman ye siɲɛ kelen:

Ka kɛɲɛ ni wari suguya ye

Nin portfolio yɔrɔ in na, a ka ɲi ka lakanafɛnw sɔrɔ minnu bɛ jago kɛ wari sabatilen caman na (dɔrɔmɛ, ɛrɔ, yuan, a ɲɔgɔnnaw). O cogo la, fɛn o fɛn, hali ni wari dɔ binna kosɛbɛ, o tɛna nɔba bila wariko bolofara bɛɛ nafa la.

Ka kɛɲɛ ni jamana ye

Aw kana a to jamana kelen ka nafolo ka dalajɛ aw ka bolomafara kɔnɔ, nka aw k’u tila siɲɛ kelen diɲɛ jamana ɲɛmɔgɔ caman cɛ. O bɛna kɛ sababu ye ka bɔnɛba sɔrɔ ni fɛn barikama dɔ kɛra jamana dɔ la, n’o ye a ka sɔrɔko hakɛ binna.

Ka kɛɲɛ ni nafolo suguya ye

Fɔlɔ, ninnu ye aksidanw, bonw ani lakanafɛn wɛrɛw ye. Ni a ye jatew san, waridonna, fɔlɔ, a b’a labɛn k’u ka quotations, ani, ka kɛɲɛ n’o ye, sɔngɔ bɛna bonya. Ni a bɛ bond san, a bɛ a jigi da, fɔlɔ, kupon sɔrɔta sarali sabatilenw kan u kan. Ka fara o kan, aw bɛ se fana ka wari bila wari falenfalen nafolo la (BPIF,

ETF ), wari ani sanu. [caption id="attachment_11983" align="aligncenter" width="624"]

Sɔrɔko siratigɛ la

Minnu fana, hali n’u bɛ kɛ ni sarati ye, u bɛ tila ka kɛ sabatilenw ye minnu nafa bɛ sabati. Wa kuraw, ni kokuradonni hakɛ ka bon, minnu bɛ faratiw lase u ma, nka ni waridonnaw ɲɛnabɔra, u bɛ se ka sɔrɔba lase mɔgɔ ma minnu y’u seko ye waati kɔnɔ.

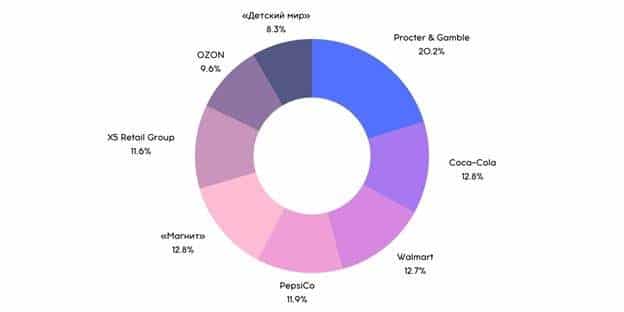

Ka kɛɲɛ ni sosiyetew ye

Sosiyete kɛrɛnkɛrɛnnenw ka jatew sɔrɔli. Sugandili min b’a ɲini waridonna fɛ a ka dɔnniya jugu sɔrɔ suguya cogoyaw la, a ka se ka taamasiyɛnw ɲɛminɛ ani ka hakilina jugu sɔrɔ. Ni aw bɛ lakanafɛnw san, aw ka kan k’aw janto a la ko nafolo kelen tɛ tɛmɛ 10% kan wariko bolofara la, wa sɔrɔko bolofara kelen tɛ tɛmɛ 20% kan. Ka i ka wariko bolodalen caman kɛ cogo nɔgɔman na: https://youtu.be/CA7d9VSi7NE

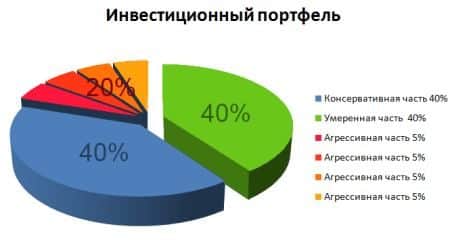

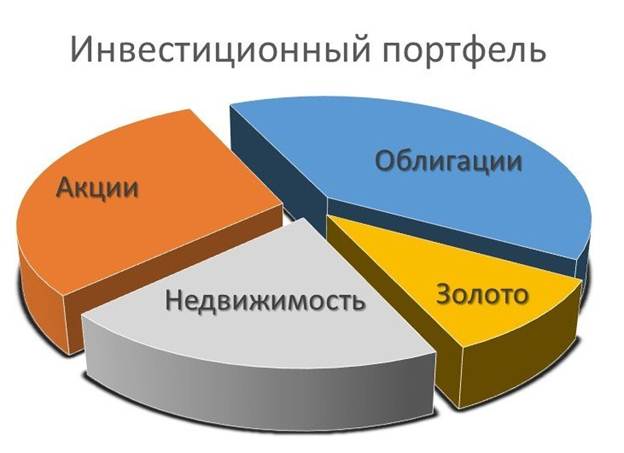

Diversification (danfara) kunba ye mun ye n’i bɛ wari bila

« Portfolio » miiriya min bɛ ta bi, o ye fɛɛrɛ ye min b’a to i bɛ se ka nafolo sugandi minnu bɛ na ni sɔrɔ caman ye ni farati fitininw ye. A ka fɔ la, walasa ka faratiw ɲɛnabɔ ka ɲɛ wariko la, mɔgɔ bɛ se ka wari bila fɛn caman na. O la, n’i ye nafolo faratilenw ni nafolo sabatilenw fara ɲɔgɔn kan, i bɛ se ka portfolio balannen dɔ da. Misali la, ka fara aksidanw kan, i bɛ se ka bonw fana san. O waati kelen na, wariko farati bɛɛ bɛna dɔgɔya kosɛbɛ ka tɛmɛ minɛn kelen-kelen sanni kan. O hakilina b’a jira fana ko nafolo ka kan ka bɛn sɔrɔko seko ni dɔnko siratigɛ la, minnu ni ɲɔgɔn cɛ tɛ kelen ye fewu. Misali la, an k’a fɔ ko lakanafɛn dɔw nafa bɛ jigin kosɛbɛ k’a sababu kɛ fɛnɲɛnamafagalan dɔw sɔngɔ bonya ye, dɔw bɛ wuli kosɛbɛ. [caption id=”jateminɛ_12003″ align=”sɛbɛnni-yɔrɔ”.

Diversifying an Inversion Portfolio – Nafa ni dɛsɛ

I n’a fɔ baarakɛcogo bɛɛ, fɛn caman kɛli bɛ ni nafa ni dɛsɛ ye.

Nafa minnu bɛ sɔrɔ fɛn caman na

Siga t’a la, fɛn minnu bɛ danfara la, olu ye ninnu ye:

- Faratiw dɔgɔyali ka se hakɛ ma min bɛ sɔn . A ka c’a la, waritigi bɛna bɔnɛ wari caman na, o bɛ dɔgɔya kosɛbɛ.

- Fɛɛrɛ min bɛ sɔrɔ waridonna dɔ bolo ka nafolo yɔrɔ dɔ bila nafolomafɛnw na minnu bɛ farati la, nka nafa caman bɛ minnu na . Nafolodoncogo caman na, o nafolo suguw tɛna dɔ fara farati hakɛ bɛɛ kan.

- Lakanali ka bɔ suguya caman sɛgɛsɛgɛli la.

- Waati kuntaalajan kɔnɔ, a bɛ se ka dɔ fara waridonna ka nafa bɛɛ kan .

Nafa minnu bɛ sɔrɔ fɛn caman kɛli la

Fɛnɲɛnɛmafagalan nafaw ye ninnu ye:

- A tɛna mɔgɔ tanga sigida faratiw ma minnu bɛ nɔ bila lakanafɛnw bɛɛ la sugu la.

- Gɛlɛya minnu bɛ sɔrɔ wariko bolofara dɔ ɲɛnabɔli la, bawo ni nafolo caman bɛ a kɔnɔ, a ɲɛnabɔli ka gɛlɛn ka taa a fɛ.

- Ni dɔ farala komisiyɔnw kan, ni waritigi bɛ lakana caman san, a ka kan ka komisiyɔn caman sara.

- Ni fɛn caman kɛra ka caya kojugu, o bɛ se ka dɔ bɔ kosɛbɛ portfolio nafa la.

- Sɔrɔko danmadɔ ye waati kunkurunnin kɔnɔ.

Diversification bɛ nɔ bila cogo min na wariko bolofara ka dannaya la ani nafolo tilacogo ɲuman kɛcogo: https://youtu.be/GH6e9aY2BOI

Yala misaliw bɛ yen wariko bolofara minnu bɛ balansi dafalen na wa

Dɔnniyakɛlaw ni waridonnaw b’a ɲini kabini tuma jan ka wariko bolofara “ideal” dɔ da min bɛ se ka nafa caman di ka sɔrɔ ka faratiw bɛɛ dɔgɔya pewu. Nka o portfolio sugu bɛ se ka kɛ diɲɛ “ideal” dɔrɔn de kɔnɔ, wa ikomi waridonnaw ka kan ka baara kɛ ni tiɲɛ ye, a bɛna se k’a dɔn portfolio jumɛn bɛna nafa sɔrɔ kosɛbɛ san tan kɔnɔ san tan kɔfɛ dɔrɔn. Diɲɛ sɔrɔko bɛ ka Changé tuma bɛɛ wa a fɛn dɔw yeli tɛ se ka fɔ abada. O la, waridonnaw man kan k’u ka waati kɛ ka wari bilayɔrɔ “ideal” ɲini. Wa a nafa ka bon ka portfolio dɔ lajɛ min bɛ bɛn kosɛbɛ sisan cogoyaw ma tigitigi bolomafara suguw kɔnɔ, ka baara daminɛ n’o ye. Walasa ka faamuyali tigitigi ni dafalen sɔrɔ dugukolo taamasiyɛnw kan, A ka kan ka jateminɛ kɛ wariko bolofara suguya dɔw la minnu ka di kosɛbɛ. [caption id="jatebɔ_12615" align="aligncenter" bonya="444"].

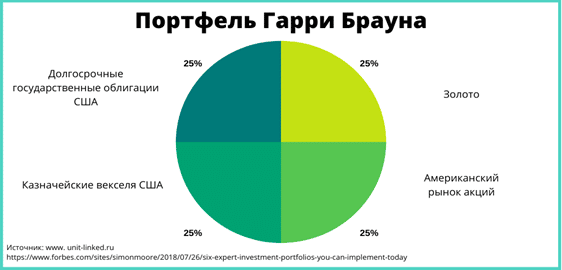

Investissement portfolio suguya – “portefeuille perpétuel”.

Nin suguya in bɔra san kɛmɛ tɛmɛnen san 70 daminɛ na, wa a ye wariko bolofara suguya nɔgɔman ye min bɛ bɛn wariko

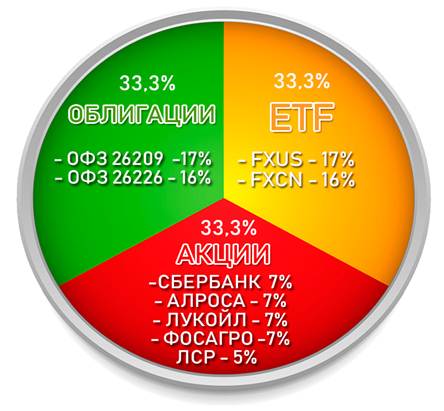

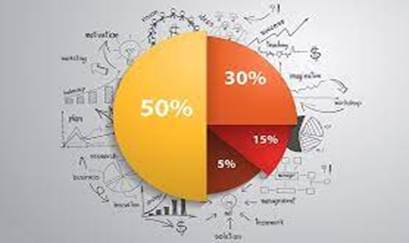

Investissement portfolio suguya – 50 ka se 50 ma

Nin portfolio in kɔnɔ, nafolo min bilalen don, 50% bɛ don jatebɔsɛbɛnw sanni na ani 50% bɛ don bonw na. O waati kelen na, kɔnɔna nafolo sɔrɔlenw fana bɛ caman kɛ, o la ni jatebɔ fanba ye Ameriki ka tɔnw ta ye, o tuma na bond kɔnɔ, a yɔrɔ min nafa ka bon kosɛbɛ, o bɛ kɛ Sinuwa walima Risi ka baarakɛda dɔw ta ye.

- TSPX (Amerika ka buluw) – 30% .

- TMOS (Risi jamana ka buluw) – 5% .

- VTBE (jamana wɛrɛw ka tɔnw ka jatew) -15% .

- Bond minnu hakɛ ye kɛmɛsarada la bi duuru ye portfolio kɔnɔ :

- OFZ (bond minnu bɛ Risi jamana ka nafolo minisiriso la) – 30% .

- FXRU (Risi ka tɔnw ka waribonw) — 10% .

- FXRB (Risi ka tɔn dɔ ka waribonw ni lakanani ka bɔ fɛnw falenfalenni na) – 10%.

Investissement portfolio suguya – “Portfolio avancé”.

Nin sugu in ni “portefeuille eternelle” bɛ ɲɔgɔn na yɔrɔ dɔ la, nka danfaraba fana b’a ni ɲɔgɔn cɛ. Fɔlɔ, a bɛ wari bilali la fɛnw feereli la ani minnu bɛ wele ko fɛn wɛrɛw – kriptowari, warijɛ, timbre, seko ni dɔnko baara, fɛn kɔrɔw.

- Jateblaw – 25%.

- Bond pake – 25% ye.

- Nɛgɛ nafamaw – 20%.

- Immobilier – 20% ye.

- Nafolodoncogo wɛrɛw – 10%.

Investissement portfolio suguya – “Wari portfolio”.

O ɲɔgɔnna nafolodonni portfolio bɛ kɛ wari dɔrɔn de ye, wa a man kan ka sɔrɔ lakika faralen sɔrɔ walima ka waribonw dalajɛ. Nka o portfolio sugu ka bon kosɛbɛ nafolo bilalenw marali la. Wa, ni waridonna b’a fɛ k’a ka musaka nataw kɛ ka bɔ o portfolio in na, o tuma na, kun t’a la ka wariko jiginni kɛ.

Balancogo kura ye fɛɛrɛ ye min bɛ faratiw caya bali wariko bolofara dɔ la

Baara taabolo la, nafolo hakɛ min bɛ wariko bolofara kɔnɔ, o bɛ se ka Changé kosɛbɛ. O bɛ kɛ bawo nafolo suguya minnu bɛ portfolio kɔnɔ, olu nafa tɛ kelen ye. U dɔw sɔngɔ bɛna wuli joona kosɛbɛ, wa ni wale si ma kɛ, o tuma na, waati dɔ la, a bɛ se ka kɛ ko nafolo suguya kelen dɔrɔn de bɛna daminɛ ka jatebɔ kɛ wariko bolofara nafa fanba la. Wa, a dabɔra cogo min na, o balanbaliya sugu min bɛ wariko bolofara kɔnɔ, faratiw bɛna bonya. Walasa ka a yɛrɛ tanga o ko sugu ma, waridonna ka kan k’a ka waridonna ka bolofara balan tuma ni tuma. Mun na a ka kan ka tɔnɔ sɔrɔ nafolo minnu bɛ ka bonya, ka baara kɛ ni o hakɛw ye walasa ka nafolo sɔrɔ minnu tɛ bonya kosɛbɛ walima hali ka jigin fo ka se portfolio ka balansi sɔrɔ kokura. Ni balansi min b wariko bolofara kɔnɔ, o b b n b nkan fitinin na (1–3%), o tuma foyi t se ka b n bolomafara la. Ni balansi tiɲɛna ni 10% ni kɔ ye, o tuma na fɛ, a ka kan ka balansi kura don portifaliw la, ka segin a cogo kɔrɔ la nafolo hakɛ la.

Misali la:

A ka kɛ ko waridonna dɔ ka bolomafara fɔlɔ tun ye 70/30 ye. Jatedenw yɔrɔ danfaralen dɔ sɔngɔ bonyalen don, sisan o hakɛ in bɛ 80/20 na kaban. Walasa ka portfolio segin a ka balansi fɔlɔ la, waridonna ka kan ka bond caman san walima ka a ka jate dɔw feere. O waati kelen na, a ka kan ka to an hakili la ko balansi kura kun t ka dɔ fara waridonna ka nafa kan, nka ka dɔ bɔ a ka faratiw la minnu bɛ se ka sɔrɔ.