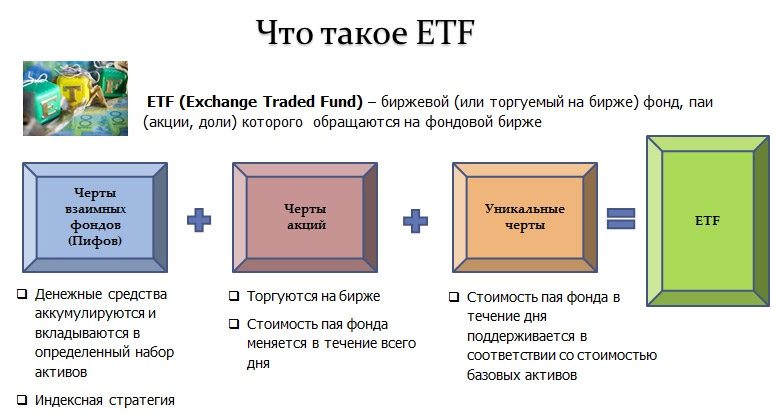

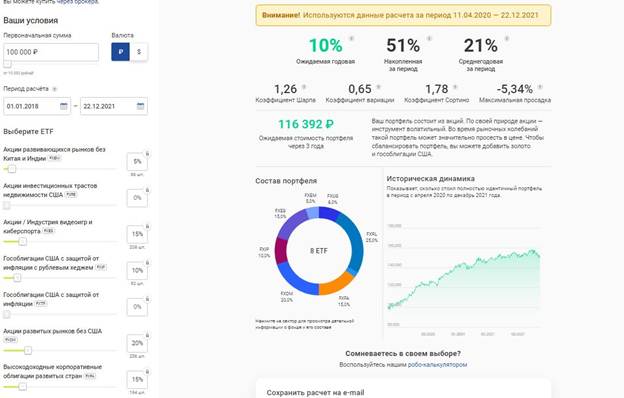

ETF traded fund – what is it in simple words about complex.ETF (exchange-traded fund) funds are a form of collective investment. By purchasing a share of such a fund for only 4000 rubles, you become the owners of a small share of shares in companies such as Microsoft, Apple, MasterCard, Tesla, Facebook, Google, McDonald’s and many others. The most diversified VTI fund includes over 3,900 shares. To repeat this diversification in their account, a private investor would need too much capital. For most inverters, this diversification is not available. There are index exchange-traded funds that exactly copy the composition and proportions of shares of world indices, commodities and funds for precious metals, ETFs for bonds and money market instruments. There are over 100 different ETFs on the US market that have implemented different strategies. For example,Eternal Portfolio Strategy

Ray Dalio ”(investments in stocks, bonds and gold with periodic imbalances), investments in stocks of a certain sector of specific countries. With the help of an ETF portfolio, you can collect a diversified portfolio by industry and country for investors with a very modest deposit. There are passive management ETFs, which exactly follow the dynamics of an index or a product, and active management funds, in which the income and drawdown are regulated by the managers. The most common funds are passive management – they have lower commissions and their dynamics does not depend on the human factor.

Differences between ETFs and mutual funds

The Russian analogue of ETF is a mutual fund (mutual investment fund). Despite the similarities, there are some differences.

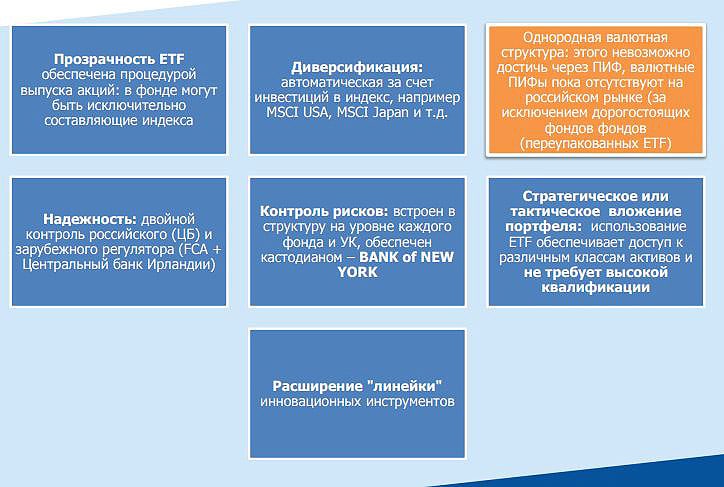

- Most ETFs are passive management with an open strategy . This gives an advantage to the investor, since it is clear in what instruments and in what proportions money is invested. An investor can be sure that when investing in ETFs on gold, his investments will exactly repeat the dynamics of the precious metal.

- Unit investment funds are active management funds . The financial result depends largely on the actions and mistakes of the manager. A real situation is when the dynamics of unit investment funds is negative in a strong bull market. But when the market falls, unit investment funds may outperform the market.

- ETFs will allow you to collect a diversified portfolio , by country, industry or strategy.

- ETFs pay dividends if they are paid by the stock of the index they follow. In most cases, dividends are reinvested in the original proportion.

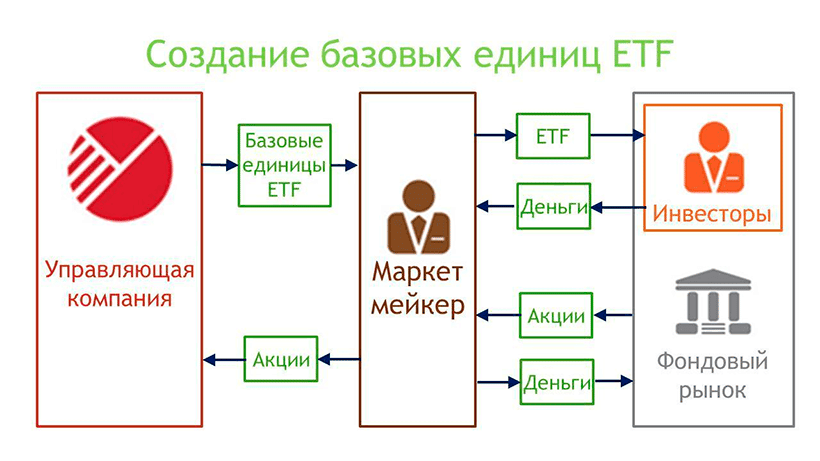

- ETFs are traded on an exchange , a market maker maintains liquidity. There is no need to contact the management company for the purchase. It is enough to have a brokerage account with any licensed broker.

- ETF fees are several times lower compared to mutual funds .

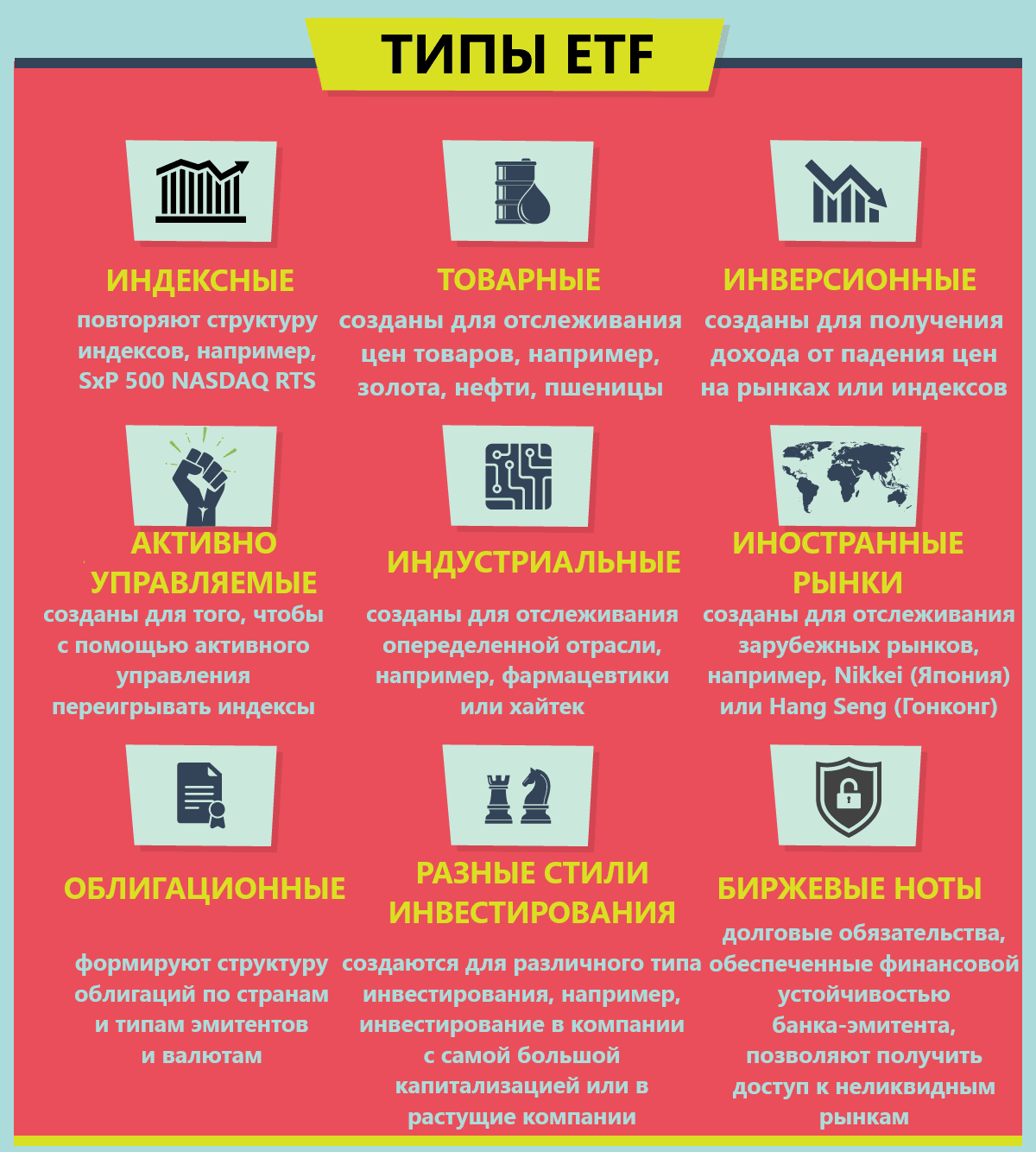

ETF types

Existing ETFs can be divided into the following groups:

- By country – funds investing in almost all countries where there is a stock market are represented on the US stock exchange. There are separate ETFs for each index of that country.

- By sectors of the economy – there are ETFs for specific sectors of the economy, where stocks of a specific sector of the economy of the country in question are collected. An investor may not buy the entire index, but invest only in promising industries in his opinion.

- By financial instruments – ETF can be distinguished for stocks, bonds, money market instruments (short-term bonds up to 3 months), foreign exchange ETFs, ETFs for precious metals, industrial goods, real estate.

ETF on MICEX

More than 1,500 different ETFs are available on the US NYSE.

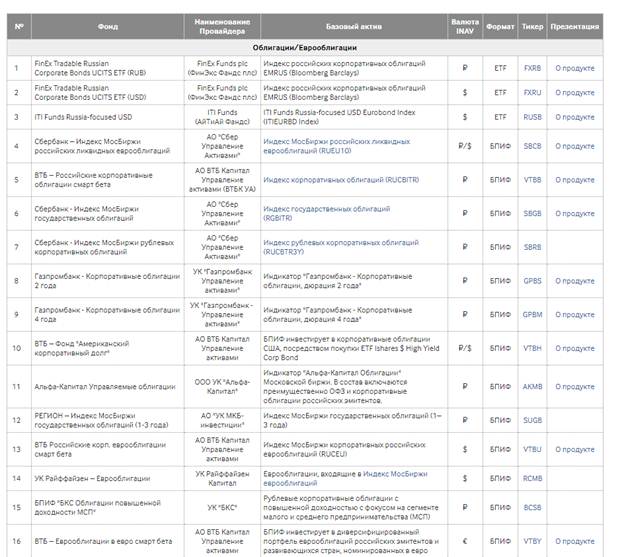

The Moscow Exchange offers a much more modest list of ETFs for Russian investors (many ETFs are available for purchase only to qualified investors). Currently, there are 128 ETFs and BIFs available on the Moscow Exchange. Finex offers the following ETFs:

- FXRB – Index of Russian corporate bonds denominated in rubles.

- FXRU – Index of Russian corporate bonds denominated in dollars.

- FXFA is an index of high yield corporate bonds of developed countries.

- FXIP – US government bonds, with inflation protection with a ruble hedge, denominated in rubles.

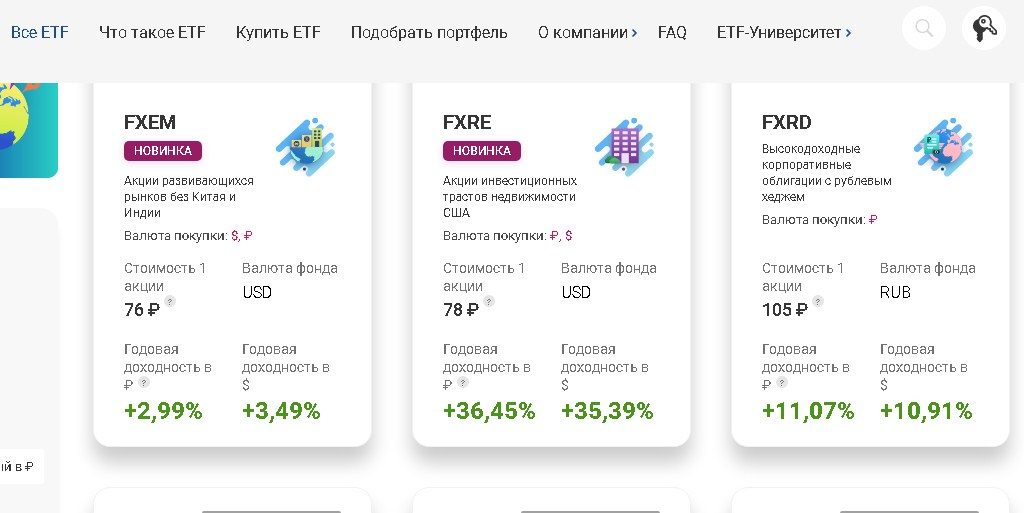

- FXRD – high yield dollar bonds, benchmark – Solactive USD Fallen Angel Issuer Capped Index.

- FXKZ – the fund invests in shares of Kazakhstan.

- FXRL – investment in the Russian RTS index.

- FXDE is an investment in the German stock market.

- FXIT is an investment in the American technology sector.

- FXUS is an investment in the American SP500 index.

- FXCN is an investment in the Chinese stock market.

- FXWO is an investment in shares of the global market, its portfolio includes more than 500 shares from 7 largest countries of the world.

- FXRW is an investment in high-cap US stocks.

- FXIM is an investment in the US IT sector.

- FXES is a US gaming and esports stock.

- FXRE is an investment in US real estate investment trusts.

- FXEM – investments in stocks of developing countries (except China and India).

- FXGD is an investment in gold.

Finex is currently the only company offering ETF investments to Russian traders.

There are similar products from Sberbank, VTB, BCS, Finam, Alfa Capital,

Tinkoff Investments , Aton and others. But they all belong to the BIF. Many asset management companies offer similar products (the fund following the SP500 broad market

index is represented by Sberbank, Alfa Capital and VTb). The dynamics are almost identical, but investors who bought Finex shares in a small profit due to lower commissions. A feature of ETFs on the Moscow Stock Exchange is that the ETF’s currency is dollars and in order to buy such an ETF, rubles from the account are first converted into dollars. There are etf denominated in rubles (with a currency hedge), acquiring them, the investor is protected from fluctuations in the exchange rate of the dollar against the ruble.

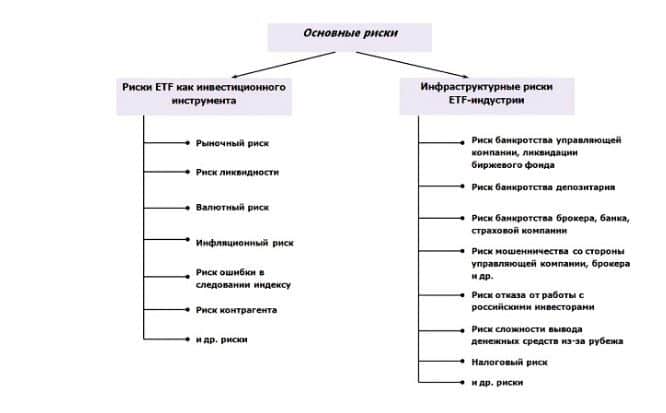

Investing in ETFs

The main advantage of investing in ETFs is maximum portfolio diversification for low-capital investors. The principle of long-term investment is “don’t put all your eggs in one basket”. An ETF investor can diversify his portfolio by asset class (stocks, bonds) – depending on the chosen strategy, change the proportions. Within the class, he can change the proportions between stocks of different sectors of different countries. Have a broadly diversified portfolio of Eurobonds. The minimum lot of Eurobonds starts from 1000 $, for diversification you need to have at least 15-20 different names. This is already a fairly tangible amount. When investing in ETFs on the Eurobond index, you can purchase a basket of 25 Eurobonds for just 1,000 rubles. In addition, the investor has the opportunity to purchase highly profitable “

junk “bonds of Russia and the world. To secure their portfolio, an investor can add investments in gold.

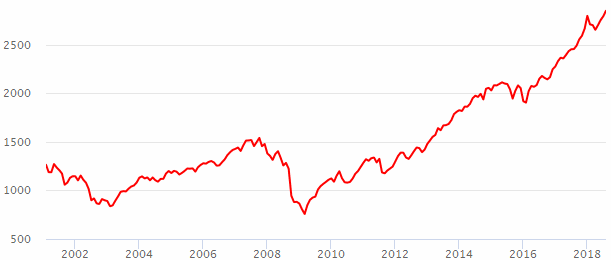

ETF profitability

ETF profitability is completely dependent on market dynamics. At short intervals of up to 1-3 years, it is quite difficult to predict it, because there are many factors to consider. For a period of 10 years or more, assets are likely to be more expensive than they are today. But this does not mean that for a period of 10 years you will see positive dynamics every day. Let’s look at the dynamics of the broad US stock market SP500:

Commissions

In addition to the exchange commission when buying and selling (according to the broker’s tariff

, but some brokers do not charge commission when buying ETFs), you need to pay a management commission. On passively managed ETFs, FInex is charged 0.9% per year. This amount is not charged directly from the investor’s brokerage account, but is debited every day and accounted for in quotes. If you bought an ETF, the price of which has increased by 10% over the year, this means that in fact it has increased by 10.9%.

It is unpleasant that the commission is paid regardless of the investment result. If the index fund suffered a 10% loss in a year, you would have a 10.9% loss.

How to buy ETF

The easiest way is to purchase ETF funds on the Moscow Exchange. Foreign brokers offer a larger selection of ETFs with lower fees. For comparison, there are foreign ETFs with a commission of 0.004% versus a Finex commission of 0.9%. Through a foreign broker, it is possible to buy ETF for cryptocurrency. A new instrument in which pension funds and large US investors are already beginning to invest. The Central Bank warns of the dangers of investing in bitcoin ETFs. If this tool proves its stability (investment period is at least 10 years), Russian providers will add it to their lineup. But do not forget that in the Russian Federation ETFs can be purchased on

IISand return 13% of taxes. Many brokers do not take commissions for maintaining an account and you can fund your account once a month or a week for small amounts. It is recommended to enter foreign markets, starting with an investment of $ 10-20 thousand.

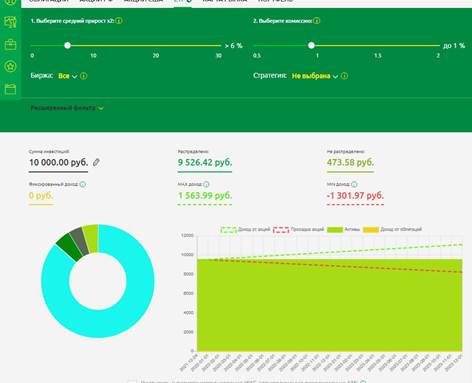

ETF portfolio formation principle

Passive investing in index funds is pretty much the same thing as retirement money managers. The investment horizon matters – you shouldn’t try to build an ETF portfolio for 1-2 years. The main tenet of investing in ETFs is the regularity of investments, regardless of the market situation. To select suitable ETFs, the investor will be helped by the Moscow Exchange website, where you can see a list of all traded exchange-traded funds – https://www.moex.com/msn/etf.

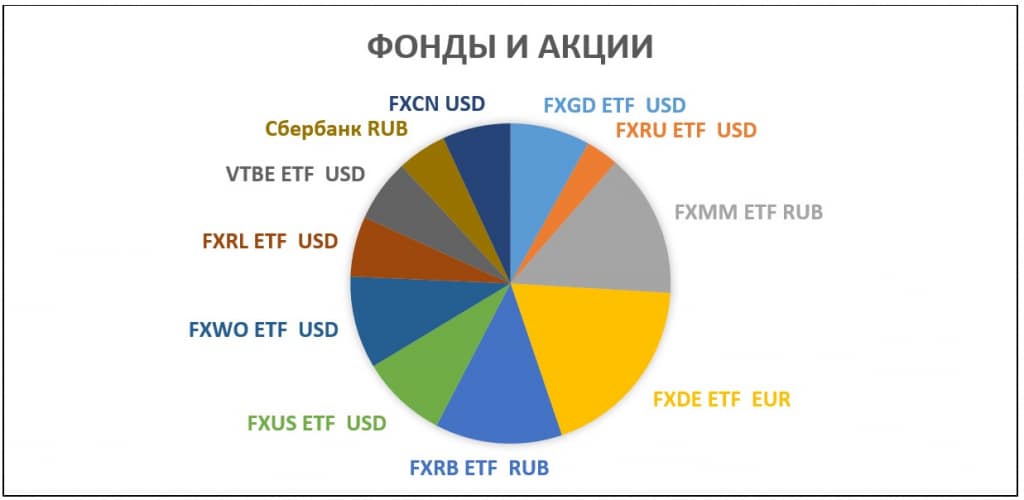

- FXMM is a US money market fund investing in short US bonds for 1-3 months.

This fund is analogous to a demand deposit. A distinctive feature is that its graph is a straight line directed upwards at an angle of 45 degrees.

- BPIF RFI “VTB – Equity Fund of Developing Countries” (VTBE ETF) . To diversify, we will add to the portfolio an asset investing in developing countries.

In the ETF screener, select all assets that are invested in mixed assets. Let’s focus on vtbe etf. This fund invests in assets of developing countries through the purchase of foreign etf ISHARES CORE MSCI EM. Investments in this fund will ensure diversification across countries. At the same time, the fund’s commission is only 0.71%. When buying through a VTB broker, there is no exchange commission.

- VTBH ETF . Now, to reduce portfolio volatility, let’s add bonds. VTBH ETF provides an opportunity to invest in high yield US bonds. To do this, the exchange-traded fund buys shares of a foreign ETF ISHARES HIGH YIELD CORP BOND.

- DIVD ETF – the exchange-traded fund follows the RF Dividend Stock Index. The index includes 50% of the best shares of the Russian Federation in terms of: dividend yield, dividend stability, issuance quality. Due to the payout of dividends and the quality of business models, higher returns are expected than for the broad stock market (average annual return from March 2007 to date 15.6% versus 9.52% for the broad stock market)

- For investments in the American stock market, TECH (invests in the American NASDAQ 100 index) from Tinkoff Investments and FXUS , which repeats the dynamics of the broad US stock market SP500 , are best suited.

- Also noteworthy is the TGRN ETF from Tinkoff Investments . Average annual yield at the level of 22% per annum. The fund invests in leading green technology companies around the world.

- ETF FXRL is an index fund that follows the dynamics of the Russian RTS index. Given that the RTS is a dollar-denominated index, etf provides some protection against currency fluctuations. With the growth of the dollar, the RTS index grows stronger than the MICEX. The received dividends are reinvested in the fund’s shares. The fund pays 10% dividend tax.

- To guard against inflation, add gold etf like FXGD . The fund’s commission is only 0.45%. The Fund monitors the price of physical gold in the global market as accurately as possible, and allows it to protect itself from inflation without VAT.

- In addition, you should pay attention to ETFs that follow the All Weather / Perpetual Portfolio strategy – etf opnw from Opening Broker or TUSD ETF from Tinkoff Investments . The fund has diversification inside, the investor does not need to make additional efforts. The managers invest in equal shares in stocks, bonds, gold. Etf opnw also invests in US real estate funds.

For holders of brokerage accounts, this type of ETF, although very convenient, is too expensive. Better to take a little time and put together an ETF portfolio yourself. Over the period of 20 years, even insignificant 0.01-0.05% commission turns into tangible amounts.

When choosing the most promising ETFs, you should try to think more globally. Investment results of the last two years do not guarantee the same success in the future. Investing in stocks that have shown explosive growth may turn out to be unprofitable over the next few years. The sector may be overheated and then pause. Investing in a broad index is more profitable because the composition of the index is constantly changing. Weak companies are being replaced by strong ones. Many of the companies included in the SP500 index were no longer on the market 10 years ago, but the dynamics of the index did not suffer from this. One should strive to think more globally, not look at the current dynamics of the fund, try to choose less risky and more diversified solutions. Having identified the most promising ETFs in each asset class,where the investor wants to invest money should be allocated for each share. It is recommended to adhere to the following proportions:

- 40% of the portfolio is allocated for the purchase of the stock . For diversification, stocks are divided by country and industry. Each type of ETF is allocated an equal share within this group;

- 30% – bonds . This will reduce the overall return on the portfolio, but at the same time reduce the volatility of the brokerage account. That will have a positive effect on the investor’s nervous system during difficult periods;

- 10% of the portfolio are investments in gold . Conditionally protective part of the portfolio. Perhaps later, this part of the portfolio can be replaced by investments in cryptocurrencies;

- 20% – promising areas – high-tech stocks, investments in green companies for promising rapid growth.

ETF Guide – 15 main questions: what are ETF funds, how they work, how to make money on them: https://youtu.be/I-2aJ3PUzCE Investing in ETFs implies regularity and long term. It is convenient to replenish your portfolio every month – the well-known postulate “pay yourself first”. When replenishing, you should adhere to the chosen strategy, observe the proportions of assets. Some assets will fall in value, while their share in the portfolio will decline. Other assets will rise in value, and their share will grow. You should not try too carefully to observe the proportions – deviations of 5-10% are within the normal range. There are two ways to maintain the proportions – selling assets that have risen in price and buying those that are lagging behind. Or only the purchase of those lagging behind due to replenishment. Do not sell until the investment objectives are achieved.Which of these two methods will be chosen is not so important. It is important to choose an investment method to follow it. With the constant purchase of lagging assets and the sale of assets that have shown growth, the investor always buys at the bottom and sells at the top. At the same time, he will not determine the most favorable prices, but on average the portfolio will show positive dynamics over a long period of time, and this is the most important thing.