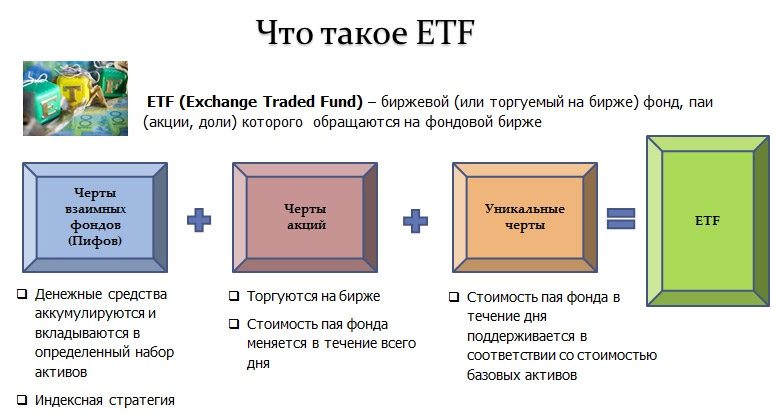

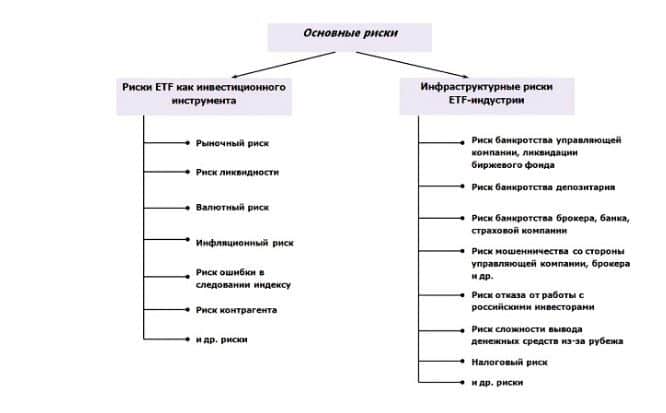

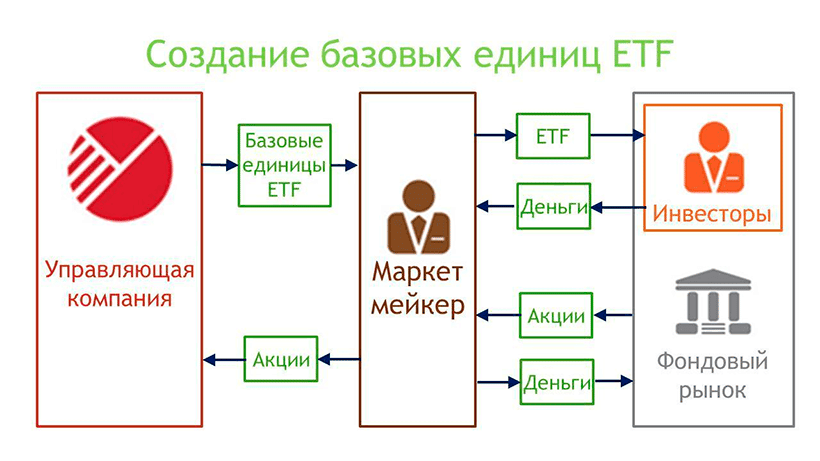

Exchange-traded ETF fund – deɛn ne no wɔ nsɛmfua a ɛnyɛ den mu fa complex no ho.ETFs (sika a wɔde sesa sika) yɛ ɔkwan bi a wɔfa so de sika hyɛ mu a wɔbom yɛ. Sɛ wotɔ sikakorabea a ɛte saa no mu kyɛfa de gye ruble 4,000 pɛ a, wobɛyɛ obi a wowɔ kyɛfa ketewaa bi wɔ nnwumakuw te sɛ Microsoft, Apple, MasterCard, Tesla, Facebook, Google, McDonald’s ne afoforo pii mu. VTI sikakorabea a ɛwɔ nneɛma ahorow pii no mu bi ne sika bɛboro 3,900. Sɛnea ɛbɛyɛ na wɔasan ayɛ nneɛma ahorow a ɛte saa wɔ wɔn akontaabu mu no, ankorankoro bi a wɔde wɔn sika bɛto mu no behia sika kɛse dodo. Wɔ inverter dodow no ara fam no, saa diversification yi nni hɔ. Sika ahorow a wɔde index exchange di gua a ɛyɛ wiase index ahorow, aguade ne dade a ɛsom bo sikakorabea ahorow, ETF ahorow a wɔde yɛ bonds ne sika gua so nnwinnade no mu kyɛfa a wɔahyehyɛ ne ne fã ahorow no ho mfonini pɛpɛɛpɛ wɔ hɔ. Sika ahorow bɛboro 100 na wɔde sesa nneɛma wɔ U.S. gua so a ɛde akwan horow di dwuma. Nhwɛsoɔ,

Ray Dalio ” (sika a wɔde hyɛ stocks, bonds ne sika kɔkɔɔ mu a ɛnkari pɛ bere ne bere mu), sika a wɔde hyɛ aman pɔtee bi fã pɔtee bi mu kyɛfa mu.” Ɛdenam ETF sikakorabea mmoa so no, wubetumi aboaboa sikakorabea ahorow a ɛsono emu biara ano sɛnea nnwuma ne ɔman a wɔde wɔn sika ahyɛ mu no te a wode sika ketewaa bi a wode bɛto hɔ. ETF ahorow a wɔhwɛ so a ɛnyɛ adwuma wɔ hɔ a edi index anaa aguade bi mu nkɔso akyi pɛpɛɛpɛ, ne sika a wɔhwɛ so a ɛyɛ nnam, a sika a wonya ne sika a wɔtwe fi mu no yɛ nea adwuma so ahwɛfo na wɔhwɛ so. Sika a wɔtaa de di dwuma ne passive management – wɔwɔ fees a ɛba fam na wɔn dynamics nnyina onipa factor so.

Nsonsonoe a ɛda ETF ne mutual funds ntam

Russiafo analogue a ɛwɔ ETF no yɛ mutual fund (mutual investment fund). Ɛmfa ho sɛ nsɛdi ahorow no, nsonsonoe ahorow bi wɔ hɔ

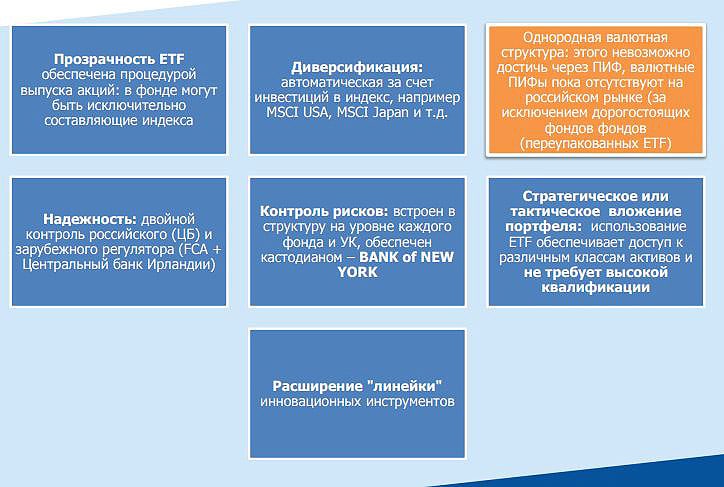

- Wɔde ɔkwan a wɔabue ano na ɛhwɛ ETF dodow no ara so wɔ ɔkwan a ɛnyɛ adwuma so . Eyi ma nea ɔde sika no ahyɛ mu no nya mfaso, efisɛ ɛda adi pefee sɛ nnwinnade bɛn na wɔde sika no hyɛ mu wɔ dodow ahe mu. Obi a ɔde ne sika hyɛ mu betumi anya awerɛhyem sɛ sɛ ɔde ne sika reto ETF ahorow mu de hwehwɛ sika kɔkɔɔ a, ne sika a ɔde bɛto mu no bɛsan ayɛ dade a ɛsom bo no ahoɔden no pɛpɛɛpɛ.

- Mutual investment funds yɛ sikakorabea ahorow a wɔde di dwuma denneennen . Sikasɛm mu aba no gyina ɔpanyin no nneyɛe ne mfomso ahorow so kɛse. Tebea ankasa ne bere a mutual fund no mu nkɔso yɛ bɔne wɔ nantwinini gua a ɛyɛ den mu no. Nanso wɔ gua no asehwe mu no, ebia sika a wɔde boa wɔn ho wɔn ho no bɛyɛ papa asen gua no.

- ETFs bɛma wo kwan ma woaboaboa portfolio ahorow ahorow ano , sɛnea ɔman, nnwuma anaa nhyehyɛe te.

- ETF ahorow no tua kyɛfa sɛ wɔde index no mu kyɛfa a wodi akyi no tua wɔn a. Mpɛn pii no, wɔsan de sika a wɔde bɛkyɛ no hyɛ mu sɛnea na ɛte kan no.

- Wɔde ETF ahorow di gua wɔ aguadidan bi so , na obi a ɔyɛ gua so nneɛma kɔ so kura sika a wɔde di dwuma no mu. Ɛho nhia sɛ wo ne adwumakuw a ɛhwɛ so no di nkitaho na woatɔ biribi. Ɛdɔɔso sɛ wubenya brokerage akontaabu wɔ broker biara a ɔwɔ tumi krataa no nkyɛn.

- ETF commissions no so tew mpɛn pii sɛ wɔde toto mutual funds ho a .

ETF ahorow ahorow

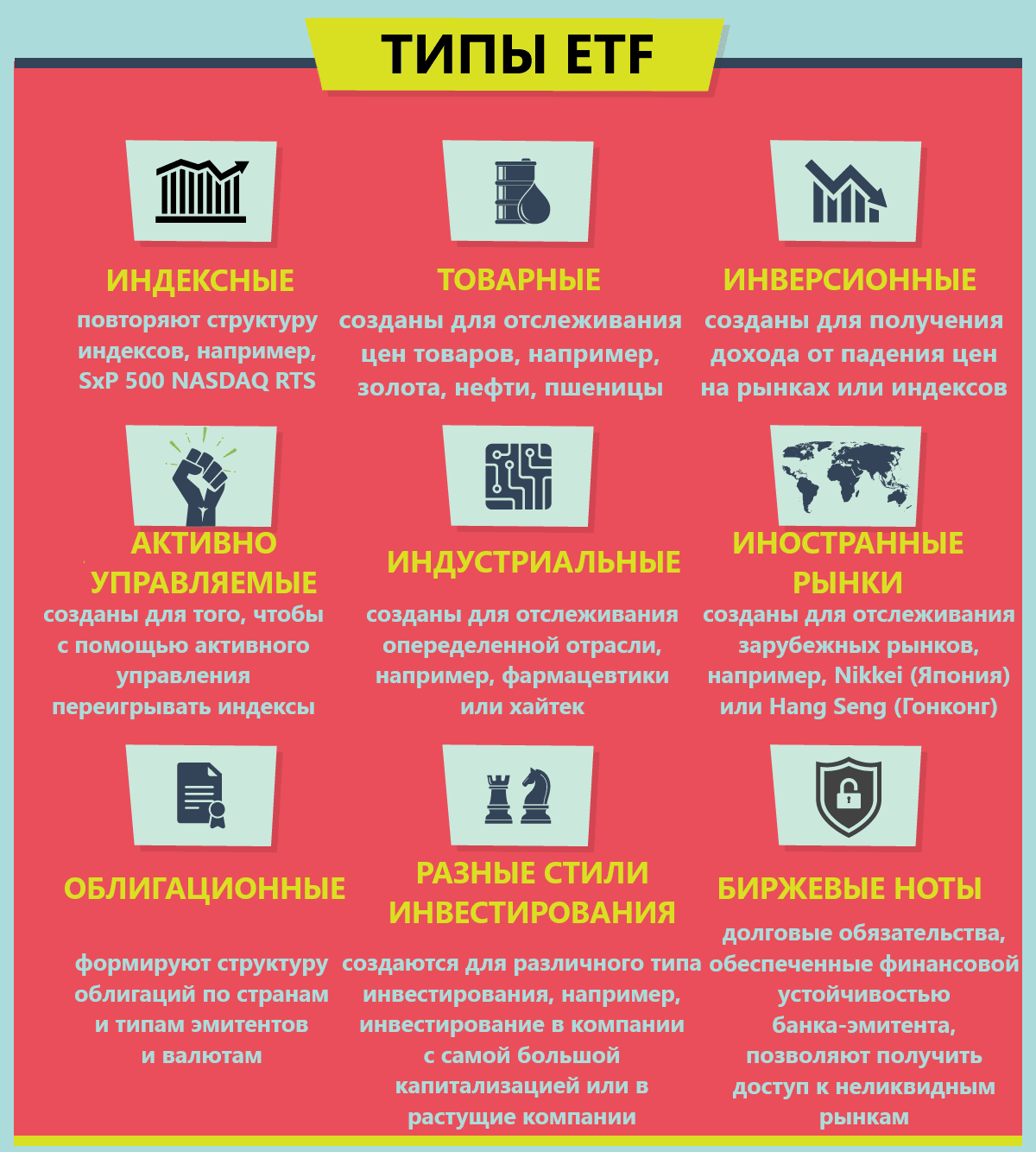

Wobetumi akyekyɛ ETF ahorow a ɛwɔ hɔ dedaw no mu akuw a edidi so yi:

- Sɛnea ɔman biara te – wɔ U.S. sikakorabea no so no, sika bi wɔ hɔ a ɛde sika hyɛ aman a ɛkame ayɛ sɛ sikakorabea wɔ hɔ nyinaa mu. ETF ahorow a ɛsono emu biara wɔ hɔ ma ɔman yi index biara.

- Sɛnea sikasɛm mu nnwuma ahorow kyerɛ no – ETF ahorow wɔ hɔ ma sikasɛm mu nnwuma pɔtee bi, baabi a wɔboaboa ɔman a wɔreka ho asɛm no sikasɛm fã pɔtee bi kyɛfa ano. Ebia obi a ɔde ne sika hyɛ mu rentɔ index no nyinaa, na mmom ɔde ne sika bɛto nnwuma a ɛhyɛ bɔ nkutoo mu wɔ n’adwene mu.

- Wɔ sikasɛm mu nnwinnade ho – wobetumi akyekyɛ ETF ahorow ama stocks, bonds, sika gua so nnwinnade (bere tiaa mu bonds a ɛkɔ asram 3), sika ETFs, ETFs ama dade a ɛsom bo, mfiridwuma mu nneɛma, adan ne afie.

ETF wɔ MICEX so

ETF ahorow bɛboro 1,500 na ɛwɔ NYSE no so.

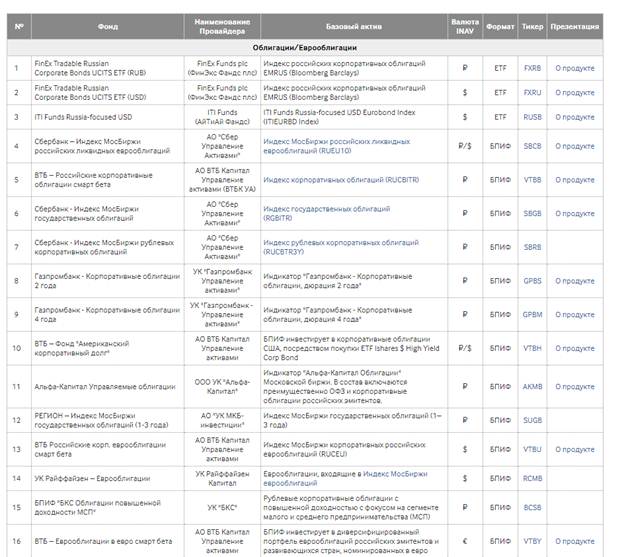

Moscow Exchange no de ETF ahorow a ɛyɛ mmerɛw kɛse ma Russiafo a wɔde wɔn sika hyɛ mu no (etf pii wɔ hɔ a wobetumi atɔ ama wɔn a wɔde wɔn sika hyɛ mu a wɔfata nkutoo). Mprempren, ETF ne BIF 128 na ɛwɔ Moscow Exchange no so. Finex de ETF ahorow a edidi so yi ma:

- FXRB – Index a ɛkyerɛ Russia nnwumakuw nkrataa a wɔde rubles ayɛ.

- FXRU – Index a ɛkyerɛ Russia nnwumakuw nkrataa a wɔde dɔla ayɛ.

- FXFA yɛ aman a wɔanya nkɔso no nnwumakuw nkrataa a ɛma wonya sika pii ho kyerɛwtohɔ.

- FXIP – U.S. aban bonds, a ɛwɔ inflation ahobammɔ a ruble hedge, denominated wɔ rubles.

- FXRD – dɔla a ɛma wonya sika kɛse, nhwɛso – Solactive USD Fallen Angel Issuer Capped Index.

- FXKZ – sikakorabea no de sika to Kazakhstan kyɛfa mu.

- FXRL yɛ sika a wɔde ahyɛ Russia RTS index mu.

- FXDE yɛ sika a wɔde hyɛ Germany sikakorabea.

- FXIT yɛ sika a wɔde ahyɛ Amerika mfiridwuma mu.

- FXUS yɛ sika a wɔde ahyɛ U.S. SP500 index mu.

- FXCN yɛ sika a wɔde ahyɛ Chinafo sikakorabea.

- FXWO yɛ sika a wɔde ahyɛ wiase nyinaa gua so kyɛfa mu, ne portfolio no mu kyɛfa bɛboro 500 a efi aman akɛse 7 a ɛwɔ wiase no mu ka ho.

- FXRW yɛ sika a wɔde hyɛ U.S. sikakorabea ahorow a ɛwɔ sika kɛse mu.

- FXIM yɛ sika a wɔde ahyɛ U.S. IT adwumayɛkuw mu.

- FXES – kyɛfa a ɛwɔ U.S. nnwumakuw mu wɔ agodie adwuma ne eSports mu.

- FXRE yɛ sika a wɔde hyɛ U.S. adan ne afie ho sikakorabea ahorow mu.

- FXEM – sika a wode beto aman a afei na wɔrenya nkɔsoɔ no kyɛfa mu (gye China ne India).

- FXGD yɛ sika kɔkɔɔ a wɔde hyɛ mu.

Mprempren Finex nkutoo ne adwumakuw a ɛde ETF sika a wɔde bɛto mu ma Russia aguadifo.

Nneɛma a ɛte saa ara wɔ hɔ a efi Sberbank, VTB, BCS, Finam, Alfa Capital,

Tinkof Investments , Aton ne afoforo. Nanso wɔn nyinaa yɛ BPIF dea. Nnwumakuw pii a wɔhwɛ so no de nneɛma a ɛte saa ara ma (sikakorabea a edi gua so nkyerɛkyerɛmu a ɛtrɛw

SP500 akyi no, Sberbank, Alfa Capital ne VTB na egyina hɔ ma). Ɛkame ayɛ sɛ nneɛma a ɛrekɔ so no yɛ pɛ, nanso sikakorafo a wɔtɔɔ Finex kyɛfa no nyaa mfaso kakra esiane sika a wɔde mae a ɛba fam nti. Ade bi a ɛwɔ ETF a ɛwɔ Moscow Exchange no mu ne sɛ ETF no sika yɛ dɔla, na sɛnea ɛbɛyɛ a wobetumi atɔ ETF a ɛte saa no, wodi kan dannan rubles a efi akontaabu no mu ma ɛyɛ dɔla. Ɛwɔ hɔ etf denominated wɔ rubles (a sika hedge), denam wɔn a wobenya so no, investor no bɔ ho ban fi ahuruhuruw wɔ dɔla no mu kɔ ruble sikasesɛw mu.

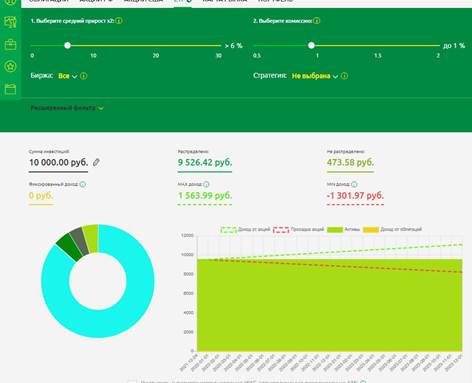

Nnyinasosɛm a ɛne sɛ wɔbɛhyehyɛ ETF portfolio

Ɛkame ayɛ sɛ sika a wɔde hyɛ index sikakorabea ahorow mu a wɔnyɛ hwee no te sɛ nea sika so ahwɛfo a wɔakɔ pɛnhyen yɛ no ara pɛ. Sikasɛm horizon no ho hia – ɛnsɛ sɛ wobɔ mmɔden sɛ wobɛboaboa ETF portfolio ano mfe 1-2. Postulate titiriw a ɛfa sika a wɔde bɛto ETFs mu ne sika a wɔde hyɛ mu daa, a gua so tebea mfa ho. Sɛ wopɛ sɛ wopaw ETF ahorow a ɛfata a, Moscow Exchange wɛbsaet no bɛboa nea ɔde ne sika ahyɛ mu no, baabi a wubetumi ahu sika a wɔde sesa nneɛma a wɔde di gua nyinaa din – https://www.moex.com/msn/etf. [caption id="attachment_12049" ahyɛnsodeɛ="ahyɛnsodeɛ mfimfini" ntrɛmu="624"].

- FXMM yɛ U.S. sika gua so sikakorabea a ɛde sika hyɛ U.S. nkrataa tiawa mu bosome 1-3.

Saa sikakorabea yi ne sika a wɔde sie a wɔhwehwɛ no di nsɛ. Ade a ɛda nsow ne sɛ ne mfonini no yɛ nsensanee tẽẽ a wɔde kyerɛ soro wɔ anim a ɛyɛ digrii 45.

- BPIF RFI “VTB – Aman a Wɔrenya Nkɔso no Sikakorabea” (VTBE ETF) . Sɛ yɛbɛma nneɛma ahorow agu ahorow a, momma yɛmfa agyapade bi a ɛde sika hyɛ aman a afei na wɔrenya nkɔso mu no nka sikakorabea no ho.

Momma yɛnpaw wɔ ETF screener no mu nyinaa agyapade a ɛde sika hyɛ agyapade a wɔadi afra mu. Momma yɛmfa yɛn adwene nsi vtbe etf so. Saa sikakorabea yi de sika to aman a afei na wɔrenya nkɔsoɔ no agyapadeɛ mu denam amannɔne etf ISHARES CORE MSCI EM a wɔbɛtɔ so. Sika a wɔde bɛto sikakorabea yi mu no bɛma wɔanya nneɛma ahorow wɔ aman ahorow mu. Bere koro no ara mu no, sikakorabea no commission yɛ 0.71% pɛ. Sɛ wofa VTB broker so tɔ a, sika biara nni hɔ a wɔde sesa nneɛma.

- VTBH ETF a ɛwɔ hɔ no . Afei, sɛ yɛbɛtew portfolio no mu nsakrae so a, momma yɛmfa bonds nka ho. VTBH ETF ma wonya hokwan de sika hyɛ U.S. bonds a ɛma wonya sika pii mu. Sɛnea ɛbɛyɛ a wɔbɛyɛ eyi no, sikakorabea a wɔde sikasesa di gua no tɔ amannɔne ETF ISHARES HIGH YIELD CORP BOND no mu kyɛfa.

- DIVD ETF – sikakorabea a wɔde sikasesɛw di gua di Russia Ɔman no mu kyɛfa a wɔde ma no ho nkyerɛkyerɛmu no akyi. Index no ka 50% a eye sen biara wɔ Russia Ɔman no mu wɔ: kyɛfa aba, kyɛfa a ɛbɛgyina pintinn, nea ɔde mae no su. Esiane sɛ wotua kyɛfa ne adwumayɛ ho nhyehyɛe ahorow no yiye nti, wɔhwɛ kwan sɛ wobenya mfaso kɛse asen sika a wɔde di dwuma wɔ gua a ɛtrɛw no mu (sɛ wɔkyekyem pɛpɛɛpɛ a, afe afe mfaso a wonya fi March 2007 de besi nnɛ no yɛ 15.6% hyia 9.52% ma sika a wɔde di dwuma wɔ gua a ɛtrɛw no mu)

- Wɔ sika a wɔde bɛto U.S. sikakorabea gua so no, TECH (de sika hyɛ U.S. NASDAQ 100 index mu) a efi Tinkoff Investments ne FXUS , a ɛsan yɛ nneɛma a ɛkɔ so wɔ U.S. sikakorabea a ɛtrɛw SP500 no mu no fata yiye.

- Adwene nso fata sɛ TGRN ETF a efi Tinkoff Investments hɔ . Sɛ wɔkyekyɛ mu a, afe biara aba a wonya no yɛ 22% afe biara. Sikakorabea no de sika hyɛ mfiridwuma mu akannifo a wɔn ho tew mu wɔ wiase nyinaa.

- ETF FXRL yɛ index sikakorabea a edi Russia RTS index no nkɔso akyi. Esiane sɛ RTS yɛ dɔla nkyerɛkyerɛmu nti, etf de ahobammɔ bi ma wɔ sika a ɛsakrasakra ho. Bere a dɔla no renya nkɔanim no, RTS index no nyin denneennen sen MICEX no. Wɔsan de sika a wonya no mu kyɛfa no hyɛ sikakorabea no kyɛfa mu. Fund no tua tow wɔ kyɛfa a wonya no ho a ɛyɛ 10%.

- Sɛnea ɛbɛyɛ a wobɛbɔ wo ho ban afi nneɛma bo a ɛkɔ soro ho no, ɛsɛ sɛ wode sika kɔkɔɔ etf ka ho, sɛ nhwɛso no, FXGD . Sikakorabea no commission no yɛ 0.45% pɛ. Fund no di honam fam sika kɔkɔɔ bo a ɛwɔ wiase nyinaa gua so no akyi pɛpɛɛpɛ sɛnea ɛbɛyɛ yiye biara, na ɛma wo kwan ma wobɔ wo ho ban fi nneɛma bo a ɛkɔ soro ho a wontua VAT.

- Afei nso, hwɛ ETF ahorow a edi All Weather/Perpetual Portfolio nhyehyɛe akyi – etf opnw a efi Otkritie Broker anaa TUSD ETF a efi Tinkoff Investments . Sikakorabea no wɔ diversification wɔ mu, enhia sɛ investor no bɔ mmɔden foforo. Adwuma so ahwɛfo de wɔn sika hyɛ stocks, bonds, sika kɔkɔɔ mu pɛpɛɛpɛ. Etf opnw nso de sika hyɛ U.S. adan ne afie ho sika mu.

Wɔ brokerage akontaabu wuranom fam no, ɛwom sɛ saa ETF yi yɛ mmerɛw yiye de, nanso ne bo yɛ den dodo. Ɛyɛ papa sɛ wubegye bere kakra na w’ankasa woakyekye ETF portfolio. Wɔ mfe 20 mu no, 0.01-0.05% a wɔde ma a ɛho nhia mpo dan sika a wotumi hu.

Sɛ worepaw ETF ahorow a ɛhyɛ bɔ sen biara a, ɛsɛ sɛ wobɔ mmɔden sɛ wubesusuw wiase nyinaa ho kɛse. Nea afi sika a wɔde asie mu aba wɔ mfe abien a atwam no mu no nkyerɛ sɛ daakye bɛyɛ yiye saa ara. Ebia sika a wɔde bɛto sikakorabea ahorow a ada no adi sɛ ɛrenya nkɔso ntɛmntɛm no bɛyɛ nea mfaso nni so wɔ mfe kakraa a edi hɔ no mu. Ebia ɔfã no bɛyɛ hyew dodo na afei wagye n’ahome. Sika a wɔde bɛto index a ɛtrɛw mu no yɛ nea mfaso wɔ so kɛse efisɛ sɛnea wɔahyehyɛ index no mu no sakra bere nyinaa. Wɔde nnwumakuw a ɛyɛ den si nnwumakuw a ɛyɛ mmerɛw ananmu. Nnwumakuw pii a wɔde wɔn kaa SP500 index no ho no nni gua so bio mfe 10 a atwam ni, nanso index no mu nkɔso no anhu amane wɔ eyi ho. Ɛsɛ sɛ wobɔ mmɔden sɛ wubesusuw wiase nyinaa ho kɛse, na ɛnyɛ sɛ wobɛhwɛ mprempren nkɔso a ɛwɔ sikakorabea no mu, bɔ mmɔden sɛ wobɛpaw ano aduru a asiane nnim na egu ahorow pii. Bere a yɛahu ETF ahorow a ɛhyɛ bɔ sen biara wɔ agyapade kuw biara mu no, . baabi a ɔdefo no pɛ sɛ ɔde sika gu mu no, ɛsɛ sɛ wɔkyekyɛ sika ma ne kyɛfa no mu biara. Wɔkamfo kyerɛ sɛ ɛsɛ sɛ wodi nneɛma a edidi so yi so:

- Wɔde sikakorabea no mu 40% ma sɛ wɔmfa ntɔ kyɛfa . Sɛnea ɛbɛyɛ a wɔbɛma nneɛma ahorow ahorow no, wɔkyekyɛ nneɛma a wɔde asie mu no mu sɛnea ɔman ne nnwuma te. Wɔma ETF ahorow biara kyɛfa a ɛyɛ pɛ wɔ kuw yi mu;

- 30% – nkitahodi ahorow . Eyi bɛtew mfaso a ɛwɔ sikakorabea no nyinaa so, nanso bere koro no ara mu no, ɛbɛtew brokerage akontaabu no mu nsakrae so. Nea ɛbɛka nea ɔde ne sika ahyɛ mu no ntini nhyehyɛe no yiye wɔ mmere a emu yɛ den mu;

- 10% wɔ portfolio no mu – sika kɔkɔɔ a wɔde bɛto mu . Nsɛm bi a ɛbɔ ho ban a ɛwɔ portfolio no mu. Ebia akyiri yi wobetumi de sika a wɔde bɛto cryptocurrencies mu asi portfolio no fã yi ananmu;

- 20% – mmeae a ɛhyɛ bɔ – mfiridwuma a ɛkorɔn stocks, sika a wɔde hyɛ nnwumakuw “green” mu ma nkɔso ntɛmntɛm ho bɔhyɛ.

ETF akwankyerɛ – Nsɛmmisa titire 15: dɛn ne ETF sika, ɔkwan bɛn so na ɛyɛ adwuma, sɛnea wonya sika wɔ ho: https://youtu.be/I-2aJ3PUzCE Sika a wode bɛto ETF mu no kyerɛ sɛ wɔyɛ no daa ne bere tenten. Ɛyɛ mmerɛw sɛ wobɛsan ahyɛ portfolio no ma ɔsram biara – postulate a wonim no yiye “tua wo ho ka kan.” Sɛ woresan ahyɛ mu ma a, ɛsɛ sɛ wudi ɔkwan a woapaw no so, hwɛ agyapade no fã ahorow. Agyapade binom bo bɛkɔ fam, bere a wɔn kyɛfa wɔ sikakorabea no so bɛtew. Agyapade afoforo bo bɛkɔ soro, wɔn kyɛfa bɛkɔ soro. Ɛnsɛ sɛ wobɔ mmɔden yiye dodo sɛ wobɛkora nsusuwii ahorow no so – deviations a ɛyɛ 5-10% no wɔ nea ɛfata no mu. Akwan mmienu na woafa so akura nsusuie mu – woatɔn agyapadeɛ a ne boɔ akɔ soro na woatɔ deɛ aka akyi no. Anaasɛ wɔbɛtɔ wɔn a wɔaka akyi esiane sɛ wɔde nneɛma foforo ahyɛ mu ma nti no ara kwa. Ntɔn kosi sɛ wubedi botae ahorow a ɛfa sika a wode bɛto mu no ho. Akwan abien yi mu nea ɛwɔ he na wɔpaw no ho nhia saa. Ɛho hia sɛ wopaw ɔkwan a wobɛfa so de sika ahyɛ mu a wode bedi akyi. Esiane sɛ wɔsan tɔ nneɛma a aka akyi bere nyinaa na wɔtɔn agyapade a ada nkɔso adi nti, bere nyinaa nea ɔde ne sika hyɛ mu no tɔ nneɛma wɔ ase na ɔtɔn wɔ soro. Bere koro no ara mu no, ɔrenkyerɛ nneɛma bo a eye sen biara, nanso sɛ wɔkyekyem pɛpɛɛpɛ a, portfolio no bɛda nkɔso pa adi wɔ bere tenten mu, na eyi ne ade a ɛho hia sen biara.