The article was created as a compilation of popular posts about loans in the OpexBot telegram channel . Added and improved. In the Telegram channel you can study the opinion of Russians on this matter. And we will continue. Credit is primarily a tool. Like any tool, you need to be able to use it and understand what it is for. It is important to understand when you can take it, when you can’t, and how to repay the borrowed funds.

- Don’t take or give a loan until you understand this

- Pay off the loan with liabilities

- Last minute tour to credit slavery

- Let’s figure it out, let’s do the math

- Don’t take out a loan for a vacation

- There is a sweet pill

- See the reefs and not drown in debt

- A loan can help fix the cost of a trip

- A vacation loan can be considered an investment

- There is a clear plan for repaying the loan taken out for vacation

- Save up, go on vacation and not go crazy

- Accumulation

- Thinking like an investor

- Saving

- How to repay loans as quickly and efficiently as possible

- Snowball

- snow avalanche

- Which is more effective?

Don’t take or give a loan until you understand this

You should not pay off debt obligations with assets that yield more per annum than the interest on the loan. This could be bonds, deposits, dividends, business. There is no need to urgently withdraw money from a brokerage account, sell a business, or close a deposit. This is how a business works when it takes out a loan for development. When it pays interest on income. And has additional profit.

Pay off the loan with liabilities

A loan is often taken out against them. Treat loans and life like a business. If there is a liability against which the loan was taken, and it weighs on you, then sell it and close it. For example, a car or a phone that was taken out of emotion. From here we can draw the opposite conclusion. Taking out a loan to fix your problem is a mistake. Most often this is done by people who a) do not want to use their brains to solve problems; b) are accustomed to living beyond their means; c) they like to show off.

A car, a TV, a larger apartment – these are all liabilities.

You can take out a loan for production needs. If the business model implies a higher profitability than the interest rate. In this case, you invest in a business that will generate much more for you.

Last minute tour to credit slavery

If you ever feel stupid, think about those who took out a loan for a vacation, or for a wedding.

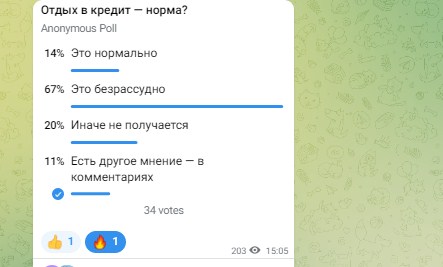

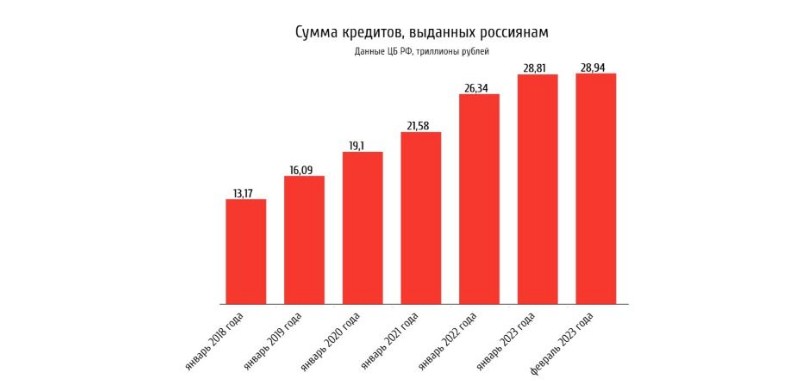

The quintessential shortsightedness is taking out a loan for your honeymoon. Having an unpaid debt for the wedding celebration itself. But what do our readers think about vacation loans:  Interesting statistics:

Interesting statistics:

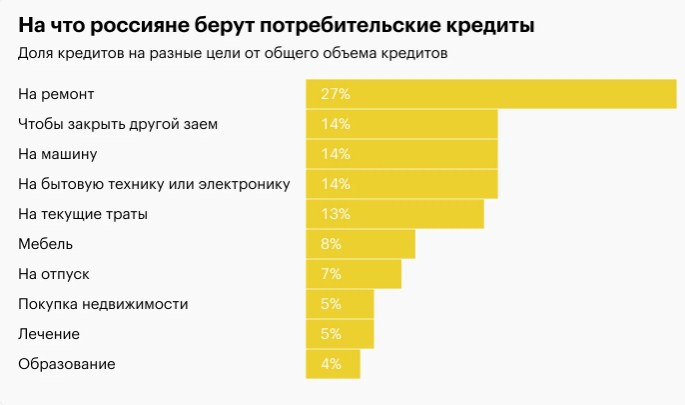

- Point 1. Every fifth Russian goes on vacation on credit. Credit cards and cash loans are popular.

- Point 2. Vacation loans most often turn into problem debts. Because such loans are often emotionally charged.

Everyone needs to rest so that the cuckoo doesn’t sound the all-clear. But you need to rest the way you earned it – on your own. At the stage of capital accumulation, I took a car, a tent and went to the sea, the river, or to an inexpensive holiday home. Fortunately, there are so many beautiful places in the Russian Federation.

No one has canceled domestic tourism. Now, according to statistics, 70 million Russians travel within the country.

Vacation is about emotions, and emotions depend primarily on us and how we feel about ourselves. Is it better to have a cool rest on the river bank with peace of mind? Or take out a loan for 300k at 20% and, while drinking an over-sweetened cocktail in Turkey, think about how to give it back? A rhetorical question.

Let’s figure it out, let’s do the math

We immediately dismiss microfinance organizations with 40-50% per annum. It’s taboo. Consumer loan from a bank: 20-30%, which is also very expensive. I took 100k, 10k a month payment. Overpayment up to 24k. But as an option. Credit card . There are credit cards with no interest rate. But these have many nuances with service, commissions, additional conditions and fines. And the more transparent the terms on a credit card, the higher the interest rate. From 20-30% and above. If you have already decided, study the conditions as closely as possible, all the “stars and sub-stars”. You shouldn’t open a limit of 300k with a salary of 50k. I think this is clear? ⁉ Targeted vacation loan. The advantage is that interest rates are lower. But the tour can only be taken from a partner company and for clearly defined purposes: tickets, room, excursion.

Don’t take out a loan for a vacation

But if there is such a task, carefully compare the offers. Sometimes a consumer loan turns out to be more profitable than the tour operator’s offer. Use a loan calculator. Then study the pitfalls of each individually. They definitely will.

Always have a backup plan. What will you do if the credit card does not work in Turkey?

But in general, this is a special perverted form of masochism – to exchange two weeks of positive emotions for 2 years of credit slavery.

There is a sweet pill

There are options and situations when you can take out a vacation loan. Sometimes it’s even necessary! When, why and how to do it correctly, I’ll tell you further.

See the reefs and not drown in debt

So, when might a holiday loan be a good idea?

A loan can help fix the cost of a trip

If you know exactly where and when you will be vacationing, you can fix a favorable price for tickets and accommodation in advance. A situation where there is no money, but there will be soon, and the tour needs to be taken here and now on the cheap.

A vacation loan can be considered an investment

Let me explain: there is a big difference between taking out a loan (in our case for a vacation) when you have no money and when you have plenty of it.

When you have money, but you don’t want to take the cash out of your assets: investments, business. Let’s say you have 500k rubles in securities at a 2% yield per month. That’s 10k a month. So why would you take cash out of them if you can pay interest on 5k rubles.

There is a clear plan for repaying the loan taken out for vacation

And a credit card option was found on which you don’t have to pay interest. For example, there is a protection period, which in some banks can be 30-60 days. Some also return cashback from the trip back to the card. Grace period and other conditions vary from day to day. Needs to be monitored carefully.

But I am categorically against taking such a vacation with the thought: someday I will cry.

But in my opinion, it’s better to save money for a vacation. Not necessarily in the cache. To prevent inflation from looting. You can save in a separate deposit so that the penny drips. Or invest in OFZs, for example, just in time for next summer and the coupons will be available and can be sold. You can save up in 10 months without damaging your budget with any income level. How? I’ll tell you further.

Save up, go on vacation and not go crazy

You can save for a vacation without compromising your budget and lifestyle. A set of measures that a Russian with an average income or even lower can focus on. Shall we figure it out? Let’s divide all the possibilities into two groups: accumulation and saving.

Accumulation

The first task is to set the goal in a timely manner so that before your vacation in a hurry you do not take out loans and inadequate offers from tour operators. For example, a specific goal is Turkey 6/7 in 5* two adults and a child for 60k rubles. We factor in inflation, the ruble exchange rate and other risks. We get 80k that we need to save up in a year for a vacation in August 2024. That is, we need to save about 6,700 rubles a month. Saving 10-15% of the income of those who later travel is a workable option in which most people will not notice a deterioration in their lifestyle. Is it less than the required amount? For example, with a salary of 40,000, it will be possible to save 4,000. ?

Thinking like an investor

We use short-term OFZs. The yield is higher than that of deposits. The increase in capital in the form of coupons will be insignificant, but stable. In a year, the securities can be sold and inflation will be leveled out. It is better not to go into highly profitable but risky instruments without knowledge. Demand bonds OFZ-PD and OFZ-n. The latter can be redeemed ahead of schedule at a price no more than the face value and no less than the purchase price. You can open a brokerage account to buy bonds, for example, in FINAM. There you can select a bond according to specified parameters. Set aside 10-15% of all income, not just salary. Bonus, gifts, part-time work. If you can do more, great. What if you organize your life into a permanent vacation. The “work for a year, rest for 14 days” model is gradually becoming obsolete. Lately it’s been turned upside down

Saving

By the way, 6,700 rubles is the approximate cost of 30 packs of cigarettes. Few people quit smoking because of financial issues. But it’s an interesting fact. If you can save 4,000 of the 6,700 you need, find something you can save another 2,700 on. There are a lot of options. I’ll indicate which ones I use. On other amounts, goals and deadlines, but that doesn’t matter. Financial planning . Be sure to keep a spending diary. Paper, electronic on a smartphone, linked to a bank card. It’s a matter of taste, but the choice is wide. There is a chance that you are leaving just 2700 for fast food. Do you need it? Tickets. If you fly on your own, buy tickets 2-3 months in advance. From that part of the budget that will be formed by April 2024. It’s cheaper. Study the routes. For example, a flight through Sochi may be 10-15k cheaper than through Moscow. Simple calculation, mathematics and you already know how to achieve your goal.

It is only important to understand in the end – is this your true goal, or is it just accepted? Maybe it’s worth spending a vacation away from people almost for free, and investing the saved 80k in business, securities, education?

So Türkiye 2024? You can start now. We set our own personal goal. We save, and when it comes out, we save wisely. And in a year we’ll think about what to do with this wealth. Priorities change, but tickets can be returned.

How to repay loans as quickly and efficiently as possible

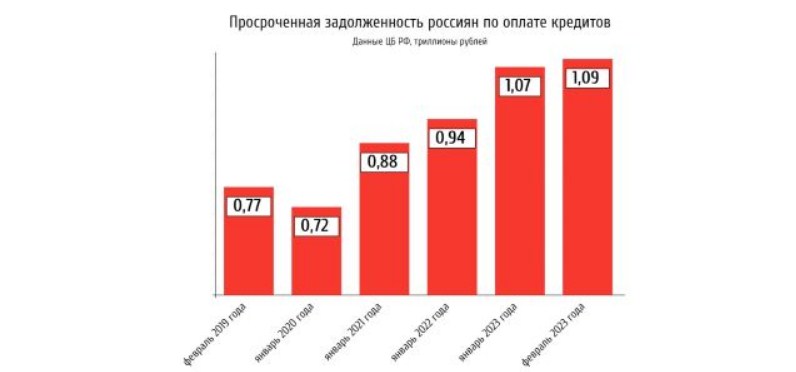

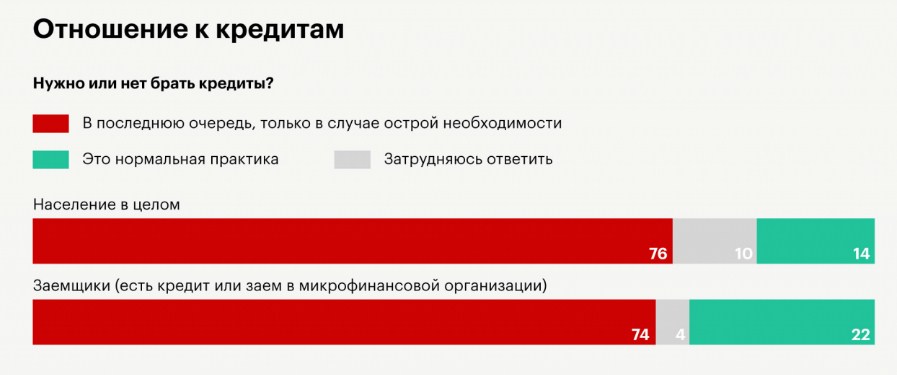

Keep two popular and effective techniques proven by research: snowball and snow avalanche . About 50% of Russians have loans. Many people have more than one loan/debt. The statistics need to be corrected. Is not it?  And what kind of investments can we talk about while you are deeply in debt? The problem is not even with the loans themselves. The problem is that many are trying to extinguish them without a clear strategy. And so they flounder in debt bondage for years, overpaying interest, but not repaying the loan balance.

And what kind of investments can we talk about while you are deeply in debt? The problem is not even with the loans themselves. The problem is that many are trying to extinguish them without a clear strategy. And so they flounder in debt bondage for years, overpaying interest, but not repaying the loan balance.

Snowball

The strategy is to pay off loans from smallest to largest.

The order is determined by the amount owed, not the interest rate.

At the same time, for all but the smallest, the minimum required payment is paid. We throw all our strength into the smallest debt. After closing the smallest debt, we direct all the freed-up resources to closing the second, then the third. What we have. With each closed debt, the psychological burden decreases. And also, like a snowball, the released resource accumulates to work with the body of the loan for larger debts.

snow avalanche

A method of repaying loans in which they are repaid starting with the highest interest rate.

After repaying the loan with the highest interest rate, they move on to the loan with the next highest interest rate. Continue until everything is covered.

Which is more effective?

From a mathematical point of view, the snow avalanche method is more effective. Over time, snowballing pays more interest than the snowball method, which focuses on interest rates. People, for the most part, are not rational creatures. And personal finance is 20% knowledge and 80% behavior. Research shows that people trying to reduce debt need “quick wins” (that is, paying off the smallest debt) to stay motivated to reduce their overall debt. Thus, small goals that are clear how to close are more attractive to most. If psychological things are alien to you and you are a rationalist-mathematician, then you should follow the path of an avalanche. My goal is to plant a seed of truth and reveal understanding of the process. What you definitely shouldn’t do

Hæ, kveðjur frá hinu mikla Illuminati bræðralagi…þessi skilaboð eru til að bjóða þér að vera hluti af okkur og taka þátt í *FRÆGÐ*MÁTTUR*AUÐUR*VERND* og einnig $1.000.000 sem velkomin gjöf, bíl að eigin vali, hús að eigin vali og mánaðartekjur upp á $3.000….svaraðu játandi ef þú hefur áhuga

TELEGRAM@sacredilluminatiunion

NETFANG

sacredilluminatiunion@usa.com

Kæri umsækjandi

Ég er einkalánveitandi og býð upp á óverðtryggð og allar aðrar tegundir lána með mjög hagstæðum vöxtum, aðeins 2%. Við bjóðum upp á eftirfarandi lán: 1. persónulegt lán. 2. viðskiptalán. 3. húsnæðislán. 4. lán til að greiða niður skuldir. 5. fyrirtækjalán. 6. Þú getur einnig haft samband við okkur varðandi aðrar tegundir lána og við munum greiða lánið út á reikninginn þinn á innan við 3 virkum dögum, án tafar. Athugið: bankinn er alltaf tilbúinn að millifæra lánið á reikninginn þinn, sem ég bíð eftir svari þínu með

JÁ.

upgradeloan46@gmail.com

Hæ, kveðjur frá hinu mikla Illuminati bræðralagi…þessi skilaboð eru til að bjóða þér að vera hluti af okkur og taka þátt í *FRÆGÐ*MÁTTUR*AUÐUR*VERND* og einnig $1.000.000 sem velkomin gjöf, bíl að eigin vali, hús að eigin vali og mánaðartekjur upp á $3.000….svaraðu játandi ef þú hefur áhuga

TELEGRAM@sacredilluminatiunion

NETFANG

sacredilluminatiunion@usa.com