Exchange-traded ETF fund – o ye mun ye daɲɛ nɔgɔmanw na complexe ko la.ETF (nafolo minnu bɛ jago kɛ ni fɛnw falenfalenni ye) ye jɛkafɔ suguya dɔ ye. Ni i ye o nafolo sugu in niyɔrɔ san ni ruble 4000 dɔrɔn ye, i bɛ kɛ jatebɔyɔrɔ fitinin dɔ tigi ye, i n’a fɔ Microsoft, Apple, MasterCard, Tesla, Facebook, Google, McDonald’s ani fɛn caman wɛrɛw. VTI ka bolofara min ka ca ni bolofara ye, a ka bolofara 3900 ni kɔ bɛ yen. Walasa ka segin o fɛn caman ɲɔgɔnna caman kan u ka jatebɔsɛbɛn kɔnɔ, waritigi kɛrɛnkɛrɛnnen dɔ bɛna waribon caman de wajibiya. Inverter fanba fɛ, o diversification in tɛ sɔrɔ. Index exchange-jago nafolo dɔw bɛ yen minnu bɛ diɲɛ indices, fɛnw ni nɛgɛ nafamaw nafolo, ETFw ka bonw ani wariko suguya minɛnw ka jatebɔw ni u hakɛw kopi tigitigi. Ameriki sugu la, wari falenfalen nafolo suguya 100 ni kɔ bɛ yen minnu bɛ fɛɛrɛ suguya caman waleya. I n’a fo,

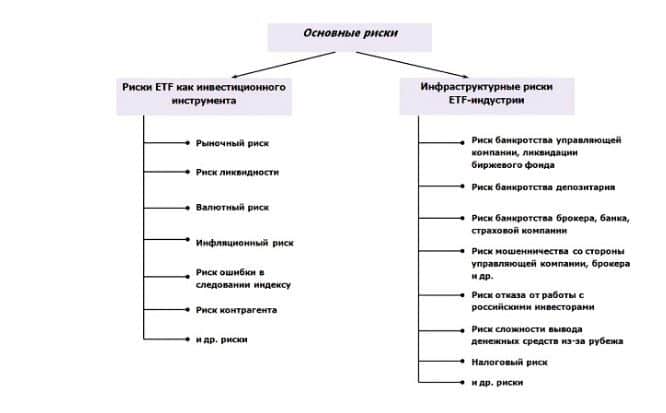

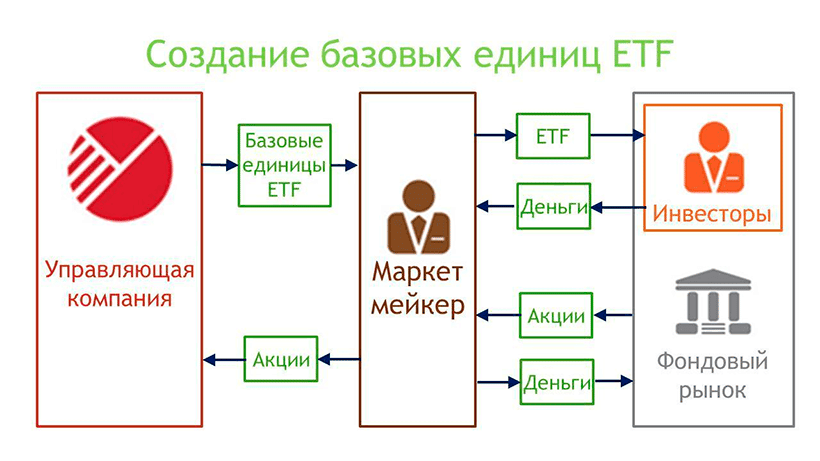

Ray Dalio ” (wari bilali aksidanw na, bonw ani sanu na ni balanbaliya ye waati ni waati), wari bilali jamana kɛrɛnkɛrɛnnenw ka seko ni dɔnko siratigɛ la. Ni ETF portfolio dɛmɛni ye, i bɛ se ka portfolio suguya caman lajɛ ka kɛɲɛ ni izini ni jamana ye, ni wari bilalenw ye minnu ka dɔgɔ kosɛbɛ. ETF minnu maralen don cogo la, olu b yen minnu b tugu tigitigi index walima jagofɛn dɔ ka dinamiki la, ani nafolo minnu bɛ mara baara la, minnu kɔnɔ, sɔrɔ ni bɔli bɛ labɛn ɲɛmɔgɔw fɛ. Nafolo minnu ka ca kosɛbɛ, olu ye ɲɛnabɔli pasif ye – u ka sara ka dɔgɔ ani u ka dinamiki tɛ bɔ hadamaden ka ko la.

Danfara minnu bɛ ETFw ni ɲɔgɔndɛmɛ nafolo cɛ

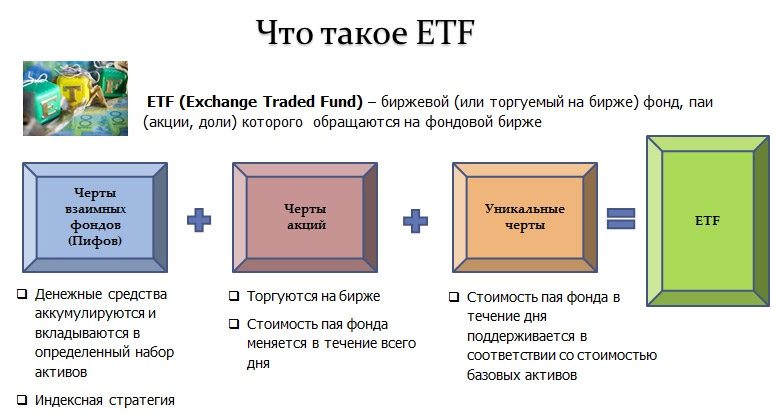

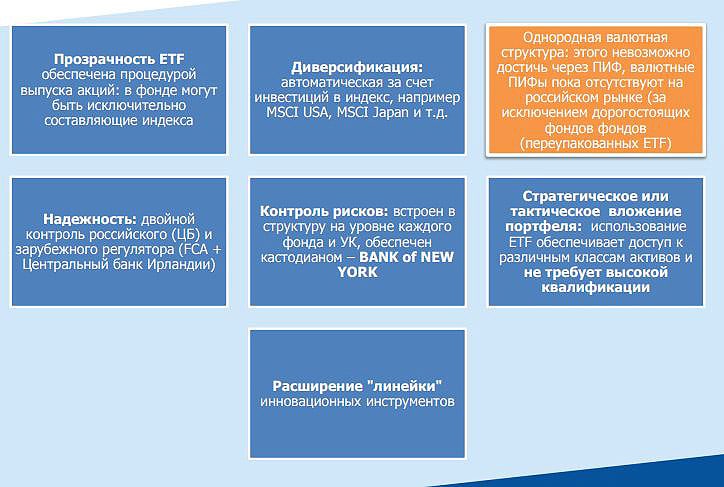

ETF ka Risi analogue ye mutuel fund (mutuel investissement fond) ye. Hali ni u bɔlen don ɲɔgɔn fɛ, danfara dɔw bɛ u ni ɲɔgɔn cɛ

- ETF fanba bɛ ɲɛnabɔ cogo la min tɛ baara kɛ ni fɛɛrɛ dafalen ye . O bɛ nafa di waridonna ma, bawo a jɛlen don ko wari bɛ don minɛn jumɛnw na hakɛ jumɛnw na. Investisseur bɛ se ka da a la ko ni a bɛ wari bila ETFw la sanu kama, a ka investissements bɛna segin tigitigi nɛgɛ nafama in ka fanga kan.

- ɲɔgɔndɛmɛ nafolo ye ɲɛnabɔli nafolo ye min bɛ baara kɛ . Nafolo sɔrɔta bɛ bɔ ɲɛmɔgɔ ka walew ni a ka filiw de la kosɛbɛ. Ko lakika ye ni mutual fund ka dinamiki ye ko jugu ye misi sugu barikama kɔnɔ. Nka sugu bintɔ, ɲɔgɔndɛmɛ nafolo bɛ se ka fisaya ni sugu ye.

- ETFw bɛna a to i ka se ka portfolio suguya caman lajɛ , ka kɛɲɛ ni jamana, izini walima fɛɛrɛw ye.

- ETFw bɛ jatebɔ kɛ ni u bɛ sara ni u bɛ tugu index min na, o jatebɔw fɛ. A ka c’a la, jatebɔw bɛ segin ka don a hakɛ fɔlɔ la.

- ETFw bɛ jago kɛ fɛnw falen-falen na , ani sugu dilannikɛla bɛ wariko mara. Wajibi tɛ ka kuma ɲɛmɔgɔyaso fɛ walasa ka sanni kɛ. A bɛ bɔ ka kɛ ni brokerage jatebɔsɛbɛn ye ni broker ye min ka lase bɛ a la.

- ETF komisiyɔnw ka dɔgɔ siɲɛ caman ni i ye u suma ni ɲɔgɔndɛmɛ nafolo ye .

ETF suguyaw

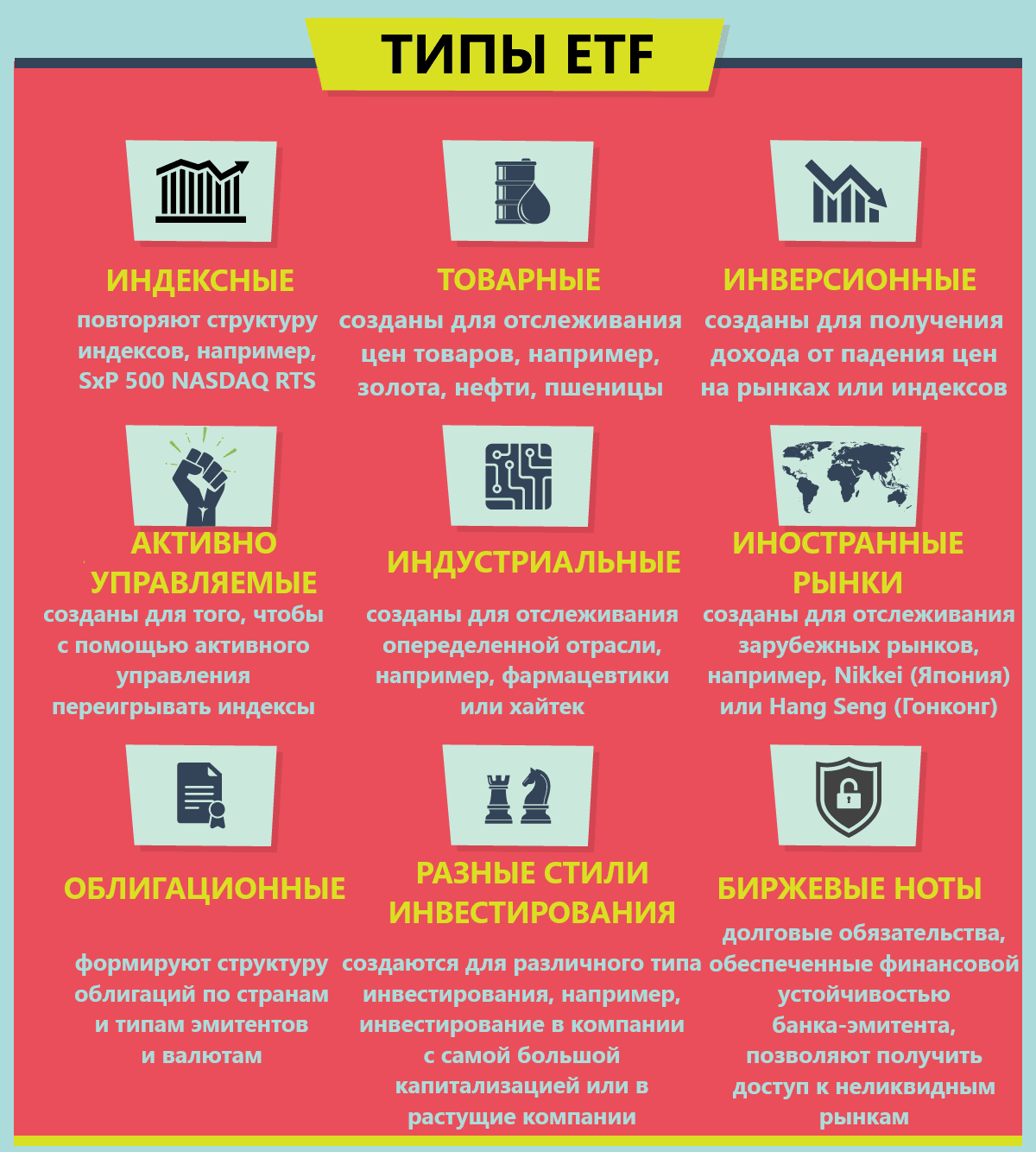

ETF minnu bɛ yen, olu bɛ se ka tila ka kɛ kulu ninnu ye:

- Jamana kɔnɔ – Ameriki ka bolomafara kan, nafolo dɔw bɛ yen minnu bɛ wari bila jamana bɛɛ la, bolomafara bɛ yɔrɔ minnu na. ETF danfaralenw bɛ jamana in ka index kelen-kelen bɛɛ la.

- Sɔrɔko seko ni dɔnko siratigɛ la – ETFw bɛ sɔrɔ sɔrɔko bolofara kɛrɛnkɛrɛnnenw kama, jamana min kofɔlen don, o bolofara kɛrɛnkɛrɛnnen dɔ ka jatew bɛ lajɛ yɔrɔ min na. A bɛ se ka kɛ ko waridonna tɛ index bɛɛ san, nka a bɛ wari bila izini layidu talenw dɔrɔn de la a hakili la.

- Nafolosɔrɔminɛnw kama – ETFw bɛ se ka tilatila ka ɲɛsin aksidanw ma, bondw, wariko suguya minɛnw (bond kuntaala surunw fo kalo 3), wariko ETFw, ETFw ka ɲɛsin nɛgɛ nafamaw ma, izini fɛnw, sow ni dugukolow.

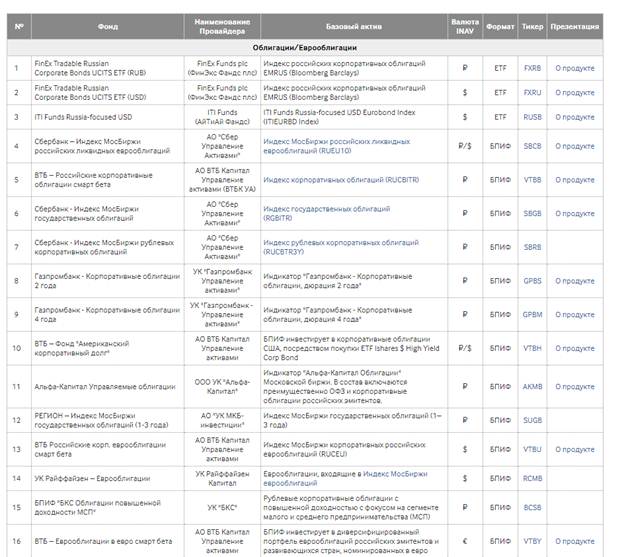

ETF kan MICEX

ETF suguya 1500 ni kɔ bɛ sɔrɔ NYSE kan.

Moskow Exchange bɛ ETFw lisi dɔ di min ka dɔgɔ kosɛbɛ Risi waridonnaw ma (etf caman bɛ sɔrɔ sanni kama waridonnaw dɔrɔn de fɛ minnu bɛ se). Sisan, ETF ni BIF 128 bɛ sɔrɔ Moskow Exchange la. Finex bɛ nin ETF ninnu dilan:

- FXRB – Index min bɛ Risi ka tɔnw ka bonw jira minnu bɛ bɔ rubles la.

- FXRU – Index min bɛ Risi ka tɔnw ka bonw jira minnu bɛ bɔ dɔrɔmɛ la.

- FXFA ye jamana yiriwalenw ka tɔnw ka bonw jiracogo ye min bɛ sɔrɔ caman bɔ.

- FXIP – Ameriki gofɛrɛnaman ka bonw, ni nafolosɔrɔbaliya lakanani ye ni ruble hedge ye, u bɛ jate rubles la.

- FXRD – dɔrɔmɛ bonw ka tɔnɔba, jateminɛ – Solactive USD Fallen Angel Issuer Capped Index.

- FXKZ – o bolofara bɛ wari bila Kazakstan jamana ka jatew la.

- FXRL ye wari bilalen ye Risi RTS index la.

- FXDE ye wari bilali ye Alemaɲi ka bolomafara sugu la.

- FXIT ye wari bilali ye Ameriki ka seko ni dɔnko siratigɛ la.

- FXUS ye wari bilalen ye Ameriki SP500 index la.

- FXCN ye wari bilalen ye Siniwa jamana ka bolomafara sugu la.

- FXWO ye wari bilali ye diɲɛ suguba ka jatew la, a ka bolofara kɔnɔ, jatedenw ka ca ni 500 ye ka bɔ diɲɛ jamanaba 7 la.

- FXRW ye wari bilali ye Ameriki ka bolomafaraw la minnu ka bon kosɛbɛ.

- FXIM ye wari bilali ye Ameriki IT seko ni dɔnko siratigɛ la.

- FXES – Ameriki ka tɔnw ka jatew tulonkɛko la ani eSports.

- FXRE ye wari bilali ye Ameriki ka dugukoloko wari bilali dannayatɔnw na.

- FXEM – wari bilali jamana yiriwalenw ka jateminεw la (n’a ma fɔ Sinuwa ni Ɛndujamana).

- FXGD ye wari bilali ye sanu na.

Finex ye baarakɛda kelen ye min bɛ ETF wari bilali di Risi jagokɛlaw ma sisan.

O ɲɔgɔnna fɛnw bɛ yen minnu bɛ bɔ Sberbank, VTB, BCS, Finam, Alfa Capital,

Tinkof Investments , Aton ani dɔ wɛrɛw la. Nka u bɛɛ ye BPIF ta ye. Ɲɛmɔgɔyaso caman bɛ o fɛn kelenw dilan (nafolo min bɛ tugu suguya caman jiralan

SP500 kɔ , o bɛ jira Sberbank, Alfa Capital ani VTB fɛ). Dinamikiw bɛ ɲini ka kɛ kelen ye, nka waridonna minnu ye Finex ka jatew san, olu ye nafa sɔrɔ dɔɔnin k’a sababu kɛ komisiyɔnw dɔgɔyali ye. ETF ka ko dɔ ye Moskow Exchange la, o ye ko ETF ka wari ye dɔrɔmɛ ye, wa walasa ka o ETF sugu san, rubɛw ka bɔ jatebɔsɛbɛn kɔnɔ, olu bɛ fɔlɔ ka wuli ka kɛ dɔrɔmɛ ye. Etf bɛ yen minnu bɛ fɔ rubɛw la (ni wari bɛrɛbɛrɛ ye), n’u sɔrɔla waridonna bɛ lakana ka bɔ panni na dɔrɔmɛ la ka taa ruble wari falenfalen na.

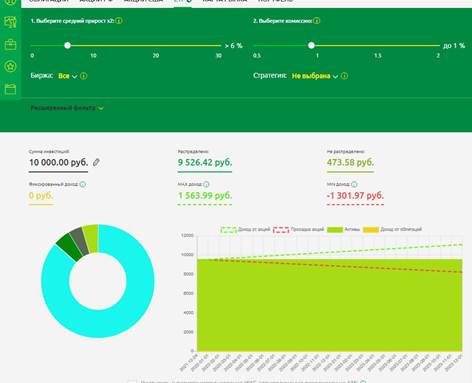

Sariyasen min ye ka ETF portfolio dɔ sigi sen kan

Passive investing in index funds, o ni lakɔlibila wari ɲɛmɔgɔw bɛ min kɛ, o bɛ kelen ye kosɛbɛ. Investissement horizon nafa ka bon – i man kan k’a ɲini ka ETF portfolio lajɛ san 1-2 kɔnɔ. Nafolodonni ETFw la, o postulate kunba ye wari bilali sabatili ye, suguya cogoya mana kɛ min o min ye. Walasa ka ETF bɛnnenw sugandi, Moskow Exchange ka siti bɛna waridonna dɛmɛ, i bɛ se ka jagokɛlaw ka jagokɛlaw ka nafolo bɛɛ lisɛli ye yɔrɔ min na – https://www.moex.com/msn/etf. [caption id="jatebɔ_12049" align="aligncenter" bonya="624"].

- FXMM ye Ameriki wariko bolofara ye min bɛ wari bila Ameriki ka bon surunw na kalo 1-3 kɔnɔ.

O nafolo in bɛ tali kɛ wari bilalen na min bɛ kɛ ni ɲinini ye. O danfara dɔ ye ko a ja ye tigɛli ye min ɲɛsinnen bɛ san fɛ ni degere 45 ye.

- BPIF RFI “VTB – Jamana yiriwalenw ka bolomafara” (VTBE ETF) . Walasa ka fɛn caman kɛ, an ka nafolo dɔ fara a kan min bɛ wari bila jamana yiriwalenw na.

An ka nafolo bɛɛ sugandi ETF sɛgɛsɛgɛlikɛlan kɔnɔ minnu bɛ wari bila nafolo ɲagaminenw na. An ka an sinsin vtbe etf kan. Nin bolofara in b wari bila jamana yiriwalenw ka nafolo la jamana wɛrɛw ka etf ISHARES CORE MSCI EM sanni fɛ. Nafolo minnu bɛ don o nafolosɔrɔsiraw la, olu bɛna kɛ sababu ye ka fɛn caman kɛ jamanaw kɔnɔ. O waati kelen na, nafolosɔrɔsiraw ka komisiyɔn ye 0,71% dɔrɔn ye. Ni i bɛ sanni kɛ VTB dilanbaga dɔ fɛ, wari falen-falen komisiyɔn tɛ yen.

- VTBH ETF ye . Sisan, walasa ka dɔ bɔ portfolio (boli) la, an ka bonw fara a kan. VTBH ETF bɛ sababu di ka wari bila Ameriki ka bonw la minnu bɛ sɔrɔ kosɛbɛ. Walasa k’o kɛ, fɛnw falenfalen bolofara bɛ jamana wɛrɛw ka ETF ISHARES HIGH YIELD CORP BOND ka jatew san.

- DIVD ETF – bolofara min bɛ jago kɛ ni fɛnw falenfalenni ye, o bɛ tugu Risi jamana ka jatebɔfɛnw jatebɔcogo la. Index in kɔnɔ, 50% bɛ sɔrɔ Risi jamana ka jatebɔ ɲumanw na, o siratigɛ la: jatebɔ sɔrɔta, jatebɔ sabatili, jatebɔla ka jogo ɲuman. K’a sababu kɛ jatebɔ sarali ye ani jagokɛcogo misaliw ka ɲi, nafa caman bɛ sɔrɔ ka tɛmɛ bolomafara suguba kan (san sɔrɔta hakɛ danmadɔ k’a ta san 2007 marisikalo la ka na se bi ma, o ye 15,6% ye ni 9,52% ye bolomafara suguba la)

- Ni wari bilali Ameriki bolomafara sugu la, TECH (a bɛ wari bila Ameriki NASDAQ 100 index la) ka bɔ Tinkoff Investments ani FXUS , n’o bɛ Ameriki bolomafaraba SP500 ka fanga lasegin, olu de bɛnnen don kosɛbɛ.

- Jateminɛ fana ka kan ni TGRN ETF ye ka bɔ Tinkoff Investments la . San o san sɔrɔta hakɛ bɛ se 22% ma san kɔnɔ. O bolofara bɛ wari bila fɛɛrɛ saniyalenw ɲɛmɔgɔw la diɲɛ fan bɛɛ.

- ETF FXRL ye index fund ye min bɛ tugu Risi RTS index ka dinamiki kɔ. Ni an y’a jateminɛ ko RTS ye dɔrɔmɛ taamasiyɛn ye, etf bɛ lakana dɔw di wariko jiginni ma. Dɔrɔmɛ bonya fɛ, RTS index bɛ bonya ka tɛmɛ MICEX kan. Jatebɔ minnu bɛ sɔrɔ, olu bɛ segin ka don nafolosɔrɔsiraw ka jatew kɔnɔ. Fondo bɛ takasi sara 10% jatebɔ la.

- Walasa ka i yɛrɛ tanga nafolosɔrɔbaliya ma, i ka kan ka sanu etf fara a kan, misali la, FXGD . Fondo komisiyɔn ye 0,45% dɔrɔn de ye. Fondation bɛ sanu farikoloma sɔngɔ lajɛ diɲɛ sugu la cogo bɛnnen na, wa a b’a to i k’i yɛrɛ tanga nafolosɔrɔbaliya ma ni PIB tɛ.

- Ani fana, aw ye ETFw lajɛ minnu bɛ tugu All Weather/Perpetual Portfolio fɛɛrɛ dɔ kɔ – etf opnw ka bɔ Otkritie Broker walima TUSD ETF ka bɔ Tinkoff Investments . Fond bɛ diversification kɔnɔ, investisseur mago tɛ ka cɛsiri wɛrɛw kɛ. Kuntigiw bɛ wari bila cogo kelen na aksidanw, bonw, sanu na. Etf opnw fana bɛ wari bila Ameriki ka dugukoloko nafolo la.

Brokerage jatew tigiw fɛ, nin ETF suguya in, hali n’a ka nɔgɔn kosɛbɛ, a sɔngɔ ka gɛlɛn kojugu. A ka fisa ka waati dɔɔnin ta ka ETF portfolio jɔ i yɛrɛ ye. San 20 kɔnɔ, hali komisiyɔn nafamaba 0,01-0,05% bɛ wuli ka kɛ hakɛ yetaw ye.

Ni aw bɛ ETFw sugandi minnu bɛ layidu ta kosɛbɛ, aw ka kan k’a ɲini ka miiri kosɛbɛ diɲɛ kɔnɔ. San fila tɛmɛnenw ka nafolodonni jaabiw tɛ garanti di o ɲɛtaa kelen ma don nataw la. Nafolo minnu bɛ kɛ aksidanw na minnu y’a jira ko u bɛ bonya teliya la, olu bɛ se ka kɛ nafa tɛ minnu na san damadɔ nataw kɔnɔ. Sekɔrɔ bɛ se ka sumaya kojugu ka sɔrɔ ka lafiɲɛbɔ kɛ. Ka wari bila index (index) la min ka bon kosɛbɛ, o bɛ nafa caman lase a ma bawo index (index) cogoya bɛ ɲɔgɔn Changé tuma bɛɛ. Sosiyete barikamaw bɛ bila sosiyete barikamaw nɔ na. Sosiyete caman minnu tun bɛ SP500 index kɔnɔ, olu tun tɛ sugu la tugun a san 10 ye nin ye, nka index in ka dinamiki ma tɔɔrɔ o la. Aw ka kan k’aw jija ka miiri kosɛbɛ diɲɛ kɔnɔ, aw kana nafolosɔrɔsiraw ka fanga lajɛ sisan, k’aw jija ka fɛɛrɛw sugandi minnu tɛ faratiba la ani minnu ka ca ni fɛn caman ye. Ka sɔrɔ ka ETF minnu bɛ layidu ta kosɛbɛ nafolo suguya kelen-kelen bɛɛ la, olu jira, waridonna b’a fɛ ka wari bila yɔrɔ min na, o ka kan ka bila a ka jate kelen-kelen bɛɛ la. A ka ɲi aw ka tugu nin hakɛ ninnu kɔ:

- 40% bɛ bɔ portfolio la ka ɲɛsin aksidanw san . Walasa ka fɛn caman kɛ, stockw bɛ tila jamana ni izini na. ETF suguya kelen-kelen bɛɛ bɛ di ni jatebɔ kelen ye nin kulu in kɔnɔ;

- 30% – bonw . O bɛna dɔ bɔ portfolio nafa bɛɛ lajɛlen na, nka o waati kelen na, dɔ bɛna bɔ brokerage jatebɔsɛbɛn ka sɛgɛsɛgɛli la. Fɛn min bɛna nɔ ɲuman bila waridonna ka hakili-la-ko la waati gɛlɛnw na;

- 10% ye portfolio – wari bilali sanu na . Portfolio yɔrɔ min bɛ lakana ni sarati ye. Laala kɔfɛ, nin portfolio in yɔrɔ bɛ se ka bila a nɔ na ni wari bilali ye kriptowariw la ;

- 20% – yɔrɔ minnu bɛ layidu ta – tekinoloji kɔrɔw ka bolomafaraw, wari bilali “green” tɔnw na walasa ka layidu ta ka bonya teliya.

ETF guide – Ɲininkali kunbaba 15 : ETF nafolo ye mun ye, u bɛ baara kɛ cogo min na, wari sɔrɔcogo u kan: https://youtu.be/I-2aJ3PUzCE Ka wari bila ETFw la, o b’a jira ko a bɛ kɛ tuma bɛɛ ani ka waati jan kɛ. A ka nɔgɔn ka portfolio falen kalo o kalo – o ye postulate lakodɔnnen ye “i yɛrɛ sara fɔlɔ.” Ni aw bɛ fɛnw falen, aw ka kan ka tugu fɛɛrɛ sugandilen na, ka nafolo hakɛw kɔlɔsi. Nafolo dɔw sɔngɔ bɛna jigin, k’a sɔrɔ u niyɔrɔ bɛna dɔgɔya portfolio kɔnɔ. Nafolo wɛrɛw nafa bɛna bonya, u niyɔrɔ bɛna bonya. Aw man kan ka aw jija kojugu ka hakɛw mara – deviations de 5-10% bɛ sɔrɔ a dan na. Fɛɛrɛ fila bɛ yen walasa ka hakɛw mara – nafolo minnu sɔngɔ wulila, olu feereli ani minnu bɛ kɔfɛ, olu san. Walima ka mɔgɔ minnu to kɔfɛ ka da a kan u falen don, olu san dɔrɔn. Aw kana feere fo ni wariko kuntilenna dafara. Nin fɛɛrɛ fila la jumɛn bɛ sugandi, o nafa tɛ ten. A nafa ka bon ka wari bilacogo dɔ sugandi walasa ka tugu o kɔ. Ni kɔfɛfɛnw sanni kokura tuma bɛɛ ani ka nafolo feere minnu ye bonya jira, waritigi bɛ sanni kɛ tuma bɛɛ duguma, ka feere sanfɛ. O waati kelen na, a tɛna sɔngɔw latigɛ minnu ka ɲi kosɛbɛ, nka ni a kɛra fɛn caman ye, portfolio bɛna fanga ɲuman jira waati jan kɔnɔ, wa o de ye fɛn nafamaba ye.