Ingxowa-mali ye-ETF yotshintshiselwano – yintoni na ngamagama alula malunga ne-complex.Ii-ETF (iimali ezithengiswayo) luhlobo lotyalo-mali oluhlangeneyo. Ngokuthenga isabelo sengxowa-mali enjalo kwi-ruble ye-4,000 kuphela, uba ngumnini wesabelo esincinci sezabelo kwiinkampani ezifana neMicrosoft, Apple, MasterCard, Tesla, Facebook, Google, McDonald’s kunye nabanye abaninzi. Eyona ngxowa-mali ye-VTI ibandakanya ngaphezulu kwe-3,900 yesitokhwe. Ukuphinda loo mahluko kwiakhawunti yakhe, umtyali-zimali wabucala uya kufuna imali eninzi kakhulu. Kwii-inverters ezininzi, oku kuxutywa akufumaneki. Kukho iimali ezirhweba ngesalathiso ezikopa kanye ukubunjwa kunye nobungakanani bezabelo zezalathisi zehlabathi, imveliso kunye neengxowa-mali zesinyithi ezixabisekileyo, ii-ETF zeebhondi kunye nezixhobo zemarike yemali. Kukho ngaphezu kwe-100 yeemali ezahlukeneyo zotshintshiselwano kwimarike yase-US ezalisekisa izicwangciso ezahlukeneyo. Umzekelo,

Ray Dalio ” (utyalo-mali kwizitokhwe, iibhondi kunye negolide ngokungalingani kwexesha), utyalo-mali kwizabelo zecandelo elithile lamazwe athile. Ngoncedo lwepotfoliyo ye-ETF, unokuqokelela ipotifoliyo eyohlukeneyo ngoshishino kunye nelizwe labatyali-mali ngediphozithi ethobeke kakhulu. Kukho ii-ETF ezilawulwa ngokungenzi nto ezilandela ngokuthe ngqo ukuguquguquka kwesalathiso okanye imveliso, kunye neemali zolawulo ezisebenzayo, apho ingeniso kunye nokutsalwa phantsi zilawulwa ngabaphathi. Ezona ngxowa-mali zixhaphakileyo lulawulo lwe-passive – zinemirhumo ephantsi kwaye amandla azo axhomekeke kwinto yomntu.

Umahluko phakathi kwee-ETF kunye neengxowa-mali ezihlangeneyo

I-analogue yaseRashiya ye-ETF yingxowa-mali yokubambisana (i-mutual investment fund). Nangona kukho ukufana, kukho ukungafani

- Uninzi lwee-ETF zilawulwa ngokungenzi nto ngesicwangciso esivulekileyo . Oku kunika inzuzo kumtyalo-mali, kuba kucacile ukuba zeziphi izixhobo kwiyiphi imilinganiselo imali etyalwe ngayo. Umtyali-mali unokuqiniseka ukuba xa etyala imali kwi-ETF yegolide, utyalo-mali lwakhe luya kuphinda ngokuchanekileyo ukuguqulwa kwesinyithi esixabisekileyo.

- Iingxowa-mali zotyalo-mali ezihlangeneyo ziimali zolawulo ezisebenzayo . Isiphumo semali sixhomekeke kakhulu kwizenzo kunye neempazamo zomphathi. Imeko yangempela xa i-dynamics ye-mutual fund ingalunganga kwimarike yenkomo eyomeleleyo. Kodwa ekuwa kweemarike, iimali zokubambisana zinokuba ngcono kunemarike.

- Ii- ETF ziya kukuvumela ukuba uqokelele ipotifoliyo eyohlukeneyo , ngokwelizwe, ishishini okanye isicwangciso.

- Ii- ETF zihlawula izabelo ukuba zihlawulwe ngezabelo zesalathiso ezisilandelayo. Kwiimeko ezininzi, izabelo ziphinda zityalwe kumlinganiselo wokuqala.

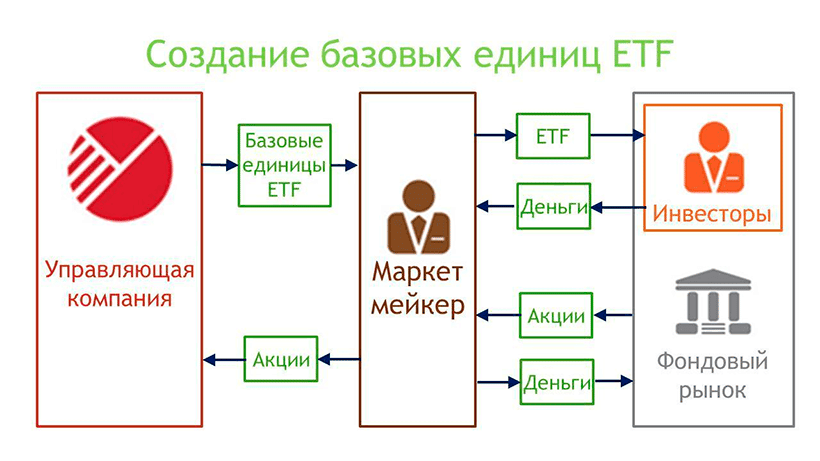

- Ii- ETF zithengiswa ngokutshintshiselana , kwaye umenzi wemarike ugcina imali yokuhlawula amatyala. Akukho mfuneko yokuqhagamshelana nenkampani yokulawula ukuthenga. Kwanele ukuba ne-akhawunti ye-brokerage kunye nawuphi na umthengisi onelayisensi.

- Iikhomishini ze-ETF ziphantsi ngamaxesha amaninzi xa kuthelekiswa neemali ezihlangeneyo .

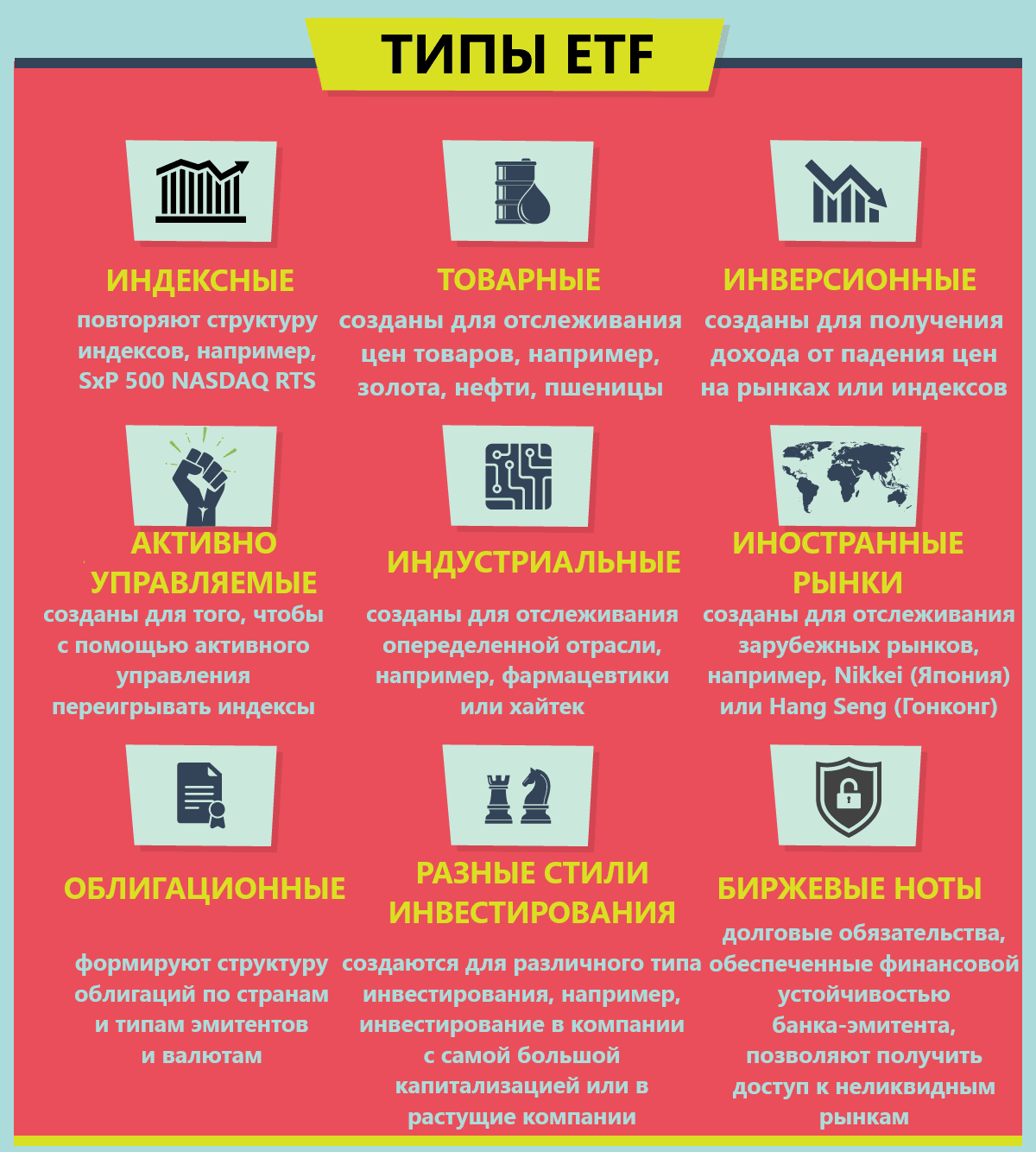

Iindidi zee-ETF

Ii-ETF ezikhoyo zingohlulwa ngokwala maqela alandelayo:

- Ngelizwe – kwi-stock exchange yase-US kukho iimali ezityala imali phantse kuwo onke amazwe apho kukho i-stock market. Kukho ii-ETFs ezahlukeneyo kwisalathiso ngasinye seli lizwe.

- Ngamacandelo oqoqosho – kukho ii-ETF zamacandelo athile oqoqosho, apho izabelo zecandelo elithile loqoqosho lwelizwe elichaphazelekayo ziqokelelwa. Umtyalo-mali akanakho ukuthenga yonke isalathisi, kodwa utyalomali kuphela kumashishini athembisayo ngombono wakhe.

- Kwizixhobo zemali – ii-ETF zingabelwa izitokhwe, iibhondi, izixhobo zemarike yemali (iibhondi zexesha elifutshane ukuya kwiinyanga ezi-3), ii-ETF zemali, ii-ETF zeentsimbi ezixabisekileyo, iimpahla zoshishino, i-real estate.

I-ETF kwi-MICEX

Kukho ngaphezulu kwe-1,500 yee-ETF ezahlukeneyo ezikhoyo kwi-NYSE.

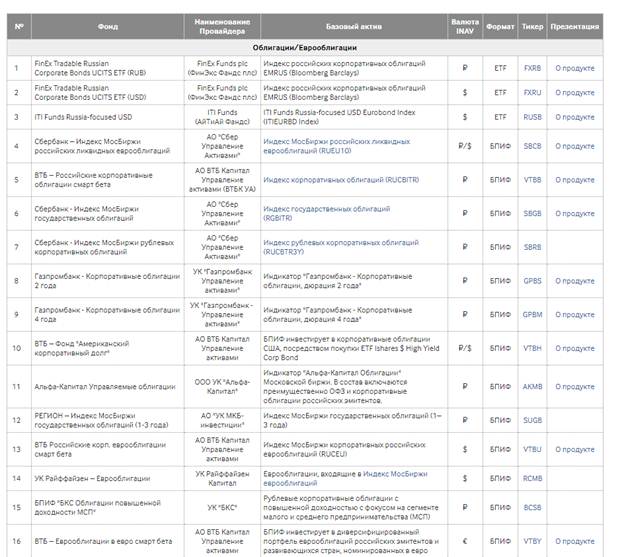

Utshintshiselwano lwaseMoscow lubonelela ngoluhlu oluthozamileyo kakhulu lwe-ETF kubatyali-mali baseRashiya (ii-etf ezininzi ziyafumaneka ukuze zithengwe kuphela kubatyali-mali abafanelekileyo). Okwangoku, ii-ETF ze-128 kunye ne-BIF ziyafumaneka kwi-Moscow Exchange. IFinex ibonelela ngezi ETF zilandelayo:

- I-FXRB – Isalathiso se-Russian corporate bonds efakwe kwii-ruble.

- I-FXRU – Isalathiso seebhondi zenkampani zaseRussia ezifakwe kwiidola.

- I-FXFA sisalathiso seebhondi zeenkampani ezivelisa isivuno esikhulu kumazwe aphuhlileyo.

- I-FXIP – iibhondi zorhulumente wase-US, kunye nokukhuselwa kwexabiso lokunyuka kwamaxabiso kunye ne-ruble hedge, zifakwe kwi-ruble.

- I-FXRD – i-dollar ephezulu yebhondi yesivuno, i-benchmark – i-Solactive USD Fallen Angel Issuer Capped Index.

- I-FXKZ – ingxowa-mali ityalomali kwizabelo zaseKazakhstan.

- I-FXRL lutyalo-mali kwi-RTS index yaseRashiya.

- IFXDE lutyalo-mali kwimarike yemasheya yaseJamani.

- I-FXIT lutyalo-mali kwicandelo lobuchwephesha baseMelika.

- I-FXUS lutyalo-mali kwi-US SP500 index.

- I-FXCN lutyalo-mali kwimarike yemasheya yaseTshayina.

- I-FXWO lutyalo-mali kwizabelo zemarike yehlabathi, ipotifoliyo yayo ibandakanya ngaphezu kwezabelo ze-500 ezivela kumazwe angama-7 amakhulu ehlabathi.

- I-FXRW yi-investment kwi-stock-cap yase-US ephezulu.

- I-FXIM lutyalo-mali kwicandelo le-IT yase-US.

- I-FXES – izabelo zeenkampani zase-US kwicandelo lokudlala kunye ne-eSports.

- I-FXRE lutyalo-mali kwi-US real estate investment trusts.

- I-FXEM – utyalo-mali kwizabelo zamazwe asaphuhlayo (ngaphandle kweTshayina neIndiya).

- I-FXGD lutyalo-mali kwigolide.

IFinex okwangoku kuphela kwenkampani enikezela ngotyalo-mali lwe-ETF kubarhwebi baseRussia.

Kukho iimveliso ezifanayo ezivela Sberbank, VTB, BCS, Finam, Alfa Capital,

Tinkof Investments , Aton kunye nabanye. Kodwa bonke ngabakwaBPIF. Iinkampani ezininzi zolawulo zibonelela ngeemveliso ezifanayo (ingxowa-mali elandela isalathisi semarike ebanzi

SP500 imelwe yi-Sberbank, i-Alfa Capital kunye ne-VTB). I-dynamics iphantse yafana, kodwa abatyali-mali abathenge izabelo zeFinex bazuze kancinci ngenxa yeekomishini ezisezantsi. Isici se-ETF kwi-Moscow Exchange kukuba imali ye-ETF yidola, kwaye ukuze uthenge i-ETF enjalo, ii-ruble ezivela kwi-akhawunti ziguqulwa kuqala zibe ngamadola. Kukho ii-etf ezifakwe kwii-ruble (kunye ne-hedge yemali), ngokuzifumana umtyalo-mali ukhuselwe kwi-jump kwi-dollar ukuya kwizinga lokutshintshiselwa kwe-ruble.

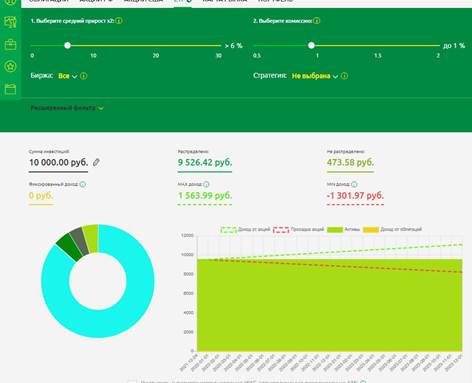

Umgaqo wokwenza i-ETF portfolio

Utyalo-mali olwenziwayo kwiingxowa-mali zesalathiso lufana kakhulu nanjengoko kwenziwa ngabaphathi bemali abadla umhlala-phantsi. I-horizon horizon ibalulekile – akufanele uzame ukuqokelela iphothifoliyo ye-ETF iminyaka eyi-1-2. I-postulate ephambili yokutyalo-mali kwii-ETF kukuhlala rhoqo kutyalo-mali, kungakhathaliseki ukuba imeko yemarike. Ukukhetha ii-ETF ezifanelekileyo, i-website ye-Moscow Exchange iya kunceda umtyalo-mali, apho unokubona uluhlu lwazo zonke iimali ezithengiswayo ezithengiswayo – https://www.moex.com/msn/etf.

- I- FXMM yingxowa -mali yemarike yemali yase-US etyala imali kwiibhondi ezimfutshane zase-US kwithuba leenyanga ezi-1-3.

Le ngxowa-mali iyafana nedipozithi yemfuno. Isici esahlukileyo kukuba igrafu yayo ngumgca othe ngqo ojoliswe phezulu kwi-angle ye-45 degrees.

- I-BPIF RFI “i-VTB – iNgxowa-mali yoLingano yaMazwe asakhulayo” (VTBE ETF) . Ukwahluka, songeze i-asethi etyala imali kumazwe asaphuhlayo kwipotfoliyo.

Makhe sikhethe kwi-ETF screener zonke ii-asethi ezityalomali kwii-asethi ezixubileyo. Masiqwalasele kwi-vtbe etf. Le ngxowa-mali ityala imali kwii-asethi zamazwe asaphuhlayo ngokuthengwa kwe-etf yangaphandle ISHARES CORE MSCI EM. Utyalo-mali kule ngxowa-mali luya kuqinisekisa ukuhlukana kumazwe ngamazwe. Ngelo xesha, ikhomishini yengxowa-mali i-0.71% kuphela. Xa uthenga nge-VTB broker, akukho khomishini yokutshintshiselana.

- VTBH ETF . Ngoku, ukunciphisa ukuguquguquka kwepotfoliyo, masidibanise iibhondi. I-VTBH ETF inika ithuba lokutyala imali kwiibhondi zase-US ezinesivuno esikhulu. Ukwenza oku, ingxowa-mali ethengisiweyo ithenga izabelo ze-ETF ISHARES HIGH YIELD CORP BOND yangaphandle.

- I-DIVD ETF – ingxowa-mali ethengisiweyo ilandela isalathiso sezabelo zezabelo zeRussian Federation. Isalathiso sibandakanya i-50% yezabelo ezingcono kakhulu ze-Russian Federation ngokubhekiselele: isivuno se-dividend, i-dividend stability, umgangatho womniki. Ngenxa yentlawulo yesahlulo kunye nomgangatho weemodeli zoshishino, imbuyekezo ephezulu kunemarike ye-equity ebanzi ilindelekile (imbuyekezo engumndilili yonyaka ukususela ngoMatshi 2007 ukuza kuthi ga ngoku yi-15.6% vs. 9.52% kwimarike yezabelo zamashishini ngokubanzi)

- Utyalo-mali kwi-stock market yase-US, i- TECH (utyalo-mali kwi-US NASDAQ 100 index) evela kwi-Tinkoff Investments kunye ne -FXUS , ephindaphinda i-dynamics ye-stock market yase-US ebanzi ye-SP500, ifaneleke kakhulu.

- Ingqalelo ikwafanele i -TGRN ETF esuka kuTyalo-mali lwe-Tinkoff . Umyinge wesivuno sonyaka ukwinqanaba lama-22% ngonyaka. Le ngxowa-mali ityala imali kwiinkokeli zeteknoloji ezicocekileyo kwihlabathi jikelele.

- I-ETF FXRL yingxowa -mali yesalathiso elandela i-dynamics ye-Russian RTS index. Njengoko i-RTS isalathiso sedola, i-etf ibonelela ngokhuseleko ekuguquguqukeni kwemali. Ngokukhula kwedola, i-RTS index ikhula yomelele kune-MICEX. Izahlulo ezifunyenweyo ziphinda zityalwe kwizabelo zengxowa-mali. INgxowa-mali ihlawula irhafu kwizabelo ze-10%.

- Ukukhusela kwi-inflation, kufuneka udibanise i-etf yegolide, umzekelo, i-FXGD . Ikhomishini yengxowa-mali yi-0.45% kuphela. INgxowa-mali ilandelela ixabiso legolide ebonakalayo kwimarike yehlabathi ngokuchanekileyo kangangoko, kwaye ikuvumela ukuba uzikhusele ekunyukeni kwamaxabiso ngaphandle kweVAT.

- Kwakhona, jonga ii-ETF ezilandela iQhinga leMozulu Yonke/Engapheliyo iPotfoliyo – etf opnw evela kwi-Otkritie Broker okanye iTUSD ETF esuka kwi-Tinkoff Investments . Ingxowa-mali inokwahlukana ngaphakathi, umtyali-mali akafuni ukuba enze iinzame ezongezelelweyo. Abaphathi batyala imali ngokulinganayo kwizitokhwe, iibhondi, igolide. I-Etf opnw ikwatyala imali kwiimali zezindlu zase-US.

Kubanikazi beeakhawunti ze-brokerage, olu hlobo lwe-ETF, nangona lulula kakhulu, lubiza kakhulu. Kungcono ukuthatha ixesha elincinci kwaye wakhe i-ETF portfolio ngokwakho. Kwisithuba seminyaka engama-20, nokuba iikomishoni ezingabalulekanga ze-0.01-0.05% zijika zibe yimali ebonakalayo.

Xa ukhetha ezona ETFs zithembisayo, kufuneka uzame ukucinga ngakumbi kwihlabathi jikelele. Iziphumo zotyalo-mali zeminyaka emibini edlulileyo aziqinisekisi impumelelo efanayo kwixesha elizayo. Utyalo-mali kwizitokhwe olubonise ukukhula ngokukhawuleza lusenokubonakala lungenangeniso kule minyaka imbalwa izayo. Icandelo linokuthi ligqithise kwaye lithathe ikhefu. Utyalo-mali kwisalathiso esibanzi kunenzuzo ngakumbi kuba ukubunjwa kwesalathisi kuhlala kutshintsha. Iinkampani ezibuthathaka zitshintshwa zomeleleyo. Iinkampani ezininzi ezibandakanyiweyo kwisalathisi se-SP500 zazingekho kwimarike kwiminyaka eyi-10 edlulileyo, kodwa i-dynamics yesalathisi ayizange ihlupheke kule nto. Kuya kufuneka uzame ukucinga ngakumbi kwihlabathi jikelele, ungajongi uguquko lwangoku lwengxowa-mali, zama ukukhetha izisombululo ezingeyongozi kakhulu kunye nezahlukeneyo. Emva kokuba uchonge ezona ETFs zithembisayo kwiklasi nganye ye-asethi, apho umtyali-mali afuna ukutyala imali kufuneka yabelwe isabelo sakhe ngasinye. Kucetyiswa ukuba kulandelwe le milinganiselo ilandelayo:

- I-40% yepotfoliyo yabelwe ukuthenga izabelo . Ukwahlukahlukana, izitokhwe zahlulwe ngokwelizwe kunye neshishini. Uhlobo ngalunye lwe-ETF lunikwa isabelo esilinganayo kweli qela;

- 30% – iibhondi . Oku kuya kunciphisa imbuyekezo yonke yepotfoliyo, kodwa kwangaxeshanye ukunciphisa ukuguquguquka kwe-akhawunti ye-brokerage. Yintoni eya kuchaphazela kakuhle inkqubo ye-nervous ye-investimenti ngamaxesha anzima;

- I-10% yepotfoliyo – utyalo-mali kwigolide . Inxalenye ekhuselayo yepotfoliyo. Mhlawumbi kamva le nxalenye yepotfoliyo inokutshintshwa ngotyalo-mali kwi-cryptocurrencies;

- I-20% – iindawo ezithembisayo – i-stocks high-tech, utyalo-mali kwiinkampani “eziluhlaza” ezithembisa ukukhula ngokukhawuleza.

Isikhokelo se-ETF – imibuzo eyi-15 ephambili: zithini iimali ze-ETF, zisebenza njani, indlela yokwenza imali kuzo: https://youtu.be/I-2aJ3PUzCE Utyalo-mali kwii-ETF luthetha ukuba rhoqo kunye nexesha elide. Kukulungele ukuzalisa iphothifoliyo rhoqo ngenyanga – i-postulate eyaziwayo “zihlawule kuqala.” Xa uzalisa kwakhona, kufuneka unamathele kwisicwangciso esikhethiweyo, uqaphele umlinganiselo we-asethi. Ezinye ii-asethi ziya kuwa kwixabiso, ngelixa isabelo sazo kwipotfoliyo siya kuncipha. Ezinye ii-asethi ziya kukhula ngexabiso, isabelo sabo siya kukhula. Akufanele uzame ngononophelo kakhulu ukugcina imilinganiselo – ukunxaxha kwe-5-10% kuphakathi koluhlu oluqhelekileyo. Zimbini iindlela zokugcina umlinganiselo – ukuthengisa impahla ethe yanyuka amaxabiso kunye nokuthenga ezo zisemva. Okanye ukuthenga nje abo bashiyekileyo ngenxa yokuzaliswa kwakhona. Musa ukuthengisa de kuhlangatyezwane neenjongo zotyalo-mali. Yeyiphi kwezi ndlela zimbini ekhethiweyo ayibalulekanga kangako. Kubalulekile ukukhetha indlela yotyalo-mali ukuyilandela. Ngokuphinda kuthengwe ngokuphindaphindiweyo emva kunye nokuthengisa iimpahla ezibonise ukukhula, umtyalo-mali uhlala ethenga ezantsi kwaye ethengisa phezulu. Ngelo xesha, akayi kumisela amaxabiso amnandi kakhulu, kodwa ngokuqhelekileyo ipotifoliyo iya kubonisa amandla aphilileyo ngexesha elide, kwaye le nto ibaluleke kakhulu.