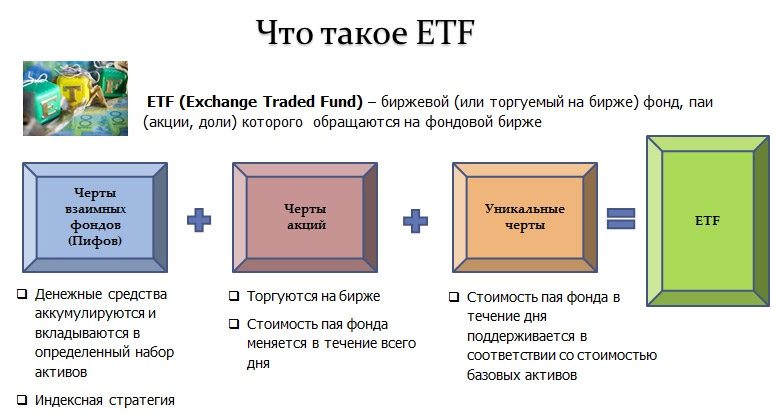

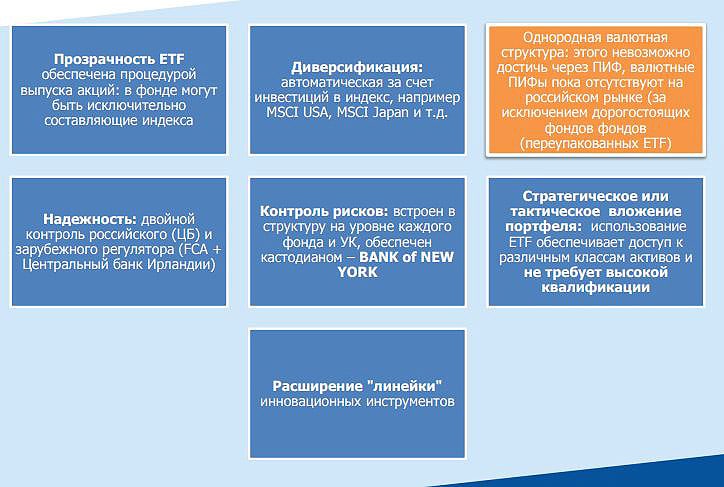

Asusun ETF na musayar musayar – menene a cikin kalmomi masu sauƙi game da hadaddun.ETFs (kuɗin da aka yi ciniki da musanya) wani nau’i ne na saka hannun jari na gamayya. Ta hanyar siyan kaso na irin wannan asusu akan rubles 4,000 kacal, za ku zama mai karamin kaso na hannun jari a kamfanoni kamar Microsoft, Apple, MasterCard, Tesla, Facebook, Google, McDonald’s da sauran su. Mafi yawan asusu na VTI ya ƙunshi hannun jari sama da 3,900. Don maimaita irin wannan bambancin a cikin asusun su, mai saka jari mai zaman kansa zai buƙaci babban jari mai yawa. Ga mafi yawan inverters, wannan bambancin ba ya samuwa. Akwai kuɗaɗen da aka yi musayar fihirisa waɗanda ke kwafi daidai da abun da ke ciki da kuma adadin hannun jari na fihirisar duniya, kayayyaki da kuɗaɗen karafa masu daraja, ETFs don shaidu da kayan kasuwancin kuɗi. Akwai sama da kuɗi daban-daban na musayar kuɗi 100 a cikin kasuwar Amurka waɗanda ke aiwatar da dabaru daban-daban. Misali,

Ray Dalio ” (saba jari a hannun jari, shaidu da zinariya tare da rashin daidaituwa na lokaci-lokaci), saka hannun jari a cikin hannun jari na takamaiman yanki na takamaiman ƙasashe. Tare da taimakon babban fayil na ETF, zaku iya tattara ɗimbin fayil ta masana’antu da ƙasar masu saka hannun jari tare da madaidaicin ajiya. Akwai ETFs da ba a iya sarrafa su ba waɗanda ke bin daidaitattun yanayin fihirisa ko kayayyaki, da kuma kuɗaɗen gudanarwa masu aiki, waɗanda manajoji ke tsara kudaden shiga da faɗuwa. Mafi yawan kuɗin da aka fi sani da shi shine gudanarwar m – suna da ƙananan kudade kuma yanayin su bai dogara da yanayin ɗan adam ba.

Bambance-bambance tsakanin ETFs da kuɗaɗen juna

Analogin Rasha na ETF shine asusun juna (asusun zuba jari na juna). Duk da kamanceceniya, akwai wasu bambance-bambance

- Yawancin ETFs ana sarrafa su ba tare da izini ba tare da dabarun buɗewa . Wannan yana ba da fa’ida ga mai saka hannun jari, tun da yake a bayyane yake a cikin waɗanne kayan aikin nawa ne aka kashe kuɗin. Mai saka hannun jari zai iya tabbatar da cewa lokacin da yake saka hannun jari a cikin ETFs don zinare, jarinsa zai sake maimaita ƙarfin ƙarfe mai daraja.

- Kuɗaɗen saka hannun jarin kuɗi ne na gudanarwa masu aiki . Sakamakon kudi ya dogara da yawa akan ayyuka da kuskuren mai sarrafa. Ainihin halin da ake ciki shine lokacin da sauye-sauye na asusun juna ya kasance mara kyau a cikin kasuwa mai karfi mai karfi. Amma a faɗuwar kasuwa, kuɗin haɗin gwiwar na iya zama mafi kyau fiye da kasuwa.

- ETFs za su ba ku damar tattara nau’ikan fayil daban-daban , ta ƙasa, masana’antu ko dabarun.

- ETFs suna biyan rabon idan an biya su ta hannun hannun jarin index ɗin da suke bi. A mafi yawancin lokuta, ana sake saka hannun jari akan rabon kuɗi na asali.

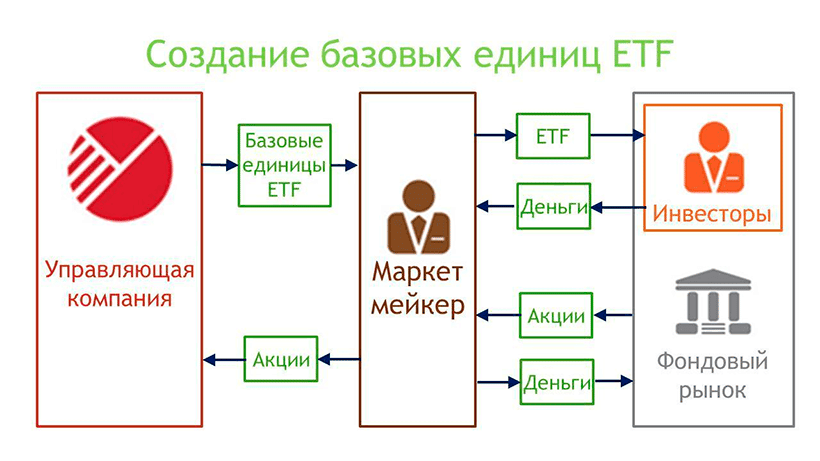

- Ana siyar da ETFs akan musayar , kuma mai yin kasuwa yana kula da ƙima. Babu buƙatar tuntuɓar kamfanin gudanarwa don siye. Ya isa a sami asusun dillali tare da kowane dillali mai lasisi.

- Kwamitocin ETF sun ninka sau da yawa idan aka kwatanta da kuɗin juna .

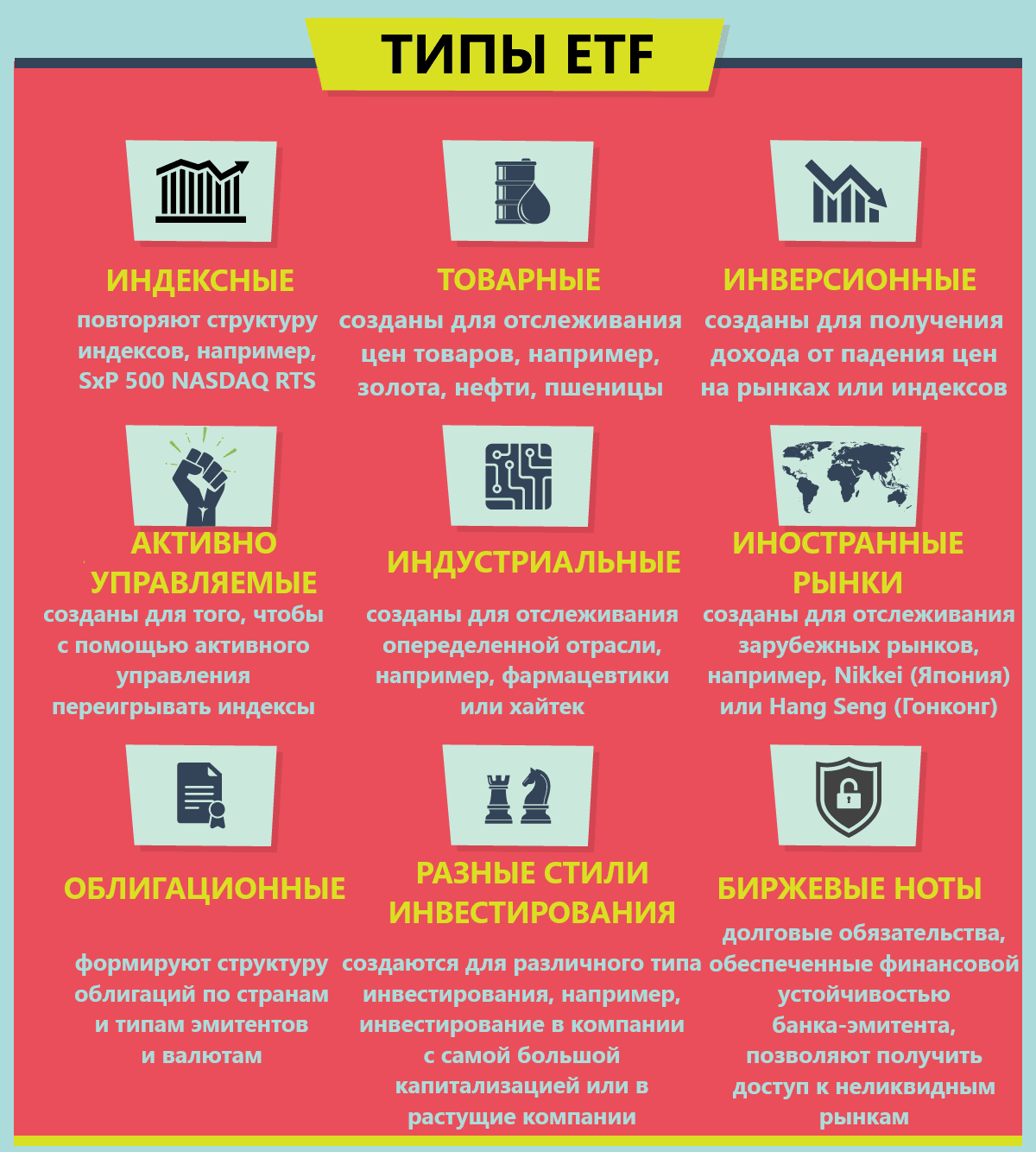

Nau’in ETFs

Za a iya raba ETFs da ke wanzu zuwa ƙungiyoyi masu zuwa:

- Ta ƙasa – akan musayar hannun jarin Amurka akwai kuɗi da ke saka hannun jari a kusan duk ƙasashen da ke da kasuwar hannayen jari. Akwai daban-daban ETFs ga kowace fihirisar wannan ƙasa.

- Ta sassa na tattalin arziki – akwai ETFs don takamaiman sassan tattalin arziki, inda aka tattara hannun jari na wani yanki na tattalin arzikin ƙasar da ake magana. Mai saka hannun jari bazai saya duka index ba, amma zuba jari kawai a cikin masana’antu masu ban sha’awa a ra’ayinsa.

- Don kayan aikin kuɗi – ETFs za a iya kasaftawa don hannun jari, shaidu, kayan kasuwancin kuɗi (hanyoyin gajeren lokaci har zuwa watanni 3), ETFs na kuɗi, ETFs don karafa masu daraja, kayan masana’antu, dukiya.

ETF akan MICEX

Akwai sama da 1,500 daban-daban ETFs da ake samu akan NYSE.

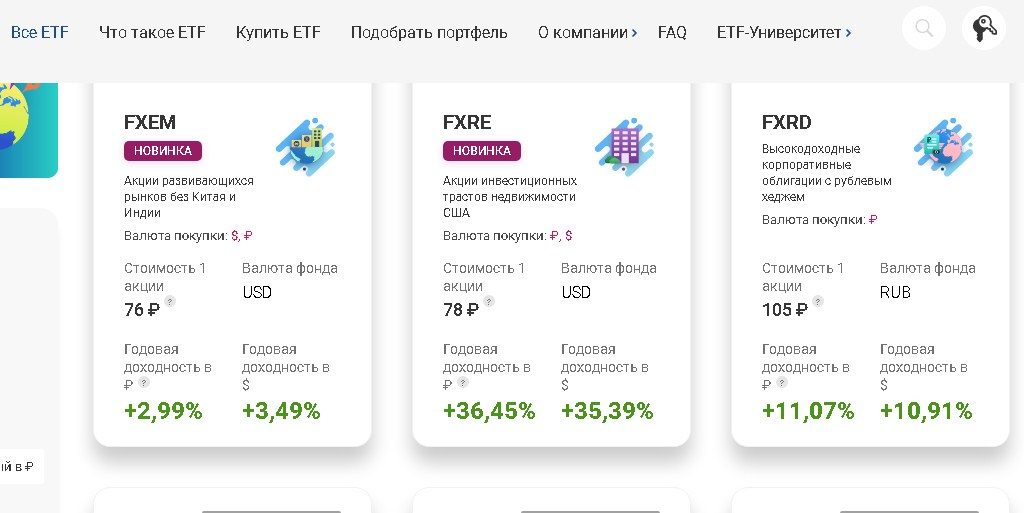

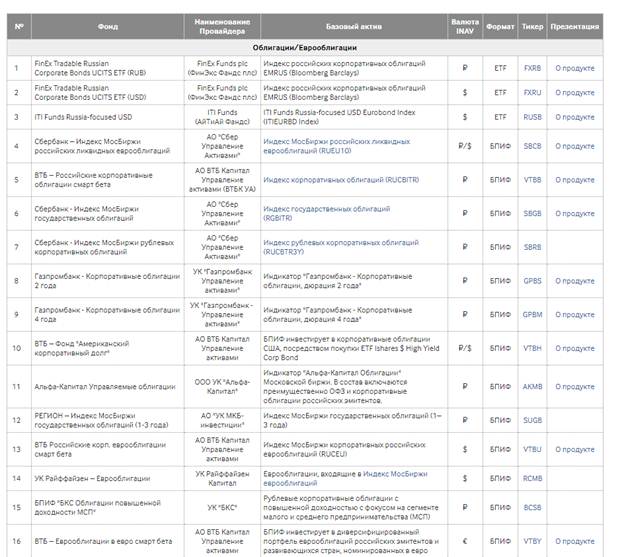

Musanya ta Moscow tana ba da jerin mafi ƙasƙanci na ETF ga masu zuba jari na Rasha (yawancin etfs suna samuwa don siye kawai ga ƙwararrun masu saka hannun jari). A halin yanzu, 128 ETFs da BIFs suna samuwa akan musayar Moscow. Finex yana ba da ETFs masu zuwa:

- FXRB – Fihirisar haɗin gwiwar kamfanoni na Rasha da aka ƙididdige su a cikin rubles.

- FXRU – Fihirisar haɗin gwiwar kamfanoni na Rasha da aka ƙima a cikin daloli.

- FXFA ginshiƙi ne na haɗin gwiwar kamfanoni masu yawan amfanin ƙasa na ƙasashen da suka ci gaba.

- FXIP – Hukunce-hukuncen gwamnatin Amurka, tare da kariyar hauhawar farashi tare da shingen ruble, ana ƙididdige su a cikin rubles.

- FXRD – dala babban hanu mai yawan amfanin ƙasa, ma’auni – Solactive USD Fallen Angel Issuer Capped Index.

- FXKZ – asusun yana zuba jari a hannun jari na Kazakhstan.

- FXRL zuba jari ne a cikin ma’aunin RTS na Rasha.

- FXDE zuba jari ne a kasuwar hannun jarin Jamus.

- FXIT zuba jari ne a fannin fasahar Amurka.

- FXUS zuba jari ne a cikin ma’aunin US SP500.

- FXCN zuba jari ne a kasuwar hannayen jarin kasar Sin.

- FXWO zuba jari ne a cikin hannun jari na kasuwannin duniya, kundin sa ya ƙunshi fiye da hannun jari 500 daga manyan ƙasashe 7 na duniya.

- FXRW zuba jari ne a cikin manyan hannayen jari na Amurka.

- FXIM zuba jari ne a sashen IT na Amurka.

- FXES – hannun jari na kamfanonin Amurka a fannin wasan kwaikwayo da eSports.

- FXRE zuba jari ne a cikin amintattun saka hannun jari na Amurka.

- FXEM – zuba jari a cikin hannun jari na kasashe masu tasowa (sai China da Indiya).

- FXGD zuba jari ne a cikin zinari.

Finex a halin yanzu shine kawai kamfani da ke ba da hannun jari na ETF ga ‘yan kasuwa na Rasha.

Akwai irin wannan samfurori daga Sberbank, VTB, BCS, Finam, Alfa Capital,

Tinkof Investments , Aton da sauransu. Amma duk suna cikin BPIF. Yawancin kamfanonin gudanarwa suna ba da samfuran irin wannan (asusun da ke biye da babban ma’aunin kasuwa na

SP500 yana wakiltar Sberbank, Alfa Capital da VTB). Halin da ake ciki kusan kusan iri ɗaya ne, amma masu saka hannun jari waɗanda suka sayi hannun jarin Finex sun ɗan amfana kaɗan saboda ƙananan kwamitocin. Wani fasali na ETF akan musayar Mosko shine cewa kudin ETF shine daloli, kuma don siyan irin wannan ETF, ana canza ruble daga asusun zuwa daloli. Akwai etf da aka ƙididdige su a cikin rubles (tare da shingen kuɗi), ta hanyar samun su mai saka hannun jari yana da kariya daga tsalle-tsalle a cikin dala zuwa ƙimar musanya ruble. [taken magana id = “abin da aka makala_12042” align = “aligncenter” nisa = “800”

Zuba jari a cikin ETFs

Babban fa’idar saka hannun jari a cikin ETFs shine matsakaicin rarrabuwa na fayil ga masu saka hannun jari tare da ƙaramin jari. Ka’idar saka hannun jari na dogon lokaci shine “kada ku sanya ƙwai a cikin kwando ɗaya”. Mai saka hannun jari a cikin ETF na iya sarrafa fayil ɗin sa ta ajin kadara (hannun jari, shaidu) – dangane da dabarun da aka zaɓa, canza ma’auni. A cikin aji, yana iya canza ma’auni tsakanin hannun jari na sassa daban-daban na ƙasashe daban-daban. Yi babban fayil iri-iri na Eurobonds. Matsakaicin adadin Eurobonds yana farawa daga $1000, don haɓakawa ya zama dole a sami aƙalla 15-20 ƙungiyoyi daban-daban. Wannan ya riga ya zama adadin gaske. Lokacin saka hannun jari a cikin ETF don Indexididdigar Yurobond, zaku iya siyan kwandon Eurobonds 25 akan kawai 1,000 rubles. Bugu da kari, mai saka hannun jari yana da damar siyan kadarorin da ake samu mai girma don karamin sashi na fayil ɗin.

takarce » bond na Rasha da kuma duniya. Don tabbatar da fayil ɗin sa, mai saka jari na iya ƙara saka hannun jari a cikin zinariya.

ETF yawan amfanin ƙasa

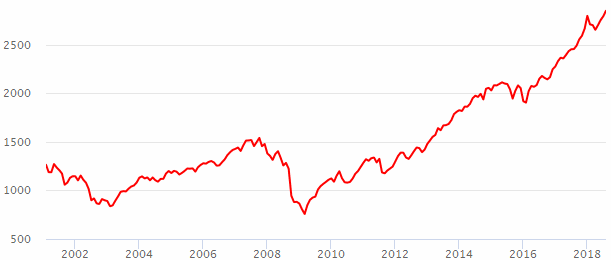

Abubuwan da aka dawo da ETF sun dogara gaba ɗaya akan yanayin kasuwa. A cikin ɗan gajeren lokaci har zuwa shekaru 1-3, yana da wuya a hango shi, saboda dole ne a yi la’akari da abubuwa da yawa. A cikin tsawon shekaru 10, tare da babban matakin yiwuwar, kadarorin za su yi tsada fiye da yadda suke yi a yau. Amma wannan ba yana nufin cewa za ku ga ingantaccen kuzari kowace rana cikin shekaru 10 ba. Bari mu kalli yadda babban kasuwar hannun jari ta Amurka SP500:

Kwamitocin

Baya ga hukumar musanya lokacin siye da siyarwa (bisa ga

jadawalin dillali , amma wasu dillalai ba sa cajin kwamiti lokacin siyan ETF), kuna buƙatar biyan kuɗin gudanarwa. FInex m ETFs yana cajin 0.9% kowace shekara. Ba a caje wannan adadin kai tsaye daga asusun dillali na mai saka jari, amma ana ci bashin kowace rana kuma ana la’akari da ƙimar ƙima. Idan ka sayi ETF wanda ya karu da kashi 10 cikin 100 a cikin shekara, wannan yana nufin haƙiƙa ya haura 10.9%.

Yana da ban sha’awa cewa an biya hukumar ba tare da la’akari da sakamakon zuba jari ba. Idan asusun ƙididdiga ya sami asarar 10% a cikin shekara guda, za ku sami asarar 10.9%.

Yadda ake siyan ETF

Hanya mafi sauƙi don siyan kuɗin ETF shine a kan Moskow Exchange. Dillalai na ƙasashen waje suna ba da zaɓi mafi girma na ETFs tare da ƙananan kudade. Don kwatantawa, akwai ETFs na waje tare da kuɗin 0.004% tare da kuɗin Finex na 0.9%. Ta hanyar dillali na waje, ana iya siyan ETF don cryptocurrency. Wani sabon kayan aiki wanda kudaden fansho da manyan masu zuba jari na Amurka sun riga sun fara saka hannun jari a ciki. Babban bankin ya yi kashedin game da haɗarin saka hannun jari a bitcoin ETFs. Idan wannan kayan aiki ya tabbatar da kwanciyar hankali (lokacin zuba jari shine akalla shekaru 10), masu samar da Rasha za su kara da shi a cikin layi. Amma kar ka manta cewa a cikin Tarayyar Rasha ETF za a iya saya akan

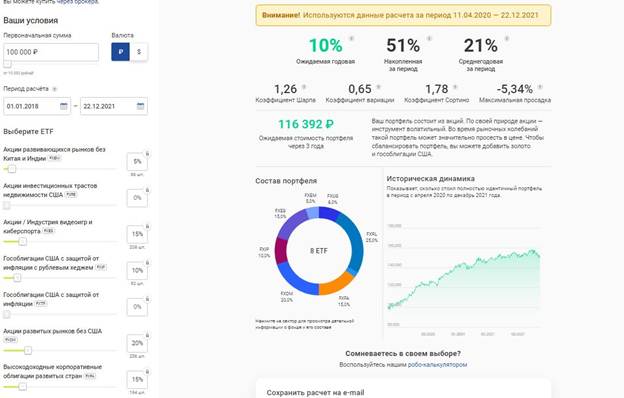

IISda mayar da 13% haraji. Dillalai da yawa ba sa biyan kuɗi don kula da asusun kuma yana yiwuwa a ba da kuɗin asusun sau ɗaya a wata ko mako a cikin ƙananan kuɗi. Ana ba da shawarar shiga kasuwannin waje, farawa tare da zuba jari na $ 10-20 dubu. [taken magana id = “abin da aka makala_12053” align = “aligncenter” nisa = “666”]

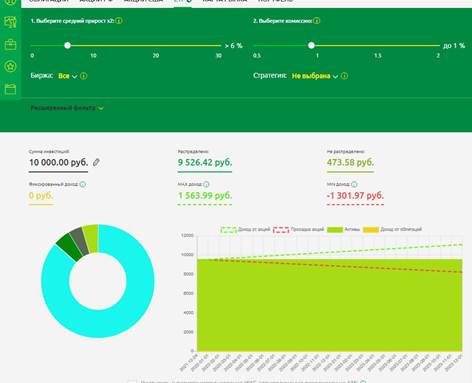

Ka’idar samar da fayil na ETF

Zuba hannun jari a cikin kuɗaɗen ƙididdiga yayi daidai da abin da manajojin kuɗi masu ritaya ke yi. Hannun hannun jari yana da mahimmanci – bai kamata ku yi ƙoƙarin tattara fayil ɗin ETF na shekaru 1-2 ba. Babban postulate na saka hannun jari a cikin ETFs shine na yau da kullun na saka hannun jari, ba tare da la’akari da yanayin kasuwa ba. Don zaɓar ETF masu dacewa, gidan yanar gizon Musanya na Moscow zai taimaka wa mai saka hannun jari, inda zaku iya ganin jerin duk kuɗin da aka yi musayar musayar – https://www.moex.com/msn/etf. [taken magana id = “abin da aka makala_12049” align = “aligncenter” nisa = “624”]

- FXMM asusun kasuwancin kuɗi ne na Amurka wanda ke saka hannun jari a cikin gajerun shaidu na Amurka na tsawon watanni 1-3.

Wannan asusu yayi kwatankwacin adadin ajiya na bukata. Wani fasali na musamman shi ne cewa jadawalinsa madaidaiciyar layi ne wanda aka nuna sama a kusurwar digiri 45.

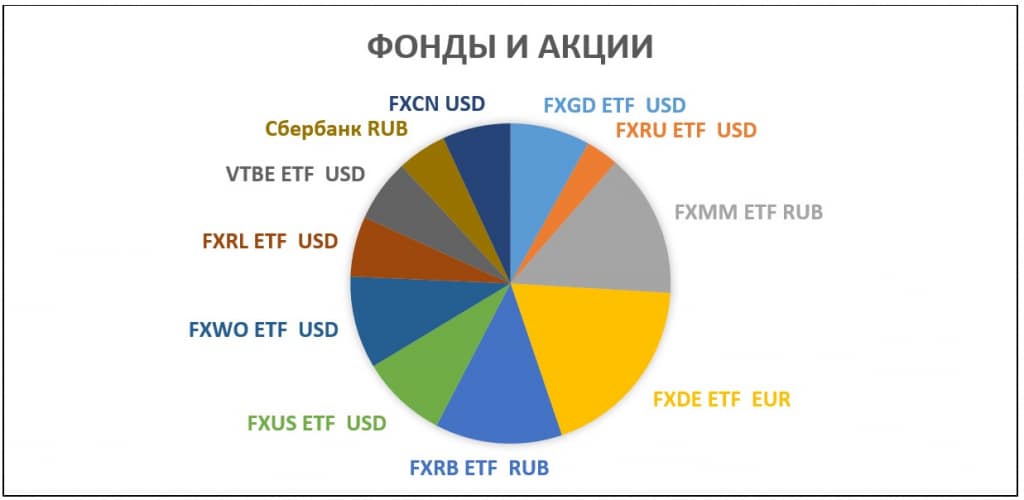

- BPIF RFI “VTB – Asusun Haƙƙin Ƙasashe Masu tasowa” (VTBE ETF) . Don bambanta, bari mu ƙara wani kadara da ke zuba jari a ƙasashe masu tasowa a cikin fayil ɗin.

Bari mu zaɓi a cikin mai binciken ETF duk kadarorin da ke saka hannun jari a cikin gauraye kadarorin. Bari mu mai da hankali kan vtbe etf. Wannan asusun yana zuba jari a cikin kadarorin kasashe masu tasowa ta hanyar siyan etf ISHARES CORE MSCI EM na waje. Zuba jari a cikin wannan asusun zai tabbatar da bambance-bambance a cikin ƙasashe. A lokaci guda kuma, kwamitin asusun ya kasance kawai 0.71%. Lokacin siye ta hanyar dillali na VTB, babu hukumar musanya.

- VTBH ETF girma Yanzu, don rage rashin ƙarfi na fayil ɗin, bari mu ƙara shaidu. VTBH ETF ana kasuwanci dashi a shafukan yanar gizo na kasuwanci daban-daban. Don gano ƙididdigar hannun jari na shekarar da ta gabata, yi sama sama da jadawalin tarihin ISHARES HIGH YIELD CORP.

- DIVD ETF – asusun musayar musayar ya bi ginshiƙi na rarraba hannun jari na Tarayyar Rasha. Ma’auni ya haɗa da 50% na mafi kyawun hannun jari na Tarayyar Rasha dangane da: yawan amfanin ƙasa, kwanciyar hankali na rabo, ingancin mai bayarwa. Saboda rabon rabon da ingancin samfuran kasuwanci, ana sa ran samun mafi girma fiye da kasuwa mai faɗi (matsakaicin dawowar shekara-shekara daga Maris 2007 zuwa yau 15.6% vs. 9.52% for the wide ãdal market)

- Don zuba jarurruka a kasuwannin hannayen jari na Amurka, TECH (zuba jari a cikin US NASDAQ 100 index) daga Tinkoff Investments da FXUS , wanda ke yin kwatankwacin abubuwan da ke cikin manyan kasuwannin hannayen jari na Amurka SP500, sun fi dacewa.

- Hankali kuma ya cancanci TGRN ETF daga Tinkoff Investments . Matsakaicin yawan amfanin ƙasa na shekara yana kan matakin 22% a kowace shekara. Asusun yana saka hannun jari ga shugabannin fasaha masu tsabta a duniya.

- ETF FXRL asusun ƙididdiga ne wanda ke biye da haɓakar ma’aunin RTS na Rasha. Ganin cewa RTS index ɗin dala ne, etf yana ba da wasu kariya daga canjin kuɗi. Tare da haɓakar dala, alamar RTS tana girma da ƙarfi fiye da MICEX. An sake saka hannun jarin da aka samu a hannun jarin asusun. Asusun yana biyan haraji akan rabon kashi 10%.

- Don kare kariya daga hauhawar farashin kaya, yakamata ku ƙara etf na zinari, misali, FXGD . Hukumar asusu shine kawai 0.45%. Asusun yana bin farashin gwal na zahiri a kasuwannin duniya daidai gwargwadon iko, kuma yana ba ku damar kare kanku daga hauhawar farashi ba tare da VAT ba.

- Har ila yau, nemi ETFs waɗanda ke bin All Weather/Perpetual Portfolio dabarun – etf opnw daga Otkritie Broker ko TUSD ETF daga Tinkoff Investments . Asusun yana da rarrabuwa a ciki, mai saka hannun jari baya buƙatar yin ƙarin ƙoƙari. Manajoji suna saka hannun jari daidai a hannun jari, shaidu, gwal. Etf opnw kuma yana saka hannun jari a cikin kuɗaɗen gidaje na Amurka.

Ga masu asusun dillalai, irin wannan nau’in ETF, ko da yake ya dace sosai, yana da tsada sosai. Zai fi kyau ɗaukar ɗan lokaci kaɗan kuma gina fayil ɗin ETF da kanku. A cikin tsawon shekaru 20, ko da ƙananan kwamitocin 0.01-0.05% sun juya zuwa adadi mai ma’ana.

Lokacin zabar mafi kyawun ETFs, ya kamata ku yi ƙoƙarin yin tunani sosai a duniya. Sakamakon zuba jari na shekaru biyu da suka gabata ba ya tabbatar da nasarar iri ɗaya a nan gaba. Zuba jari a hannun jari wanda ya nuna saurin girma na iya zama mara amfani a cikin ‘yan shekaru masu zuwa. Sashin na iya yin zafi sosai sannan a huta. Zuba jari a cikin fa’ida mai fa’ida ya fi riba saboda abun da ke cikin ma’aunin yana canzawa koyaushe. An maye gurbin kamfanoni masu rauni da masu karfi. Yawancin kamfanoni da aka haɗa a cikin ma’aunin SP500 ba su kasance a kasuwa shekaru 10 da suka gabata ba, amma haɓakar index ɗin bai sha wahala daga wannan ba. Ya kamata ku yi ƙoƙari don ƙarin tunani a duniya, kar ku kalli yanayin halin yanzu na asusun, ƙoƙarin zaɓar mafi ƙarancin haɗari da ƙarin mafita iri-iri. Bayan gano mafi kyawun ETFs a kowane aji na kadara, inda mai saka jari ke son zuba jari sai a ware wa kowane hannun jarinsa. Ana ba da shawarar yin biyayya ga ma’auni masu zuwa:

- An ware kashi 40% na fayil ɗin don siyan hannun jari . Don rarrabuwa, ana raba hannun jari ta ƙasa da masana’antu. Ana ba kowane nau’in ETF daidai gwargwado a cikin wannan rukunin;

- 30% – shaidu . Wannan zai rage yawan dawowar fayil ɗin gaba ɗaya, amma a lokaci guda rage rashin daidaituwa na asusun dillali. Abin da zai tabbatar da tasiri ga tsarin mai juyayi na mai saka jari a cikin lokuta masu wuyar gaske;

- 10% na fayil – zuba jari a cikin zinariya . Sashi na fayil ɗin yana da kariyar sharaɗi. Wataƙila daga baya za a iya maye gurbin wannan ɓangaren fayil ɗin ta hanyar saka hannun jari a cikin cryptocurrencies;

- 20% – yankuna masu ban sha’awa – manyan hajoji na fasaha, zuba jari a cikin kamfanoni “kore” don haɓaka haɓaka mai sauri.

Jagorar ETF – Tambayoyi 15 masu mahimmanci: menene kudaden ETF, yaya suke aiki, yadda ake samun kuɗi akan su: https://youtu.be/I-2aJ3PUzCE Zuba jari a cikin ETFs yana nufin na yau da kullum da kuma dogon lokaci. Ya dace don sake cika fayil ɗin kowane wata – sanannen postulate “biya kanka da farko.” Lokacin sake cikawa, ya kamata ku bi dabarun da aka zaɓa, kula da adadin kadarorin. Wasu kadarorin za su faɗi cikin farashi, yayin da rabonsu a cikin fayil ɗin zai ragu. Sauran kadarorin za su yi girma cikin ƙima, rabon su zai girma. Kada ku yi ƙoƙari sosai don kiyaye ma’auni – rarrabuwa na 5-10% suna cikin kewayon al’ada. Akwai hanyoyi guda biyu don kula da rabo – sayar da kadarorin da suka tashi a farashi da kuma sayen wadanda suka ragu. Ko kuma kawai siyan waɗanda suka ragu a baya saboda cikawa. Kar a sayar har sai an cimma manufofin zuba jari. Wanne daga cikin waɗannan hanyoyin guda biyu da aka zaɓa ba shi da mahimmanci. Yana da mahimmanci a zaɓi hanyar saka hannun jari don bi ta. Tare da ci gaba da sake siyan koma baya da sayar da kadarorin da suka nuna girma, mai saka hannun jari koyaushe yana saye a ƙasa yana siyarwa a sama. A lokaci guda kuma, ba zai ƙayyade mafi kyawun farashi ba, amma a matsakaita fayil ɗin zai nuna tasiri mai kyau a cikin dogon lokaci, kuma wannan shine mafi mahimmanci.