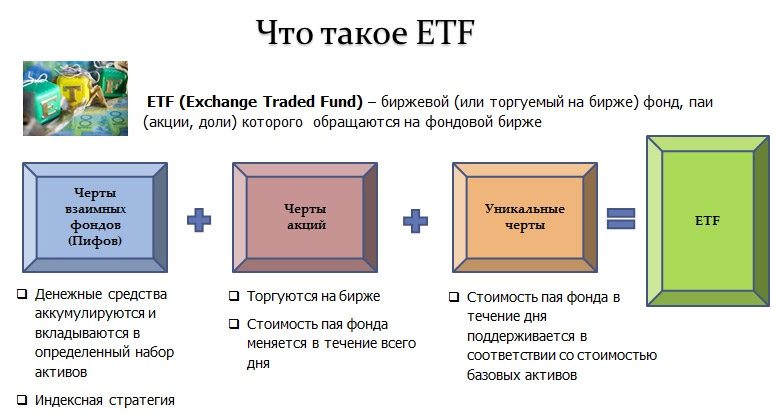

Exchange-traded ETF fund – what is it in simple words about the complex.ETFs (exchange-traded funds) are a form of collective investment. By purchasing a share of such a fund for only 4,000 rubles, you become the owner of a small share of shares in companies such as Microsoft, Apple, MasterCard, Tesla, Facebook, Google, McDonald’s and many others. VTI’s most diversified fund includes over 3,900 stocks. To repeat such diversification in their account, a private investor would require too much capital. For most inverters, this diversification is not available. There are index exchange-traded funds that exactly copy the composition and proportions of shares of world indices, commodity and precious metals funds, ETFs for bonds and money market instruments. There are over 100 different exchange-traded funds in the US market that implement different strategies. For example,

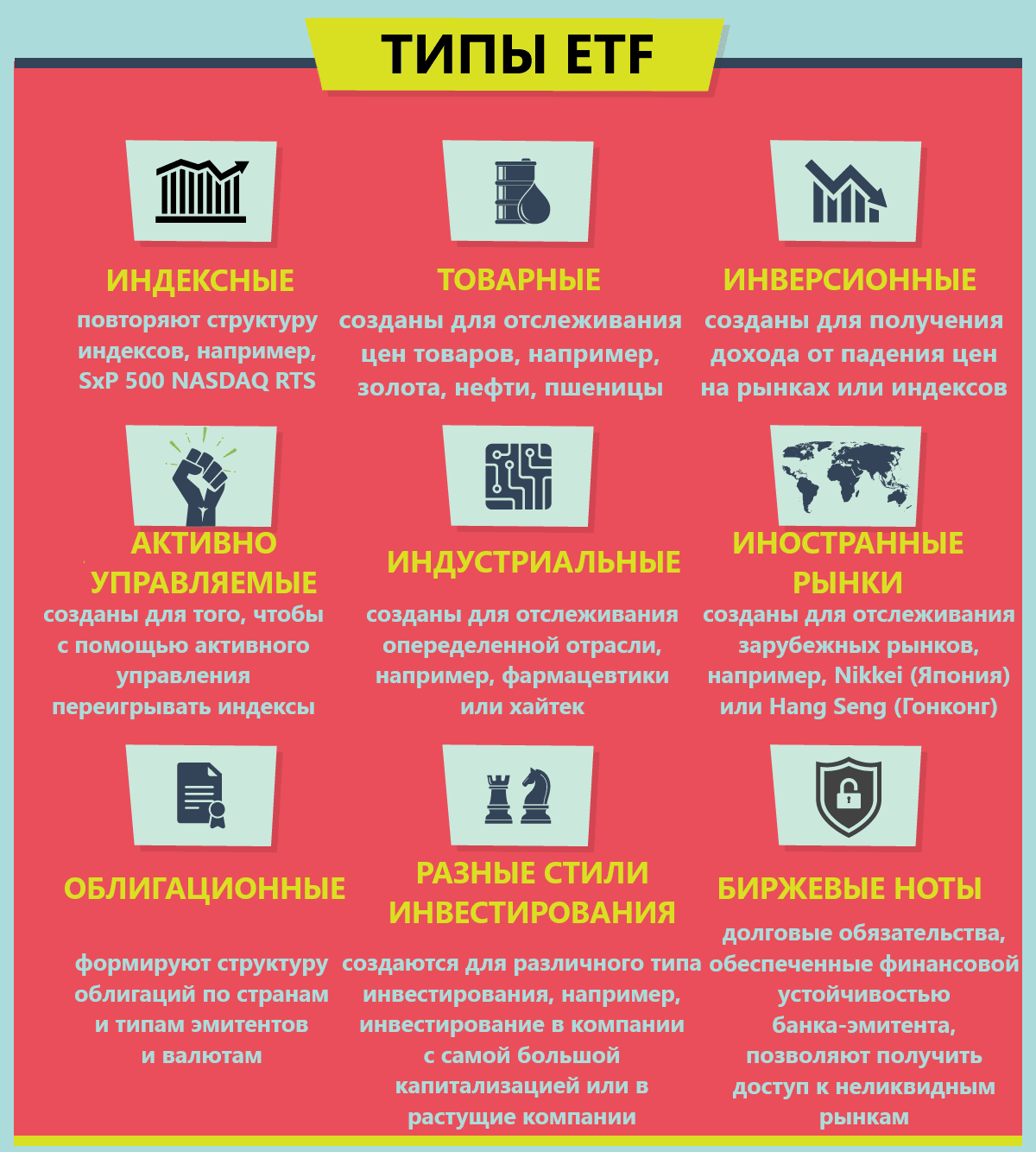

Ray Dalio ” (investments in stocks, bonds and gold with periodic imbalance), investments in shares of a specific sector of specific countries. With the help of an ETF portfolio, you can collect a diversified portfolio by industry and country of investors with a very modest deposit. There are passively managed ETFs that exactly follow the dynamics of an index or commodity, and active management funds, in which income and drawdown are regulated by managers. The most common funds are passive management – they have lower fees and their dynamics does not depend on the human factor.

Differences between ETFs and mutual funds

The Russian analogue of the ETF is a mutual fund (mutual investment fund). Despite the similarities, there are some differences

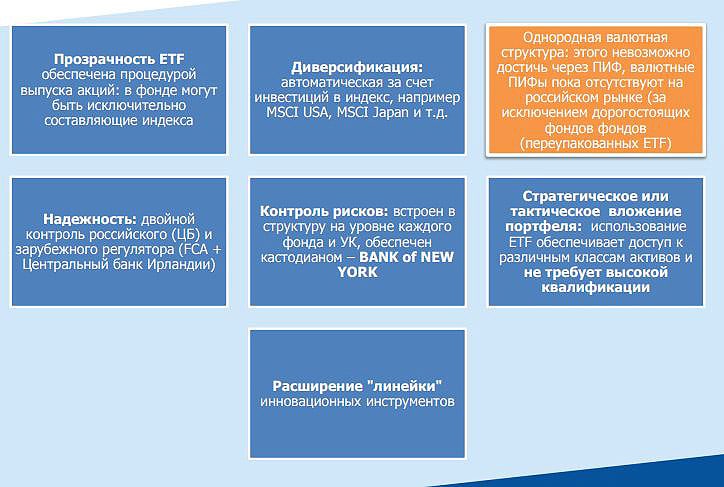

- Most ETFs are passively managed with an open strategy . This gives an advantage to the investor, since it is clear in which instruments in what proportions the money is invested. An investor can be sure that when investing in ETFs for gold, his investments will exactly repeat the dynamics of the precious metal.

- Mutual investment funds are active management funds . The financial result depends largely on the actions and mistakes of the manager. A real situation is when the dynamics of the mutual fund is negative in a strong bull market. But in the fall of the market, mutual funds may be better than the market.

- ETFs will allow you to collect a diversified portfolio , by country, industry or strategy.

- ETFs pay dividends if they are paid by the shares of the index they follow. In most cases, dividends are reinvested at the original proportion.

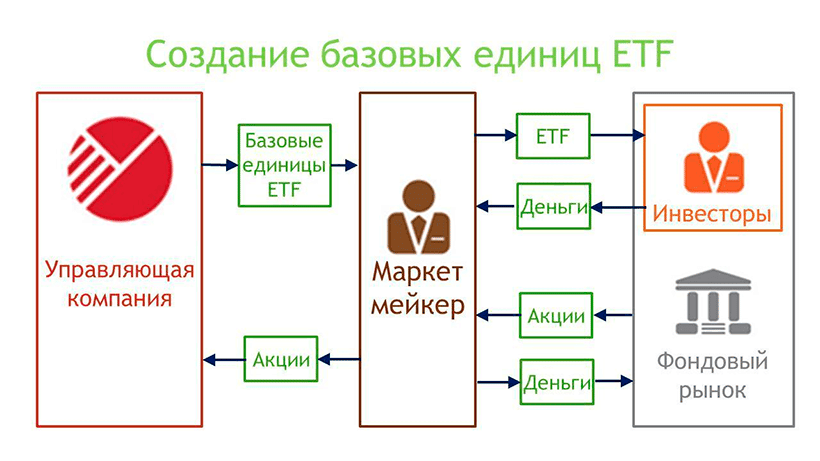

- ETFs are traded on an exchange , and a market maker maintains liquidity. There is no need to contact the management company for a purchase. It is enough to have a brokerage account with any licensed broker.

- ETF commissions are several times lower compared to mutual funds .

Types of ETFs

Existing ETFs can be divided into the following groups:

- By country – on the US stock exchange there are funds that invest in almost all countries where there is a stock market. There are separate ETFs for each index of this country.

- By sectors of the economy – there are ETFs for specific sectors of the economy, where the shares of a particular sector of the economy of the country in question are collected. An investor may not buy the entire index, but invest only in promising industries in his opinion.

- For financial instruments – ETFs can be allocated for stocks, bonds, money market instruments (short-term bonds up to 3 months), currency ETFs, ETFs for precious metals, industrial goods, real estate.

ETF on MICEX

There are over 1,500 different ETFs available on the NYSE.

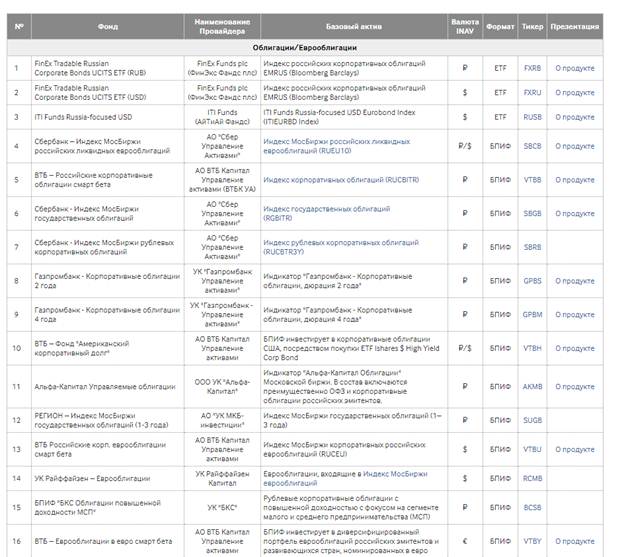

The Moscow Exchange offers a much more modest list of ETFs for Russian investors (many etfs are available for purchase only to qualified investors). Currently, 128 ETFs and BIFs are available on the Moscow Exchange. Finex offers the following ETFs:

- FXRB – Index of Russian corporate bonds denominated in rubles.

- FXRU – Index of Russian corporate bonds denominated in dollars.

- FXFA is an index of high-yield corporate bonds of developed countries.

- FXIP – US government bonds, with inflation protection with a ruble hedge, are denominated in rubles.

- FXRD – dollar high yield bonds, benchmark – Solactive USD Fallen Angel Issuer Capped Index.

- FXKZ – the fund invests in shares of Kazakhstan.

- FXRL is an investment in the Russian RTS index.

- FXDE is an investment in the German stock market.

- FXIT is an investment in the American technology sector.

- FXUS is an investment in the US SP500 index.

- FXCN is an investment in the Chinese stock market.

- FXWO is an investment in shares of the global market, its portfolio includes more than 500 shares from 7 largest countries of the world.

- FXRW is an investment in high-cap US stocks.

- FXIM is an investment in the US IT sector.

- FXES – shares of US companies in the gaming sector and eSports.

- FXRE is an investment in US real estate investment trusts.

- FXEM – investments in shares of developing countries (except China and India).

- FXGD is an investment in gold.

Finex is currently the only company offering ETF investments to Russian traders.

There are similar products from Sberbank, VTB, BCS, Finam, Alfa Capital,

Tinkof Investments , Aton and others. But they all belong to BPIF. Many management companies offer similar products (the fund following the broad market index

SP500 is represented by Sberbank, Alfa Capital and VTB). The dynamics are almost identical, but investors who bought Finex shares benefited slightly due to lower commissions. A feature of the ETF on the Moscow Exchange is that the currency of the ETF is dollars, and in order to buy such an ETF, rubles from the account are first converted into dollars. There are etf denominated in rubles (with a currency hedge), by acquiring them the investor is protected from jumps in the dollar to ruble exchange rate.

The principle of forming an ETF portfolio

Passive investing in index funds is pretty much the same as what retiree money managers do. The investment horizon matters – you should not try to collect an ETF portfolio for 1-2 years. The main postulate of investing in ETFs is the regularity of investments, regardless of the market situation. To select suitable ETFs, the Moscow Exchange website will help the investor, where you can see a list of all traded exchange-traded funds – https://www.moex.com/msn/etf.

- FXMM is a US money market fund that invests in US short bonds for a period of 1-3 months.

This fund is analogous to a demand deposit. A distinctive feature is that its graph is a straight line directed upwards at an angle of 45 degrees.

- BPIF RFI “VTB – Emerging Countries Equity Fund” (VTBE ETF) . To diversify, let’s add an asset that invests in developing countries to the portfolio.

Let’s select in the ETF screener all the assets that invest in mixed assets. Let’s focus on vtbe etf. This fund invests in the assets of developing countries through the purchase of foreign etf ISHARES CORE MSCI EM. Investments in this fund will ensure diversification across countries. At the same time, the fund’s commission is only 0.71%. When buying through a VTB broker, there is no exchange commission.

- VTBH ETF . Now, to reduce the volatility of the portfolio, let’s add bonds. VTBH ETF provides an opportunity to invest in high-yield US bonds. To do this, the exchange-traded fund buys shares of the foreign ETF ISHARES HIGH YIELD CORP BOND.

- DIVD ETF – an exchange-traded fund follows the index of dividend stocks of the Russian Federation. The index includes 50% of the best shares of the Russian Federation in terms of: dividend yield, dividend stability, quality of the issuer. Due to the dividend payout and the quality of the business models, a higher return than the broad equity market is expected (average annual return from March 2007 to date 15.6% vs. 9.52% for the broad equity market)

- For investments in the US stock market, TECH (invests in the US NASDAQ 100 index) from Tinkoff Investments and FXUS , which replicates the dynamics of the broad US stock market SP500, are best suited.

- Attention also deserves TGRN ETF from Tinkoff Investments . The average annual yield is at the level of 22% per annum. The fund invests in clean technology leaders around the world.

- ETF FXRL is an index fund that follows the dynamics of the Russian RTS index. Given that the RTS is a dollar index, etf provides some protection against currency fluctuations. With the growth of the dollar, the RTS index grows stronger than the MICEX. Dividends received are reinvested in the fund’s shares. The Fund pays a tax on dividends of 10%.

- To protect against inflation, you should add gold etf, for example, FXGD . The fund commission is only 0.45%. The Fund tracks the price of physical gold on the global market as accurately as possible, and allows you to protect yourself from inflation without VAT.

- Also, look out for ETFs that follow an All Weather/Perpetual Portfolio strategy – etf opnw from Otkritie Broker or TUSD ETF from Tinkoff Investments . The fund has diversification inside, the investor does not need to make additional efforts. Managers invest equally in stocks, bonds, gold. Etf opnw also invests in US real estate funds.

For owners of brokerage accounts, this type of ETF, although very convenient, is too expensive. It is better to take a little time and build an ETF portfolio on your own. Over a period of 20 years, even insignificant 0.01-0.05% commissions turn into tangible amounts.

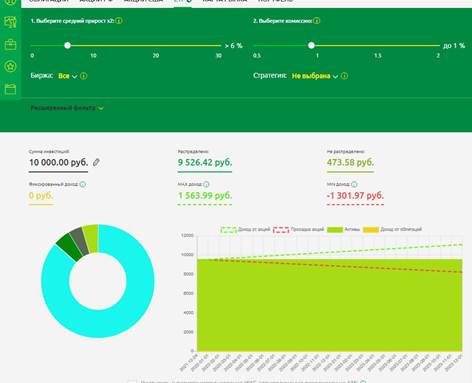

When choosing the most promising ETFs, you should try to think more globally. Investment results of the last two years do not guarantee the same success in the future. Investments in stocks that have shown rapid growth may turn out to be unprofitable over the next few years. The sector may be overheated and then take a break. Investing in a broad index is more profitable because the composition of the index is constantly changing. Weak companies are replaced by strong ones. Many companies included in the SP500 index were no longer on the market 10 years ago, but the dynamics of the index did not suffer from this. You should strive to think more globally, not look at the current dynamics of the fund, try to choose less risky and more diversified solutions. Having identified the most promising ETFs in each asset class, where the investor wants to invest money should be allocated for each of his shares. It is recommended to adhere to the following proportions:

- 40% of the portfolio is allocated to buy shares . For diversification, stocks are divided by country and industry. Each type of ETF is given an equal share within this group;

- 30% – bonds . This will reduce the overall return of the portfolio, but at the same time reduce the volatility of the brokerage account. What will positively affect the nervous system of the investor in difficult periods;

- 10% of the portfolio – investments in gold . Conditionally protective part of the portfolio. Perhaps later this part of the portfolio can be replaced by investments in cryptocurrencies;

- 20% – promising areas – high-tech stocks, investments in “green” companies for promising rapid growth.

ETF guide – 15 main questions: what are ETF funds, how do they work, how to make money on them: https://youtu.be/I-2aJ3PUzCE Investing in ETFs implies regularity and long-term. It is convenient to replenish the portfolio every month – the well-known postulate “pay yourself first.” When replenishing, you should adhere to the chosen strategy, observe the proportions of assets. Some assets will fall in price, while their share in the portfolio will decrease. Other assets will grow in value, their share will grow. You should not try too carefully to keep the proportions – deviations of 5-10% are within the normal range. There are two ways to maintain proportions – selling assets that have risen in price and buying up those that are lagging behind. Or just buying up those who are lagging behind due to replenishment. Do not sell until the investment objectives are met. Which of these two methods is chosen is not so important. It is important to choose an investment method to follow it. With constant re-buying of lagging behind and selling assets that have shown growth, the investor always buys at the bottom and sells at the top. At the same time, he will not determine the most favorable prices, but on average the portfolio will show positive dynamics over a long period of time, and this is the most important thing.