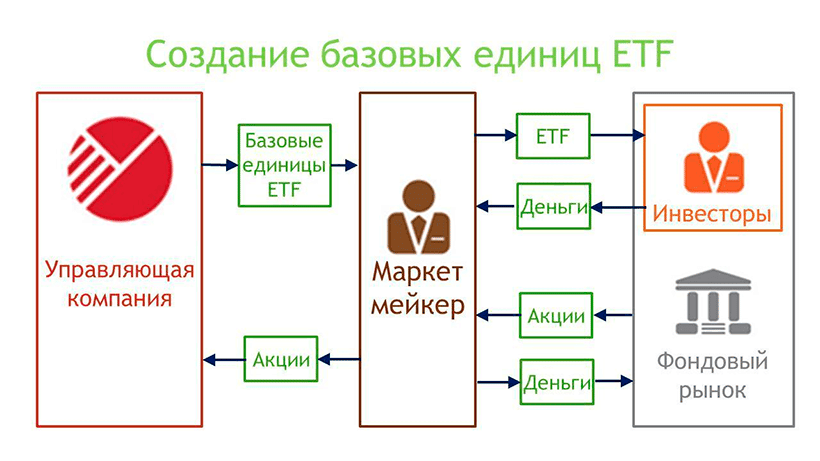

Exchange-sitsatsa ETF ga – nukae nye le nya bɔbɔewo me ku ɖe nu sesẽ la ŋu.ETF (ga siwo wotsɔna ɖɔlia gae) nye gadede asi ɖekae ƒomevi aɖe. Ne èƒle ga ma tɔgbe ƒe akpa aɖe ɖe ruble 4,000 ko nu la, àva zu akpa sue aɖe si le dɔwɔƒewo abe Microsoft, Apple, MasterCard, Tesla, Facebook, Google, McDonald’s kple bubu geɖewo ene me tɔ. VTI ƒe ga si me wowɔa nu vovovowo le wu la ƒe akpa aɖewoe nye ga si wu 3,900. Be woagawɔ nu vovovo mawo le woƒe gakɔnta me la, ame ŋutɔ ƒe gadelawo abia ga gbogbo aɖe akpa. Le inverter akpa gãtɔ gome la, vovototodedeameme sia meli o. Ga siwo wodzrana le index exchange me li siwo srɔ̃a xexeame ƒe indices, adzɔnuwo kple ga xɔasiwo ƒe ga, ETF na bonds kple ga ƒe asitsatsa ƒe dɔwɔnuwo ƒe akpawo ƒe wɔwɔme kple woƒe agbɔsɔsɔme pɛpɛpɛ. Ga vovovo siwo wu 100 ye le United States ƒe asitsatsa me siwo wɔa mɔnu vovovowo ŋudɔ. Le kpɔɖeŋu me,

Ray Dalio ” (gadede adzɔnuwo, gagbalẽwo kple sika me kple ɣeyiɣi aɖewo ƒe dadasɔ), gadede dukɔ aɖewo ƒe akpa aɖe koŋ ƒe gomewo me. To ETF ƒe gaxɔgbalẽvi ƒe kpekpeɖeŋu me la, àte ŋu aƒo gaxɔgbalẽvi vovovowo nu ƒu le dɔwɔƒewo kple dukɔ siwo me gadelawo le nu kple ga si mesɔ gbɔ kura o. ETF siwo dzi wokpɔna le mɔ si mewɔa dɔ o nu la li siwo kplɔa index alo adzɔnu aɖe ƒe ŋusẽkpɔɖeamedzi ɖo pɛpɛpɛ, kple ga siwo dzi wokpɔna le dɔ me, siwo me dɔdzikpɔlawo kpɔa gakpɔkpɔ kple gaɖeɖe dzi le. Ga siwo bɔ wue nye passive management – woƒe fetu le sue wu eye woƒe dynamics menɔ te ɖe amegbetɔ ƒe nuwɔna dzi o.

Vovototo siwo le ETF kple mutual funds dome

Russiatɔwo ƒe ETF ƒe nɔnɔmetata si sɔ kple wo nɔewo nye ga si wotsɔna dea gae (mutual investment fund). Togbɔ be woɖi wo nɔewo hã la, vovototo aɖewo li

- Wokpɔa ETF akpa gãtɔ dzi le mɔ si mewɔa naneke o nu kple aɖaŋu si le ʋuʋu ɖi . Esia naa viɖe nɔa gadelawo si, elabena eme kɔ ƒã be dɔwɔnu kawo mee wotsɔa gaa dea gae le agbɔsɔsɔ ka me. Gadelawo ate ŋu aka ɖe edzi be ne yede ga ETF-wo me hena sika la, yeƒe gadede asiwo agbugbɔ ga xɔasi la ƒe ŋusẽ agblɔ pɛpɛpɛ.

- Ga siwo wotsɔna dea gae ɖekae nye ga siwo wotsɔna kpɔa gae siwo le dɔ dzi vevie . Ga si ado tso eme la nɔ te ɖe dɔdzikpɔla la ƒe nuwɔnawo kple vodadawo dzi koŋ. Nɔnɔme ŋutɔŋutɔe nye ne ga si wotsɔ kpena ɖe ame ŋu ƒe ŋusẽkpɔɖeamedzia menyo o le nyitsu ƒe asi sesẽ aɖe me. Gake le asitsatsa ƒe anyidzedze me la, ga si wotsɔna ƒoa ƒui ate ŋu anyo wu asitsaƒea.

- ETFs ana nàƒo gaxɔgbalẽvi vovovowo nu ƒu , le dukɔ, dɔwɔƒe alo aɖaŋu nu.

- ETF -wo xea ga si woama na amewo nenye be index si dzi wozɔna ɖo ƒe akpa aɖewoe xea wo. Zi geɖe la, wogbugbɔa ga si woama na amewo la dea eme le agbɔsɔsɔ si nɔ anyi gbã la nu.

- Wodzraa ETF -wo le asitsaƒe aɖe , eye asitsalawo léa ga si woate ŋu aƒle la me ɖe asi. Mehiã be nàte ɖe dɔwɔƒe si kpɔa dɔa dzi ŋu atsɔ aƒle nu o. Esɔ gbɔ be asitsahabɔbɔ ƒe akɔnta nanɔ asitsaha ɖesiaɖe si si mɔɖegbalẽ le gbɔ.

- ETF ƒe dɔdzikpɔfewo ɖiɖi zi gbɔ zi geɖe ne wotsɔe sɔ kple ga si wotsɔna ƒoa gae .

ETF ƒomeviwo

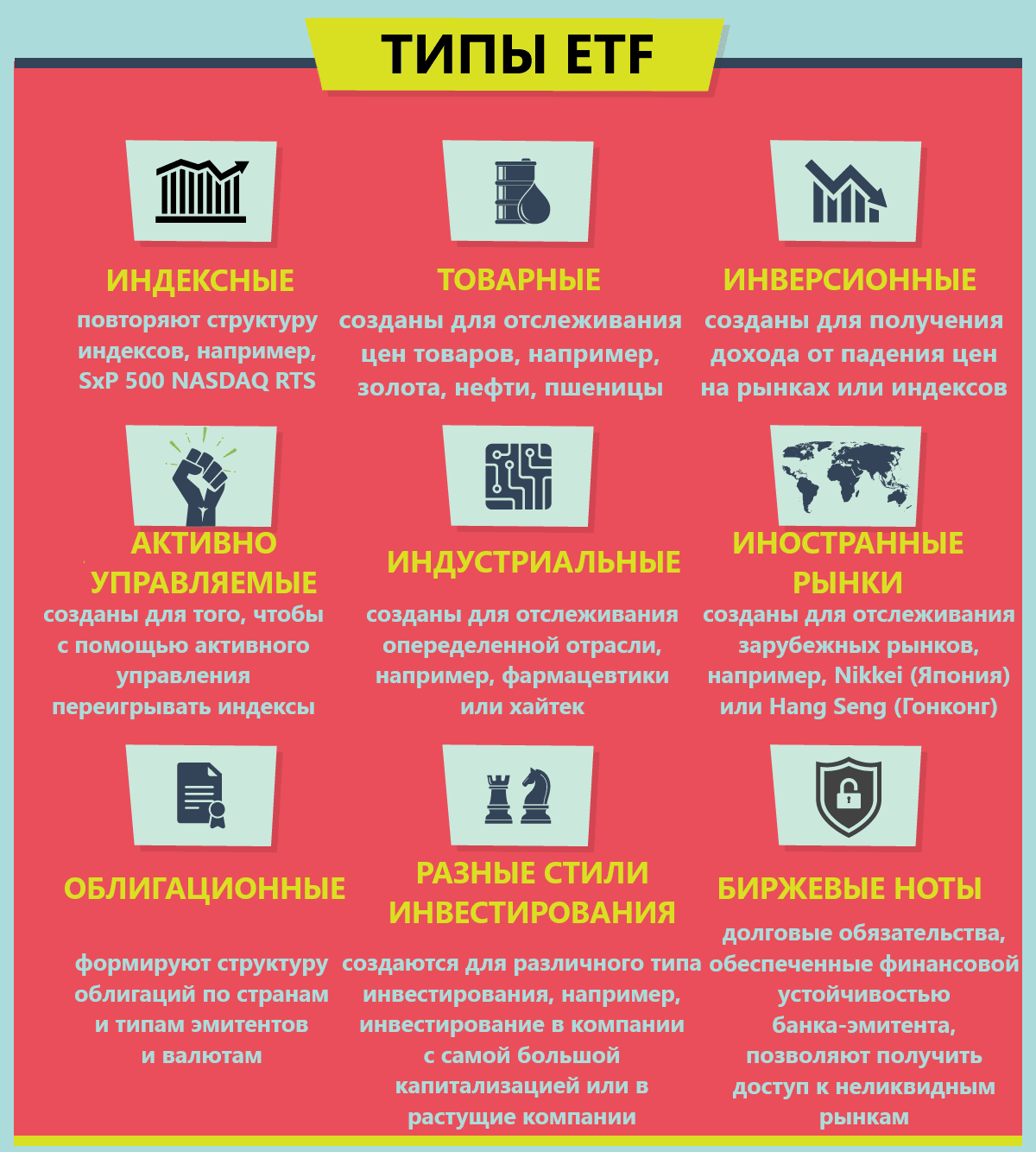

Woateŋu ama ETF siwo li fifia ɖe hatsotso siwo gbɔna me:

- Le dukɔwo nu – le United States ƒe gaxɔmenudzraƒewo la, ga aɖewo li siwo dea ga dukɔ siwo katã kloe ƒe asitsaƒe le la me. ETF vovovowo li na dukɔ sia ƒe index ɖesiaɖe.

- Le ganyawo ƒe akpawo nu – ETFwo li na ganyawo ƒe akpa aɖewo koŋ, afisi woƒoa dukɔ si ŋu nya ku ɖo ƒe ganyawo ƒe akpa aɖe koŋ ƒe gomewo nu ƒu le. Ðewohĩ gadelawo maƒle index bliboa o, ke boŋ dɔwɔƒe siwo ŋugbe wodo le eƒe nukpɔsusu nu koe de gae.

- Le gaŋutiɖoɖowo gome – Woateŋu ama ETFwo na adzɔnuwo, gagbalẽwo, gaxɔgbalẽviwo (ɣeyiɣi kpui aɖe ƒe gagbalẽwo vaseɖe ɣleti 3), ga ƒe ETFwo, ETFwo na ga xɔasiwo, dɔwɔƒewo ƒe adzɔnuwo, anyigba kple xɔwo.

ETF le MICEX dzi

ETF vovovo siwo wu 1,500 ye li le NYSE.

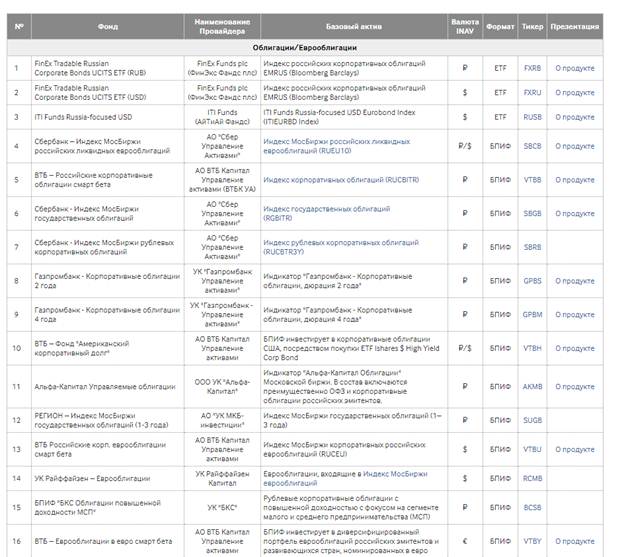

Moscow Exchange la naa ETF ƒe xexlẽdzesi si le sue wu sã na Russiatɔ gadelawo (etf geɖewo li na gadelawo siwo dze ko be woaƒle). Fifia la, ETF kple BIF 128 ye le Moscow Exchange. Finex naa ETF siwo gbɔna:

- FXRB – Russiatɔwo ƒe dɔwɔƒewo ƒe gagbalẽwo ƒe xexlẽdzesi si woŋlɔ ɖe rubles me.

- FXRU – Russiatɔwo ƒe dɔwɔƒewo ƒe gagbalẽ siwo woŋlɔ ɖe dɔlar me ƒe dzesi.

- FXFA nye dukɔ deŋgɔwo ƒe dɔwɔƒewo ƒe gagbalẽ siwo me wokpɔa ga geɖe le ƒe dzesi.

- FXIP – United States dziɖuɖu ƒe gagbalẽwo, kple ga ƒe asixɔxɔ takpɔkpɔ kple ruble hedge, ƒe ŋkɔwo le ruble me.

- FXRD – dɔlar ƒe fetu gã ƒe gagbalẽwo, dzidzenu – Solactive USD Fallen Angel Issuer Capped Index.

- FXKZ – gaxɔa dea ga Kazakhstan ƒe gomewo me.

- FXRL nye gadede Russia ƒe RTS ƒe dzesi me.

- FXDE nye gadede Germany ƒe gaxɔmenudzraƒewo.

- FXIT nye gadede Amerikatɔwo ƒe mɔ̃ɖaŋudɔwɔƒewo.

- FXUS nye gadede United States ƒe SP500 ƒe dzesi me.

- FXCN nye gadede asi le China ƒe gaxɔmenudzraƒewo.

- FXWO nye gadede xexeame ƒe asitsatsa ƒe akpawo me, eƒe gaxɔgbalẽviwo ƒe akpa siwo wu 500 tso xexeame ƒe dukɔ gãtɔ 7 me le eme.

- FXRW nye gadede United States ƒe gaxɔmenu siwo ƒe asi de ŋgɔ me.

- FXIM nye gadede asi na United States ƒe IT dɔwɔƒea.

- FXES – gomekpɔkpɔ le United States dɔwɔƒewo le fefewɔƒewo kple eSports.

- FXRE nye gadede asi le United States ƒe aƒewo kple anyigbawo ƒe gadede asi ƒe nudzraɖoƒewo me.

- FXEM – gadede dukɔ madeŋgɔwo ƒe gomekpɔkpɔ me (negbe China kple India koe mele eme o).

- FXGD nye gadede sika me.

Finex koe nye dɔwɔƒe ɖeka kolia si le ETF ƒe gadede asi na Russiatɔ asitsalawo fifia.

Wole nu mawo tɔgbe tso Sberbank, VTB, BCS, Finam, Alfa Capital,

Tinkof Investments , Aton kple bubuawo gbɔ. Gake wo katã wonye BPIF tɔ. Dɔwɔƒe geɖe siwo kpɔa dɔa dzi la naa adzɔnu mawo tɔgbe (ga si kplɔ asitsatsa ƒe dzesi gbadzaa

SP500 ɖo la nye esi Sberbank, Alfa Capital kple VTB le tsitre ɖi na). Nusiwo dzɔna le wo me la sɔ kloe, gake gadelawo siwo ƒle Finex ƒe gomewo kpɔ viɖe vie le esi woxɔ dɔdzikpɔfewo dzi ɖe kpɔtɔ ta. ETF ƒe akpa aɖe si le Moscow ƒe Asitsaƒeae nye be ETF ƒe ga nye dɔlar, eye be woate ŋu aƒle ETF ma tɔgbe la, wotrɔa ruble siwo le gakɔntaa me wòzua dɔlar gbã. Woli etf denominated le rubles (kple ga ƒe hedge), to wo xɔxɔ me la, wokpɔa gadelawo ta tso titri le dɔlar me yi ruble ƒe asitɔtrɔ me.

Gɔmeɖose si nye be woaɖo ETF ƒe agbalẽdzraɖoƒe

Gadede index funds me si mewɔa naneke o la sɔ kple nusi dzudzɔxɔxɔledɔme ƒe gadzikpɔlawo wɔna kloe. Gadede asi ƒe ɣeyiɣia le vevie – mele be nàdze agbagba aƒo ETF ƒe gaxɔgbalẽvi nu ƒu ƒe 1-2 o. Nu vevitɔ si wogblɔna le gadede ETFwo me ŋue nye gadede asi edziedzi, metsɔ le asitsatsa ƒe nɔnɔme me o. Be nàtia ETF siwo sɔ la, Moscow Exchange ƒe nyatakakadzraɖoƒea akpe ɖe gadelawo ŋu, afisi nàte ŋu akpɔ ga siwo katã wodzrana le asitɔtrɔ me ƒe ŋkɔwo le – https://www.moex.com/msn/etf. [caption id="attachment_12049" ɖoɖowɔwɔ ="ɖoɖo ƒe titina" kekeme ="624"].

- FXMM nye United States ƒe ga ƒe asitsahabɔbɔ si dea ga United States ƒe gagbalẽ kpuiwo me hena ɣleti 1-3 ƒe ɣeyiɣi.

Ga sia sɔ kple ga si wotsɔ dea ga si wobia tso ame si. Nusi ɖe dzesi enye be eƒe nɔnɔmetata nye fli dzɔdzɔe si woɖo ɖe dzi le dzogoe 45 dzi.

- BPIF RFI “VTB – Dukɔ siwo le ŋgɔ yim ƒe ga si woatsɔ awɔ dɔe” (VTBE ETF) . Be míawɔ nu vovovowo la, mina míatsɔ nunɔamesi aɖe si dea ga dukɔ madeŋgɔwo me akpe ɖe gaxɔgbalẽvia ŋu.

Mina míatia nunɔamesi siwo katã dea ga nunɔamesi siwo wotsaka me la le ETF screener la me. Mina míalé fɔ ɖe vtbe etf ŋu. Ga sia dea ga dukɔ madeŋgɔwo ƒe nunɔamesiwo me to duta etf ISHARES CORE MSCI EM ƒeƒle me. Gadede gaxɔ sia me ana woawɔ nu vovovowo le dukɔwo me. Le ɣeyiɣi ma ke me la, gaxɔa ƒe dɔdzikpɔha nye 0.71% ko. Ne èle nu ƒlem to VTB ƒe asitsaha aɖe dzi la, womewɔa gaɖɔliɖɔli ƒe dɔdzikpɔfe aɖeke o.

- VTBH ƒe ETF . Azɔ, be míaɖe gaxɔgbalẽvia ƒe tɔtrɔ dzi akpɔtɔ la, mina míatsɔ gagbalẽwo akpe ɖe eŋu. VTBH ETF naa mɔnukpɔkpɔ amewo be woade ga United States ƒe gagbalẽ siwo me ga geɖe le me. Be woawɔ esia la, ga si wodzrana le asitɔtrɔ me la ƒlea duta ETF ISHARES HIGH YIELD CORP BOND ƒe akpa aɖewo.

- DIVD ETF – ga si wodzrana le asitɔtrɔ me la kplɔa Russia Dukɔa ƒe ga si woama na amewo ƒe dzesiwo ɖo. Index la lɔ Russia Dukɔa ƒe gome nyuitɔwo ƒe 50% ɖe eme le: mama ƒe kutsetse, mama ƒe liƒo, amesi nae ƒe nyonyome. Le mama ƒe fexexe kple asitsatsa ƒe kpɔɖeŋuwo ƒe nyonyome ta la, wole mɔ kpɔm na gakpɔkpɔ si lolo wu gakpɔkpɔ ƒe asi gbadzaa (ƒe sia ƒe ƒe gakpɔkpɔ le mama dedie nu tso March 2007 vaseɖe fifia 15.6% tsɔ wu 9.52% na gakpɔkpɔ ƒe asi gbadzaa)

- Le gadede United States ƒe gaxɔmenudzraƒewo gome la, TECH (gadede United States ƒe NASDAQ 100 ƒe dzesi me) tso Tinkoff Investments kple FXUS gbɔe sɔ nyuie wu , si gbugbɔa United States ƒe gaxɔmenudzraƒe gbadzaa SP500 ƒe ŋusẽkpɔɖeamedziwo gblɔna.

- Edze be woalé ŋku ɖe eŋu hã be TGRN ETF tso Tinkoff Investments gbɔ . Ƒe sia ƒe ƒe kutsetse le mama dedie nu le 22% ƒe sia ƒe ƒe seƒe. Gaxɔa dea ga mɔ̃ɖaŋununya dzadzɛwo ƒe ŋgɔnɔlawo me le xexeame godoo.

- ETF FXRL nye index fund si kplɔa Russia ƒe RTS index ƒe ŋusẽkpɔɖeamedzi ɖo. Esi wònye be RTS nye dɔlar ƒe dzesi ta la, etf naa takpɔkpɔ aɖewo tso ga ƒe tɔtrɔ me. Esi dɔlar le dzidzim ɖe edzi la, RTS ƒe dzesi la dzina ɖe edzi sesĩe wu MICEX. Wogbugbɔa ga si woama na amewo la dea gaxɔa ƒe akpawo me. Gaxɔa xea adzɔ ɖe ga si woama na amewo ta si nye 10%.

- Be nàkpɔ tawò tso ga ƒe asixɔxɔ me la, ele be nàtsɔ sika etf akpe ɖe eŋu, le kpɔɖeŋu me, FXGD . Gaxɔa ƒe dɔdzikpɔha nye 0.45% ko. Gaxɔa léa ŋku ɖe sika ŋutɔŋutɔ ƒe asi ŋu le xexeame katã ƒe asi me pɛpɛpɛ alesi nàte ŋui, eye wònaa nèkpɔa ɖokuiwò ta tso ga ƒe asixɔxɔ me VAT manɔmee.

- Azɔ hã, kpɔ ETF siwo zɔna ɖe All Weather/Perpetual Portfolio ƒe aɖaŋuɖoɖo dzi – etf opnw tso Otkritie Broker alo TUSD ETF tso Tinkoff Investments gbɔ . Gaxɔa me diversification le eme, mehiã be gadelawo nadze agbagba bubuwo o. Dɔdzikpɔlawo dea ga gaxɔgbalẽviwo, gagbalẽwo, sika me sɔsɔe. Etf opnw hã dea ga United States ƒe aƒewo kple anyigbawo ƒe ga me.

Le asitsalawo ƒe gakɔntawo tɔ gome la, togbɔ be ETF sia ƒomevi sɔ ŋutɔ hã la, exɔ asi akpa. Anyo wu be nàxɔ ɣeyiɣi vi aɖe eye nàtu ETF ƒe agbalẽdzraɖoƒe le ɖokuiwò si. Le ƒe 20 ƒe ɣeyiɣi aɖe me la, 0.01-0.05% ƒe dɔdzikpɔha siwo mele vevie o gɔ̃ hã trɔna zua ga home siwo woate ŋu akpɔ kple ŋku.

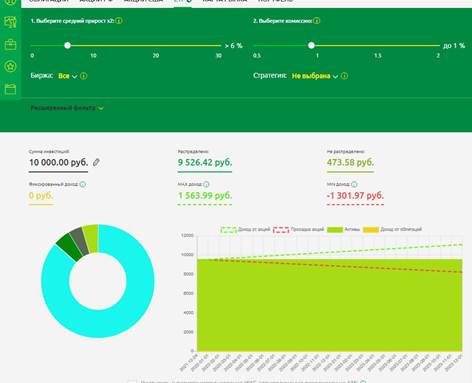

Ne èle ETF siwo ŋugbe wodo wu tiam la, ele be nàdze agbagba abu tame le xexeame katã wu. Nusiwo do tso gadede asi me le ƒe eve siwo va yi me mefia be woakpɔ dzidzedze ma ke le etsɔme o. Gadede asi na adzɔnu siwo ɖee fia be wole dzidzim ɖe edzi kabakaba la ate ŋu ava zu viɖe aɖeke le ƒe ʋɛ siwo gbɔna me o. Ðewohĩ akpaa axɔ dzo akpa eye emegbe wòagbɔ ɖe eme vie. Gadede dzesidegbalẽvi si keke ta me ɖea vi geɖe wu elabena dzesidegbalẽvia ƒe wɔwɔme nɔa tɔtrɔm ɣesiaɣi. Wotsɔa dɔwɔƒe sesẽwo ɖoa dɔwɔƒe siwo gbɔdzɔ la teƒe. Dɔwɔƒe geɖe siwo nɔ SP500 ƒe dzesidegbalẽvia me meganɔ asi me ƒe 10 enye sia o, gake dzesidegbalẽvia ƒe ŋusẽkpɔɖeamedzi mekpe fu le esia ta o. Ele be nàdze agbagba abu tame le xexeame katã wu, ke menye be nàlé ŋku ɖe gaxɔa ƒe nɔnɔme si li fifia ŋu o, nàdze agbagba atia egbɔkpɔnu siwo me afɔku mele o eye woto vovo wu. Esi wode dzesi ETF siwo ŋugbe wodo wu le nunɔamesiwo ƒe hatsotso ɖesiaɖe me vɔ la, . afisi gadelawo di be yeade ga le la, ele be woaɖo ga ɖe eƒe gomenɔamesi ɖesiaɖe ta. Wokafui be woawɔ ɖe agbɔsɔsɔ siwo gbɔna dzi:

- Woɖoa gaxɔgbalẽvia ƒe 40% ɖi be woatsɔ aƒle gomewo . Le nu vovovowo wɔwɔ gome la, womaa nudzraɖoƒewo ɖe dukɔ kple dɔwɔƒewo nu. Wonaa gome si sɔ le ETF ƒomevi ɖesiaɖe me le ƒuƒoƒo sia me;

- 30% – agbalẽviwo ƒe agbalẽviwo . Esia aɖe ga si woakpɔ tso gaxɔgbalẽvia me katã dzi akpɔtɔ, gake le ɣeyiɣi ma ke me la, aɖe asitsahabɔbɔa ƒe gakɔnta ƒe tɔtrɔ dzi akpɔtɔ. Nusi akpɔ ŋusẽ nyui ɖe gadelawo ƒe lãmekawo dzi le ɣeyiɣi sesẽwo me;

- 10% le portfolio la me – gadede sika me . Gaxɔgbalẽvia ƒe akpa si kpɔa ame ta le nɔnɔme aɖewo nu. Ðewohĩ emegbe woate ŋu atsɔ gadede cryptocurrencies me aɖɔli gaxɔgbalẽvia ƒe akpa sia;

- 20% – nuto siwo ŋugbe wodo – mɔ̃ɖaŋununya deŋgɔ ƒe adzɔnuwo, gadede dɔwɔƒe “amagbewo” me hena dzidziɖedzi kabakaba ƒe ŋugbedodo.

ETF ƒe mɔfiame – Biabia vevi 15: nukae nye ETF gawo, aleke wowɔa dɔe, alesi woawɔ akpɔ ga le wo ŋu: https://youtu.be/I-2aJ3PUzCE Gadede ETFwo me fia be woawɔ nu edziedzi eye woanɔ anyi ɣeyiɣi didi. Esɔ be nàgbugbɔ aɖo agbalẽdzraɖoƒea me ɣleti sia ɣleti – nukpɔsusu nyanyɛ si nye “xe fe na ɖokuiwò gbã.” Ne èle nu gbugbɔm la, ele be nàwɔ ɖe aɖaŋu si nètia dzi, lé ŋku ɖe nunɔamesiwo ƒe agbɔsɔsɔme ŋu. Nuwo dometɔ aɖewo ƒe asi aɖiɖi, gake woƒe gomekpɔkpɔ le gaxɔa me ya dzi aɖe akpɔtɔ. Nunɔamesi bubuwo ƒe asixɔxɔ adzi ɖe edzi, woƒe gome adzi ɖe edzi. Mele be nàdze agbagba nyuie akpa be nàlé agbɔsɔsɔmeawo ɖe te o – vovototo siwo nye 5-10% le dometsotso si sɔ me. Mɔ eve li siwo dzi woato alé agbɔsɔsɔme me ɖe asi – nunɔamesi siwo ƒe asi yi dzi la dzadzra kple esiwo tsi megbe la ƒle. Alo amesiwo tsi megbe le nusiwo wogbugbɔ ɖo wo me ta la ƒle ko. Mègadzrae o vaseɖe esime woɖo gadodo ƒe taɖodzinuwo gbɔ hafi. Mɔnu eve siawo dometɔ kae woatia mele vevie nenema gbegbe o. Ele vevie be nàtia gadodo ƒe mɔnu aɖe si dzi nàto awɔ ɖe edzi. Esi wogbugbɔa nu siwo tsi megbe la ƒlena ɣesiaɣi eye wodzraa nunɔamesi siwo ɖe dzidziɖedzi fia ta la, gadelawo ƒlea nu le ete ɣesiaɣi eye wòdzraa nu le etame. Le ɣeyiɣi ma ke me la, matso nya me le asi siwo nyo wu ŋu o, gake le mama dedie nu la, gaxɔgbalẽvia aɖe ŋusẽ nyuiwo afia le ɣeyiɣi didi aɖe me, eye esiae nye nu vevitɔ kekeake.