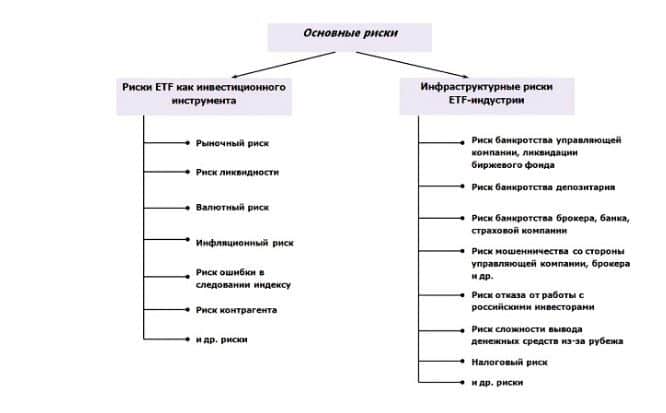

Isikhwama se-ETF esihweba ngokushintshana – siyini ngamagama alula mayelana nenkimbinkimbi.Ama-ETF (izimali ezihweba ngokushintshaniswa) ziwuhlobo lokutshalwa kwezimali okuhlangene. Ngokuthenga ingxenye yesikhwama esinjalo ngama-ruble angu-4,000 kuphela, uba umnikazi wesabelo esincane samasheya ezinkampanini ezifana neMicrosoft, Apple, MasterCard, Tesla, Facebook, Google, McDonald’s nabanye abaningi. Isikhwama se-VTI esihluke kakhulu sihlanganisa amasheya angaphezu kuka-3,900. Ukuphinda ukuhlukahluka okunjalo ku-akhawunti yakhe, umtshali-zimali ozimele uzodinga imali eningi kakhulu. Kuma-inverter amaningi, lokhu kuhlukahluka akutholakali. Kukhona izimali ezihwebelana ngokuhwebelana ngenkomba ezikopisha ncamashi ukwakheka nezilinganiso zamasheya ezinkomba zomhlaba, izikhwama zempahla kanye nezinsimbi eziyigugu, ama-ETF amabhondi namathuluzi emakethe yemali. Kunezimali ezingaphezu kwe-100 ezihwebelana ngokuhwebelana ezimakethe zase-US ezisebenzisa amasu ahlukene. Ngokwesibonelo,

Ray Dalio ” (ukutshalwa kwezimali ezitokweni, amabhondi kanye negolide ngokungalingani ngezikhathi ezithile), ukutshalwa kwezimali kumasheya omkhakha othile wamazwe athile. Ngosizo lwephothifoliyo ye-ETF, ungakwazi ukuqoqa iphothifoliyo ehlukahlukene ngemboni kanye nezwe labatshalizimali ngediphozithi encane kakhulu. Kunama-ETF aphethwe ngendlela engenzi lutho alandela ncamashí ukuguquguquka kwenkomba noma impahla, kanye nezimali zokuphatha ezisebenzayo, lapho imali engenayo kanye nokwehla kulawulwa abaphathi. Izimali ezivame kakhulu ukuphatha – zinezindleko eziphansi futhi amandla azo awancikile entweni yomuntu.

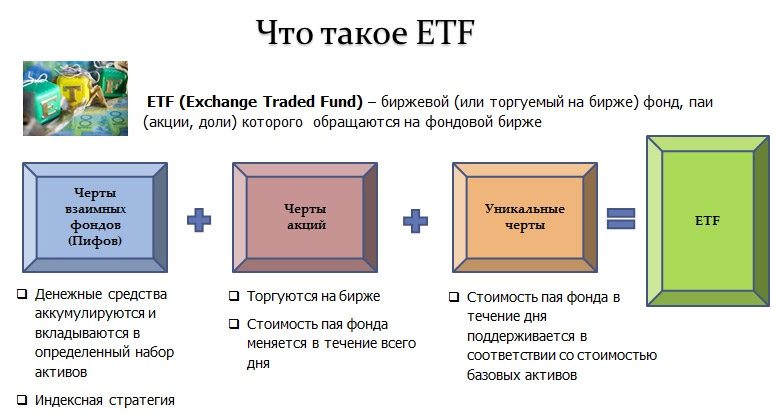

Umehluko phakathi kwe-ETF ne-mutual funds

I-analogue yaseRussia ye-ETF yisikhwama sokubambisana (mutual investment fund). Naphezu kokufana, kukhona ukuhluka okuthile

- Ama-ETF amaningi aphathwa ngokungenzi lutho ngesu elivulekile . Lokhu kunikeza inzuzo kumtshali-zimali, ngoba kuyacaca ukuthi yimaphi amathuluzi ukuthi imali itshalwe kuphi. Umtshali-zimali angaqiniseka ukuthi lapho etshala imali kuma-ETF egolide, ukutshalwa kwezimali kwakhe kuzophinda ncamashi amandla ensimbi eyigugu.

- Izimali zokutshala izimali ezihlanganyelwe ziyizikhwama zokuphatha ezisebenzayo . Umphumela wezezimali uncike kakhulu ezenzweni nasemaphutheni omphathi. Isimo sangempela yilapho i-dynamics ye-mutual fund ingalungile emakethe yezinkunzi eqinile. Kodwa ekwindla yemakethe, izimali ezihlangene zingase zibe ngcono kunemakethe.

- Ama- ETF azokuvumela ukuthi uqoqe iphothifoliyo ehlukahlukene , ngezwe, imboni noma isu.

- Ama- ETF akhokha izabelo uma ekhokhwa ngamasheya enkomba abayilandelayo. Ezimweni eziningi, izinzuzo zibuye zitshalwe ngesilinganiso sokuqala.

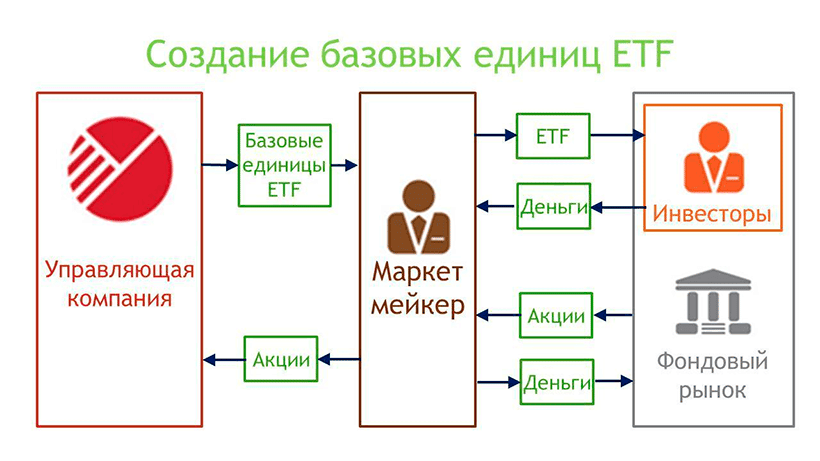

- Ama- ETF athengiswa ngokuhwebelana , futhi umenzi wemakethe ugcina imali. Asikho isidingo sokuxhumana nenkampani yabaphathi ukuze uthenge. Kwanele ukuba ne-akhawunti yomthengisi nanoma yimuphi umthengisi onelayisensi.

- Amakhomishini e-ETF aphansi ngokuphindaphindiwe uma kuqhathaniswa nezimali ezihlanganyelwe .

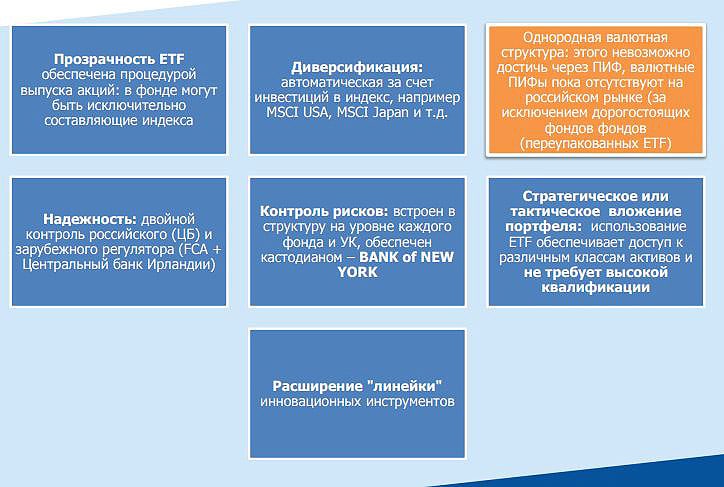

Izinhlobo zama-ETF

Ama-ETF akhona angahlukaniswa ngamaqembu alandelayo:

- Ngezwe – e-US stock exchange kunezimali ezitshala cishe kuwo wonke amazwe lapho kunemakethe yamasheya. Kukhona ama-ETF ahlukene wenkomba ngayinye yaleli zwe.

- Ngemikhakha yezomnotho – kukhona ama-ETF emikhakha ethile yezomnotho, lapho kuqoqwa amasheya omkhakha othile womnotho wezwe okukhulunywa ngalo. Umtshali-zimali angeke athenge yonke inkomba, kodwa atshale imali kuphela ezimbonini ezithembisayo ngokombono wakhe.

- Ngamathuluzi ezezimali – ama-ETF angabelwa izitoko, amabhondi, amathuluzi emakethe yemali (amabhondi esikhathi esifushane afika ezinyangeni ezi-3), ama-ETF ohlobo lwemali, ama-ETF ensimbi eyigugu, izimpahla zemboni, izindlu nomhlaba.

I-ETF ku-MICEX

Kunama-ETF ahlukene angaphezu kuka-1,500 atholakala ku-NYSE.

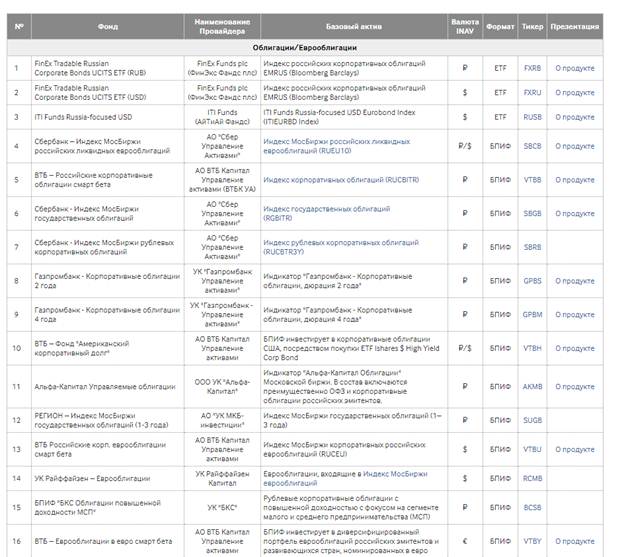

I- Moscow Exchange inikeza uhlu olunesizotha kakhulu lwama-ETF kubatshalizimali baseRussia (ama-etf amaningi atholakala ukuze athengwe kuphela kubatshalizimali abaqeqeshiwe). Njengamanje, ama-ETF angu-128 nama-BIF ayatholakala e-Moscow Exchange. I-Finex inikeza ama-ETF alandelayo:

- I-FXRB – Inkomba yamabhondi ezinkampani zaseRussia ahlanganiswe ngama-ruble.

- I-FXRU – Inkomba yamabhondi ezinkampani zaseRussia enziwe ngamadola.

- I-FXFA inkomba yamabhondi ezinkampani anesivuno esikhulu samazwe athuthukile.

- I-FXIP – Amabhondi kahulumeni wase-US, anokuvikelwa kwamandla emali ngothango lwe-ruble, afakwa ngama-ruble.

- I-FXRD – idola lamabhondi esivuno esiphezulu, ibhentshimark – I-Solactive USD Fallen Angel Issuer Capped Index.

- I-FXKZ – isikhwama sitshala kumasheya e-Kazakhstan.

- I-FXRL iwutshalomali kunkomba ye-RTS yaseRussia.

- I-FXDE iwutshalomali emakethe yamasheya yaseJalimane.

- I-FXIT iwutshalomali emkhakheni wezobuchwepheshe waseMelika.

- I-FXUS iwutshalomali kunkomba ye-US SP500.

- I-FXCN iwutshalomali emakethe yamasheya yaseShayina.

- I-FXWO iwutshalomali kumasheya ezimakethe zomhlaba, iphothifoliyo yayo ihlanganisa amasheya angaphezu kuka-500 avela emazweni ayi-7 amakhulu emhlabeni.

- I-FXRW iyi-investimenti emasheya aphezulu ase-US.

- I-FXIM iwutshalomali emkhakheni we-IT wase-US.

- I-FXES – amasheya ezinkampani zase-US emkhakheni wemidlalo kanye ne-eSports.

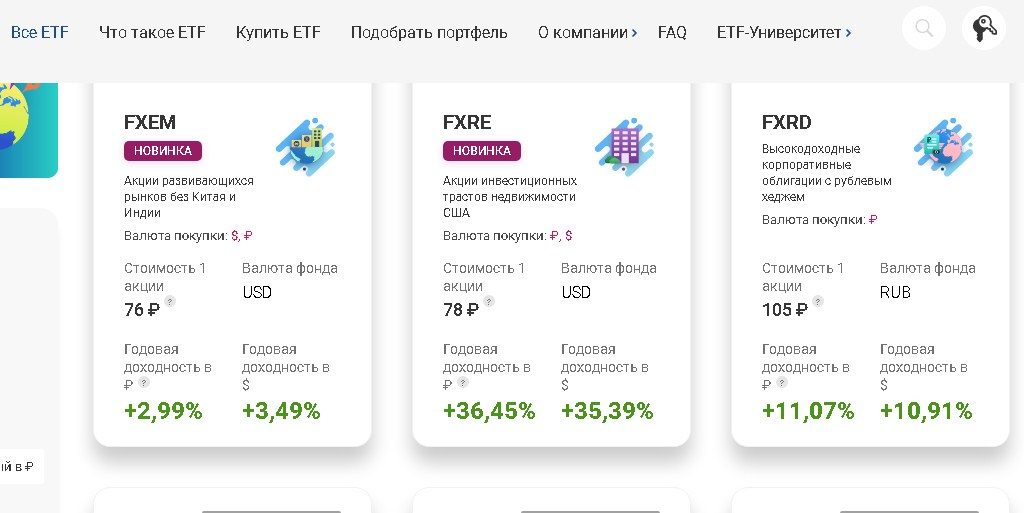

- I-FXRE iwutshalomali kuma-trust okutshalwa kwezakhiwo zase-US.

- I-FXEM – ukutshalwa kwezimali kumasheya amazwe asathuthuka (ngaphandle kwe-China ne-India).

- I-FXGD iwutshalomali egolideni.

I-Finex okwamanje iyona kuphela inkampani enikeza ukutshalwa kwezimali kwe-ETF kubahwebi baseRussia.

Kukhona imikhiqizo efanayo evela Sberbank, VTB, BCS, Finam, Alfa Capital,

Tinkof Investments , Aton nabanye. Kodwa zonke zingabe-BPIF. Izinkampani eziningi zokuphatha zinikeza imikhiqizo efanayo (isikhwama esilandela inkomba yemakethe ebanzi

SP500 imelwe yi-Sberbank, i-Alfa Capital ne-VTB). I-dynamics icishe ifane, kodwa abatshalizimali abathenge amasheya e-Finex bazuze kancane ngenxa yamakhomishini aphansi. Isici se-ETF ku-Moscow Exchange ukuthi imali ye-ETF ingamadola, futhi ukuze uthenge i-ETF enjalo, ama-ruble asuka ku-akhawunti aguqulwa kuqala abe amadola. Kukhona ama-etf ahlelwe ngama-ruble (ngothango lwemali), ngokuwathola umtshali-zimali uvikelekile ekugxumeni kwedola kuya kusilinganiso sokushintshaniswa kwe-ruble. [i-id yamagama-ncazo = “okunamathiselwe_12042” align = “aligncenter” wide = “800”

Ukutshala imali kuma-ETF

Inzuzo enkulu yokutshala imali kuma-ETF ukuhlukahluka okuphezulu kwephothifoliyo kubatshalizimali abanemali encane. Umgomo wokutshala izimali zesikhathi eside uthi “ungawabeki wonke amaqanda akho kubhasikidi owodwa”. Umtshali-zimali ku-ETF angakwazi ukuhlukanisa iphothifoliyo yakhe ngesigaba sempahla (amasheya, amabhondi) – kuye ngesu elikhethiwe, shintsha izilinganiso. Ngaphakathi kwekilasi, angakwazi ukushintsha izilinganiso phakathi kwamasheya emikhakha ehlukene yamazwe ahlukene. Yiba nephothifoliyo ehlukahlukene kakhulu yama-Eurobonds. Inani elincane lama-Eurobond liqala ku-$1000, ukuze kuhlukaniseke kuyadingeka ukuthi okungenani kube namahlelo ahlukene ayi-15-20. Leli selivele linani elibambekayo. Lapho utshala imali ku-ETF ye-Eurobond Index, ungathenga ubhasikidi wama-Eurobond angu-25 ngama-ruble angu-1,000 nje kuphela. Ngaphezu kwalokho, umtshali-zimali unethuba lokuthenga impahla enesivuno esikhulu engxenyeni encane yephothifoliyo.

okungenamsoco » izibopho zaseRussia nezwe. Ukuze avikele iphothifoliyo yakhe, umtshali-zimali angakwazi ukwengeza utshalomali egolideni.

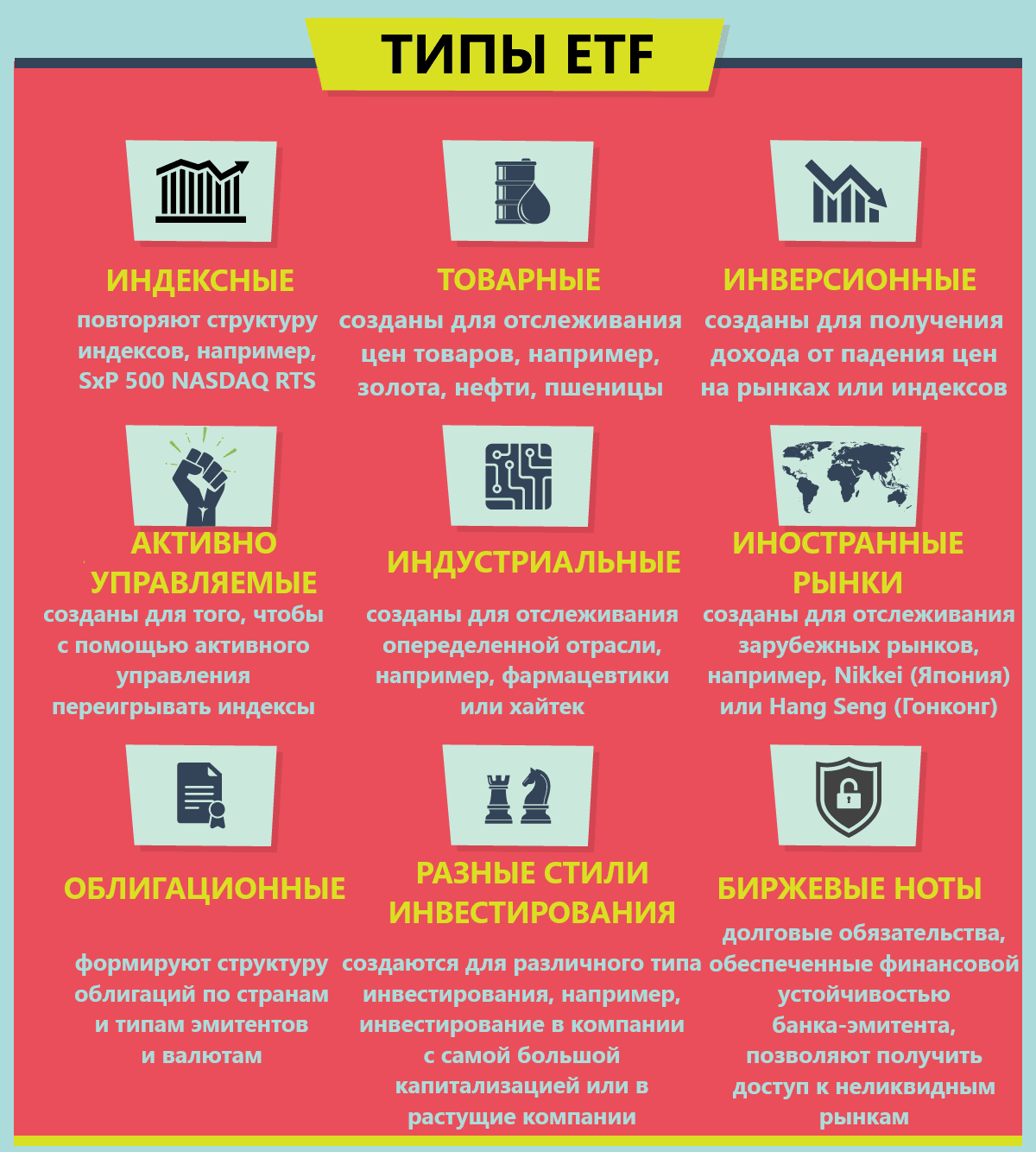

Inzuzo ye-ETF

Ukubuyiselwa kwe-ETF kuncike ngokuphelele ku-dynamics yemakethe. Ngezikhathi ezimfushane kuze kufike eminyakeni engu-1-3, kunzima kakhulu ukukubikezela, ngoba izici eziningi okufanele zicatshangelwe. Esikhathini esiyiminyaka eyi-10, ngezinga eliphezulu lokungenzeka, izimpahla zizobiza ngaphezu kwalokho ezikwenzayo namuhla. Kodwa lokhu akusho ukuthi uzobona ukuguquguquka okuhle nsuku zonke esikhathini esiyiminyaka eyi-10. Ake sibheke ukuguquguquka kwemakethe yamasheya ebanzi yase-US SP500:

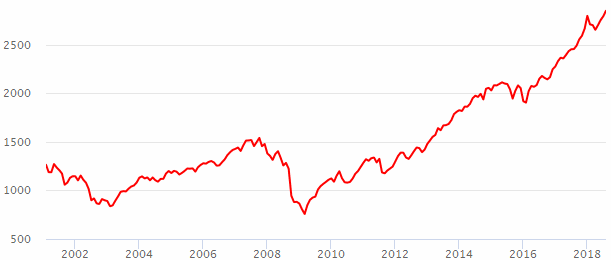

Amakhomishini

Ngaphandle kwekhomishana yokushintshanisa lapho uthenga futhi uthengisa (ngokusho

kwentela yomthengisi , kodwa abanye abathengisi abakhokhi ikhomishini lapho bethenga i-ETF), udinga ukukhokha imali yokuphatha. Ama-ETF aphethwe i-Finex akhokhiswa u-0.9% ngonyaka. Lesi samba asikhokhiswa ngokuqondile ku-akhawunti ye-brokerage yomtshali-zimali, kodwa sidonswa nsuku zonke futhi sicatshangelwe kumakhotheshini. Uma uthenge i-ETF ekhuphuke ngo-10% ngonyaka, lokho kusho ukuthi empeleni ikhuphuke ngo-10.9%.

Akujabulisi ukuthi ikhomishini ikhokhelwe kungakhathalekile ukuthi uthini umphumela wokutshalwa kwezimali. Uma isikhwama senkomba silahlekelwe ngo-10% ngonyaka, uzoba nokulahlekelwa okungu-10.9%.

Ungayithenga kanjani i-ETF

Indlela elula yokuthenga izimali ze-ETF kuseMoscow Exchange. Abathengi bakwamanye amazwe bahlinzeka ngokukhethwa okukhulu kwama-ETF anezindleko eziphansi. Uma kuqhathaniswa, kukhona ama-ETF angaphandle anenkokhelo engu-0.004% uma kuqhathaniswa nenkokhelo ye-Finex engu-0.9%. Ngomthengisi wangaphandle, kungenzeka ukuthenga i-ETF ye-cryptocurrency. Ithuluzi elisha izikhwama zempesheni kanye nabatshalizimali abakhulu base-US asebeqala ukutshala kulo. I-Central Bank ixwayisa ngezingozi zokutshala imali kuma-ETF bitcoins. Uma leli thuluzi lifakazela ukuzinza kwalo (isikhathi sokutshala imali okungenani iminyaka eyi-10), abahlinzeki baseRussia bazoyengeza ohlwini lwabo. Kodwa ungakhohlwa ukuthi e-Russian Federation ETF angathengwa ku-

IISbese ubuyisela izintela ezingu-13%. Abathengi abaningi abakhokhisi noma yiziphi izimali zokugcina i-akhawunti futhi kungenzeka ukuxhasa i-akhawunti kanye ngenyanga noma ngesonto ngamanani amancane. Kunconywa ukungena ezimakethe zakwamanye amazwe, kuqala ngokutshalwa kwezimali kwezinkulungwane eziyi-10-20 zamaRandi. [i-id yamagama-ncazo = “okunamathiselwe_12053″ align=”aligncenter” wide=”666″]

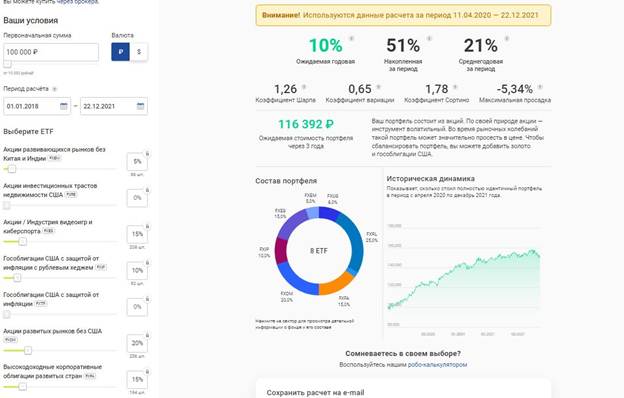

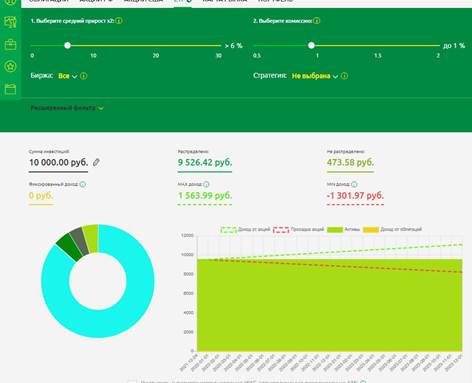

Umgomo wokwenza iphothifoliyo ye-ETF

Ukutshala imali okungenzi lutho ezikhwameni zenkomba kufana kakhulu nalokho okwenziwa abaphathi bemali asebethathe umhlalaphansi. Umkhathi wokutshalwa kwezimali ubalulekile – akufanele uzame ukuqoqa iphothifoliyo ye-ETF iminyaka engu-1-2. Umgomo oyinhloko wokutshala izimali kuma-ETF ukujwayela kokutshalwa kwezimali, kungakhathaliseki ukuthi isimo semakethe sinjani. Ukuze ukhethe ama-ETF afanelekile, iwebhusayithi ye-Moscow Exchange izosiza umtshali-zimali, lapho ungabona khona uhlu lwazo zonke izimali ezihwebayo ezihwebayo – https://www.moex.com/msn/etf. [i-id yamagama-ncazo = “okunamathiselwe_12049” align = “aligncenter” wide = “624”]

- I- FXMM isikhwama semakethe yemali yase-US etshala imali kumabhondi amafushane ase-US isikhathi esiyizinyanga ezi-1-3.

Lesi sikhwama sifana nediphozithi yokufunwa. Isici esihlukile ukuthi igrafu yayo ingumugqa oqondile oqondiswe phezulu nge-engeli engu-45 degrees.

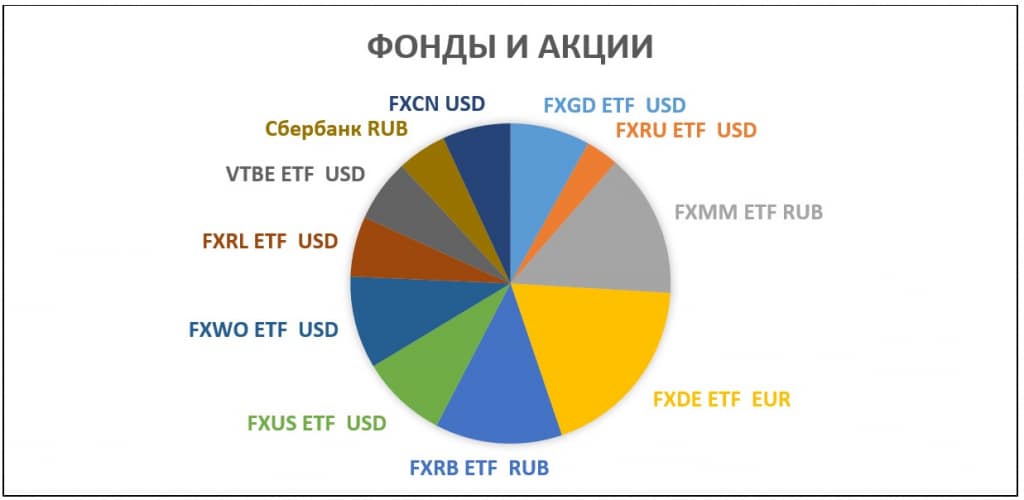

- I-BPIF RFI “VTB – Emerging Countries Equity Fund” (VTBE ETF) . Ukuze sihlukanise, ake sengeze impahla etshala emazweni asathuthuka kuphothifoliyo.

Masikhethe kusihloli se-ETF wonke amafa atshala ezimpahleni ezixubile. Ake sigxile ku-vtbe etf. Lesi sikhwama sitshala izimpahla zamazwe asathuthuka ngokuthenga i-etf yangaphandle ISHARES CORE MSCI EM. Ukutshalwa kwezimali kulesi sikhwama kuzoqinisekisa ukuhlukahluka emazweni ngamazwe. Ngesikhathi esifanayo, ikhomishini yesikhwama ingu-0.71% kuphela. Lapho uthenga nge-VTB broker, ayikho ikhomishini yokushintshanisa.

- Izindleko zamasheya VTBH ETF . Manje, ukuze sinciphise ukuntengantenga kwephothifoliyo, ake sengeze amabhondi. I-VTBH ETF inikeza ithuba lokutshala imali kumabhondi ase-US anesivuno esikhulu. Ukuze wenze lokhu, isikhwama esihwebelana ngokuhwebelana sithenga amasheya e-ETF ISHARES HIGH YIELD CORP BOND yangaphandle.

- I-DIVD ETF – isikhwama esihwebelana ngokuhwebelana silandela inkomba yezabelo zezabelo ze-Russian Federation. Inkomba ihlanganisa u-50% wamasheya angcono kakhulu e-Russian Federation ngokuya: isivuno se-dividend, ukuzinza kwe-dividend, ikhwalithi yokhiphayo. Ngenxa yenkokhelo yezabelo nekhwalithi yamamodeli ebhizinisi, kulindeleke imbuyiselo ephezulu kunemakethe yezabelomali ebanzi (inzuzo emaphakathi yonyaka kusukela ngoMashi 2007 kuze kube manje u-15.6% uma uqhathaniswa no-9.52% wemakethe yezabelomali ebanzi)

- Ngokutshalwa kwezimali emakethe yamasheya yase-US, i- TECH (itshala ku-US NASDAQ 100 index) evela ku-Tinkoff Investments kanye ne- FXUS , ephindaphinda amandla emakethe yesitoko ebanzi yase-US SP500, ifaneleka kangcono.

- Ukunakwa nakho kufanele i- TGRN ETF evela ku-Tinkoff Investments . Isilinganiso sesivuno sonyaka sisezingeni lama-22% ngonyaka. Lesi sikhwama sitshala imali kubaholi bezobuchwepheshe obuhlanzekile emhlabeni jikelele.

- I- ETF FXRL yisikhwama senkomba esilandela amandla enkomba ye-Russian RTS. Uma kubhekwa ukuthi i-RTS iyinkomba yedola, i-etf inikeza isivikelo esithile ekuguquguqukeni kohlobo lwemali. Ngokukhula kwedola, inkomba ye-RTS ikhula ibe namandla kune-MICEX. Izabelo ezitholiwe ziphinde zitshalwe emasheya esikhwama. Isikhwama sikhokha intela kuma-dividend ka-10%.

- Ukuze uvikele ekukhuphukeni kwamandla emali, kufanele wengeze i- gold etf, isibonelo, i-FXGD . Ikhomishana yesikhwama ingu-0.45% kuphela. Isikhwama silandelela intengo yegolide eliphathekayo emakethe yomhlaba wonke ngokunembe ngangokunokwenzeka, futhi ikuvumela ukuba uzivikele ekwenyukeni kwamandla emali ngaphandle kwe-VAT.

- Futhi, bheka ama-ETF alandela isu le-All Weather/Perpetual Portfolio – etf opnw from Otkritie Broker noma TUSD ETF from Tinkoff Investments . Isikhwama sinokuhlukahluka ngaphakathi, umtshali-zimali akadingi ukwenza imizamo eyengeziwe. Abaphathi batshala imali ngokulinganayo ezitokisini, kumabhondi, egolideni. I-Etf opnw iphinde itshale izimali ezikhwameni zemizi yase-US.

Kubanikazi bama-akhawunti omthengisi, lolu hlobo lwe-ETF, nakuba lulula kakhulu, lubiza kakhulu. Kungcono ukuthatha isikhathi esincane futhi wakhe iphothifoliyo ye-ETF uwedwa. Esikhathini esiyiminyaka engama-20, ngisho namakhomishini angasho lutho angu-0.01-0.05% aphenduka amanani abambekayo.

Lapho ukhetha ama-ETF athembisa kakhulu, kufanele uzame ukucabanga kabanzi emhlabeni jikelele. Imiphumela yokutshalwa kwezimali yeminyaka emibili edlule ayiqinisekisi impumelelo efanayo esikhathini esizayo. Ukutshalwa kwezimali esitokweni okubonise ukukhula ngokushesha kungase kungabi nanzuzo eminyakeni embalwa ezayo. Umkhakha ungase ushiswe ngokweqile bese uthatha ikhefu. Ukutshala imali kunkomba ebanzi kunenzuzo enkulu ngoba ukwakheka kwenkomba kushintsha njalo. Izinkampani ezibuthakathaka zithathelwa indawo yiziqinile. Izinkampani eziningi ezifakwe ohlwini lwe-SP500 zazingasekho emakethe eminyakeni eyi-10 edlule, kodwa ukuguquguquka kwenkomba akuzange kuhlupheke kulokhu. Kufanele ulwele ukucabanga kabanzi emhlabeni jikelele, ungabheki ukuguquguquka kwamanje kwesikhwama, zama ukukhetha izixazululo ezingenabungozi nezihlukene kakhulu. Ngemva kokuhlonza ama-ETF athembisa kakhulu esigabeni ngasinye sempahla, lapho umtshali-zimali efuna ukutshala imali kufanele yabelwe ingxenye ngayinye yamasheya akhe. Kunconywa ukunamathela kuzilinganiso ezilandelayo:

- U-40% wephothifoliyo wabelwa ukuthenga amasheya . Ngokuhlukahluka, amasheya ahlukaniswa ngezwe nezimboni. Uhlobo ngalunye lwe-ETF lunikezwa isabelo esilinganayo ngaphakathi kwaleli qembu;

- 30% – amabhondi . Lokhu kuzonciphisa ukubuyiselwa okuphelele kwephothifoliyo, kodwa ngesikhathi esifanayo kunciphise ukuguquguquka kwe-akhawunti yomthengisi. Yini ezothinta kahle isimiso sezinzwa somtshali-zimali ngezikhathi ezinzima;

- 10% wephothifoliyo – ukutshalwa kwezimali kugolide . Ingxenye yephothifoliyo evikela ngokwemibandela. Mhlawumbe kamuva le ngxenye yephothifoliyo ingashintshwa ngokutshalwa kwezimali kuma-cryptocurrencies;

- I-20% – izindawo ezithembisayo – amasheya aphezulu, ukutshalwa kwezimali ezinkampanini “eziluhlaza” ezithembisa ukukhula okusheshayo.

Umhlahlandlela we-ETF – imibuzo eyinhloko engu-15: ziyini izimali ze-ETF, zisebenza kanjani, indlela yokwenza imali ngazo: https://youtu.be/I-2aJ3PUzCE Ukutshala imali kuma-ETF kusho ukujwayela kanye nesikhathi eside. Kuhle ukugcwalisa iphothifoliyo njalo ngenyanga – i-postulate eyaziwayo “zikhokhele wena kuqala.” Lapho ugcwalisa, kufanele ulandele isu elikhethiwe, ubheke izilinganiso zempahla. Ezinye izimpahla zizokwehla ngentengo, kanti isabelo sazo kuphothifoliyo sizokwehla. Ezinye izimpahla zizokhula ngenani, isabelo sazo sizokhula. Akufanele uzame ngokucophelela kakhulu ukugcina izilinganiso – ukuchezuka kuka-5-10% kungaphakathi kwebanga elijwayelekile. Kunezindlela ezimbili zokugcina izilinganiso – ukuthengisa impahla ekhuphuke intengo kanye nokuthenga lezo ezisalela emuva. Noma ukuthenga nje labo abasalela emuva ngenxa yokugcwaliswa. Ungathengisi kuze kube yilapho izinjongo zokutshala izimali sezifinyelelwe. Iyiphi kulezi zindlela ezimbili ekhethiwe ayibalulekile kangako. Kubalulekile ukukhetha indlela yokutshala imali ukuze uyilandele. Ngokuqhubeka nokuthenga kabusha okusalela emuva nokudayiswa kwempahla ekhombise ukukhula, umtshali-zimali uhlale ethenga phansi futhi adayise phezulu. Ngesikhathi esifanayo, ngeke anqume amanani angcono kakhulu, kodwa ngokwesilinganiso iphothifoliyo izobonisa ama-dynamics amahle esikhathini eside, futhi lokhu kuyinto ebaluleke kakhulu.