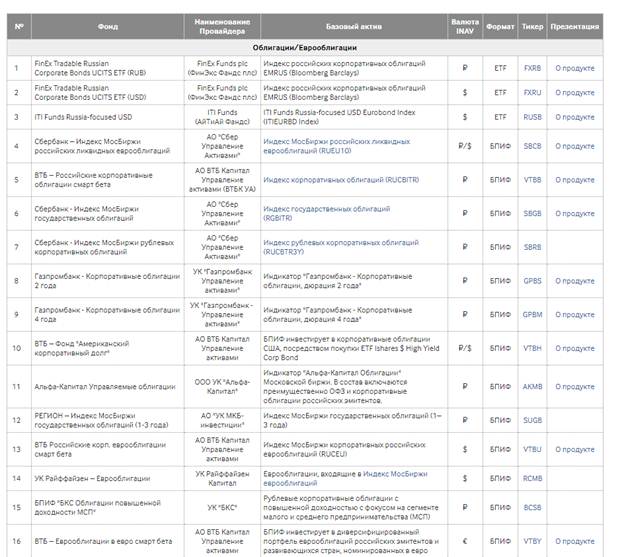

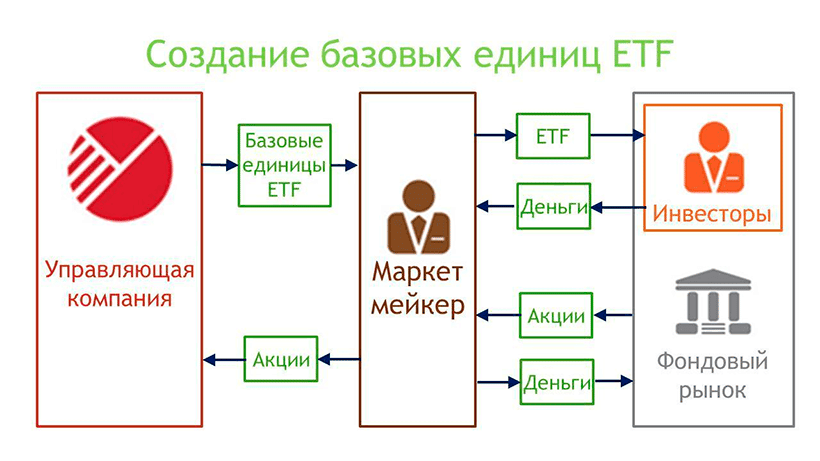

Guhana-kugurisha ETF ikigega – niki mumagambo yoroshye yerekeye urwego.ETFs (amafaranga yo gucuruza) ni uburyo bwo gushora hamwe. Muguze umugabane wiki kigega kumafaranga 4000 gusa, uba nyiri umugabane muto wimigabane mubigo nka Microsoft, Apple, MasterCard, Tesla, Facebook, Google, McDonald’s nibindi byinshi. Ikigega kinini cya VTI kirimo imigabane irenga 3.900. Kugirango usubiremo gutandukana muri konti yabo, umushoramari wigenga yakenera igishoro kinini. Kuri inverters nyinshi, uku gutandukana ntikuboneka. Hariho indangagaciro zivunjisha-zigurisha neza zigizwe neza nigipimo cyimigabane yimigabane yibipimo byisi, ibicuruzwa nibicuruzwa byamabuye y’agaciro, ETFs kububiko nibikoresho byisoko ryamafaranga. Hariho amafaranga arenga 100 atandukanye yo kugurisha mu isoko rya Amerika ashyira mubikorwa ingamba zitandukanye. Kurugero,

Ray Dalio “(ishoramari mu bubiko, inguzanyo na zahabu hamwe n’uburinganire buri gihe), ishoramari mu migabane y’urwego runaka rw’ibihugu runaka. Hifashishijwe portfolio ya ETF, urashobora gukusanya portfolio itandukanye ninganda nigihugu cyabashoramari ufite amafaranga make cyane. Hano hari ETF icungwa neza ikurikiza neza imbaraga za index cyangwa ibicuruzwa, hamwe namafaranga yo gucunga neza, aho amafaranga yinjira nogusohoka bigengwa nabayobozi. Amafaranga asanzwe ni imiyoborere yoroheje – bafite amafaranga make kandi imbaraga zabo ntiziterwa nibintu byabantu.

Itandukaniro hagati ya ETFs na mutuelle

Ikirusiya analogue ya ETF ni ikigega cya mutuelle (ikigega cyo gushora imari). Nubwo bisa, hariho itandukaniro

- ETFs nyinshi zicungwa neza hamwe ningamba zifunguye . Ibi biha inyungu umushoramari, kubera ko bigaragara mubikoresho bingana iki amafaranga yashowe. Umushoramari arashobora kwizera neza ko mugihe ashora imari muri ETFs zahabu, ishoramari rye rizasubiramo neza imbaraga zicyuma cyagaciro.

- Amafaranga yo gushora imari ni amafaranga yo gucunga neza . Ibisubizo byamafaranga biterwa ahanini nibikorwa namakosa yumuyobozi. Ibintu nyabyo nigihe imbaraga za mutuelle ari mbi kumasoko akomeye. Ariko mugihe cyo kugabanuka kwisoko, mutuelle irashobora kuba nziza kuruta isoko.

- ETFs izagufasha gukusanya ibintu bitandukanye , ukurikije igihugu, inganda cyangwa ingamba.

- ETFs yishyura inyungu niba zishyuwe nimigabane yibipimo bakurikiza. Mu bihe byinshi, inyungu zisubirwamo ku gipimo cyambere.

- ETFs igurishwa muburyo bwo kuvunja , kandi uwukora isoko agumana ubwishingizi. Ntibikenewe ko ubariza isosiyete icunga kugirango ugure. Birahagije kugira konte ya brokerage hamwe numuhuza wese wabiherewe uruhushya.

- Komisiyo za ETF ziri hasi cyane ugereranije na mutuelle .

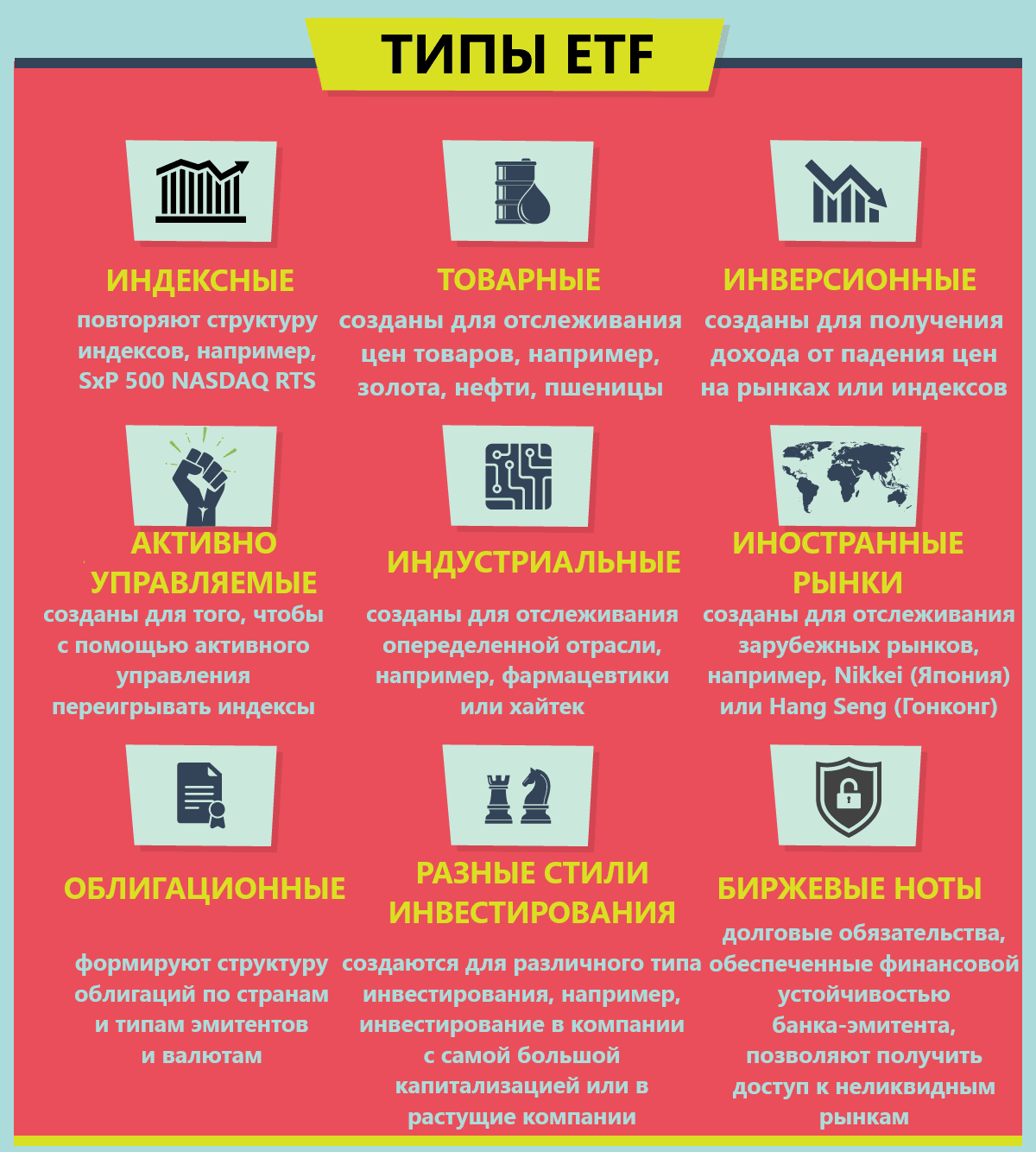

Ubwoko bwa ETF

ETF iriho irashobora kugabanywamo amatsinda akurikira:

- Ku gihugu – ku ivunjisha ry’Amerika hari amafaranga ashora mu bihugu hafi ya byose ahari isoko ryimigabane. Hariho ETF zitandukanye kuri buri cyegeranyo cyiki gihugu.

- Ukurikije imirenge yubukungu – hari ETF kumirenge yihariye yubukungu, ahakusanyirizwa imigabane yumurenge runaka wubukungu bwigihugu. Umushoramari ntashobora kugura ibipimo byose, ariko gushora gusa mubikorwa bitanga umusaruro mubitekerezo bye.

- Kubikoresho byimari – ETF irashobora gutangwa kububiko, ibicuruzwa, ibikoresho byisoko ryamafaranga (inguzanyo zigihe gito kugeza kumezi 3), amafaranga ETFs, ETF kubutare bwagaciro, ibicuruzwa byinganda, imitungo itimukanwa.

ETF kuri MICEX

Hano hari ETF zirenga 1.500 zitandukanye kuri NYSE.

Isoko rya Moscou ritanga urutonde rworoheje rwa ETFs kubashoramari b’Abarusiya (etf nyinshi ziraboneka kugura gusa kubashoramari babishoboye). Kugeza ubu, 128 ETF na BIF zirahari ku Isoko rya Moscou. Finex itanga ETF ikurikira:

- FXRB – Ironderero ry’inguzanyo z’amasosiyete yo mu Burusiya yerekanwe mu mafaranga.

- FXRU – Ironderero ry’inguzanyo z’amasosiyete yo mu Burusiya yerekanwe mu madorari.

- FXFA ni indangagaciro yumusaruro mwinshi wibigo byibihugu byateye imbere.

- FXIP – Ingwate za leta zunzubumwe za Amerika, hamwe no kurinda ifaranga hamwe n’uruzitiro rwa ruble, zivugwa mu mafaranga.

- FXRD – amadolari menshi yumusaruro mwinshi, igipimo – Solactive USD Yaguye Umumarayika Yatanze Impapuro zafashwe.

- FXKZ – ikigega gishora imari mu migabane ya Qazaqistan.

- FXRL nishoramari mubipimo byuburusiya RTS.

- FXDE ni ishoramari ku isoko ryimigabane yo mu Budage.

- FXIT nishoramari murwego rwikoranabuhanga muri Amerika.

- FXUS nishoramari muri Amerika SP500.

- FXCN ni ishoramari ku isoko ryimigabane mu Bushinwa.

- FXWO nishoramari mumigabane yisoko ryisi yose, portfolio yayo irimo imigabane irenga 500 yaturutse mubihugu 7 binini kwisi.

- FXRW nishoramari ryimigabane myinshi yo muri Amerika.

- FXIM nishoramari murwego rwikoranabuhanga muri Amerika.

- FXES – imigabane yamasosiyete yo muri Amerika murwego rwimikino na eSports.

- FXRE ni ishoramari muri Amerika ishoramari ryimitungo itimukanwa.

- FXEM – ishoramari mu migabane y’ibihugu biri mu nzira y’amajyambere (usibye Ubushinwa n’Ubuhinde).

- FXGD nishoramari muri zahabu.

Kugeza ubu Finex niyo sosiyete yonyine itanga ishoramari rya ETF kubacuruzi bo mu Burusiya.

Hano hari ibicuruzwa bisa na Sberbank, VTB, BCS, Finam, Umurwa mukuru wa Alfa,

Tinkof ishoramari , Aton nibindi. Ariko bose ni aba BPIF. Ibigo byinshi byubuyobozi bitanga ibicuruzwa bisa (ikigega gikurikira isoko yagutse yisoko

SP500 ihagarariwe na Sberbank, Alfa Capital na VTB). Imbaraga zirasa, ariko abashoramari baguze imigabane ya Finex bungutse bike kubera komisiyo zo hasi. Ikiranga ETF ku Isoko ry’i Moscou ni uko ifaranga rya ETF ari amadorari, kandi kugira ngo ugure ETF nk’iyi, amafaranga ava kuri konti abanza guhindurwa amadorari. Hano hari etf igereranwa na rubles (hamwe nuruzitiro rwifaranga), mukubigura umushoramari arinzwe gusimbuka mumadolari kugeza ku gipimo cy’ivunjisha.

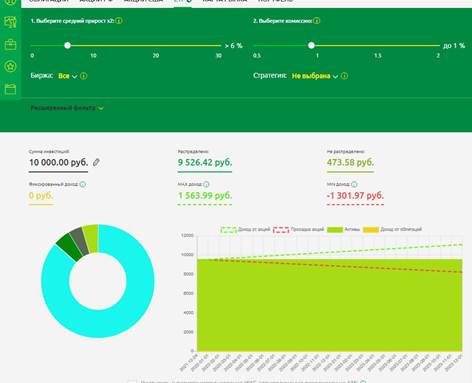

Ihame ryo gushiraho ETF portfolio

Gushora imari mu bipimo ngenderwaho ni byiza cyane nkibyo abashinzwe amafaranga yizabukuru bakora. Ishoramari ritambitse – ntugomba kugerageza gukusanya ETF portfolio mumyaka 1-2. Igikorwa nyamukuru cyo gushora imari muri ETF nuburyo busanzwe bwishoramari, tutitaye kumiterere yisoko. Guhitamo ETF ibereye, urubuga rwo guhana amakuru rwa Moscou ruzafasha umushoramari, aho ushobora kubona urutonde rwamafaranga yose yagurishijwe-yagurishijwe – https://www.moex.com/msn/etf. [ibisobanuro id = “umugereka_12049” align = “aligncenter” ubugari = “624”]

- FXMM ni ikigega cy’isoko ry’amafaranga muri Amerika gishora imari muri Amerika mugihe gito cyamezi 1-3.

Iki kigega kirasa no kubitsa. Ikintu cyihariye ni uko igishushanyo cyacyo ari umurongo ugororotse werekeza hejuru ku nguni ya dogere 45.

- BPIF RFI “VTB – Ibihugu bivuka binganya ikigega” (VTBE ETF) . Kugirango dutandukanye, reka twongere umutungo ushora imari mubihugu bikiri mu nzira y’amajyambere mu nshingano.

Reka duhitemo muri ecran ya ETF umutungo wose ushora mumitungo ivanze. Reka twibande kuri vtbe etf. Iki kigega gishora mumitungo yibihugu bikiri mu nzira y’amajyambere binyuze mu kugura etf y’amahanga ISHARES CORE MSCI EM. Ishoramari muri iki kigega rizafasha gutandukana mu bihugu. Muri icyo gihe, komisiyo y’ikigega ni 0,71% gusa. Iyo uguze ukoresheje umuhuza wa VTB, nta komisiyo yo guhanahana amakuru.

- VTBH ETF . Noneho, kugirango ugabanye ihindagurika rya portfolio, reka twongereho bonds. VTBH ETF itanga amahirwe yo gushora imari muri Amerika itanga umusaruro mwinshi. Kugirango ukore ibi, ikigega cyagurishijwe kigura imigabane yamahanga ya ETF ISHARES HIGH YIELD CORP BOND.

- DIVD ETF – ikigega cyagurishijwe gikurikiza igipimo cyimigabane yinyungu za Federasiyo yUburusiya. Umubare urimo 50% byimigabane myiza yuburusiya bwu Burusiya mubijyanye: umusaruro winyungu, ituze ryinyungu, ubwiza bwuwabitanze. Bitewe no kwishyura inyungu hamwe nubuziranenge bwubucuruzi bwubucuruzi, hateganijwe inyungu nyinshi kurenza isoko ry’imigabane yagutse (impuzandengo yumwaka kuva muri Werurwe 2007 kugeza 15.6% na 9.52% kumasoko yagutse)

- Ku ishoramari ku isoko ry’imigabane muri Amerika, TECH (ishora muri Amerika NASDAQ 100) muri Tinkoff Investments na FXUS , yigana imbaraga z’isoko ryagutse ry’imigabane muri Amerika SP500, irakwiriye.

- Icyitonderwa kandi gikwiye TGRN ETF kuva Tinkoff Ishoramari . Impuzandengo yumwaka yumwaka iri kurwego rwa 22% kumwaka. Ikigega gishora imari mu bayobozi b’ikoranabuhanga rifite isuku ku isi.

- ETF FXRL ni ikigega ngenderwaho gikurikiza imbaraga z’Uburusiya RTS. Urebye ko RTS ari igipimo cy’idolari, etf itanga uburinzi bwo kwirinda ihindagurika ry’ifaranga. Hamwe n’izamuka ry’idolari, indangagaciro ya RTS ikura kurusha MICEX. Inyungu yakiriwe isubizwa mumigabane yikigega. Ikigega gitanga umusoro ku nyungu za 10%.

- Kurinda ifaranga, ugomba kongeramo zahabu etf, kurugero, FXGD . Komisiyo y’ikigega ni 0.45% gusa. Ikigega gikurikirana igiciro cya zahabu yumubiri ku isoko ryisi yose uko bishoboka kose, kandi igufasha kwirinda ubwiyongere bw’ifaranga nta TVA.

- Kandi, reba ETF ikurikiza ingamba zose zikirere / Ibihe Byose bya Portfolio – etf opnw yo muri Otkritie Broker cyangwa TUSD ETF kuva Tinkoff Investments . Ikigega gifite itandukaniro imbere, umushoramari ntakeneye kongera imbaraga. Abayobozi bashora kimwe mubigega, ingwate, zahabu. Etf opnw ishora kandi mumafaranga yimitungo itimukanwa yo muri Amerika.

Kubafite amakonte ya brokerage, ubu bwoko bwa ETF, nubwo bworoshye, buhenze cyane. Nibyiza gufata umwanya muto ukubaka portfolio ya ETF wenyine. Mugihe cyimyaka 20, niyo komisiyo idafite agaciro 0.01-0.05% ihinduka mumafaranga agaragara.

Mugihe uhisemo ETF itanga ikizere, ugomba kugerageza gutekereza cyane kwisi. Ibisubizo by’ishoramari mu myaka ibiri ishize ntabwo byemeza intsinzi imwe mugihe kizaza. Ishoramari mu bubiko ryerekanye iterambere ryihuse rishobora guhinduka inyungu mu myaka mike iri imbere. Umurenge urashobora gushyuha hanyuma ugafata ikiruhuko. Gushora imari mugari byunguka cyane kuko ibigize indangagaciro bihora bihinduka. Ibigo bidakomeye bisimburwa nibikomeye. Ibigo byinshi byashyizwe mubipimo bya SP500 ntibyari bikiri ku isoko hashize imyaka 10, ariko imbaraga zurutonde ntizigeze zibabazwa nibi. Ugomba kwihatira gutekereza cyane kwisi yose, ntukarebe imbaraga ziki kigega, gerageza uhitemo ingaruka nke kandi zitandukanye. Tumaze kumenya ETF itanga icyizere muri buri cyiciro cyumutungo, aho umushoramari ashaka gushora amafaranga agomba gutangwa kuri buri mugabane we. Birasabwa gukurikiza ibipimo bikurikira:

- 40% ya portfolio yagenewe kugura imigabane . Kubitandukanye, imigabane igabanijwe nigihugu ninganda. Buri bwoko bwa ETF bwahawe umugabane ungana muri iri tsinda;

- 30% – ingwate . Ibi bizagabanya kugaruka kwinshingano rusange, ariko icyarimwe bigabanye ihindagurika rya konti ya brokerage. Niki kizagira ingaruka nziza muburyo bwimitsi yumushoramari mubihe bigoye;

- 10% bya portfolio – ishoramari muri zahabu . Igice gikingira igice cya portfolio. Ahari nyuma iki gice cya portfolio kirashobora gusimburwa nishoramari muri cryptocurrencies;

- 20% – ahantu hizewe – ububiko bwikoranabuhanga buhanitse, ishoramari mumasosiyete “icyatsi” kugirango yizere iterambere ryihuse.

Ubuyobozi bwa ETF – Ibibazo 15 byingenzi: amafaranga ya ETF niki, bakora gute, uburyo bwo kubashakira amafaranga: https://youtu.be/I-2aJ3PUzCE Gushora imari muri ETF bisobanura guhoraho kandi igihe kirekire. Nibyiza kuzuza portfolio buri kwezi – uzwi cyane kuri posita “iyishyure mbere.” Iyo wuzuza, ugomba gukurikiza ingamba zatoranijwe, ukareba igipimo cyumutungo. Umutungo umwe uzagabanuka kubiciro, mugihe umugabane wabo muri portfolio uzagabanuka. Indi mitungo izamuka mu gaciro, umugabane wabo uziyongera. Ntugomba kugerageza witonze kugirango ugumane ibipimo – gutandukana kwa 5-10% biri murwego rusanzwe. Hariho uburyo bubiri bwo kugumana ibipimo – kugurisha umutungo wazamutse kubiciro no kugura ibiri inyuma. Cyangwa kugura gusa abasigaye inyuma kubera kuzuzwa. Ntugurishe kugeza intego zishoramari zujujwe. Nubuhe buryo bubiri bwatoranijwe ntabwo ari ngombwa. Ni ngombwa guhitamo uburyo bwishoramari kugirango ubukurikire. Hamwe no guhora wongera kugura inyuma no kugurisha umutungo wagaragaje iterambere, umushoramari burigihe agura hepfo akagurisha hejuru. Muri icyo gihe, ntabwo azagena ibiciro byiza, ariko ugereranije ugereranije portfolio izerekana imbaraga nziza mugihe kirekire, kandi nikintu cyingenzi.