The article was created based on a series of posts from the OpexBot Telegram channel , supplemented by the author’s vision and the opinion of the AI. Where in Russia can a novice investor invest money in 2026: a small amount and a minimum of knowledge.

- Where to invest wisely and without nerves during the crisis in 2026 – even a beginner can do it, the percentages will tell you

- Bonds

- “Blue chips” – shares of the first echelon of the Russian Federation

- Mutual funds and ETFs – ready-made portfolios

- Gold

- What I wouldn’t recommend

- 10% per annum without risk – on housing, children, Goa and disco

- TOP 5 valuable investment tips for a novice investor

- Where to invest money for passive income in 2026: what does artificial intelligence think?

Where to invest wisely and without nerves during the crisis in 2026 – even a beginner can do it, the percentages will tell you

It’s difficult to outpace inflation, but let’s try. Or at least break even. Yes, so that it is relatively safe. So, inflation at the end of 2022 was 12%.

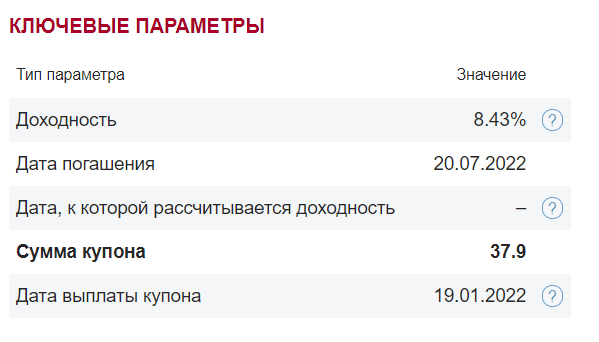

Bonds

10-14% yield. There are options where the risks will be moderate. He explained why investing in bonds is better than taking money to the bank. I won’t repeat myself.

“Blue chips” – shares of the first echelon of the Russian Federation

Over the long term, many companies grow steadily. Growth leaders for the year Sber +92%; MTS +40%; NOVATEK + 25%; Tatneft +9%. More details here . And the tall divas pay. This year the divas have paid, or will pay, Sberbank, Beluga Group, NOVATEK and others. But there are also opposite examples: the fall of Gazprom, for example. Diversification is a must.

Mutual funds and ETFs – ready-made portfolios

Allows you to invest small amounts. For example, by purchasing a share of a mutual investment fund linked to the Moscow Exchange index, you will immediately invest in all the shares of leading Russian companies. Bonuses: wide choice, reliability, tax deduction. Profitability can be up to 20-30% per annum. Information is publicly available.

Gold

13.26% return over the last year. A working option for long-term investments. Over the years, the price of the precious metal only increases, and during periods of crisis, growth accelerates. Well, selling/exchanging gold helps you survive in a critical situation.

What I wouldn’t recommend

- Deposit. 8-10% per annum . Inflation will win. There are currently no deposits in Russia that would outpace inflation in percentage terms. And the banking crisis has not been canceled. Dummy capsules can also be found in the Russian Federation.

- Cash . 0% per annum. Money must work. Under the mattress, cash is being devalued by inflation every day. And they can also be “gobbled up” by children, unexpected and much-needed “wants”, or thieves. There should be cash, but as a financial cushion that you can instantly access.

- Real estate is stability. Real estate investment is one of the safest instruments available today. But not for any capital.

https://youtu.be/l7xdYiKhXPU

10% per annum without risk – on housing, children, Goa and disco

I’ll add specifics on where to invest wisely and without nerves during the crisis in 2026. Suitable for those investors who have low risk tolerance. Or, as part of an investment portfolio, where the main task is to preserve capital and protect funds from inflation. There are a lot of tests to determine risk tolerance online. Only instruments available to everyone for purchase on MOEX, or through the broker Tinkoff and others. For a conditional million rubles we take: For 300-400k bonds* . 50 to 50%. OFZ at 9-10%. And corporate bonds at 10-15% with low risk. For example: Seligdar, Norilsk Nickel, Sberbank and other reliable issuers. For 300-400k bonds in yuan. Yield from 4%. The safest and most profitable investment in foreign currency at the moment. Bank deposits in yuan are less than 3%. The Yuanization of the economy is just taking off. Trading volume in yuan is growing from month to month. In addition to income from coupons, there is an option to profit from exchange rate differences. Polyus, Segezha, and RUSAL have bonds denominated in yuan. The full list includes dozens of issuers. *Explained above why investing in bonds is better than taking money to the bank. At 150-300k blue chip stocks . We choose those that pay divas. Many people pay, but not all. The stability of dividend payments is reflected by the DSI index. But let’s keep it simple. In 2023 with divas: Sberbank, Norilsk Nickel, Lukoil, Tatneft literally announced payment today. At 150-300k gold

Does not constitute individual investment advice. Remember that investing in securities is always a risk.

TOP 5 valuable investment tips for a novice investor

- Diversify your portfolio: Don’t put all your eggs in one basket. Diversifying your portfolio by can help spread risk and potentially increase returns.

- Have a long-term investment horizon: Investing is a long-term game, and short-term market fluctuations should not deter you from your investment strategy.

- Understand your risk tolerance: Know how much risk you are willing to take. This will help you make informed investment decisions and determine an investment strategy that suits your risk tolerance.

- Keep your emotions in check: Don’t make impulsive investment decisions based on emotions such as fear or greed.

- Do your own research: Don’t rely solely on the advice of others. It is important to do your own research and exercise due diligence when making investment decisions.

Where to invest money for passive income in 2026: what does artificial intelligence think?

Where to invest is a question that worries many. There are many opportunities in the world to invest your money and achieve material success. However, choosing the right investment can be the key factor determining success or failure in a given business. Having studied the various possibilities, we can identify several main areas that are promising for investment. First, stocks are one of the most popular investments. Exchange trading offers a wide selection of shares of various companies, from large international corporations to small startups. Investing in stocks can bring good returns, but requires careful analysis of the market and the company in which you plan to invest. Secondly, real estate is a stable and traditional investment object. Purchasing residential or commercial properties can provide stable income in the form of rent or future resale opportunities. However, to successfully invest in real estate, you need to competently choose a location and analyze the market. Thirdly, investing in your own business is one of the most risky, but also potentially profitable options. Owning your own business gives you the opportunity to control your profits, but requires serious financial and time investments. Selecting a business area and creating an effective strategy are key aspects of success in a given investment. Finally, we must not forget about diversifying the investment portfolio. A variety of asset types—stocks, bonds, securities, cryptocurrencies—can help reduce risk and provide more stable long-term returns. To successfully invest in real estate, you need to competently choose a location and analyze the market. Thirdly, investing in your own business is one of the most risky, but also potentially profitable options. Owning your own business gives you the opportunity to control your profits, but requires serious financial and time investments. Selecting a business area and creating an effective strategy are key aspects of success in a given investment. Finally, we must not forget about diversifying the investment portfolio. A variety of asset types—stocks, bonds, securities, cryptocurrencies—can help reduce risk and provide more stable long-term returns. To successfully invest in real estate, you need to competently choose a location and analyze the market. Thirdly, investing in your own business is one of the most risky, but also potentially profitable options. Owning your own business gives you the opportunity to control your profits, but requires serious financial and time investments. Selecting a business area and creating an effective strategy are key aspects of success in a given investment. Finally, we must not forget about diversifying the investment portfolio. A variety of asset types—stocks, bonds, securities, cryptocurrencies—can help reduce risk and provide more stable long-term returns. but also potentially profitable options. Owning your own business gives you the opportunity to control your profits, but requires serious financial and time investments. Selecting a business area and creating an effective strategy are key aspects of success in a given investment. Finally, we must not forget about diversifying the investment portfolio. A variety of asset types—stocks, bonds, securities, cryptocurrencies—can help reduce risk and provide more stable long-term returns. but also potentially profitable options. Owning your own business gives you the opportunity to control your profits, but requires serious financial and time investments. Selecting a business area and creating an effective strategy are key aspects of success in a given investment. Finally, we must not forget about diversifying the investment portfolio. A variety of asset types—stocks, bonds, securities, cryptocurrencies—can help reduce risk and provide more stable long-term returns.