Kunezindlela ezimbalwa abatshalizimali nabahwebi abangasiza ngazo ukunciphisa ubungozi. Enye yalezi ukugoqa.

Iyini ingqikithi ye-hedging, iyini futhi isebenza kanjani esibonelweni sangempela

Ukubiyela kuyisilinganiso sokunciphisa ubungozi obuvela ezimakethe zezimali. Ngamafuphi, wenza uhwebo oluhlehlayo ukuze unxephezele ukulahlekelwa okungenzeka endaweni eyayivulwe ngaphambilini.

Isibonelo:

Ake sithi ungumnikazi wesabelo se-Gazprom. Ngenxa yokulungiswa okungenzeka kwezintengo zegesi kanye ne-geopolitics, wesaba ukuthi izingcaphuno zesitoko zizowa. Kulokhu, ungasebenzisa i-hedging. Okungukuthi, vula isikhundla ekuweni kwesitoko. Uma lokhu kungenzeki, khona-ke uzolahlekelwa kancane. Ingxenye encane kuphela yenhloko-dolobha, eyabekwa ekwindla. Kodwa uma amaphepha e-Gazprom ewa, khona-ke uzokwenza inzuzo ngesivumelwano esifushane. Izofaka ukulahlekelwa endaweni evuliwe ngaphambilini.

- I- Hedge Funds . Baphatha izimali zabanye abantu ngokomsebenzi futhi basebenzisa amasu ahlukahlukene ahlobene nokukhawulela ubungozi bemakethe.

- Abathekelisa Nabathekelisa . Izinkampani ezinjalo ziqinisekisa ubungozi obuhlobene nokuphazamiseka kwamaketanga okuhlinzeka noma izinguquko kuzinga lokushintshisana.

- Abahwebi . Abaqapheli bavula izindawo zokuhlehla entweni efanayo. Umgomo uwukunciphisa ingozi yokuguquguquka ekuhwebeni.

- Abatshalizimali abakhulu . Baqinisekisa ubungozi bephothifoliyo ngezwe, imali kanye nezimboni.

I-Hedge ayitholakali kubadlali abakhulu kuphela. Ibuye isetshenziswe ngabatshalizimali abancane abazimele abanemali encane.

Kungani udinga ukuvikela ingozi ngamagama alula

Ithuluzi lokuphepha lisetshenziselwa lezi zinhloso ezilandelayo:

- Ukuvikelwa kwesikhundla eside uma kungenzeka ukuwa kwempahla. Ungavula ukuhweba okufushane ephepheni elifanayo. Uma ushintsha inani lentengo, ngeke ulahlekelwe cishe lutho.

- Umshwalense wokuhweba okufushane uma kwenzeka kukhuphuka intengo yempahla. Ukuze wenze lokhu, udinga ukuvula isikhundla eside entweni efanayo. Lokhu kuzoqinisekisa ngokumelene ne-volatility.

- Hedge ngokumelene nezinguquko zenani lokushintshanisa. Ukubiyela engcupheni yemali kuyindlela yokuvikela izimali zakho uma kwenzeka kuba nokuguquguquka kwezinga lokushintshisana kwamazwe angaphandle.

- Ukunciphisa ubungozi bokusebenza obuqondene ngqo nomjikelezo webhizinisi. Isibonelo, uthango lusetshenziswa uma kwenzeka ukwephulwa kwezinsuku zokulethwa.

- Ukuqedwa kokungaqiniseki. Uma ungenalo uhlelo olucacile lokuthi kuzokwenzekani emakethe esikhathini esizayo esiseduze, khona-ke ungaphendukela kuthango. Thenga amathuluzi aphambene futhi uvikele imali enkulu ngokumelene nezinguquko ezingaba khona zevelu.

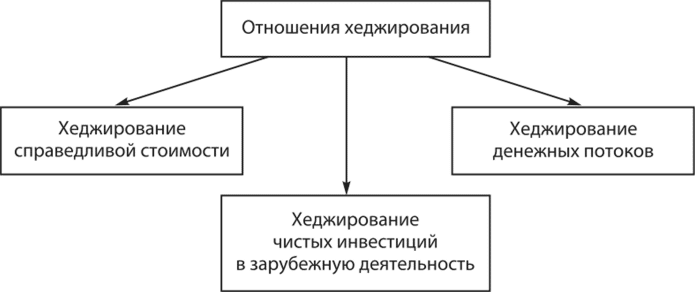

Izinhlobo zokubiyela ekuhwebeni, ekuhwebeni hhayi ekuhwebeni

Kunezigaba eziningana ze-hedge. Zonke zincike esihlokweni. Ake sicabangele eziyisisekelo kakhulu. Ngohlobo lwensimbi:

- Ukuhwebelana – izinkontileka ezidwetshwa ekuhwebeni. Izinsimbi zokuvikela ezidumile ziyizinketho nekusasa. Basiza ekuqinisekiseni izingozi zezimali. Iqembu lesithathu ekwenziweni yindlu yokusula. Unesibopho sokwenza kanye nokulethwa kwenkontileka.

- I- OTC – izinkontileka eziphothulwa ngaphandle kokuhwebelana. Umthengi nomthengisi bangakwazi ukwenza umsebenzi ngokuqondile noma babandakanye inkampani yangaphandle. Izinsimbi zokuvikela eziyinhloko zingaya phambili kanye nokushintshaniswa. Lokhu kuthenga kwenzeka kanye. Azinakuthengiswa izinkampani zangaphandle. I-OTC hedging ivamise ukusetshenziselwa ukukhawulela ubungozi bebhizinisi.

Ngosayizi wezingcuphe ezifakwe kumshwalense:

- uthango olugcwele – usayizi wokuthengiselana okuphambene ulingana nomthamo wesikhundla sokuqala esivulekile;

- uthango oluyingxenye – umthamo we-counter-trade ungaphansi kobukhulu bendawo evuliwe ngaphambilini.

Ngolunye uhlobo:

- Uthango lomthengi . Umtshali-zimali uqinisekisa ubungozi obuhlobene nokukhuphuka kwamanani okungenzeka noma ukuwohloka kwemigomo yenkontileka yenkontileka.

- Uthango lomdayisi . Kulokhu, ubungozi bunikezwa umshwalense ngokumelene nokwehla kwamanani okungenzeka noma ukuwohloka kwemibandela yenkontileka.

Ngesikhathi sokuthenga:

- Uthango lwakudala . Okokuqala, benza isivumelwano esikhulu, bese kuba isivumelwano somshuwalense.

- I- Superior Hedge . Konke kwenzeka ngenye indlela. Okokuqala, benza isivumelwano somshuwalense, bese kuba esiyinhloko.

Ngohlobo lwempahla eyisisekelo:

- uthango oluhlanzekile – impahla eyisisekelo ekuhwebeni okuyinhloko nokuhlehlayo iyafana;

- cross – isikhundla esiyinhloko sinomshwalense ngenye impahla eyisisekelo.

Ngohlobo lwemibandela yenkontileka yokuvikela:

- unilateral – ukulahlekelwa kwezezimali kanye nemali engenayo kuthathwa uhlangothi olulodwa kuphela lokuthengiselana;

- amazwe amabili – ukuhlukaniswa kwenzuzo nezindleko kuwela nhlangothi zombili.

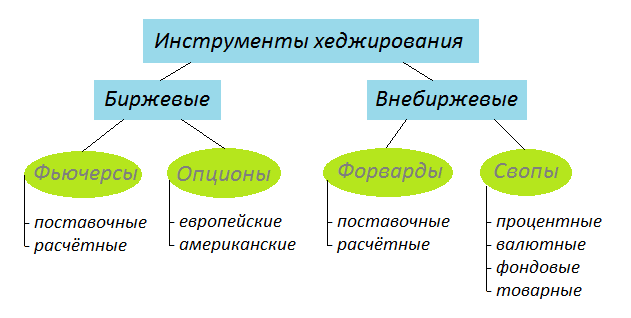

Hedging Izinsimbi

Izinsimbi zokushintshana eziyinhloko zokuvikela yilezi:

- Isimo esifushane . Kulesi simo, uboleka izibambiso, uzithengise, bese uzithenga ngenani eliphansi. Umehluko phakathi kwentengo yokuthengisa neyokuthenga kabusha inzuzo ezokwenziwa emakethe ephansi. Ukuhweba okunjalo kubizwa nge-margin trading. Uhweba ngezitoko ezibolekiwe. Umthengisi uzothatha ikhomishana yokusebenzisa izibambiso. Ingase futhi ivale ngenkani ukuhweba ngezinga elingathandeki kuwe uma isikhundla singavikelekile.

- Inketho . Lesi yinkontileka lapho umthengi angathengisa khona impahla ngenani elinqunywe kusengaphambili. Futhi akunandaba ukuthi intengo izoba yini ngesikhathi sokuthengisa. Uma ulindele ukwehla kwezingcaphuno zempahla, bese uthenga inketho ye-PUT. Ngakho, ulungisa intengo yephepha. Ngokuzayo, uma amasheya ewa, ungakwazi ukuthengisa impahla ngentengo yoqobo. Uma izingcaphuno zingawi, khona-ke unelungelo lokungayidayisi impahla.

- Ikusasa . Lesi yinkontileka yokuthengiswa kwempahla ngedethi ethile ngenani elinqunywe kusengaphambili. Uma ucabanga ukuthi iphepha lizoshibhile, bese uthengisa inkontileka yesikhathi esizayo. Ngosuku lomnqamulajuqu lwenkontileka, elinye iqembu lizophoqeleka ukuthi lithenge impahla ngentengo enqunywe kusengaphambili.

- Shintsha . Njengengxenye yomsebenzi oya phambili, abathintekayo bashintsha izinkokhelo isikhathi esithile. Ukubiyela okunjalo kuvame ukusetshenziswa ngabaphathi bezikhwama. Isibonelo, inkampani ye- FinEx lapho iphatha izimali ze-ETF.

- Ama – ETF aphambene . Izimali ezinjalo zenzelwe ukufana nezilinganiso ezizilandelayo. Uma inkomba eyinhloko iwe, bese iphakama. Ama-ETF aphambene anikeza ukukhula ku-1x, 2x, njll. Okusho ukuthi, ukuhweba nge-leverage kuyatholakala.

Okubalulekile! Amathuluzi angenhla okuvikela ubungozi atholakala kubatshalizimali abaqeqeshiwe kuphela.

Emakethe ye-over-the-counter, i-front isetshenziselwa uthango. Le nkontileka ibandakanya ukulethwa kwempahla eyisisekelo. Imigomo yenkontileka yokudlulisela phambili isethwa amaqembu ngokwawo. [i-id yamagama-ncazo = “okunamathiselwe_14276″ align=”aligncenter” wide=”631″]

Isibonelo se-Hedging

Inkomba yedola laseMelika kanye negolide kunokuhlobana okuhle okuphambene. Uma umtshali-zimali enegolide kuphothifoliyo yakhe, futhi esaba ukuwa kwenani lempahla, khona-ke angakwazi ukubiyela ubungozi ngenkontileka yesikhathi esizayo yenkomba yedola laseMelika. Lolu hlobo lwe-hedging lubizwa ngokuthi i-cross hedging.

Amaphutha lapho usebenzisa uthango

Lapho kuvinjelwa izingozi, abatshalizimali abangenalwazi nabahwebi ngezinye izikhathi benza amaphutha. Ngenxa yalokho, ziholela ekulahlekelweni kwengxenye yenhloko-dolobha. Amaphutha ajwayelekile kakhulu wokuvikela yilawa:

- impahla eyisisekelo ikhethwe ngokungalungile ngesikhathi sothango oluphambanayo;

- izimo eziyiphutha zokuthengiselana zisethiwe;

- ithuluzi lokuhweba elingalungile lokubiyela likhethiwe;

- asikho isibambiso sokuhweba ngenzuzo;

- ivolumu ye-counter-transaction ibalwe ngokungalungile.

Ubuhle nobubi

| Izinzuzo | Amaphutha |

| Isu lokubiyela lisiza ekusheshiseni ukwehla kwenani lempahla. | Udinga ukukhokha amakhomishini kubadayisi ngokwenza uhwebo oluhlehlayo. |

| Kunokwenyuka kokusimama kwemali engenayo yephothifoliyo ngebanga elide. | Umshwalense awukhokhi njalo. Ikakhulukazi uma uthango oluphambanayo olunezimpahla ezihlukene ezingaphansi. |

| Azikho izinguquko ezinkulu. Iphothifoliyo imelana kakhulu nokuguquguquka okubukhali kwezingcaphuno. | Ungalahlekelwa kakhulu uma kunemikhawulo yokushintshisana. Isibonelo, ngesikhathi sokuhweba kwe-margin nge-average noma i-liquidity ephansi. |

| Amasu we-Hedging ayasebenza emakethe yokushintshanisa kanye nasekuhwebeni kwe-crypto. | Kukhona ukwanda kwenani eliphelele lemisebenzi. Zonke izindawo ezivulekile kufanele zigadwe. Uma kungenjalo, ungaphuthelwa isikhathi esihle sokuphuma. |

| Konke okwenziwayo kuvikelekile. | Ukuze ufinyelele inhlobonhlobo yamathuluzi, udinga isimo somtshali-zimali oqeqeshiwe. |

I-Hedging umsebenzi oyinkimbinkimbi wokunciphisa ubungozi ngokusebenzisa amathuluzi akhethekile. Zisetshenziswa kuphela abahlanganyeli bemakethe abangochwepheshe. Ngakho-ke, ngaphambi kokwenza ukuthengiselana okunjalo, qonda isimiso sokusebenza kokunye okuphuma kokunye. Lokhu ngeke nje konge imali enkulu, kodwa kuzophinde kuhlukanise ukutshalwa kwezimali okuzayo.