Akwan pii wɔ hɔ a sikasɛm mu asisifo ne aguadifo betumi afa so aboa ma asiane ano abrɛ ase. Eyinom mu biako ne hedging.

- Dɛn ne hedging no mu ade titiriw, dɛn ne ne ɔkwan bɛn so na ɛyɛ adwuma wɔ nhwɛso ankasa so

- Dɛn nti na wuhia asiane ho banbɔ wɔ nsɛmfua a ɛnyɛ den mu

- Hedging ahorow a ɛwɔ exchange no so, wɔ aguadi mu na ɛnyɛ exchange no so

- Nnwinnade a Wɔde Bɔ Nneɛma Ho ban

- Hedging Nhwɛso

- Mfomso a wodi bere a wode hedge redi dwuma no

- Mfaso ne ɔhaw ahorow

Dɛn ne hedging no mu ade titiriw, dɛn ne ne ɔkwan bɛn so na ɛyɛ adwuma wɔ nhwɛso ankasa so

Hedging yɛ adeyɛ a wɔde tew asiane ahorow a ɛba sikasɛm gua ahorow so no so. Ne titiriw no, woyɛ reverse trade de tua adehwere a ebetumi aba wɔ gyinabea a woadi kan abue no ho ka.

Nhwɛso:

Momma yɛnka sɛ wowɔ Gazprom kyɛfa. Esiane nteɛso a ebetumi aba wɔ gas bo ne geopolitics mu nti, wusuro sɛ stock quotes no bɛhwe ase. Wɔ eyi mu no, wubetumi de wo ho ato hedging so. Ɛne sɛ, bue gyinabea bi wɔ stock no asehwe ho. Sɛ eyi ansi a, ɛnde wobɛhwere kakra. Ahenkurow no fã ketewaa bi pɛ, a wɔde too asehwe no so. Nanso sɛ Gazprom nkrataa no hwe ase a, ɛnde wubenya mfaso wɔ apam tiawa bi so. Ɛbɛkata nneɛma a wɔhwere wɔ gyinabea a wɔadi kan abue no so.

- Hedge Sikakorabea ahorow . Wɔde adwumayɛfo hwɛ afoforo sika kɛse so na wɔde akwan horow a ɛfa gua so asiane ahorow a wɔbɛto ano hye ho di dwuma.

- Wɔn a Wɔde Kɔ Amannɔne ne Wɔn a Wɔde Ba Amannɔne . Nnwumakuw a ɛtete saa no hwɛ asiane ahorow a ɛbata nneɛma a wɔde ma no a ɛbɛhaw anaasɛ nsakrae a ɛba wɔ sika a wɔde sesa nneɛma mu no ho insurance.

- Aguadifo . Speculators bue reverse gyinabea ahorow wɔ adwinnade koro no ara so. Botae no ne sɛ wɔbɛtew asiane a ɛwɔ aguadi mu a ɛbɛsakrasakra mu no so.

- Sikakorabea akɛse . Wɔhwɛ portfolio asiane ahorow so sɛnea ɔman, sika ne nnwuma te.

Ɛnyɛ agofomma akɛse nkutoo na wobetumi anya hedge. Ankorankoro sikakorafo nketewa a wonni sika kɛse biara nso de di dwuma.

Dɛn nti na wuhia asiane ho banbɔ wɔ nsɛmfua a ɛnyɛ den mu

Wɔde ahobammɔ adwinnade no di dwuma ma nneɛma a edidi so yi:

- Gyinabea tenten bi ho banbɔ sɛ ebia agyapade no bɛhwe ase a. Wubetumi abue Short trade wɔ krataa koro no ara so. Sɛ wosakra bo a wɔbɔ no a, ɛkame ayɛ sɛ worenhwere hwee.

- Insurance a wɔde bɛyɛ aguadi tiawa bi sɛ agyapade no bo kɔ soro a. Sɛ wobɛyɛ eyi a, ɛsɛ sɛ wubue Long position wɔ adwinnade koro no ara so. Eyi bɛma wɔahwɛ ahu sɛ nneɛma bɛkɔ so ayɛ basaa.

- Hedge fi nsakrae a ɛba wɔ sikasesɛw mu no ho. Sika mu asiane ho banbɔ yɛ ɔkwan a wobɛfa so abɔ wo sikasɛm ho ban sɛ amannɔne sika bo bɛsakra a.

- Adwumayɛ mu asiane ahorow a ɛfa adwumayɛ mu kyinhyia no ho pɔtee a wɔbɛtew so. Sɛ nhwɛso no, wɔde hedge di dwuma bere a wɔabu nna a wɔde bɛma no so no.

- Nneɛma a wontumi nsi pi a wobeyi afi hɔ. Sɛ wunni nhyehyɛe a emu da hɔ a ɛfa nea ɛbɛba gua no so daakye a enni akyiri ho a, ɛnde wubetumi de wo ho ato banbɔ so. Kɔtɔ nnwinnade a wɔde di dwuma wɔ ɔkwan a ɛne ne ho di nsɛ na hwɛ sika kɛse a ebetumi aba wɔ ne bo mu no ho.

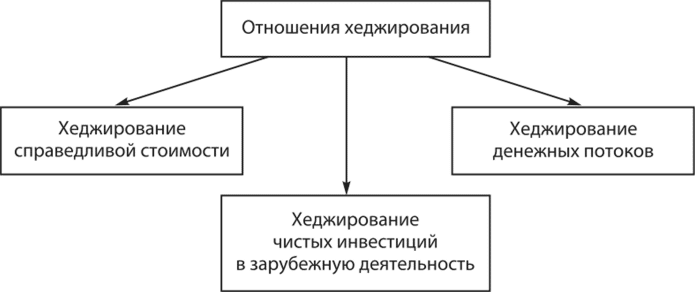

Hedging ahorow a ɛwɔ exchange no so, wɔ aguadi mu na ɛnyɛ exchange no so

Hedge ho nkyekyem ahorow pii wɔ hɔ. Wɔn nyinaa gyina asɛm no so. Momma yensusuw nea ɛho hia sen biara no ho. Sɛnea adwinnade no te:

- Nsesae – apam a woahyehye wo nsesa-sesae no so. Hedging nnwinnade a agye din ne nneɛma a wobetumi apaw ne daakye. Wɔboa ma wonya sika fam asiane ahorow ho insurance. Onipa a ɔto so abiɛsa wɔ asɛm no mu ne adwumakuw a wɔhwɛ nneɛma so no. Ɔno na ɔhwɛ apam no so na ɔde ma.

- OTC – apam a wodi mu wo nsakraee no akyi. Adetɔfo ne nea ɔtɔn no betumi ayɛ asɛm no tẽẽ anaasɛ wɔde obi a ɔto so abiɛsa bɛka ho. Nneɛma titiriw a wɔde bɔ ho ban ne forwards ne swaps. Saa nkitahodi ahorow yi yɛ nea wɔyɛ no pɛnkoro. Wontumi ntɔn mma nnipa foforo. Wɔtaa de OTC hedging di dwuma de siw adwumayɛ mu asiane ano.

Sɛnea asiane ahorow a wɔabɔ ho ban no kɛse te no:

- full hedging – reverse transaction no kɛseɛ ne volume a ɛwɔ gyinabea a ɛdi kan a ɛbue no yɛ pɛ;

- partial hedging – dodoɔ a ɛwɔ counter-trade no mu no sua sene gyinabea a wɔadi kan abue no kɛseɛ.

Sɛnea counterparty no su te:

- Adetɔfo a wɔde wɔn ho to so . Nea ɔde ne sika hyɛ mu no hwɛ asiane ahorow a ebetumi aba sɛ nneɛma bo bɛkɔ soro anaasɛ apam no mu nsɛm a ɛwɔ apam no mu no bɛsɛe no ho insurance.

- Ɔtɔnfo no banbɔ . Wɔ eyi mu no, wɔyɛ asiane ahorow ho insurance fi nneɛma bo a ebetumi akɔ fam anaasɛ apam no mu nsɛm a ɛbɛsɛe no ho.

Eduu bere a wɔde di gua no:

- Classic hedge a ɛyɛ fɛ . Nea edi kan no, wɔkyerɛw apam titiriw no, afei wɔyɛ insurance ho nhyehyɛe no.

- Hedge a Ɛkorɔn . Biribiara si ɔkwan foforo so. Nea edi kan no, wɔyɛ insurance ho nhyehyɛe, afei nea ɛyɛ titiriw no.

Sɛnea agyapade a ɛwɔ ase no te:

- pure hedging – agyapadeɛ a ɛwɔ aseɛ wɔ aguadi titire ne akyire mu no yɛ korɔ;

- cross – gyinabea titire no wo insurance a wode agyapadee foforo a ewo ase.

Sɛnea hedging apam no mu nsɛm te no:

- ɔfã biako – sikasɛm mu adehwere ne sika a wonya no, ɔfã biako pɛ na ɛsoa wɔ asɛm no mu;

- afã abien – mfaso ne ka a wobo mu no nkyekyem no hwe afanu mmienu no nyinaa.

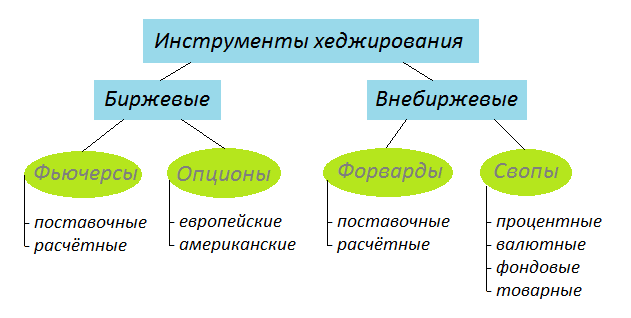

Nnwinnade a Wɔde Bɔ Nneɛma Ho ban

Nneɛma atitiriw a wɔde sesa nneɛma a wɔde bɔ ho ban ne:

- Gyinabea tiawa . Wɔ tebea yi mu no, wobɔ bosea nkrataa, tɔn, na afei wotɔ no bo a ɛba fam. Nsonsonoe a ɛda bo a wɔtɔn ne nea wɔsan tɔ ntam ne mfaso a wobenya wɔ gua a ɛkɔ fam mu. Wɔfrɛ aguadi a ɛte saa no margin trading. Wodi gua wɔ stock ahorow a woabɔ bosea mu. Broker no begye commission wɔ securities a wɔde bedi dwuma no ho. Ebetumi nso de ahoɔden atoto aguadi bi mu wɔ ɔkwan a ɛmfata so mma wo sɛ wɔannya dibea no a.

- Ɔkwan a wobɛfa so . Eyi yɛ apam a ɛma adetɔfo no betumi atɔn agyapade bi wɔ bo a wɔahyɛ ato hɔ so. Na ɛho nhia sɛ ɛbo no bɛyɛ bere a wɔretɔn no. Sɛ wohwɛ kwan sɛ agyapade ho nsɛm a wɔka no so bɛtew a, ɛnde tɔ PUT option. Enti, wohyehyɛ krataa no bo. Daakye, sɛ kyɛfa no hwe ase a, ɛnde wubetumi atɔn agyapade no wɔ bo a na ɛwɔ hɔ mfiase no so. Sɛ quotes anhwe ase a, ɛnde wowɔ hokwan sɛ worentɔn agyapade no.

- Daakye a ɛbɛba . Eyi yɛ apam a wɔyɛ de tɔn agyapade bi da pɔtee bi wɔ bo a wɔahyɛ ato hɔ so. Sɛ wususuw sɛ krataa no bo bɛyɛ mmerɛw a, ɛnde na wotɔn daakye apam. Wɔ da a ɛsɛ sɛ wɔyɛ apam no mu no, ɛbɛyɛ ɔfã foforo no asɛyɛde sɛ ɔtɔ agyapade no wɔ bo a wɔahyɛ ato hɔ so.

- Nneɛma a wɔde sesa . Sɛ́ asɛm a wɔde kɔ anim no fã no, afã horow no sesa sika a wotua no ma bere pɔtee bi. Mpɛn pii no, sikakorabea so ahwɛfo na wɔde ahobammɔ a ɛte saa di dwuma. Sɛ nhwɛso no, FinEx adwumakuw no bere a wɔhwɛ ETF sika so no.

- ETF ahorow a wɔadannan no . Wɔayɛ sika a ɛte saa no sɛnea ɛbɛyɛ a ɛbɛkyerɛ gyinapɛn ahorow a wodi akyi no. Sɛ index titiriw no hwe ase a, ɛnde wɔkɔ soro. Inverse ETFs ma nkɔso wɔ 1x, 2x, ne nea ɛkeka ho mu. Ɛne sɛ, aguadi a wɔde leverage di dwuma no wɔ hɔ.

Ɛhia! Asiane ho banbɔ nnwinnade a ɛwɔ atifi hɔ no wɔ hɔ ma wɔn a wɔde wɔn sika hyɛ mu a wɔfata nkutoo.

Wɔ gua a wɔtɔn nneɛma a wɔmfa nnuru nhyɛ mu so no, wɔde animgyinafo di dwuma de bɔ ho ban. Saa apam yi fa agyapade a ɛwɔ ase no a wɔde bɛma ho. Nsɛm a ɛwɔ forward contract no mu no, afã horow no ankasa na wɔde si hɔ.

Hedging Nhwɛso

U.S. dɔla index ne sika kɔkɔɔ no wɔ abusuabɔ pa a ɛne no bɔ abira. Sɛ obi a ɔde ne sika hyɛ mu wɔ sika kɔkɔɔ wɔ ne sikakorabea, na osuro sɛ agyapade no bo bɛkɔ fam a, ɛnde obetumi abɔ asiane ahorow no ho ban denam daakye apam a wɔbɛyɛ ama U.S. dɔla kyerɛwtohɔ no so. Wɔfrɛ saa hedging yi cross hedging.

Mfomso a wodi bere a wode hedge redi dwuma no

Sɛ wɔrebɔ asiane ahorow ho ban a, ɛtɔ mmere bi a, wɔn a wɔde wɔn sika hyɛ mu ne aguadifo a wonni osuahu no di mfomso. Ne saa nti, ɛma wɔhwere ahenkurow no fã bi. Mfomso a ɛtaa di wɔ hedging ho ne:

- wɔpaw agyapade a ɛwɔ ase no wɔ ɔkwan a ɛnteɛ so wɔ cross hedge mu;

- wɔde tebea horow a ɛnteɛ a ɛfa asɛm no ho si hɔ;

- wɔpaw aguadi adwinnade a ɛnteɛ a wɔde bɛbɔ ho ban;

- biribiara nni hɔ a wɔde bɛbɔ ho ban a wɔde bɛdi gua a wɔde leverage di gua;

- wɔabu counter-transaction no dodow ho akontaa wɔ ɔkwan a ɛnteɛ so.

Mfaso ne ɔhaw ahorow

| Mfaso a ɛwɔ so | Mfomso ahorow |

| Hedging strategy boa ma agyapade bi bo a ɛkɔ fam no yɛ mmerɛw. | Ɛsɛ sɛ wutua commissions ma brokers wɔ reverse trades a wɔyɛ no ho. |

| Nkɔanim aba wɔ sika a wonya fi sikakorabea no gyina pintinn wɔ akyirikyiri. | Ɛnyɛ bere nyinaa na insurance tua ka. Titiriw bere a cross hedging ne agyapade ahorow a ɛwɔ ase no. |

| Nneɛma akɛse biara nni hɔ a wɔde bɛtwe nneɛma afi mu. Portfolio no bɛyɛ nea ɛko tia nsakrae a emu yɛ den wɔ nsɛm a wɔafa aka mu no kɛse. | Wubetumi ahwere ade kɛse sɛ ɛba sɛ anohyeto ahorow bi wɔ hɔ a, wubetumi ahwere nneɛma a wɔde sesa nneɛma no. Sɛ nhwɛso no, bere a wɔreyɛ margin aguadi a leverage anaasɛ liquidity a ɛba fam wom no. |

| Hedging akwan horow no yɛ nea wɔde di dwuma wɔ exchange gua so ne crypto aguadi mu. | Nkɔanim aba wɔ nnwuma dodow a wɔyɛ nyinaa mu. Ɛsɛ sɛ wɔhwɛ gyinabea biara a ɛbue no so. Sɛ ɛnte saa a, wubetumi apa bere pa a wode befi mu no. |

| Nkitahodi nyinaa yɛ nea ahobammɔ wom. | Sɛ wopɛ sɛ wunya nnwinnade ahorow pii a, wuhia sɛ wunya obi a ɔfata sɛ ɔde ne sika hyɛ mu. |

Hedging yɛ adwuma a ɛyɛ den a wɔde tew asiane so denam nnwinnade titiriw a wɔde di dwuma so. Wɔn a wɔyɛ adwumaden a wɔde wɔn ho hyɛ gua so nkutoo na wɔde di dwuma. Enti, ansa na wobɛyɛ nnwuma a ɛtete saa no, te nnyinasosɛm a ɛne sɛ derivative biara yɛ adwuma no ase. Ɛnyɛ sɛ eyi bɛma wɔakora sika kɛse so nko, na mmom ɛbɛma sika a wɔde bɛto mu daakye no ayɛ ahorow ahorow nso.