Pane nzira dzinoverengeka idzo vanoisa mari nevatengesi vanogona kubatsira kudzikisira njodzi. Imwe yeiyi ihedging.

Chii chinonzi hedging, chii uye chinoshanda sei pamuenzaniso chaiwo

Hedging chiyero chekudzikisa njodzi dzinomuka mumisika yemari. Muchidimbu, iwe unoita reverse trade kutsiva kurasikirwa kunobvira pane yakambovhurwa chinzvimbo.

Muenzaniso:

Ngatiti iwe une chikamu cheGazprom. Nekuda kwekugadziriswa kunogona kuitika mumitengo yegesi uye geopolitics, unotya kuti stock quotes inodonha. Muchiitiko ichi, iwe unogona kushandisa hedging. Ndiko, vhura chinzvimbo pakudonha kwemasheya. Kana izvi zvikasaitika, ipapo iwe ucharasikirwa zvishoma. Chikamu chiduku cheguta guru, chakaiswa pakuwa. Asi kana mapepa eGazprom akadonha, ipapo iwe uchaita purofiti pane pfupi dhiri. Ichavhara kurasikirwa pane yakambovhurwa chinzvimbo.

- Hedge Funds . Ivo nehunyanzvi vanobata mari yevamwe vanhu uye vanoshandisa nzira dzakasiyana siyana dzine chekuita nekudzikamisa njodzi dzemusika.

- Vatengesi neVatengesi . Makambani akadaro anochengetedza njodzi dzine chekuita nekukanganiswa kwemaketani ekupa kana shanduko muyero yekutsinhana.

- Vatengesi . Vafungidziri vanovhura reverse positions pachiridzwa chimwe chete. Chinangwa ndechekuderedza njodzi yekusagadzikana mukutengesa.

- Vakuru vemari . Ivo vanochengetedza njodzi dzepodfolio nenyika, mari uye indasitiri.

Hedge inowanikwa kwete kune vatambi vakuru chete. Inoshandiswawo nevadiki vatengesi vega vane mari shoma.

Sei uchida njodzi hedging mumashoko akareruka

Chishandiso chekuchengetedza chinoshandiswa kune zvinotevera zvinangwa:

- Kudzivirirwa kwechinzvimbo chakareba kana zvichibvira kuwira muasset. Unogona kuvhura Short trade pabepa rimwechete. Kana ukashandura mutengo wemutengo, iwe ucharasikirwa nechero chinhu.

- Inishuwarenzi yekutengeserana kwenguva pfupi kana kuwedzera kwemutengo weasset. Kuti uite izvi, unofanirwa kuvhura Nzvimbo Yakareba pachiridzwa chimwe chete. Izvi zvinodzivirira kubva kune volatility.

- Hedge inopesana nekuchinja kwemutengo wekuchinjana. Currency risk hedging inzira yekuchengetedza mari yako kana paine kushanduka kuri kuita mari yekunze.

- Kuderedza njodzi dzekushanda dzakananga kune kutenderera kwebhizinesi. Semuenzaniso, ruzhowa runoshandiswa kana paine kukanganisa kwemazuva ekutumira.

- Kubvisa kusava nechokwadi. Kana iwe usina chirongwa chakajeka chezvichaitika kumusika munguva pfupi iri kutevera, saka iwe unogona kushandisa ruzhowa. Tenga inverse zviridzwa uye insure capital inopesana nezvinogoneka shanduko mukukosha.

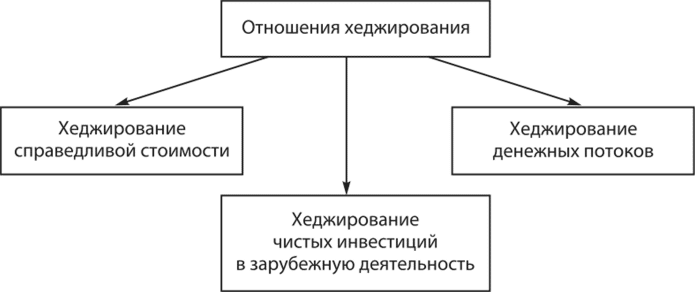

Mhando dzehedhi pakuchinjana, mukutengesa uye kwete pakuchinjana

Kune akati wandei Classifications of hedge. Zvose zvinoenderana nechinyorwa. Ngatitarisei izvo zvinonyanya kukosha. Nemhando yechiridzwa:

- Exchange – zvibvumirano zvinogadzirwa pakuchinjana. Zviridzwa zvehedging zvakakurumbira sarudzo uye remangwana. Vanobatsira kuchengetedza njodzi dzemari. Wechitatu bato mukutengeserana ndiyo imba yekuchenesa. Iye ane mutoro wekuita uye kuendesa kontrakiti.

- OTC – zvibvumirano zvinopedzwa kunze kwekutsinhana. Mutengi uye mutengesi anogona kuita kutengeserana zvakananga kana kusanganisira wechitatu bato. Iyo huru hedging zviridzwa ndeyekumberi uye swaps. Izvi zvekutengeserana ndezvenguva imwe chete. Izvo hazvigone kutengeswa kune vechitatu mapato. OTC hedging inowanzo shandiswa kudzikamisa njodzi dzebhizinesi.

Nehukuru hwenjodzi dzakaiswa insured:

- full hedging – saizi ye reverse transaction yakaenzana nehuwandu hwenzvimbo yekutanga yakavhurika;

- partial hedging – huwandu hweiyo counter-trade ishoma pane saizi yenzvimbo yakavhurwa kare.

Nerudzi rwebato:

- Buyer hedge . Muridzi anochengetedza njodzi dzine chekuita nekuwedzera kwemitengo kana kuderera kwezvibvumirano zvekondirakiti.

- Ruzhowa rwemutengesi . Muchiitiko ichi, njodzi dzinochengeterwa inishuwarenzi pamusoro pekudonha kunogona kuitika kwemitengo kana kuderera maererano nechibvumirano.

Panguva yekutengeserana:

- Classic hedge . Kutanga, vanogadzira dhiri huru, ipapo dhiri yeinishuwarenzi.

- Superior Hedge . Zvose zvinoitika neimwe nzira. Kutanga, vanogadzira dhizaini yeinishuwarenzi, ipapo iyo huru.

Nemhando yepasi peasset:

- yakachena hedging – iyo yepasi asset mune huru uye reverse trades yakafanana;

- muchinjika – chinzvimbo chikuru chinopihwa inishuwarenzi neimwe iripasi asset.

Nemhando yehedging contract term:

- unilateral – kurasikirwa kwemari uye mari inotakurwa nedivi rimwe chete rekutengeserana;

- bilateral – kupatsanurwa kwepurofiti uye mari inowira kumativi ese.

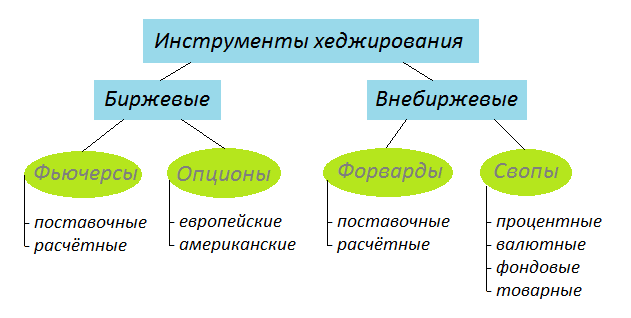

Hedging Instruments

Midziyo mikuru yekuchinjana yehedging ndeiyi:

- Short position . Mumamiriro ezvinhu aya, unokwereta zvivimbiso, wozvitengesa, uye wozozvitenga nemutengo wakaderera. Musiyano uripo pakati pemutengo wekutengesa uye wekutengazve purofiti ichaitwa mumusika wakaderera. Kutengeserana kwakadaro kunonzi margin trading. Munotengesa mumasheya akakwereta. Iyo broker inotora komisheni yekushandisa securities. Inogona zvakare kuvhara nechisimba kutengeserana pachiyero chisina kunaka kwauri kana chinzvimbo chisina kuchengetedzwa.

- Option . Ichi chibvumirano icho mutengi anogona kutengesa asset nemutengo wakagara watemwa. Uye hazvina basa kuti mutengo uchavei panguva yekutengesa. Kana iwe uchitarisira kudzikira kweasethi makotesheni, saka tenga PUT sarudzo. Nokudaro, iwe unogadzirisa mutengo wepepa. Mune ramangwana, kana migove ikadonha, ipapo iwe unogona kutengesa iyo asset pamutengo wepakutanga. Kana makotesheni akasadonha, saka une kodzero yekusatengesa asset.

- Ramangwana . Ichi chibvumirano chekutengeswa kweasset pazuva rakatemwa nemutengo wakafanotemerwa. Kana iwe uchifunga kuti bepa richava rakachipa, saka iwe unotengesa remangwana chibvumirano. Pazuva rakakodzera rechibvumirano, mumwe munhu anosungirwa kutenga asset nemutengo wakatarwa.

- Swap . Sechikamu chekutengeserana kwepamberi, mapato anotsinhana mubhadharo kune imwe nguva. Kuvhara kwakadaro kunowanzo shandiswa nema fund managers. Semuenzaniso, kambani yeFinEx painoronga mari yeETF .

- Inverse ETFs . Mari dzakadaro dzakagadzirirwa kuratidza mabhenji avanotevedzera. Kana iyo huru index inodonha, ivo vanosimuka. Inverse ETFs inopa kukura mu1x, 2x, nezvimwe. Ndiko kuti, kutengeserana nekuwedzera kunowanikwa.

Zvakakosha! Izvo zviri pamusoro pengozi hedging zviridzwa zvinongowanikwa kune vanokwanisa vanoisa mari.

Mumusika we-over-the-counter, kumberi kunoshandiswa kuvhara. Chibvumirano ichi chinosanganisira kuendeswa kwechinhu chiri pasi. Mitemo yechibvumirano chepamberi inotarwa nemapato pachavo.

Muenzaniso wekushongedza

Iyo US dollar index negoridhe zvine yakanaka inverse corelation. Kana mushambadzi ane goridhe mune yake portfolio, uye anotya kudonha kwemutengo weasset, saka anogona kuvhara njodzi kuburikidza neremangwana kondirakiti yeUS dollar index. Rudzi rweruzhowa urwu runonzi cross hedging.

Kukanganisa kana uchishandisa hedge

Pakukomberedza njodzi, vatengesi vasina ruzivo uye vatengesi dzimwe nguva vanokanganisa. Somugumisiro, vanotungamirira mukurasikirwa kwechikamu cheguta guru. Kukanganisa kwakanyanya kwehedhi ndeiyi:

- iyo yepasi asset yakasarudzwa zvisiri izvo panguva yemuchinjikwa hedge;

- mamiriro asina kururama ekutengeserana akaiswa;

- iyo isiriyo yekutengesa chiridzwa chehedging inosarudzwa;

- hapana chibatiso chekutengesa nekuwedzera;

- vhoriyamu ye-counter-transaction haina kuverengerwa zvisizvo.

Zvayakanakira nezvayakaipira

| Zvakanakira | Zvikanganiso |

| A hedging strategy inobatsira kudzikamisa kudonha kwemutengo weasset. | Iwe unofanirwa kubhadhara makomisheni kune vatengesi vekuita reverse trades. |

| Kune kuwedzera kwekugadzikana kwemari yepodfolio pane imwe nzvimbo yakareba. | Inishuwarenzi haipedzi nguva dzose. Kunyanya kana kuyambuka hedging nezvinhu zvakasiyana zvepasi. |

| Hapana matambudziko makuru. Iyo portfolio inova inoshingirira kuchinjika kwakapinza mumakotesheni. | Iwe unogona kutambura kurasikirwa kwakakomba muchiitiko chezvirambidzo zvekutsinhana. Semuyenzaniso, panguva yekutengeserana kwemargin neineverage kana yakaderera liquidity. |

| Hedging maitiro anoshanda mumusika wekuchinjana uye mukutengesa kwe crypto. | Kune kuwedzera kwehuwandu hwehuwandu hwekutengesa. Nzvimbo yega yega yakavhurika inofanirwa kutariswa. Zvikasadaro, unogona kupotsa nguva yakanaka yekubuda. |

| Zvese zvekutengesa zvakachengeteka. | Kuti uwane maturusi akasiyana siyana, unoda chimiro chemudyaridzi ane hunyanzvi. |

Hedging ibasa rakaoma rekudzikisa njodzi kuburikidza nekushandisa zvakakosha maturusi. Iwo anoshandiswa chete nenyanzvi dzemusika vatori vechikamu. Nokudaro, usati waita kutengeserana kwakadaro, nzwisisa nheyo yekushanda kweimwe neimwe yakabva. Izvi hazvizongo chengetedza capital chete, asiwo inosiyanisa mari yeramangwana.