A futures contract is used to make transactions for the purchase and sale of a commodity or asset in the planned future at a fixed price. This obligation is how this security differs from an option that gives the right to buy or sell, but is not forced to do so. Futures oblige both parties to the transaction to fulfill their obligations. At the same time, the material exchange of goods in the course of such trade operations is not performed.

- What are futures and why they are used in the investment market

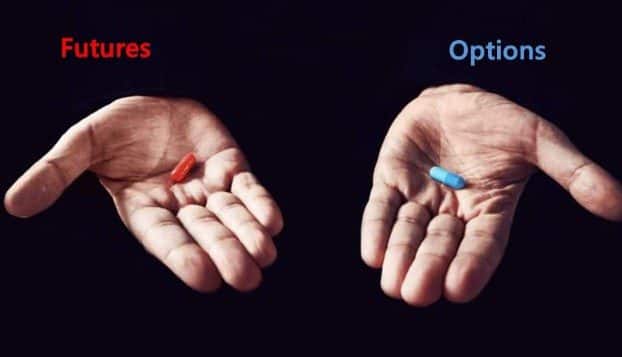

- Differences between futures and options

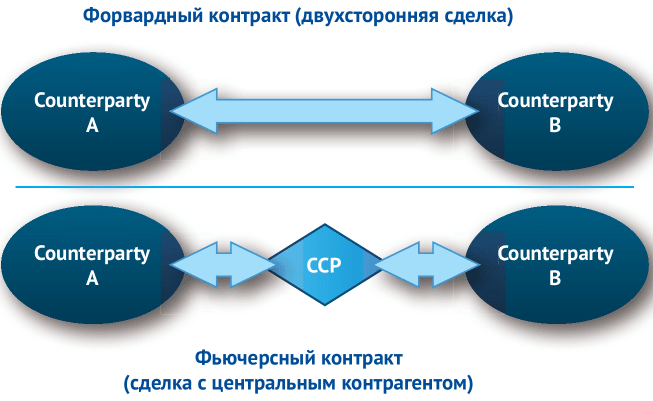

- Differences between futures and forward contracts

- Futures trading strategies

- Pros and cons of futures trading

- Types of futures contracts

- Futures contract price – contango and backwardation

- Insurance

- Expiry dates

What are futures and why they are used in the investment market

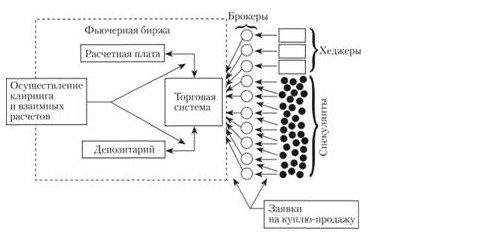

Futures contracts are used to establish the real market price for a particular instrument. They have certain applied value for investors:

- Speculative transactions , allowing to extract material benefits.

- Risk insurance through hedging , which is interesting for suppliers and buyers of goods.

Futures are used in commodity and commodity markets, they are characterized by the main parameters:

- Execution time, namely the date on which the transaction is scheduled.

- The subject of the transaction, in particular, raw materials, securities or goods, currency.

- The exchange on which the transaction is made.

- Quote units.

- Margin size.

- Preserving the balance of both parties to the contract.

- Replenishment of balance A and decrease in balance B.

- Replenishment of the balance of B against the background of a decrease in the balance of A.

If there is a replenishment of the buyer’s account against the background of a reduction in the seller’s account, then the value of the instrument increases. That is, investor A would be able to buy the product at a lower price and resell it at a higher price, thus extracting a material benefit. In fact, the exchange saves market participants from carrying out the necessary operations, settlements, immediately giving the party of the transaction the difference in real money. If the price has not changed, then the balance remains the same. The third scenario is realized if the price of the goods falls, which was initially beneficial to the seller. Now you can sell goods on more favorable terms, the current market price of which is less than the one that was registered in the contact. If we were talking about a real product, then the seller could buy it at market value and sell it at the price specified in the futures. Exchange, in this situation, relieves the parties from the need to transport the real goods, but simply makes the necessary calculations and replenishes the seller’s account for a certain amount, which is the difference between the market value and the price specified in the contract. If one of the parties refuses the futures before the moment of its execution, then after the expiration of the terms prescribed in the contract, the value indicated in the document and the market price of the goods are compared.

Differences between futures and options

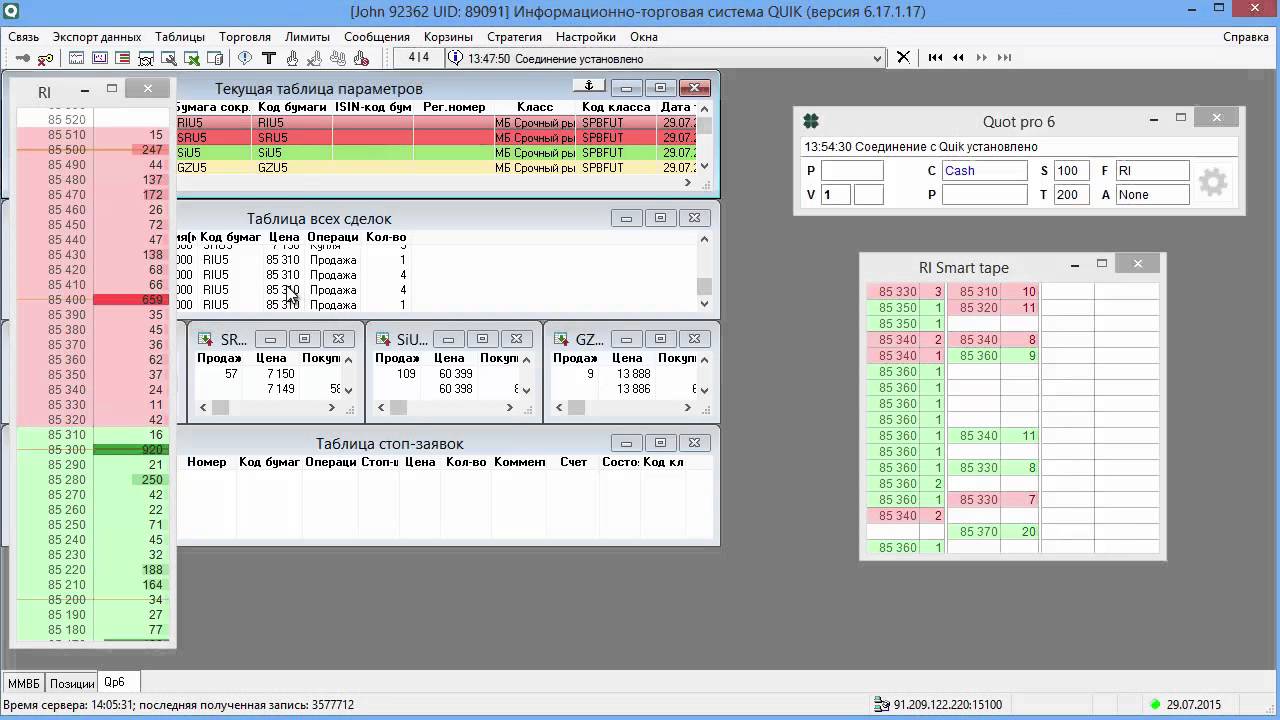

Futures and options contracts differ in the obligations of the parties. This manifests itself during the expiration period. [caption id="attachment_11885" align="aligncenter" width="391"]

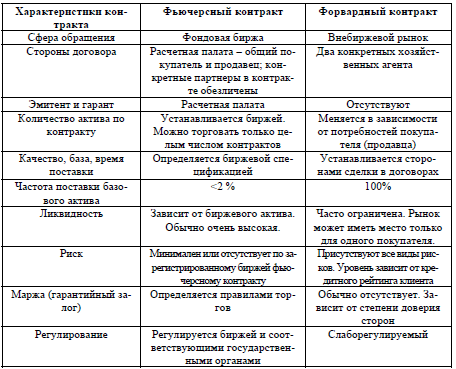

Differences between futures and forward contracts

There are also differences between forward and futures contracts that investors enter into. A forward is a one-time transaction made outside the exchanges and assuming that the purchase of a commodity, securities or currency will take place in the future. The parties discuss the main conditions in advance:

- price;

- terms;

- additional conditions.

In this case, the transaction is carried out with real assets, and not as with futures, when we are not talking about the transfer of goods.

The forward is designed to insure the participants in the transaction against price fluctuations that are likely to occur in the future. There are no strict standards when concluding a contract, therefore, such transactions cannot be carried out on the exchange.

- goals – the forward will be concluded for the sale or purchase of real assets, which implies the consideration of all conditions that are beneficial to both parties. In the second case, futures contracts are hedging their own positions or benefiting from price differences. Futures only in 5% of cases lead the parties to the exchange of real goods or financial instruments;

- volume of the asset – when concluding a forward contract, the participants in the transaction independently calculate the required volume, taking into account their needs. In the case of futures, the volumes are determined by the exchange, and market participants have the right to implement a certain number of contracts;

- quality of instruments – forward provides an opportunity to use assets of any quality, depending on what requests come from the buyer. When it comes to futures, the quality of the instruments is determined by the specification of the exchange;

- delivery of goods – when signing a forward, assets are always delivered, and when concluding a futures delivery is carried out in the form established by the exchange, but in most cases it does not come to this at all;

- terms – the terms of delivery when signing the forward are determined by the parties to the transaction. The terms of futures contracts are determined by the exchange;

- liquidity – a forward contract is characterized by limited liquidity, since the terms of its conclusion are acceptable for a certain circle of counterparties between which it was concluded. Futures are highly liquid instruments, however, the level of this indicator depends on the quality of the underlying asset.

Futures trading strategies

To trade futures, traders use several popular techniques:

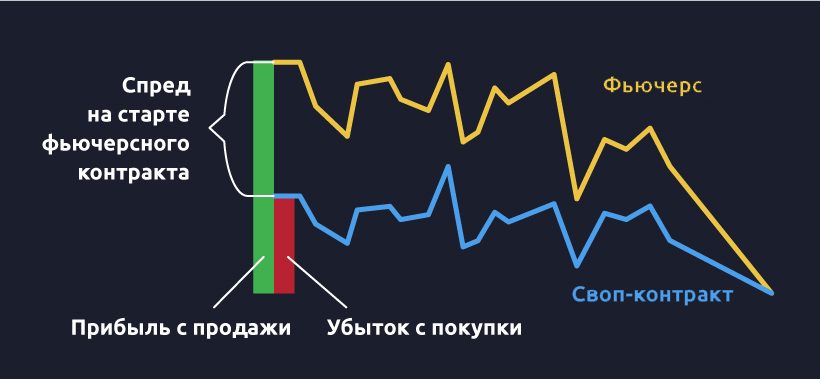

- the exchange schedule of the contract is compared with the next month for which the delivery is scheduled and the reporting period following it;

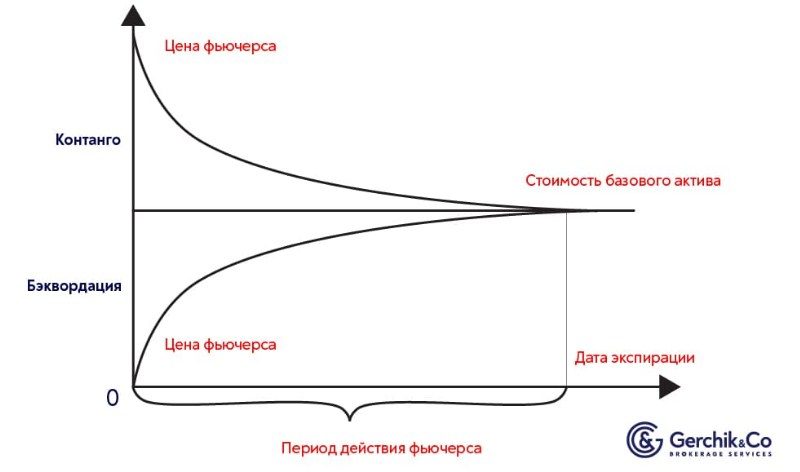

- a comparison is made between the spot price of a share and a futures contract, if its value is higher, then we are talking about contango , which is considered a premium relative to the price of an asset. If the situation is reversed on the market, then it is called backwardation , which is considered a discount in relation to the base cost. It is on the exchange rate difference that arises in this situation that traders earn;

- study of the futures chart using technical analysis, indicators, fundamental factors that can affect the price of the contract.

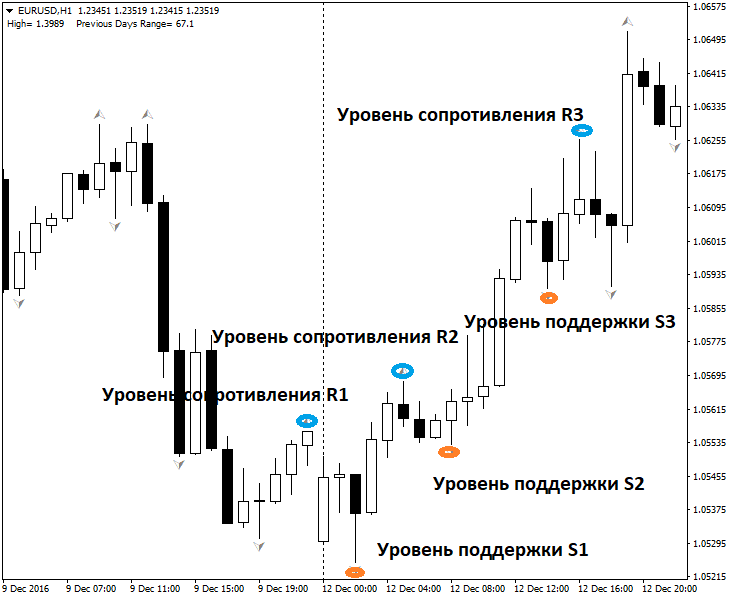

Trading by support levels:

- temporal;

- spatial;

- calendar.

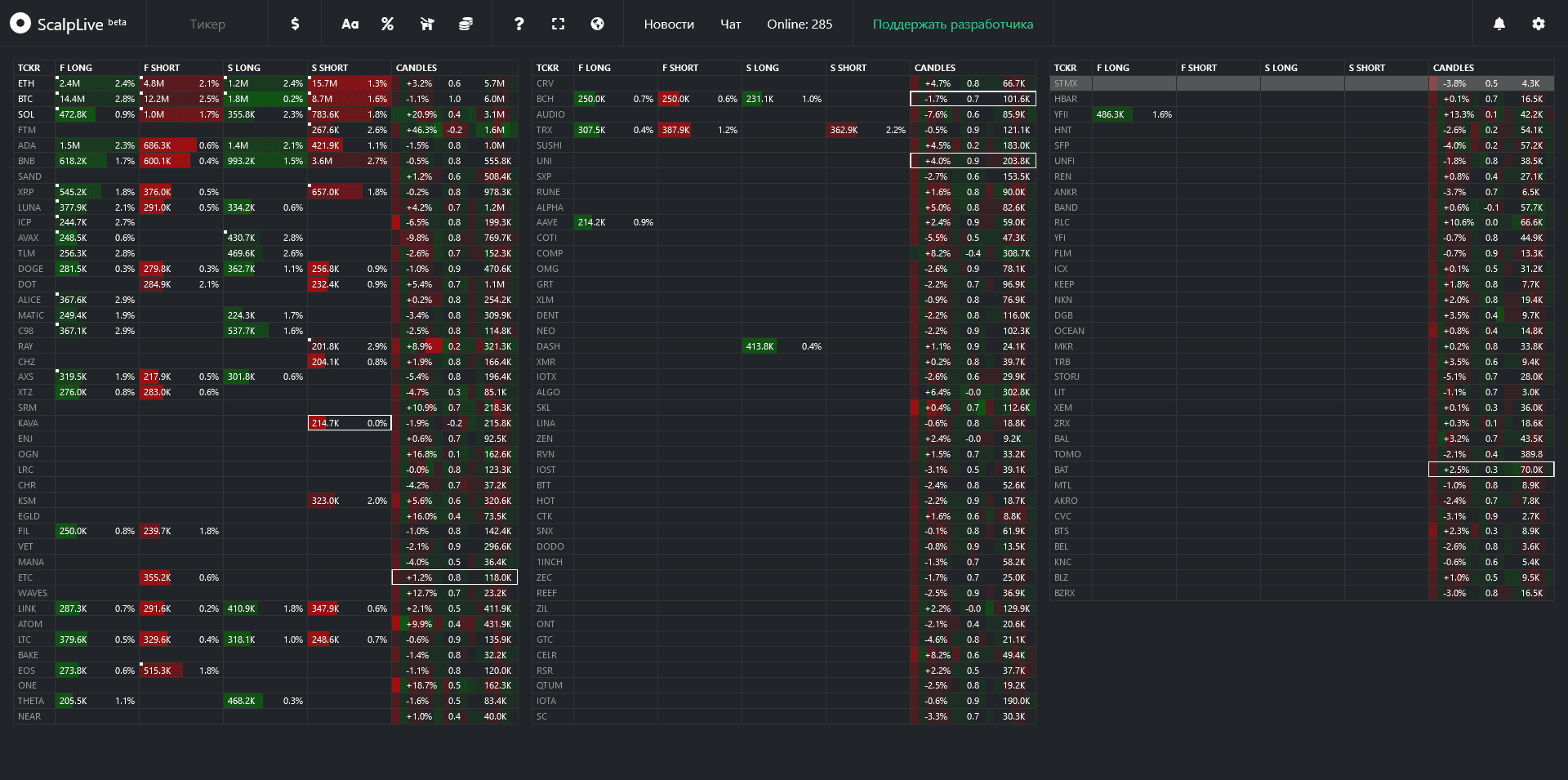

[caption id="attachment_11884" align="aligncenter" width="820"]

Pros and cons of futures trading

There are several advantages of futures trading:

- no additional costs and hidden fees;

- there is access to a pool of futures with an expiration for a year;

- high liquidity of the asset, volatility and dynamic trading.

Disadvantages of trading futures contracts:

- not suitable for long-term trading, as it is valid for a certain time;

- when expiration occurs, deals are closed automatically, taking into account the current market price and pending orders are deleted;

- you cannot transfer open trades to a contract expiring next month.

Weigh all the pros and cons before trading these highly risky instruments.

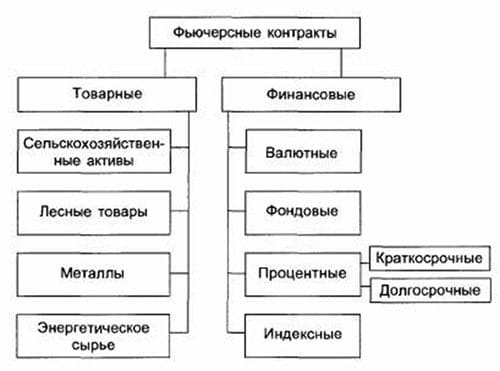

Types of futures contracts

There are two types of futures contracts:

- Delivery.

- Settlement – without deliveries.

Deliverable futures oblige the buyer and seller to actually sell the goods and pay for them within the terms specified in the contract. The settlement between them is carried out at the price that was fixed on the last day of trading. If, with the due date, the seller was unable to provide the buyer with the goods, then the exchange imposes penalties on him.

Estimatedfutures is in no way connected with the actual supply of products. It is assumed that one of the parties will pay the other party to the transaction the difference between the value of the asset at the time of the transaction and the actual price of the product at the time of the contract expiration. The settlement between counterparties is made in money, and the physical delivery of goods is not provided. Such transactions are made for hedging or speculative manipulation. Hedging allows you to level the probable losses received when concluding a contract in another market.

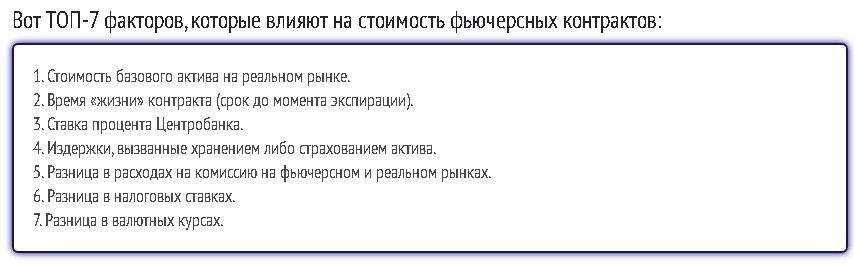

Futures contract price – contango and backwardation

A futures contract is categorized as a single exchange commodity, with a value different from the price of the asset. This indicator may be affected by forecasts and risks caused by a likely change in the subject of previously reached agreements. The price of an asset in the market and the futures price of this commodity can have a negative or positive ratio.

If the contract is more expensive than the asset, then this state is called contango. In the case when the situation is reversed, we are talking about backwardation.

In this situation, most investors hope that the price of the asset on the exchanges will soon drop significantly.

Insurance

Trading is carried out subject to the provision of a transaction, through a deposit, the amount of which is 2 – 10% of the price of the contract asset. This is the insurance required by the exchange from both parties entering into the contract. The set amount is blocked on the accounts, forming a kind of collateral. If the price of the futures goes up, then the seller’s margin increases, and if it goes down, it decreases. This mechanism allows you to avoid the payment procedure when concluding a contract. When a future is held until it closes, the parties fulfill their obligations by delivering assets or transferring cash. When one of the participants does not want to fulfill his obligations, the exchange does it for him, leaving himself a certain amount from the guarantee. This scheme only works for contracts that provide for the delivery of an asset.

Expiry dates

There are several contract expiration dates. For example, for the dollar index, stocks, financial instruments, the expiration date is quarterly on the third Friday of the last month of the quarter. There are futures with a monthly exit, in particular CME Crude Oil. Other types of contracts may end on other days. To trade futures productively, you should remember the expiration date of the contract. If there is an unexpected decrease in volume after the expiration of the next day of trading, then the timing is right, and most traders begin to close transactions before the termination of the contract.

zur

Mani mlaif malaqa