International manufacturing companies are increasingly aware of their environmental, social and ethical business impact. The ESG investment market is constantly growing, but not all investors are familiar with this concept. Let’s consider socially responsible investing in more detail, give a definition, and also provide a list of domestic and foreign companies that are of the greatest interest for long-term ESG investment.

What is ESG

ESG (environmental, social, governance) investing is a form of socially responsible investment that prioritizes the corporation that has the lowest environmental impact. Simply put, when investors buy shares of those companies that:

- They do not spoil the atmosphere, biosphere and noosphere.

- They treat their employees well and pay them decent wages.

As part of the voluntary implementation of the ESG policy, companies can become members of the PRI Association. The Association undertakes to represent the interests of the partner in dialogue with various regulators, governments of other countries, etc. In return, the participating company is obliged to comply with the principles of socially responsible investment.

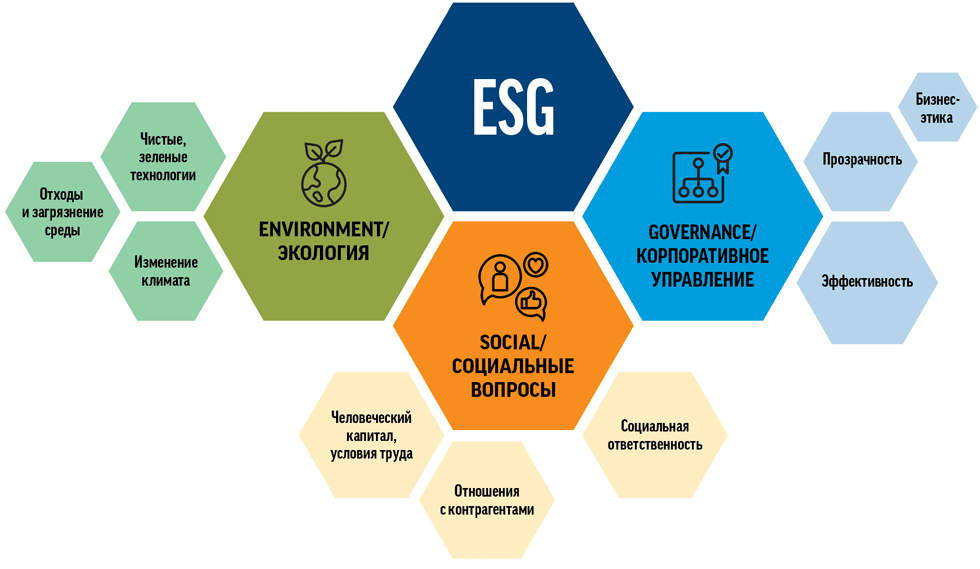

Components of ESG

- “E”. “Clean” : the level of development of environmentally friendly production technologies that have a positive impact on the environment; the company’s impact on climate change; the amount of greenhouse gases emitted, the amount of use of limited natural resources (fresh water, forest, rare animals, etc.).

- “S”. “Social component” : level of social development; gender, sex and age composition of employees; working conditions; investments in social projects aimed at supporting continuous education and training of employees.

- “G”. “Management” (business ethics) : organizational structure, effectiveness of company management strategies.

Environmental, Social and Corporate Governance – ESG’s Megatrend Green Investments: https://youtu.be/L2PKBl8iUR4

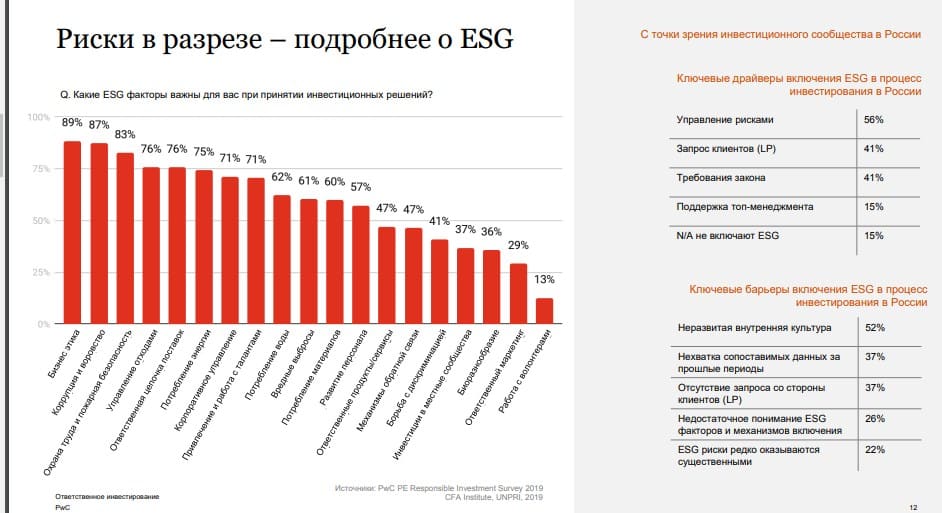

Research on ESG

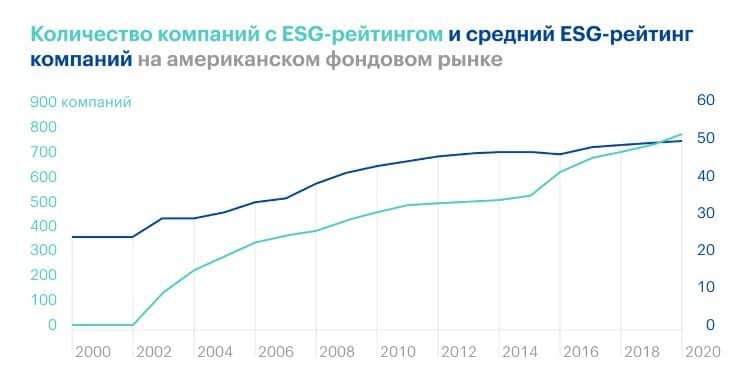

The popularity of the ESG approach in investing is supported by a lot of research. In a written Whitepaper from Shareholder to Stakeholder written by Oxford University scientists, it is estimated that about 20% of global assets are currently managed in a socially responsible manner. Moreover, awareness of ESG issues has increased significantly in recent years, as evidenced by the dramatic increase in the importance of this trend. This trend is not unique to institutional investors: a 2015 Campden Research study found that nearly 60% of high-income US households view ESG investing as a form of permanent additional income.

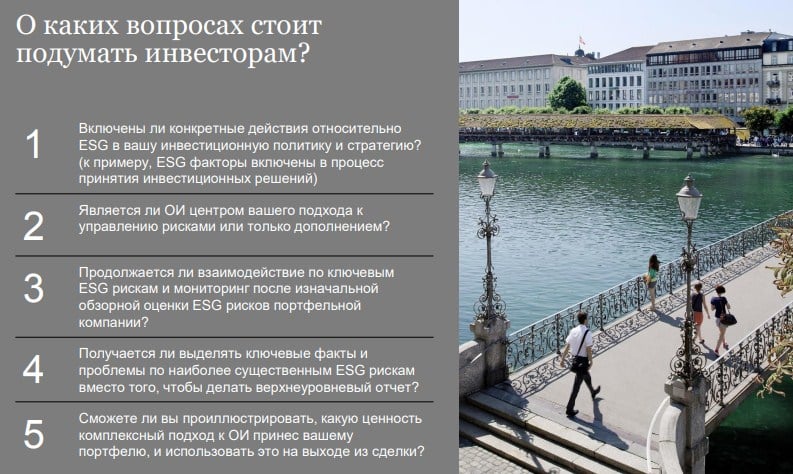

Features of ESG investment

Considering ESG factors when investing can help avoid problems in the long run. For example, a mining company is the least likely to go into a bear market if it has a sound environmental policy and the press cannot paint a large manufacturing company in a negative light. Another industrial company is less likely to face strikes from workers if it treats them fairly and considers their interests. Issues related to management or a company’s negative impact on the environment can cause irreparable damage to reputation, affect profits, and severely depress share price.

Possible risks and potential profitability

Accounting for ESG factors does not give a 100% guarantee of success. The same can be said about the classical method of analyzing the exchange market. However, criteria for socially responsible investment can increase the chance of earning a return on investment in the long run.

Domestic and foreign companies

Finding the most suitable pool of companies for ESG investment is difficult because the investor needs to spend a huge amount of time analyzing charts, reading news and studying the stock market. How to determine which company is ESG and which is not? Each reporting period, independent funds draw up charts and ratings of companies with high potential for ESG investment. Investors can familiarize themselves with the research of the following investment firms:

- MSCI.

- Sustainalytics.

- FTSE.

- Vigeo Eiris.

- ISS.

- TruValue Labs.

- RobecoSAM.

- RepRisk.

Compilers of ratings evaluate companies according to different criteria, so the ratings can vary greatly. The general conclusion should be built from the totality of all the information studied.

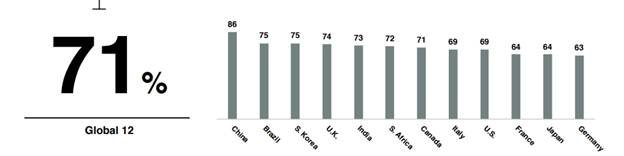

For example, a recently published study titled “2020 Edelman Trust Barometer Brands and the Coronavirus” looked at the countries with the highest number of companies that voluntarily adhere to the principles of socially responsible investing. China ranked first, Brazil second, and South Korea third. Based on the presented statistics, we can conclude that the East Asian and South American stock markets will soon begin to attract ESG investors.

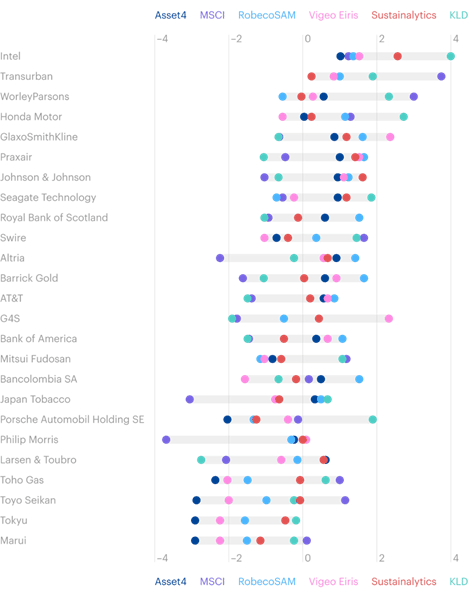

Infographics on foreign companies

“Deviations from the normalized

ESG rating for foreign companies.” The graph shows the most popular corporations that are engaged in manufacturing activities.

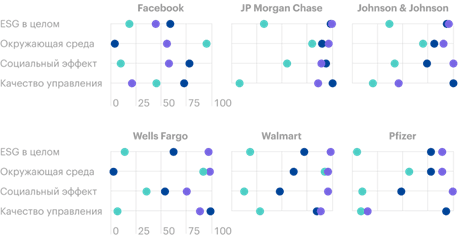

Evaluation of large “giants” from various investment funds –

FTSE,

Sustainanalytics,

MSCI. Companies were evaluated according to 4 criteria – “ESG as a whole”, “Environment”, “Social effect”, “Management quality”.

However, one should not blindly believe such studies. They are ordinary people who can make mistakes. For example, in 2020, a scandal erupted. The Belgian company Solvay, which dumps chemical production waste directly into the sea, was in the highest line of the ESG rating according to the independent investment fund MSCI. When the hoax was exposed, Solvay’s stock plummeted – and the high rating didn’t help. ESG investing is interesting:

ESG investing

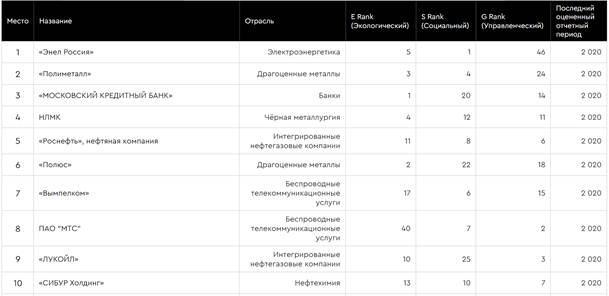

Domestic companies – ESG investments in Russia

The independent agency RAEX-Europe has compiled an ESG rating of Russian companies. The study was published on December 15th. The first 10 places were distributed among those companies that are of the greatest interest. The evaluation was based on three criteria – E Rank, S Rank and G Rank.

Overview of VTB Capital Investments

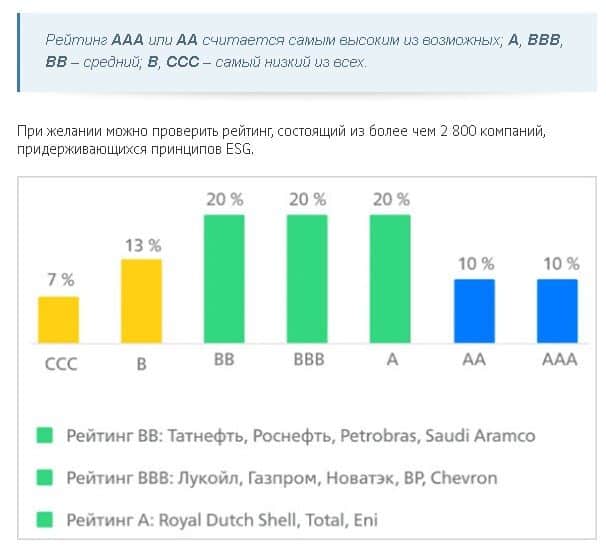

On September 27, VTB Capital launched the 11th exchange-traded mutual fund, which invests in the shares of Russian companies with the most successful ESG policy in the field of socially responsible investment. Trading in shares became available both during the daytime and evening sessions. The VTB Mutual Fund is ideal for passive investors and professional traders who prefer to close small deals. Analytics of potentially successful companies implementing the practice of socially responsible investment is regularly published on the official website of VTB Capital. You can read the reports in more detail by following the link – https://www.vtbcapital-am.ru/analititic/esgmonitor/ The reports contain short news excerpts with brief content. Users can follow the active link and read any news. At the end of each article, VTB shares its opinion on the situation, as well as forecasts for future events. On the last page – the ESG rating of Russian companies on the ABCD scale. Right now, VTB gives preference to Lukoil, Rosneft and the Polymetal production holding.

Additionally

Where else can you find useful information? For example, at events that are regularly held as part of the development of domestic business. On November 25, 2021, top managers of the largest domestic companies and financial and credit institutions spoke at the Vedomosti communication platform. The theme of the conference is “ESG Investments in Russia: Towards a Green Economy”. [caption id="attachment_12021" align="aligncenter" width="927"]