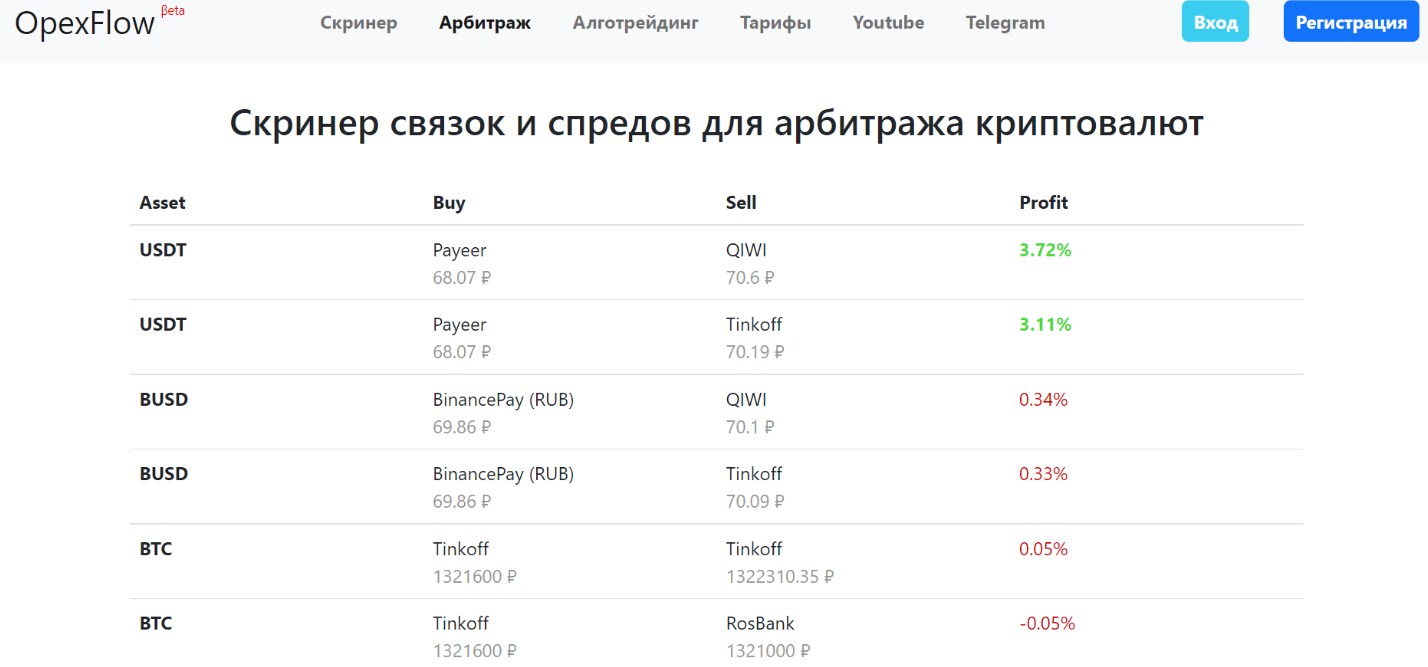

What software is needed for cryptocurrency arbitrage, how to use an online arbitrage scanner – opexflow screener, registration, tariffs, training. Screeners or scanners of links and spreads for arbitrage on exchanges and p2p is a special software that automatically finds the most profitable and suitable trading opportunities. The scanner conducts a thorough analysis, considers popular crypto platforms, but the main thing is to select exactly those on which you can profitably buy or sell a certain currency, and make a profit on the price difference. https://opexflow.com/p2p has these capabilities, it is a link and spread screener for cryptocurrency arbitrage. Quickly online, the software selects the most optimal bundles, indicates to the crypto exchange where you can take the necessary actions for arbitration.  Arbitrage trading on a crypto exchange is a rather complicated procedure, it requires a lot of operations and actions. And in order to earn money on it, you need not only experience and knowledge of the basics, but also the ability to use special tools. It is bundle and spread scanners that automate and facilitate the search for profitable opportunities.

Arbitrage trading on a crypto exchange is a rather complicated procedure, it requires a lot of operations and actions. And in order to earn money on it, you need not only experience and knowledge of the basics, but also the ability to use special tools. It is bundle and spread scanners that automate and facilitate the search for profitable opportunities.

- How you can make money on screeners for intra-exchange and inter-exchange cryptocurrency arbitrage

- What is a scanner for cryptocurrency arbitrage – how does the software work

- What functionality is planned in the opexflow cryptocurrency arbitrage scanner

- Block “Choice of exchanges”

- Arbitrator settings block

- Results table

- Block logging

- Why Choose Opexflow Service – Key Benefits

How you can make money on screeners for intra-exchange and inter-exchange cryptocurrency arbitrage

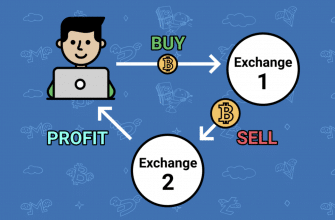

Crypto trading arbitrage is a series of actions to make a profit based on the difference in the value of an asset on different exchanges. Namely, the trader is looking for the moment when there is the highest difference between the prices of cryptocurrency on one or different exchanges, and then he buys it where it is sold the cheapest. After that, he sells it at a higher price, and when the price converges, the trader closes positions and takes profit. At the moment, the exchanges use the following options for commercial arbitrage:

- Buying + moving cryptocurrencies from exchange to exchange . It looks like this: to begin with, a crypt is bought where it is cheaper, it is displayed on the exchange, where it is more expensive, and it is already being sold on it. As a result, profit is fixed. But this scheme has a significant risk – this is time, namely, while the money goes from one exchange to another, the value may change. If this particular arbitrage option is used for trading, then it is worth choosing options with large divergence rates. Also, for this type of arbitrage, a screener-scanner of bundles and spreads is relevant, which works instantly online.

- International arbitration of cryptocurrencies. Its essence is as follows: if the quotes diverge, you can buy an asset on one exchange, and its sale will be carried out on another, located in a different jurisdiction and country.

- Buying and selling currencies within the same exchange . Opexflow software allows you to search for links and spreads for this type of arbitrage.

To make making money on arbitration much easier and more convenient, special services and assistant programs were created – among such software is the opexflow scanner, which is suitable for intra -exchange , international and inter- exchange arbitration . Opexflow helps you find cryptocurrency exchanges at the best prices with maximum spreads. The program scans quotes between crypto exchanges online, and then looks for opportunities for arbitrage. Convenient functionality, after the completion of beta testing, you can select exchanges for which prices will be scanned for the required pairs of cryptocurrencies. If necessary, you can include additional pairs or remove them from the general list. How to look for working links for crypto arbitrage

To make making money on arbitration much easier and more convenient, special services and assistant programs were created – among such software is the opexflow scanner, which is suitable for intra -exchange , international and inter- exchange arbitration . Opexflow helps you find cryptocurrency exchanges at the best prices with maximum spreads. The program scans quotes between crypto exchanges online, and then looks for opportunities for arbitrage. Convenient functionality, after the completion of beta testing, you can select exchanges for which prices will be scanned for the required pairs of cryptocurrencies. If necessary, you can include additional pairs or remove them from the general list. How to look for working links for crypto arbitrage

What is a scanner for cryptocurrency arbitrage – how does the software work

Recently, cryptocurrency arbitrage has become a popular way to make money. It is used by many experienced traders as well as beginners, and it is a great chance to capitalize on speculative trading schemes. Usually, the rate of crypto assets is formed in accordance with the balance of supply and demand. The more buyers there are in the market, the higher the quotes will be. But due to the fact that crypto trading is carried out at the same time on many exchanges, the rates of tokens and coins on different platforms can vary greatly. And this feature can be used to earn money. Many traders make a profit by reselling cryptocurrencies, they earn on the difference. Work algorithm:

- The trader, using the scanner of bundles and spreads, finds several profitable and suitable crypto-exchanges, for which the cost of crypto-assets differs.

- Looks for links with the maximum spread.

- After that, you need to buy a coin or token with a small exchange rate.

- Next, the digital currency is transferred to the crypto exchange with the best quotes.

- The asset is then sold at a better price.

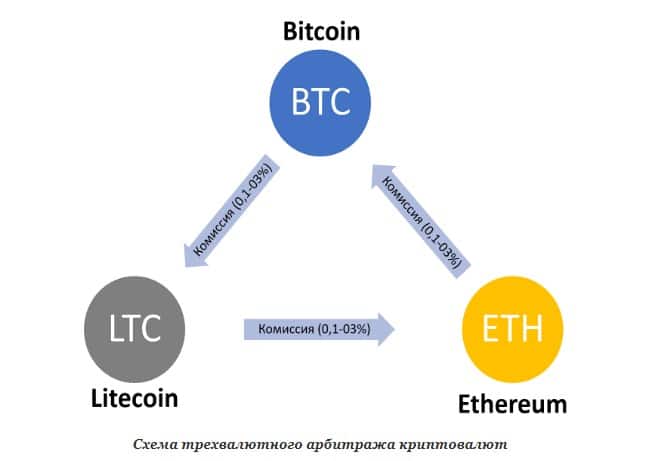

In addition to the classic arbitrage, there is a more complex option – the stock triangle. In this situation, the trader makes a profit on the difference in quotes of several trading pairs within the same crypto platform.

What functionality is planned in the opexflow cryptocurrency arbitrage scanner

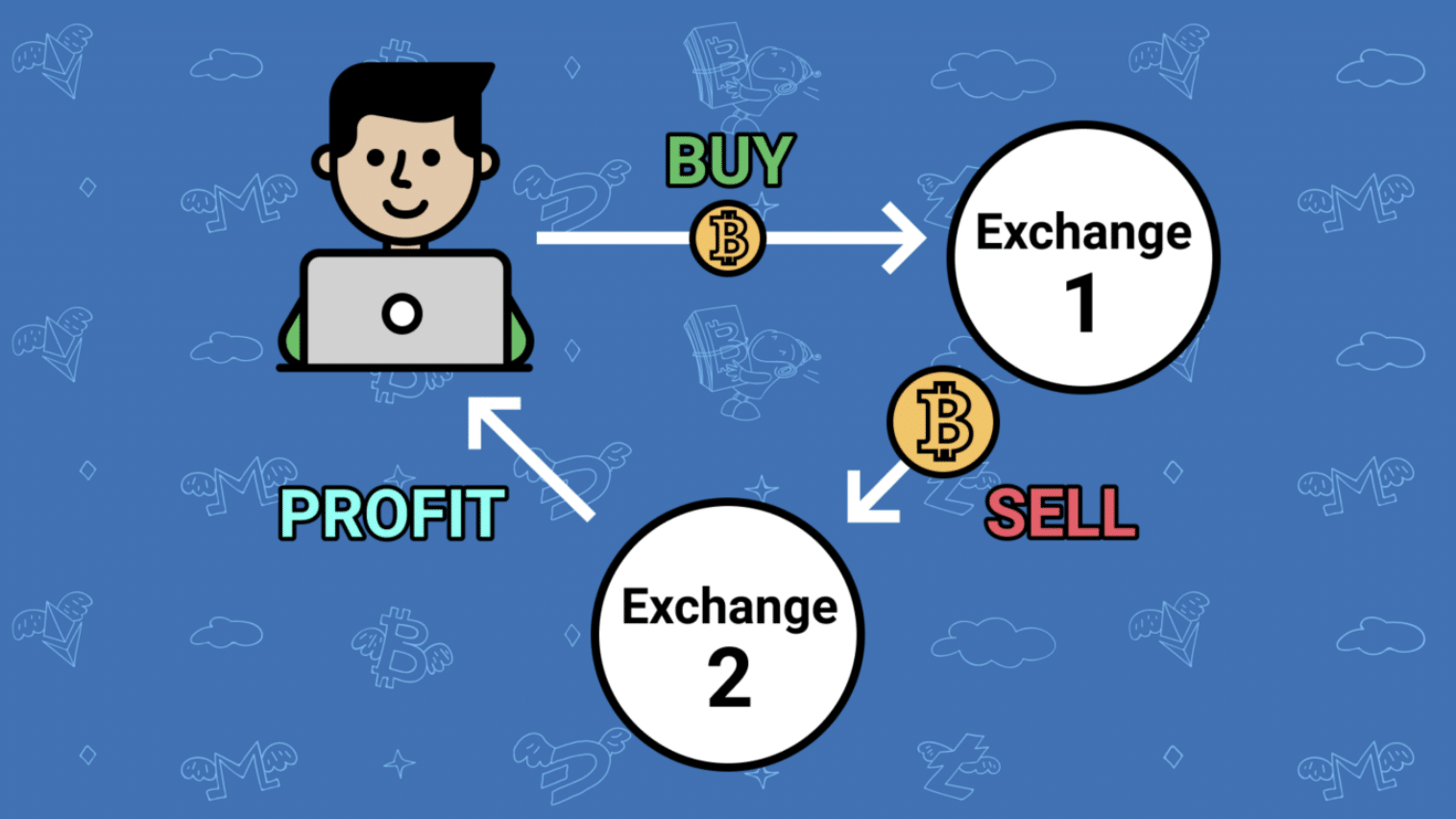

The screener for ligaments and spreads for arbitrage cryptocurrencies opexflow has a clear design and functionality. Opexflow is in beta testing mode, it is constantly being improved, supplemented with new tools that can facilitate cryptocurrency arbitrage.

Block “Choice of exchanges”

It will display all the exchanges on which you can search for assets. When using, you can check the boxes next to those exchanges that you are interested in. If there is an * sign next to the name of the exchange, then this means that there are important remarks, information, additions, and they will be indicated in the instructions.

Arbitrator settings block

This block is intended for setting up the arbitration module. You can also find a sub-block called “Select Pairs”, in which you should select the pairs that will be the most interesting and suitable for conducting an arbitrage opportunity scan. If desired, you can select all pairs with a specific base currency or specify specific pairs from currencies. If some currencies are not needed, then they can be removed, and for this they can be entered in the list in the “Exclude currencies” field. The block has a section “Update frequency”, it sets the time intervals at which the robot must update information on arbitration . The “Minimum profit threshold, %” section indicates the minimum limit, upon reaching which the robot displays the necessary information in the table. “Maximum Profit Threshold, %” is the upper limit relative to profit indicators. The “Force volume” mode allows you to get the full volume for all currency pairs. Many exchange platforms, with a large amount of data regarding quotes, cannot provide reliable information on volumes, and in order to obtain them, you need to submit separate requests. And it is the use of forcing that allows you to get such volumes. In the “Minimum Volume” section, you can filter volume indicators. The “Set Delay” item is used to set an artificial delay between sending forced requests for volume indicators. This is due to the fact that many exchanges have restrictive measures regarding the number of requests per minute, and with frequent requests, the service may consider that a DDOS attack is being carried out on the exchange and block access to data for a while. Additionally, you can check the box next to the “Save history” section, and then the arbitration data will be saved. They will be saved in separate MS Excel files, they can be downloaded, viewed and analyzed. After making the required settings, setting the necessary parameters, the user can click on the “Run” button, and after that the program will automatically update the information in the table automatically.

Results table

In the service, you can see a table that indicates all the arbitrage opportunities found. They are sorted by profitability. If desired, the user can sort the data by other indicators.

Block logging

Records are made in this block, information is indicated on what the scanner is currently doing, what processes and operations it is performing.

Why Choose Opexflow Service – Key Benefits

While there are many screen readers available that come with a wide range of tools and features, https://opexflow.com/ has its upsides. It includes everything you need to work with cryptocurrency arbitrage in a simple and easy way. Among the advantages of the scanner are:

- works with many popular crypto exchanges;

- allows for various arbitrage options;

- includes a full set of tools for tracking quotes;

- all results and information are reflected in real time;

- automates and speeds up processes;

- allows you to build effective strategies.

Opexflow is constantly being improved, updated and supplemented with various useful features. Users can also make their wishes and suggestions, and opexflow will definitely take them into account, include them in the next version of the scanner to improve efficiency and convenience.Beta testing and final debugging of the screener for ligaments and spreads for arbitrage cryptocurrencies opexflow is nearing completion – you can already apply right now, we will contact you as soon as there are free places.