Futures are derivative financial instruments that acquire their value as a result of changes in the prices of underlying financial instruments. In fact, these are obligations to purchase or sell a commodity (financial instrument) in a certain quantity and at a certain time (a certain period of time) at pre-agreed prices. Exchanges where futures are sold and bought form the terms of trade agreements (contracts).

Futures contracts are fixed-term (have a limited expiration date) and stop trading when it expires.

Screener is a concept that comes from the English word screen (sieve, sieve), which is widely used in many areas, such as sociology, advertising, etc. This concept is also used in stock trading, including futures trading.

- Best Futures Screeners

- Finviz

- Morningstar

- Equity monitoring from Equity.today

- stock watcher

- market watch

- Yahoo Finance Screener

- OTC Markets

- Examples of analysis using screeners

- Futures in investing

- What futures can be purchased on the market

- Conclusion of futures contracts and work on them

- Features of cryptocurrency futures trading

- What are cryptocurrency futures contracts?

- Cryptocurrency futures device

- Margin

- Calculations on crypto futures

Best Futures Screeners

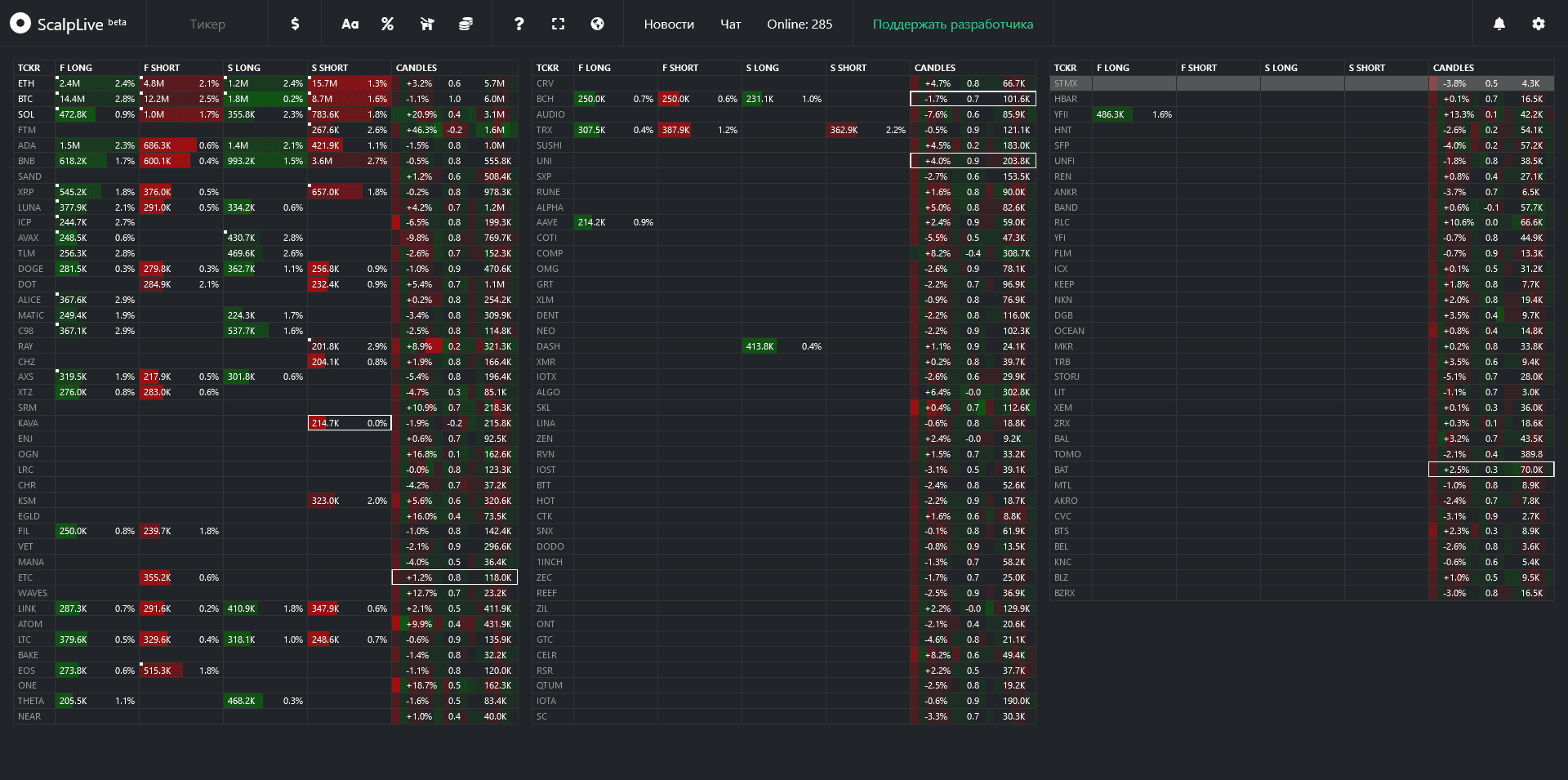

At its core, a screener is a service with a set of filters (volume, percentage of changes, graphical display, current changes, etc.), which allows you to select from the whole variety of futures exactly those that a trader needs at a given time. Such services are simply necessary for everyone who works on stock exchanges, both domestic and in Europe, Asia, America, where up to several thousand positions in securities, cryptocurrencies, etc. can be accessed. In practice, the use of screeners allows you to quickly and efficiently obtain all the information a trader needs, which is the key to his successful work on the exchange. There are a lot of such screeners and they can be used when purchasing almost any futures contracts, from oil and gas to

cryptocurrency. Such platforms that operate on both the European and American stock markets include the popular screeners discussed below.

Finviz

A very popular free service that does not require registration, which provides analytical materials on both securities and futures, indices, and currencies.

Morningstar

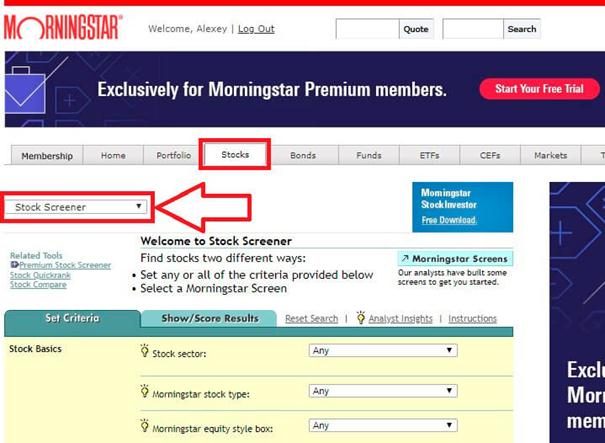

One of the most famous Morningstary screeners. To start working on it, you need to go through a free registration for the Basic version. The window is selected in the pop-up list as seen from the screenshot.

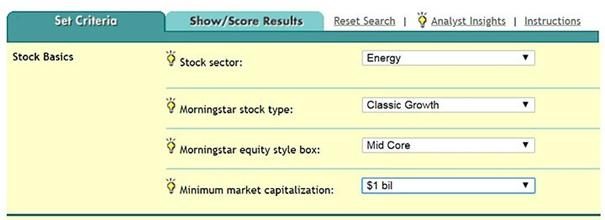

- Stock sector (sector);

- Morningstar stock type (share type);

- Morningstar equity style box (capital calculation according to specialized Morningstar formulas);

- Minimum market capitalization (minimum market capitalization of shares).

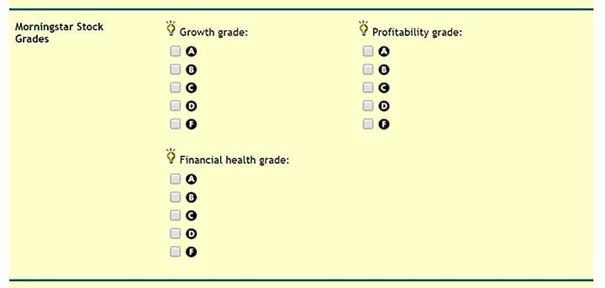

- stock growth assessment (Growth grade);

- financial stability assessment (Financial health grade);

- Profitability grade.

The assessment is carried out on a scale from A – F.

- revenue growth over the last 3 years (3-year revenue growth);

- own profitability (Return on equity (ROE);

- income growth forecast for the next 5 years (5-year forecasted earnings growth).

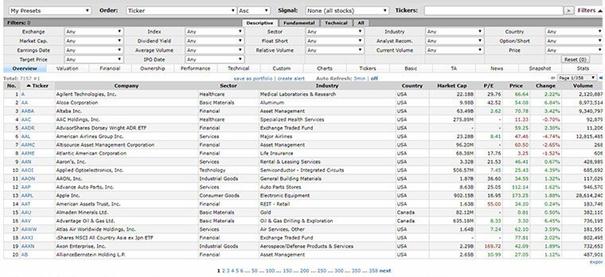

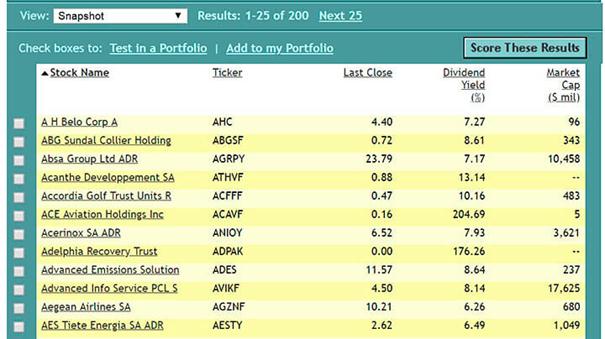

Then there are several more filters: total income for various periods, P / E ratios, dividends. As a result of using filters, the following table is obtained (filters for 6% dividends).

The screener can produce no more than 200 results as a result of the analysis.

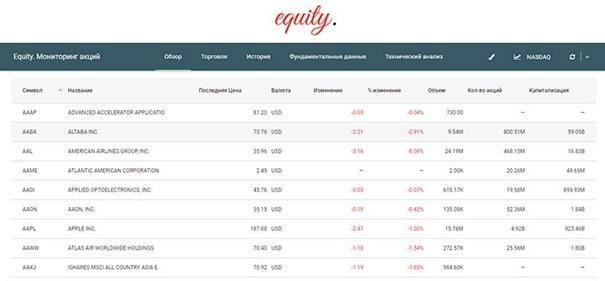

Equity monitoring from Equity.today

This is a very convenient screener for traders who do not have enough knowledge of exchange terminology in English. The system interface looks like this.

- Overview – contains a series of data on assets (value of shares, type of currency, percentage change, capitalization, etc.);

- Trading – a category containing extended information about stock prices (Bid, Ask, Size, Day Low, High and others);

- History – also a category of price indicators for more significant and old periods (%Change 52 Week Low, High, and others);

- Fundamental – coefficients that can be considered classic (EPS, Price / Book, Cash and others);

- Those. analysis – performed on moving averages (50 Day MA, 200 Day MA, etc.).

To apply filters on this screener, you need to hover the cursor over the line of interest, and click the filter icon. After that, the screen displays general information, the company which owns the shares, and charts:

stock watcher

This screener is available without registration, it reflects more than 7.5 thousand positions for which it is possible to screen. It contains a significant number of filters that reflect different categories.

- Main parameters (price, ATR, gaps, percent change, volumes, etc.).

- Techno. Parameters (extremums for 50 days, Range, etc.).

- Fundamental parameters (P/E, Shares Float and other ratios).

- Level 1 (sorting by different indicators Ask, Bid, Size and others).

- Premarket (price at the time of the upcoming market opening, and other indicators).

- Signals (price levels, sizes, volume peaks and other signal systems).

- Other (sorted by ticker, IPO date,).

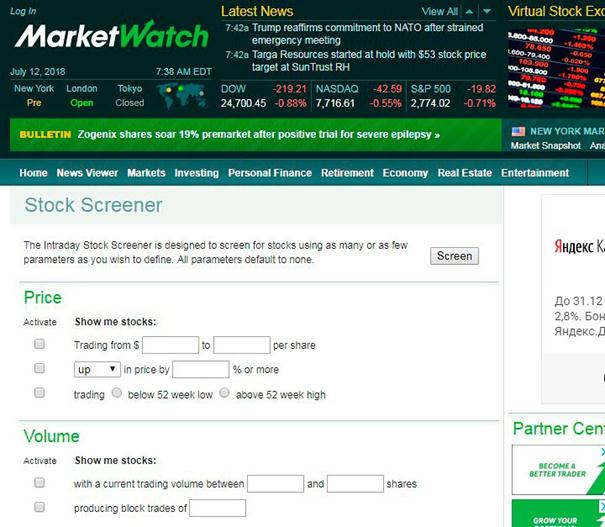

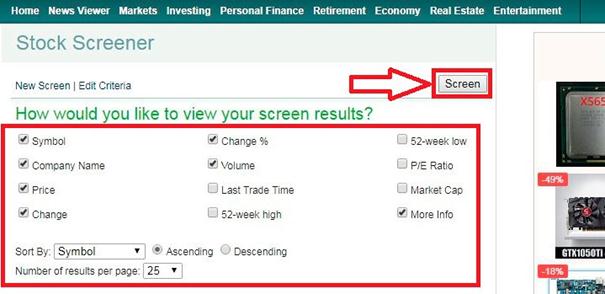

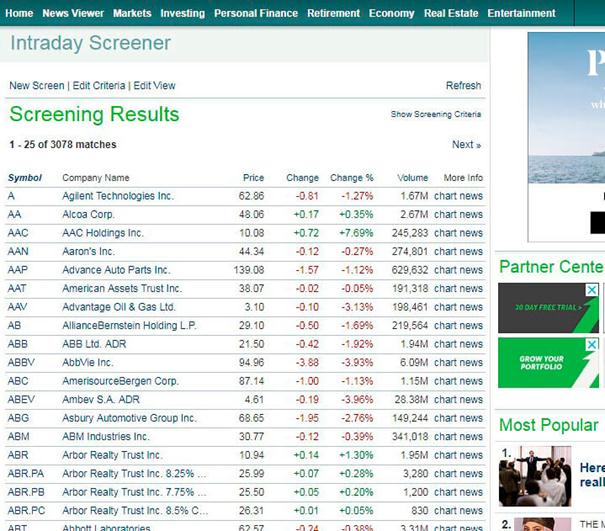

market watch

This screener has only 6.5 thousand tools, but you can work on it without registration.

- Price – this section indicates the price, price range, percentage changes, place in relation to the 52-week extreme;

- Volume — category in which the current volume is indicated;

- Fundamentals — P/E ratio and market capitalization.

- Technicals – ratios for the 50-day moving average and indices.

- Exchange & Industry – the exchange and its sectors are selected.

In order to start working in the screening, you need to use the “Screen” button, then specify the required fields and sorting options:

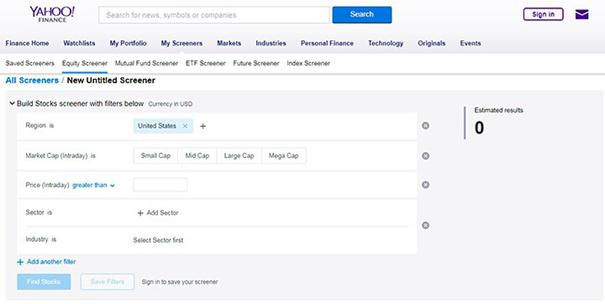

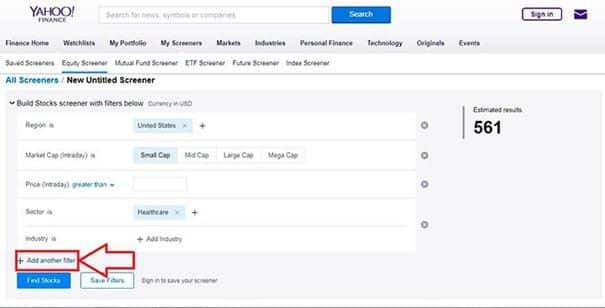

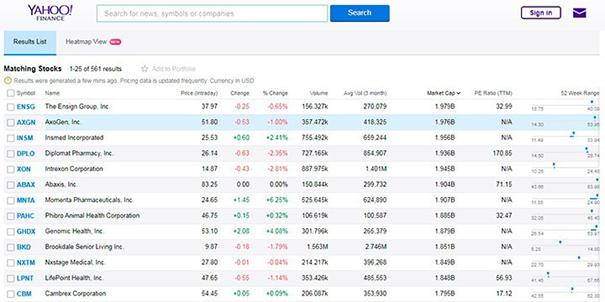

Yahoo Finance Screener

Almost all search platforms have their own screeners. Which includes Yahoo Finance Screener. It has a fairly extensive database of filters and you can work on it without registration, while the number of tools with which you can work is almost unlimited.

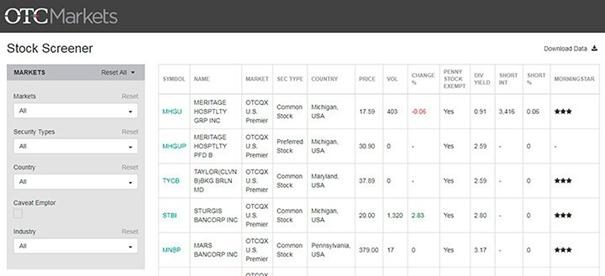

OTC Markets

This is a free screener that allows you to work with a large (over 17,000) number of tools for free. The system itself has the following interface: The

- Markets – allows you to select general indicators (region, industry, instrument type);

- Growth – data that is related to cost, percentage changes and volumes;

- Performance – indicators of changes in prices and volumes.

Screening is performed automatically, just select the desired filter. However, the list of filters on it is relatively small. Therefore, it is best to use it when you need to work on several exchanges at once, and there is no need for a large number of filters.

Examples of analysis using screeners

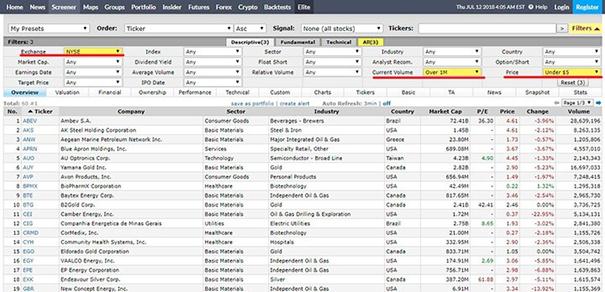

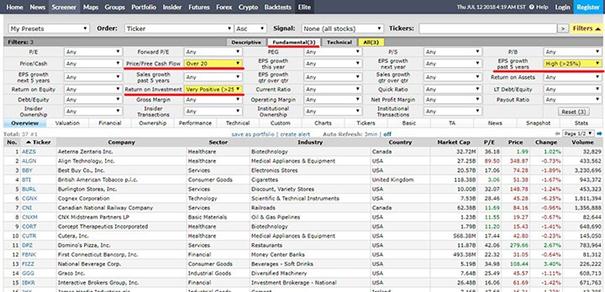

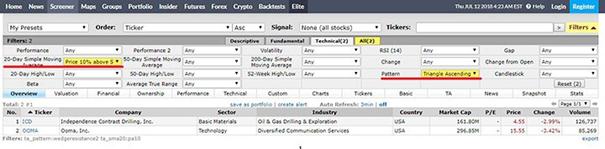

For the analysis, we will use Finviz and run it through different filters. The analysis will be carried out by the Descriptive filter on the NYSE stock exchange, the price per share is 5 USD, the volume is more than 1 million.

Futures in investing

It is clear that initially futures were created to reduce the risks of producers. But today, futures are purchased by private investors, if it is necessary to pre-fix prices for oil, gas, precious metals, agricultural products and much more. With their help, investors earn on assets that are not purchased directly, such as oil.

What futures can be purchased on the market

In our country today the most popular are futures contracts related to oil, gas, gold and other precious metals, currency. In recent years, cryptocurrency futures contracts have become increasingly popular. More recently, it was assumed that the end buyer, within the time specified in the contract, would receive a real asset, which would be delivered using the exchange. Now, on the day the contract ends, the parties simply settle on the derivative. At the same time, futures can be freely traded on the stock exchange for the entire period of the contract. The prices for such assets directly depend on the prices for the underlying instruments, so traders have the opportunity to earn on the very process of buying / selling them, but such operations require certain experience and knowledge. Therefore, investors who are just starting to work on the exchanges,

Conclusion of futures contracts and work on them

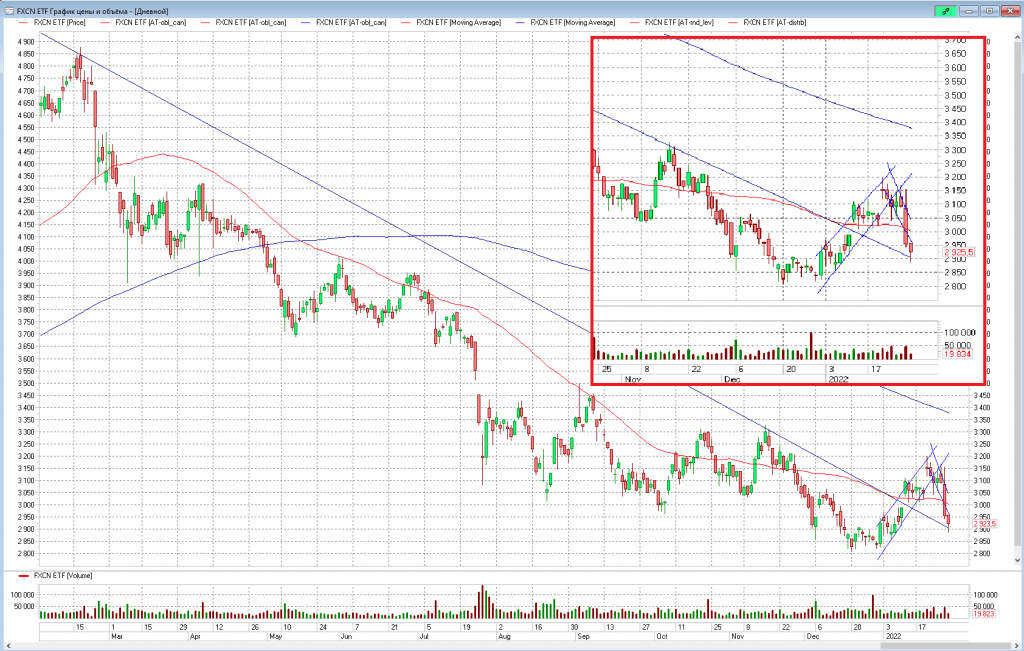

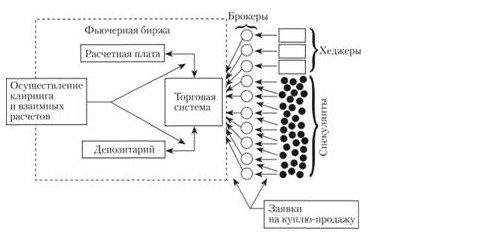

Futures contracts are concluded exclusively on the exchange. The seller submits his application, which indicates a specific price and term. After that, it is waiting for the buyer, who will be satisfied with the set conditions. But there is another way, when the seller simply chooses from the list of applications submitted by buyers. The exchange always publishes lists of offers from both sellers and buyers. Using futures screener platforms, you can always choose the most optimal positions. As soon as the contract is concluded, the exchange assumes all obligations for its proper execution. [caption id="attachment_11871" align="aligncenter" width="564"]

Features of cryptocurrency futures trading

Buying/selling crypto futures became possible relatively recently, in 2017. And from that moment on, they began to confidently conquer world exchanges, as they opened up additional wide opportunities for traders to invest. Today, more than 5,000 cryptocurrencies are available on the exchanges and their number is constantly increasing, which suggests that crypto trading will not decrease its popularity for a very long time.

What are cryptocurrency futures contracts?

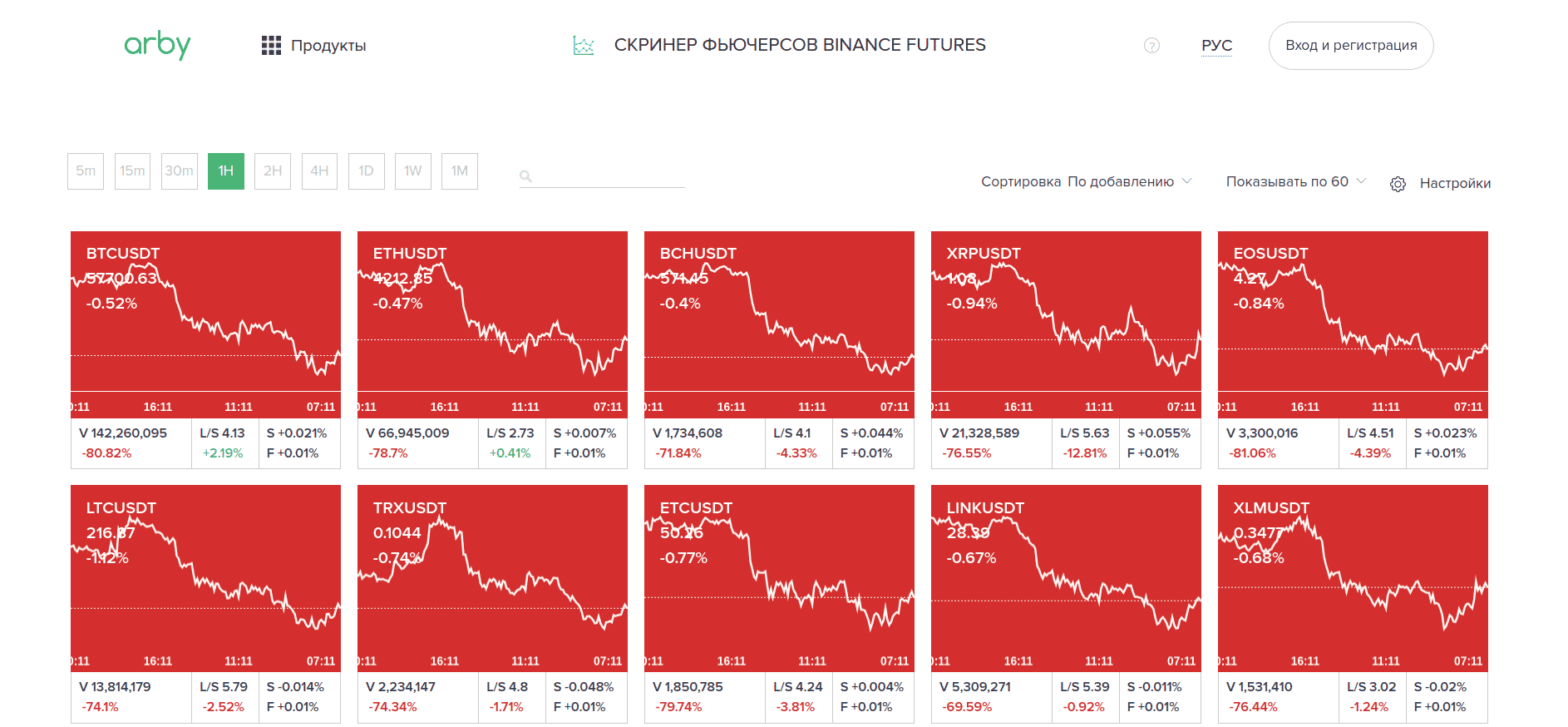

Thanks to such contracts, exchange participants gained wide access to cryptocurrencies. In terms of its functions, this tool resembles fund indices or product futures, in which the trader assumes all the risks associated with the price of the cryptocurrency. Here the trader uses cash, but does not trade cryptocurrency in the literal sense of the word. The high level of volatility of cryptocurrencies makes it possible to purchase it at low prices and put them up for auction with significant increases. How to trade cryptocurrency futures: Kraken Futures tips: https://youtu.be/uPCeUYwSg7c Buying/selling crypto futures is available on a number of online platforms (electronic exchanges) which include: Binance Futures, Coinbase, Huobi Global, Kraken, Bitfinex and many more other. On these platforms, very convenient screeners are available, the filters on which make it easy to isolate the crypt that the client needs. [caption id="attachment_12134" align="aligncenter" width="1886"]

Cryptocurrency futures device

Cryptocurrency trading is associated with a set of problems that are not inherent in other futures. These include, first of all, a negative image in many countries, and a high degree of volatility. But these are not always disadvantages, as a high degree of volatility is often used by investors to earn money. One of the important features of cryptocurrency trading is that the risk is associated exclusively with the value of the currency, since its acquisition does not make the trader the actual owner of the asset. Another very important element in the trading process is ”

leverage “.“. It is this that allows the trader to buy cryptocurrency not at the price set on the spot market, but by paying only a part of it. This is only possible when dealing with futures.

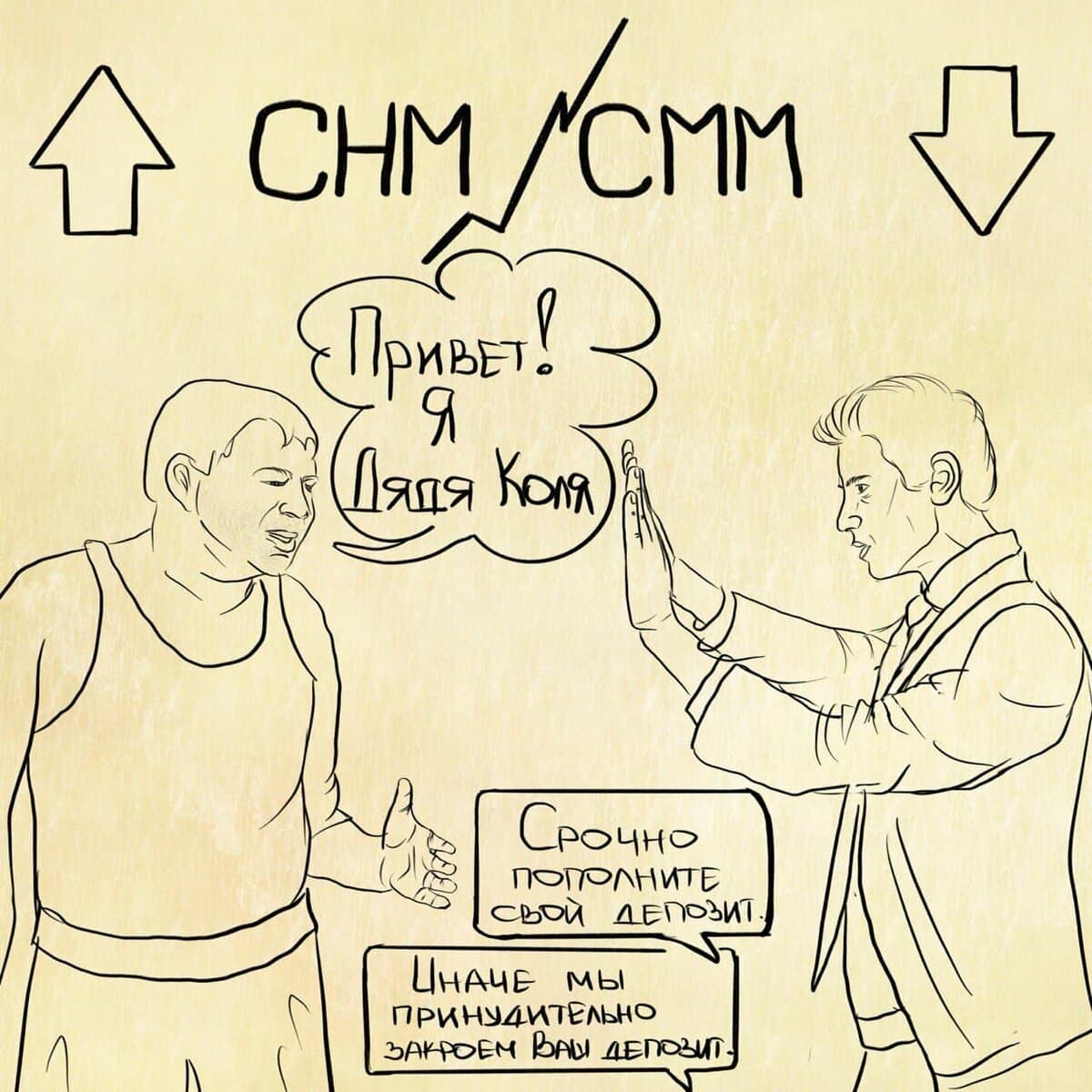

Margin

In order to acquire a position on the exchange, you need to deposit a margin, and the opening of each new trading position will require additional financial security. Maintenance margin is the minimum amount of funds that a trader needs to maintain an open trading position. The maintenance margin level is supervised by the exchange, which makes it possible to keep track of the collateral that is used. If the investor runs out of the limit, the positions are subject to liquidation.

Calculations on crypto futures

Mutual settlements on such transactions are not similar to traditional systems. Exchanges have developed a mechanism that aims to constantly equalize futures and index prices. This mechanism is the funding rate. The rate is calculated based on the difference in prices in the spot and futures markets. When working with an exchange, it must be taken into account that funding rates can have a negative impact on investor returns, because funding rates can soar due to market overheating. And as a result, investors will not be able to maintain “long positions”.