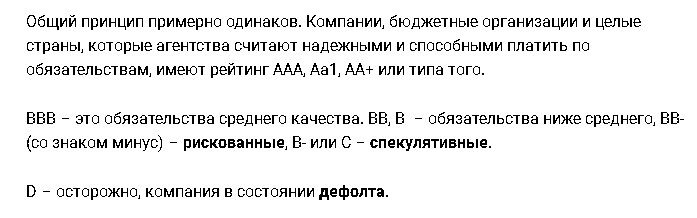

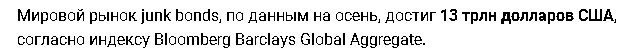

Junk bonds (high-yield bond, non-investment-grade bond, speculative-grade bond, junk bond) are speculative securities with an extremely low credit rating. They are characterized by a negative financial reputation and high risks. However, this is a highly profitable instrument, trading in which allows you to get large profits. Bonds are issued with high interest rates, attracting entrepreneurs who want to buy out their companies that are about to go bankrupt.

How the history of the junk bond market began

The history of the junk bond market began in the 70s of the XX century. Michael Milken has done analytical research on unrated securities. He was able to prove that building a diversified portfolio of low-grade bonds is more profitable in the long term than highly rated instruments. However, in this case, the probability of default increases significantly. Michael Milken has identified the cyclical nature of the market, which consists in periodic downturns in safe securities, it is at this time that the rise of junk bonds begins.

- fallen angels – firms that previously had a high rating, but now faced certain difficulties;

- rising stars – startups with small assets and insufficient financial strength, which have a low rating;

- High-debt companies are practically bankrupts or actually acquired companies with huge debts;

- Capital-intensive companies are firms that have insufficient capital or enterprises that are unable to obtain loans, as well as those wishing to attract investors from among individuals and legal entities.

How to invest in junk bonds the right way

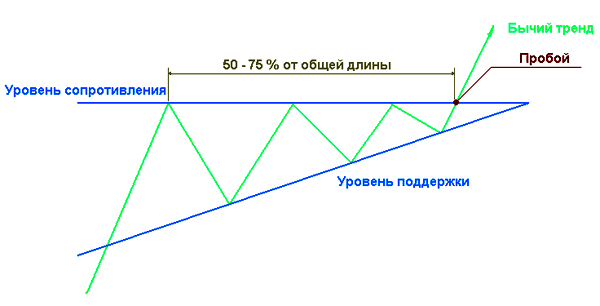

Before investing in this instrument, it is necessary to calculate how expedient it is and analyze the existing risks. Initially, the market is analyzed to study the history of the issuing companies. A market research is being conducted to get an idea of the current economic activity and other factors affecting the solvency of firms. You will need to take care of investment diversification and buy securities from several issuers. Based on the analysis carried out, a long-term forecast of interest rates and the dynamics of their change is carried out. The instrument’s profitability and its behavior in the market are characterized by a number of features:

- active use of debt obligations in the market with their profitability exceeding the profit on rating assets;

- an increase or decrease in the interest rate does not affect the price of the instrument, which cannot be said for ordinary debt obligations. This is due to the short maturity period and the high return on the asset;

- profitability on junk bonds directly depends on the situation in the economy.

How to choose an issuer

Investors recommend investing in junk bonds no more than a quarter of the savings. To reduce risks, the share of one issuer in the portfolio should not exceed 5%. Experienced investors rarely invest in this type of assets more than 10% of their funds in circulation. When choosing bonds to buy, it is necessary to study the activities of the issuer, in particular, find out if he has other securities and debt obligations. They pay attention to the company’s public debts and the total amount of debt burden, which determines the possibility of on-lending in a situation with an increased risk of default. The prospects of the business with which the company is connected are also taken into account. The prospect of a business idea will most likely help the company settle with its creditors.