Countertrend in trading and features of trading against the trend. The vast majority of trading methods rely on the trend. However, there is not much information about the countertrend approach in trading. In this article, we will discuss trading against the trend on a theoretical level, as well as present strategies for implementing in the market.

- Definition of countertrend trading

- Advantages of the countertrend trading method

- Cons of trading against the trend

- Best practices for trading against the trend

- Always have a stop loss in the market

- Do not add to an already unprofitable position

- Wait for confirmation before going against the trend

- Don’t risk more than 2% on a trade

- Trading strategy against the trend

- Marketmaking

Definition of countertrend trading

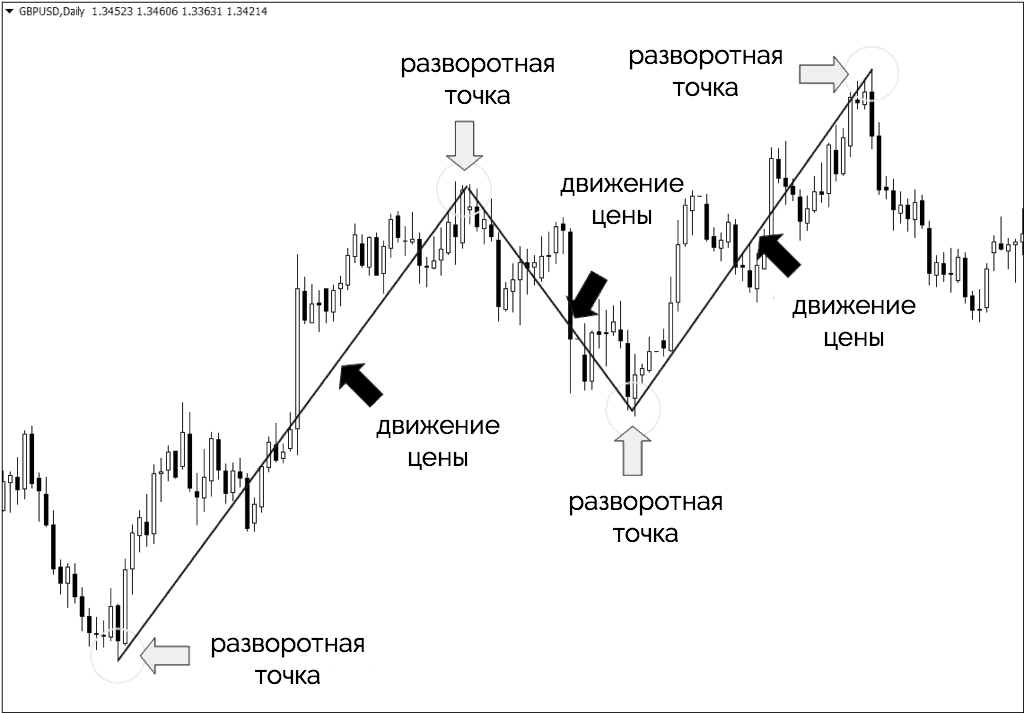

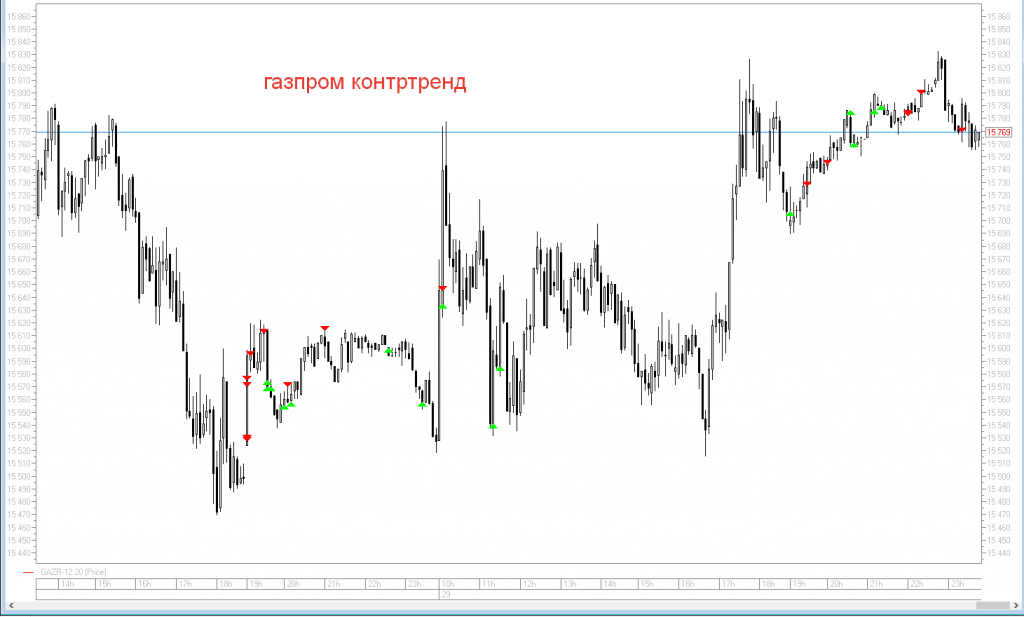

Countertrend trading is an approach to trading where a trader seeks to profit from price movements that go against the prevailing trend. Traders working against the trend are trying to catch a short-term price pullback or a complete reversal. Typically, trading strategies against the trend have a medium-term duration – the position is held from several days to several weeks. But this is not an ironclad rule: although not so many, there are also short-term traders with counter-trend strategies who make deals

intraday. In general, strategies based on this approach are suitable for any timeframe. Trading against the trend is the opposite of following the trend. While trend trading means catching momentum breakouts and then moving with the trend for as long as possible, countertrend style requires finding potential reversal points. Both trading styles can be profitable in the right market conditions and when they are in tune with personal psychology – for some traders, one approach may be better than the others, simply because of personality traits.

Definition. Trend traders seek to detect and participate in impulsive price movements, while counter traders seek to find critical reversal points in order to take advantage of corrective price movements.

Advantages of the countertrend trading method

The opposite style of trading can sometimes be tricky, but there are certain advantages to trading against the crowd from time to time, as outlined below. Profit from one trade is potentially greater than any other approach. Trend-following strategies tend to offer lower risk and lower rewards as well. Countertrading, on the other hand, is always a greater risk, which is rewarded with greater profits. As a result, such a trader will have lower maximum drawdowns. In addition, when these drawdowns occur, you can exit such losing periods faster than anyone else in the market. And also from the bonuses we note:

- Shorter periods in position . Countertrading is applicable to positions of any length, and is much more suitable for short-term positions than regular trading. Holding positions for a relatively short period of time is suitable for those who tend to lose focus.

- More opportunities to realize your advantage . Because of the shorter holding periods we just mentioned, countertrend traders benefit from their strategy in the market more often than longer-term traders. It is not uncommon for countertrend trading systems to generate 75 or more trades per year for a particular instrument. This would be very uncommon for most trend based strategies.

- It is not necessary to predict long-term price behavior . Players against the market can quickly open and close positions. They do not need to predict the price for long periods of time. Instead, they have the ability to focus on short to medium term price fluctuations, be flexible and trade both sides of the market. It is enough to guess just one price reversal.

Cons of trading against the trend

Now that you have an idea of some of the advantages of the countertrend style, we should also mention some of the disadvantages of this approach. For most traders, especially those who are new to trading or inexperienced, it is much better to trade with the trend first, and here is why:

- You are going against the natural flow of the market . In the markets, as in life, it is always easier to follow the path of least resistance. When a trend is in motion, it tends to persist – as a result of trying to go against this trend, can (and will) lead to a whole series of losing trades.

- Market trends are much easier to spot than pivot points . Turning points in the market can happen very quickly. So fast that you hardly have time to react. Trends, on the other hand, are much easier to recognize and often persist for a long time – so as a countertrader, you will be playing against people who have an advantage upfront.

- It is psychologically difficult to be the opponent – there is no greater feeling of pressure in trading than trading against everyone. You will have to open a position against the crowd and the market. While it can certainly boost your ego, it can also be dangerous and hurt both your trading account and your own psyche when you get it wrong.

- You will rarely make big profits – you should not expect regular profitable trades, expect rare big pluses to the bank. You won’t get average gains regularly, you’ll have more highs and lows – that’s the essence of this approach.

Best practices for trading against the trend

No matter how confident we may be in our trading valuation, we must not forget that “the markets can remain irrational longer than we can remain solvent.” Let’s discuss some of the best practices related to trading against the trend in the market. These basic guidelines will be equally helpful whether you are trading FX, futures or stocks.

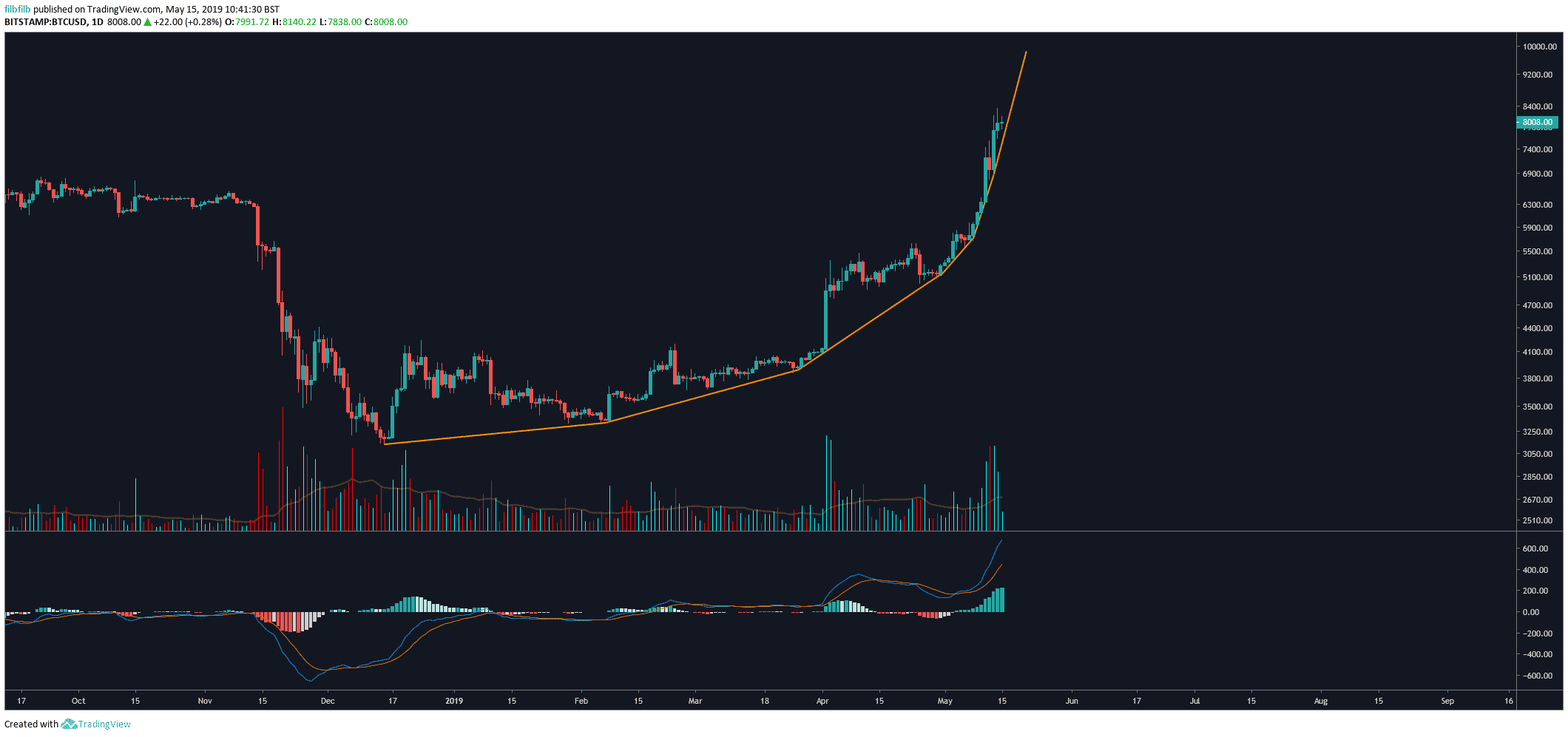

Do not trade against the trend during a parabolic price move.

Any time the price behaves abnormally, especially during strong uptrends or strong downtrends that resemble one-way price movements or, worse, parabolic price movements, it is best not to engage in countertrends. You should stay on the sidelines and wait until the market volatility decreases.

Always have a stop loss in the market

Some traders prefer to have so-called mental stops in the market rather than stop losses. A mental stop is essentially the price at which a trader

believes they will close a position if the trade moves against them. A real stop loss, on the other hand, is placed in the market and triggered automatically when a certain level is reached. Countertraders should always have only this kind of stop in the market, because the very approach of playing against the market is very vulnerable to sudden adverse price movements.

Do not add to an already unprofitable position

Some countertrends tend to increase their positions when prices move against them. While this approach may work for very experienced, extremely disciplined people, the vast majority will quickly break the bank. It is difficult to pinpoint a possible pivot point, and you will often be wrong, an impulsive increase in position will definitely put you in an uncomfortable position.

Wait for confirmation before going against the trend

Add some trigger (based, for example, on an indicator) to your countertrend strategy, the operation of which would be mandatory for entering the market. While waiting for such confirmation can sometimes reduce the reward-to-risk ratio of a trade, if used correctly, it will increase your overall win rate. This is especially true in counter trading, where even the slightest miscalculation can lead to a losing outcome.

Don’t risk more than 2% on a trade

The success of any trading strategy largely depends on proper and well-planned risk management. One area of risk management that traders should pay particular attention to is position sizing. Positions that are too small often result in low interest income, while positions that are too large can lead to potentially catastrophic damage. Traders trading against the market should risk no more than 2% of the pot.

Trading strategy against the trend

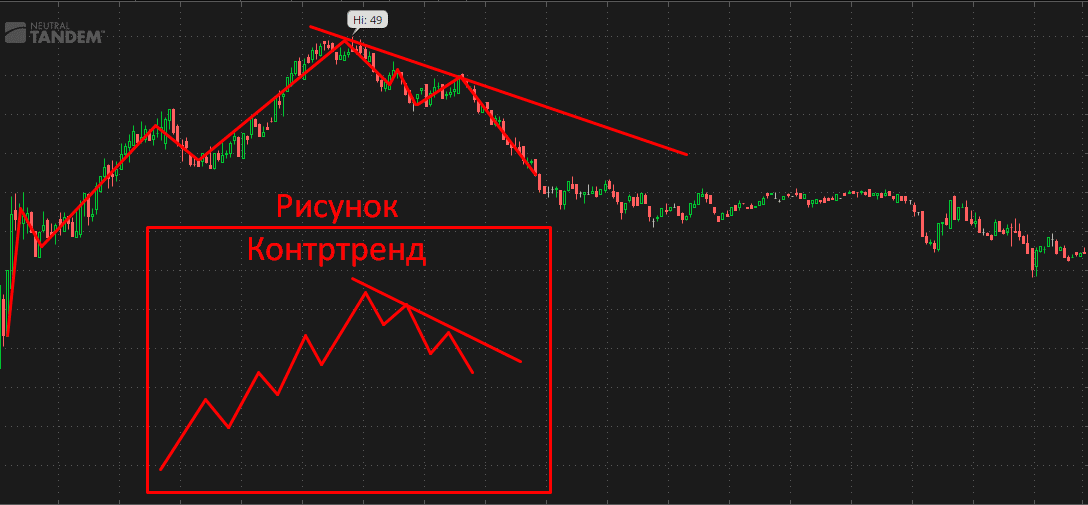

Now that you have an idea of what this style of trading looks like, let’s solidify our knowledge and develop a trading strategy. We will use technical indicators. In financial markets, you will often see three separate price pushes in the direction of a trend that are interrupted by two smaller corrections. Those who are familiar with Dow Theory or Elliott Wave Theory will recognize its impulse structure. If you are not familiar with the Elliott Wave Principle concepts, you can still use this method.

- The chart should show a step structure, clearly showing three separate price pushes.

- There is a divergence if you draw a line between the swing lows of the second and third shocks and a line connecting the same bottoms on the RSI indicator chart.

Draw a bearish trend line at this point, connecting the corrective peaks in a bearish “jump” price move.

- An entry buy order is placed at the breakout price of this trend line.

- A stop loss order must be placed at the low of the candle prior to the breakout candle.

The rules for entering a short position are mirrored. Countertrend in trading, trading strategy against the trend: https://youtu.be/8UN7iDmswOA

Marketmaking

Another example of counter-trend trading for experienced exchange participants is market maker trading. Such a trader makes deals in both directions. When the market begins to actively move in one direction, MM builds up the position against the market movement, accumulating a loss on the position. The ideal market for MM is one that stands still. In this case, others either buy at the price of MM, or sell at its price. And the worst thing for a market maker is when the market moves in one direction. The likelihood of a sustainable trend on large timeframes is higher, so market makers make deals in the plane of high-frequency trading. By now, you should have an idea of the reverse approach to trading and how it differs from trend trading. Although moving against the main trend can be very profitable, this approach is not for beginners. Even experienced traders should take the time to study the various signs of an imminent market reversal. Many successful players use two strategies at once – they trade both with the trend and against it, depending on the situation.