Junk bonds (gaxɔgbalẽvi si me wokpɔa ga geɖe le, gaxɔgbalẽvi si me gadede asi le o, nususugblɔ ƒe gagbalẽ, junk bond) nye nususugblɔ ƒe gaxɔgbalẽvi siwo ƒe gaxɔgbalẽvi ƒe dzeside le sue ŋutɔ. Woƒe dzesiwoe nye ŋkɔ gbegblẽ le ganyawo ŋu eye afɔku geɖe le wo me. Gake esia nye dɔwɔnu si me viɖe geɖe le, si me asitsatsa le nana nèkpɔa viɖe gãwo. Woɖea gagbalẽwo ɖe go le deme gã aɖe nu, si hea asitsala siwo di be yewoaƒle yewoƒe dɔwɔƒe siwo le kpo dom nu la vɛ.

Alesi junk bond ƒe asitsatsa ƒe ŋutinya dze egɔmee

Junk bond ƒe asitsatsa ƒe ŋutinya dze egɔme le ƒe 1970-awo me. Michael Milken nɔ numekuku siwo wowɔna le gaxɔgbalẽ siwo ŋu dzeside aɖeke mele o ŋu me dzodzro me. Ete ŋu ɖo kpe edzi be ɖoɖowɔwɔ ɖe agbalẽdzraɖoƒe vovovo siwo me gagbalẽ siwo ƒe asi bɔbɔ le ŋu le ɣeyiɣi didi aɖe megbe, hea viɖe geɖe vɛ ne wotsɔe sɔ kple dɔwɔnu siwo ƒe dzeside kɔkɔ. Gake le go sia me la, alesi wòate ŋu adzɔe be woaxe fe ɖe eta la dzina ɖe edzi ŋutɔ. Michael Milken de dzesi asitsatsa ƒe tsatsam, si nye gaxɔgbalẽvi siwo ŋu kakaɖedzi le ƒe ɖiɖi tso ɣeyiɣi yi ɣeyiɣi, ɣeyiɣi sia mee gagbalẽ gbegblẽwo ƒe dzidziɖedzi dzea egɔme tsoe.

- mawudɔla siwo dze anyi – dɔwɔƒe siwo ƒe dzeside kɔkɔ tsã, gake fifia wodo go kuxi aɖewo;

- ɣletivi siwo le dzidzim ɖe edzi – dɔwɔƒe siwo le dɔ gɔme dzem siwo si nunɔamesi suewo le eye ganyawo ƒe liƒo mesɔ gbɔ o, siwo ƒe dzeside le sue;

- Dɔwɔƒe siwo nyi fe geɖe la nye dɔwɔƒe siwo do kpo nu kloe alo dɔwɔƒe siwo woxɔ ŋutɔŋutɔ siwo ŋu fe gbogbo aɖewo le;

- Dɔwɔƒe siwo zãa ga geɖe nye dɔwɔƒe siwo ƒe ga mesɔ gbɔ o alo dɔwɔƒe siwo mete ŋu doa ga o, kpakple esiwo di be yewoahe gadelawo tso ame ɖekaɖekawo kple dɔwɔƒe siwo le se nu dome.

Alesi woade ga agbalẽ siwo me womezãa ga le o me

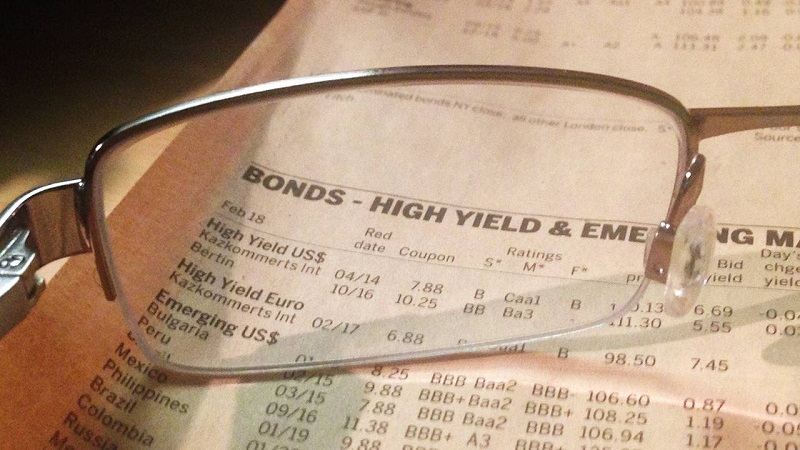

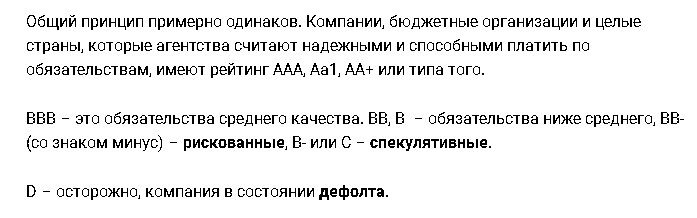

Hafi woade ga dɔwɔnu sia me la, ele be woabu akɔnta le alesi wòsɔe ŋu eye woaku afɔku siwo li fifia me. Le gɔmedzedzea me la, wodzroa asitsatsa me be woasrɔ̃ nu tso dɔwɔƒe siwo naa ga la ƒe ŋutinya ŋu. Wowɔa asitsatsa ŋuti numekuku be woakpɔ ganyawo ƒe dɔwɔna si li fifia kple nu bubu siwo kpɔa ŋusẽ ɖe dɔwɔƒewo ƒe gazazã dzi la ƒe susu aɖe. Ahiã be nàlé ŋku ɖe gadede asi ƒe vovototodedeameme ŋu eye nàƒle gaxɔgbalẽvi siwo tso dɔwɔƒe geɖe siwo naa ga la gbɔ. Wonɔa te ɖe numekuku si wowɔ dzi wɔa deme ƒe agbɔsɔsɔme kple woƒe tɔtrɔ ƒe ŋusẽkpɔɖeamedzi ƒe nyagblɔɖi ɣeyiɣi didi aɖe. Viɖe si dɔwɔnua kpɔna kple eƒe nuwɔna le asi me la ɖe dzesi le nu geɖe ŋu:

- fenyinyi ƒe agbanɔamedziwo zazã vevie le asi me kple woƒe kutsetse ŋutɔŋutɔ si wu viɖe si wokpɔna le nunɔamesi siwo woɖo ɖe dzeside me;

- deme ƒe dzidziɖedzi alo edziɖeɖekpɔtɔ mekpɔa ŋusẽ ɖe dɔwɔnua ƒe asi dzi o, si womate ŋu agblɔ tso fenyinyi ƒe agbanɔamedzi dzrowo ŋu o. Esia tso ɣeyiɣi siwo mehiã boo o le ɣeyiɣi si woatsɔ axe fe na nunɔamesiawo me kple viɖe gbogbo si le nunɔamesi la ŋu gbɔ;

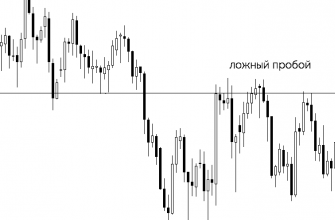

- viɖekpɔkpɔ le junk bonds me nɔ te ɖe nɔnɔme si le ganyawo me dzi tẽ.

Ale si nàtia amesi naa gae

Gadelawo kafui be màgade ga si nèdzra ɖo ƒe akpa enelia wu gagbalẽ siwo me gblẽ o me o. Be woaɖe afɔkuwo dzi akpɔtɔ la, mele be adzɔha ɖeka ƒe gomekpɔkpɔ le gaxɔgbalẽvia me nawu 5% o. Ƒã hafi gadelawo bibiwo dea woƒe ga siwo li ƒe 10% kple edzivɔ ɖe nunɔamesi sia ƒomevi me. Ne wole gagbalẽwo tiam be woaƒle la, ehiã be woasrɔ̃ nu tso amesi do gae ƒe dɔwɔnawo ŋu, vevietɔ, be woanya nenye be gaxɔgbalẽvi kple fe bubuwo le esi. Woléa ŋku ɖe dɔwɔƒea ƒe dukɔa ƒe fewo kple fe bliboa ƒe agba ŋu, si fiaa alesi wòanya wɔ be woado ga na ame le nɔnɔme si me afɔku si le eme be woaxe fe ɖe eta la dzina ɖe edzi. Wobua asitsatsa si me dɔwɔƒea do ƒome kplii ƒe mɔkpɔkpɔwo hã ŋu. Anɔ eme godoo be asitsatsa ƒe susu aɖe ƒe mɔkpɔkpɔ akpe ɖe dɔwɔƒea ŋu wòaxe fe na fenyilawo.