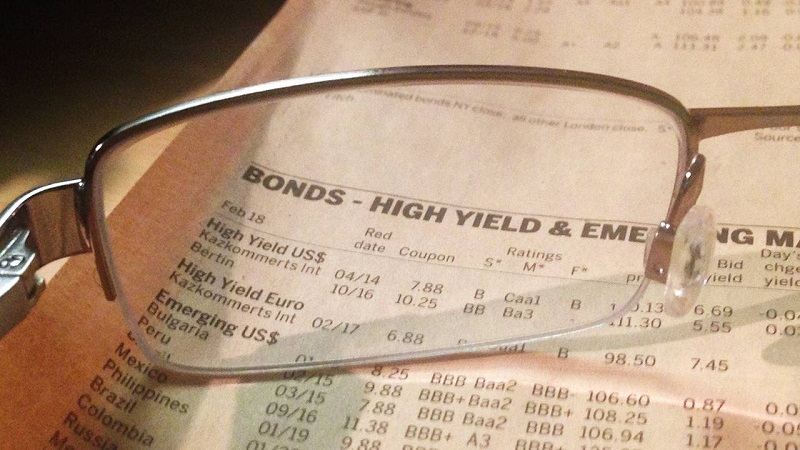

Junk bonds (high-yield bond, non-investment-grade bond, speculative-grade bond, junk bond) are speculative securities with an extremely low credit rating. They are characterized by a negative financial reputation and high risks. However, this is a highly profitable instrument, trading in which allows you to get big profits. Bonds are issued at high interest rates, attracting entrepreneurs who want to buy out their companies that are about to fail.

How the history of the junk bond market began

The history of the junk bond market began in the 1970s. Michael Milken was engaged in analytical studies of securities that do not have a rating. He was able to prove that the formation of a diversified portfolio of low-grade bonds in the long run, brings more profit in comparison with instruments with a high rating. However, in this case, the probability of default increases significantly. Michael Milken identified the cyclicality of the market, which consists in periodic declines in reliable securities, it is at this time that the rise of junk bonds begins.

- fallen angels – firms that previously had a high rating, but now faced with certain difficulties;

- rising stars – start-up companies with small assets and insufficient financial stability, which have a low rating;

- High-debt companies are practically bankrupt or actually acquired firms with huge debts;

- Capital-intensive companies are firms that have insufficient capital or enterprises that are unable to obtain loans, as well as those wishing to attract investors from among individuals and legal entities.

How to invest in junk bonds

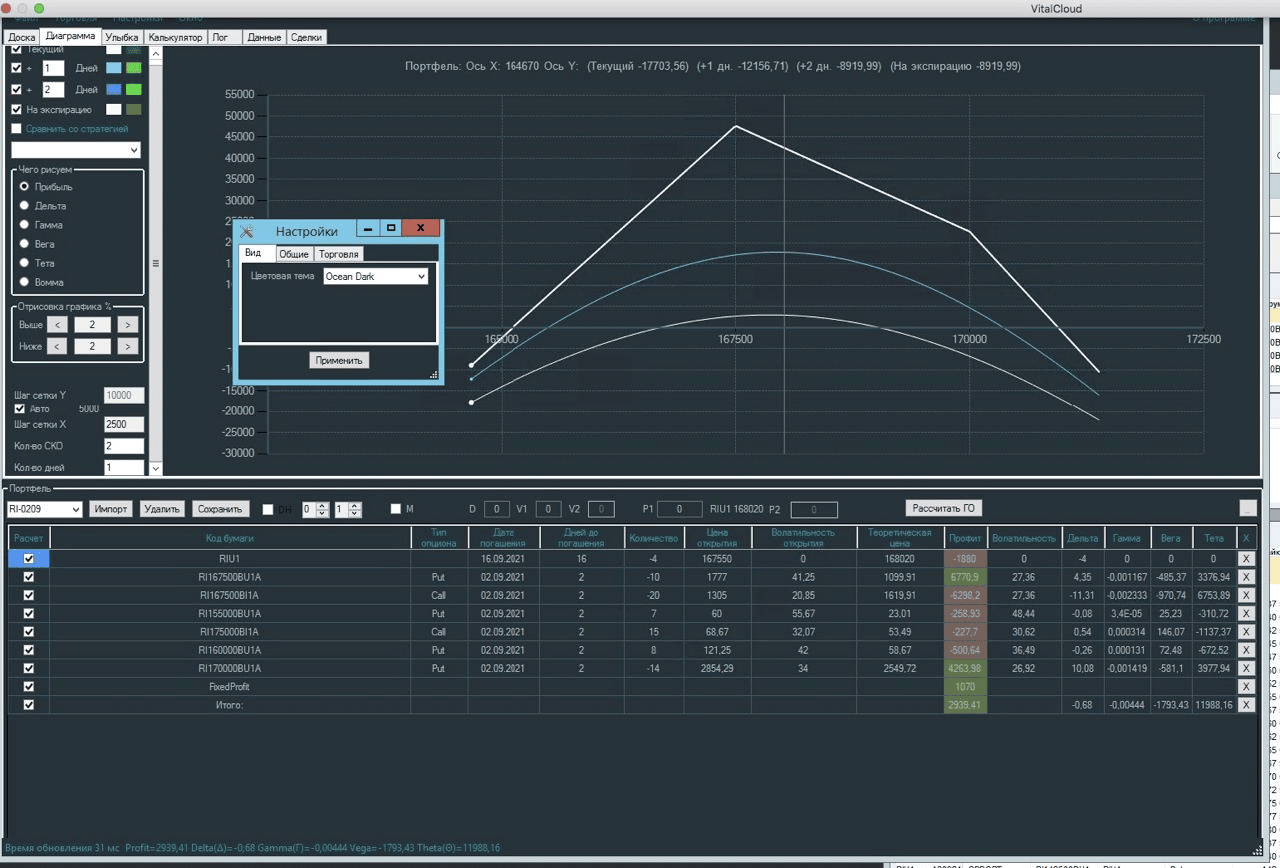

Before investing in this instrument, it is necessary to calculate how expedient it is and analyze the existing risks. Initially, the market is analyzed to study the history of the issuing companies. Market research is carried out to get an idea of the current economic activity and other factors affecting the solvency of firms. You will need to take care of the diversification of investments and buy securities of several issuers. Based on the analysis carried out, a long-term forecast of interest rates and the dynamics of their change is carried out. The profitability of the instrument and its behavior in the market is characterized by a number of features:

- active use of debt obligations in the market with their real yield exceeding the profit on rating assets;

- an increase or decrease in the interest rate does not affect the price of the instrument, which cannot be said about ordinary debt obligations. This is due to the insignificant terms to the maturity period and the high profitability of the asset;

- profitability on junk bonds directly depends on the situation in the economy.

How to choose an issuer

Investors recommend investing no more than a quarter of your savings in junk bonds. To reduce risks, the share of one issuer in the portfolio should not exceed 5%. Experienced investors rarely invest more than 10% of their available funds in this type of assets. When choosing bonds for purchase, it is necessary to study the activities of the issuer, in particular, to find out if he has other securities and debt obligations. They pay attention to the public debts of the company and the total debt burden, which determines the possibility of on-lending in a situation with an increase in the risk of default. They also take into account the prospects of the business with which the enterprise is connected. The prospects of a business idea will most likely help the company pay off creditors.