The article was created based on a series of posts from the OpexBot Telegram channel , supplemented by the author’s vision and the opinion of the AI. Investments in bonds in the Russian Federation 2026: a short educational program, as well as the author’s idea of why deposits are worse than bonds in the current conditions.

- Investing in bonds

- You can’t make money on deposits, but there is an affordable alternative: bonds

- Below the inflation rate: this is how much you can “earn” on a deposit in Russia

- An alternative for everyone: investing in bonds

- Finhack: increasing bond yields

- Why is it good to enter bonds when the key rate rises?

- Loans and deposits

- It is more profitable to keep money on deposits

- Bonds

- Stock

- So what should I do?

Investing in bonds

Investments in bonds (bonds) in Russia are one of the popular tools for generating income and diversifying a portfolio. Bonds are financial instruments that are issued by a government or corporation to raise financing for a specified period.

The investor becomes the lender and receives interest in the form of coupon payments during the life of the bond.

You can’t make money on deposits, but there is an affordable alternative: bonds

My opinion: you have to be crazy to open a deposit for a year, 5 or 10 years. Especially in rubles. I also tell you how to increase bond yields.

Below the inflation rate: this is how much you can “earn” on a deposit in Russia

Inflation in the Russian Federation at the end of 2022 amounted to 12%. The best rates on short-term deposits (6 months) up to 10% per annum. The best rates on long-term deposits (12 months or more) are up to 7-9%. And early withdrawal of money is impossible without losing interest earned. And one more argument against: the tax rate on interest on deposits is 13%.

An alternative for everyone: investing in bonds

Bonds are good for conservative investors. These are securities for long-term investment. Government bonds, then bonds of large state-owned companies and large private companies are the most reliable. The more reliable a bond is and the higher its rating, the lower its income. Bonds with increased risk offer higher returns. Reliable bonds give a coupon yield of 12-14%. Which is higher than the deposit. A little, but higher than inflation. The main advantage of bonds: the yield is higher than on deposits. And also:

- Every adult resident of Russia can invest in bonds.

- Low threshold for entry – 600-1000 rubles.

- By adding bonds, the investor initially knows how much he will receive in the end.

- Bonds can be sold at any time without losing the accumulated interest.

- Diversification – you can buy bonds from a large number of different companies. From OFZ to riskier bonds with average risk. For example, 75 to 25% in an investment portfolio.

Finhack: increasing bond yields

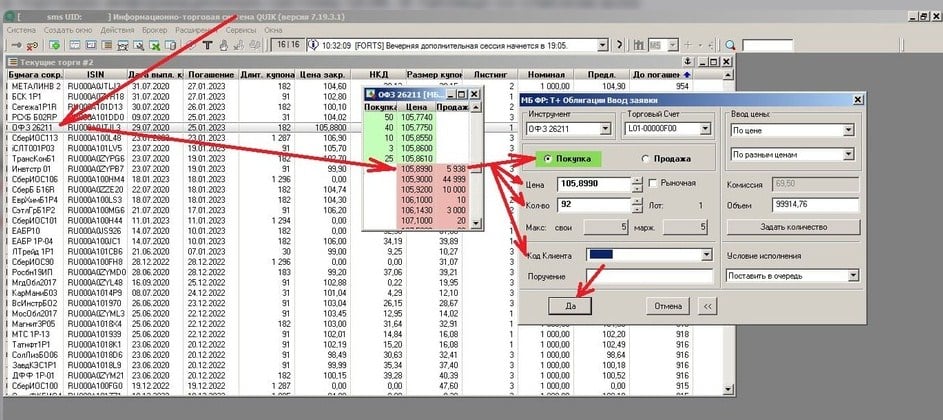

Open an individual investment account. Earn money on investments and receive + 13% from the state on the amount deposited into IIS*. No fraud, just sleight of hand. * There is a nuance. Payment up to a maximum of 400k rubles. Lasts at least 3 years. And all this time the money has been frozen. That is, the yield is 13/3 + 13/2 + 13%. ✔As part of long-term investing, instead of a deposit, I add bonds with the prospect of income in 10-20 years. Approximately 25% of the securities portfolio. More bonds means less risk, and vice versa. Not all bonds are created equal . Bonds for beginners: how to earn money, profitability, coupons, types of bonds: https://youtu.be/Fk1QrZmE9KM

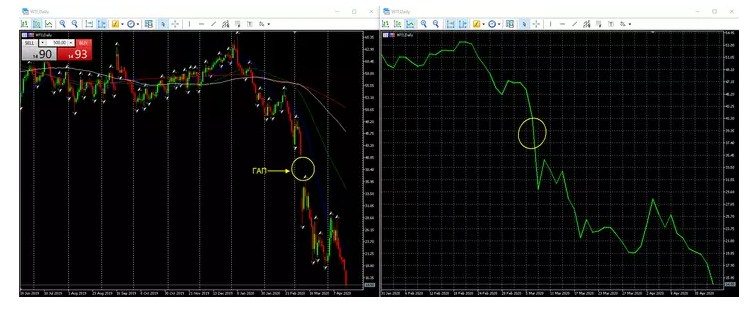

Why is it good to enter bonds when the key rate rises?

What is the key bet for us, how does it affect us? The key rate is the minimum interest rate at which the Central Bank lends to other banks of the Russian Federation, and those, in turn, to citizens and businesses. Which has an impact on the entire market.

Loans and deposits

If the rate rises, which is exactly what analysts expect, then loans become more expensive for individuals and companies. In our case, up to 8%. ⬇ Raising the rate makes the ruble more expensive, inflation and the economy slow down. ⬇ The population spends less, takes out less loans: not profitable. The mortgage market is falling, car loans and consumer loans are less accessible.

It is more profitable to keep money on deposits

The rate determines the maximum percentage at which money can be deposited. Business suffers, financial indicators fall. Indebted and unprofitable companies are in a special risk zone. There is no cheap money, and debt refinancing is unprofitable. Opening a new business is more difficult.

Bonds

When rates rise, new government bonds have higher yields. The attractiveness of bonds issued earlier decreases, as does the price. Therefore, RGBI falls by 1.6% over the month. Prices fall, yields rise. Rates on government bonds have increased over the past month. For example, per annum from 9.3% to 10.2%. https://youtube.com/shorts/ali067TZe9o?feature=share

Stock

Loans are becoming more expensive, businesses are investing less in development. Shares are losing liquidity. There is an outflow of capital towards less risky instruments – bonds and deposits.

So what should I do?

We don’t panic; when the key rate rises, we buy short-term and medium-term government bonds so that we can buy more profitable issues the next time the rate rises. We don’t take loans, we can take deposits.