What is a buyback agreement and how does a REPO deal work? In the financial world, there are many different transactions, purchase, sale, exchange (barter). Among them are REPO operations (repurchase agreement), which provide for a short-term loan, followed by the repurchase of financial assets. Such a transaction is similar to a loan at a pawnshop, only there the borrower does not receive interest on the loan, but gives hard-earned money to return his thing.

- REPO operation

- In what cases are REPO operations applied?

- How does a REPO agreement work when withdrawing money?

- Transaction procedure

- Classifications of REPO transactions – direct and reverse

- How to receive dividends on pledged shares?

- Risks under REPO agreement

- How to reduce risks

- REPO revaluation

- Revaluation of REPO agreement on the example of the Central Bank

- Mandatory terms of the REPO agreement

- REPO in Russia

- An example of a REPO transaction

REPO operation

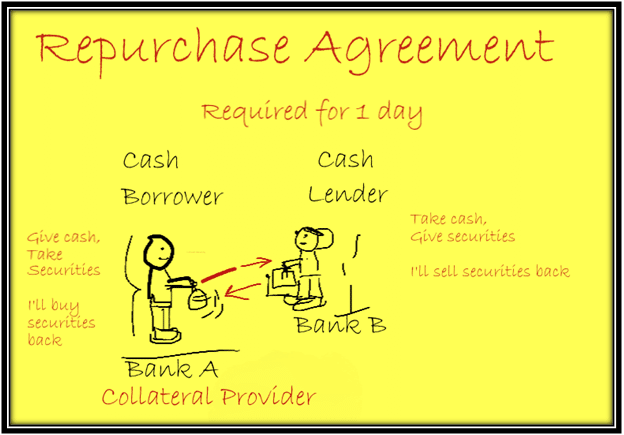

A REPO transaction is a contract for the sale and purchase of financial assets with an obligation to repurchase. As a rule, transactions are carried out at night, and the return is made the next morning or afternoon. In other words, this is a short-term loan, with collateral in the form of financial assets: stocks, bonds. The advantages of REPO are factors for both sides of the transaction:

- The seller , most often a trader, receives the funds without banking red tape.

- The buyer , usually a broker , invests at a fixed rate and minimal risk.

In what cases are REPO operations applied?

The investor concludes a deal only with a legal entity. Most often acts as a buyer: broker, bank, manager, dealer, etc. With several types of trading, debt becomes a necessity. As a rule, this is:

- Marginal withdrawal of funds is the withdrawal of money, in which stocks and other securities play a huge role.

- Margin trading – position transfer.

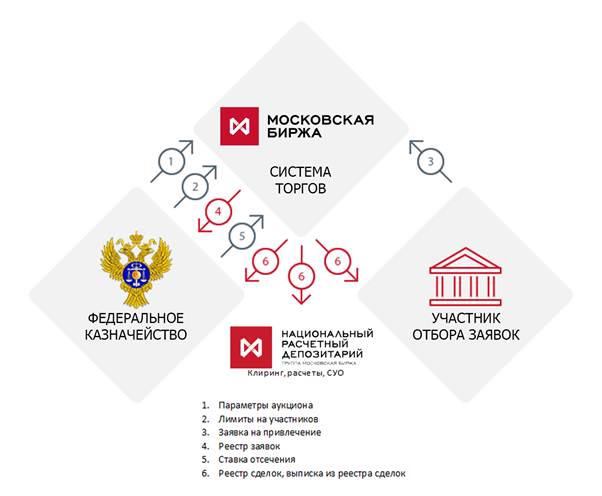

- Trading in the market with a Central Agent.

How does a REPO agreement work when withdrawing money?

Many legal entities lend money by taking bonds, stocks and other securities. The money from the loan is withdrawn to a personal account for personal use. The maximum amount of money given to one person is equal to the cost of one security with an initial risk rate – a discount.

Transaction procedure

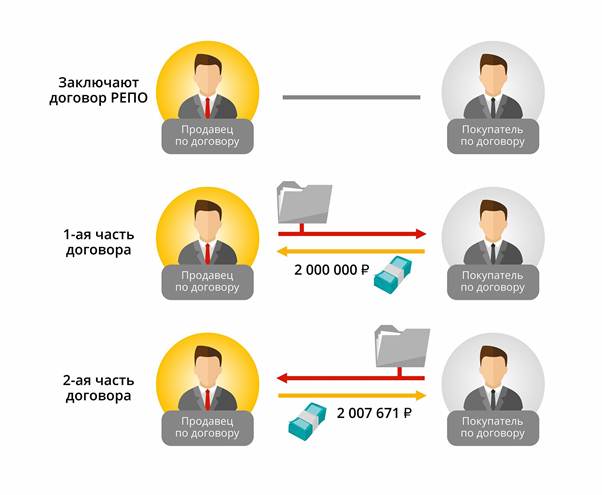

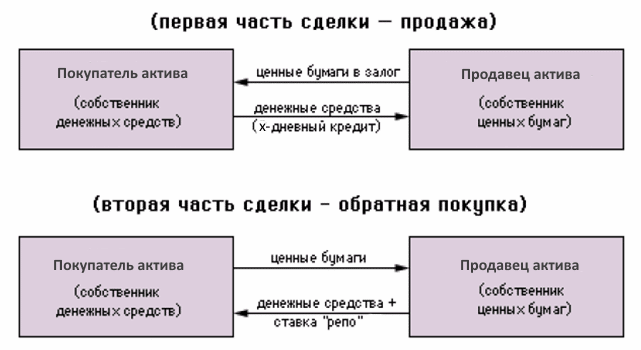

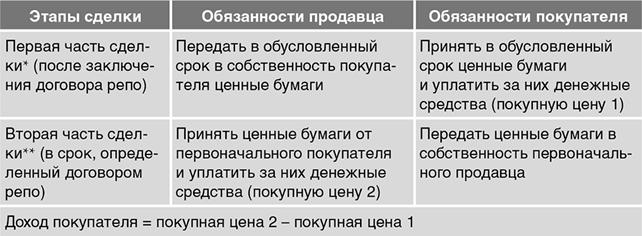

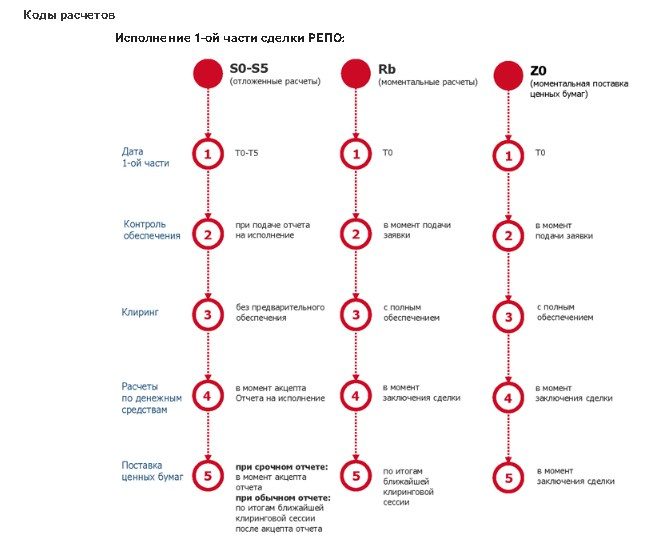

At the very beginning, a contract is drawn up, consisting of two parts: Based on this document, the seller transfers financial assets to the buyer, the seller undertakes to accept them on the stated date and pay a predetermined amount.

Classifications of REPO transactions – direct and reverse

Two types of transactions exist today: direct and reverse repos.

- Direct repurchase transactions imply: the person who borrowed the money makes a repurchase of his shares on the designated day.

- Reverse REPOs differ significantly from the previous transaction – the investor receives the subject of the contract for the time being and pays the full amount for it. At the end of the transaction, he returns the papers, receiving the agreed amount.

- Intraday – the transaction takes place during the day.

- Deal through the night – a deal starts one day and ends the next.

- Valid – the term of the transaction can stretch for a month. With this type, the deal is valid until a certain date, it has a fixed date for the last part of the deal.

- Open – the deadline for the execution of the second part of the REPO is not set.

For example, a conditional trader in need of money entered into a reverse REPO. A legal entity acted as a lender.

The trader had 3,000 shares sold for $3 million even though they were worth $3,500,000. Based on the REPO contract, the term was set for a month.

After this time, the trader withdraws his shares and pays an additional amount on top of the principal. As a result, a month later he took shares for 3 million 200 thousand. 200 thousand – the percentage that has come up for the month of using the broker’s money.Many people compare a repo to a pawnshop. The borrower also sells an expensive item and after a month returns his item, paying interest. If a person does not come for papers, then the broker who executed the REPO can sell them, just as they sell things in pawnshops. How direct and reverse REPO transactions work – video explanation on the buyback agreement: https://youtu.be/p8Lx2dIUUj4

How to receive dividends on pledged shares?

If the list of those who should receive dividends is determined during the REPO, then all the money received from the dividends goes to the seller in full, because he is the official owner of the securities, albeit a temporary one. But the law “On the securities market” protects the sellers of shares. In case of receiving dividends from pledged shares, the buyer must transfer this money to the seller. If he decides to keep them for himself, then the amount of the repurchase of securities will begin to decrease due to the appropriated dividends.

At the same time, the seller of securities also has a number of prohibitions. He cannot take part in the meeting of shareholders during the period of the transaction, and also cannot appeal against their decisions and transactions of the joint-stock company.

What is a REPO agreement, what an investor and a trader need to know: https://youtu.be/u38hZgb5dIo

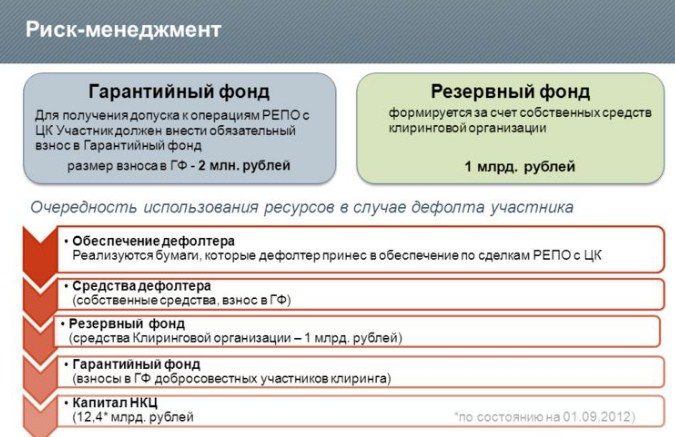

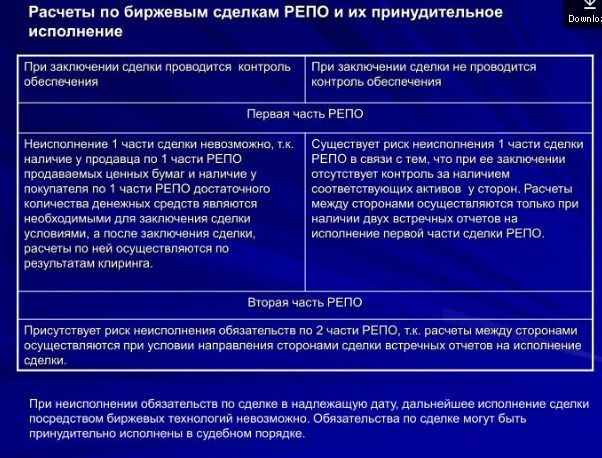

Risks under REPO agreement

The main danger during the commission of such transactions is the failure to fulfill the second part of the contract. Sometimes the seller of shares does not have enough funds to redeem his papers. Then the buyer sells them and fully recovers the losses. The worst situation for traders is when the seller returns a month later with money and interest, and the one who bought the portfolio has already sold it. It often happens that both intermediaries of the transaction refuse to fulfill the second part of the contract. This often happens when a stock has gone up or down in value. Because of this, there is a risk of market volatility, due to which one of the parties will refuse to fulfill their obligations, because the contract says one amount, and the securities may exceed this price, or they will start to cost unprofitably cheap.

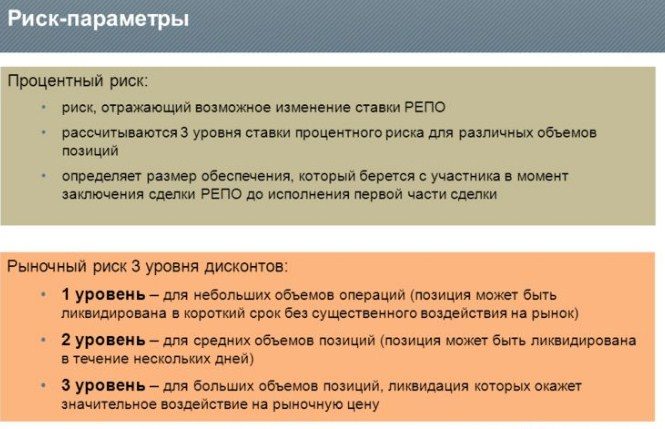

How to reduce risks

There are two ways to mitigate risk: discounts and premiums. Discount – the difference between the price of pledged shares on the market and the money specified in the REPO agreement. In the case of the investor in the example, it can be seen that the shares are worth much more than the amount that he will return to the broker with interest. Therefore, he has a motive to buy back these shares even at a premium. This type of discount is called “initial”. The size of the discount is calculated as a percentage and directly depends on the stability of the shares. If a trader has pledged stable

blue chips, then the discount percentage will be less than that of a less stable company. The compensation fee is another way to protect yourself when making a REPO transaction. This is money or securities that a trader transfers to a broker, or vice versa, if the price of pledged securities has changed dramatically. This is a free execution of the second clause of the contract to reduce the risk of default.

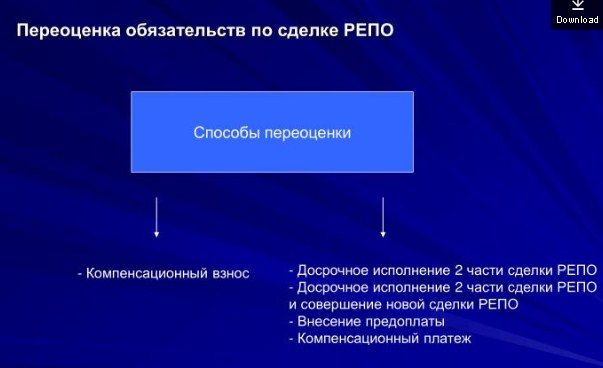

REPO revaluation

The upper and lower revaluation must be present in the REPO agreement. The owner of the shares has the right to conduct an upper revaluation if the price of the securities went up above the allowed level.

Prior to the conclusion of a REPO, the parties agree on the moment at which the line of price growth and its fall will be, and also calculate the deficit and excess margin.

When the time comes for reassessment, both parties agree among themselves on further actions. They may not carry out revaluation, but make the second act of the REPO transaction ahead of schedule: one sells shares, and the second buys them with interest. The interest will be completely different from what is specified in the contract and will vary from the growth of shares. After the completion of the REPO, the parties can draw up a new agreement, taking into account the new prices of securities and the early closing of the transaction. There is a completely different line of behavior when prices change and revaluation. The party that has suffered the most losses may demand the payment of margin contributions in the form of a portion of the shares and cash. If the payment was made in a monetary unit, and not in securities, then interest is charged. You can also return the entire amount with interest. The same applies to securities.

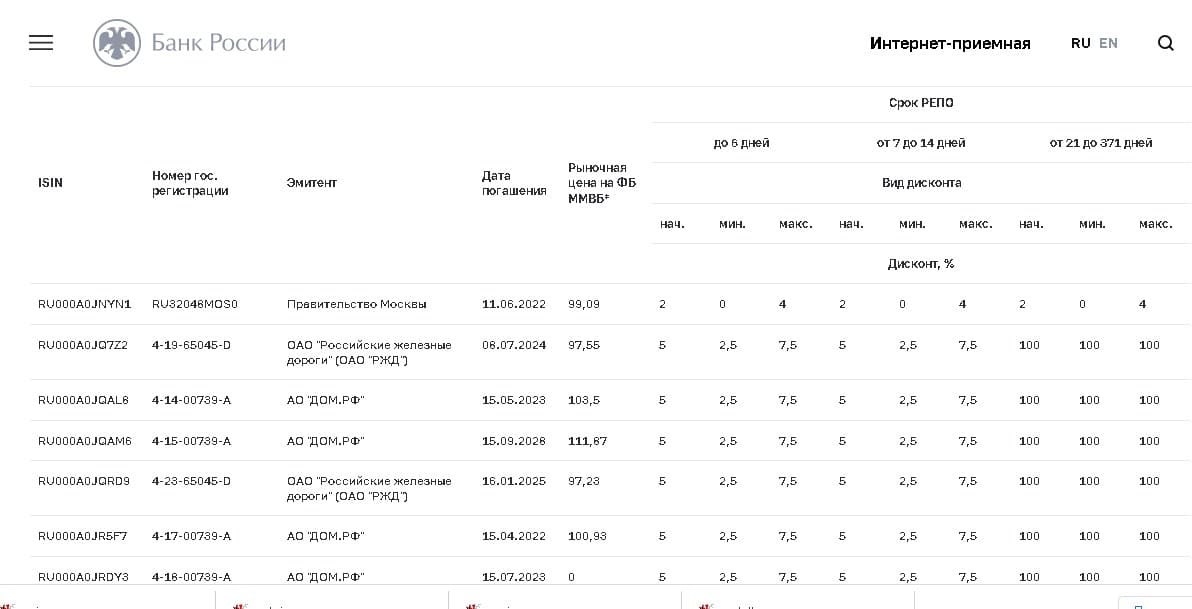

Revaluation of REPO agreement on the example of the Central Bank

Let’s look at how securities are revalued at the Bank of Russia. During the term of the REPO agreement, the bank revalues the pledged securities every day. After the revaluation, the entity sets upper and lower limits for discounts. Thanks to these calculations, the price between the securities and the total amount that the borrower will return is determined. Thanks to this, both parties avoid the obligation to pay material damages. However, the Bank of Russia is obliged to compensate the borrower’s losses if the REPO was concluded at the auction and the discount exceeded the upper limit. If the discount crosses the lower limit, the Bank returns compensation in the form of money. If the REPO was concluded by persons not at organized auctions using a number of special systems, then the Bank is no longer obligated to pay contributions in cash. First of all, the indebted bank covers the damage of the borrower with securities. Money is issued only if the bank does not have the required number of shares. There are a number of advantages to such REPOs concluded not at auctions using the Bloomberg system: revaluation is carried out by the Bank of Russia not separately for each transaction, but for the entire series of transactions made by the Bank of Russia during the day.

Mandatory terms of the REPO agreement

When concluding an agreement, both parties need to negotiate a number of conditions before concluding a deal. The prerequisites for REPO are:

- Possibility to re-evaluate the value of securities . It is necessary to include this clause in the agreement in order to avoid incidents and further problems.

- The legal status of both parties entering into a transaction . When concluding an agreement, the parties agree among themselves whether a general agreement will be concluded, or an agreement by each party in its own name.

REPO in Russia

Investment fund shares, certificates, papers, shares – everything that has some value on the stock exchange become instruments for trading on the stock exchange. REPO is concluded between a person and a legal entity, if it is: a broker, dealer, depository, clearing company, credit institution. Two individuals cannot enter into a transaction

An example of a REPO transaction

The broker and the person involved in trading entered into a forward REPO deal on 09/23/2021. During the first part of the transaction, the trader sold a package of 1,000 shares of a natural resources company to a broker and received 300,000 rubles for them. The price for each share in the first part of REPO was 300 rubles. The agreement states that the seller undertakes to buy back his shares on 10/25/2021 for 303,160 rubles. The interest for each share at the end of the month was 3.16 rubles. As a result, the trader paid only 3,160 rubles, or 12% per annum. This transaction is direct, due to the fact that the shares were returned by their owner. Based on this example, it is clear that the client sold 1,000 shares of a certain company valued at a 20% discount to hedge against a price spike. The period in which the transaction was made 24.09 – 25.10. During this period, there was a correction and the company’s shares began to cost 309 rubles per share already on 28.09. Banks of Russia carry out these operations to support cash in commercial banks. To do this, the Central Bank calls REPO a transaction for the sale and purchase of securities with a mandatory repurchase or sale on a specified date. To conduct such a transaction, there is a list of shares on the official website of the Central Bank that are ready for instant purchase / sale through REPO. It also contains the dates and results of such transactions. ready for instant purchase/sale through REPO. It also contains the dates and results of such transactions. ready for instant purchase/sale through REPO. It also contains the dates and results of such transactions.

Foydali ma’lumot bo’libdi