International manufacturing companies are increasingly aware of their environmental, social and business ethics. The ESG investment market is constantly growing, but not all investors are familiar with this concept. Let’s consider socially responsible investment in more detail, give a definition, and also provide a list of domestic and foreign companies that are of greatest interest for long-term ESG investment.

What is ESG

ESG (environmental, social, governance) investment is a form of socially responsible investment, in which priority is given to a corporation that has a minimum impact on the environment. Simply put – when investors buy shares of those companies that:

- They do not spoil the atmosphere, biosphere and noosphere.

- Treat their employees well and pay them decent wages.

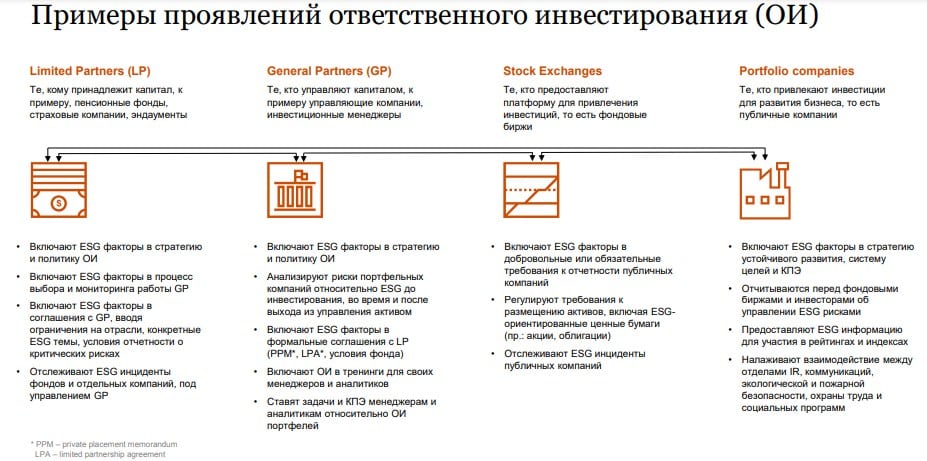

As part of the voluntary implementation of the ESG policy, companies can become members of the PRI Association. The Association undertakes to represent the interests of the partner in dialogue with various regulators, governments of other countries, etc. In return, the participating company is obliged to adhere to the principles of socially responsible investment.

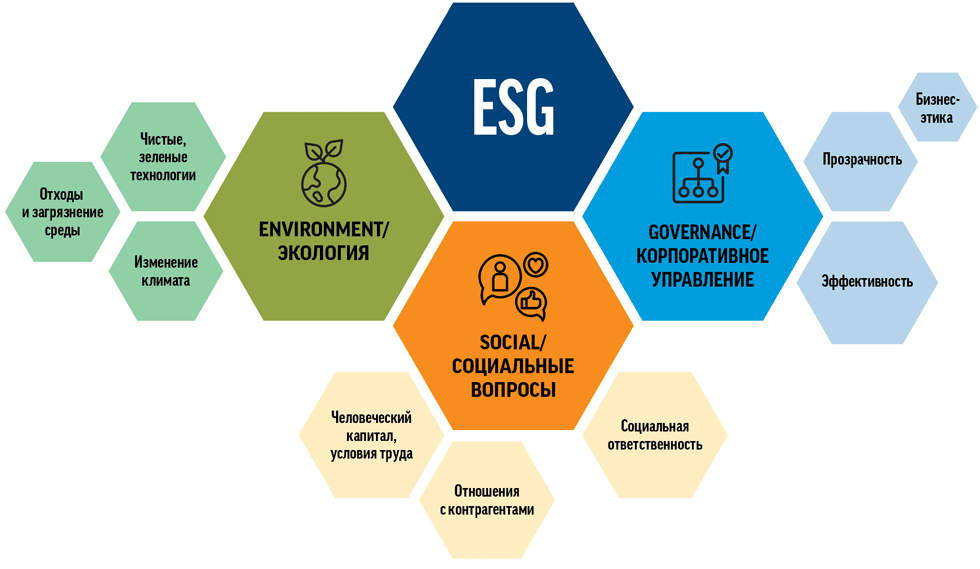

ESG components

- “E”. “Ecological cleanliness” : the level of development of environmentally friendly production technologies that have a positive impact on the environment; the company’s impact on climate change; the amount of greenhouse gases emitted, the amount of use of limited natural resources (fresh water, forest, rare animals, etc.).

- “S”. “Social component” : the level of social development; gender, sex and age composition of employees; working conditions; investments in social projects aimed at supporting continuing education and training of employees.

- “G”. “Management” (business ethics) : organizational structure, the effectiveness of company management strategies.

Environmental, Social and Corporate Governance – ESG’s Megatrend Green Investment: https://youtu.be/L2PKBl8iUR4

ESG Research

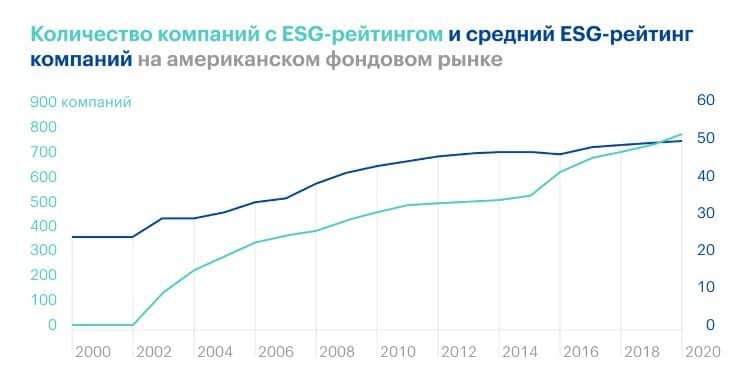

The popularity of the ESG approach to investing is supported by a wealth of research. In a written Whitepaper “From Shareholder to Stakeholder”, written by scientists at Oxford University, it is estimated that about 20% of global assets are currently managed on the basis of socially responsible investment principles. Moreover, awareness of ESG issues has grown significantly in recent years, as evidenced by the sharp rise in the significance of this trend. This trend is not unique to institutional investors: a 2015 Campden Research study found that nearly 60% of high-income US households view ESG investing as a separate form of permanent side income.

Features of ESG investing

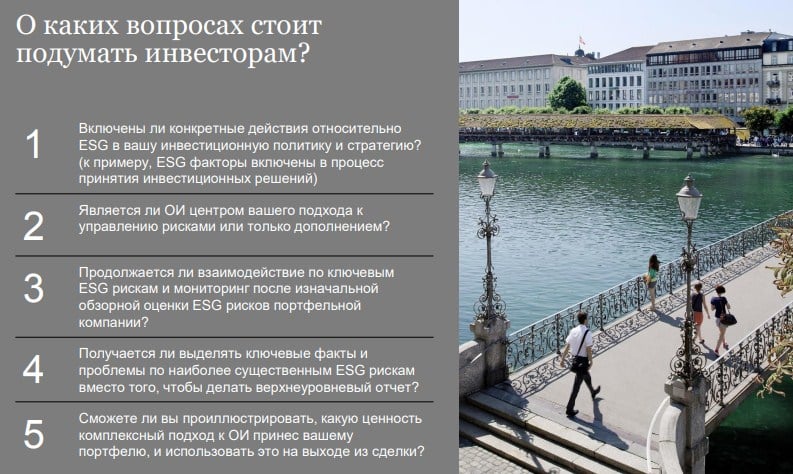

Taking ESG into account when investing can help avoid problems in the long run. For example, a mining company is least likely to be bearish if it has sound environmental policies and the press cannot portray a large manufacturing company in a negative light. Another industrial company is less likely to face strikes from workers if it treats them fairly and takes their interests into account. Problems related to management or negative environmental impact of a company can cause irreparable damage to reputation, affect profits and severely reduce the share price.

Potential risks and potential profitability

Taking ESG factors into account does not provide a 100% guarantee of success. The same can be said about the classical method of analyzing the exchange market. However, socially responsible investing criteria can increase the chances of earning a return on investment in the long term.

Domestic and foreign companies

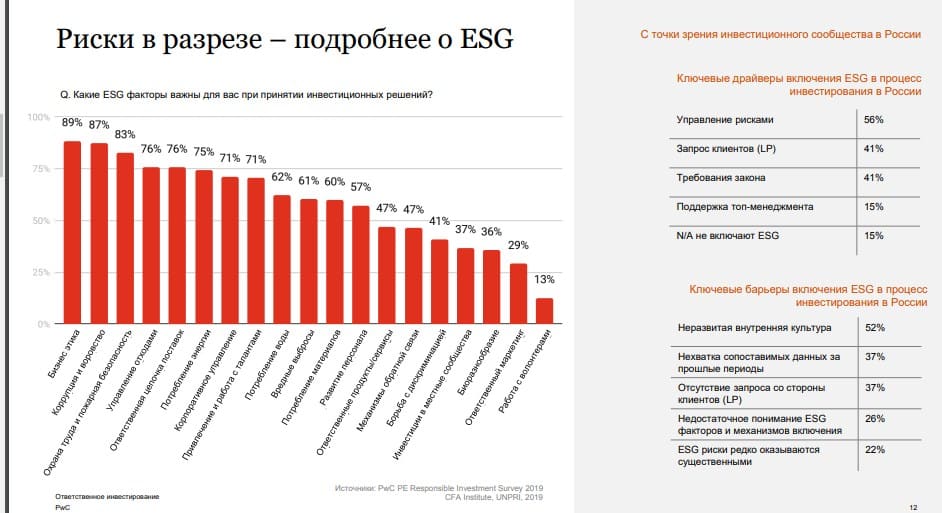

Finding the most suitable pool of companies for ESG investing is complicated by the fact that an investor needs to spend a huge amount of time analyzing charts, reading news and studying the stock market. How to determine which company is ESG and which is not? Independent funds each reporting period compile charts and ratings of companies with high potential for ESG-investing. Investors can familiarize themselves with the research of the following investment firms:

- MSCI.

- Sustainalytics.

- FTSE.

- Vigeo Eiris.

- ISS.

- TruValue Labs.

- RobecoSAM.

- RepRisk.

Rating compilers evaluate companies according to different criteria, so ratings can vary widely. The general conclusion should be built from the totality of all the information studied.

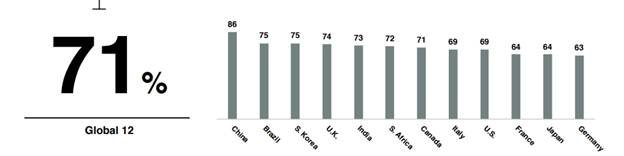

For example, a recently published study titled “2020 Edelman Trust Barometer Brands and the Coronavirus” looked at the countries with the largest number of companies that voluntarily adhere to socially responsible investing principles. China came first, Brazil came second, and South Korea came third. Based on the presented statistics, we can conclude that the East Asian and South American stock markets will soon begin to attract ESG investors.

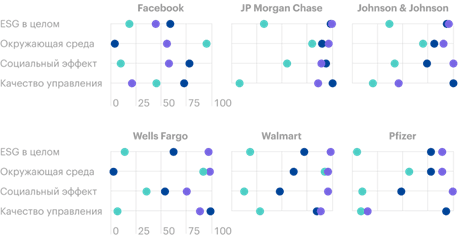

Foreign companies infographics

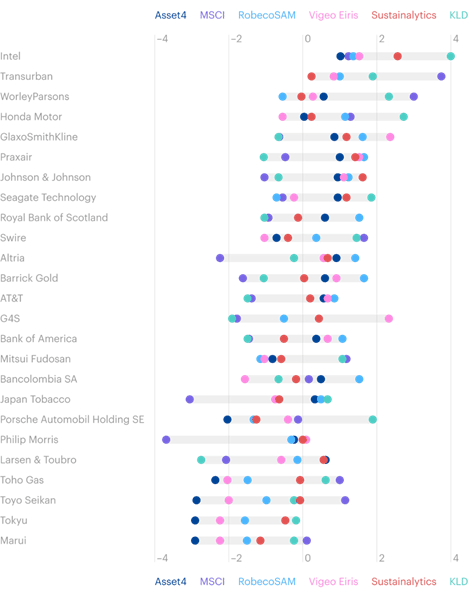

“Deviations from the normalized

ESG rating for foreign companies.” The graph shows the most popular corporations that are engaged in manufacturing activities.

Evaluation of large “giants” by various investment funds –

FTSE,

Sustainanalytics,

MSCI. The companies were assessed according to 4 criteria – “ESG in general”, “Environment”, “Social impact”, “Quality of management”.

However, you should not blindly believe such studies. They are made up of ordinary people who can be wrong. For example, a scandal erupted in 2020. The Belgian company Solvay, which dumps chemical waste directly into the sea, was in the highest line of the ESG rating according to the independent investment fund MSCI. When the fraud was exposed, Solvay’s stock crashed – and a high rating did not help. ESG investing is interesting:

ESG investing

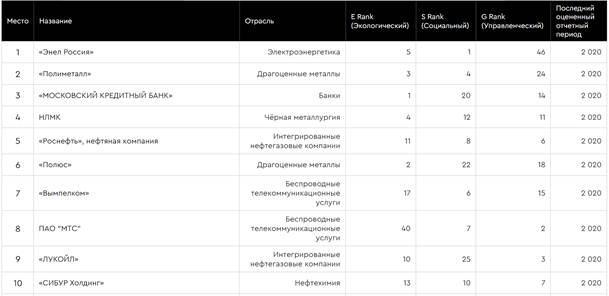

Domestic companies – ESG investments in Russia

The independent agency RAEX-Europe has compiled an ESG rating of Russian companies. The study was published on December 15th. The first 10 places were distributed among those companies that are of the greatest interest. The evaluation was carried out according to three criteria – E Rank, S Rank and G Rank.

Overview of VTB Capital Investments

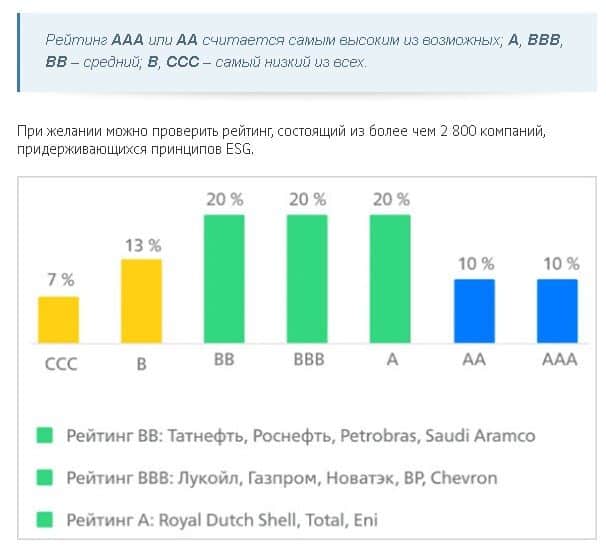

On September 27, VTB Capital launched the 11th exchange-traded mutual fund investing in the shares of Russian companies with the most successful ESG policy in the field of socially responsible investment. Trades in shares became available both during the daytime and within the evening session. Mutual investment fund VTB is ideal for passive investors and professional traders who prefer to close small deals. Analytics of potentially successful companies implementing the practice of socially responsible investment are regularly published on the official website of VTB Capital. Follow the link for more details on the reports – https://www.vtbcapital-am.ru/analitic/esgmonitor/ The reports contain small news excerpts with a summary. Users can follow the active link and read any news.At the end of each article, VTB shares its opinion on the situation, as well as forecasts for future events. The last page contains the ESG rating of Russian companies on the ABCD scale. Right now, VTB is giving preference to Lukoil, Rosneft and the Polymetal production holding.

Additionally

Where else can you find useful information? For example, at events that are regularly held as part of the development of domestic business. On November 25, 2021, top managers of the largest domestic companies and financial institutions spoke at the Vedomosti communication platform. The theme of the conference is “ESG Investments in Russia: Towards a Green Economy.”