Mutual fund (mutual investment fund) – what is it in simple words, open-ended Mutual Funds and Close-ended Mutual Funds mutual funds. Mutual investment funds are of particular interest to small and medium-sized investors. This approach makes it possible to invest in various assets and receive passive income.

- Mutual Funds: the concept and principles of operation of Mutual Funds

- Mutual Funds, ETFs, Mutual Funds: Common and Differences

- Advantages and disadvantages of joint investment

- What are mutual funds

- openness

- Asset selection

- Profitability and risks of collective investment

- How to invest

- Popular and reliable mutual funds

- Vanguard Long-Term Investment-Grade Adm (VWETX)

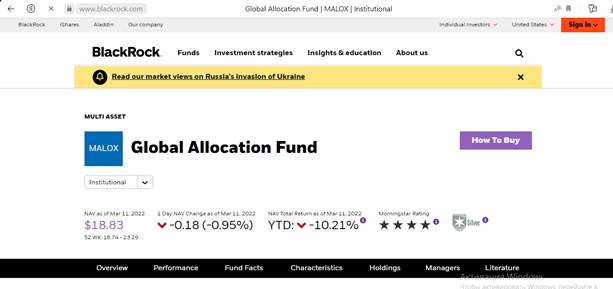

- BlackRock Global Allocation Instl (MALOX)

Mutual Funds: the concept and principles of operation of Mutual Funds

Mutual or joint investment funds were originally created with the aim of attracting cash injections into the economy from investors with an average income. Such revenues and the principle of their pooling for investment in large projects allowed the development of capitalist production in European countries as early as the 19th century.

US mutual funds date back to 1924. Similar structures appeared in Russia at the end of the 20th century.

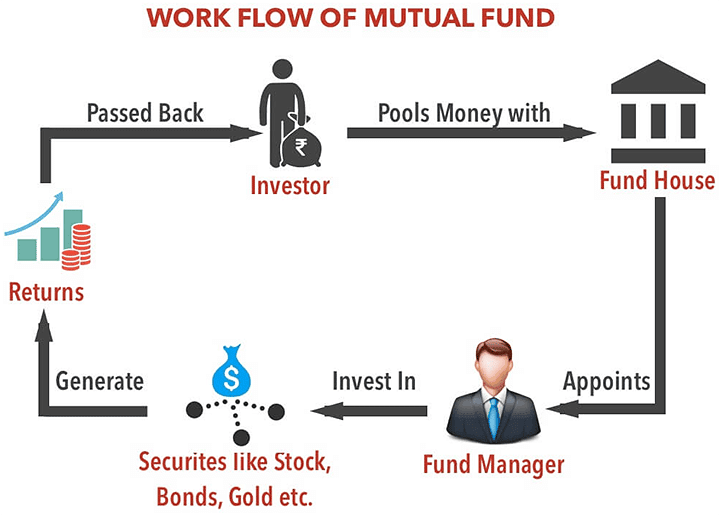

The idea and principles of interaction between an investor and an investment company are practically the same for all types of funds. Lacking the necessary knowledge and skills in the investment market, small investors entrust their financial resources to professional investment funds. They are entrusted with the development of a strategy, the conduct of organizational measures, and the timely adjustment of actions depending on market conditions.

Mutual Funds, ETFs, Mutual Funds: Common and Differences

As a first approximation, all these investment funds represent the same thing. Indeed, they are built on the same principles, but there are significant differences. Closer to the type under consideration is ETF – index mutual fund. This structure builds its activities on tracking stock indices. Despite more passive capital raising strategies, ETFs are gaining popularity overseas. This is due to greater transparency, low fees and a well-functioning index tracking mechanism.

Important! Due to the changed political and economic environment, investments in Russian mutual funds are at great risk due to the high level of uncertainty. The interaction of investment companies with the Central Bank of Russia, the main stock exchanges, allows you to conduct business as usual, but with some restrictions.

Unlike foreign investment funds, Russian ones are created only as mutual funds. The payment of dividends in this organizational and legal form is not provided. Abroad, it is permissible to create investment funds in the form of joint-stock companies. Shares of mutual funds, depending on its type (open or closed), are distributed either through the fund or through the stock exchange.

Advantages and disadvantages of joint investment

Like any process of investing money in financial instruments, joint investment has not only advantages, but also requires taking into account certain “pitfalls”. Mutual funds, in terms of common sense, have advantages:

- This type of activity of investment companies is strictly regulated by the legislation of any country . It is the funds that are responsible for the investment process. Developing an investment strategy and tactics is the task of the fund. In this case, the investor plays a passive role. By investing his funds, he only receives income. Protection of investors is provided by contractual relations with the investment company.

- The investor does not need to invest significant amounts . The value of expensive assets can be many times greater than the potential of potential small and medium-sized investors. A positive effect for them is achieved by the joint acquisition of such assets by joining an investment fund.

At the same time, investors should be prepared for the fact that the value of the asset may not justify growth expectations in the future. Like any other financial transaction, investing through mutual funds is subject to the risk of loss of income. What are mutual funds – in simple words: https://youtu.be/k4TYFq1_zv4

What are mutual funds

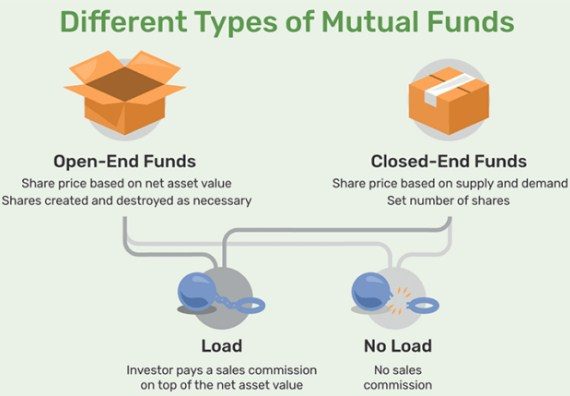

Mutual funds are divided into different types based on criteria such as

openness

There are the following types:

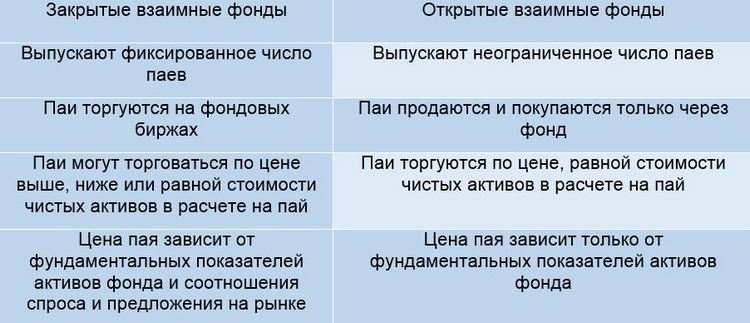

- open -ended funds regularly issue new shares, which are distributed among new investors. Depending on the collection of commissions, two subclasses are distinguished: a fund with no load (commission is not charged), a fund with a load (commission is charged). In any case, open-end investment funds can buy shares from investors. Distribution of shares goes only through the fund.

- closed -end funds issue a limited number of units, do not purchase previously distributed units. Trades are made through stock exchanges.

Note! The purchase of closed-end units is possible only through brokers or on the stock exchange. It is necessary to be careful about investing in these funds if the portfolio of assets is not fully formed.

Asset selection

Mutual funds build activity on the acquisition of various types of assets. It can be:

- Promotions . It is used to profit from the shares of large companies in the long term.

- Bonds . First of all, there is interest in investing in long-term government bonds and bonds of large corporations. However, the investor must be aware that the income will be taxed. The investment in long-term bonds of municipalities is released from the tax burden.

- Shares and bonds . Funds that work in both directions are called balanced.

- Short-term debt securities are government and corporate (taxed) or municipal (tax free). These funds are called money market mutual funds.

- Real estate for commercial, social or residential purposes .

Interesting to know! In economically developed countries, mutual investment funds are involved in maintaining public pension systems. The main contributors are pensioners, the assets used are blocks of reliable shares of large corporations with a steady income. Funds are invested for a short period, the maximum period is 5 years. Mutual funds with similar characteristics are called pension funds. Found wide distribution in the USA, Canada, Japan.

Profitability and risks of collective investment

The acquisition of any package of securities or a certain number of shares in a mutual investment fund is aimed at generating income. The investor is interested in how reliable such income is. It depends on the success of the collective investment fund itself, its strategy. Studying the previous experience of such a structure will minimize the risks of losing this income. The mutual fund investor takes a passive part in generating income, but he must have a clear understanding of the risks of loss. These risks include:

- The risk of a decrease in the value of assets. In the financial market or the real estate market, situations are not ruled out when the price of an asset can “fall”. As a result, the investor loses on the capital invested in mutual fund shares.

- Interest rate risk, i.e. decrease in interest rates, which will lead to a drop in the yield of the share.

- Liquidity risk, i.e. quality of securities. This can lead to the loss of their value.

- The risk of financial insolvency. As a result of the onset of a crisis, most depositors may demand a return on investment. This will require large financial resources, which the fund simply does not have.

Important! When evaluating the investment structure in terms of profitability and risk, one should not forget about commissions and payments to the investment fund. Different companies have different fees. You need to understand that funds with higher yields have significant costs and higher fees.

How to invest

When deciding to invest through mutual funds, you need to analyze all possible options. When purchasing units (shares) of a foreign mutual fund, it is important to understand that you will need to open an account with a foreign bank. It is also mandatory to notify the tax office. If interaction with foreign structures causes difficulties, then it is better to choose a domestic alternative.

As an example, consider the situation with the Mercury mutual fund. The structure has been recognized as a financial pyramid since 2015. In 2017, it changed its name to Mercury Global. It is still popular in some post-Soviet countries.

Popular and reliable mutual funds

Vanguard Long-Term Investment-Grade Adm (VWETX)

The group, founded by John Bogle, includes 120 mutual funds, more than 200 index funds. Particularly attractive is that the group’s funds do not charge a commission. The attractiveness of the group is obvious, it includes more than 20 million investors from 170 countries. Third position among US mutual funds. Focuses on medium-term debt securities

BlackRock Global Allocation Instl (MALOX)

It has several structural divisions. This makes it possible to invest in all types of assets. To focus only on high-yielding stocks, there is a separate fund.