Mutual fund (mutual investment fund) – o ye mun ye daɲɛ nɔgɔmanw na, Mutual Funds da wulilenw ani Mutual Funds dafalenw mutual funds. Mutuel investment funds nafa ka bon kɛrɛnkɛrɛnnenya la waridonna fitininw ni cɛmancɛw la. O fɛɛrɛ in bɛ kɛ sababu ye ka wari bila nafolo suguya caman na ani ka sɔrɔ pasif sɔrɔ.

- Mutuel Funds : Mutual Funds baara hakilina ni sariyakolow

- Mutuel Funds, ETFs, Mutuel Funds: Jɛɲɔgɔnya ani danfara

- Nafa ni dɛsɛ minnu bɛ sɔrɔ jɛ-ka-baara la

- Mutual funds ye mun ye

- da wulilen

- Nafolo sugandili

- Nafa sɔrɔli ani farati minnu bɛ sɔrɔ jɛkafɔ la

- Cogo min na ka wari bila

- Mutuel funds minnu bɛ fɔ kosɛbɛ ani minnu bɛ se ka da u kan

- Vanguard ka nafolodonni kuntaalajan-Grade Adm (VWETX) .

- BlackRock Duniya Jamanaw ka Jɛkulu (MALOX) .

Mutuel Funds : Mutual Funds baara hakilina ni sariyakolow

Mutuel walima jɛkafɔ nafolosɔrɔsiraw dabɔra fɔlɔ ni laɲini ye ka warijɛ pikiriw sama ka don sɔrɔko la ka bɔ waridonnaw fɛ minnu ka sɔrɔ hakɛ danmadɔ. O sɔrɔ suguw ani u faralen ɲɔgɔn kan sariyakolo walasa ka wari bila porozɛbaw la, o ye sira di kapitalisimu sɛnɛ yiriwali ma Erɔpu jamanaw kɔnɔ kabini san kɛmɛ 19nan na.

Ameriki ka nafolosɔrɔsiraw bɛ bɔ san 1924. O cogoya kelenw bɔra Irisi jamana na san kɛmɛ 20nan laban na.

Hakilina ni sariyakolo minnu b b n waridonna ni waridonna ka baara k n, olu ye kelen ye nafolo suguya b la. Ni dɔnniya ni seko wajibiyalenw tɛ wariko sugu la, waridonna misɛnninw b’u ka wariko nafolo kalifa wariko nafolotigiw ka nafolosɔrɔsiraw ma. U kalifalen don ni fɛɛrɛ dɔ labɛnni ye, ka jɛkulu ka fɛɛrɛw tigɛ, ani ka walew ladilan waati bɛnnen na ka kɛɲɛ ni suguya cogoyaw ye.

Mutuel Funds, ETFs, Mutuel Funds: Jɛɲɔgɔnya ani danfara

I n’a fɔ jatebɔ fɔlɔ, nin wariko nafolo ninnu bɛɛ bɛ fɛn kelen de jira. Tiɲɛ na, u jɔlen bɛ sariyakolo kelenw de kan, nka danfaraba bɛ u ni ɲɔgɔn cɛ. Min ka surun suguya la min bɛ jateminɛ na, o ye ETF – index mutual fund ye. O jɔli in b’a ka baaraw jɔ stock indices (tɔnw ka indices) nɔfɛtaama kan. Hali ni waribonw lajɛcogo fɛɛrɛw bɛ ka caya, ETFw bɛ ka bonya sɔrɔ jamana kɔkan. O bɛ bɔ kɛnɛyako caman na, musaka dɔgɔyali ani index tracking mechanism min bɛ baara kɛ ka ɲɛ.

Nafama! K’a sababu kɛ politiki ni sɔrɔko sigida caman yeli ye, waridon minnu bɛ kɛ Risi jamana ka bolomafaraw la, olu bɛ faratiba la k’a sababu kɛ dankarili caman ye. Nafolodonna tɔnw ni Irisi Banki Sentɛrɛli, n’o ye bolomafarabaw ye, olu ka jɛɲɔgɔnya b’a to i bɛ se ka jago kɛ i n’a fɔ a bɛ kɛ cogo min na tuma bɛɛ, nka ni dantigɛli dɔw ye.

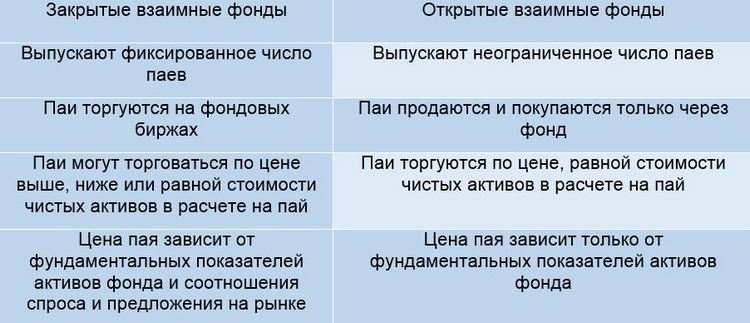

A tɛ i n’a fɔ jamana wɛrɛw ka nafolodonnafolo, Irisi taw bɛ dabɔ dɔrɔn i n’a fɔ ɲɔgɔndɛmɛ nafolo. Jatebɔsɛbɛn sarali o jɛkulu ni sariya siratigɛ la, o tɛ di. Jamana kɔkan, a bɛ se ka kɛ ka nafolodon nafolo dabɔ jɛkuluw cogo la. Mutuel funds ka jateminεw, ka kɛɲɛ n’a suguya ye (da wulilen walima a datugulen), olu bɛ tilatila nafolosɔrɔsiraw fɛ walima bourse fɛ.

Nafa ni dɛsɛ minnu bɛ sɔrɔ jɛ-ka-baara la

I n’a fɔ wari bilali taabolo bɛɛ la wariko minɛnw na, jɛkafɔ nafa tɛ dɔrɔn, nka a bɛ ɲini fana ka “jaan” dɔw jateminɛ. Mutual funds, hakili ɲuman siratigɛ la, nafaw b’u la:

- wariko tɔnw ka baara suguya in bɛ labɛn kosɛbɛ jamana o jamana sariyaw fɛ . O ye nafolo ye min bɛ wariko taabolo ɲɛnabɔ. Nafolodoncogo ni fɛɛrɛw labɛnni ye nafolosɔrɔsiraw ka baara ye. O cogo la, waridonna bɛ jɔyɔrɔba ta. Ni a y’a ka nafolo bila, a bɛ sɔrɔ dɔrɔn de sɔrɔ. Investisseurs lakanani bɛ kɛ ni bɛnkansɛbɛnw ye ni investissement sosiyete ye.

- waridonna mago t’ a la ka wari caman bila . Nafolo sɔngɔ gɛlɛnw nafa bɛ se ka caya siɲɛ caman ka tɛmɛ waridonna fitininw ni cɛmancɛw ka seko kan minnu bɛ se ka kɛ. Nafa ɲuman min bɛ sɔrɔ u la, o bɛ sɔrɔ o nafolo suguw sɔrɔli jɛlen fɛ, u kɛtɔ ka don wariko bolofara dɔ la.

O waati kelen na, waridonnaw ka kan ka labɛn walasa nafolo nafa bɛ se ka kɛ sababu ye ka bonya jigiya jira don nataw la. I n’a fɔ wariko jago tɔw bɛɛ, wari bilali ɲɔgɔndɛmɛ nafolosɔrɔsiraw fɛ, o bɛ se ka kɛ sababu ye ka sɔrɔ bɔnɛ. Mutuel funds ye mun ye – daɲɛ nɔgɔmanw na: https://youtu.be/k4TYFq1_zv4

Mutual funds ye mun ye

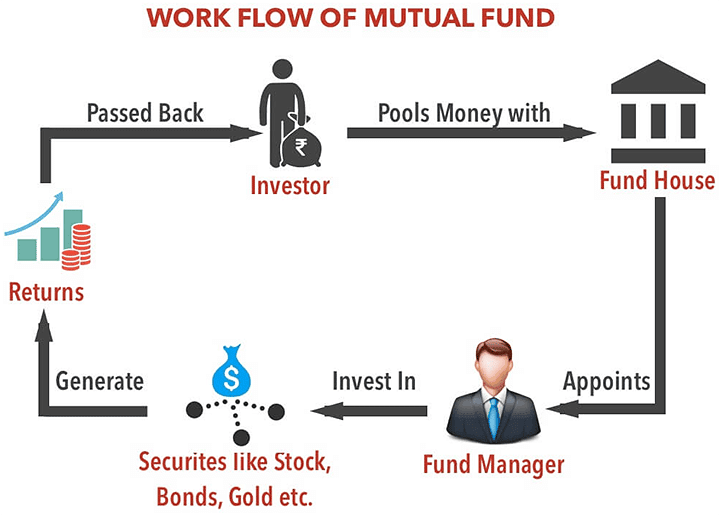

Mutual funds bɛ tila suguya wɛrɛw la ka da sariyaw kan i n’a fɔ

da wulilen

A suguyaw bɛ yen:

- nafolo dafalenw bɛ to ka jatebɔ kura bɔ, minnu bɛ tilatila waridonna kuraw cɛ. Ka da komisiyɔnw dalajɛli kan, kulu fitinin fila bɛ danfara don u ni ɲɔgɔn cɛ: nafolo min tɛ doni ye (komisiyɔn tɛ sara), nafolo min bɛ doni ta (komisiyɔn bɛ sara). A mana kɛ cogo o cogo, waridonnafolo dafalenw bɛ se ka jatew san waridonnaw fɛ. Jatebɔsɛbɛnw tilatilali bɛ tɛmɛ nafolosɔrɔsiraw dɔrɔn de fɛ.

- closed -end nafolo bɛ unit hakɛ danma bɔ , aw kana unit tilalenw san ka tɛmɛ . Jagokɛlaw bɛ Kɛ ni boursew ye.

Nɔti! Unités closed-end sanni bɛ se ka kɛ dɔrɔn brokers fɛ walima stock exchange kan. A ka kan ka an janto wari bilali la o nafolo ninnu na ni nafolomafɛnw ka portfolio ma sigi ka dafa.

Nafolo sugandili

Mutuel funds bɛ baara jɔ nafolo suguya caman sɔrɔli kan. A bɛ se ka kɛ:

- Promotions (laɲiniw ) . A bɛ kɛ ka tɔnɔ sɔrɔ sosiyetebaw ka jatew la waati jan kɔnɔ.

- Bondw . A fɔlɔ, nafa bɛ sɔrɔ ka wari bila gɔfɛrɛnaman ka bonw kɔnɔ minnu bɛ mɛn senna ani tɔnbaw ka bonw. Nka, waridonna ka kan k’a dɔn ko sɔrɔ bɛna kɛ takasi ye. Nafolo min bɛ kɛ minisiriso ka bon kuntaalajanw na, o bɛ bɔ impositi doni na.

- Jateminɛw ni bonw . Nafolo minnu bɛ baara kɛ sira fila bɛɛ fɛ, olu bɛ wele ko balansi.

- Juru minnu bɛ waati kunkurunnin kɔnɔ, olu ye gɔfɛrɛnaman ni tɔnw ye (impositi bɛ bɔ u la) walima minisiriso (takisi tɛ minnu na). O nafolo ninnu bɛ wele ko wariko suguya ɲɔgɔndan nafolo.

- Sow minnu bɛ kɛ jago, sigida walima sigiyɔrɔko kama .

A ka di ka dɔn! Jamana minnu yiriwara sɔrɔko siratigɛ la, ɲɔgɔndɛmɛ nafolosɔrɔsiraw bɛ foroba pensiyɔn siraw marali la. Dɛmɛbaga kunbabaw ye pensiyɔntigiw ye, nafolo minnu bɛ kɛ, olu ye tɔnbabaw ka bolomafaraw ye minnu bɛ se ka da u kan, ni sɔrɔ sabatilen don. Nafolo bɛ don waati kunkurunnin kɔnɔ, waati min ka ca ni san 5 ye. Mutuel fund minnu ka jogo ye kelen ye, olu b wele ko pension funds. A ye jɛnsɛnni caman sɔrɔ Ameriki, Kanada, Zapɔn.

Nafa sɔrɔli ani farati minnu bɛ sɔrɔ jɛkafɔ la

Lakanalifɛnw pake o pake walima bolomafara hakɛ dɔ sɔrɔli jɛkulu ka bolomafara kɔnɔ, o kun ye ka sɔrɔ sɔrɔ. Investisseur b’a fɛ k’a dɔn o sɔrɔ sugu bɛ se ka da a kan cogo min na. A bɛ bɔ jɛkulu ka bolomafara yɛrɛ ka ɲɛtaa la, a ka fɛɛrɛbɔ. O cogoya in ka ko kɛlen tɛmɛnenw kalanni bɛna dɔ bɔ faratiw la minnu bɛ sɔrɔ o sɔrɔ in bɔnɛni na. Mutual fund waridonna b’a sen don a la cogo la min tɛ se ka kɛ, nka a ka kan ka faamuyali jɛlen sɔrɔ bɔnɛ faratiw kan. O faratiw ye ninnu ye:

- Farati min bɛ nafolo nafa dɔgɔyali la. Nafolosɔrɔ sugu la walima dugukolofeere sugu la, ko dɔw tɛ bɔ kɛnɛ kan ni nafolo dɔ sɔngɔ bɛ se ka “bin”. O de kosɔn, waridonna bɛ bɔnɛ a ka waribon na min bɛ wari bila mutual fund ka jatew la.

- Tɔnɔ sɔrɔli farati, n’o ye. tɔnɔw dɔgɔyali, o bɛna kɛ sababu ye ka jatebɔ sɔrɔta dɔgɔya.

- Liquidité farati, n’o ye. lakanafɛnw ka ɲumanya. O bɛ se ka kɛ sababu ye k’u nafa tiɲɛ.

- Farati min bɛ wariko gɛlɛya la. Gɛlɛya dɔ daminɛni kosɔn, wari bilabaga fanba bɛ se ka ɲini ka nafa sɔrɔ u ka wari bilalen na. O bɛna wariko nafoloba de wajibiya, nafolosɔrɔsiraw tɛ minnu bolo dɔrɔn.

Nafama! Ni mɔgɔ bɛ nafolodoncogo jateminɛ nafa ni farati siratigɛ la, mɔgɔ man kan ka ɲinɛ komisiyɔnw ni wari sarataw kɔ wariko bolofara la. Sosiyete suguya wɛrɛw ka sara tɛ kelen ye. Aw ka kan k’a faamu ko nafolo minnu bɛ sɔrɔ ka caya, olu musaka ka bon kosɛbɛ, wa u sara ka ca.

Cogo min na ka wari bila

Ni aw b’a latigɛ ka wari bila ɲɔgɔn na nafolosɔrɔsiraw fɛ, aw ka kan ka sugandiliw bɛɛ sɛgɛsɛgɛ minnu bɛ se ka kɛ. Ni aw bɛ jamana wɛrɛ ka bolomafara dɔ ka unité (shares) san, a nafa ka bon aw k’a faamu ko aw bɛna a ɲini ka jatebɔsɛbɛn da wuli jamana wɛrɛ ka banki dɔ la. A wajibiyalen don fana ka impositi biro ladɔnniya. Ni jɛɲɔgɔnya ni jamana wɛrɛw ka sigikafɔw bɛ gɛlɛyaw lase mɔgɔ ma, o tuma na, a ka fisa ka jamana kɔnɔ fɛɛrɛ wɛrɛ sugandi.

Misali la, aw ye ko kɛlenw lajɛ ni Mɛkisiki ka bolofara ye. O jɔli in ye wariko piramidi ye kabini san 2015. 2017 sàn, a y’a tɔgɔ Yɛlɛma k’a Kɛ Mercury Global ye. A bɛ fɔ hali bi jamana dɔw la minnu bɛ Soviyetiki kɔfɛ.

Mutuel funds minnu bɛ fɔ kosɛbɛ ani minnu bɛ se ka da u kan

Vanguard ka nafolodonni kuntaalajan-Grade Adm (VWETX) .

O kulu in, min sigira sen kan John Bogle fɛ, o kɔnɔ, 120 bɛ yen minnu bɛ ɲɔgɔn dɛmɛ, n’o ye index fund 200 ni kɔ ye. Kɛrɛnkɛrɛnnenya la, min bɛ mɔgɔ ɲɛnajɛ, o ye ko kulu ka nafolo tɛ komisiyɔn ɲini. Jɛkulu in ka mɔgɔw samali ye kɛnɛ kan, a kɔnɔ, waridonna miliyɔn 20 ni kɔ bɛ yen ka bɔ jamana 170 la. Jyɔrɔ sabanan Ameriki ka nafolosɔrɔsiraw cɛma. A bɛ sinsin juruw kan minnu bɛ waati cɛmancɛ la

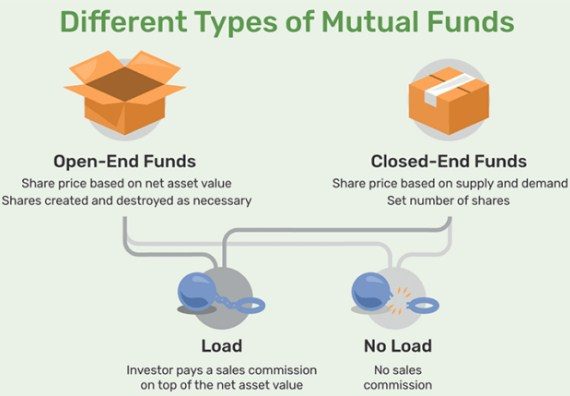

BlackRock Duniya Jamanaw ka Jɛkulu (MALOX) .

A bɛ ni jɔli-jatebɔ-yɔrɔ damadɔ ye. O b’a to wari bɛ se ka don nafolo suguya bɛɛ la. Walasa ka sinsin aksidanw dɔrɔn kan minnu bɛ nafa caman sɔrɔ, nafolosɔrɔsiraw danfaralen bɛ yen.