BPIFs – what are they in simple terms and how to invest in exchange-traded mutual funds, how to buy on the Moscow Exchange. Starting in 2020, people are increasingly interested in investing to ensure a carefree old age or simply increase their investments, but investments require certain knowledge. In this article we are talking about BPIFs, we will analyze the advantages and disadvantages of the instrument, and also answer frequently asked questions.

- What is BPIF in simple words

- Peculiarities

- How BPIF works

- How to buy a BPIF

- Step-by-step instruction

- What are the costs and commissions

- Selecting an ETF

- Kinds

- Pros and cons of BPIFs

- Do I need to pay taxes with BPIF

- Is it possible for the military, police and civil servants to invest in BPIF

- BPIFs and conditions at the beginning of 2022

- Exchange-traded mutual funds On the Moscow Exchange

- Tinkoff

- Sberbank

- VTB

- Questions and answers

What is BPIF in simple words

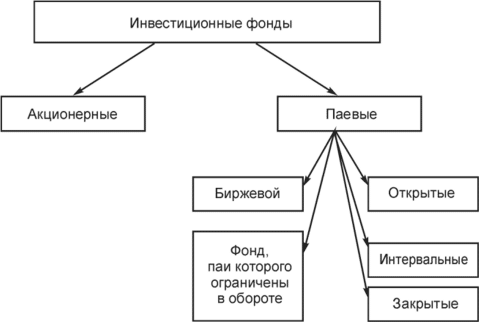

The abbreviation of BPIF is an exchange-traded investment fund. This is an instrument, the main purpose of which is to provide higher returns compared to deposits in conventional banking products. It is suitable for both experienced investors and beginners. On the exchange you can find BPIF and ETF funds, they have one significant difference:

- ETFs are funds that are registered outside the Russian Federation, but they are available for purchase in Russia;

- BPIF is no different from its predecessor, except that such funds are registered only in the Russian Federation, the portfolio may include securities of companies from other countries.

It is also worth noting that there is a mutual fund – a mutual investment fund that is not traded on stock exchanges. The purchase of this type of asset can be made directly from the management company. You don’t even

need a brokerage account for this. https://articles.opexflow.com/investments/pif.htm But BPIF securities can be purchased directly on the stock exchange. It is enough for an investor to enter the stock exchange directly or through intermediaries, for example, through

Tinkoff Investments , select a fund and purchase the required number of shares. BPIFs may include: shares of profitable companies, currency, precious metals, such as gold, as well as other property. Ordinary mutual fund or exchange mutual fund – what to choose and how one differs from the other: https://youtu.be/fpoDFrnvQDo

Peculiarities

BPIFs are not subject to active management, since management companies hold shares for a long time, so speculation is out of the question. Usually the structure of the fund’s portfolio does not change for ten years. The purchase of fund units makes it possible to invest in assets that are not available on exchange markets separately. The founders of the funds make regular reports, so there is no doubt about transparency. Also, in most exchange markets, you can track the structure of the portfolio in real time.

How BPIF works

The founders of BPIFs acquire assets with the funds that investors have invested in the fund by buying shares. The latter, in turn, becomes a co-owner of all securities in the portfolio. A share is the same security as an ordinary share. Unit prices are formed automatically, this happens every day, with the exception of weekends. They depend on the value of the assets that are in the fund’s portfolio. For example, if the securities of one of the companies have risen sharply, then the share will rise in price, this also happens in the opposite direction. BPIF and ETF – what are the differences, similarities and differences, pros and cons: https://youtu.be/4wPpZM_JmCs

How to buy a BPIF

Before you start buying any assets, you need to open a brokerage account. The easiest way to do this is through large online banks, which provide for the possibility of investing in securities, for example:

- Tinkoff;

- Alfa Bank;

- Sberbank.

https://articles.opexflow.com/brokers/brokerskij-schet.htm Of course, there are other banks, but these are the most popular in the Russian Federation. You can also open a brokerage account directly, for example, on the Moscow Exchange. Sberbank exchange-traded mutual funds: is it worth investing in SBMX, SBSP, SBRB, SBCB and SBGB mutual funds: https://youtu.be/DBRrF-z-1do

Step-by-step instruction

Using the example of the

Tinkoff Investments application https://www.tinkoff.ru/invest/, we will analyze how you can purchase fund units. To purchase, register in the application, and then go to the “What to buy” section, it is located at the very bottom of the program.

What are the costs and commissions

Do not forget about commissions, as brokers provide services on a paid basis. Depending on the selected asset, the commission may vary slightly, but when buying a large number of shares, the investor will feel the difference, so you need to pay attention to it. Three main costs can be distinguished, in addition to the cost of the share.

- broker commission . Usually it is minimal and does not exceed 0.1-0.3%, since brokers are interested in cooperation with individuals.

- Covering the costs of an exchange-traded fund . Does not exceed 0.1% of the average yield per year.

- Commission established by the founders . It is needed so that the management company can manage assets.

The interest that goes towards the fund’s expenses and management is usually included in the price of the share. They are calculated daily, depending on the value of the total portfolio.

About BPIFs on MOEX https://www.moex.com/s190

Selecting an ETF

There are many approaches to choosing a fund, almost all of them are closely related to the goals of investments, since they have a different level of risk. Specific goals will help you choose the right ETF. For example, balanced funds are resilient to falling stocks because they have assets in their portfolio that can compensate for falls. Such a fund can be called conservative, since the risks and returns are low. Ideal to cover inflation and capitalize a bit. Risk funds that consist of shares are suitable for long-term goals. Most stocks rise over a distance, but can be erratic for short periods of time. It is equally important to choose the currency in which to invest in the fund. In Russia, they usually invest in the ruble, but the long-term perspective depreciates the national currency faster than the euro or US dollar. There are two main rules:

- the assets of the fund should not depend on each other;

- the commission for buying and selling should be minimal.

After buying an asset, it is better to forget about it, since there is no point in watching the growth or fall of shares. Once a month or even less often, you can

diversify your portfolio .

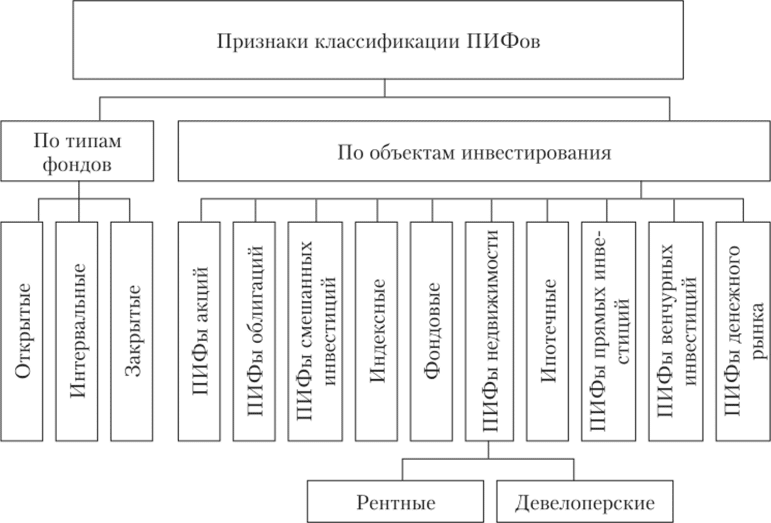

Kinds

There are three main types of BPIFs.

- Open . This type is suitable for beginners, you can buy and sell an asset during business hours without restrictions. It is considered the least risky, since the investor has maximum control over his investments.

- Interval . Buying and selling is allowed only at certain intervals, usually several periods throughout the year, and the period does not exceed two weeks. The risks and rewards are greater than the open view, because the founders can manage the funds and not worry that illiterate investors will start to panic during a correction or a short-term drop.

- Closed . This type implies a long-term investment – at least for several years. Assets cannot be managed in any way until the fund expires.

Pros and cons of BPIFs

Due to the number of BPIFs, an investor can immediately invest in a wide range of assets. But every tool has its advantages and disadvantages. The positives include:

- the ability to buy securities that are not on the Russian market or stock exchanges;

- convenient to diversify your portfolio;

- mutual funds are not subject to taxes on dividends of Russian companies;

- the cost of one share of domestic BPIFs can be several rubles, which allows you to enter with minimal investment;

- you can buy foreign assets through BPIFs, this will save you from unnecessary problems with tax returns;

- the opportunity to receive a tax deduction, subject to the availability of an individual investment account.

The yield of Russian BPIFs may be higher than foreign ETFs, whose portfolio is similar. The disadvantages include:

- some funds are not transparent enough;

- large commissions initiated by the founders;

- costs associated with dividend tax;

- sometimes asset prices in funds lag behind real ones.

Do I need to pay taxes with BPIF

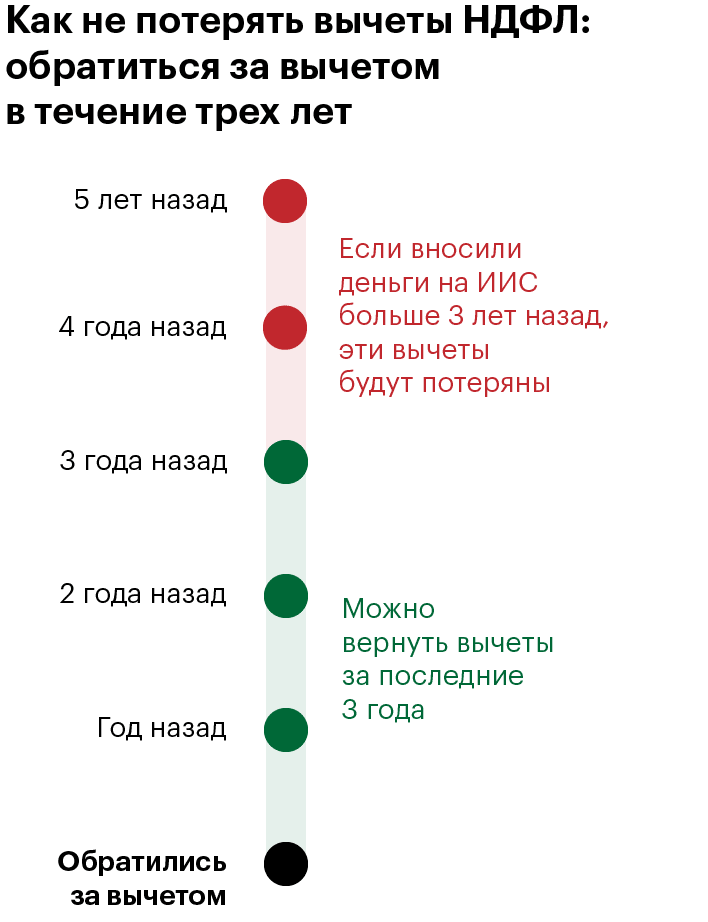

Taxes on dividends, shares and coupon payments are paid by the fund management company. The investor is obliged to pay tax only on the income that he receives during the sale of securities, that is, on the difference between the sale and purchase prices. If you keep funds in the BPIF for more than three years, then the investor is exempt from paying tax on tax benefits. To receive a tax break, you must hold shares for at least three years, provided that the income was lower than three million rubles annually. That is, if an investor has earned less than nine million rubles in three years, then he is exempt from paying tax on a tax deduction.

Is it possible for the military, police and civil servants to invest in BPIF

Employees of law enforcement agencies of the Russian Federation can invest in BPIFs, which include only domestic assets. But there is a ban on foreign funds, which is spelled out in the law “On Combating Corruption”. It is worth noting that not all positions fall under this ban, so it is better to familiarize yourself with the list.

BPIFs and conditions at the beginning of 2022

Today there are more and more

brokers who want to find permanent investors. If earlier you had to stand in huge queues to buy a security, now everything happens online by pressing the “Buy” button. Each broker offers its own conditions and has unique features.

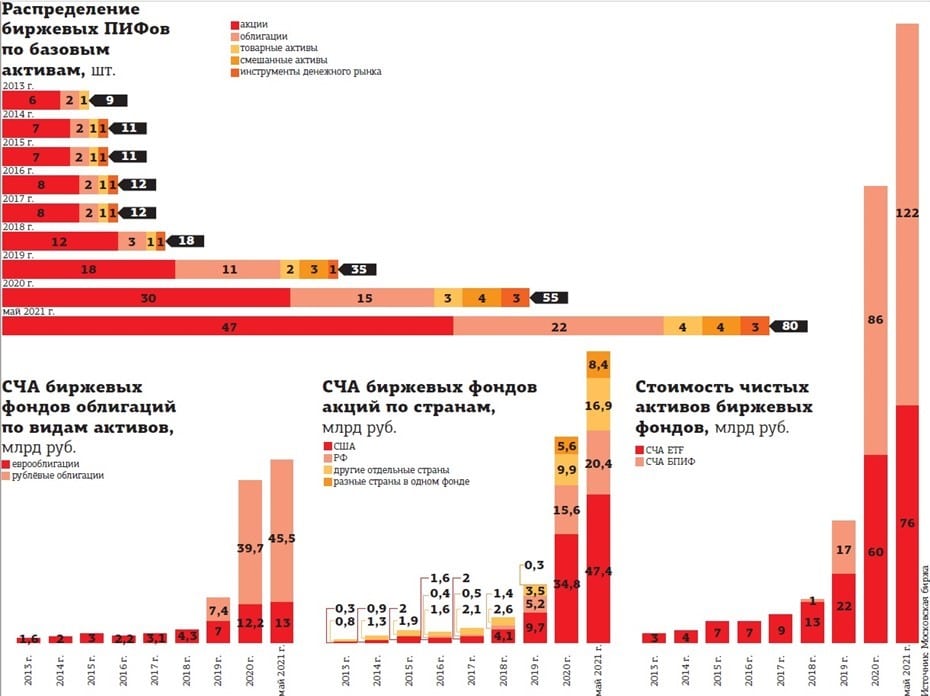

Exchange-traded mutual funds On the Moscow Exchange

Moscow Exchange at the time of 2022 offers the following BPIFs https://www.moex.com/msn/etf. This helps beginners understand how it works. You can start investing in funds on the Moscow Exchange from 100 rubles.

Tinkoff

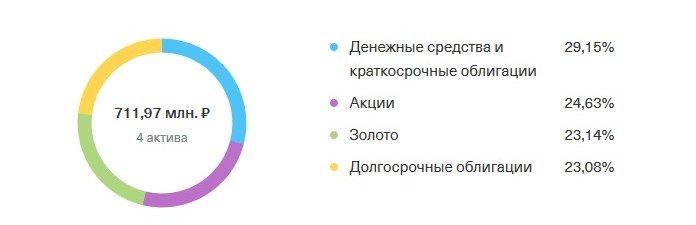

Tinkoff has several popular BPIFs, link https://www.tinkoff.ru/invest/tinkoff-capital/, they guarantee sustainable portfolio growth over time. You can purchase, for example, shares of the RUB Eternal Portfolio fund, which is completely exempt from the broker’s commission.

Sberbank

Sberbank offers many BPIFs https://www.sberbank.ru/ru/person/investments/pifs with any level of risk. Ideal for novice investors. The entry threshold is 1 share, and the cost starts from a few rubles. You can buy or sell assets instantly during business hours, and commissions and costs do not exceed 1 percent.

VTB

The bank manages more than 20 BPIFs https://broker.vtb.ru/services/pif/, updates the price of the asset every day at no cost, and also protects savings from inflation. The minimum entry threshold is 1000 rubles. The risk-moderate fund has returned more than 12 percent over the past year. BPIFs on the Moscow Exchange are in the screenshot below, and the full list for 2022 is available at https://www.moex.com/msn/etf: MOEX

Only stocks, bonds, currency, property and certain other assets can be included in an exchange-traded mutual fund. A foreign fund cannot include a BPIF, or be a fund that is registered outside the Russian Federation.

Questions and answers

What happens if the founders of the fund go bankrupt? An investment fund is not the property of a management company. If the company goes bankrupt, then it will not be possible to recover funds from the BPIF, all funds will be reimbursed to the owners, the fund will cease to exist, and the founders will lose their license.

Should I sell shares if the price of the fund falls? This question is faced by every newcomer who starts investing in mutual funds. The fact is that the point of most funds is long-term returns, so if the risks are small, then this is just a short-term correction. In any case, whether to sell or not is an individual decision of each investor, it does not hurt to understand what exactly is falling in price, conduct analytics, and only after these manipulations make a final decision.

Is it possible to build a portfolio on my own so as not to pay extra fees to the fund? If there is time and opportunity, then no one forbids you to form a portfolio on your own. However, this is not always profitable, since management companies have qualified specialists who work on the portfolio all the time.

Can BPIF guarantee profitability? Firstly, it is simply impossible, because no one knows what will happen to the assets tomorrow. And secondly, it is prohibited by law.