BPIFw – u ye mun ye kuma nɔgɔmanw na ani wari bila cogo min na fɛnw falenfalen-falen-falen-falenw na, sanni kɛcogo Moskow Exchange kan. K’a daminɛ san 2020 na, mɔgɔw b’u mago don ka taa a fɛ ka wari bila walasa ka kɔrɔya haminanko sɔrɔ walima ka dɔ fara u ka wari bilalenw kan dɔrɔn, nka wari bilali bɛ dɔnniya dɔw de wajibiya. Nin barokun in kɔnɔ an bɛ kuma BPIFw kan, an bɛna minɛn in nafa n’a dɛsɛw sɛgɛsɛgɛ, ka ɲininkaliw fana jaabi minnu bɛ kɛ tuma caman na.

- BPIF ye mun ye daɲɛ nɔgɔmanw na

- Kɛrɛnkɛrɛnnenya la

- BPIF bɛ baara kɛ cogo min na

- BPIF sancogo

- Kalansen minnu bɛ kɛ senfɛ-senfɛ

- O musakaw ni komisiyɔnw ye mun ye

- ETF dɔ sugandili

- A suguyaw

- BPIFw nafa ni u dɛsɛ

- Yala ne ka kan ka takasi sara ni BPIF ye wa

- Yala a bɛ se ka kɛ sɔrɔdasiw, polisiw ani jamana baarakɛlaw ka wari bila BPIF la wa

- BPIFw ni sariyaw san 2022 daminɛ na

- Exchange-traed mutual funds Moskow ka fɛnw falen-falen

- Tinkoff ye

- Sberbank ye

- VTB ye

- Ɲininkaliw ni jaabiw

BPIF ye mun ye daɲɛ nɔgɔmanw na

BPIF tɔgɔ surunyalen ye warimarayɔrɔ ye min bɛ jago kɛ ni wari falenfalen ye. Nin ye baarakɛminɛn ye, min kunba ye ka nafa caman di ni i ye a suma ni wari bilalenw ye banki ka fɛn dilannenw na. A bɛnnen don waridonna ŋanaw ni waridon daminɛbagaw bɛɛ ma. Exchange kan i bɛ se ka BPIF ni ETF nafolo sɔrɔ, danfaraba kelen bɛ u ni ɲɔgɔn cɛ:

- ETFw ye nafolo ye minnu tɔgɔ sɛbɛnna Irisi jamana kɔkan, nka u bɛ sɔrɔ ka san Irisi jamana na;

- BPIF tɛ danfara bɔ a ɲɛfɛ, fo n’a y’a sɔrɔ o nafolo suguw sɛbɛnnen don Irisi jamana dɔrɔn de la, portfolio bɛ se ka kɛ jamana wɛrɛw ka tɔnw ka lakanafɛnw ye.

A ka kan fana k’a dɔn ko jɛ-ka-baara bɛ yen – jɛ-ka-baara bolofara min tɛ jago kɛ boursew la. Nin nafolo suguya in sanni bɛ se ka kɛ ka ɲɛsin ɲɛmɔgɔyaso ma. I mago tɛ hali

brokerage jatebɔsɛbɛn na o ko la. https://articles.opexflow.com/investments/pif.htm Nka BPIF ka lakanafɛnw bɛ se ka san k’a ɲɛsin aksidan ma. A bɛ bɔ waritigi dɔ bolo ka don bolomafara kɔnɔ k’a ɲɛsin a yɛrɛ ma walima cɛmancɛlamɔgɔw fɛ, misali la,

Tinkoff Investments fɛ , ka bolofara dɔ sugandi ani ka bolomafara hakɛ wajibiyalen san. BPIFw b se ka k: tɔnw ka tɔnw ka jatew, wari, nɛgɛ nafamaw, i n’a fɔ sanu, ani nafolo wɛrɛw. Fonds mutuel ordinaire ou mutuel de changement – i ka kan ka min sugandi ani cogo min na kelen ni tɔ kelen tɛ kelen ye: https://youtu.be/fpoDFrnvQDo

Kɛrɛnkɛrɛnnenya la

BPIFw tɛ ɲɛmɔgɔya waleyali kɔrɔ, bawo ɲɛmɔgɔyasobaw bɛ jatebɔ kɛ waati jan kɔnɔ, o la, hakilinata tɛ se ka kɛ. A ka c’a la, nafolosɔrɔsiraw ka bolofara jɔcogo tɛ Changé san tan kɔnɔ. Nafolosɔrɔsiraw sanni bɛ kɛ sababu ye ka wari bila nafolomafɛnw na minnu tɛ sɔrɔ wari falenfalen suguw la u danma. Nafolo in sigibagaw bɛ kunnafoniw di tuma bɛɛ, o la, siga t’a la kɛnɛyako la. Ani fana, wari falen-falen sugu fanba la, i bɛ se ka portfolio sigicogo lajɛ waati yɛrɛ la.

BPIF bɛ baara kɛ cogo min na

BPIFw sigibagaw bɛ nafolo sɔrɔ ni nafolo ye, waridonnaw ye min bila nafolosɔrɔsiraw la, u kɛtɔ ka jatebɔw san. O laban in fana bɛ kɛ lakanafɛnw bɛɛ tigi ye min bɛ portfolio kɔnɔ. Jatebɔ ye lakana kelen ye ni jatebɔsɛbɛn gansan ye. Unit sɔngɔw bɛ sigi sen kan u yɛrɛma, o bɛ kɛ don o don, fo dɔgɔkun labanw. U bɛ bɔ nafolomafɛnw nafa la minnu bɛ nafolosɔrɔsiraw ka bolomafara kɔnɔ. Misali la, ni sosiyete dɔ ka lakanafɛnw wulila kosɛbɛ, o tuma na, jatebɔ bɛna wuli sɔngɔ la, o fana bɛ kɛ sira wɛrɛ fɛ. BPIF ni ETF – danfara jumɛnw bɛ u ni ɲɔgɔn cɛ, u ni ɲɔgɔn cɛ ani u tɛ kelen ye, u nafa ni u dɛsɛ: https://youtu.be/4wPpZM_JmCs

BPIF sancogo

Sani i ka nafolo fɛn o fɛn san, i ka kan ka jatebɔsɛbɛn dɔ da wuli. O kɛcogo nɔgɔman ye ɛntɛrinɛti bankibaw ye, minnu bɛ se ka kɛ sababu ye ka wari bila lakanafɛnw na, misali la:

- Tinkofu ye;

- Alfa Banki ye;

- Sberbank ye.

https://articles.opexflow.com/brokers/brokerskij-schet.htm Tiɲɛ don, banki wɛrɛw bɛ yen, nka ninnu de ka di kosɛbɛ Risi jamana kɔnɔ. Aw bɛ se fana ka brokerage jatebɔsɛbɛn da wuli k’a ɲɛsin a yɛrɛ ma, misali la, Moskow Exchange kan. Sberbank ka fɛnw falen-falen-jago-tɔnw : yala a nafa ka bon ka wari bila SBMX, SBSP, SBRB, SBCB ani SBGB ka nafolosɔrɔsiraw la: https://youtu.be/DBRrF-z-1do

Kalansen minnu bɛ kɛ senfɛ-senfɛ

Ni an bɛ baara kɛ ni

Tinkoff Investments ka baarakɛminɛn misali ye https://www.tinkoff.ru/invest/, an bɛna sɛgɛsɛgɛli kɛ aw bɛ se ka nafolosɔrɔsiraw san cogo min na. Walasa ka sanni kɛ, i tɔgɔ sɛbɛn application kɔnɔ, ka tila ka taa “Mun san” yɔrɔ la, a bɛ sɔrɔ porogaramu jukɔrɔ yɛrɛ.

O musakaw ni komisiyɔnw ye mun ye

Aw kana ɲinɛ komisiyɔnw kɔ, bawo dilanbagaw bɛ baara kɛ ni sara ye. Ka kɛɲɛ ni nafolo sugandilen ye, komisiyɔn bɛ se ka ɲɔgɔn ta dɔɔnin, nka ni i bɛ jatebɔ caman san, waritigi bɛna danfara dɔn, o la i ka kan k’i janto a la. Musaka kunba saba bɛ se ka faranfasi, ka fara jatebɔ musaka kan.

- broker komisiyɔn . A ka c’a la, a ka dɔgɔn, wa a tɛ tɛmɛ 0,1-0,3% kan, bawo dilanbagaw b’u mago don jɛkafɔ la ni mɔgɔ kelen-kelen bɛɛ ye.

- Ka wari falen-falen nafolomafɛnw musakaw dafa . A tɛ tɛmɛ 0,1% kan sɔrɔta hakɛ danmadɔ la san kɔnɔ.

- Komisiɔn min sigira senkan a sigibagaw fɛ . A mago bɛ a la walasa ɲɛmɔgɔyaso ka se ka nafolo mara.

Tɔnɔ min bɛ taa nafolosɔrɔsiraw musakaw ni a ɲɛnabɔli la, a ka c’a la, o bɛ don jatebɔ sɔngɔ la. U bɛ jate don o don, ka kɛɲɛ ni portfolio bɛɛ nafa ye.

BPIFw ko la MOEX kan https://www.moex.com/s190

ETF dɔ sugandili

Fɛɛrɛ caman bɛ yen ka ɲɛsin nafolosɔrɔsiraw sugandili ma, a bɛ se ka fɔ ko u bɛɛ bɛ tali kɛ wariko laɲiniw na kosɛbɛ, bawo u ka farati hakɛ tɛ kelen ye. Laɲini kɛrɛnkɛrɛnnenw bɛna aw dɛmɛ ka ETF ɲuman sugandi. Misali la, nafolo balansi bɛ se ka muɲu ni aksidanw binna bawo nafolo dɔw b’u ka bolomafara kɔnɔ minnu bɛ se ka binni musakaw sara. O nafolo sugu bɛ se ka wele ko conservateur, bawo faratiw ni nafaw ka dɔgɔ. Ideal ka inflation dafa ani ka capitalize dɔɔnin. Farati nafolo minnu bɛ kɛ ni jatebɔw ye, olu bɛnnen don kuntilenna kuntaalajanw ma. Stock fanba bɛ wuli yɔrɔjan, nka a bɛ se ka kɛ fɛn ye min tɛ wuli ka bɔ a nɔ na waati kunkuruni kɔnɔ. A nafa ka bon o cogo kelen na ka wari sugandi min bɛ se ka wari bila nafolosɔrɔsiraw la. Irisi jamana na, a ka c’a la, u bɛ wari bila ruble la, nka waatijan jateminɛ bɛ jamana wari nafa dɔgɔya joona ka tɛmɛ ɛrɔ walima Ameriki dɔrɔmɛ kan. Sariyaba fila de bɛ yen:

- bolofara ka nafolo man kan ka da ɲɔgɔn kan ;

- komisiyɔn min bɛ sɔrɔ sanni ni feereli la, o ka kan ka kɛ fitinin ye.

Nafolo sanni kɔfɛ, a ka fisa i ka ɲinɛ o kɔ, bawo nafa foyi t’a la ka jatew bonya walima u bincogo kɔlɔsi. Siɲɛ kelen kalo kɔnɔ walima hali ka tɛmɛ o kan, i bɛ se

ka i ka portfolio caman kɛ .

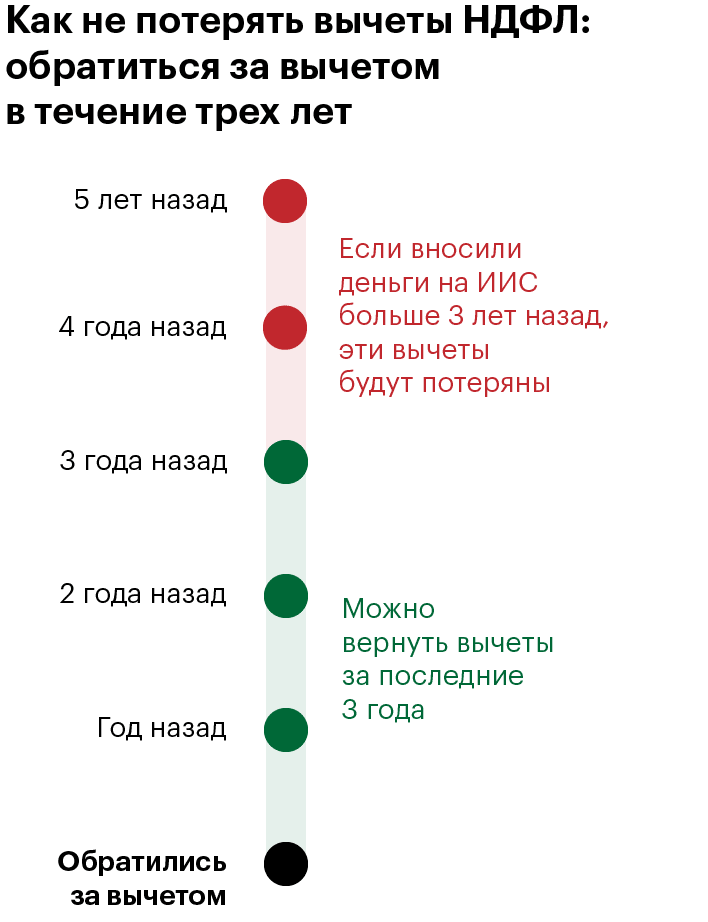

Yala ne ka kan ka takasi sara ni BPIF ye wa

Takisi minnu bɛ bɔ jatebɔ, jatebɔ ani kupon sarali la, olu bɛ sara nafolo mara jɛkulu fɛ. Investisseur wajibiyalen don ka impositi sara dɔrɔn a bɛ sɔrɔ min sɔrɔ lakanafɛnw feereli senfɛ, o kɔrɔ ye ko danfara min bɛ feereli ni sanni sɔngɔw cɛ. Ni i ye nafolo mara BPIF la ka tɛmɛ san saba kan, o tuma na, waridonna tɛ se ka impositi sara impositi nafaw la. Walasa ka impositi dɔgɔyali sɔrɔ, i ka kan ka jatebɔsɛbɛnw mara san saba ni kɔ, n’a sɔrɔla ko sɔrɔ tun ka dɔgɔ ni miliyɔn saba ye san o san. O kɔrɔ ye ko ni waridonna dɔ ye wari sɔrɔ min ma se miliyɔn kɔnɔntɔn ma san saba kɔnɔ, o tuma na, a bɛ bɔ impositi sarali la impositi dɔ bɔli la.

Yala a bɛ se ka kɛ sɔrɔdasiw, polisiw ani jamana baarakɛlaw ka wari bila BPIF la wa

Irisi jamana sariyasunba ka baarakɛlaw bɛ se ka wari bila BPIFw la, minnu bɛ jamana kɔnɔ nafolo dɔrɔn de la. Nka dankarili bɛ jamana wɛrɛw ka nafolo la, o min sɛbɛnnen bɛ sariya kɔnɔ min tɔgɔ ye ko “On Commbating Corruption”. A ka kan ka fɔ ko jɔyɔrɔ bɛɛ tɛ don nin dankarili in na, o la a ka fisa i k’i yɛrɛ dɔn lisi in na.

BPIFw ni sariyaw san 2022 daminɛ na

Bi,

dilanbaga minnu b’a fɛ ka waridonna banbaliw sɔrɔ, olu bɛ ka caya ka taa a fɛ. Ni fɔlɔ i tun ka kan ka jɔ layidu belebelebaw la walasa ka lakana san, sisan fɛn bɛɛ bɛ kɛ ɛntɛrinɛti kan ni “San” butɔn digilen ye. Broker kelen-kelen bɛɛ b’a ka cogoyaw di ani a ka fɛn kɛrɛnkɛrɛnnenw b’a la.

Exchange-traed mutual funds Moskow ka fɛnw falen-falen

Moscow Exchange waati la san 2022 bɛ nin BPIF ninnu di https://www.moex.com/msn/etf. O bɛ daminɛbagaw dɛmɛ a ka baara kɛcogo faamuya. Aw bɛ se ka daminɛ ka wari bila nafolo la Moskow Exchange la ka bɔ 100 rubles la.

Tinkoff ye

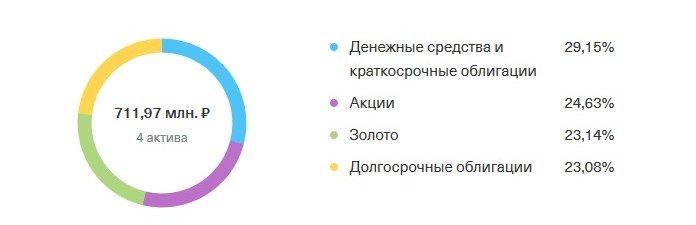

Tinkoff ka BPIF caman bɛ yen minnu bɛ fɔ kosɛbɛ, link https://www.tinkoff.ru/invest/tinkoff-capital/, u bɛ garanti di portfolio yiriwali sabatili ma waati kɔnɔ. Aw bɛ se ka misali la, RUB Eternal Portfolio bolofara ka jatew san, o min tɛ bɔ dilanbaga ka komisiyɔn na pewu.

Sberbank ye

Sberbank bɛ BPIF caman di https://www.sberbank.ru/ru/person/investments/pifs ni farati hakɛ o hakɛ ye. A ka ɲi kosɛbɛ waridonna kuraw ma. Donni dakun ye 1 ye, wa musaka bɛ daminɛ ni ruble damadɔw ye. I bɛ se ka nafolo san walima k’a feere o yɔrɔnin bɛɛ baarakɛwaatiw la, wa komisiyɔnw ni musakaw tɛ tɛmɛ kɛmɛsarada la 1 kan.

VTB ye

Banki bɛ BPIF 20 ni kɔ ɲɛnabɔ https://broker.vtb.ru/services/pif/, ka nafolo sɔngɔ kura don o don musaka tɛ min na, ani fana ka bolomafaraw lakana ka bɔ nafolosɔrɔbaliya la. A doncogo fitinin ye 1000 rubles ye. Farati-dafalen bolofara ye nafa sɔrɔ min ka ca ni kɛmɛsarada la 12 ye san tɛmɛnen kɔnɔ. BPIF minnu bɛ Moskow Exchange kan, olu bɛ ja in na min bɛ duguma, ani san 2022 lisi dafalen bɛ sɔrɔ https://www.moex.com/msn/etf: MOEX[/sɛbɛn ɲɛ]

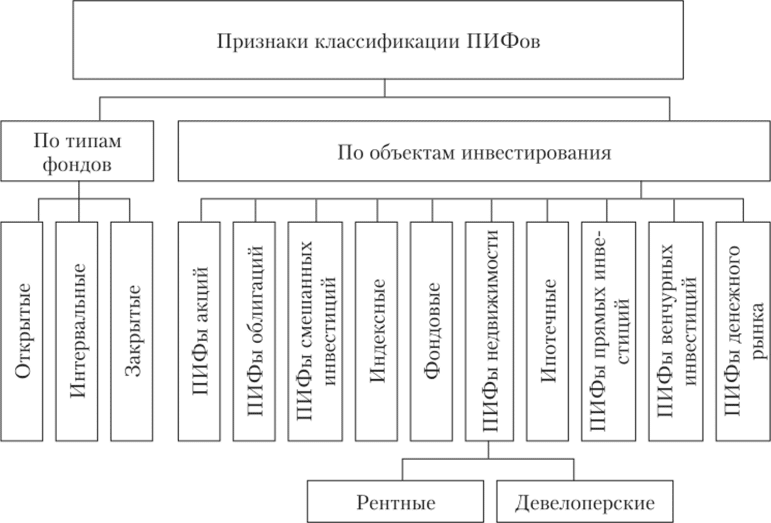

Aksidanw, bonw, wari, nafolo ani nafolo wɛrɛw dɔrɔn de bɛ se ka don fɛnw falenfalen nafolo la. Dunan ka nafolosɔrɔsiraw tɛ se ka BPIF don a kɔnɔ, walima ka kɛ nafolosɔrɔsiraw ye min tɔgɔ sɛbɛnna Risi jamana kɔkan.

Ɲininkaliw ni jaabiw

Ni nafolosɔrɔsiraw sigibagaw ye banki fili, mun bɛ kɛ? Investissement fund tɛ ɲɛmɔgɔyaso dɔ ka bolofɛn ye. Ni sosiyete in binna, o tuma na, a tɛna se ka nafolo sɔrɔ BPIF fɛ, nafolo bɛɛ bɛ segin a tigiw ma, nafolo bɛ ban, a sigibagaw bɛna bɔnɛ u ka lase la.

Yala ne ka kan ka jatew feere ni waribon sɔngɔ binna wa? Nin ɲininkali in bɛ mɔgɔ kura bɛɛ ɲɛ min bɛ wari bilali daminɛ ɲɔgɔndɛmɛ nafolo la. Tiɲɛ ye ko nafolo fanba kun ye nafa kuntaalajan ye, o la ni faratiw ka dɔgɔ, o tuma na nin ye waati kunkurunnin latilenni dɔrɔn de ye. A mana kɛ cogo o cogo, ni feereli walima feereli tɛ, o ye waridonna kelen-kelen bɛɛ ka latigɛ ye, a tɛ dimi k’a faamu fɛn min tigitigi bɛ ka jigin sɔngɔ la, ka jateminɛw kɛ, ani dɔrɔn o manipulew kɛlen kɔfɛ ka latigɛ laban kɛ.

Yala a bɛ se ka kɛ ka portfolio dɔ jɔ ne yɛrɛ ma walasa ne kana wari wɛrɛw sara o nafolosɔrɔsiraw la wa? Ni waati ni sababu bɛ yen, o tuma na fɛ, mɔgɔ si t’i bali ka portfolio dɔ sigi i yɛrɛ ye. Nka, o tɛ nafa sɔrɔ tuma bɛɛ, bawo ɲɛmɔgɔyasobaw bɛ ni kɛrɛnkɛrɛnnenw ye minnu bɛ se kosɛbɛ, minnu bɛ baara kɛ portfolio kan waati bɛɛ.

Yala BPIF bɛ se ka nafa sɔrɔli garanti wa? A fɔlɔ, a tɛ se ka kɛ dɔrɔn, bawo mɔgɔ si t’a dɔn min bɛna kɛ nafolo la sini. Wa a filanan, a dagalen don sariya fɛ.