What is financial leverage (financial leverage, leverage), the essence of the concept in trading in simple words with examples, dangers in practice and possible benefits.

- The concept of leverage in trading – an educational program for beginners in simple words about the complex

- How to calculate leverage – calculation examples, calculator

- Leverage for trader and investor

- Risks and Benefits

- Features of leverage on different platforms – on Forex, stock market, on binance

- Stock market

- Forex

- How leverage works on Binance

- Isolated Margin

- Cross Margin

The concept of leverage in trading – an educational program for beginners in simple words about the complex

Financial leverage is a broker’s service for providing a loan of funds or assets. Targeted loan – funds are provided for the purchase of liquid stocks, bonds or currencies. The funds on the client’s balance act as collateral. Trading with leverage is called margin lending. The collateral for obtaining a loan from a broker is a margin. Leverage on the exchange allows you to open transactions for an amount exceeding the balance of the trading account by 5, 100, 500, or more times. When a trader believes that the probability of a successful outcome of a transaction is high, he uses leverage and makes a big profit.

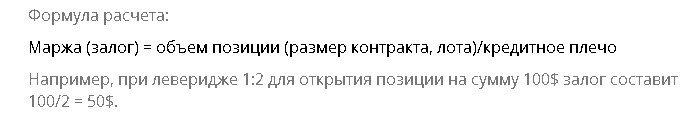

How to calculate leverage – calculation examples, calculator

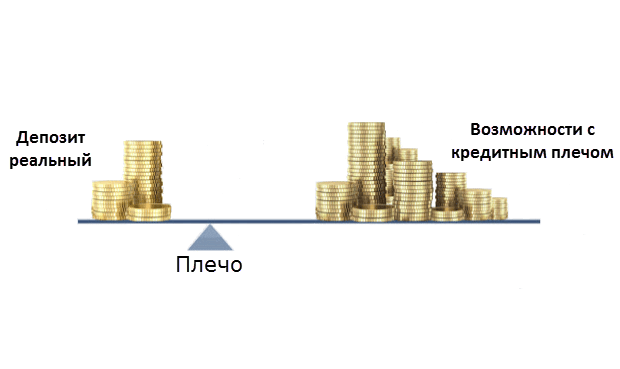

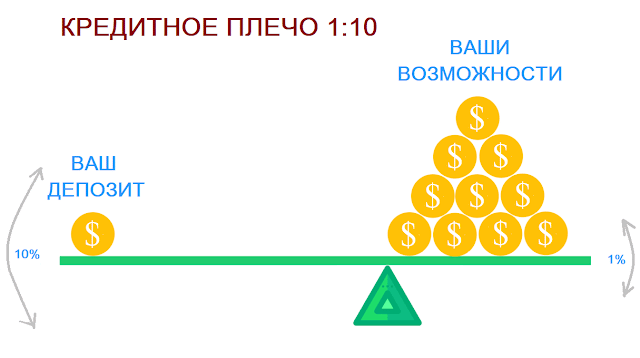

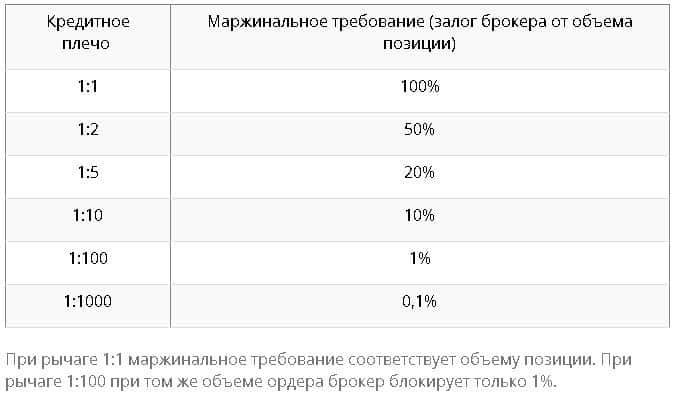

Let’s use an example to show what leverage is in simple words. Let’s say a trader has an account balance of $1,000. He buys Gazprom shares (leverage 1 1) for $ 5 a share for the entire capital, enough funds for 200 shares. But suddenly there is positive news on Nord Stream and the trader makes a forecast about the rapid growth of shares. There is no own funds to buy more shares, but the broker provides a leverage of 1 to 5 and the trader buys shares for another $4,000. At the same time, there are 1,000 shares of Gazprom on the balance sheet, the trader’s own funds of $ 1,000 are blocked, the broker took these funds as collateral (margin). [caption id="attachment_7644" align="aligncenter" width="560"]

Leverage for trader and investor

A trader is a natural or legal person who makes transactions on the stock exchange, tracking the market patterns and calculating the short-term perspective. An investor is an individual (or legal) person who buys assets on the stock exchange in order to make a profit in the form of interest or by increasing the market value. The investor evaluates the fundamental indicators of the company, the situation in the country and in the world and invests, expecting to make a profit in the long term. However, the main difference between a trader and an investor is that the trader clearly understands at what price level the position will be closed with a loss. The investor is ready to suffer losses for years if the fundamental situation remains favorable. An experienced trader can keep risks at the same level regardless of the leverage used, but successful trades will be much more profitable. The investor cannot control the risk when trading with leverage, transactions are long-term and the fee for providing a loan does not pay off. Is it worth using leverage in trading – risks, dangers and benefits of leverage: https://youtu.be/qlH8FBN7MF4

Risks and Benefits

Leverage is a tool. Any tool in the hands of an experienced master is capable of creating masterpieces, while for a beginner it can only cause pain and disappointment. Leverage provides the following options:

- make transactions for amounts many times greater than the trading deposit;

- increase the deposit many times over in a short time;

- open deals with a forecast for a decrease in quotes, in this case the trader borrows not cash, but assets. The resulting shares are sold at the market price, and then, under favorable circumstances, are bought at a reduced price. The shares are returned to the broker, and the trader makes a profit;

- make transactions immediately, without waiting for the transfer between trading platforms to be processed.

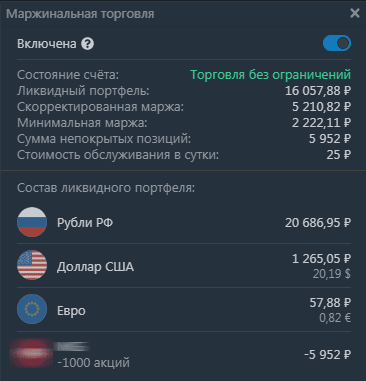

[caption id="attachment_7645" align="aligncenter" width="640"]

- with poor risk management, loss of capital in a short time;

- in some cases (when trading derivatives through a licensed broker of the Russian Federation); loss of an amount exceeding the deposit several times.

- rules for working with leverage;

- do not use leverage without experience collecting trading statistics. Make sure the trading strategy is profitable;

- carefully read the contract with the broker. Do not trade volatile assets with leverage (for example, gas, oil, cryptocurrencies) with brokers who do not have an insurance deposit in case of force majeure and shift losses onto the shoulders of the client;

- clearly define the rules for exiting the transaction in an unfavorable situation.

Features of leverage on different platforms – on Forex, stock market, on binance

Stock market

When trading shares on the Russian stock market, most brokers provide a margin trading service. BCS and Finam provide margin lending automatically to all clients (within the framework of the FFMS regulations). Starting this year, investors who have not received the status of a qualified investor have restrictions on the amount of leverage and the choice of securities. In Tinkoff Investments, the margin lending service is disabled by default; to use it, you must enable the option in the settings. Broker Sberbank does not provide leverage above 1 to 1 as long as the client’s assets are less than 500 thousand rubles.

With a deposit of 200,000 rubles and an open margin position of 1,000,000 rubles, only the fee for providing leverage will be 80,000 rubles. And this is almost half of the deposit. In addition, if the shares do not stand still, but move opposite to the forecast, this will lead to the ruin of the investor.

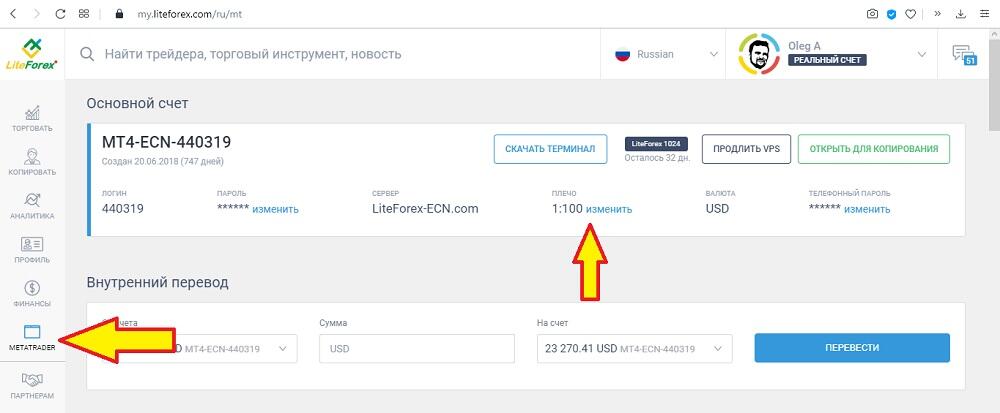

Forex

In the forex market, 1 standard lot is equivalent to 100,000 currency units. Most forex traders do not have this amount, so dealing centers offer fractional contracts from 0.01 standard lot (equivalent to 1000 units of currency) and provide leverage. According to the legislation of the Russian Federation, forex brokers licensed by the Central Bank are not entitled to provide leverage higher than 1 to 50. The maximum leverage for alpha forex is 1 to 40.

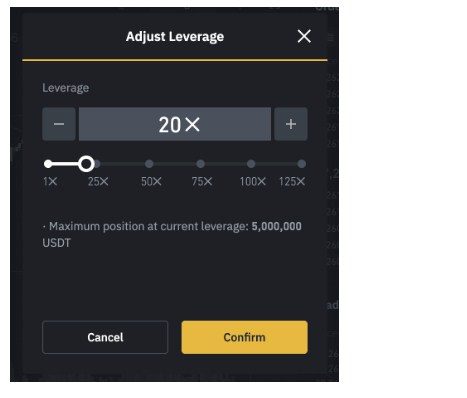

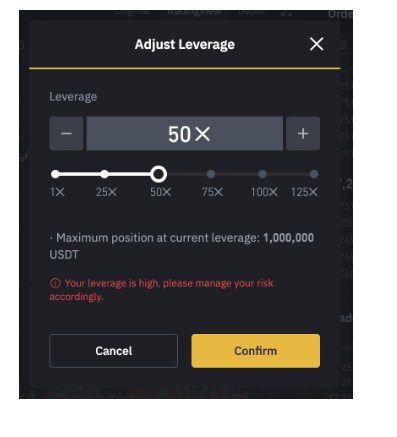

How leverage works on Binance

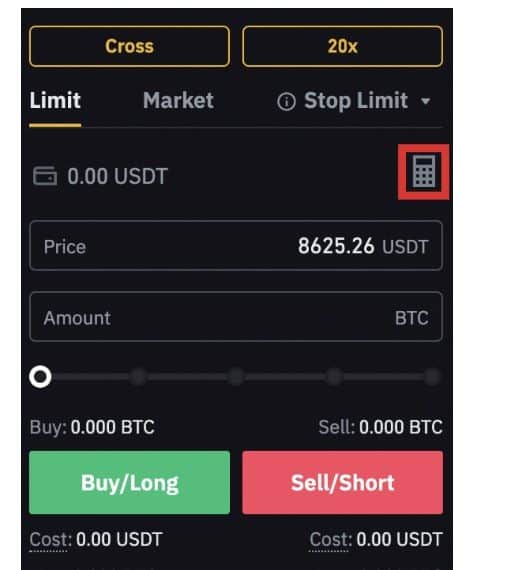

Due to the high volatility of crypto-assets, trading on margin is more risky compared to the stock or foreign exchange market. Before you start trading futures or cryptocurrencies, the system will offer you to pass a test. There will be no access to trading until the system has verified that the client fully understands the Binance leverage mechanism. Correct answers are highlighted in green. After a few attempts, even a complete beginner will memorize the basics. By default, Binance provides leverage of 20 for futures trading. [caption id="attachment_7649" align="aligncenter" width="467"]

Isolated Margin

When choosing the isolated margin mode, the funds are blocked and the funds are calculated for each coin separately. This helps if there is a black sheep in the portfolio. Liquidation occurs only for one position, and does not lead to the liquidation of all positions.

Cross Margin

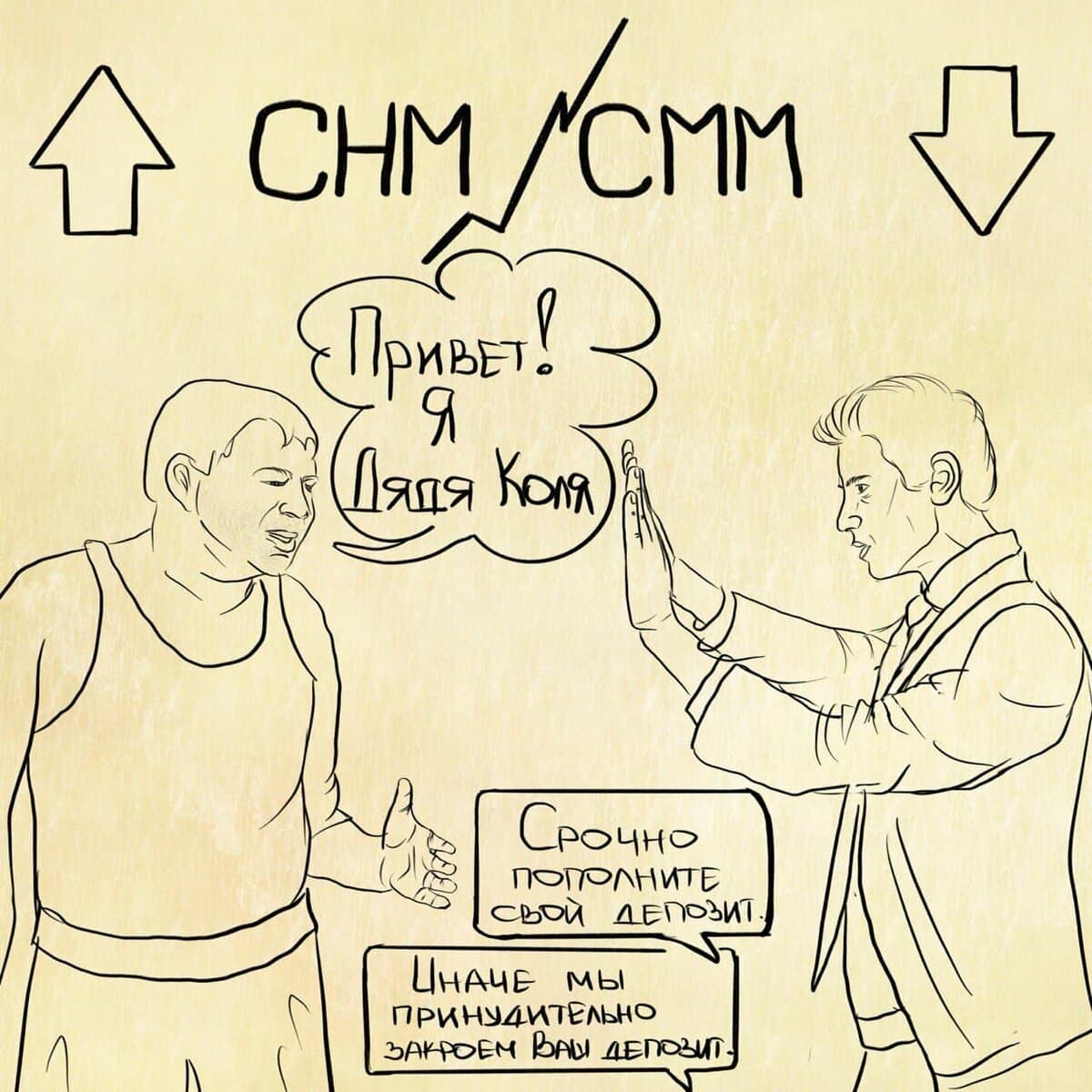

The cross margin mode is suitable for experienced traders building a portfolio based on correlations. Margin is divided across all positions. So profitable positions support unprofitable ones. With a sharp collapse or rise of one position, the entire futures account is liquidated. It is recommended to close trades without waiting for liquidation, using stop orders. It is not always possible to accurately calculate the stop order level. The financial market is rife with manipulation in which price moves towards a likely massive accumulation of stops and reverses. After some time, in a rising market, the illusion may arise that stop orders are not worth placing. After all, quotes will still go up. Instead of closing a losing trade, you need to add more funds to maintain margin requirements. For a while, this approach will be profitable. An event will occur when it becomes clear that this is not manipulation, but a real bear market, it is too late. Losses have reached a critical value and cannot be compensated.