Dɛn ne sikasɛm mu mfaso (sikasɛm mu mfaso, mfaso), adwene no mu ade titiriw wɔ aguadi mu wɔ nsɛmfua a ɛnyɛ den mu a nhwɛso ahorow wom, asiane ahorow a ɛwɔ nneyɛe mu ne mfaso horow a ebetumi aba.

- Adwene a ɛfa leverage wɔ aguadi mu – nkyerɛkyerɛ nhyehyɛe ma wɔn a wɔrefi ase wɔ nsɛmfua a ɛnyɛ den mu fa nea ɛyɛ den no ho

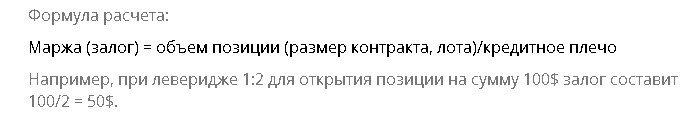

- Sɛnea wobu leverage – akontabuo nhwɛsoɔ, akontabuo

- Leverage ma aguadifo ne sikakorafo

- Asiane ne Mfaso a Ɛwɔ So

- Nneɛma a ɛwɔ leverage wɔ platform ahorow so – wɔ Forex, stock gua so, wɔ binance so

- Sikakorabea ahorow

- Forex a wɔde di dwuma

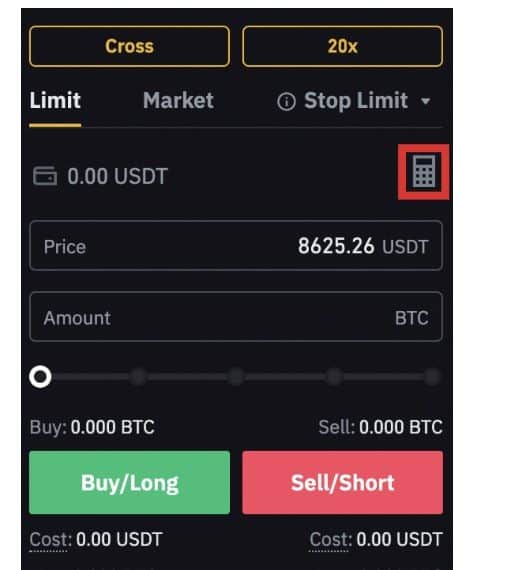

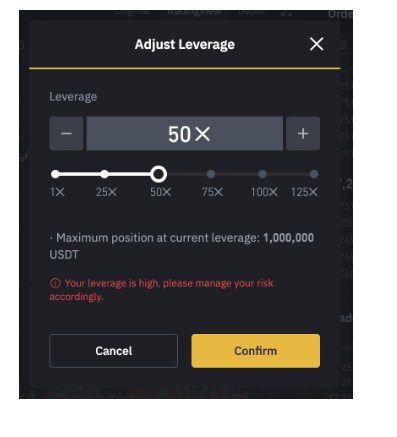

- Sɛnea leverage yɛ adwuma wɔ Binance so

- Margin a Wɔatew Ne Ho

- Cross Margin

Adwene a ɛfa leverage wɔ aguadi mu – nkyerɛkyerɛ nhyehyɛe ma wɔn a wɔrefi ase wɔ nsɛmfua a ɛnyɛ den mu fa nea ɛyɛ den no ho

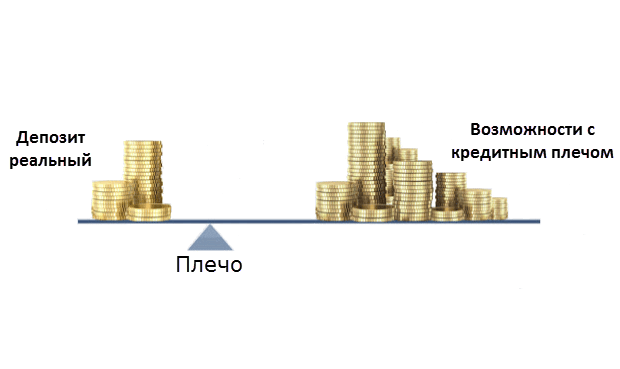

Sikasɛm mu mfaso yɛ aguadifo adwuma a wɔde sika anaa agyapade bɔ bosea. Boa a wɔde asi wɔn ani so – wɔde sika ma de tɔ nsuo stocks, bonds anaa sika. Sika a ɛwɔ nea ɔde retɔ no no sika a aka no so no yɛ adwuma sɛ nea wɔde bɛbɔ ho ban. Wɔfrɛ aguadi a wɔde leverage di gua no margin lending. Nneɛma a wɔde gye bosea fi aguadifo bi hɔ no yɛ sika a wɔde bɛbɔ bosea. Leverage a ɛwɔ exchange no so ma wutumi bue nnwuma ma sika a ɛboro nea aka wɔ aguadi akontaabu no mu mpɛn 5, 100, 500, anaa nea ɛboro saa. Sɛ aguadifo bi gye di sɛ nea ebetumi afi asɛm bi mu aba yiye no dɔɔso a, ɔde leverage di dwuma na onya mfaso kɛse.

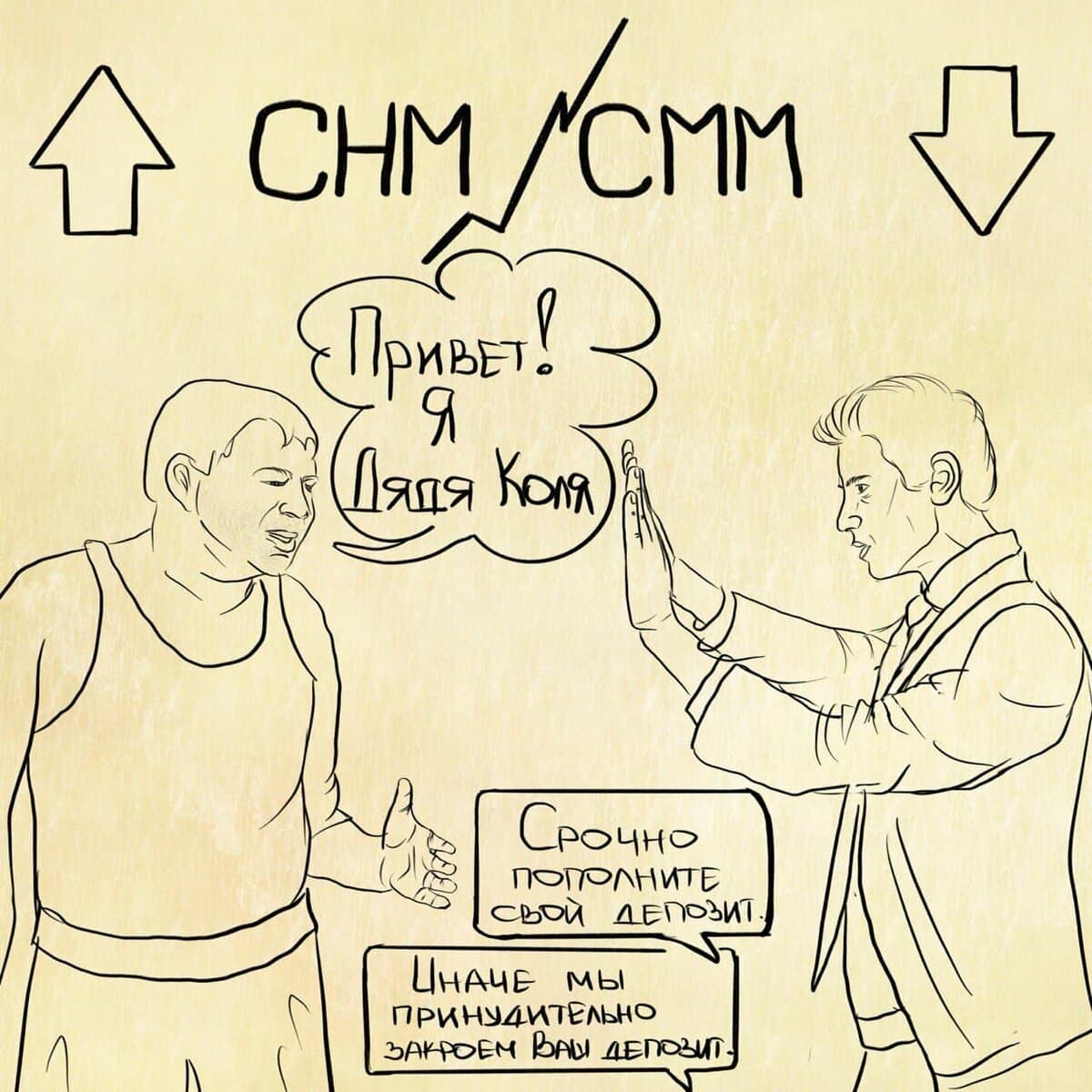

Leverage ma aguadifo ne sikakorafo

Oguadifo yɛ onipa anaa mmara kwan so nipa a ɔyɛ nnwuma wɔ stock exchange, di gua so nhyehyɛe akyi na obu bere tiaa mu adwene no ho akontaa. Sikakorafoɔ yɛ ankorankoro (anaasɛ mmara kwan so) obi a ɔtɔ agyapadeɛ wɔ sikakorabea sɛdeɛ ɛbɛyɛ a ɔbɛnya mfasoɔ wɔ mfɛntom mu anaasɛ ɔbɛma gua so boɔ akɔ soro. Ɔdefoɔ no hwɛ adwumakuo no nsɛnkyerɛnneɛ titire, tebea a ɛwɔ ɔman no mu ne wiase no mu na ɔde ne sika hyɛ mu, hwɛ kwan sɛ ɔbɛnya mfasoɔ wɔ berɛ tenten mu. Nanso, nsonsonoe titiriw a ɛda aguadifo ne obi a ɔde ne sika hyɛ mu ntam ne sɛ aguadifo no te bo a wɔde bɛto gyinabea no mu a wɔbɛhwere ade no ase pefee. Nea ɔde ne sika hyɛ mu no ayɛ krado sɛ obehwere nneɛma mfe pii sɛ tebea titiriw no kɔ so yɛ papa a. Oguadifo a ne ho akokwaw betumi ama asiane ahorow no akɔ so ayɛ nea ɛfata ɛmfa ho sɛnea wɔde di dwuma no, nanso aguadi a edi mu no benya mfaso kɛse. Nea ɔde ne sika hyɛ mu no ntumi nni asiane no so bere a ɔde leverage redi gua no, nkitahodi yɛ bere tenten na sika a wɔbɔ wɔ bosea a wɔde ma ho no ntua. So ɛfata sɛ wode leverage di dwuma wɔ aguadi mu – asiane, asiane ne mfaso a ɛwɔ leverage so: https://youtu.be/qlH8FBN7MF4

Asiane ne Mfaso a Ɛwɔ So

Leverage yɛ adwinnade. Adwinnade biara a ɛwɔ owura a ne ho akokwaw nsam no tumi yɛ adwinni ahorow a ɛyɛ nwonwa, bere a wɔ obi a ɔrefi ase fam no, ebetumi de ɛyaw ne abasamtu nkutoo aba. Leverage ma wonya nneɛma a edidi so yi:

- yɛ nnwuma a ɛboro sika a wɔde asie wɔ aguadi mu no so mpɛn pii;

- ma sika a wode asie no nkɔ soro mpɛn pii wɔ bere tiaa bi mu;

- open deals with a forecast for a decrease in quotes, wɔ eyi mu no, aguadifo no mfa sika bɔ bosea, na mmom agyapade. Wɔtɔn kyɛfa a efi mu ba no wɔ gua so bo so, na afei wɔ tebea horow a eye mu no, wɔtɔ no bo a wɔatew so. Wɔsan de kyɛfa no ma aguadifo no, na aguadifo no nya mfaso;

- yɛ nkitahodi ntɛm ara, a wontwɛn sɛ wɔbɛyɛ nsakrae a ɛda aguadibea ahorow ntam no ho adwuma.

[caption id="attachment_7645" align="aligncenter" width="640"]

- esiane asiane ho nhyehyɛe a enye nti, sika kɛse a wɔhwere wɔ bere tiaa bi mu;

- wɔ tebea horow bi mu no (bere a wɔde nneɛma a wonya fi mu di gua denam Russia Ɔman no aguadifo bi a ɔwɔ tumi krataa so); sika a ɛboro sika a wɔde asie no so a wɔhwere mpɛn pii.

- mmara a ɛfa adwuma a wɔde leverage yɛ ho;

- mfa leverage nni dwuma a wunni osuahu wɔ aguadi ho akontaabu a wɔboaboa ano no mu. Hwɛ sɛ aguadi ho nhyehyɛe no yɛ nea mfaso wɔ so;

- kenkan apam a wo ne broker no yɛe no yiye. Mfa agyapade a ɛyɛ basaa a ɛwɔ leverage (sɛ nhwɛso no, gas, ngo, cryptocurrencies) di gua ne brokers a wonni insurance deposit sɛ force majeure ba a na wɔdannan adehwere gu client no mmati so;

- kyerɛkyerɛ mmara a wɔde befi asɛm no mu wɔ tebea a enye mu no mu pefee.

Nneɛma a ɛwɔ leverage wɔ platform ahorow so – wɔ Forex, stock gua so, wɔ binance so

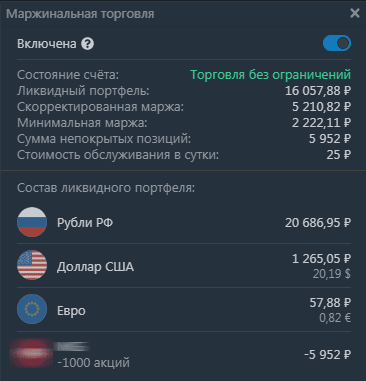

Sikakorabea ahorow

Sɛ wɔredi gua wɔ Russia sikakorabea ahorow mu a, aguadifo dodow no ara de sika a wɔde di gua ho adwuma ma. BCS ne Finam de margin lending ma afɛfoɔ nyinaa ankasa (wɔ FFMS mmara no mu). Efi afe yi no, sikasɛm mu asisifo a wonnyaa sikakorafo a ɔfata dibea no wɔ anohyeto ahorow wɔ sika dodow a wɔde bɛto gua ne sika a wɔbɛpaw no ho. Wɔ Tinkoff Investments mu no, wɔagyae margin lending service no default;sɛ wode bedi dwuma a, ɛsɛ sɛ wo ma option no yɛ adwuma wɔ nhyehyɛe no mu. Broker Sberbank mfa leverage a ɛboro 1 kosi 1 mma bere tenten a client no agyapade nnu rubles mpem 500 no.

Sɛ wode sika a wode bɛto hɔ a ɛyɛ ruble 200,000 na woabue margin gyinabea a ɛyɛ ruble 1,000,000 a, ɛka a wɔbɔ wɔ leverage a wɔde ma ho nkutoo na ɛbɛyɛ rubles 80,000. Na ɛkame ayɛ sɛ eyi yɛ sika a wɔde asie no fã. Nea ɛka ho no, sɛ kyɛfa no annyina hɔ, na mmom ɛne nea wɔahyɛ ho nkɔm no bɔ abira a, eyi bɛma nea ɔde ne sika ahyɛ mu no asɛe.

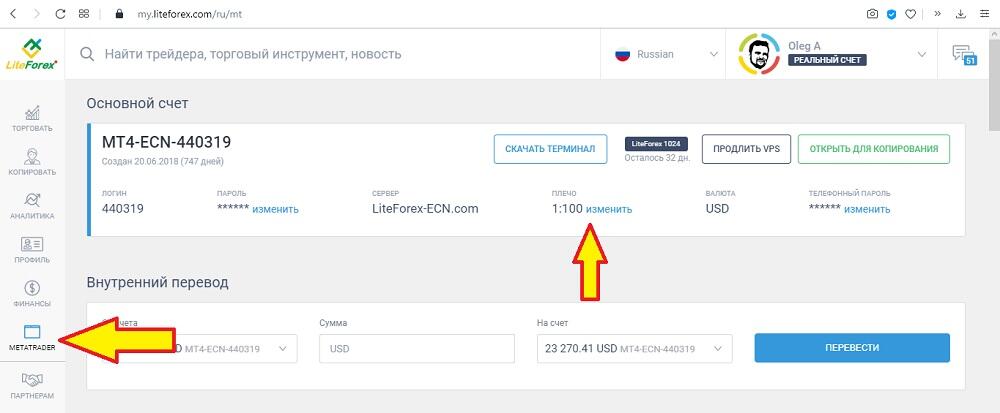

Forex a wɔde di dwuma

Wɔ forex gua so no, 1 standard lot yɛ pɛpɛɛpɛ 100,000 sika units. Forex aguadifo dodow no ara nni saa sika yi, enti dealing centers de fractional contracts fi 0.01 standard lot (a ɛne sika 1000 units yɛ pɛ) na ɛma leverage. Sɛnea Russia Federation mmara kyerɛ no, forex brokers a Central Bank ama wɔn tumi krataa no nni hokwan sɛ wɔde leverage a ɛboro 1 kosi 50. Leverage a ɛsen biara ma alpha forex yɛ 1 kosi 40.

Margin a Wɔatew Ne Ho

Sɛ wopaw isolated margin mode no a, wosiw sika no kwan na wobu sika no ho akontaa ma sika biara wɔ ɔkwan soronko so. Eyi boa sɛ oguan tuntum bi wɔ portfolio no mu a. Liquidation ba ma dibea biako pɛ, na ɛmma dibea ahorow nyinaa gyae.

Cross Margin

Cross margin mode no fata ma aguadifo a wɔn ho akokwaw a wɔrekyekye portfolio a egyina nkitahodi so. Wɔakyekyɛ margin mu wɔ gyinabea ahorow nyinaa mu. Enti dibea ahorow a mfaso wɔ so boa nea mfaso nni so. Sɛ gyinabea biako hwe ase kɛse anaasɛ ɛkɔ soro a, wogyae daakye akontaabu no nyinaa. Wɔkamfo kyerɛ sɛ ɛsɛ sɛ wɔto aguadi mu a wontwɛn sɛ wobegyae, denam ahyɛde ahorow a wɔde begyae di dwuma. Ɛnyɛ bere nyinaa na wobetumi abu stop order level no ho akontaa pɛpɛɛpɛ. Sikasɛm gua no ayɛ ma wɔ manipulation a ɛma bo kɔ kɔ kɛse a ɛbɛyɛ sɛ boaboa ano a ɛyɛ gyinabea ne akyi. Bere bi akyi, wɔ gua a ɛrenya nkɔanim mu no, ebia adwenem naayɛ bɛba sɛ wɔmfa nneɛma a wɔkra a wogyae no nyɛ nea ɛfata sɛ wɔde ma. Ne nyinaa akyi no, nsɛm a wɔafa aka no bɛda so ara akɔ soro. Sɛ́ anka wobɛto aguadi a ɛrehwere mu no, ɛsɛ sɛ wode sika pii ka ho na ama woakɔ so akura margin ahwehwɛde ahorow no mu. Wɔ bere tiaa bi mu no, mfaso bɛba saa kwan yi so. Adeyɛ bi bɛba bere a ɛda adi pefee sɛ eyi nyɛ nsakrae, na mmom asono gua ankasa a, aka akyi dodo. Nneɛma a wɔahwere no adu bo titiriw bi ho na wontumi ntua ho ka.