The article was created based on a series of posts from the OpexBot Telegram channel , supplemented by the author’s vision and the opinion of the AI.

Who is Richard Dennis and what does turtle racing have to do with it?

Richard Denis is the “leader of the turtles,” the “prince of the pit,” who has proven from his experience the harm of emotions in trading. The approach to trading is faith in technical analysis, systematicity, learning ability, harm of emotions. Born in Chicago in January 1949. First experience was lumpy. $400 borrowed from my father was successfully “merged” on the stock exchange. Then, $1.6 thousand turned into $1 million at age 25. He founded the Drexel Fund, and by the beginning of 1980 he had earned $100 million. In a dispute with a friend, what is more important in trading: training and system, or emotions and innate abilities, he proved the first. His “turtles,” novice traders, brought in a profit of $175 million in a year. In 1987, after Black Monday, he lost 50% of his and his clients’ assets. Admitted that he deviated from his own strategy and made several emotional transactions. Left the market “forever”. In 1994 he returned, in 1995-96 trading robots brought +108% and +112%. Called them “the only way to win in the futures market.”

He founded the Drexel Fund, and by the beginning of 1980 he had earned $100 million. In a dispute with a friend, what is more important in trading: training and system, or emotions and innate abilities, he proved the first. His “turtles,” novice traders, brought in a profit of $175 million in a year. In 1987, after Black Monday, he lost 50% of his and his clients’ assets. Admitted that he deviated from his own strategy and made several emotional transactions. Left the market “forever”. In 1994 he returned, in 1995-96 trading robots brought +108% and +112%. Called them “the only way to win in the futures market.”

Turtle strategy in the stock market: basic theory

Richard Denis’ Turtle Strategy, also known as Trendographics, is a trading strategy that is based on the principle of following the market trend. This strategy was developed by famous trader Richard Denis in the 1980s and has become one of the most popular strategies in technical analysis. The basic idea behind Richard Denis’ turtle strategy is that the trend is the most problematic part of the market movement, so the trader must focus on identifying it and following it. The strategy suggests using various tools and rules to determine the trend and points of entry and exit from the market. One of the key aspects of the strategy is the use of an automated system to determine market entry and exit points. A trader must determine what market conditions are considered “trending” and use those conditions to decide whether to enter the market. This may include the use of various indicators such as moving averages or trend strength indicators. When a trader identifies a trend, he must set entry and exit points according to the rules of the turtle strategy. For example, a trader may use broken trend lines or other confirmatory signals to determine market entry and exit points. One of the main advantages of Richard Denis’s turtle strategy is its simplicity and logic. This makes it accessible to traders of all experience levels and can help improve trading results. However, Like any strategy, Richard Denis’ turtle strategy is not a universal solution and does not guarantee profit. Traders should use this strategy in combination with other tools and market analysis to make informed decisions about entering and exiting positions. https://youtu.be/UbeMr6cbcyg?si=UzbPVQ6yGKnS9bzP

One of the key aspects of the strategy is the use of an automated system to determine market entry and exit points. A trader must determine what market conditions are considered “trending” and use those conditions to decide whether to enter the market. This may include the use of various indicators such as moving averages or trend strength indicators. When a trader identifies a trend, he must set entry and exit points according to the rules of the turtle strategy. For example, a trader may use broken trend lines or other confirmatory signals to determine market entry and exit points. One of the main advantages of Richard Denis’s turtle strategy is its simplicity and logic. This makes it accessible to traders of all experience levels and can help improve trading results. However, Like any strategy, Richard Denis’ turtle strategy is not a universal solution and does not guarantee profit. Traders should use this strategy in combination with other tools and market analysis to make informed decisions about entering and exiting positions. https://youtu.be/UbeMr6cbcyg?si=UzbPVQ6yGKnS9bzP

Practical meaning and author’s vision of the turtle strategy

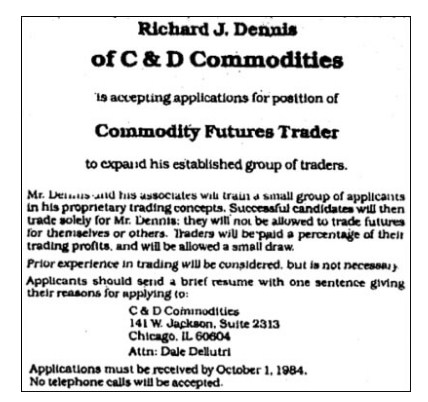

Richard Denis conducted an experiment in which over 10 years the profit of a group of traders amounted to over $150 million. An advertisement in which Richard Denis recruits fellow traders for his experiment  [ /caption] The experiment answered the question: what is important for a trader’s success? System, plan, strategy, self-discipline? Or innate qualities, gifts and intuition?

[ /caption] The experiment answered the question: what is important for a trader’s success? System, plan, strategy, self-discipline? Or innate qualities, gifts and intuition?

The turtle strategy is a closed trading system that affects all aspects of trading

Concept

There is no place for emotions in the market; consistency and balance are needed. The result is important, not the process. Sometimes the impossible can happen, but you need to stick to the plan day after day. It is important to start from the size of the deposit. Strategy is knowing exactly when you will buy or sell.

Risk management

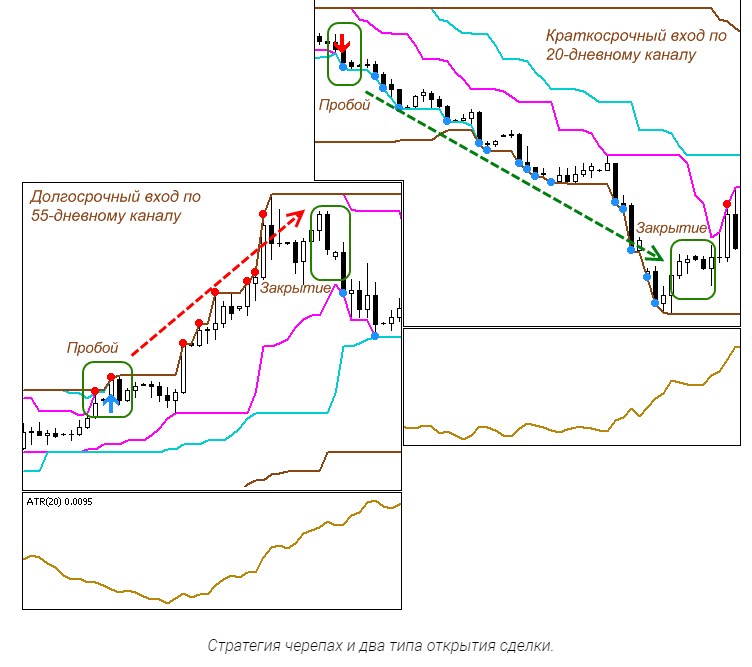

An approach. Following the trend , wide, long period of holding open positions, a large number of small losses/small number of large profits. Turtle strategy is complex. And it has several controversial points. In short, the Turtle System is divided into 2 parts: System 1: Short-term system based on a 20-day breakthrough . The entry condition is a breakout of the 20-day high or low. The trade was skipped if the previous signal was successful. System 2: Long-term system based on the 55-day breakout . The principle is the same, but data for 55 days is taken into account. This method was used in case the 20 day breakthrough was missed due to the reasons stated above.  But the point is different.

But the point is different.

What does the turtle strategy give us?

One of the key ideas is that the trading system is critical. If there is a strategy and you strictly adhere to it, then there will be a profit. Otherwise, instinct and emotions will prevail.

Excessive passionarity and emotionality lead to the loss of the impulse of the self-preservation instinct to overtrade and drain the depot.

According to the “turtles” themselves, it was necessary to be prepared for a large number of small “elks”. Which is psychologically difficult. A series of small losses can be discouraging. In the turtle strategy, several successful trades covered and offset the loss. But they had to wait. Not everyone strictly adhered to the long-term strategy and ended up in the red. This is a psychological problem. In trading, human nature and our interests are often at odds with each other.

Как можно научиться