Nafolosɔrɔko ye mun ye (nafolosɔrɔko, nafabɔsira), hakilina jɔnjɔn jago la daɲɛ nɔgɔmanw na ni misaliw ye, faratiw waleyali la ani nafa minnu bɛ se ka sɔrɔ.

- Leverage in trading hakilina – kalan bolodalen don daminɛbagaw ye daɲɛ nɔgɔmanw na complexe kan

- Leverage jatebɔ cogo – jatebɔ misaliw, jatebɔlan

- Leverage ka jagokɛla ni waridonna

- Faratiw ni nafaw

- Features de leverage sur les plateformes différentes – sur Forex, sur marché, sur binance

- Aksidan sugu la

- Forex ye

- Leverage bɛ baara kɛ cogo min na Binance kan

- Marge Isolée (Marge Isolée).

- Cross Margin (Kɔrɔsili Marge).

Leverage in trading hakilina – kalan bolodalen don daminɛbagaw ye daɲɛ nɔgɔmanw na complexe kan

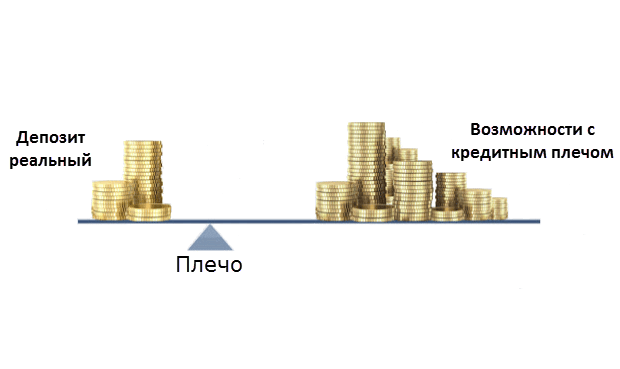

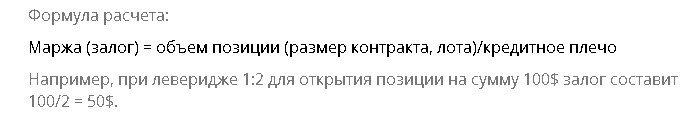

Nafolosɔrɔko ye dilanbaga ka baara ye min bɛ kɛ ka nafolo walima nafolo juru di. Jɔrɔ laɲinitaw – nafolo bɛ di ka ɲɛsin aksidan jilamaw, bonw walima wariw sanni ma. Nafolo minnu bɛ kiliyan ka balansi kan, olu bɛ kɛ garanti ye. Jago kɛli ni leverage ye, o bɛ wele ko margin lending. Garanti min bɛ kɛ ka juru sɔrɔ dilanbaga dɔ fɛ, o ye margin ye. Leverage on the exchange b’a to i bɛ se ka jago daminɛ ni wari hakɛ ye min bɛ tɛmɛ jago jatebɔsɛbɛn balansi kan siɲɛ 5, 100, 500 walima ka tɛmɛ o kan. Ni jagokɛla dɔ dalen b’a la ko jago dɔ ka ɲɛtaa sɔrɔli seko ka bon, a bɛ baara kɛ ni leverage ye, ka tɔnɔba sɔrɔ.

Leverage ka jagokɛla ni waridonna

Jagokɛla ye mɔgɔ ye min bɛ sɔrɔ a yɛrɛ la walima min bɛ sariya sira fɛ, min bɛ jago kɛ bourse la, ka suguya cogoyaw nɔfɛtaama ani ka waati kunkurunnin jateminɛ. Investisseur ye mɔgɔ kelen ye (walima sariya siratigɛ la) min bɛ nafolo san bourse la walasa ka tɔnɔ sɔrɔ tɔnɔ cogo la walima ka dɔ fara sugu nafa kan. Investisseur bɛ sosiyete ka taamasiyɛn jɔnjɔnw jateminɛ, jamana kɔnɔ ani diɲɛ kɔnɔ ani ka wari bila, k’a jira ko a bɛna tɔnɔ sɔrɔ waati jan kɔnɔ. Nka, danfaraba min bɛ jagokɛla ni waridonna cɛ, o ye ko jagokɛla b’a faamu ka jɛya sɔngɔ hakɛ min na, jɔyɔrɔ bɛna da ni bɔnɛ ye. Investisseur labɛnnen don ka bɔnɛ sɔrɔ san caman kɔnɔ ni ko jɔnjɔn tora ka ɲɛ. Jagokɛla min bɛ se kosɛbɛ, o bɛ se ka faratiw to u hakɛ kelen na, a mana kɛ fɛn o fɛn ye, nka jagokɛlaw bɛna nafa sɔrɔ kosɛbɛ. Investisseur tɛ se ka farati kunbɛn ni a bɛ jago kɛ ni leverage ye, jago bɛ kɛ waati jan kɔnɔ ani juru dicogo sara tɛ sara. Yala nafa b’a la ka baara kɛ ni leverage ye jago la – faratiw, faratiw ani leverage nafaw: https://youtu.be/qlH8FBN7MF4

Faratiw ni nafaw

Leverage ye baarakɛminɛn ye. Baarakɛminɛn o baarakɛminɛn bɛ setigi ŋana bolo, o bɛ se ka baarakɛminɛnw dilan, k’a sɔrɔ daminɛbaga fɛ, o bɛ se ka dimi ni jigitigɛ dɔrɔn de lase mɔgɔ ma. Leverage bɛ nin sugandiliw di:

- ka jago kɛ wari hakɛw la minnu ka ca ni jagokɛlaw ka wari bilalen ye siɲɛ caman;

- dɔ fara wari bilalen kan siɲɛ caman waati kunkurunnin kɔnɔ;

- da yelennen bɛ bɛnkanw na ni jateminɛ ye ka ɲɛsin quotations dɔgɔyali ma, o cogo la jagokɛla tɛ juru ta warijɛ la, nka a bɛ nafolo ta. Jateminɛ minnu bɛ sɔrɔ o la, olu bɛ feere sugu sɔngɔ la, o kɔfɛ, ni ko ɲumanw kɛra, u bɛ san sɔngɔ dɔgɔyalen na. Jatedenw bɛ segin dilanbaga ma, jagokɛla bɛ tɔnɔ sɔrɔ;

- ka jago kɛ joona, k’a sɔrɔ i ma jagokɛyɔrɔw ni ɲɔgɔn cɛ jiginni makɔnɔ walasa ka baara kɛ.

[caption id="attachment_7645" align="aligncenter" width="640"]

- ni faratiw ɲɛnabɔli jugu ye, waribon bɔnɛni waati kunkurunnin kɔnɔ ;

- dɔw la (ni u bɛ jago kɛ fɛnw bɔlenw na Risi jamana ka dilanbaga dɔ fɛ min ka lase bɛ a bolo); bɔnɛ min bɛ tɛmɛ wari bilalen kan siɲɛ caman.

- sariyaw minnu bɛ baara kɛ ni leverage ye;

- aw kana baara kɛ ni leverage ye ni jago jatew lajɛcogo dɔn. Aw ye aw jija jagokɛcogo ka kɛ nafa ye;

- ka bɛnkansɛbɛn kalan koɲuman ni dilanbaga ye. Aw kana jago kɛ ni nafolo wulibaliw ye ni leverage ye (misali la, gazi, petoroli, kriptowariw) ni dilanbagaw ye minnu tɛ ni asiransi ye ni fanga jugu dɔ kɛra ani ka bɔnɛw wuli ka taa kiliyan kamankunw kan

- sariyaw ɲɛfɔ ka jɛya walasa ka bɔ jago la cogo jugu la.

Features de leverage sur les plateformes différentes – sur Forex, sur marché, sur binance

Aksidan sugu la

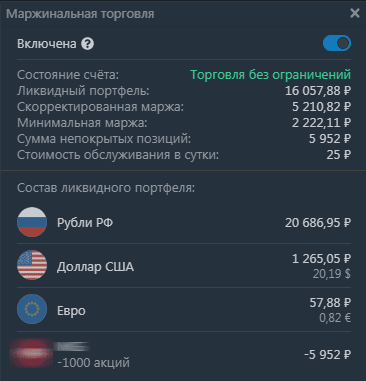

Ni u bɛ jago kɛ ni jatew ye Risi ka bolomafara sugu la, jagokɛlaw fanba bɛ jago kɛ ni margin ye. BCS ni Finam bɛ jurudonni kɛ u yɛrɛma ka ɲɛsin kiliyanw bɛɛ ma (FFMS sariyaw hukumu kɔnɔ). K’a daminɛ ɲinan na, waridonna minnu ma waridonna ŋana jɔyɔrɔ sɔrɔ, dan bɛ olu la ka ɲɛsin waribon hakɛ ma ani warimaralanw sugandili ma. Tinkoff Investments kɔnɔ, margin lending service bɛ baara kɛ ni default ye, walasa ka baara kɛ n’a ye, i ka kan ka sugandi kɛ settings kɔnɔ. Broker Sberbank tɛ leverage di min bɛ tɛmɛ 1 kan ka se 1 ma ni kiliyan ka nafolo tɛ se ruble ba 500 ma.

Ni wari bilalen ye 200.000 ruble ye ani da wulilen jɔyɔrɔ jɔyɔrɔ ye 1.000.000 rubles ye, o sara dɔrɔn de bɛna kɛ 80.000 rubles ye. Wa o bɛ ɲini ka kɛ wari bilalen tilancɛ ye. Ka fara o kan, ni jatebɔw ma jɔ yɔrɔ kelen na, nka ni u bɛ taa ɲɛ ni fɔlen ye, o bɛna kɛ sababu ye ka waridonna tiɲɛ.

Forex ye

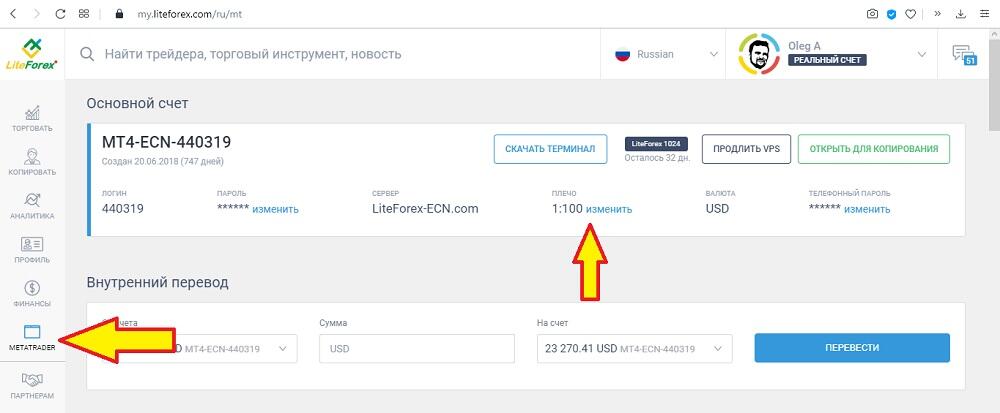

Forex sugu la, 1 standard lot bɛ bɛn 100.000 wari hakɛ ma. Forex jagokɛlaw fanba tɛ ni nin hakɛ in ye, o la, jagokɛlaw ka santiriw bɛ bɛnkansɛbɛnw dilan ka bɔ 0,01 standard lot (min bɛ bɛn wari hakɛ 1000 ma) ani ka leverage di. Ka kɛɲɛ ni Risi jamana ka sariyaw ye, forex brokers minnu ka lase bɛ Banki Sentɛrɛli fɛ, olu tɛ se ka leverage di min ka ca ni 1 ye ka se 50 ma. Leverage min bɛ se ka kɛ alpha forex ye, o ye 1 ye ka se 40 ma. [caption id="attachment_7659" align="aligncenter " bonya="1000"].

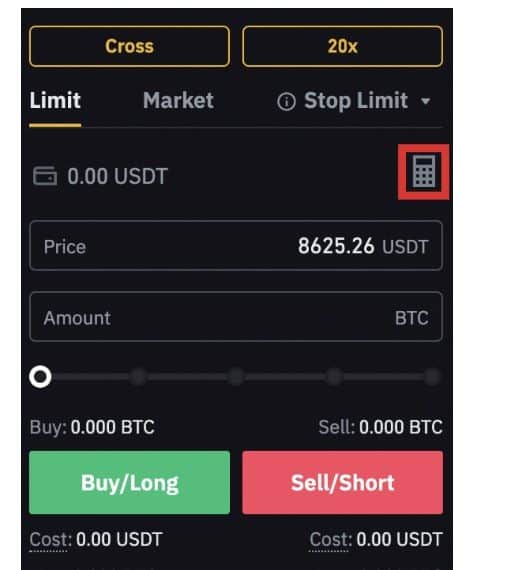

Leverage bɛ baara kɛ cogo min na Binance kan

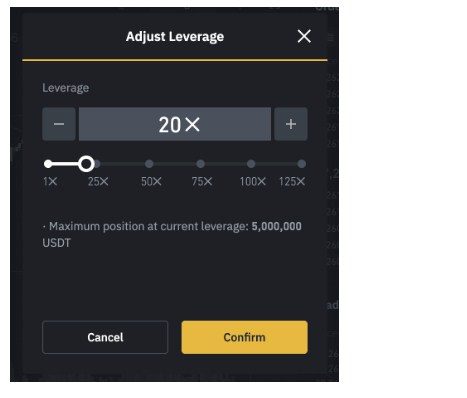

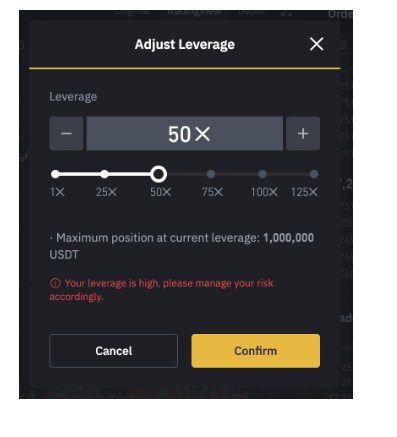

K’a sababu kɛ kripto-nafolomafɛnw ka wuli-wuliba ye, jago kɛli ni margin ye, o farati ka bon ni i ye a suma ni stock walima jamana kɔkan wari suguya ye. Sani i ka futures walima cryptocurrencies jago daminɛ, o sistɛmu bɛna a fɔ i ye ko i ka tɛmɛ kɔrɔbɔli dɔ la. Jagokɛyɔrɔ sɔrɔli tɛna kɛ fo ni sistɛmu y’a sɛgɛsɛgɛ ko kiliyan bɛ Binance leverage mechanism faamuya kosɛbɛ. Jaabi ɲumanw jiralen bɛ ni ɲɛ jɛman ye. A kɛlen kɔ ka a ɲini siɲɛ damadɔw, hali mɔgɔ min bɛ a daminɛ dafalen na, o bɛna fɛn jɔnjɔnw to a hakili la. Ka da a kan, Binance bɛ leverage di 20 ma futures jago kama [caption id="attachment_7649" align="aligncenter" width="467"]

Marge Isolée (Marge Isolée).

Ni i ye isolated margin mode sugandi, nafolo bɛ bali ani wari bɛ jate warijɛ kelen-kelen bɛɛ la kɛrɛnkɛrɛnnenya la. O bɛ dɛmɛ don ni saga nɛrɛmuguma dɔ bɛ portfolio kɔnɔ. Liquidation bɛ kɛ jɔyɔrɔ kelen dɔrɔn de kama, wa a tɛ na ni jɔyɔrɔ bɛɛ liquidation ye.

Cross Margin (Kɔrɔsili Marge).

Cross margin mode bɛnnen don jagokɛlaw ma minnu bɛ se kosɛbɛ ka portfolio jɔ ka da jɛɲɔgɔnyaw kan. Margin bɛ tila jɔyɔrɔ bɛɛ la. O la sa, jɔyɔrɔ minnu bɛ nafa sɔrɔ, olu bɛ jɔyɔrɔw dɛmɛ minnu tɛ nafa sɔrɔ. Ni jɔyɔrɔ kelen binna kosɛbɛ walima ni a wulila kosɛbɛ, siniɲɛsigi jatebɔsɛbɛn bɛɛ bɛ ban. A ka ɲi ka jagokɛlaw datugu k’a sɔrɔ i ma jɔli makɔnɔ, ka baara kɛ ni stop orders ye. A tɛ se ka kɛ tuma bɛɛ ka jatebɔ kɛ ka ɲɛ ka ɲɛsin stop order hakɛ ma. Nafolo sugu falen bɛ manipulation (manipulasiyɔn) la min kɔnɔ sɔngɔ bɛ taa ka taa jɔli ni kɔseginw dalajɛlenba la min bɛ se ka kɛ. Waati dɔ tɛmɛnen kɔfɛ, sugu min bɛ ka bonya, hakilintan bɛ se ka kɛ ko komandi jɔli nafa tɛ ka kɛ. O bɛɛ kɔfɛ, quotations bɛna wuli hali bi. Sanni i ka jago bɔnɛnen dɔ datugu, i ka kan ka wari caman fara a kan walasa ka margin wajibiyalenw mara. Waati dɔ kɔnɔ, o fɛɛrɛ in bɛna nafa sɔrɔ. Ko dɔ bɛna kɛ ni a jɛlen don ko nin tɛ manipule ye, nka ursi sugu lakika don, a bɛ tɛmɛn. Tɔnɔw sera nafaba dɔ ma, wa u tɛ se ka sara.