Nukae nye ganyawo ƒe tsɔtsɔke (ganyawo ƒe tsɔtsɔke, gazazã), nukpɔsusua ƒe vevienyenye le asitsatsa me le nya bɔbɔewo me kple kpɔɖeŋuwo, afɔku siwo le nuwɔna me kple viɖe siwo ate ŋu ado tso eme.

- Nukpɔsusu si nye leverage le asitsatsa me – hehenana ɖoɖo na gɔmedzelawo le nya bɔbɔewo me tso nusiwo sesẽ ŋu

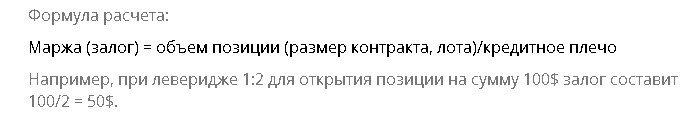

- Alesi woabu akɔnta le leverage ŋu – akɔntabubu ƒe kpɔɖeŋuwo, akɔntabubumɔ̃

- Leverage na asitsalawo kple gadelawo

- Afɔkuwo Kple Viɖe Siwo Le Eme

- Features of leverage le mɔ̃ vovovowo dzi – le Forex, stock market, le binance

- Gaxɔmenudzraƒe

- Forex ƒe nyawo

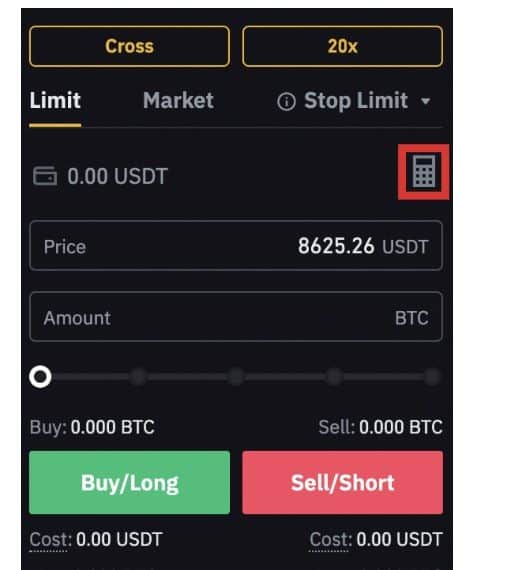

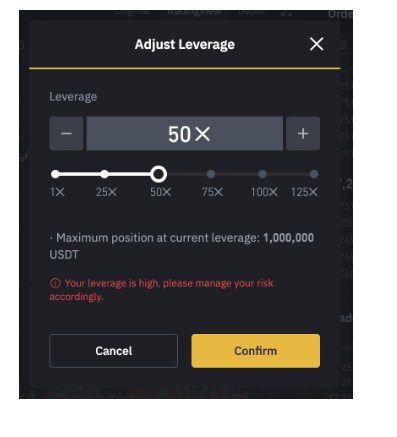

- Alesi leverage wɔa dɔ le Binance dzi

- Margin si Woɖe Ðe Vo

- Cross Margin ƒe Agbɔsɔsɔme

Nukpɔsusu si nye leverage le asitsatsa me – hehenana ɖoɖo na gɔmedzelawo le nya bɔbɔewo me tso nusiwo sesẽ ŋu

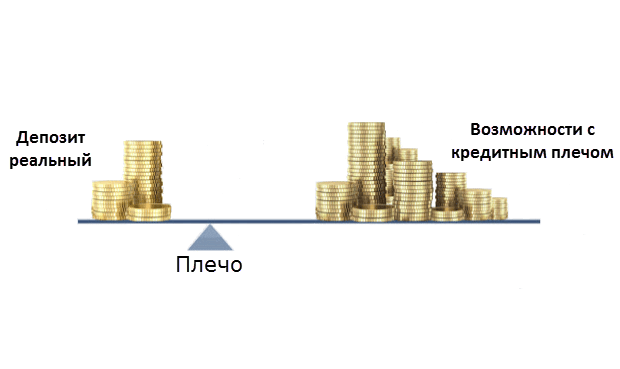

Ganyawo ƒe ŋutete nye asitsahabɔbɔ ƒe dɔwɔna hena ga alo nunɔamesiwo ƒe fedodo. Targeted loan – wotsɔa ga naa liquid stocks, bonds alo gawo ƒeƒle. Ga si le asisi la ƒe ga si susɔ me la wɔa dɔ abe agbanɔamedzi ene. Woyɔa asitsatsa kple leverage be margin lending. Nusi wotsɔna doa ga na ame tso asitsaha aɖe gbɔe nye ga si woatsɔ ado gae. Ga si nèzãna ɖe gaɖɔliɖɔliƒea ŋu nana nète ŋu ʋua ga home si wu asitsatsa ƒe gakɔnta me ga si susɔ la zi gbɔ zi 5, 100, 500, alo esi wu nenema. Ne asitsalawo xɔe se be kakaɖedzi si li be asitsatsa aɖe nadze edzi la sɔ gbɔ la, ezãa ga si wotsɔna ƒoa gae eye wòkpɔa viɖe gã aɖe.

Leverage na asitsalawo kple gadelawo

Asitsalawo nye dzɔdzɔme alo sedziwɔla si wɔa asitsatsa le gaxɔmenudzraƒe, léa ŋku ɖe asitsatsa ƒe ɖoɖowo ŋu eye wòbua ɣeyiɣi kpui ƒe nukpɔsusu ŋu. Gadelawo nye ame ɖekaɖeka (alo ame si le se nu) si ƒlea nunɔamesiwo le gaxɔmenudzraƒea be yeatsɔ akpɔ viɖe le deme me alo to asitsatsa ƒe asixɔxɔ dzi ɖeɖe kpɔtɔ me. Gadelawo daa dɔwɔƒea ƒe dzesi veviwo, nɔnɔme si le dukɔa me kple xexeame kpɔ eye wòdea ga eme, henɔa mɔ kpɔm be yeakpɔ viɖe le ɣeyiɣi didi aɖe me. Gake vovototo vevitɔ si le asitsalawo kple gadelawo domee nye be asitsalawo sea asixɔxɔ ƒe seƒe si woatu ɖoƒea kple nusiwo bu la gɔme nyuie. Gadelawo le klalo be yeabu ƒe geɖe ne nɔnɔme vevitɔa gakpɔtɔ le nyonyom. Asitsalawo bibi ate ŋu ana afɔkuwo nanɔ ɖoɖo ɖeka me eɖanye ga home ka kee wozã o, gake asitsatsa siwo akpɔ dzidzedze la aɖe vi geɖe wu. Gadelawo mate ŋu akpɔ ŋusẽ ɖe afɔkua dzi ne wole asitsadɔ wɔm kple leverage o, asitsatsa nye ɣeyiɣi didi eye fe si woxena ɖe gadodo ta mexea fe o. Ðe wòɖea vi be woazã leverage le asitsatsa me – afɔkuwo, afɔkuwo kple viɖe siwo le leverage ŋua: https://youtu.be/qlH8FBN7MF4

Afɔkuwo Kple Viɖe Siwo Le Eme

Leverage nye dɔwɔnu aɖe. Dɔwɔnu ɖesiaɖe si le aƒetɔ bibi aɖe si me la te ŋu wɔa asinudɔwɔwɔwo, evɔ le gɔmedzela gome la, vevesese kple dziɖeleameƒo koe wòate ŋu ahe vɛ. Leverage naa tiatia siwo gbɔna la li:

- wɔ asitsatsa ɖe ga home siwo lolo wu asitsatsa ƒe ga si wotsɔ de eme la zi gbɔ zi geɖe;

- dzi ga si nède eme la ɖe edzi zi gbɔ zi geɖe le ɣeyiɣi kpui aɖe me;

- ʋu nubablawo kple nyagblɔɖi be woaɖe ga homewo dzi akpɔtɔ, le go sia me la, asitsala la doa ga menye ga o, ke boŋ nunɔamesiwoe. Wodzraa gome siwo dona tso eme la ɖe asi si woƒlena le asi me nu, eye emegbe le nɔnɔme nyuiwo me la, woƒlea wo le asi si dzi woɖe kpɔtɔ nu. Wogbugbɔa gomeawo naa asitsalawo, eye asitsalawo kpɔa viɖe;

- wɔ asitsatsa enumake, evɔ màlala be woawɔ dɔ tso asitsatsa ƒe mɔnuwo dome tsɔtsɔ yi teƒe bubu ŋu o.

[caption id="attachment_7645" align="aligncenter" width="640"]

- ne afɔkuwo gbɔ kpɔkpɔ nyuie o, ga si bu le ɣeyiɣi kpui aɖe me;

- le go aɖewo me la (ne wole asitsadɔwo wɔm to Russia Dukɔa ƒe asitsahabɔbɔ si si mɔɖegbalẽ le dzi); ga home si wu ga si wotsɔ de eme la ƒe bu zi geɖe.

- se siwo ku ɖe dɔwɔwɔ kple leverage ŋu;

- mègazã leverage nuteƒekpɔkpɔ manɔmee le asitsatsa ŋuti akɔntabubuwo nuƒoƒoƒu me o. Kpɔ egbɔ be asitsatsa ƒe aɖaŋua ɖe vi;

- xlẽ nubabla si wowɔ kple asitsaha la nyuie. Mègadzra nunɔamesi siwo me trɔna le kple leverage (le kpɔɖeŋu me, gas, ami, cryptocurrencies) kple asitsalawo siwo si nugblẽfexeɖoɖo ƒe ga mele o nenye be ŋusẽ si gbɔ eme dzɔ eye nàtrɔ nusiwo bu ɖe asisi la ƒe abɔta o;

- ɖe se siwo dzi woato ado le asitsatsa me le nɔnɔme madeamedzi aɖe me la me nyuie.

Features of leverage le mɔ̃ vovovowo dzi – le Forex, stock market, le binance

Gaxɔmenudzraƒe

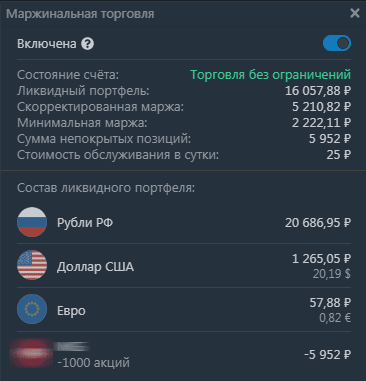

Ne wole asitsadɔwo wɔm le Russia ƒe gaxɔmenudzraƒewo la, asitsalawo dometɔ akpa gãtɔ naa asitsatsa ƒe dɔwɔna aɖe si me woɖea ga le. BCS kple Finam naa gadodo le wo ɖokui si na asisiwo katã (le FFMS ƒe sewo ƒe ɖoɖoa me). Tso ƒe sia me la, seɖoƒe li na gadelawo siwo mexɔ gadelawo ƒe ɖoƒe si dze o la le ga home si woatsɔ awɔ dɔe kple gaxɔgbalẽvi siwo woatia ŋu. Le Tinkoff Investments me la, wowɔa margin lending service la nuwɔametɔe le gɔmedzedzea me;be nàzãe la, ele be nàna tiatia la nawɔ dɔ le ɖoɖoawo me. Broker Sberbank menaa leverage si wu 1 va ɖo 1 o zi alesi asisi la ƒe nunɔamesiwo mede ruble akpe 500 o ko.

Ne wotsɔ ga home si nye ruble 200,000 de gadzraɖoƒe eye woƒe ga home si nye ruble 1,000,000 le ʋuʋu ɖi la, fe si woaxe ɖe ga si woatsɔ awɔ dɔe ta koe anye ruble 80,000. Eye esia nye ga si woda ɖe gadzraɖoƒea ƒe afã kloe. Tsɔ kpe ɖe eŋu la, ne gomeawo metsi tre ɖe teƒe ɖeka o, gake woʋu tsi tre ɖe nya si wogblɔ ɖi ŋu la, esia ana gadelawo nagblẽ.

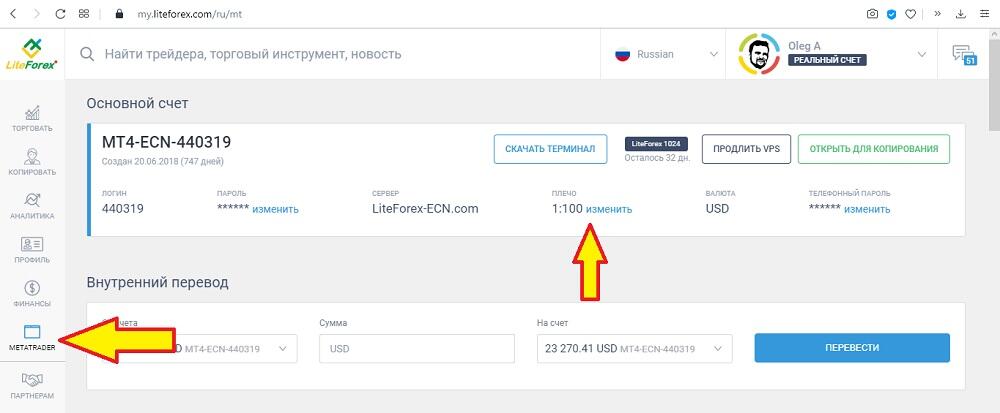

Forex ƒe nyawo

Le forex asi me la, 1 dzidzenu lot sɔ kple 100,000 ga units. akpa gãtɔ forex asitsalawo mekpɔa ga home sia o, eyata asitsaƒewo naa fractional nubablawo tso 0.01 standard lot (si sɔ kple 1000 units ga) eye wonaa leverage. Le Russia Dukɔa ƒe se nu la, forex asitsalawo siwo si mɔɖegbalẽ le tso Titina Gadzraɖoƒea gbɔ la mekpɔ mɔ ana leverage si wu 1 va ɖo 50. Leverage si sɔ gbɔ wu na alpha forex nye 1 va ɖo 40.

Margin si Woɖe Ðe Vo

Ne wole isolated margin mode tiam la, woxea mɔ ɖe gaawo nu eye wobua ga la ƒe akɔnta na gaku ɖesiaɖe ɖe vovo. Esia kpena ɖe ame ŋu ne alẽ yibɔ aɖe le agbalẽdzraɖoƒea. Ðeɖekpɔkpɔ dzɔna na ɖoƒe ɖeka ko, eye mehea ɖoƒewo katã ƒe ɖeɖeɖa vɛ o.

Cross Margin ƒe Agbɔsɔsɔme

Cross margin mode la sɔ na asitsala bibi siwo le portfolio si wotu ɖe kadodowo dzi tum ɖo. Woma margin ɖe ɖoƒewo katã me. Eyata ɖoƒe siwo me viɖe le doa alɔ esiwo me viɖe aɖeke mele o. Ne ɖoƒe ɖeka mu alo dzi ɖe edzi vevie la, woɖea etsɔme gakɔnta bliboa ɖa. Wokafui be woatu asitsatsawo evɔ womalala be woaɖe asi le wo ŋu o, woazã sededewo be woadzudzɔ asitsatsa. Menye ɣesiaɣie wòanya wɔ be woabu akɔnta le ɖoɖo si nu woatɔ te nu ŋu ƒe seƒe ŋu pɛpɛpɛ o. Ganyawo ƒe asi yɔ fũ kple asitɔtrɔ le nɔnɔmewo ŋu si me asixɔxɔa ʋuna yia nusiwo ate ŋu adzɔ be woatɔ te nu kple esiwo woatrɔ ɖe megbe ƒe ƒuƒoƒo gã aɖe gbɔ. Le ɣeyiɣi aɖe megbe, le asi si le dzidzim ɖe edzi me la, susu ate ŋu ado mo ɖa be nudɔdɔ siwo woadzudzɔ la meɖea vi be woawɔ o. Le nyateƒe me la, nyayɔyɔwo agadzi ɖe edzi kokoko. Le esi teƒe be nàtu asitsatsa si bu la, ele be nàtsɔ ga geɖe akpe ɖe eŋu be nàlé ga si woakpɔ tso eme ƒe nudidiwo me ɖe asi. Viɖe le mɔnu sia ŋu hena ɣeyiɣi aɖe. Nudzɔdzɔ aɖe adzɔ ne eva dze ƒã be menye asitɔtrɔ le ame ŋue nye esia o, ke boŋ bear ƒe asi ŋutɔŋutɔe la, etsi megbe akpa. Nusiwo bu la ɖo asixɔxɔ vevi aɖe gbɔ eye womate ŋu axe fe na wo o.