Mene ne abin da ake amfani da shi na kudi (kudi na kudi, ƙaddamarwa), ma’anar ra’ayi a cikin ciniki a cikin kalmomi masu sauƙi tare da misalai, haɗari a cikin aiki da kuma yiwuwar amfani.

- Manufar yin aiki a cikin ciniki – shirin ilimi don masu farawa a cikin kalmomi masu sauƙi game da hadaddun

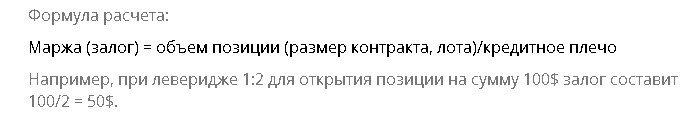

- Yadda za a lissafta leverage – misalan lissafi, kalkuleta

- Leverage ga mai ciniki da masu saka hannun jari

- Hatsari da Fa’idodi

- Siffofin haɓakawa akan dandamali daban-daban – akan Forex, kasuwar hannun jari, akan binance

- Kasuwar hannayen jari

- Forex

- Yadda yin amfani da ke aiki akan Binance

- Keɓe Margin

- Ketare Margin

Manufar yin aiki a cikin ciniki – shirin ilimi don masu farawa a cikin kalmomi masu sauƙi game da hadaddun

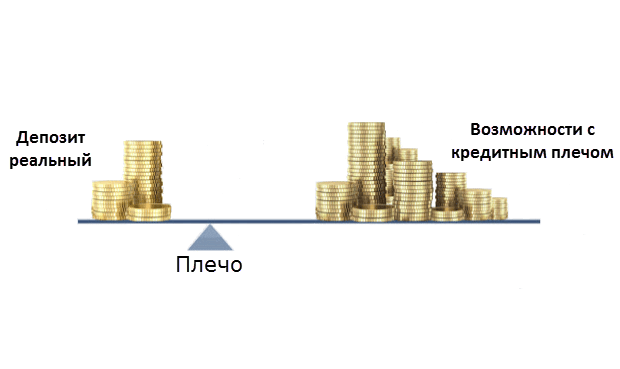

Ƙimar kuɗi sabis ne na dillali don ba da lamuni na kuɗi ko kadarori. Lamuni da aka yi niyya – ana ba da kuɗi don siyan hannun jari, shaidu ko agogo. Kuɗaɗen da ke kan ma’auni na abokin ciniki suna aiki azaman lamuni. Ciniki tare da leverage ana kiransa rancen gefe. Lamunin samun lamuni daga dillali yana da iyaka. Leverage akan musayar yana ba ku damar buɗe ma’amaloli don adadin da ya wuce ma’auni na asusun ciniki ta 5, 100, 500, ko fiye da sau. Lokacin da mai ciniki ya yi imanin cewa yuwuwar samun nasarar cin nasara na ma’amala yana da girma, yana amfani da haɓaka kuma yana samun riba mai yawa. [taken magana id = “abin da aka makala_7655” align = “aligncenter” nisa = “648”]

Yadda za a lissafta leverage – misalan lissafi, kalkuleta

Bari mu yi amfani da misali don nuna abin da ake amfani da shi a cikin sauƙi. Bari mu ce dan kasuwa yana da ma’auni na asusu na $1,000. Ya sayi hannun jari na Gazprom (leverage 1 1) don $ 5 rabon ga dukan babban birnin kasar, isasshen kuɗi don hannun jari 200. Amma ba zato ba tsammani akwai labarai masu kyau a kan Nord Stream kuma mai ciniki yana yin hasashe game da saurin haɓakar hannun jari. Babu wani kuɗin kansa don siyan ƙarin hannun jari, amma dillali yana ba da damar 1 zuwa 5 kuma ɗan kasuwa ya sayi hannun jari don wani $ 4,000. A lokaci guda, akwai 1,000 hannun jari na Gazprom a kan ma’auni, an katange kuɗin da mai ciniki ya mallaka na $ 1,000, dillali ya ɗauki waɗannan kuɗi a matsayin jingina (margin). [taken magana id = “abin da aka makala_7644” align = “aligncenter” nisa = “560”]

Leverage ga mai ciniki da masu saka hannun jari

Dan kasuwa mutum ne na halitta ko na shari’a wanda ke yin ma’amala akan musayar hannun jari, bin diddigin tsarin kasuwa da ƙididdige hangen nesa na ɗan gajeren lokaci. Mai saka hannun jari shine mutum (ko na doka) wanda ya sayi kadarori akan musayar hannun jari don samun riba ta hanyar riba ko ta hanyar haɓaka ƙimar kasuwa. Mai saka hannun jari yana kimanta mahimman alamomin kamfani, halin da ake ciki a cikin ƙasa da duniya kuma yana saka hannun jari, yana tsammanin samun riba a cikin dogon lokaci. Duk da haka, babban bambanci tsakanin mai ciniki da mai saka jari shine cewa mai ciniki ya fahimci a fili a wane matakin farashin matsayi zai rufe tare da asara. Mai saka jari yana shirye ya sha asara har tsawon shekaru idan ainihin yanayin ya kasance mai kyau. Gogaggen dan kasuwa na iya kiyaye kasada a matakin guda ba tare da la’akari da abin da ake amfani da shi ba, amma cinikai masu nasara za su fi riba sosai. Mai saka jari ba zai iya sarrafa haɗari ba lokacin ciniki tare da haɓakawa, ma’amaloli na dogon lokaci kuma kuɗin don samar da lamuni ba ya biya. Shin yana da daraja yin amfani da leverage a ciniki – kasada, hatsarori da fa’idodin yin amfani: https://youtu.be/qlH8FBN7MF4

Hatsari da Fa’idodi

Leverage kayan aiki ne. Duk wani kayan aiki a hannun ƙwararren gwani yana da ikon ƙirƙirar ƙira, yayin da mafari zai iya haifar da ciwo da rashin jin daɗi. Leverage yana ba da zaɓuɓɓuka masu zuwa:

- yin ma’amaloli don adadi da yawa sau da yawa fiye da ajiyar ciniki;

- ƙara yawan ajiya sau da yawa a cikin ɗan gajeren lokaci;

- bude ma’amaloli tare da tsinkaya don raguwar ƙididdiga, a cikin wannan yanayin mai ciniki ya ba da bashi ba tsabar kudi ba, amma dukiya. Ana sayar da hannun jarin da aka samu a farashin kasuwa, sa’an nan kuma, a cikin yanayi mai kyau, ana siyan su akan farashi mai rahusa. Ana mayar da hannun jari ga dillali, kuma mai ciniki yana samun riba;

- yin ma’amaloli nan da nan, ba tare da jiran canja wuri tsakanin dandamali na ciniki don sarrafa su ba.

[taken magana id = “abin da aka makala_7645” align = “aligncenter” nisa = “640”]

- tare da rashin kulawar haɗari mara kyau, asarar jari a cikin ɗan gajeren lokaci;

- a wasu lokuta (lokacin da aka samo asali na kasuwanci ta hanyar dillali mai lasisi na Tarayyar Rasha); asarar adadin da ya wuce ajiya sau da yawa.

- dokoki don aiki tare da leverage;

- kar a yi amfani da leverage ba tare da ƙwarewar tattara kididdigar ciniki ba. Tabbatar cewa dabarun ciniki yana da riba;

- a hankali karanta kwangilar tare da dillali. Kada ku yi musayar kadarorin da ba su da ƙarfi tare da haɓaka (misali, gas, mai, cryptocurrencies) tare da dillalai waɗanda ba su da ajiyar inshora idan akwai majeure mai ƙarfi da jujjuya asara a kan kafaɗun abokin ciniki;

- a fili ayyana ƙa’idodin fita ciniki a cikin yanayi mara kyau.

[taken magana id = “abin da aka makala_7651” align = “aligncenter” nisa = “1200”]

Siffofin haɓakawa akan dandamali daban-daban – akan Forex, kasuwar hannun jari, akan binance

Kasuwar hannayen jari

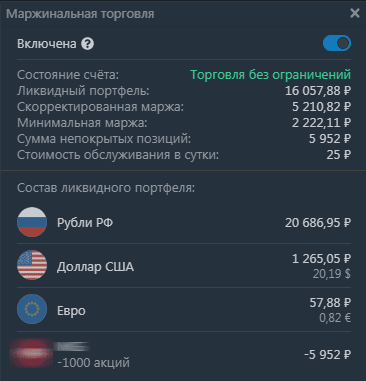

Lokacin ciniki hannun jari a kan kasuwar hannun jari na Rasha, yawancin dillalai suna ba da sabis na cinikin gefe. BCS da Finam suna ba da rancen gefe ta atomatik ga duk abokan ciniki (a cikin tsarin dokokin FFMS). Tun daga wannan shekara, masu zuba jari waɗanda ba su sami matsayi na ƙwararrun masu saka hannun jari suna da ƙuntatawa akan adadin abin da za a iya amfani da su da kuma zaɓin tsaro. A cikin Tinkoff Investments, sabis ɗin ba da lamuni na gefe yana kashe ta tsohuwa; don amfani da shi, dole ne ku kunna zaɓi a cikin saitunan. Broker Sberbank ba ya ba da damar yin amfani da sama da 1 zuwa 1 idan dai dukiyar abokin ciniki ta kasa da 500 dubu rubles.

Tare da ajiyar kuɗi na 200,000 rubles da matsayi na gefe na 1,000,000 rubles, kawai kudin don samar da kayan aiki zai zama 80,000 rubles. Kuma wannan kusan rabin ajiya ne. Bugu da kari, idan hannun jari ba su tsaya cik ba, amma sun matsa gaba da hasashen, wannan zai haifar da lalatar mai saka hannun jari.

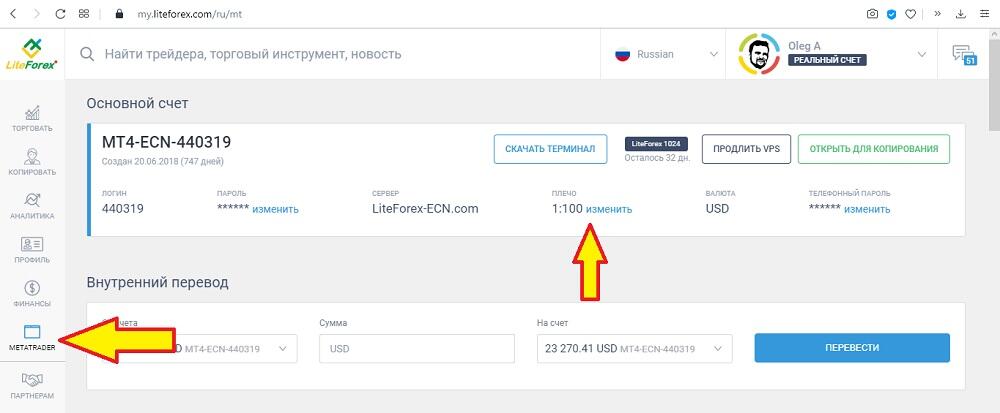

Forex

A cikin kasuwar forex, daidaitattun kuri’a 1 daidai yake da raka’o’in kuɗi 100,000. Yawancin ‘yan kasuwa na forex ba su da wannan adadin, don haka cibiyoyin mu’amala suna ba da kwangiloli daga 0.01 daidaitattun yawa (daidai da raka’a 1000 na kuɗi) kuma suna ba da fa’ida. Bisa ga dokar Tarayyar Rasha, dillalan dillalai masu lasisi na Babban Bankin ba su da damar ba da damar yin amfani da sama da 1 zuwa 50. Matsakaicin ƙimar alpha forex shine 1 zuwa 40. [taken magana id=”attachment_7659″ align=”aligncenter” ” nisa = “1000”]

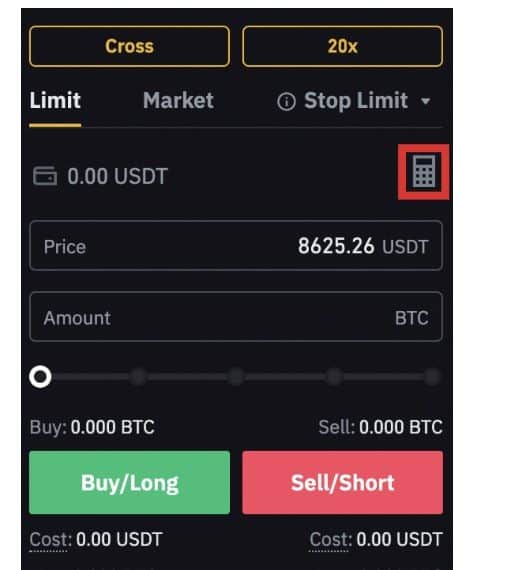

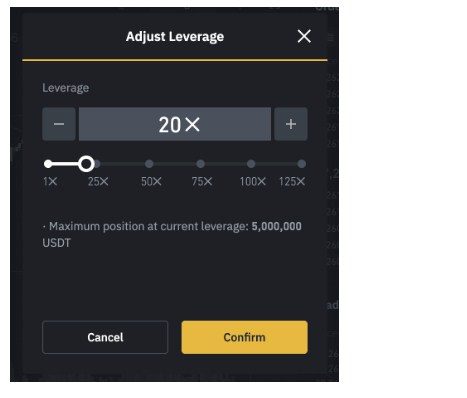

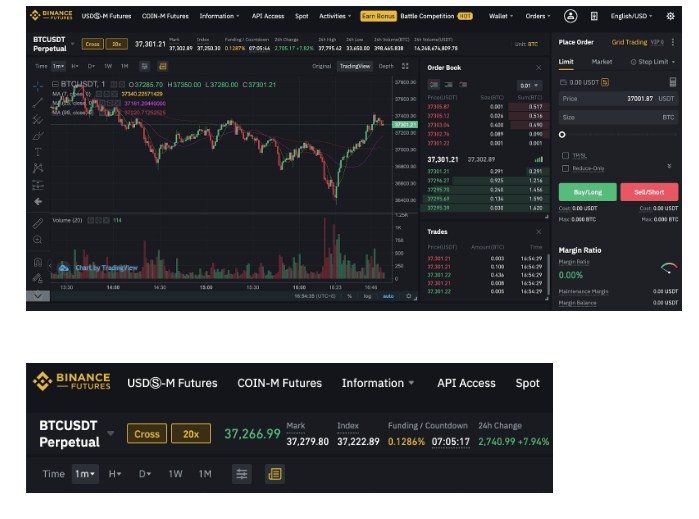

Yadda yin amfani da ke aiki akan Binance

Saboda girman rashin daidaituwa na kadarori na crypto, ciniki akan gefe ya fi haɗari idan aka kwatanta da hannun jari ko kasuwar musayar waje. Kafin ka fara kasuwanci na gaba ko cryptocurrencies, tsarin zai ba ka damar cin nasara. Ba za a sami damar yin ciniki ba har sai tsarin ya tabbatar da cewa abokin ciniki ya fahimci cikakkiyar hanyar yin amfani da Binance. Ana haskaka madaidaitan amsoshi cikin kore. Bayan ‘yan yunƙuri, ko da cikakken mafari zai haddace abubuwan yau da kullun. Ta hanyar tsoho, Binance yana ba da damar yin amfani da 20 don ciniki na gaba. [taken magana id = “abin da aka makala_7649” align = “aligncenter” nisa = “467”]

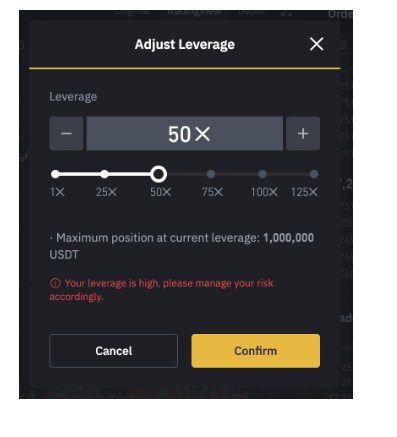

Keɓe Margin

Lokacin zabar keɓantaccen yanayin gefe, ana toshe kuɗin kuma ana ƙididdige kuɗin don kowane tsabar kuɗi daban. Wannan yana taimakawa idan akwai baƙar fata a cikin fayil ɗin. Liquidation yana faruwa ne kawai don matsayi ɗaya, kuma baya haifar da rushewar duk matsayi. [taken magana id = “abin da aka makala_7658” align = “aligncenter” nisa = “691”]

Ketare Margin

Yanayin giciye ya dace da ƙwararrun ƴan kasuwa suna gina fayil bisa alaƙa. An raba gefe a duk wurare. Don haka matsayi masu riba suna tallafawa marasa riba. Tare da rugujewar rugujewa ko hawan matsayi ɗaya, gabaɗayan asusu na gaba ya lalace. Ana ba da shawarar rufe kasuwancin ba tare da jiran ruwa ba, ta amfani da umarni tasha. Ba koyaushe yana yiwuwa a ƙididdige matakin odar tsayawa daidai ba. Kasuwar hada-hadar kudi tana cike da magudi wanda farashin ke tafiya zuwa ga yuwuwar tarin tsayawa da juyawa. Bayan wani lokaci, a cikin kasuwa mai tasowa, tunanin zai iya tasowa cewa umarnin dakatarwa ba su cancanci sanyawa ba. Bayan haka, ƙididdiga za su ci gaba. Maimakon rufe kasuwancin da ya ɓace, kuna buƙatar ƙara ƙarin kuɗi don kula da buƙatun gefe. Na ɗan lokaci, wannan hanyar za ta kasance mai riba. Wani lamari zai faru lokacin da ya bayyana cewa wannan ba magudi ba ne, amma ainihin kasuwar bear, ya yi latti. Asara ta kai ga ƙima mai mahimmanci kuma ba za a iya biya ba.