The article was created based on a series of posts from the OpexBot Telegram channel , supplemented by the author’s vision and the opinion of the AI. Beginner trader? Then come to us. How can a beginner go broke, or go broke but as painlessly as possible: playing on the stock exchange for beginners in conditions close to real ones.

- Starting point: don’t do it like everyone else, but do it the right way

- A proven rational and emotionally easy way

- When can a novice trader switch completely to trading?

- How to survive at the very beginning of your journey: specific steps on how to make money on the stock exchange for a beginner

- Exchange for beginners: a chain of actions for a competent start on the exchange

- Read some good books

- The task is to get a base

- Don’t get involved in binaries, Forex

- Choose a broker

- Run a virtual deposit on a demo account for a few days

- Choosing a real trading terminal

- Choose a risk management strategy

- Control your emotions

- Understand what is bad and what is good

- Prepare to fall and rise

- And now the rules from Opexbot: how a beginner can make money on the stock exchange, what a beginner needs to know, how to make money and not go broke

- What’s next?

- How not to replenish the collection of such stories?

- Advice from experienced traders: 10 tips from experienced traders for beginners

- Always use a trading plan

- Treat trading like a business

- Use technology to your advantage

- Protect your trading capital

- Become a Market Researcher

- Only risk what you can afford to lose.

- Develop a methodology and bidding system

- Always use stop loss

- Know when to stop trading

- Accept the market as it comes

- For a novice trader: the right broker is your first joker

- The first task is to select reliable brokers working on the Moscow Exchange

- Minimum first deposit amount

- Deposit fees and transaction fees

- Application for trading on a smartphone

- What about sanctions?

Starting point: don’t do it like everyone else, but do it the right way

Especially on the stock exchange. As it happens. A person learns about trading and dives headlong into the abyss. Dedicates all his time to the terminal. He flies in, doesn’t know anything, wants to grab some money, but quickly loses the deposit.  Along the way, I took out a loan, quit my job, and quarreled with my loved ones. This is the path to fatigue, burnout and family problems.

Along the way, I took out a loan, quit my job, and quarreled with my loved ones. This is the path to fatigue, burnout and family problems.

A proven rational and emotionally easy way

Incorporate gradually. No need to quit your job. Plan your time. Organize your trading so that you devote 50% of your free time to trading. For some it’s 2 hours a day. Some people have 5 hours a week. As practice shows, no matter how busy you are and the pace of life, you can set aside a few hours for trading. You can reduce the time to enter the market with the help of training materials , tools and assistant bots .

Trading should be not only profitable, but also comfortable. Gradually assimilate into the new reality, make the stock exchange part of your happy life.

When can a novice trader switch completely to trading?

When you realize that trading suits you mentally and psychologically. And, of course, it will begin to bring significant profits. You can devote more time to trading. Change job and profile. Top up your deposit. Develop.

How to survive at the very beginning of your journey: specific steps on how to make money on the stock exchange for a beginner

Exchange for beginners: a chain of actions for a competent start on the exchange

How to put all the links together. And where does the chain most often break? It is worth understanding that the stock exchange is a battlefield where hundreds of thousands of traders fight for money. And the most savvy in all aspects survive: technically, informationally, psychologically. So where to start in order to join in relatively safely and not merge right away?

Read some good books

For a novice trader, books are a storehouse of knowledge and experience. To understand how money, investments, and the market work. How the crowd thinks. Jack Schwager, Ray Dalio, Benjamin Graham. That’s enough for a start. Binge reading at this stage is rather harmful. There is no critical evaluation of what I have read yet.

The task is to get a base

Don’t get involved in binaries, Forex

That’s why binaries . Forex is a complex foreign exchange market. And a big shoulder. Drainage is 99% guaranteed. I recommend the option: Moscow Exchange + stock market. https://articles.opexflow.com/stock-exchange/moex.htm Minimal risks, deposit and commissions. Here you can “bargain your hand.”

The goal is to minimize risk.

Choose a broker

Run a virtual deposit on a demo account for a few days

The task is to study the buttons, functionality of the trading terminal, and indicators.

Choosing a real trading terminal

I recommend QUIK. The most popular in the CIS, supports many exchanges. It has many possibilities and necessary settings. The task is to choose a reliable terminal that will cover all your needs.

Choose a risk management strategy

How many losing trades in a row will knock you out of the market? At the initial stage, selects the most risk-resistant systems. Remember, you are just getting started. Do not swim breaststroke with the risk of drowning. The task is to survive and learn to stay afloat.

Control your emotions

How? Record all transactions

. Evaluate on what emotions/news they were accepted. We form rules and habits. The task is to form the right habits and improve emotional intelligence.

. Evaluate on what emotions/news they were accepted. We form rules and habits. The task is to form the right habits and improve emotional intelligence.

Understand what is bad and what is good

Learn to read a chart. Volumes, price behavior. How does a glass work? Get involved in technical analysis. The task is to become technically savvy. https://articles.opexflow.com/analysis-methods-and-tools/indikatory-texnicheskogo-analiza.htm

Prepare to fall and rise

This is normal in trading and in life. The task is to learn from mistakes, draw conclusions and adjust the rules.

The global task of the first steps is to understand that trading is also a business and fishing in a muddy pond will not work here.

How to make money for a beginner on the stock exchange, think about it, a novice trader: https://youtu.be/9-z2o_TywCg?si=ZP2Pa8gpomr0JBb8

And now the rules from Opexbot: how a beginner can make money on the stock exchange, what a beginner needs to know, how to make money and not go broke

Fundamental rules for a novice trader.

What’s next?

Without a system and risk management, the deposit is necessarily lost. In the worst case, more money is poured in, drained again, and so on until complete disappointment sets in.

How not to replenish the collection of such stories?

Relatively simple, following the rules. Conquering the science of trading should be gradual. When you come to the stock exchange, you are in the role of catching up with those who have been there for years. The original goal is not to make money. And study the market, learn not to lose, or lose a little. Trade gradually, in small steps. It is important to collect your own statistics and build your own system. Trade on small deposits and with a small percentage of the deposit. Try to maintain 1-2 positions. Don’t jump into dozens of lots at once. The first failures are an invaluable experience. And with experience comes controlled success as a professional trader. Not just beginner’s luck. Don’t throw everything into the trading furnace at once You can’t put trading above everything. Can be successfully combined with work. Moreover, there is no need to put trading between yourself and your family. Getting support from those closest to you in your endeavors is already half the success in any business.

Result: a confident trader, a happy family.

Gradually join this interesting field, study, develop and gain experience and stable profit.

Advice from experienced traders: 10 tips from experienced traders for beginners

Always use a trading plan

A trading plan is a set of rules that define a trader’s entry, exit, and money management criteria for each purchase. Thanks to modern technology, test a trading idea before risking real money. This practice, known as backtesting, allows you to apply your trade idea using historical data and determine whether it is viable. Once the plan is developed and backtesting shows good results, it can be used in real trading.

But remember that this cannot be a recommendation for action or investment advice. This is only testing to understand the market.

Sometimes your trading plan won’t work. Get out of it and start over. The important thing here is to stick to the plan. Making trades outside of your trading plan, even if they turn out to be profitable, is considered a bad strategy.

Treat trading like a business

To be successful, you must treat trading as a full-time or part-time business and not as a hobby. If you treat this as a hobby, there will be no real desire to learn. Trading is a business that involves costs, losses, taxes, uncertainty, stress and risk. As a trader, you are essentially a small business owner and need to do your research and strategize to maximize your business’s potential.

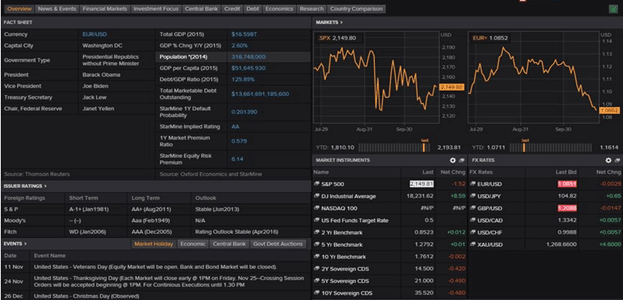

Use technology to your advantage

Trading is a competitive business. It’s safe to assume that the person on the other side of the transaction is making full use of all available technology. Charting platforms provide traders with endless opportunities to view and analyze markets. Backtesting your idea using historical data prevents costly mistakes. Receiving market updates via smartphone allows us to monitor trades anywhere. Technologies we take for granted, such as high-speed Internet connections, can make trading more efficient.

Use modern robots and other services to increase your chances of success.

Using technology to your advantage and keeping up with new products can be a fun and rewarding part of trading.

Protect your trading capital

Saving enough money to fund your trading account takes time and effort. This can be even more difficult if you have to do it twice. It is important to note that protecting your trading capital is not synonymous with avoiding losing trades. All traders have losing trades. Capital protection involves avoiding unnecessary risks and taking all measures to preserve your trading account.

Become a Market Researcher

Think of it as continuing education. Traders need to stay focused on learning more every day. It is important to remember that understanding markets and their intricacies is an ongoing, lifelong process. Thorough research allows traders to understand the facts, such as what different economic reports mean. Focus and observation allow traders to hone their instincts and learn nuances. World politics, news events, economic trends, and even the weather all influence markets. The market environment is dynamic. The better traders understand past and current markets, the better prepared they are for the future.

Only risk what you can afford to lose.

Before using real money, make sure that the money in this trading account is an acceptable loss. If this is not the case, the trader must continue to save until he has accumulated financial resources for the first deposit. Losing money is quite a traumatic experience. Moreover, if we are talking about capital, which should not be risked at all.

Develop a methodology and bidding system

Taking the time to develop a reliable trading system is well worth the effort. Don’t believe in magic pills, signals from information gypsies and “hundred-pound” forecasts. Traders who take the time to learn usually have an easier time absorbing all the misinformation available on the Internet. Learning to trade requires time, perseverance and an understanding of what is being done and why.

Always use stop loss

A stop loss is a predetermined amount of risk that a trader is willing to accept on each trade. The stop loss can be a specific amount, or a percentage, but it limits the trader’s risk during the trade. Using a stop loss can take some of the stress out of trading because the specific amount lost on each trade is initially known. This also allows you not to sit at the terminal around the clock. Not having a stop loss is a bad practice, even if it results in a winning trade. Exiting a trade with a stop and therefore a losing trade is still a good strategy as long as it follows the rules of the trading plan.

It is impossible to exit all trades with a profit. Using a protective order helps ensure that losses and risks are limited.

Know when to stop trading

There are two reasons to stop trading: an ineffective trading plan and an emotional trader. An ineffective trading strategy indicates that it is time to stop and make adjustments. This is normal practice. The main thing is to draw conclusions and make changes. Remain unemotional and keep your emotions under control. It’s just time to reconsider your trading plan. A failed strategy is a problem that needs to be solved. But this is also invaluable experience and skill leveling. But an emotionally unstable trader is a problem on a large scale. He makes a trading plan, but cannot follow it. External stress, lack of sleep, bad habits and simply mental character traits can contribute to the problem. A trader who is not in the best shape to trade should consider stopping the trade and exiting the terminal.

Accept the market as it comes

When trading, focus on the big picture. A losing trade should not make you feel aggressive or despondent. It’s part of trading. A winning deal is just one step towards success. No need to be euphoric. The big picture is important. Once a trader accepts profits and losses as part of the trading game, emotions have less of an impact on trading performance. This does not mean that you cannot rejoice at a particularly successful trade, but at such a moment it is better to pause and not make risky moves on the wave of positivity. Setting realistic goals is an important part of forward-looking trading. If you expect to be a millionaire by next Tuesday, you are setting yourself up for failure.

For a novice trader: the right broker is your first joker

We choose a broker for trading on MOEX, as the most popular exchange among traders and investors from the Russian Federation.

Information for residents.

It will also be useful for those who have already chosen a broker once. The best conditions and offers change constantly. Laziness prevents you from looking for them. Collected relevant data for you. Algorithm of actions:

The first task is to select reliable brokers working on the Moscow Exchange

We study broker ratings available on the Internet. We filter out advertising. We read real reviews, study ratings. It’s good if there are hundreds of these reviews, not just one or two. Supporting factors that indicate reliability: number of clients and timing in the market. Current figures:

- Tinkoff Investments. Recently on the market, but a leader in the number of clients. More than 16 million

- Finam. Since 1994 on the market, more than 400k clients.

- VTB broker. On the market for more than 30 years, from 300k clients.

- BCS World of Investments 28 years on the market, more than 1 million clients.

- SBER. More than 3 million clients.

Minimum first deposit amount

Let me remind you why this is important .

- Tinkoff: You can start investing with 10 rubles.

- VTB no minimum amount.

- BCS no minimum amount.

- At Finam the minimum deposit is from 15 to 30k rubles, depending on the instrument being traded.

- SBER starts from 100 rubles.

Deposit fees and transaction fees

- Tinkoff Trader tariff: 299 rubles service, 0.05% per transaction. There are quite a lot of other commissions that are not immediately visible. Details about commissions are here , and the service for accounting for them is here .

- Finam FreeTrade tariff for beginners: free service and 0% on the transaction. Low commission for intraday trading: 45 kopecks.

- VTB broker free service and 0.05% per transaction.

- BCS Trader tariff: 299 rubles service, 0.01% per transaction.

- SBER. Free service and from 0.06% per transaction.

There are other commissions too! For storing currency, for withdrawing funds Be sure to study further.

Application for trading on a smartphone

All brokers on the list have it.

What about sanctions?

The sanctions affected the ability to trade foreign assets, as well as conduct foreign exchange transactions. The sanctions list includes VTB, SBER, Tinkoff, Otkritie, MTS and others. Each has its own nuances in restrictions, which are worth studying in detail on the official websites. If you plan to trade only Russian securities, then there is no point in reacting. If you plan to work with foreign securities, then Finam and BCS World of Investments are not on the list at the moment.

Disclaimer. I don’t advertise anything, only current figures and facts. Does not constitute individual investment advice.