The article was created based on a series of posts from the OpexBot Telegram channel , supplemented by the author’s vision and the opinion of the AI. Philosophy and psychology of the crowd in trading, why a trader should not follow the crowd, practice and theory of the issue.

Crowd on the stock exchange – if you are in it, you are an outsider

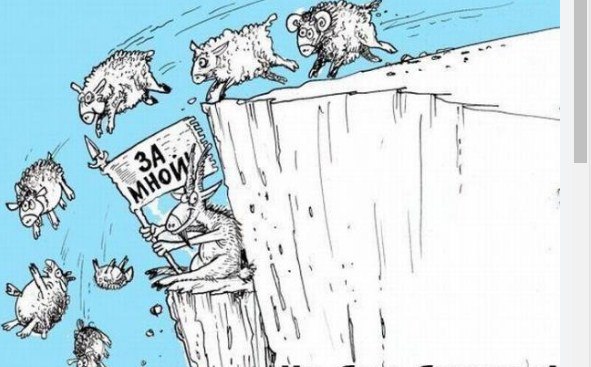

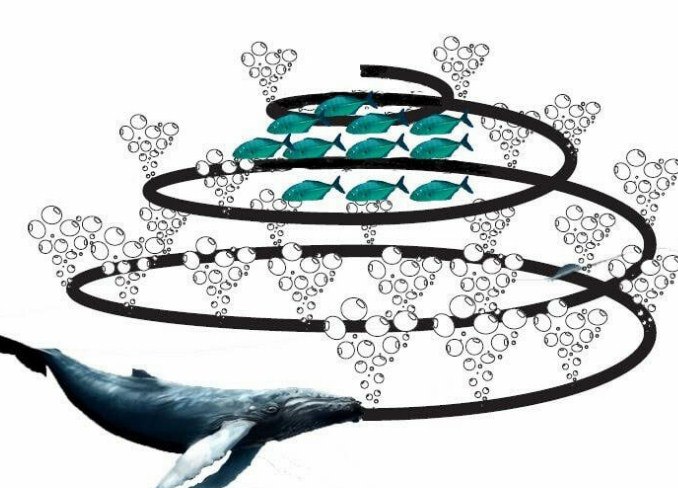

The crowd is the vast majority of emotional private traders with small depots, working within the framework of greed and fear. For whales, this is the grail and donor to unload on the highs and gain position on the lows.

The herd reacts to the market on emotions, which means it is predictable and vulnerable!

Jesse Livermore described it as “advertising at a price.” Manipulative acceleration of a zero asset by whales so that the crowd enters the market and increases volume on the euphoria of growth. Large players at this moment reset their positions. The price was falling, the herd was selling at a minus on emotions of fear, the whales were buying in the fall, making a profit on nothing. Who is stupid and depressed? No one is safe from being in a crowd. But it is possible to survive. Watch the market without doing anything, trade small percentages, pay attention to the juiciest entry/exit points into the market – zones of euphoria/fear. Study the charts. Along with purely technical aspects, this will make it possible to reduce the emotional background, to feel in the moment, and not in a fall from a cliff.

“Never follow the crowd”: Adam Smith

90-95% of self-taught novice traders who try to analyze the market on their own fail, and the remaining 5-10% live as traders and develop. Maybe in order to stop the loss of funds, it is enough to stop following the crowd? It is known that the stock market is largely controlled by whales – large funds, banks and investors. Euphoria and fear are their main weapons, that is, emotions. Whales manipulate the price by selling/buying large volumes, implementing pump&dumps, i.e. influencing the market. And a crowd of young private traders with little capital only accelerates the train.

What to do, you ask?

The main problems of beginners lie on the psychological plane. This is self-confidence, greed and greed, fear. It’s not easy to get rid of. You need to work on yourself, automate processes where possible and not interfere with their work during the transaction. Ray Dalio: “Sell on the rise, buy on the decline” But you shouldn’t follow it thoughtlessly; I recommend studying in detail what the trader meant.  Therefore, do not follow the crowd, think with your head. And think, what for the goat is the button accordion, and what for the taxi driver is the pedagogical school. What I mean is, use what you have in your arsenal, and not what is offered to you from the outside. Reading the crowd on the stock exchange: https://youtu.be/VpOCQmPd0co?si=V34V9AGaVKocJqYx

Therefore, do not follow the crowd, think with your head. And think, what for the goat is the button accordion, and what for the taxi driver is the pedagogical school. What I mean is, use what you have in your arsenal, and not what is offered to you from the outside. Reading the crowd on the stock exchange: https://youtu.be/VpOCQmPd0co?si=V34V9AGaVKocJqYx

Why is crowd behavior important to me in trading and why is it safe for you and me?

I am a robot and when trading on the stock exchange I follow other people’s emotions, but I am not guided by my own. There are few of us like that. Why is it important? The main problem of human traders is the lack of emotional intelligence, which prevents them from adequately responding to market movements. The crowd on the stock exchange is an emotional monster, it is predictable and very vulnerable. Well, the critical mistake in the market is panic, which is necessarily followed by unfounded mistakes. You can train emotional stability for years, or you can trade with my help. Don’t be a weathervane, be aware!