Risk management in trading – what is it, basic rules and tips for beginners on money and risk management. Risk management is a set of money management rules that allow you to optimize profits and keep your deposit in a series of unsuccessful transactions. Risk management rules relate to position size, closing losing positions and taking profits. The classic concepts of risk management are trading with a ratio of 1 to 3, exiting a position before the news, and the mandatory installation of a stop order. Many beginners who blindly follow these rules are waiting for losses and the loss of the entire deposit or most of it. Indeed, it is important to be able to manage risks, this is what distinguishes a trader from a casino player.

a brokerthe entire trading capital is located, replenishments are not made or they are insignificant. The capital usually amounts to a significant amount, more than 2-5 of the investor’s annual income. The goal is to maintain and increase the deposit without the risk of losing more than 30% of the deposit. For aggressive trading, the broker has a small part of the deposit on the account, not exceeding daily earnings. The goal is to earn at least 500-1000%. Let’s assume the risk of losing the deposit.

conservative trading

Absolutely all the rules of classical risk management apply to conservative trading – trading with a large deposit, the loss of which, although not catastrophic, but significantly affects the investor’s condition. Risk management rules are aimed at not losing capital even under adverse market conditions. A simple math shows that with 2% risk per trade, it takes 119 consecutive trades to make a 100% loss. If a trader has a proven strategy, does not enter into transactions at random, the onset of such a series of transactions is unlikely. And 2% is a fairly high level of risk. If you have a large capital and 2% is a large amount in rubles, to reduce the psychological burden, you can reduce the risk to 0.2-0.5%. Then you need an even longer series of losing trades.

Risk-reward ratio

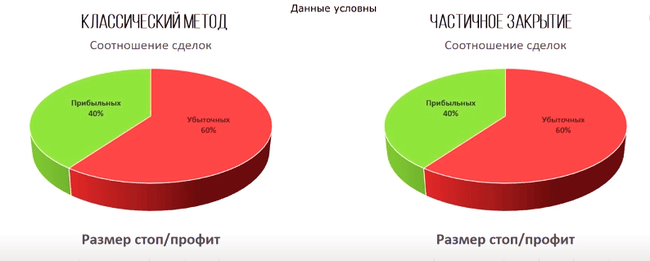

It is difficult to correctly predict the behavior of the market, which depends on many factors. Many professional traders have a win-to-loss ratio of less than 50%. At the same time, they consistently earn. The secret of success is in the ratio between a losing trade and a profitable one. The well-known expression “let profits flow and cut losses” is about this. The example below shows that with a risk-reward ratio of 1 to 3, a trader can make 50% of losing trades in a period and still be in profit. The higher the ratio, the more a trader can afford to be wrong. If, according to statistics, you make less than 60% of profitable trades, and the risk-reward ratio is less than 1 to 1, then the loss of capital is a matter of time.

Exiting a losing trade

stop order

Risk management sets the rules for exiting a losing trade. The safest option is to set a stop order upon reaching a predetermined level. For example, a trader makes a forecast about the end of the correction and the resumption of the uptrend. Opens a buy trade at point 3 and expects at least a return to the historical maximum. The ratio of risk to profit is 1 to 5. In case of an error, the trader sets a stop order at the level of point 1. Its triggering means that the forecast is erroneous and most likely the price correction has not yet been completed. Setting a stop order helps the trader avoid big losses. The transaction will be closed without the participation of the trader, he does not need to be nervous and check the chart every hour.

Closing a deal “by hand”

One such mistake can be disastrous for a trading account. It does not matter how many profitable trades were closed earlier. Therefore, this method is more suitable for experienced traders who know how to cope with emotions and understand the cost of violating money management rules. The risk of such an exit from a losing position may be higher than the calculated one, so it is better to reduce the volume by 2-3 times.

Aggressive trading – stop is the whole account

The classic rules of risk management imply that the entire trading capital of a trader is on the broker’s account and its loss will hurt financial well-being. In such a situation, violating risk management rules and risking more than 10% of the account in one transaction is tantamount to losing the deposit. If not today, then tomorrow a losing series of trades will come, which will kill the account. Also, the classic risk reward does not take into account the psychology of the trader. In theory, the rules work well, but in practice, after a series of losing trades on tilt, a trader breaks his own rules. It enters the market without a signal, takes too large lots, removes stop orders and adds volume instead of closing the loss. Subject to classical risk management, in order to consistently earn $1,000 a month, you need a deposit of at least $10,000. It is not easy for a person with an average salary to accumulate such an amount, it will take 1-3 years. And all this can be crossed out by one mistake caused by psychology.

- Set the amount of risk per day, not exceeding the daily income.

- Per day (or other period, depending on the frequency of transactions), it is allowed to make one transaction for all risk or several transactions, while the risk is shared. For example, the risk per day is $10. You can make 1 trade with a $10 stop or 5 trades with a $2 stop. It seems that the probability of making 5 losing trades is lower than 1, and the second option is preferable. But it all depends on the market situation and position size. The smaller the stop size in points, the higher the probability of loss. If you trade inside the stop day – the order should not be less than the price volatility for the last 7 hours. To determine the volatility, open the hourly chart and set the ATR (Average True Range) indicator with a period of 7. It is better if the stop is 2-3 times greater than the ATR.

- Regardless of the outcome of the trade, we risk the same amount on the next trade. Let’s say we set the rules. The risk for the day is $10, we can make 5 trades with the risk of $2. The market situation was favorable and the first transaction brought us $10. Now the bill is $20. But the next trade should still be with $2 risk (or no more than $8).

- Regular withdrawal of profits, at least 30%. If the capital is small and you do not need money for everyday needs, you can not withdraw to the card. And translate into a less risky strategy. For example, buy bonds if you trade in the stock market. Or transfer to a separate account, it is important that the transfer of money takes time. But it’s better to withdraw it from the brokerage account at least once every few months and buy something or go on vacation. This will increase motivation.

- Re-calculate the amount of risk every month. Maybe you started earning more, or your deposit has grown so much that the amount of profit seems ridiculous. If the market is against you, or you have lost some of your income and the previous amount seems large, reduce your daily risk to a comfortable level. It is extremely important that daily losses are not significant, do not cause a desire to recoup.

Risk management in trading, where and when to set stop loss and take profit, trading school: https://youtu.be/7Bfrxgu5BGI There are more risk management schemes in trading, but the basic ones are voiced above.