In the global economy, it is impossible to imagine a country without international trade. To do this, the monetary unit of any state must be commensurate with the currencies of other states. The mechanism for measuring the value of the national currency in comparison with other currencies is the exchange rate, which is influenced by many factors.

- Exchange rate – what is it?

- Factors affecting exchange rates

- Market

- Banks

- Trade balance

- On a positive trade balance

- What determines the rates of major world currencies?

- U.S. dollar

- Euro

- GBP

- Japanese yen

- Swiss frank

- Russia and ruble

- Equilibrium exchange rate

- Current macroeconomic indicators in Russia and their relationship with the ruble exchange rate

- Forecasting exchange rates

- central bank

- Currency interventions

- Money issue

- Discount rate (refinancing rate)

- Operations related to national debt obligations

- The impact of digital money on world currencies

- Influence of other factors

Exchange rate – what is it?

The exchange rate (or exchange rate) is the currency of one state, measured in the national currency of another state. The Russian ruble, the American dollar, the Japanese yen are all examples of national currencies. When we hear that the dollar exchange rate amounted to N rubles, this is the value of the Russian ruble, expressed in the US national currency. Displaying the exchange rate has a practical meaning only for a certain date. The next day, a week or a month later, the exchange rate may change significantly, and this information is already losing its relevance.

Factors affecting exchange rates

The exchange rate can be determined in two ways: market or non-market. In the first case, the rate is formed on a market basis and depends on the supply and demand for the currency. In the second case, the rate is set by the state on a legislative basis.

Market

The exchange rate in market conditions is determined by the ratio of supply and demand for the country’s currency. The exchange rate of any country in the world is usually set to 5 major world currencies, the most stable over a long period of time. It:

- U.S. dollar;

- Euro;

- English pound sterling;

- Japanese yen;

- Swiss frank.

The place where sellers and buyers of currency interact is called a currency exchange. The exchange is the place where, according to the laws of supply and demand, the most fair price is formed, in our case, the price of the national currency.

The largest currency exchange in the Russian Federation is the Moscow Interbank Currency Exchange (MICEX).

How is the demand for the national currency formed on the currency exchange? Suppose a favorable investment climate has been created in the country and foreign investors are ready to invest their capital to open new industries or develop existing ones. For production, it is necessary to purchase machines, equipment, find premises, pay salaries to employees and pay taxes – all in national currency.

To implement this plan, investors come to the stock exchange with a desire to buy the national currency of this country. The demand for the national currency increases, and accordingly, the exchange rate of this currency also increases.

Examples of changes in the exchange rate of the national currency X against the US dollar depending on the change in the volume of supply of the dollar and the national currency in the country’s foreign exchange market are presented in the table.

| Criteria | Example 1 | Example 2 | Example 3 | Example 4 | Example 5 | Example 6 |

| The volume of supply of the United States in the country’s foreign exchange market (in dollars) | 5,000,000 | 2 500 000 | 10,000,000 | 5,000,000 | 5,000,000 | 5,000,000 |

| The volume of supply of the national currency in the foreign exchange market of the country (X) | 100 000000 | 100,000,000 | 100,000,000 | 50,000,000 | 10,000,000 | 500,000,000 |

| The exchange rate of the national currency against the US dollar (conventional units) | twenty | 40 | ten | ten | 2 | 100 |

Banks

Currency exchange operations of banks is another factor affecting the exchange rate. The main consumers of banking services for the purchase and sale of foreign currency are us, ordinary citizens. We buy hard currency for:

- trips abroad;

- trying to protect their savings from inflation;

- making money transfers abroad.

The exchange rate of commercial banks for citizens differs both from the market rate and from the official rate, which is set by the Central Banks of various countries.

Due to the high cost of selling currency by banks and the low purchase rate for citizens, it is almost pointless to purchase it to earn money on changes in exchange rates.

The ratio of the official exchange rate of the ruble and the rate of purchase and sale of commercial banks is shown in the table.

| The official exchange rate of the US dollar against the ruble | US dollar purchase rate by a commercial bank | US dollar selling rate by a commercial bank |

| 75.4 | 74 | 77.7 |

Trade balance

The trade balance is the difference between the total expression of goods imported into the country (imports) and the total expression of goods exported abroad (exports). Accordingly, the trade balance can be positive (exports predominate) or negative (imports predominate). The trade balance is a very significant factor in determining the exchange rate of the national currency. An example of a negative trade balance. Negative balance of $25,000:

| Export, US dollars | Import, US dollars |

| 100,000 | 125 000 |

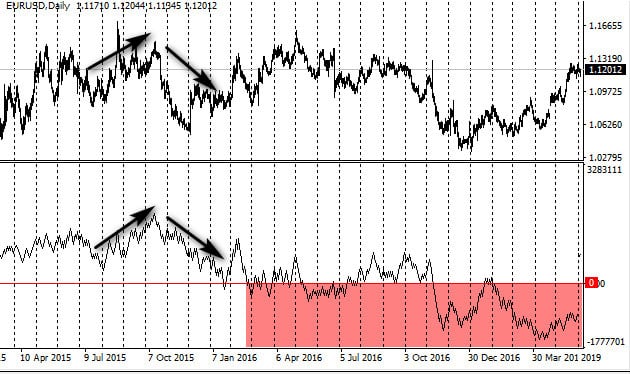

In countries with a significant share of exports of hydrocarbons or other commodities, the exchange rate of the national currency directly depends on the trade balance (the difference between exports and imports). If the revenue in foreign currency increases, the exchange rate of the national currency also increases. A striking example of the dependence of the national currency exchange rate on fluctuations in oil prices occurring on the international market is the exchange rate of the Russian ruble against the US dollar.

On a positive trade balance

A positive (or active) trade balance leads to an increase in the supply of foreign currency, mainly the US dollar, in the national market. As a result, with a constant volume of supply of the national currency, the exchange rate of the national currency rises. This is good for exporters and the country’s budget, but is it good for the economy as a whole and the citizens of the country? No. The fact is that the high exchange rate of the ruble (if we analyze the situation on the example of Russia) is extremely disadvantageous both for the majority of the country’s population and for importers. The high exchange rate of the ruble entails an increase in the cost of all imported goods. In countries such as Russia, where a significant part of everyday goods are imported, it is very important to strike a balance and keep the dollar within certain limits. An example of a positive trade balance. Positive balance of $50,000:

| Export, US dollars | Import, US dollars |

| 100,000 | 50,000 |

What determines the rates of major world currencies?

Countries whose currencies are among the five most stable currencies in the world differ significantly in terms of economic volume, geographical and socio-economic position. Therefore, the exchange rate of national currencies is influenced by various factors.

U.S. dollar

Factors affecting the US dollar exchange rate can be divided into three large groups:

- US monetary policy, conducted by the Federal Reserve System (FRS).

- Events related to the internal socio-economic and political situation in the country. Such indicators, for example, include data on GDP growth, industrial and consumer price indices, and many other financial indicators. Political processes (for example, elections) or large-scale force majeure circumstances (for example, the tragedy of September 11, 2001) directly affect the US dollar exchange rate.

- Events in foreign policy (US military operations in other countries of the world, coups in oil-producing countries, etc.).

Euro

The exchange rate of the euro against major world currencies is affected by:

- Change in the interest rate by the European Central Bank, i.e. the rate at which European commercial banks are credited.

- The state of the European economy – the euro grows when the EU economy grows. This is expressed in a change in macroeconomic indicators: GDP growth, a decrease in unemployment, an increase in indices of industrial production and business activity.

- The euro is one of the main currency instruments for investors, along with the US dollar. To some extent, the euro is a competitor to the dollar. Therefore, with negative changes in the dollar, investors buy the euro, and vice versa.

GBP

The British pound is the third most traded and invested currency in the world. The following factors influence its course:

- Domestic (inflation, interest rate and UK GDP, trade balance).

- External factors are the prices of natural commodities (mainly natural gas) and the state of trade with the US, the UK’s main trading partner.

Japanese yen

The Japanese yen is a freely convertible currency, the rate of which is determined in the foreign exchange market in accordance with supply and demand. The main factors that affect the exchange rate of the yen:

- Foreign exchange interventions of the Ministry of Finance of Japan.

- The military-political situation in the countries of the Asia-Pacific region.

- The state of affairs of the largest Japanese corporations (Toyota, Honda, Canon, etc.).

- Natural disasters in Japan.

Swiss frank

The Swiss currency is one of the most stable currencies in the world. Demand for the franc traditionally rises during trade wars between countries. The exchange rate is influenced by 2 main factors:

- The policy of the Swiss Central Bank.

- The situation in world politics and politics. The state of affairs in the Eurozone has the greatest impact.

Russia and ruble

Unlike the 5 reserve and most stable currencies of the world, the Russian ruble cannot boast of such stability.

Despite the most positive forecasts and taking into account all possible factors when predicting the ruble exchange rate, an event of a political, financial or socio-economic nature can always occur in Russia, which will have the most negative impact on the stability of the national currency.

However, when forecasting, or rather, predicting the exchange rate of the ruble against the main world currencies, one can focus on a number of factors that have a direct impact on the ruble exchange rate. These factors include:

- Commodity prices. First of all, these are world market prices for Russian natural gas and crude oil. With a decrease in oil prices, in order to compensate for the shortfall in budget revenues, the Central Bank of Russia is forced to pursue a policy of depreciating the ruble.

- foreign policy factors. The sanctions imposed by the United States and the European Union have the most negative impact on the ruble exchange rate.

- internal political factors. Political instability, uncertainty about the future among citizens, a crisis of confidence in the country’s banking system causes an increase in the volume of purchases of foreign currency and the collapse of the ruble.

- Payments by Russian companies to foreign creditors or dividend payments. Cause an increase in demand for foreign currency.

- Purchase by foreign investors of Russian Federal Loan Bonds denominated in US dollars.

Equilibrium exchange rate

In the process of pricing a product, two opposite approaches collide: the seller’s task is to sell it as expensive as possible, the buyer’s task is to buy it as cheaply as possible. At the point where the magnitude of supply and demand are equal, an equilibrium price will be reached, i.e., such a price at which sellers will have no unsold goods or services, and buyers will spend all financial resources on purchasing the necessary goods (services). In the foreign exchange market, it is also possible to form an equilibrium exchange rate. This is the rate of the national currency, set at a zero balance of trade, i.e., when the value of exports and imports equalize. Accordingly, the volume of supply and demand in the foreign exchange market will reach its equilibrium.

Current macroeconomic indicators in Russia and their relationship with the ruble exchange rate

The dependence of the Russian economy on the export of hydrocarbons is one of the key problems of the modern Russian economy. In the context of declining demand for Russian energy resources, the imposition of sanctions against Russian companies and falling prices per barrel of oil, oil and gas dependence has further aggravated.

The share of oil and gas revenues in the Russian budget in the first half of 2020 was only 29%. This is a record drop in revenues from the sale of oil and gas over the past 20 years, when the share of these revenues in the Russian budget ranged from 36% to 51%.

According to the assurances of the Ministry of Finance of the Russian Federation, Russia can live at such oil prices for several more years due to the accumulated financial reserves. Salvation from the current situation is the gradual devaluation (depreciation) of the ruble against the US dollar and other world currencies. Since January 1, 2020, the exchange rate of the ruble against the US dollar has fallen from 61 rubles to 75 rubles. Obviously, in the current conditions of low oil prices, the fall of the ruble will continue: this is one of the ways to compensate for the decline in the revenue part of the Russian budget.

Forecasting exchange rates

Accurate forecasting of exchange rates is quite a difficult task. The exchange rate is influenced by many factors of various nature – economic, financial, political, social. However, there are 3 main ways to assess the movement of exchange rates:

- mathematical – based on the use of mathematical models;

- expert – based on the assessment and conclusions of experts in the industry;

- complex – combining both methods.

central bank

The instrument for maintaining financial and price stability, which operates in most countries regardless of the state, is the central bank. The central bank in different countries may have different names (for example, in the United States, these functions are performed by the Federal Reserve System). Central banks have in their arsenal various mechanisms for influencing the exchange rate: foreign exchange interventions, money emission and a number of others.

Currency interventions

Foreign exchange intervention is a method of changing the exchange rate of the national currency used by the Central Bank. Depending on the objectives of the Central Bank, interventions result in either a depreciation of the national currency relative to the major currencies of the world, or its increase.

Interventions occur through the active supply of foreign currency in the foreign exchange market.

To reduce inflation and lower prices for imported goods, the Central Bank is pursuing a policy to strengthen the national currency (depreciate). With the depreciation (increase in the exchange rate) of the currency, the reverse process occurs, but at the same time, the income of exporters grows, which is especially important for an export-oriented economy.

Money issue

The central bank can significantly affect the exchange rate of the national currency through the issue of money. Money emission is the release into circulation of non-cash (mainly) and cash funds.

Non-cash emission is usually carried out by lending to commercial banks, cash – by launching a “printing press”.

In Russia, the foreign currency acquired by the Central Bank is accumulated in gold and foreign exchange reserves and used to adjust the ruble exchange rate. If it is necessary to increase the value of the ruble against the US dollar, the Central Bank begins to actively sell the dollars accumulated in the reserves.

Discount rate (refinancing rate)

The refinancing rate is the interest rate at which the Central Bank lends to commercial banks. The exchange rate is regulated by the Central Bank, including using the refinancing rate. By raising or lowering the discount rate, the Central Bank determines the amount of free cash from banks, which directly affects the level of supply of the national currency in the foreign exchange market.

Operations related to national debt obligations

The ruble exchange rate is influenced by the country’s debt market. Investors, including private banks, evaluate and compare the investment attractiveness of foreign currency and government debt obligations, choosing the most profitable investment tool. In fact, these two investment instruments are competitors: when the level of return on government debt obligations decreases, investors go into foreign currency, and vice versa.

The impact of digital money on world currencies

Digital money is a currency denominated in the national currency and stored only on electronic media. Examples of digital money are Webmoney, PayPal, Yandex money, and other electronic payment systems. Virtual money – cryptocurrencies – can be classified as a separate category. Cryptocurrencies are issued only on the Internet and are in no way connected with the state’s monetary system, because they are nominated in other units – bitcoins. The digital money system does not have a significant impact on the exchange rate.

Influence of other factors

The exchange rate is influenced by psychological phenomena, force majeure and various disasters. Psychological factors include public confidence in a particular currency. An increase in demand for a particular foreign currency indicates a lack of confidence in the national currency. In the modern global economy, the exchange rate is influenced by many different factors: economic, financial, socio-political and a number of others. Together, these factors determine the value of the national currency. The exchange rate of the national currency, in particular the Russian ruble, is directly reflected in the quality and standard of living of every person living in Russia.

Increase in the exchange rate