ETF funds in the Russian market: a list of the best for the Russian investor available for 2022. The abundance of ETFs is often confusing. It is rather difficult for beginners to choose the option that suits them, without understanding what instruments underlie exchange-traded funds and make up an investment portfolio. Below you can find a description of the best ETF funds in which it is profitable for Russian investors to invest.

- ETF funds: what is it

- History of occurrence

- ETF funds: the state of the Russian market

- Why are there so few ETFs on MOEKS – what funds are available on the Moscow Exchange?

- ETF funds: how they work

- Rating of the best ETF funds for a Russian investor as of 2022

- Sberbank S&P 500 Index SBSP

- VTB Moscow Exchange Index VTBX

- FXIT

- FinEx FXUS

- VTB – Liquidity

- FXRU

- Schwab US Small Cap ETF

- FinEx: US REIT UCITS ETF USD

- FXDE

- FinEx Russian RTS Equity UCITS ETF

- FinEx FXRW ETF Currency Hedge Global Stocks

- SPDR S&P 500 ETF

- FXRL

- Vanguard FTSE Developed Markets ETF

- iShares MSCI USMV

- JPMorgan US Momentum Factor ETF

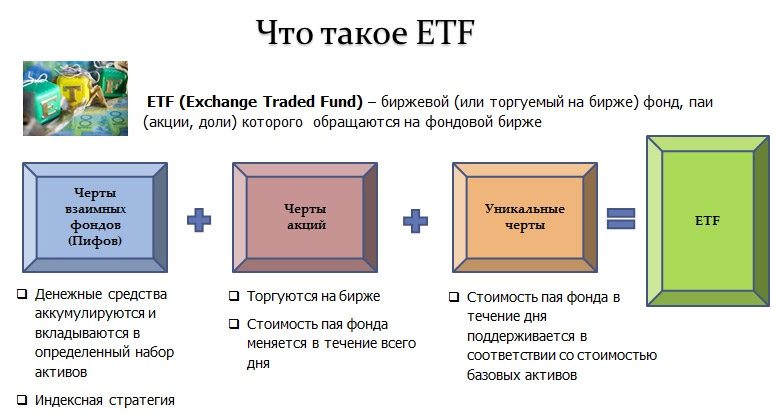

ETF funds: what is it

ETFs are called exchange traded funds, in which securities are collected based on any indices/sectors/commodities. Investing in ETFs is the easiest way to gain access to the international stock market. No special knowledge is required to invest in these funds.

By purchasing shares in an ETF, investors can invest in all securities included in the index at once. Thus,

diversification is increased and risks are reduced.

If the fund is closed or the assets are sold, the investor will receive a proportional part of their value at the time of the sale by the fund.

History of occurrence

ETFs first appeared on the market in 1989. In the US, they became available only in 1993, while in European countries it was possible to purchase shares in such funds only in 1999. In the last months of 2015, ETFs spanned over 1,800 different products in various market sectors/niches/trading strategies. Thanks to this scale, managers of investment funds managed to save money, because operating costs were profitably reduced. By December 2019, US assets under management reached $4.4 trillion. To this day, ETFs remain popular.

ETF funds: the state of the Russian market

In the last 20 years, the collective investment market in the Russian Federation has changed rapidly. If in 1999 only investment funds were allowed access to it, then towards the end of 2001 there was a division into mutual and joint-stock type of funds. Initially, only

mutual funds (mutual funds) took root in the market, and only 7 years ago ETF funds began to gain wide popularity. https://articles.opexflow.com/investments/fondy-etf.htm

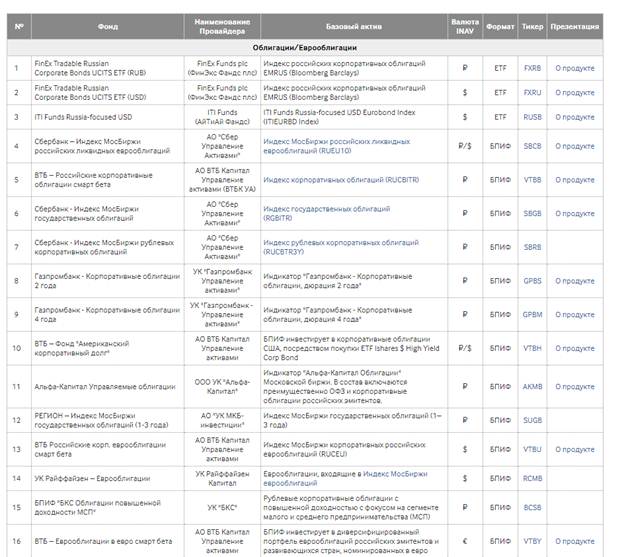

Why are there so few ETFs on MOEKS – what funds are available on the Moscow Exchange?

There are quite a few ETFs on MOEX. Experts believe that this is due to certain disadvantages. By investing in an exchange-traded fund, an investor cannot outperform the market, because index investing is designed to average returns.

The full list is available at https://www.moex.com/msn/etf

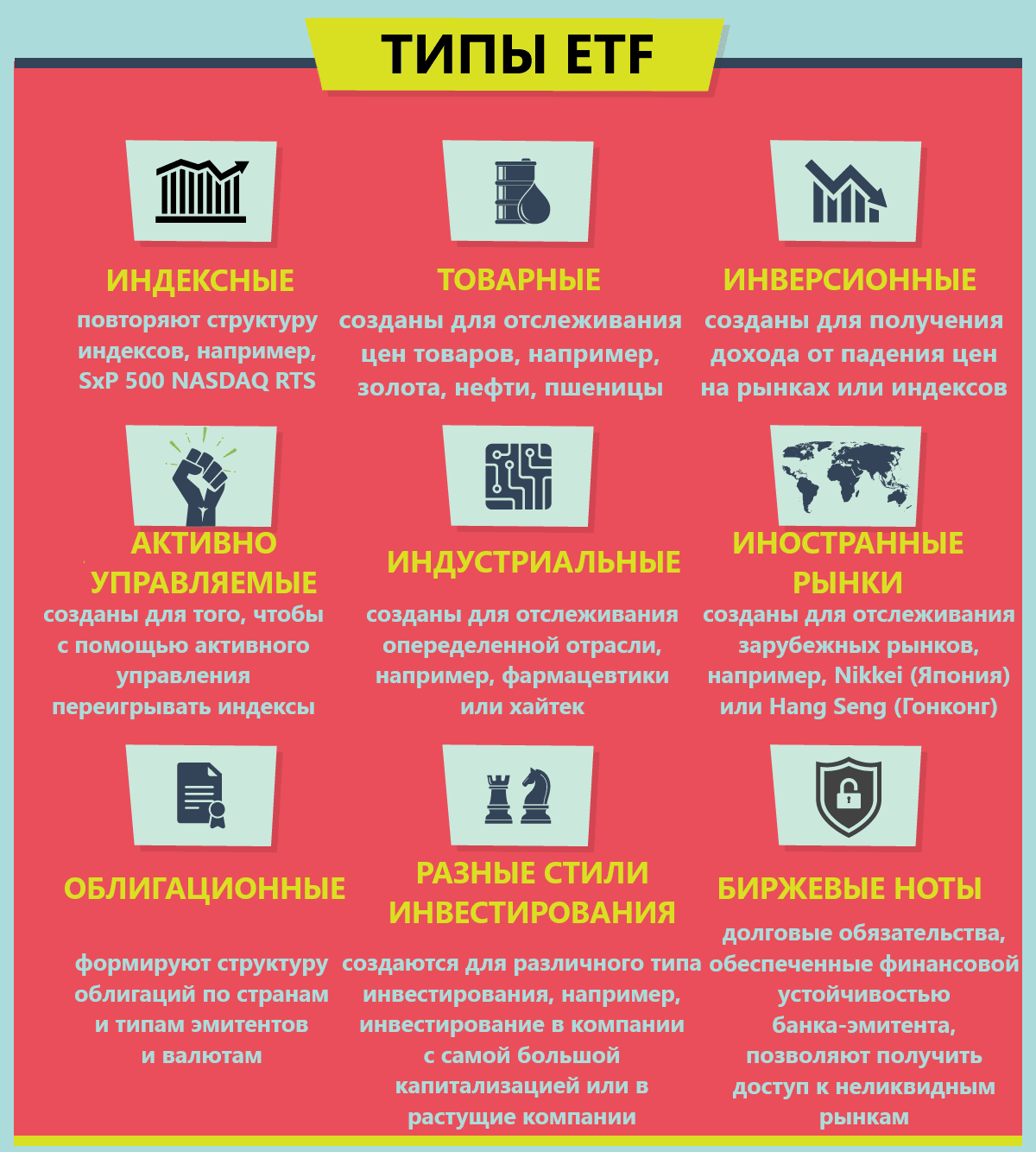

The main percentage of ETFs is represented by portfolios that repeat the structure of different stock indices (leading/sectoral). However, you can also find other funds based on complex structures of derivatives. Such funds are not available to private investors. Trading such an ETF entails serious risks. At the same time, the profit in the case when the investor managed not to miscalculate with the price will be several times higher.

ETF funds: how they work

According to the stated strategy, the fund acquires a large number of assets in its own portfolio. After that, the ETF starts issuing its own shares. You can buy and sell them on the stock exchange. Within one fund there can be more than 100 stocks in various fields of activity / niches. Shares of companies in each fund are presented in the amount in which the index is calculated. The index is used for analytical purposes in order to be able to assess which sectors of the economy/companies are growing in value. That is why the growth of the share price is not connected with the growth of the index.

Rating of the best ETF funds for a Russian investor as of 2022

ETF funds have long gained popularity in the investment market, due to the fact that people can invest money in securities with minimal costs in order to make a profit in the future.

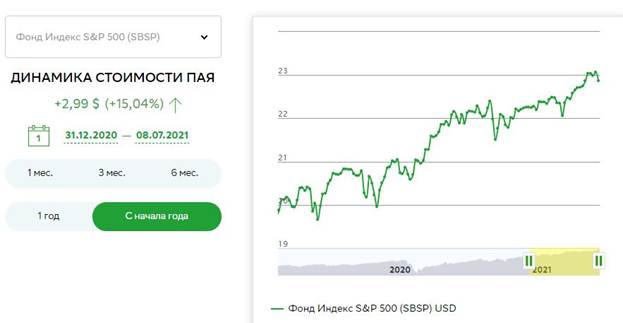

Sberbank S&P 500 Index SBSP

The S&P 500 Index is a stock index that includes the 500 largest US companies in the basket. Part of the profit received by the shareholder is reinvested as it becomes available. The structure of the fund’s investment portfolio is revised when the provider changes the composition of the index and its calculation parameters, or if necessary. Investors can buy shares in dollars/rubles. The cost of one share starts from 1,000 rubles. It should be borne in mind that the purchase of ruble ETFs is considered the most profitable. The maximum annual commission does not exceed 1.04%. The investor needs to pay a fee for:

- management – 0.8%;

- depository – 0.15%;

- other expenses – 0.05%.

Note! The last 2 cost items do not include VAT, so the total cost is 1.04%.

In cases where an investor owns shares for more than 3 years, he is exempt from taxes (by 3 million for each year).

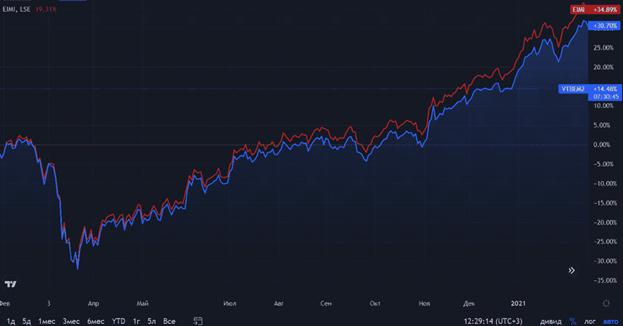

VTB Moscow Exchange Index VTBX

VTB “Moscow Exchange Index” VTBX is an exchange-traded investment fund that trades on the Moscow Exchange (Moscow Exchange) and invests in shares of companies from the Moscow Exchange Index. VTB Moscow Exchange Index VTBX invests in ordinary/preferred shares, as well as

depositary receipts for shares included in the Moscow Exchange Index. Dividends that have been received are reinvested. Purchasing fund units allows investors to invest in a diversified stock portfolio at a low cost. The total cost and commission of VTB Moscow Exchange Index VTBX does not exceed 0.69% per annum. When making purchases through the application, you do not need to pay a brokerage commission.

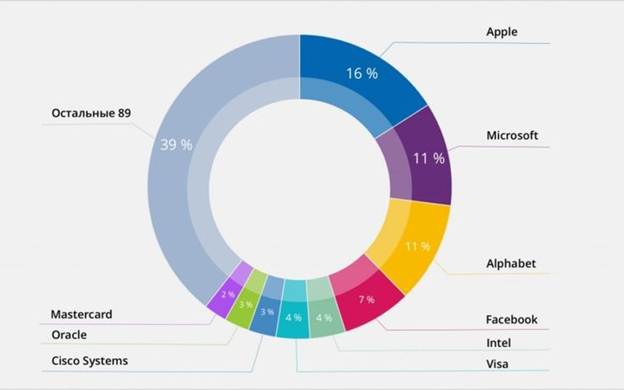

FXIT

FXIT is considered one of the most expensive funds, which includes shares of the largest IT firms. Investors can take an active part in the growth of shares of the most popular high-tech companies: Apple/Microsoft/Intel/ Visa/IBM/Cisco/Oracle, etc. The FXIT portfolio includes more than 80 issuers, which ensures asset diversification and reduces risks. Fund management fees are low.

Note! Investments in stocks often “sag”. The average annual level of income over long periods will be made up of ups / downs.

Dividends received are reinvested. If users sell fund shares using the services of

a Russian broker , the individual investor will be subject to personal income tax (13% of the difference between the purchase price and the sale price). Until the shares are sold, the tax will not be withheld. If you want to avoid paying taxes at the time of sale, you can purchase FXIT shares on IIA

( individual investment account). In this case, a tax deduction is provided.

FinEx FXUS

FinEx FXUS is one of the best ETFs out there. The portfolio includes more than 85% of US companies: Amazon/Apple/Coca-Cola/Facebook/Johnson&Johnson/Microsoft/VISA. Solactive AG is the underlying index for this fund. Investors can sell a share at any time and withdraw the invested funds along with income. The entry threshold is low. There are tax breaks:

- IIS deductions;

- long-term tenure benefit.

For your information! After the conclusion of the transaction, the funds will be debited from the account, and the share will be credited to the new investor.

VTB – Liquidity

VTB – Liquidity – a fund intended for short-term placement of funds and liquidity management. Investors can place money for a period exceeding 24 hours. Accrual of profit daily. VTB faces downside risks – Liquidity is minimal. The fund’s assets are placed in money market instruments. The annual management fee does not exceed 0.49%. The investor pays:

- management company remuneration – 0.21%;

- depository – 0.18%;

- other expenses – 0.1%.

- intraday liquidity (availability of the possibility of buying / selling a fund with a minimum spread);

- potential profitability comparable to time deposits of the largest banking institutions;

- minimal downside risk.

Interesting to know! The average monthly return of the fund is +0.28%.

FXRU

FinEx Tradable Russian Corporate Bonds UCITS ETF (FXRU) is considered to be a sought-after fund focused on the Russian Corporate Eurobond Index EMRUS (Bloomberg Barclays). Investments are reliably protected from ruble devaluation. The payment of dividends is not provided. Investors can capitalize the income received. Reinvestment of profits helps to increase the return on investment. The ETF fund is traded on the Moscow Exchange in rubles. It is necessary to take care in advance of opening a brokerage account that provides access to the Moscow Exchange. Once the account is opened, find the ETF by ticker in the broker’s mobile app/PC terminal. After that, you can engage in sales and purchases. The advantages of FXRU ET include:

- acceptable commission level, which is 0.5%;

- availability of convenient access and a minimum entry threshold;

- impeccable business reputation;

- tax preferences that will be provided when using AI for investments;

- transparent scheme of cooperation;

- combination of investment security and liquidity.

For your information! Eurobond ETFs can be massively purchased by investors due to the low entry threshold.

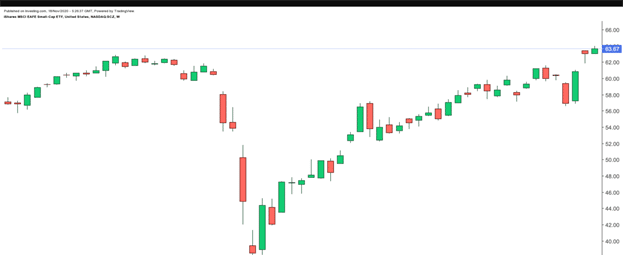

Schwab US Small Cap ETF

The Schwab US Small-Cap ETF is considered a simple, efficient, and highly diversified way to invest in small-cap stocks. The fund’s portfolio includes over 1,700 shares of small/mid-cap companies. Do not forget that the fund’s shares are tied to the US domestic economy. Schwab US Small-Cap ETF is inexpensive, which is considered a significant advantage. The dividend yield is 1.2%, and the amount of costs does not exceed 0.04%.

FinEx: US REIT UCITS ETF USD

FinEx US REIT UCITS ETF USD is a popular fund that provides a high level of diversification (investments will not depend on the state of affairs in individual sectors of the economy) and liquidity. Investors have the opportunity to quickly buy / sell assets, while saving on taxes. The fund maintenance fee is 0.6%. The strengths of FinEx: US REIT UCITS ETF USD include:

- high liquidity;

- tax efficiency;

- high diversification;

- no management costs.

Note! Dividends are reinvested in FinEx US REIT UCITS ETF USD. Thanks to this, the investor gets rid of the need to file a tax return on his own.

FXDE

FXDE ETF is a fund that allows investors to profitably invest in German stocks and the leading European economy. The portfolio includes shares of the largest companies: Siemens/SAP/Bayer/Daimler/Allianz/Adidas/Volkswagen/BMW and others. The index covers 85% of Europe’s largest stock market. The main currency of FXDE is the euro. In the event of a devaluation of the ruble, the investor will automatically benefit from the difference in rates. Selective consumer goods companies hold the largest share of FXDE. The fuel industry is completely absent.

For your information! Dividends received on shares of companies are reinvested.

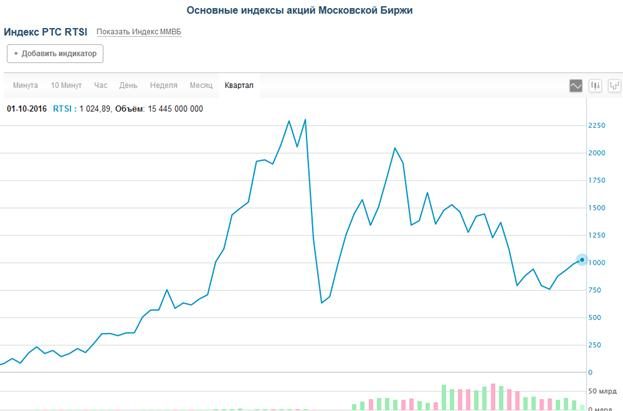

FinEx Russian RTS Equity UCITS ETF

FinEx Russian RTS Equity UCITS ETF is considered the most patriotic investment portfolio, which consists mainly of Russian stocks. Investors can invest in shares of the largest companies such as Gazprom/Lukoil/Sberbank/VTB/Surgutneftegaz/NOVATEK/Magnit/Rosneft, etc. Significant advantages of FinEx Russian RTS Equity UCITS ETF are: low commission, high dividend yield and low entry threshold. RTS Equity UCITS invests in shares from the RTS index, repeating its composition and structure. However, it is worth remembering that quotes are calculated in dollars, not in rubles. Dividends received on shares are reinvested.

FinEx FXRW ETF Currency Hedge Global Stocks

FXRW ETF is considered to be a sought-after innovative currency hedge fund in the global securities market. The FXRW ETF portfolio includes US/German/Japanese/Chinese/Australian/Russian stocks. Due to the difference in ruble / dollar rates, a couple of percent is additionally added to the yield. Through the purchase of 1 ETF share, the investor receives global diversification. The ETF is traded in Russia with a large share fraction, which is definitely an advantage. The share price starts from $0.02. In FXRW, ETFs are considered major sectors by type: Industrial / IT / Financial / FMCG / Health Care / Commodities / Durable Goods. The FXRW ETF portfolio includes shares of APPLE/MICROSOFT/ALIBABA/TENCENT/Facebook/Amazon/Toyota and others. The entry threshold is minimal. One FXRW paper can be purchased for only 1 ruble,

SPDR S&P 500 ETF

The SPDR S&P 500 ETF is a fund that was founded back in 1993. It is with him that portfolio managers habitually compare their own results, because the SPDR S&P 500 ETF is a kind of benchmark. In cases where the performance is above the index, one can be sure that the work during the year was performed well. If lower, then the investor has something to think about. The market capitalization of this fund is $284 billion. The rate of return for the last five years exceeds 70%. The annual management fee is 0.09%.

FXRL

The use of optimized physical replication is an important feature of FXRL. For a number of positions from the RTS, there is no sufficient supply/demand. What FXRL does with them on the exchange affects their market value. That is why the composition is systematically optimized: the shares of large issuers are increased, while removing low-liquid securities. The FXRL portfolio includes shares of the largest companies: Sberbank/Gazprom/Lukoil/Yandex/Rosneft/NOVATEK/Polus/Magnit. Fund commission – 0.9%. The fund does not pay dividends, but reinvests, which contributes to an increase in the value of shares.

Vanguard FTSE Developed Markets ETF

Vanguard FTSE Developed Markets ETF is a fund with European roots. The portfolio includes more than 1000 shares of the largest companies in Europe, Australia, America and Japan. The fund’s ultra-low expense ratio is a significant cost advantage over most of its competitors. The cost of management costs is 0.05%. The yield in recent years has been in the range of 16.5-16.6%.

iShares MSCI USMV

USMV offers a portfolio of US stocks with minimal volatility. The fund index uses an optimization algorithm to create a portfolio with minimal variance that takes into account the correlation between stocks, rather than just containing a basket of low selling stocks. To create an investment portfolio, the main alternative to S&P is used. The portfolio includes shares of companies with minimal volatility (for example, PepsiCo/ Merck & Co). This approach provides a reduction in the growth / sharp drops in quotations. Thanks to this, the investor receives a reliable and profitable asset at the exit.

JPMorgan US Momentum Factor ETF

The JPMorgan US Momentum Factor ETF (NYSE:JMOM) allows investors to invest in high-yielding US stocks. The foundation was founded in 2017. To date, JPMorgan US manages 273 assets worth $135 million. The dividend yield is 1.15% and the cost of investment is 0.12%. The bulk of the capital is invested in the technology sector (approximately 30%). The healthcare sector (13.3%) and industry (11.7%) are also well invested. The investment portfolio includes shares of such major companies as Amazon/Microsoft/Visa/NVIDIA/Apple. Issuers are focused on increasing revenue, over the long term / increasing profitability and return on investment.

Note! In recent years, the JPMorgan US Momentum Factor ETF (NYSE:JMOM) has gained about 12.5-13% to hit an all-time high.

How to choose ETFs on the Moscow Exchange in 2022 – how to invest, invest and not lose: https://youtu.be/OgbogdWLsh8 Acquiring ETFs for your own portfolio is considered a smart investment idea. Such funds are ready-made diversified instruments. However, in the ETF selection process, it is important not to make a mistake. By giving preference to the funds listed above, the investor can be sure that the cash deposit will not only not be lost, but will also allow you to get a good additional income.