Izimali ze-ETF emakethe yaseRussia: uhlu oluhle kakhulu lwabatshalizimali baseRussia olutholakala ngo-2022. Ubuningi be-ETF buvame ukudida. Kunzima kwabaqalayo ukukhetha inketho evumelana nabo, ngaphandle kokuqonda ukuthi yiziphi izisetshenziswa ezisekela izimali ezihwebelana ngokuhwebelana nokwenza iphothifoliyo yokutshalwa kwezimali. Ngezansi ungathola incazelo yezimali ze-ETF ezihamba phambili onenzuzo kubatshalizimali baseRussia ukuthi batshale kuzo. [i-id yamagama-ncazo = “okunamathiselwe_12049″ align=”aligncenter” wide=”624″]

- Izimali ze-ETF: kuyini

- Umlando wokwenzeka

- Izimali ze-ETF: isimo semakethe yaseRussia

- Kungani kunama-ETF ambalwa ku-MOEKS – yiziphi izimali ezitholakala ku-Moscow Exchange?

- Izimali ze-ETF: zisebenza kanjani

- Isilinganiso sezimali ezinhle kakhulu ze-ETF zomtshali-zimali waseRussia kusukela ngo-2022

- I-Sberbank S&P 500 Index SBSP

- I-VTB Moscow Exchange Index VTBX

- I-FXIT

- I-FinEx FXUS

- I-VTB – I-Liquidity

- I-FXRU

- I-Schwab US Small Cap ETF

- I-FinEx: US REIT UCITS ETF USD

- I-FXDE

- I-FinEx Russian RTS Equity UCITS ETF

- Izindleko zamasheya FinEx FXRW ETF Currency Hedge Global Stocks

- I-SPDR S&P 500 ETF

- I-FXRL

- I-Vanguard FTSE Developed Markets ETF

- iShares MSCI USMV

- Izindleko zamasheya JPMorgan US Momentum Factor ETF

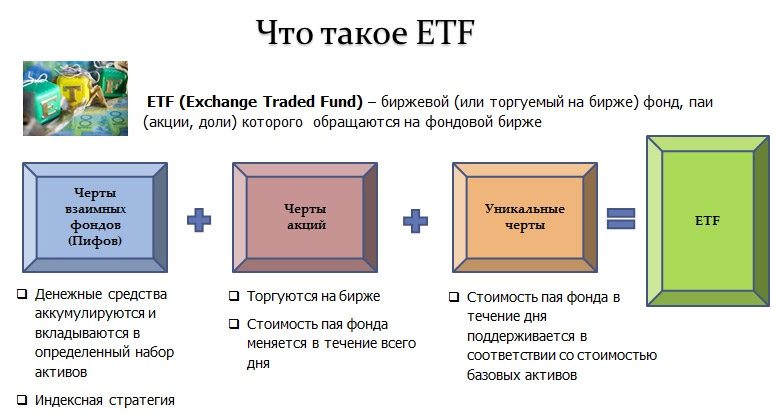

Izimali ze-ETF: kuyini

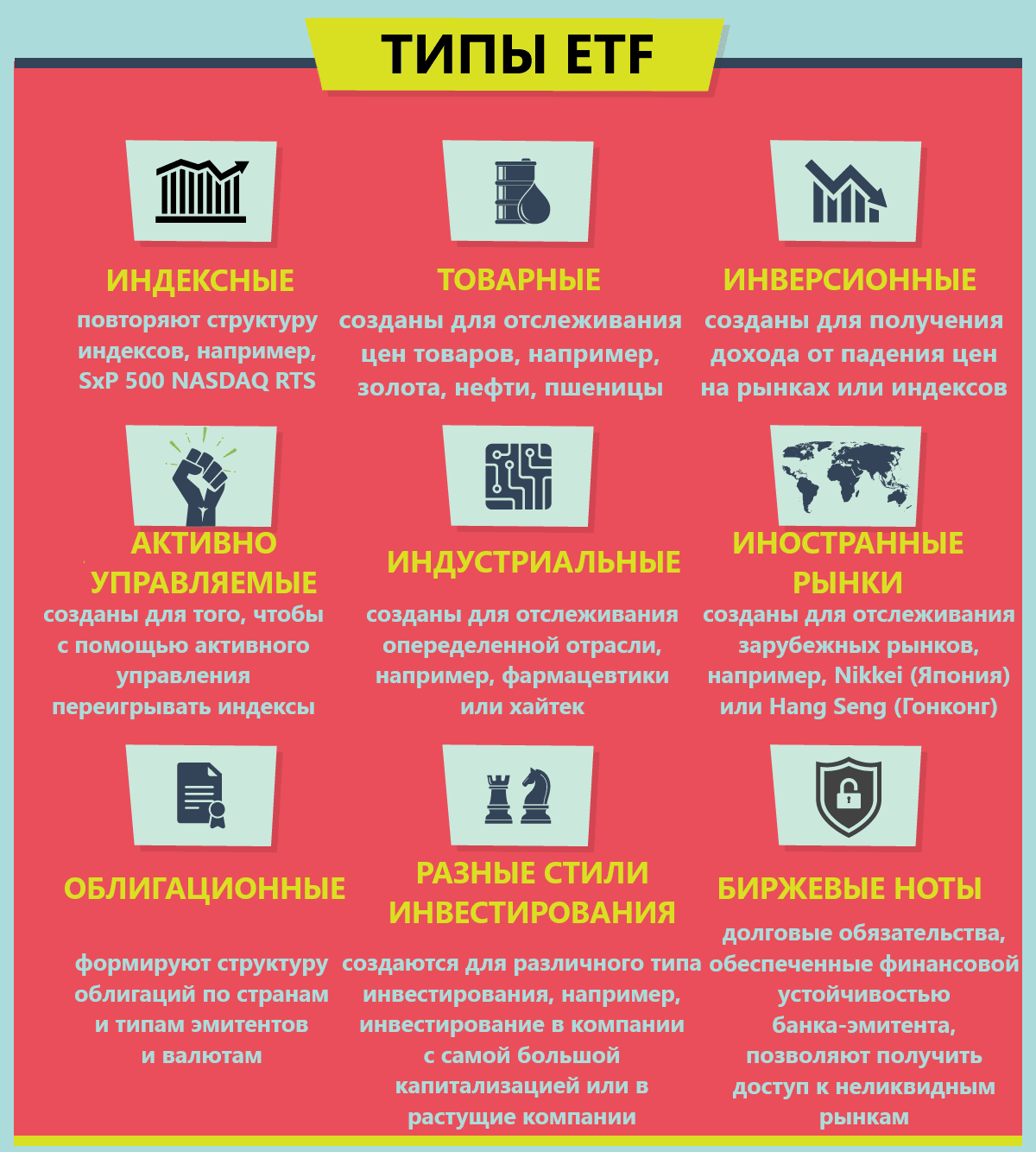

Ama-ETF abizwa ngezimali ezihwebelana ngokuhwebelana, lapho izibambiso ziqoqwa khona ngokusekelwe kunoma yiziphi izinkomba/imikhakha/impahla. Ukutshala imali kuma-ETF kuyindlela elula yokuthola ukufinyelela emakethe yamasheya yamazwe ngamazwe. Alukho ulwazi olukhethekile oludingekayo ukuze utshale imali kulezi zimali.

Ngokuthenga amasheya ku-ETF, abatshalizimali bangatshala kuzo zonke izibambiso ezifakwe kunkomba ngesikhathi esisodwa. Ngakho,

ukuhlukahluka kuyenyuka futhi izingozi ziyancipha.

Uma isikhwama sivaliwe noma izimpahla zidayiswa, umtshali-zimali uzothola ingxenye elinganayo yenani lazo ngesikhathi sokuthengisa yisikhwama.

Umlando wokwenzeka

Ama-ETF aqala ukuvela emakethe ngo-1989. E-US, zatholakala kuphela ngo-1993, kanti emazweni aseYurophu kwakungenzeka ukuthenga amasheya emali enjalo ngo-1999 kuphela. Ezinyangeni zokugcina zika-2015, ama-ETF asebenzise imikhiqizo ehlukene engaphezu kuka-1,800 emikhakheni eyahlukene yemakethe/niches/amasu okuhweba. Ngenxa yalesi sikali, abaphathi bezimali zokutshala izimali bakwazi ukulondoloza imali, ngoba izindleko zokusebenza zancishiswa ngenzuzo. NgoDisemba 2019, izimpahla zase-US ezingaphansi kwabaphathi zifinyelele ku-$4.4 trillion. Kuze kube namuhla, ama-ETF asadumile.

Izimali ze-ETF: isimo semakethe yaseRussia

Eminyakeni engu-20 edlule, imakethe yokutshala izimali ngokuhlanganyela eRussia Federation ishintshe ngokushesha. Uma ngo-1999 kuphela izimali zokutshalwa kwezimali zazivunyelwe ukufinyelela kukho, ngakho ngasekupheleni kuka-2001 kwaba khona ukuhlukana phakathi kohlobo lwezimali ezihlangene kanye nezihlanganisiwe. Ekuqaleni, i-

mutual funds kuphela (i-mutual funds) yagxila emakethe, futhi eminyakeni engu-7 kuphela edlule izimali ze-ETF zaqala ukuthandwa kakhulu. https://articles.opexflow.com/investments/fondy-etf.htm

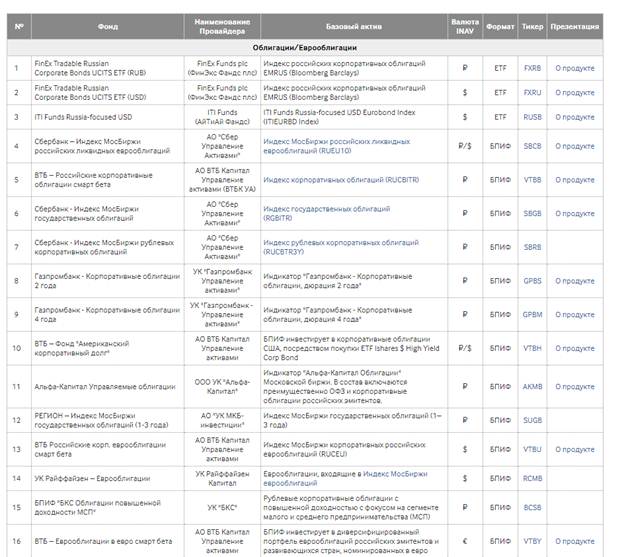

Kungani kunama-ETF ambalwa ku-MOEKS – yiziphi izimali ezitholakala ku-Moscow Exchange?

Kukhona ama-ETF ambalwa ku-MOEX. Ochwepheshe bakholelwa ukuthi lokhu kungenxa yokuntula okuthile. Ngokutshala imali esikhwameni esihweba ngokuhwebelana, umtshali-zimali akakwazi ukudlula imakethe, ngoba ukutshala imali kwenkomba kuklanyelwe ukubuyisela isilinganiso.

Uhlu oluphelele luyatholakala ku-https://www.moex.com/msn/etf

Iphesenti eliyinhloko lama-ETF limelelwa amaphothifoliyo aphinda ukwakheka kwezinkomba zesitoko (ezihamba phambili/zomkhakha). Kodwa-ke, ungathola ezinye izimali ezisekelwe ezakhiweni eziyinkimbinkimbi zokuphuma kokunye. Izimali ezinjalo azitholakali kubatshalizimali abazimele. Ukuhweba nge-ETF enjalo kuhilela ubungozi obukhulu. Ngesikhathi esifanayo, inzuzo esimweni lapho umtshali-zimali ekwazi ukungaziphathi kahle ngentengo izoba izikhathi eziningana ngaphezulu. [i-id yamagama-ncazo = “okunamathiselwe_12042″ align=”aligncenter” wide=”800″]

Izimali ze-ETF: zisebenza kanjani

Ngokwesu elishiwo, isikhwama sithola inani elikhulu lezimpahla kuphothifoliyo yaso. Ngemuva kwalokho, i-ETF iqala ukukhipha amasheya ayo. Ungawathenga futhi uwathengise emakethe yamasheya. Ngaphakathi kwesikhwama esisodwa kungaba namasheya angaphezu kwe-100 emikhakheni eyahlukene yomsebenzi / izindawo. Amasheya ezinkampani esikhwameni ngasinye avezwa ngenani inkomba ebalwa ngayo. Inkomba isetshenziselwa izinjongo zokuhlaziya ukuze ukwazi ukuhlola ukuthi yimiphi imikhakha yomnotho/izinkampani ezikhula ngenani. Yingakho ukukhula kwentengo yamasheya kungaxhumene nokukhula kwenkomba.

Isilinganiso sezimali ezinhle kakhulu ze-ETF zomtshali-zimali waseRussia kusukela ngo-2022

Izimali ze-ETF sekuyisikhathi eside zithole ukuthandwa emakethe yokutshala izimali, ngenxa yokuthi abantu bangatshala imali ezibambiso ezinezindleko ezincane ukuze benze inzuzo esikhathini eside.

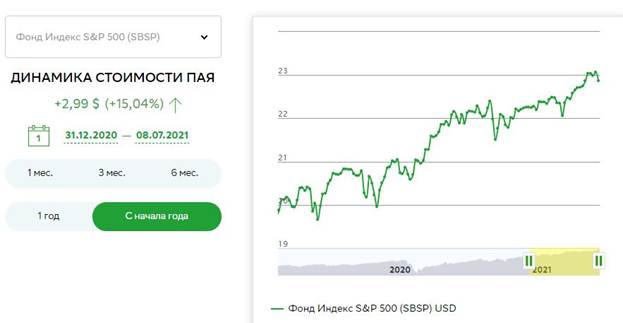

I-Sberbank S&P 500 Index SBSP

I-S&P 500 Index iyinkomba yesitoko ehlanganisa izinkampani ezinkulu zase-US ezingama-500 kubhasikidi. Ingxenye yenzuzo etholwe umninimasheya iphinde itshalwe njengoba itholakala. Isakhiwo sephothifoliyo yokutshala imali yesikhwama siyabuyekezwa lapho umhlinzeki eshintsha ukwakheka kwenkomba kanye nemingcele yayo yokubala, noma uma kunesidingo. Abatshalizimali bangathenga amasheya ngamadola/ama-ruble. Izindleko zesabelo esisodwa ziqala kusuka kuma-ruble ayi-1,000. Kufanele kukhunjulwe ukuthi ukuthengwa kwe-ruble ETF kubhekwa njengenzuzo kakhulu. Ubuningi bekhomishini yonyaka aweqi ku-1.04%. Umtshali-zimali udinga ukukhokhela imali:

- ukuphathwa – 0.8%;

- i-depository – 0.15%;

- ezinye izindleko – 0.05%.

Qaphela! Izinto ezingu-2 zokugcina azifaki i-VAT, ngakho-ke izindleko eziphelele ngu-1.04%.

Ezimweni lapho umtshali-zimali enamasheya ngaphezu kweminyaka emi-3, akakhokhiswa intela (ngezigidi ezi-3 ngonyaka ngamunye).

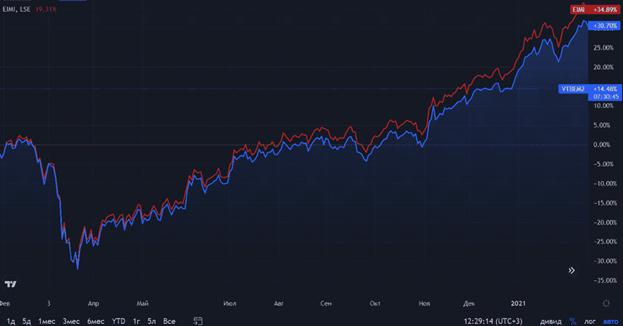

I-VTB Moscow Exchange Index VTBX

I-VTB “I-Moscow Exchange Index” i-VTBX isikhwama sokutshala izimali esihweba ngokuhwebelana esihweba nge-Moscow Exchange (Moscow Exchange) futhi sitshala amasheya ezinkampani ezivela ku-Moscow Exchange Index. I-VTB Moscow Exchange Index VTBX itshala imali kumasheya avamile/akhethwayo, kanye

namarisidi ediphozithi amasheya afakwe ku-Moscow Exchange Index. Izabelo ezitholiwe ziyatshalwa kabusha. Amayunithi esikhwama sokuthenga avumela abatshalizimali ukuthi batshale imali kuphothifoliyo yamasheya ahlukahlukene ngezindleko eziphansi. Izindleko eziphelele kanye nekhomishini ye-VTB Moscow Exchange Index VTBX ayidluli ku-0.69% ngonyaka. Lapho uthenga ngohlelo lokusebenza, awudingi ukukhokha ikhomishini yokuthengisa.

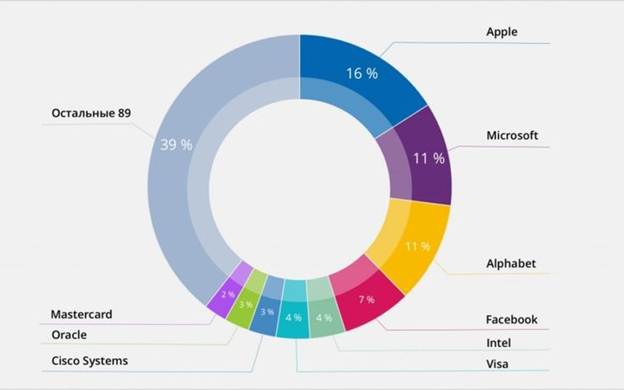

I-FXIT

I-FXIT ithathwa njengenye yezimali ezibiza kakhulu, ezihlanganisa amasheya ezinkampani ezinkulu ze-IT. Abatshalizimali bangaba neqhaza elikhulu ekukhuleni kwamasheya ezinkampani zobuchwepheshe obuphezulu ezaziwa kakhulu: i-Apple/Microsoft/Intel/ Visa/IBM/Cisco/Oracle, njll. Iphothifoliyo ye-FXIT ihlanganisa abakhiphi abangaphezu kuka-80, okuqinisekisa ukuhlukahluka kwempahla kanye kunciphisa izingozi. Izimali zokuphatha isikhwama ziphansi.

Qaphela! Ukutshalwa kwezimali ezitokisini kuvame “ukuwohloka”. Izinga elimaphakathi lonyaka lemali engenayo esikhathini eside lizokwenziwa ukwehla nokwenyuka.

Izabelo ezitholiwe ziyatshalwa kabusha. Uma abasebenzisi bethengisa amasheya esikhwama besebenzisa izinsizakalo zomthengisi wase

-Russian , umtshali-zimali ngamunye uzoba ngaphansi kwentela yemali engenayo yomuntu siqu (u-13% womehluko phakathi kwentengo yokuthenga nentengo yokuthengisa). Kuze kuthengiswe amasheya, intela ngeke ibanjwe. Uma ufuna ukugwema ukukhokha izintela ngesikhathi sokuthengisa, ungathenga amasheya e-FXIT ku-IIA

( i -akhawunti yotshalomali ngayinye). Kulokhu, kudonswa intela.

I-FinEx FXUS

I-FinEx FXUS ingenye ye-ETF ehamba phambili laphaya. Iphothifoliyo ihlanganisa ngaphezu kwama-85% ezinkampani zase-US: i-Amazon/Apple/Coca-Cola/Facebook/Johnson&Johnson/Microsoft/VISA. I-Solactive AG iyinkomba eyisisekelo yalesi sikhwama. Abatshalizimali bangathengisa amasheya nganoma yisiphi isikhathi futhi bakhiphe izimali ezitshaliwe kanye nemali engenayo. Umkhawulo wokungena uphansi. Kukhona amakhefu entela:

- IIS ebanjwayo;

- inzuzo yesikhathi eside sokuhlala.

Qaphela! Ngemuva kokuphela kokuthengiselana, izimali zizodonswa ku-akhawunti, futhi isabelo sizofakwa kumtshali-zimali omusha.

I-VTB – I-Liquidity

I-VTB – I-Liquidity – isikhwama esihloselwe ukubekwa kwezimali zesikhashana kanye nokuphathwa kwezimali. Abatshalizimali bangabeka imali isikhathi esingaphezu kwamahora angama-24. Ukuqoqwa kwenzuzo nsuku zonke. I-VTB ibhekene nezingozi eziphansi – I-Liquidity incane. Izimpahla zesikhwama zifakwa kumathuluzi emakethe yemali. Imali yokuphatha yonyaka ayidluli ku-0.49%. Umtshali-zimali uyakhokha:

- iholo lenkampani yabaphathi – 0.21%;

- i-depository – 0,18%;

- ezinye izindleko – 0.1%.

- I-intraday liquidity (ukutholakala kwamathuba okuthenga / ukuthengisa isikhwama ngokusakazwa okuncane);

- inzuzo engaba khona uma iqhathaniswa nezimali ezifakwa ezikhungweni ezinkulu zamabhange ezinkulu;

- ingozi encane yokwehla.

Kuyathakazelisa ukwazi! Isilinganiso sembuyiselo yanyanga zonke yesikhwama ngu-+0.28%.

I-FXRU

I-FinEx Tradable Russian Corporate Bonds UCITS ETF (FXRU) ibhekwa njengesikhwama esifunwa kakhulu esigxile ku-Russian Corporate Eurobond Index EMRUS (Bloomberg Barclays). Ukutshalwa kwezimali kuvikelwe ngokuthembekile ekwehliseni inani lama-ruble. Inkokhelo yezabelo ayinikeziwe. Abatshalizimali bangasebenzisa imali engenayo abayitholile. Ukutshalwa kabusha kwenzuzo kusiza ekwandiseni inzuzo ekutshalweni kwezimali. Isikhwama se-ETF sithengiswa eMoscow Exchange ngama-ruble. Kudingekile ukunakekela kusengaphambili ukuvula i-akhawunti ye-brokerage enikeza ukufinyelela ku-Moscow Exchange. Uma i-akhawunti isivuliwe, thola i-ETF ngethikha kutheminali yeselula yomthengisi/ye-PC. Ngemva kwalokho, ungahlanganyela ekuthengisweni nasekuthengeni. Izinzuzo ze-FXRU ET zifaka:

- izinga lekhomishana elamukelekayo, elingu-0.5%;

- ukutholakala kokufinyelela okulula kanye ne-threshold encane yokungena;

- idumela lebhizinisi elingenasici;

- izintandokazi zentela ezizohlinzekwa uma kusetshenziswa i-AI ekutshalweni kwezimali;

- uhlelo lokubambisana olusobala;

- inhlanganisela yokuphepha kokutshalwa kwezimali kanye ne-liquidity.

Qaphela! Ama-ETF e-Eurobond angathengwa kakhulu ngabatshalizimali ngenxa yomkhawulo ophansi wokungena.

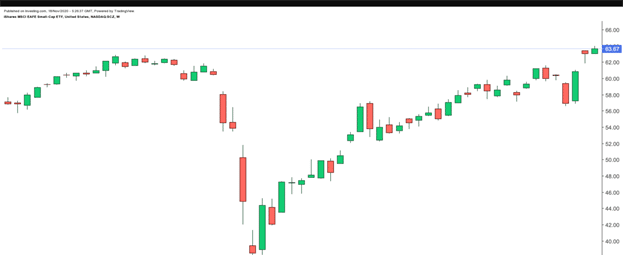

I-Schwab US Small Cap ETF

I-Schwab US Small-Cap ETF ithathwa njengendlela elula, ephumelelayo, futhi ehlukahlukene kakhulu yokutshala imali emasheya amancane. Iphothifoliyo yesikhwama ihlanganisa amasheya angaphezu kuka-1,700 ezinkampani ezincane/ezimaphakathi. Ungakhohlwa ukuthi amasheya esikhwama axhumene nomnotho wasekhaya wase-US. I-Schwab US Small-Cap ETF ayibizi, okubhekwa njengenzuzo enkulu. ikhokhele ama-dividend angu-1.2%, kanti izindleko azidluli ku-0.04%.

I-FinEx: US REIT UCITS ETF USD

I-FinEx US REIT UCITS ETF USD yisikhwama esidumile esihlinzeka ngezinga eliphezulu lokuhlukahluka (utshalo-mali ngeke luncike esimweni sezindaba emikhakheni ngayinye yezomnotho) kanye nezimali. Abatshalizimali banethuba lokuthenga ngokushesha / ukuthengisa izimpahla, kuyilapho belondoloza ezintela. Imali yokunakekela isikhwama ngu-0.6%. Amandla e-FinEx: US REIT UCITS ETF USD afaka:

- i-liquidity ephezulu;

- ukusebenza kahle kwentela;

- ukuhlukahluka okuphezulu;

- azikho izindleko zokuphatha.

Qaphela! Izabelo ze-FinEx US REIT UCITS ETF USD zitshalwe kabusha. Ngenxa yalokhu, umtshali-zimali ususa isidingo sokufaka imbuyiselo yentela eyedwa.

I-FXDE

I-FXDE ETF yisikhwama esivumela abatshalizimali ukuthi batshale imali ngokunenzuzo esitokweni saseJalimane kanye nomnotho ohamba phambili wase-Europe. Iphothifoliyo ihlanganisa amasheya ezinkampani ezinkulu kakhulu: Siemens/SAP/Bayer/Daimler/Allianz/Adidas/Volkswagen/BMW nezinye. Inkomba ihlanganisa u-85% wemakethe yamasheya enkulu kunazo zonke yase-Europe. Imali eyinhloko ye-FXDE yi-euro. Uma kwenzeka ukwehla kwe-ruble, umtshali-zimali uzozuza ngokuzenzakalelayo emehlukweni wamanani. Izinkampani ezikhethiwe zezimpahla zabathengi zinesabelo esikhulu kunazo zonke se-FXDE. Imboni kaphethiloli ayikho ngokuphelele.

Qaphela! Izabelo ezitholwa emasheya ezinkampani ziphinde zitshalwe.

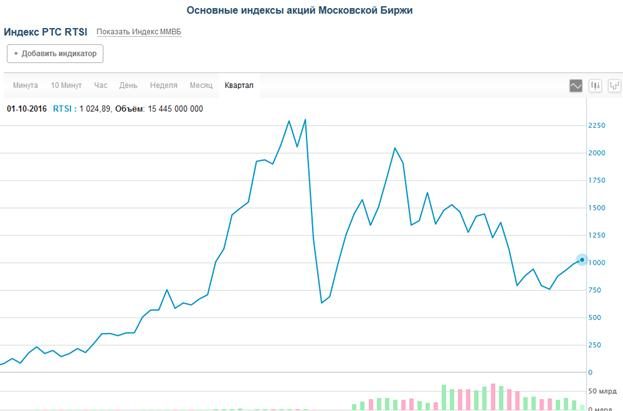

I-FinEx Russian RTS Equity UCITS ETF

I-FinEx Russian RTS Equity UCITS ETF ithathwa njengephothifoliyo yokutshala imali ethanda izwe lonke, equkethe ikakhulukazi amasheya aseRussia. Abatshalizimali bangatshala kumasheya ezinkampani ezinkulu kakhulu ezifana nalezi: I-Gazprom/Lukoil/Sberbank/VTB/Surgutneftegaz/NOVATEK/Magnit/Rosneft, njll. I-FinEx Russian RTS Equity UCITS ETF ibhekwa njengenezinzuzo ezibalulekile: ikhomishini ephansi, isivuno esikhulu se-dividend kanye umkhawulo wokungena ophansi. I-RTS Equity UCITS itshala kumasheya asuka kunkomba ye-RTS, iphinda ukwakheka nokwakheka kwayo. Kodwa-ke, kufanelekile ukukhumbula ukuthi izingcaphuno zibalwa ngamadola, hhayi ngama-ruble. Izabelo ezitholwa kumasheya ziphinde zitshalwe.

Izindleko zamasheya FinEx FXRW ETF Currency Hedge Global Stocks

I-FXRW ETF ithathwa njengesikhwama se-hedge yemali esifunwayo emakethe yezibambiso zomhlaba. Iphothifoliyo ye-FXRW ETF ihlanganisa amasheya ase-US/German/Japanese/Chinese/Australian/Russian. Ngenxa yomehluko kumanani we-ruble / dollar, amaphesenti ambalwa angeziwe esivunoni. Ngokuthenga isabelo se-ETF esingu-1, umtshali-zimali uthola ukuhlukahluka komhlaba wonke. I-ETF idayiswa eRussia ngengxenye enkulu yamasheya, okuyinzuzo nakanjani. Intengo yesabelo iqala ku-$0.02. Ku-FXRW, ama-ETF athathwa njengemikhakha emikhulu ngohlobo: Izimboni / IT / Ezezimali / FMCG / Ukunakekelwa Kwezempilo / Izimpahla / Izimpahla Ezihlala Njalo. Iphothifoliyo ye-FXRW ETF ihlanganisa amasheya e-APPLE/MICROSOFT/ALIBABA/TENCENT/Facebook/Amazon/Toyota namanye. Umkhawulo wokungena mncane. Iphepha elilodwa le-FXRW lingathengwa nge-ruble elingu-1 kuphela,

I-SPDR S&P 500 ETF

I-SPDR S&P 500 ETF yisikhwama esasungulwa emuva ngo-1993. Kuyena lapho abaphathi bephothifoliyo bevamise ukuqhathanisa imiphumela yabo, ngoba i-SPDR S&P 500 ETF iwuhlobo lokulinganisa. Ezimweni lapho ukusebenza kungaphezu kwenkomba, umuntu angaqiniseka ukuthi umsebenzi phakathi nonyaka wenziwe kahle. Uma iphansi, khona-ke umtshali-zimali unokuthile okufanele akucabange ngakho. Imali yemakethe yalesi sikhwama ingu-$284 billion. Izinga lembuyiselo yeminyaka emihlanu edlule lidlula ama-70%. Imali yokuphatha yonyaka ingu-0.09%.

I-FXRL

Ukusetshenziswa kokuphindaphinda ngokomzimba okulungiselelwe kuyisici esibalulekile se-FXRL. Ezikhundleni ezimbalwa ezivela ku-RTS, akukho ukunikezwa/isidingo esanele. Okwenziwa yi-FXRL ngabo ekuhwebeni kuthinta inani labo lemakethe. Yingakho ukwakheka kulungiselelwa ngokuhlelekile: amasheya abakhiphi abakhulu ayanda, kuyilapho kususwa izibambiso ezinoketshezi oluphansi. Iphothifoliyo ye-FXRL ihlanganisa amasheya ezinkampani ezinkulu: Sberbank/Gazprom/Lukoil/Yandex/Rosneft/NOVATEK/Polus/Magnit. Ikhomishini yesikhwama – 0.9%. Lesi sikhwama asikhokhi izabelo, kodwa sitshala kabusha, okunomthelela ekwenyukeni kwenani lamasheya.

I-Vanguard FTSE Developed Markets ETF

I-Vanguard FTSE Developed Markets ETF yisikhwama esinezimpande zaseYurophu. Iphothifoliyo ihlanganisa amasheya angaphezu kwe-1000 ezinkampani ezinkulu eYurophu, e-Australia, eMelika naseJapane. Isilinganiso sezindleko eziphansi kakhulu sesikhwama siyinzuzo enkulu yezindleko ngaphezu kwezimbangi zaso eziningi. Izindleko zokuphatha zingu-0.05%. Isivuno eminyakeni yamuva nje besisebangeni lika-16.5-16.6%.

iShares MSCI USMV

I-USMV inikeza iphothifoliyo yamasheya ase-US anokuguquguquka okuncane. Inkomba yesikhwama isebenzisa i-algorithm yokuthuthukisa ukuze kwakhiwe iphothifoliyo enomehluko omncane ocabangela ukuhlobana phakathi kwezitoko, kunokuba nje iqukethe ubhasikidi wamasheya athengiswa kancane. Ukwakha iphothifoliyo yokutshala imali, enye indlela eyinhloko ye-S&P isetshenziswa. Iphothifoliyo ihlanganisa amasheya ezinkampani ezinokuguquguquka okuncane (isibonelo, i-PepsiCo/ Merck & Co). Le ndlela ihlinzeka ngokuncipha kokukhula / ukwehla okubukhali kwezingcaphuno. Ngenxa yalokhu, umtshali-zimali uthola impahla ethembekile nenenzuzo ekuphumeni.

Izindleko zamasheya JPMorgan US Momentum Factor ETF

I-JPMorgan US Momentum Factor ETF (NYSE:JMOM) ivumela abatshalizimali ukuthi batshale esitokweni esikhiqiza kakhulu sase-US. Isisekelo sasungulwa ngo-2017. Kuze kube manje, i-JPMorgan US iphethe izimpahla ezingama-273 ezibiza amaRandi ayizigidi eziyi-135. ikhokhele ama-dividend angu-1.15 % nezindleko ze-investment ngu-0.12%. Ingxenye enkulu yemali itshalwe emkhakheni wezobuchwepheshe (cishe ama-30%). Umkhakha wezempilo (13.3%) kanye nezimboni (11.7%) nazo zitshalwe kahle. Iphothifoliyo yokutshala imali ihlanganisa amasheya ezinkampani ezinkulu njenge-Amazon/Microsoft/Visa/NVIDIA/Apple. Abakhiphi bagxile ekwandiseni imali engenayo, esikhathini eside / ekwandiseni inzuzo kanye nembuyiselo ekutshalweni kwezimali.

Qaphela! Eminyakeni yakamuva, i-JPMorgan US Momentum Factor ETF (NYSE:JMOM) izuze cishe u-12.5-13% ukuze ifinyelele phezulu.

Ungawakhetha kanjani ama-ETF ku-Moscow Exchange ngo-2022 – indlela yokutshala imali, ukutshala imali futhi ungalahlekelwa: https://youtu.be/OgbogdWLsh8 Ukuthola ama-ETF ephothifoliyo yakho kuthathwa njengombono ohlakaniphile wokutshala imali. Izimali ezinjalo zingamathuluzi ahlukahlukene enziwe ngomumo. Nokho, ekukhetheni i-ETF, kubalulekile ukuthi ungalenzi iphutha. Ngokukhetha izimali ezibalwe ngenhla, umtshali-zimali angaqiniseka ukuthi idiphozi yemali ngeke nje ilahleke, kodwa futhi izokuvumela ukuba uthole imali engenayo enhle eyengeziwe.