ETF sika wɔ Russia gua so: list a eye sen biara ma Russia investor a ɛwɔ hɔ ma 2022. ETF ahorow a ɛdɔɔso no taa ma obi adwene tu fra. Ɛyɛ den mmom ma wɔn a wɔrefi ase no sɛ wɔbɛpaw ɔkwan a ɛfata wɔn, a wɔnte nnwinnade a ɛhyɛ sika a wɔde sesa sika no ase na ɛyɛ sika a wɔde bɛto mu no ase. Ase hɔ no wubetumi ahu ETF sika a eye sen biara a mfaso wɔ so ma Russiafo a wɔde wɔn sika hyɛ mu no ho nkyerɛkyerɛmu.

- ETF sika: dɛn ne no

- Abakɔsɛm a ɛfa nneɛma a esisii ho

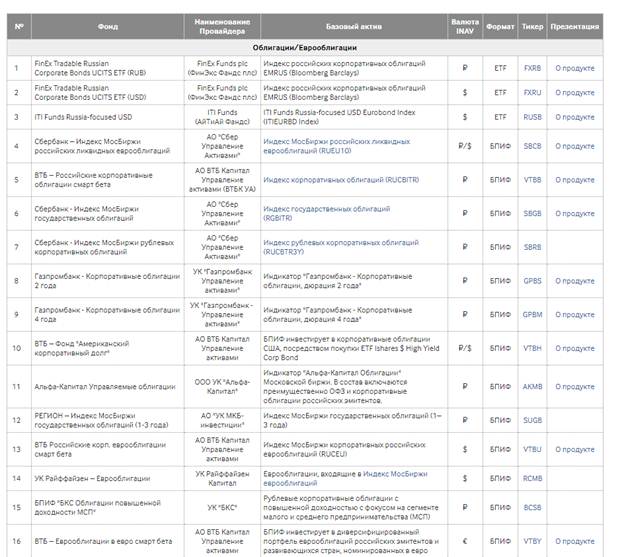

- ETF sika: tebea a ɛwɔ Russia gua so

- Adɛn nti na ETF kakraa bi na ɛwɔ MOEKS so – sika bɛn na ɛwɔ Moscow Exchange no so?

- ETF sika: sɛnea ɛyɛ adwuma

- Rating a ɛyɛ ETF sika a eye sen biara ma Russiani a ɔde ne sika hyɛ mu de besi afe 2022

- Sberbank S&P 500 Nsɛm a Wɔka Kyerɛ SBSP

- VTB Moscow Nsesaeɛ Nkyerɛkyerɛmu VTBX

- FXIT

- FinEx FXUS na ɛwɔ hɔ

- VTB – Nsuo a ɛwɔ hɔ

- FXRU

- Schwab U.S. Kapital Ketekete ETF

- FinEx: U.S. REIT UCITS AKWANKYERƐFOƆ ETF USD

- FXDE a ɛwɔ hɔ

- FinEx Russia RTS Nneɛma a Wɔde Yɛ Adwuma UCITS ETF

- FinEx FXRW ETF Sika Hedge Wiase Nyinaa Sikakorabea

- SPDR S&P 500 ETF a wɔde di dwuma wɔ ɔkwan a ɛfata so

- FXRL na ɛwɔ hɔ

- Vanguard FTSE Nkɔso Guadidan ETF

- iShares MSCI USMV na ɛyɛ adwuma yiye

- JPMorgan U.S. Nneɛma a Ɛma Nneɛma Yɛ Nkɔso ETF

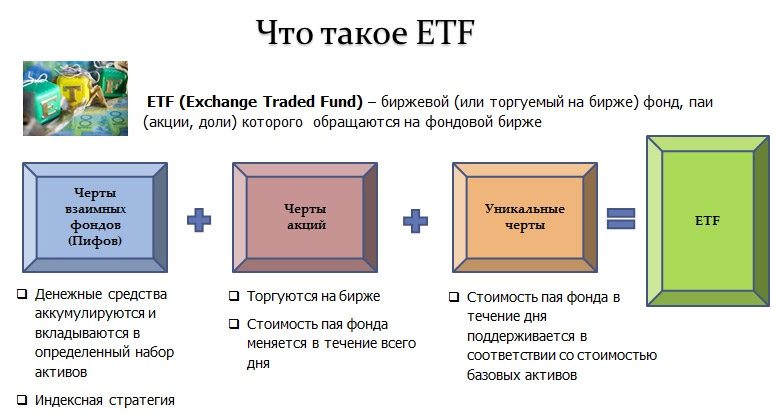

ETF sika: dɛn ne no

Wɔfrɛ ETFs sika a wɔde di gua a wɔde sesa nneɛma, a wɔboaboa ahobanbɔ ano a egyina indices/sectors/commodities biara so. Sika a wode bɛto ETF ahorow mu no ne ɔkwan a ɛyɛ mmerɛw sen biara a wobɛfa so anya kwan akɔ amanaman ntam sikakorabea. Ɛho nhia sɛ wonya nimdeɛ titiriw biara na wɔde wɔn sika ahyɛ saa sika yi mu.

Ɛdenam ETF mu kyɛfa a wɔbɛtɔ so no, wɔn a wɔde wɔn sika hyɛ mu no betumi de wɔn sika ahyɛ ahobammɔ a ɛka index no ho nyinaa mu prɛko pɛ. Enti,

nneɛma ahorow a wɔyɛ no yɛ kɛse na asiane ahorow so tew.

Sɛ wɔto sikakorabea no mu anaasɛ wɔtɔn agyapade no a, nea ɔde ne sika ahyɛ mu no benya ne bo no fã a ɛfata wɔ bere a sikakorabea no tɔn no.

Abakɔsɛm a ɛfa nneɛma a esisii ho

ETF ahorow dii kan puei wɔ gua so wɔ 1989 mu. Wɔ U.S. no, wobetumi anya bi wɔ 1993 mu nkutoo, bere a wɔ Europa aman mu no, na wotumi tɔ kyɛfa wɔ sikakorabea a ɛtete saa mu wɔ 1999 mu nkutoo. Wɔ asram a etwa to wɔ afe 2015 mu no, ETF ahorow no trɛw nneɛma ahorow bɛboro 1,800 mu wɔ gua so nnwuma ahorow/niches/aguadi akwan horow mu. Esiane saa nsenia yi nti, sikakorabea ahorow so ahwɛfo tumi siee sika so, efisɛ wɔtew adwumayɛ ho ka so ma mfaso wɔ so. Eduu December 2019 no, U.S. agyapade a ɛhwɛ so no duu dɔla ɔpepepem 4.4. Ɛde besi nnɛ no, ETF ahorow no da so ara yɛ nea nkurɔfo ani gye ho.

ETF sika: tebea a ɛwɔ Russia gua so

Wɔ mfe 20 a atwam no mu no, sika a wɔde hyɛ mu a wɔbom yɛ adwuma wɔ Russia Ɔman no mu no asesa ntɛmntɛm. Sɛ wɔ afe 1999 mu no, wɔmaa sika a wɔde bɛto mu nko ara kwan sɛ wɔbɛkɔ mu a, ɛnde ɛrekɔ afe 2001 awieeɛ no, na wɔakyekyɛ mu ayɛ no mutual ne joint-stock type of funds. Mfiase no,

mutual funds (mutual funds) nkutoo na egye ntini wɔ gua so, na mfe 7 pɛ a atwam ni no, ETF sikakorabea ahorow fii ase gyee din kɛse. https://asɛmti.opexflow.com/sika a wɔde totɔ nneɛma/fondy-etf.htm

Adɛn nti na ETF kakraa bi na ɛwɔ MOEKS so – sika bɛn na ɛwɔ Moscow Exchange no so?

ETF kakraa bi na ɛwɔ MOEX so. Abenfo gye di sɛ ɔhaw ahorow bi na ɛde eyi ba. Ɛdenam sika a ɔde bɛto sikakorabea a wɔde sikasesa di gua mu so no, obi a ɔde ne sika hyɛ mu no ntumi nyɛ adwuma yiye nsen gua no, efisɛ wɔayɛ index sika a wɔde bɛto sikakorabea no sɛnea ɛbɛyɛ a sɛ wɔkyekyem pɛpɛɛpɛ a, ɛbɛma wɔanya mfaso.

Wobetumi anya nsɛm a wɔahyehyɛ no nyinaa wɔ https://www.moex.com/msn/etf

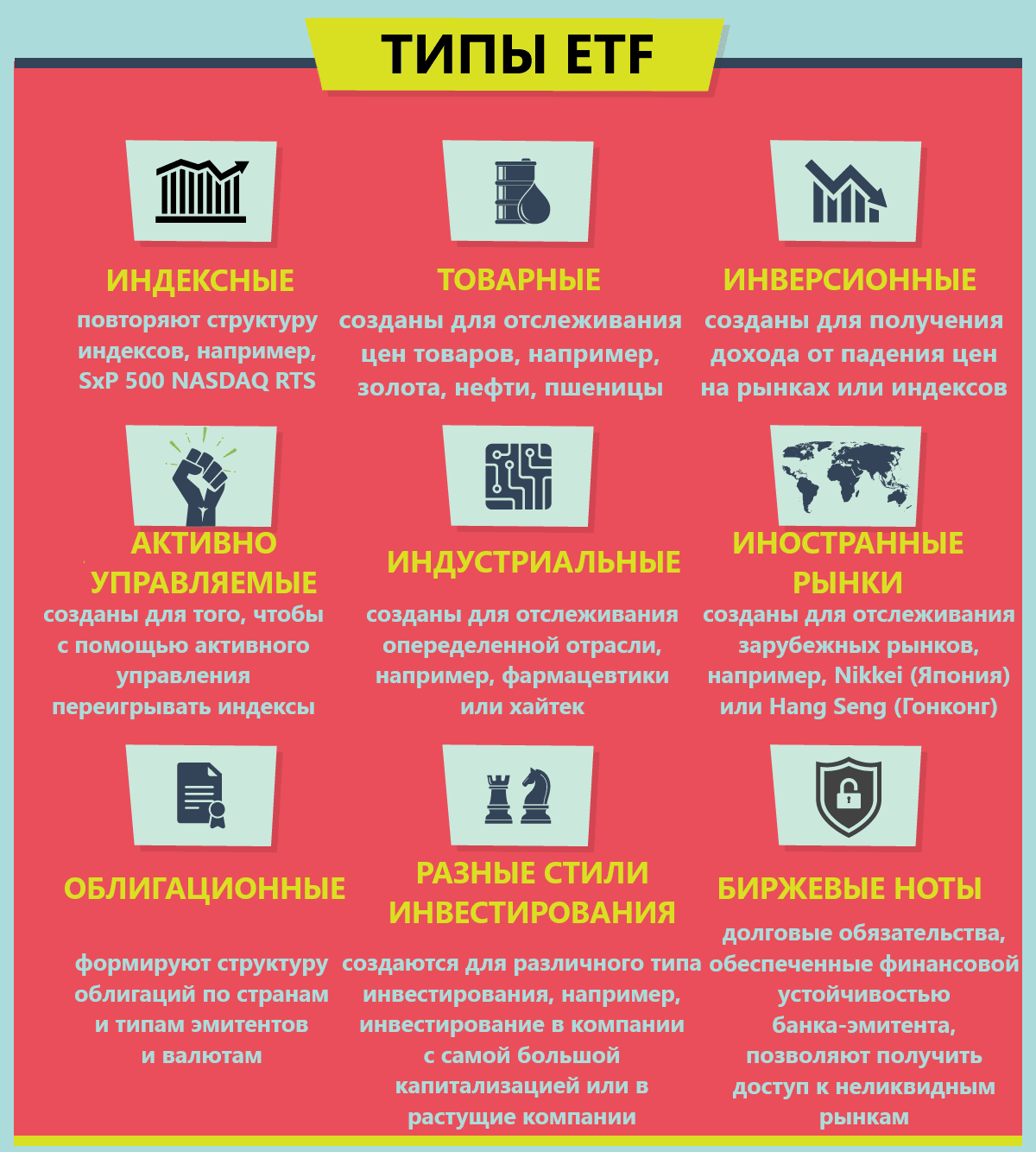

ETFs ɔha mu nkyekyɛmu titire no, wɔde portfolios a ɛsan yɛ stock indices ahodoɔ (a ɛdi kan/adwumayɛkuo) nhyehyɛɛ no gyina hɔ ma. Nanso, wubetumi nso ahu sika afoforo a egyina nhyehyɛe ahorow a ɛyɛ den a wɔde yɛ nneɛma a efi mu ba so. Sika a ɛte saa no nni hɔ mma ankorankoro a wɔde wɔn sika hyɛ mu. ETF a ɛte saa a wɔde di gua no de asiane kɛse ba. Bere koro no ara mu no, mfaso a wobenya wɔ asɛm no mu bere a nea ɔde ne sika ahyɛ mu no tumi amfa bo no ansusuw ho wɔ ɔkwan a ɛnteɛ so no bɛyɛ nea ɛboro so mpɛn pii. [nsɛmfua id=”asɛmfua_12042″ align=”aligncenter” ntrɛwmu=”800″]

ETF sika: sɛnea ɛyɛ adwuma

Sɛnea nhyehyɛe a wɔaka ho asɛm no kyerɛ no, sikakorabea no nya agyapade dodow bi wɔ n’ankasa sikakorabea. Ɛno akyi no, ETF no fi ase de n’ankasa kyɛfa ma. Wubetumi atɔ na woatɔn wɔ stock exchange. Wɔ sikakorabea baako mu no, wobetumi anya bɛboro 100 stocks wɔ nnwuma ahorow mu dwumadi / niches. Wɔde nnwumakuw a ɛwɔ sikakorabea biara mu kyɛfa no kyerɛ wɔ sika dodow a wɔde bu index no mu. Wɔde index no di dwuma de yɛ nhwehwɛmu sɛnea ɛbɛyɛ a wobetumi asusuw sikasɛm/nnwumakuw ahorow a ɛsom bo renya nkɔso no ho. Ɛno nti na kyɛfa bo a ɛkɔ soro no ne index no nkɔso nni abusuabɔ no.

Rating a ɛyɛ ETF sika a eye sen biara ma Russiani a ɔde ne sika hyɛ mu de besi afe 2022

ETF sikakorabea ahorow no agye din bere tenten wɔ sikasɛm mu gua so, esiane nokwasɛm a ɛyɛ sɛ nkurɔfo betumi de sika ahyɛ sikakorabea ahorow mu a ɛho ka sua koraa sɛnea ɛbɛyɛ a wobenya mfaso bere tenten nti.

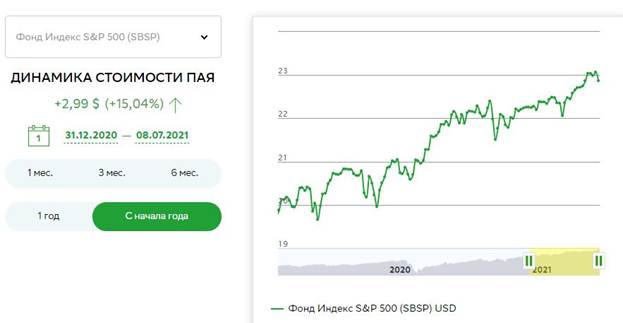

Sberbank S&P 500 Nsɛm a Wɔka Kyerɛ SBSP

S&P 500 Index yɛ stock index a ɛka U.S. nnwumakuw akɛse 500 a ɛwɔ kɛntɛn no mu no ho. Wɔsan de mfaso a nea ɔwɔ kyɛfa no nya no fã bi to hɔ bere a ɛbɛyɛ nea wobetumi anya no. Wɔhwɛ sikakorabea no sikasɛm nhyehyɛe no mu bere a nea ɔde ma no sesa sɛnea wɔahyehyɛ index no ne ne akontaabu ho nhyehyɛe ahorow, anaasɛ sɛ ɛho hia a. Sikakorafo betumi atɔ kyɛfa wɔ dɔla/ruble mu. Kyɛfa biako ho ka fi ase fi ruble 1,000 so. Ɛsɛ sɛ yɛma ɛtra yɛn adwenem sɛ wobu ruble ETF ahorow a wɔbɛtɔ no sɛ ɛyɛ nea mfaso wɔ so sen biara. Afe biara commission a ɛkyɛn so no ntra 1.04%. Ɛsɛ sɛ nea ɔde ne sika hyɛ mu no tua sika bi ma:

- adwumayɛfoɔ a wɔhwɛ so – 0.8%;

- adekoradan – 0.15%;

- ɛka afoforo a wɔbɔ – 0.05%.

Hyɛ nso! Nneɛma 2 a etwa to a ɛho ka no nka VAT ho, enti ɛka a wɔbɔ nyinaa yɛ 1.04%.

Wɔ nsɛm a obi a ɔde ne sika hyɛ mu no wɔ kyɛfa bɛboro mfe 3 mu no, wɔayi no afi tow mu (ɔpepem 3 wɔ afe biara mu).

VTB Moscow Nsesaeɛ Nkyerɛkyerɛmu VTBX

VTB “Moscow Exchange Index” VTBX yɛ sikakorabea a wɔde sikasesɛw di gua a ɛyɛ aguadi wɔ Moscow Exchange (Moscow Exchange) na ɛde sika hyɛ nnwumakuw mu kyɛfa a efi Moscow Exchange Index mu. VTB Moscow Exchange Index VTBX de sika hyɛ kyɛfa a ɛyɛ mmerɛw/wɔpɛ mu, ne

sika a wɔde sie ma kyɛfa a ɛka Moscow Exchange Index no ho. Wɔsan de sika a wɔakyekyɛ a wɔanya no to hɔ. Sikakorabea ahorow a wɔbɛtɔ no ma wɔn a wɔde wɔn sika hyɛ mu no tumi de wɔn sika hyɛ sikakorabea ahorow a ɛwɔ hɔ a ɛho ka sua mu. VTB Moscow Exchange Index VTBX no ho ka nyinaa ne commission no ntra 0.69% afe biara. Sɛ wonam application no so retɔ nneɛma a, enhia sɛ wutua brokerage commission.

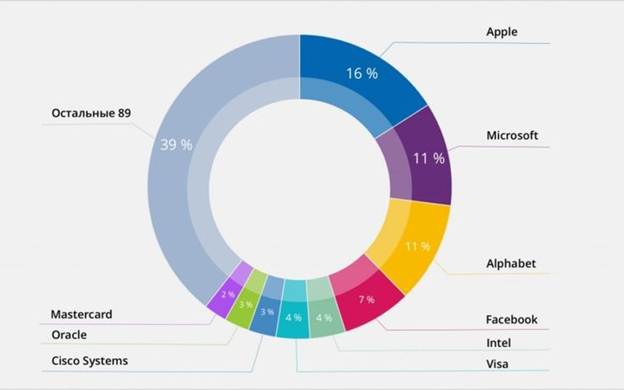

FXIT

Wobu FXIT sɛ sikakorabea a ne bo yɛ den sen biara no mu biako, a IT adwumakuw akɛse no kyɛfa ka ho. Sikakorafoɔ bɛtumi de wɔn ho ahyɛ nnwumakuo a wɔde mfiridwuma ho nimdeɛ a ɛkorɔn agye din paa no kyɛfa a ɛrenya nkɔsoɔ no mu yie: Apple/Microsoft/Intel/ Visa/IBM/Cisco/Oracle, ne nea ɛkeka ho FXIT portfolio no mu bɛboro 80 a wɔde ma, a ɛma agyapadeɛ no yɛ ahodoɔ na ɛtew asiane ahorow so. Sikakorabea sohwɛ ho sika a wɔbɔ no sua.

Hyɛ nso! Sika a wɔde hyɛ stocks mu no taa “sag”. Sɛ wɔkyekyɛ mu a, afe afe sika a wonya wɔ bere tenten mu no bɛyɛ nea ɛkɔ soro / ɛkɔ fam.

Wɔsan de sika a wɔde kyɛ nneɛma a wonya no gu mu. Sɛ wɔn a wɔde di dwuma no tɔn sikakorabea mu kyɛfa denam

Russiafo aguadifo bi nnwuma so a , ankorankoro a wɔde wɔn sika hyɛ mu no betua ankorankoro sika tow (nsonsonoe a ɛda bo a wɔtɔ ne bo a wɔtɔn ntam no mu 13%). Enkosi sɛ wɔbɛtɔn kyɛfa no, wɔrentua tow no. Sɛ wopɛ sɛ wokwati sɛ wubetua tow bere a wotɔn no a, wubetumi atɔ FXIT kyɛfa wɔ IIA

( ankorankoro sikasɛm akontaabu) so. Wɔ eyi mu no, wɔde tow a wɔtew so ma.

FinEx FXUS na ɛwɔ hɔ

FinEx FXUS yɛ ETF ahorow a eye sen biara no mu biako. Nnwumakuw a ɛwɔ U.S. bɛboro 85% na ɛka portfolio no ho: Amazon/Apple/Coca-Cola/Facebook/Johnson&Johnson/Microsoft/VISA. Solactive AG ne index a ɛwɔ ase ma saa sikakorabea yi. Wɔn a wɔde wɔn sika hyɛ mu no betumi atɔn kyɛfa bi bere biara na wɔayi sika a wɔde ahyɛ mu no aka sika a wonya ho. Entry threshold no sua. Towtua ho nhyehyɛe ahorow wɔ hɔ:

- IIS sika a wɔtew so;

- bere tenten a wɔde di dwuma bere tenten mu mfaso.

Hyɛ nso! Sɛ wɔde asɛm no ba awiei a, wobeyi sika no afi akontaabu no mu, na wɔde kyɛfa no ahyɛ nea ɔde ne sika ahyɛ mu foforo no nsa.

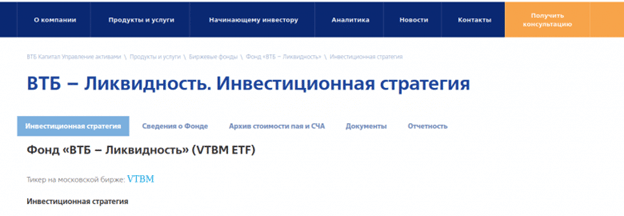

VTB – Nsuo a ɛwɔ hɔ

VTB – Liquidity – sikakorabea a wɔahyɛ da ayɛ sɛ wɔde sika bɛto hɔ bere tiaa bi mu ne sika a wɔde di dwuma ho nhyehyɛe. Sikakorafo betumi de sika ahyɛ mu ama bere a ɛboro nnɔnhwerew 24. Mfaso a wɔboaboa ano da biara da. VTB hyia asiane ahorow a ɛba fam – Liquidity no sua koraa. Wɔde sikakorabea no agyapade gu sika gua so nnwinnade mu. Afe afe adwumayɛ ho ka no ntra 0.49%. Nea ɔde ne sika ahyɛ mu no tua ka:

- adwumakuw a wɔhwɛ so no akatua – 0.21%;

- adekoradan – 0.18%;

- ɛka afoforo a wɔbɔ – 0.1%.

- intraday liquidity (a ɛwɔ hɔ a wobetumi atɔ / atɔn sikakorabea a ɛwɔ ntrɛwmu a ɛba fam koraa);

- mfaso a ebetumi aba a wobetumi de atoto sikakorabea ahorow akɛse no sika a wɔde asie bere tenten ho;

- asiane a ɛba fam koraa.

Ɛyɛ anigye sɛ wubehu! Sɛ wɔkyekyɛ mu a, sika a wonya fi sikakorabea no mu ɔsram biara yɛ +0.28%.

FXRU

FinEx Tradable Russian Corporate Bonds Wobu UCITS ETF (FXRU) sɛ ɛyɛ sikakorabea a wɔhwehwɛ a wɔde wɔn adwene si Russia Nnwumakuw Eurobond Index EMRUS (Bloomberg Barclays) so. Wɔbɔ sika a wɔde hyɛ mu no ho ban yiye na wɔabɔ ruble bo a ɛkɔ fam no ho. Wɔmfa kyɛfa a wotua no mma. Sikakorafo betumi de sika a wonya no ayɛ adwuma kɛse. Mfaso a wɔsan de hyɛ mu no boa ma mfaso a wonya fi sika a wɔde asie no mu no yɛ kɛse. Wɔde ETF sikakorabea no di gua wɔ Moscow Exchange wɔ rubles mu. Ɛho hia sɛ wodi kan hwɛ yiye na woabue brokerage akontaabu a ɛma wotumi kɔ Moscow Exchange no. Sɛ wobue akontaabu no wie a, hwehwɛ ETF no denam ticker so wɔ broker no mobile app/PC terminal no mu. Ɛno akyi no, wubetumi de wo ho ahyɛ adetɔn ne adetɔ mu. Mfaso a ɛwɔ FXRU ET so no bi ne:

- commission level a wogye tom, a ɛyɛ 0.5%;

- a wobetumi anya kwan a ɛyɛ mmerɛw ne kwan a wɔfa so kɔ mu a ɛba fam koraa;

- aguadi mu din pa a mfomso biara nni ho;

- towtua ho nhyehyɛe a wɔde bɛma bere a wɔde AI redi dwuma de ayɛ sika a wɔde bɛto mu no;

- nhyehyɛe a ɛda adi pefee a wɔde bɛyɛ biako;

- sika a wɔde bɛto mu ahobammɔ ne sika a wɔde bɛto mu a wɔaka abom.

Hyɛ nso! Eurobond ETFs betumi atɔ kɛse denam sikasɛm mu asisifo esiane sɛ wɔbɛhyɛn mu a ɛba fam nti.

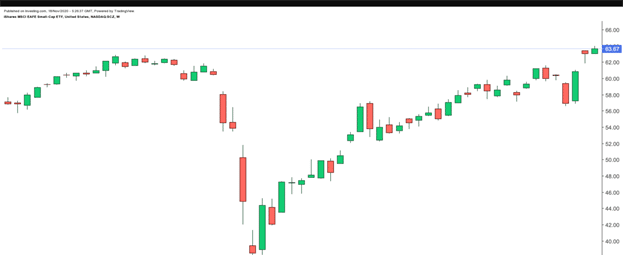

Schwab U.S. Kapital Ketekete ETF

Wobu Schwab U.S. Small-Cap ETF no sɛ ɛyɛ ɔkwan a ɛyɛ mmerɛw, ɛyɛ adwuma yiye, na ɛwɔ nneɛma ahorow pii a wɔfa so de sika hyɛ sikakorabea nketewa mu. Nnwumakuw nketewa/a ɛwɔ mfinimfini no kyɛfa bɛboro 1,700 ka sikakorabea no sikakorabea no ho. Mma wo werɛ mmfi sɛ sikakorabea no mu kyɛfa no bata U.S. ɔman no sikasɛm ho. Schwab US Small-Cap ETF no bo nyɛ den, na wobu no sɛ ɛyɛ mfaso kɛse. Nkyɛmu no aba yɛ 1.2%, na ɛka dodoɔ a wɔbɔ no ntra 0.04%.

FinEx: U.S. REIT UCITS AKWANKYERƐFOƆ ETF USD

FinEx US REIT UCITS ETF USD yɛ sikakorabea a agye din a ɛma nneɛma ahorow a ɛkorɔn (sika a wɔde bɛto mu no rennyina tebea a ɛwɔ sikasɛm mu nnwuma ankorankoro mu) ne sika a wɔde bɛto mu. Sikakorafoɔ nya hokwan tɔ / tɔn agyapadeɛ ntɛmntɛm, berɛ a wɔkora toɔ so. Sikakorabea no siesie ho ka yɛ 0.6%. Ahoɔden a ɛwɔ FinEx mu: US REIT UCITS ETF USD no bi ne:

- sika a wɔde di dwuma kɛse;

- towtua a wɔde di dwuma yiye;

- nneɛma ahorow a ɛsono emu biara a ɛkorɔn;

- ɛho ka biara nni hɔ a wɔbɔ wɔ adwumayɛ ho.

Hyɛ nso! Wɔsan de sika a wɔde bɛkyɛ no to FinEx US REIT UCITS ETF USD mu. Esiane eyi nti, nea ɔde ne sika hyɛ mu no yi hia a ehia sɛ n’ankasa de towtua ho krataa kɔma no fi hɔ.

FXDE a ɛwɔ hɔ

FXDE ETF yɛ sikakorabea a ɛma wɔn a wɔde wɔn sika hyɛ mu no tumi de wɔn sika hyɛ Germany sikakorabea ne Europa sikasɛm a edi kan no mu a mfaso wɔ so. Nnwumakuw akɛse no kyɛfa ka portfolio no ho: Siemens/SAP/Bayer/Daimler/Allianz/Adidas/Volkswagen/BMW ne afoforo.Index no kata Europa sikakorabea akɛse no 85% so. FXDE sika titiriw ne euro. Sɛ ruble no bo kɔ fam a, nea ɔde ne sika bɛto mu no benya mfaso afi nsonsonoe a ɛwɔ sika a wɔde tua ho ka mu no mu ɔno ara. Nnwumakuw a wɔpaw nneɛma a wɔde di dwuma no na wɔwɔ FXDE mu kyɛfa kɛse. Nnwuma a wɔyɛ pɛtro no nni hɔ koraa.

Hyɛ nso! Wɔsan de sika a wonya fi nnwumakuw no kyɛfa mu no gu mu.

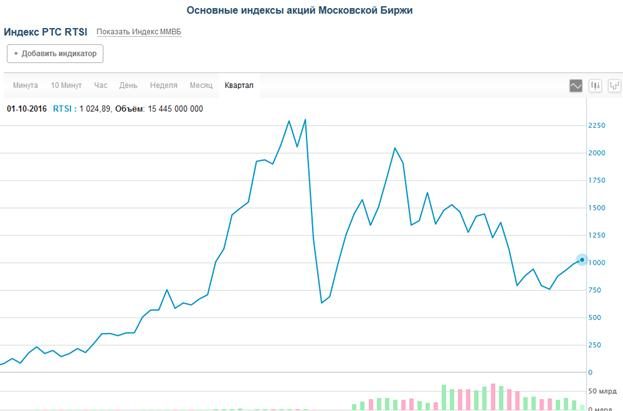

FinEx Russia RTS Nneɛma a Wɔde Yɛ Adwuma UCITS ETF

FinEx Russian RTS Equity UCITS ETF no wobu no sɛ ɛyɛ ɔman ho dɔ sen biara a wɔde bɛto sikakorabea, a Russiafo sika titiriw na ɛwom. Sikakorafoɔ bɛtumi de wɔn sika ahyɛ nnwuma akɛseɛ no mu kyɛfa te sɛ: Gazprom/Lukoil/Sberbank/VTB/Surgutneftegaz/NOVATEK/Magnit/Rosneft, ne nea ɛkeka ho FinEx Russian RTS Equity UCITS ETF no wɔbu no sɛ ɛwɔ mfasoɔ kɛseɛ: commission a ɛba fam, dividend yield a ɛkɔ soro ne a ɛba fam a wɔde hyɛn mu. RTS Equity UCITS de ne sika hyɛ kyɛfa a efi RTS index no mu, na ɛsan yɛ ne nhyehyɛe ne ne nhyehyɛe. Nanso, ɛfata sɛ yɛkae sɛ wɔde dɔla na ebu nsɛm a wɔka fa ho no ho akontaa, na ɛnyɛ ruble mu. Wɔsan de sika a wonya fi kyɛfa mu no gu mu.

FinEx FXRW ETF Sika Hedge Wiase Nyinaa Sikakorabea

Wobu FXRW ETF sɛ ɛyɛ sika a wɔde bɔ ho ban a ɛyɛ foforo a wɔhwehwɛ wɔ wiase nyinaa ahobammɔ gua so. FXRW ETF portfolio no mu bi ne U.S./German/Japan/China/Australia/Russia sika. Esiane nsonsonoe a ɛwɔ ruble / dɔla bo mu nti, wɔde ɔha biara mu nkyem abien ka aba a wonya no ho. Ɛdenam ETF kyɛfa 1 a wɔtɔ so no, sikakorafo no nya wiase nyinaa nneɛma ahorow. Wɔde ETF no di gua wɔ Russia a kyɛfa fã kɛse wom, a akyinnye biara nni ho sɛ ɛyɛ mfaso. Kyɛfa no bo fi ase fi $0.02. Wɔ FXRW mu no, wobu ETFs sɛ nnwuma akɛseɛ sɛdeɛ ɛteɛ: Mfiridwuma / IT / Sikasɛm / FMCG / Akwahosan Ho Hwɛ / Nneɛma a Wɔde Di Dwuma / Nneɛma a Ɛtena Hɔ. FXRW ETF portfolio no mu bi ne APPLE/MICROSOFT/ALIBABA/TENCENT/Facebook/Amazon/Toyota ne afoforo kyɛfa.Akwan a wɔfa so kɔ mu no sua koraa. Wobetumi atɔ FXRW krataa biako de agye ruble 1 pɛ, .

SPDR S&P 500 ETF a wɔde di dwuma wɔ ɔkwan a ɛfata so

SPDR S&P 500 ETF yɛ sikakorabea a wɔde sii hɔ wɔ afe 1993 mu tɔnn. Ɛyɛ ɔno na portfolio so ahwɛfo taa de wɔn ankasa aba no toto ho, efisɛ SPDR S&P 500 ETF no yɛ benchmark bi. Wɔ nsɛm a adwumayɛ no boro index no so no, obi betumi anya awerɛhyem sɛ wɔyɛɛ adwuma a wɔyɛe wɔ afe no mu no yiye. Sɛ ɛba fam a, ɛnde nea ɔde ne sika hyɛ mu no wɔ biribi a obesusuw ho. Saa sikakorabea yi gua so sika yɛ dɔla ɔpepepem 284. Mfeɛ anum a atwam no mu mfasoɔ dodoɔ no boro 70%. Afe afe adwumayɛ ho ka yɛ 0.09%.

FXRL na ɛwɔ hɔ

Honam fam nsɛso a wɔayɛ no yiye a wɔde di dwuma no yɛ ade titiriw a ɛwɔ FXRL mu. Wɔ dibea dodow bi a efi RTS hɔ no, nneɛma a wɔde ma/ahwehwɛde a ɛdɔɔso nni hɔ. Nea FXRL ne wɔn yɛ wɔ nsakrae no mu no ka wɔn gua so bo. Ɛno nti na wɔde nhyehyɛe a wɔayɛ no yiye no: wɔma wɔn a wɔde ma akɛse no kyɛfa kɔ soro, bere a woyi ahobammɔ a ɛnyɛ sika pii fi hɔ no. FXRL portfolio no mu bi ne nnwumakuw akɛse no kyɛfa: Sberbank/Gazprom/Lukoil/Yandex/Rosneft/NOVATEK/Polus/Magnit. Sikakorabea a wɔde ma – 0.9%. Sikakorabea no ntua kyɛfa, na mmom ɛsan de sika hyɛ mu, na ɛma kyɛfa bo kɔ soro.

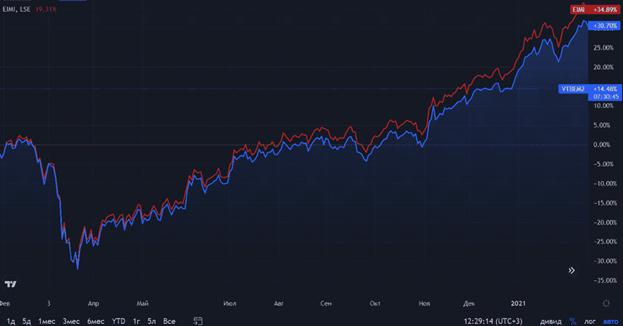

Vanguard FTSE Nkɔso Guadidan ETF

Vanguard FTSE Developed Markets ETF yɛ sikakorabea a ɛwɔ Europa ntini. Nnwumakuw akɛse a ɛwɔ Europa, Australia, Amerika ne Japan no kyɛfa bɛboro 1000 ka portfolio no ho. Sikakorabea no ka a ɛba fam koraa no yɛ ɛka a ɛho hia kɛse wɔ ne akansifo dodow no ara so. Ka a wɔbɔ wɔ adwumayɛ ho ka ho no yɛ 0.05%. Aba a wonyae wɔ mfeɛ a atwam no mu no ayɛ 16.5-16.6%.

iShares MSCI USMV na ɛyɛ adwuma yiye

USMV de portfolio a ɛwɔ U.S. stocks a ɛwɔ volatility kakraa bi ma. Fund index no de optimization algorithm di dwuma de yɛ portfolio a nsonsonoe kakraa bi na ɛwɔ mu a ɛfa abusuabɔ a ɛda stock ahorow ntam no ho, sen sɛ ɛbɛkura kɛntɛn a stock ahorow a wɔtɔn no sua wom kɛkɛ. Sɛnea ɛbɛyɛ a wɔbɛhyehyɛ sika a wɔde bɛto mu no, wɔde ɔkwan titiriw a wɔfa so si S&P ananmu na edi dwuma. Nnwumakuw a ɛnyɛ nea ɛsakrasakra pii no kyɛfa ka portfolio no ho (sɛ nhwɛso no, PepsiCo/ Merck & Co). Saa kwan yi ma nkɔso / sharp drops wɔ quotations no so tew. Esiane eyi nti, nea ɔde ne sika hyɛ mu no nya agyapade a wotumi de ho to so na mfaso wɔ so bere a wofi mu no.

JPMorgan U.S. Nneɛma a Ɛma Nneɛma Yɛ Nkɔso ETF

JPMorgan U.S. Momentum Factor ETF (NYSE: JMOM) ma wɔn a wɔde wɔn sika hyɛ mu no kwan ma wɔde wɔn sika hyɛ U.S. sikakorabea ahorow a ɛma wonya mfaso kɛse mu. Wɔde fapem no sii hɔ wɔ afe 2017 mu. Ɛde besi nnɛ no, JPMorgan US na ɛhwɛ agyapade 273 a ne bo yɛ dɔla ɔpepem 135 so. Nkyɛmu no aba yɛ 1.15% na ɛka a wɔbɔ wɔ sika a wɔde bɛto mu no yɛ 0.12%. Wɔde sika kɛseɛ no fã kɛseɛ no ara hyɛ mfiridwuma mu (bɛyɛ 30%). Akwahosan ho adwumayɛkuo (13.3%) ne nnwuma (11.7%) nso de wɔn sika ahyɛ mu yie. Nnwumakuw akɛse te sɛ Amazon/Microsoft/Visa/NVIDIA/Apple no kyɛfa ka sikasɛm nhyehyɛe no ho. Wɔn a wɔde nneɛma ma no de wɔn adwene si sika a wonya no so, wɔ bere tenten mu / mfaso a wobenya ne mfaso a wobenya afi sika a wɔde asie mu no akɔ soro.

Hyɛ nso! Wɔ nnansa yi mfe mu no, JPMorgan US Momentum Factor ETF (NYSE: JMOM) anya nkɔanim bɛyɛ 12.5-13% akɔduru bere nyinaa a ɛkorɔn sen biara.

Sɛnea wobɛpaw ETFs wɔ Moscow Exchange wɔ afe 2022 mu – sɛnea wode sika bɛto mu, de sika ahyɛ mu na woanhwere: https://youtu.be/OgbogdWLsh8 Wobu ETFs a wubenya ama w’ankasa wo portfolio sɛ ɛyɛ adwene a nyansa wom a wode bɛto sikakorabea. Sika a ɛte saa no yɛ nnwinnade ahorow a wɔayɛ krado. Nanso, wɔ ETF a wɔpaw no mu no, ɛho hia sɛ worenni mfomso. Ɛdenam sika a wɔabobɔ din wɔ atifi hɔ no a wɔde bɛma no yiye so no, nea ɔde ne sika ahyɛ mu no betumi anya awerɛhyem sɛ ɛnyɛ sɛ sika a wode asie no renhwere nko, na mmom ɛbɛma woanya sika foforo pa nso.