Kuɗin ETF a cikin kasuwar Rasha: jerin mafi kyawun masu saka hannun jari na Rasha da ke akwai don 2022. Yawancin ETFs galibi yana da rudani. Yana da wahala ga masu farawa su zaɓi zaɓin da ya dace da su, ba tare da fahimtar irin kayan aikin da ke tattare da kuɗin musayar musayar da kuma samar da fayil ɗin saka hannun jari ba. A ƙasa zaku iya samun bayanin mafi kyawun kuɗin ETF wanda yake da riba ga masu saka hannun jari na Rasha. [taken magana id = “abin da aka makala_12049” align = “aligncenter” nisa = “624”]

- Asusun ETF: menene

- Tarihin faruwa

- Asusun ETF: Jihar kasuwar Rasha

- Me yasa akwai ‘yan ETFs akan MOEKS – menene kudade ke samuwa akan Musanya ta Moscow?

- Asusun ETF: yadda suke aiki

- Ƙididdigar mafi kyawun kuɗin ETF ga mai saka hannun jari na Rasha kamar na 2022

- Sberbank S&P 500 Index SBSP

- VTB Moscow Exchange Index VTBX

- FXIT

- FinEx FXUS

- VTB – Liquidity

- Farashin FXRU

- Schwab US Small Cap ETF kasuwar kasuwa

- FinEx: US REIT UCITS ETF USD

- Farashin FXDE

- FinEx Russian RTS Equity UCITS ETF tarihin farashi

- FinEx FXRW ETF Currency Hedge Global Stock hannun jari

- SPDR S&P 500 ETF tarihin farashi

- Farashin FXRL

- Vanguard FTSE Developed Markets ETF girma

- iShares MSCI USMV

- JPMorgan US Momentum Factor ETF tarihin farashi

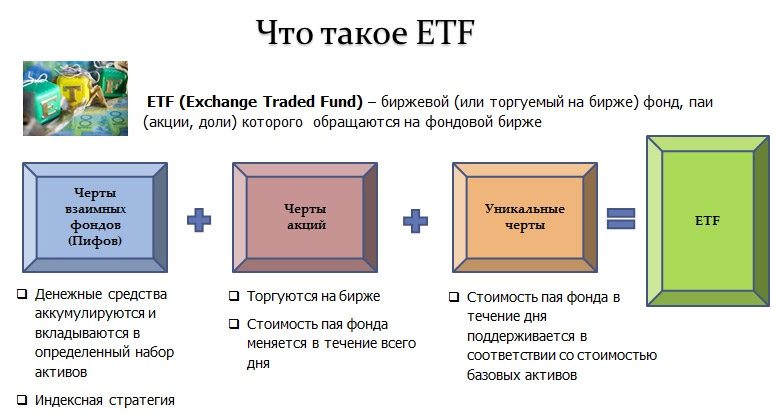

Asusun ETF: menene

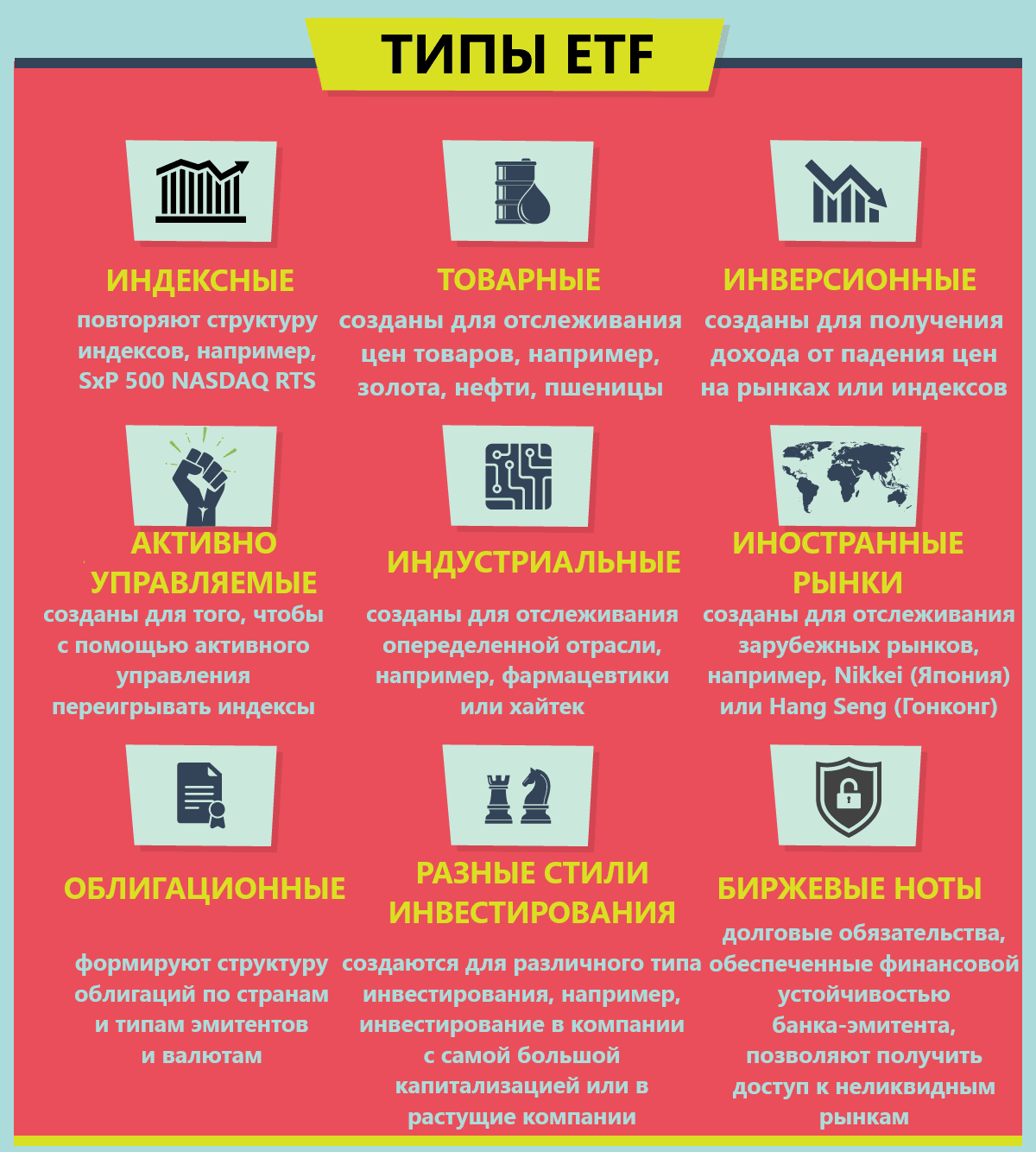

ETFs ana kiran kuɗaɗen musayar musayar, wanda a ciki ake tattara haƙƙoƙi bisa kowane fihirisa/bangaro/kayayyaki. Zuba jari a cikin ETFs shine hanya mafi sauƙi don samun dama ga kasuwannin hannun jari na duniya. Ba a buƙatar ilimi na musamman don saka hannun jari a cikin waɗannan kudade.

Ta hanyar siyan hannun jari a cikin ETF, masu saka hannun jari za su iya saka hannun jari a duk amintattun da aka haɗa a cikin fihirisar lokaci ɗaya. Don haka,

bambance-bambance yana ƙaruwa kuma ana rage haɗari.

Idan an rufe asusun ko kuma aka sayar da kadarorin, mai saka jari zai sami wani yanki na ƙimar ƙimar su a lokacin siyar da asusun.

Tarihin faruwa

ETFs ya fara bayyana a kasuwa a cikin 1989. A cikin Amurka, sun kasance kawai a cikin 1993, yayin da a cikin ƙasashen Turai yana yiwuwa a siyan hannun jari a cikin irin waɗannan kudade kawai a cikin 1999. A cikin watannin ƙarshe na 2015, ETFs sun mamaye samfuran daban-daban sama da 1,800 a cikin sassa daban-daban na kasuwa / dabarun ciniki. Godiya ga wannan ma’auni, manajoji na kudaden zuba jari sun gudanar da ajiyar kuɗi, saboda farashin aiki ya ragu da riba. Ya zuwa Disamba na 2019, kadarorin Amurka da ke karkashin kulawa sun kai dala tiriliyan 4.4. Har wa yau, ETFs sun kasance sananne.

Asusun ETF: Jihar kasuwar Rasha

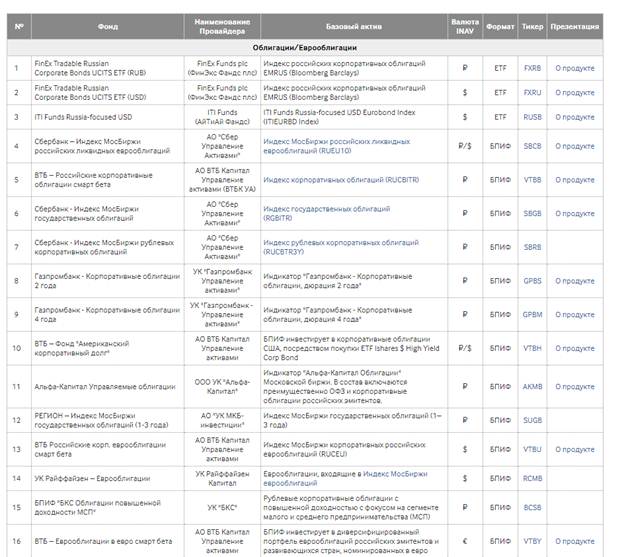

A cikin shekaru 20 da suka gabata, kasuwar hada-hadar hannun jari a Tarayyar Rasha ta canza cikin sauri. Idan a cikin 1999 kawai an ba da izinin samun damar yin amfani da kuɗaɗen saka hannun jari, to a ƙarshen 2001 an sami rarrabuwa zuwa nau’in kuɗi na juna da haɗin gwiwa. Da farko dai,

kuɗaɗen juna (asusun juna) ne kawai suka sami gindin zama a kasuwa, kuma shekaru 7 da suka wuce kuɗin ETF ya fara samun farin jini sosai. https://articles.opexflow.com/investments/fondy-etf.htm

Me yasa akwai ‘yan ETFs akan MOEKS – menene kudade ke samuwa akan Musanya ta Moscow?

Akwai wasu ‘yan ETFs akan MOEX. Masana sun yi imanin cewa wannan ya faru ne saboda wasu rashin amfani. Ta hanyar saka hannun jari a cikin asusun musayar musayar, mai saka jari ba zai iya fin kasuwa ba, saboda an tsara saka hannun jari don matsakaicin dawowa.

Ana samun cikakken jerin a https://www.moex.com/msn/etf

Babban kashi na ETFs yana wakilta ta hanyar fayil ɗin da ke maimaita tsarin fihirisar haja daban-daban (jagora/bangare). Koyaya, zaku iya samun wasu kudade bisa hadadden tsarin abubuwan da aka samo asali. Irin waɗannan kudade ba sa samuwa ga masu zuba jari masu zaman kansu. Ciniki irin wannan ETF yana haifar da haɗari mai tsanani. A lokaci guda, ribar da aka samu a cikin lamarin lokacin da mai saka jari ya gudanar da rashin kuskure tare da farashin zai kasance sau da yawa mafi girma. [taken magana id = “abin da aka makala_12042” align = “aligncenter” nisa = “800”]

Asusun ETF: yadda suke aiki

Dangane da dabarun da aka bayyana, asusun ya mallaki kadarori masu yawa a cikin kundin sa. Bayan haka, ETF ta fara fitar da nata hannun jari. Kuna iya saya da sayar da su akan musayar hannun jari. A cikin asusun ɗaya za a iya samun fiye da hannun jari 100 a fannoni daban-daban na ayyuka / alkuki. Ana gabatar da hannun jari na kamfanoni a cikin kowane asusu a cikin adadin da aka ƙididdige ƙididdiga. Ana amfani da fihirisar don dalilai na nazari domin a iya tantance waɗanne sassa na tattalin arziki/kamfanoni suke girma cikin ƙima. Abin da ya sa ba a haɗa haɓakar farashin hannun jari tare da haɓakar index.

Ƙididdigar mafi kyawun kuɗin ETF ga mai saka hannun jari na Rasha kamar na 2022

Kudaden ETF sun dade suna samun karbuwa a kasuwannin zuba jari, saboda yadda mutane za su iya saka kudi a cikin tsare-tsare masu karamin farashi don samun riba a cikin dogon lokaci.

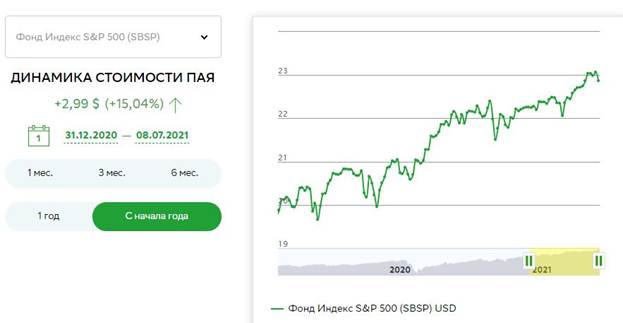

Sberbank S&P 500 Index SBSP

Indexididdigar S&P 500 index ce ta hannun jari wacce ta ƙunshi manyan kamfanonin Amurka 500 a cikin kwandon. Wani ɓangare na ribar da mai hannun jari ya karɓa ana sake saka hannun jari kamar yadda ya samu. Ana duba tsarin fayil ɗin saka hannun jari a asusun lokacin da mai bayarwa ya canza abun da ke cikin fihirisa da ma’aunin lissafinsa, ko kuma idan ya cancanta. Masu zuba jari na iya siyan hannun jari a dala/rubles. Farashin daya yana farawa daga 1,000 rubles. Ya kamata a la’akari da cewa sayen ruble ETFs ana daukar shi mafi riba. Matsakaicin hukumar shekara-shekara baya wuce 1.04%. Mai saka jari yana buƙatar biyan kuɗi don:

- gudanarwa – 0.8%;

- ajiya – 0.15%;

- sauran kashe kudi – 0.05%.

A kula! Abubuwan farashi 2 na ƙarshe ba su haɗa da VAT ba, don haka jimillar farashi shine 1.04%.

A lokuta da mai saka hannun jari ya mallaki hannun jari fiye da shekaru 3, an keɓe shi daga haraji (da miliyan 3 a kowace shekara).

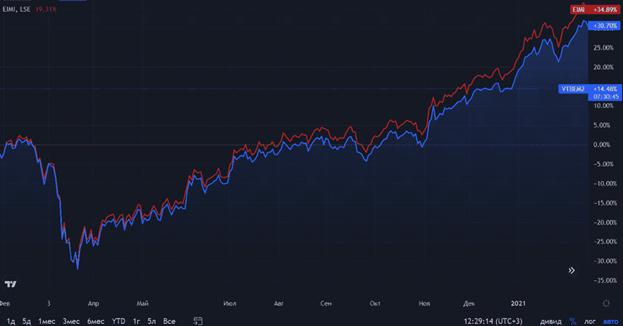

VTB Moscow Exchange Index VTBX

VTB “Moscow Exchange Index” VTBX asusun saka hannun jari ne na musayar musayar wanda ke ciniki akan musayar Moscow (Moscow Exchange) kuma yana saka hannun jari a hannun jari na kamfanoni daga Ma’auni na Mosko Exchange. VTB Moscow Exchange Index VTBX yana saka hannun jari a cikin hannun jari na yau da kullun / wanda aka fi so, da kuma

rasidun ajiya don hannun jarin da aka haɗa a cikin Ma’auni na Musanya Moscow. An sake saka hannun jarin rabon da aka karɓa. Sayen asusu yana ba masu zuba jari damar saka hannun jari a cikin babban fayil ɗin hannun jari a farashi mai rahusa. Jimlar farashi da hukumar VTB Moscow Exchange Index VTBX bai wuce 0.69% a kowace shekara ba. Lokacin yin sayayya ta hanyar aikace-aikacen, ba kwa buƙatar biyan hukumar dillalai.

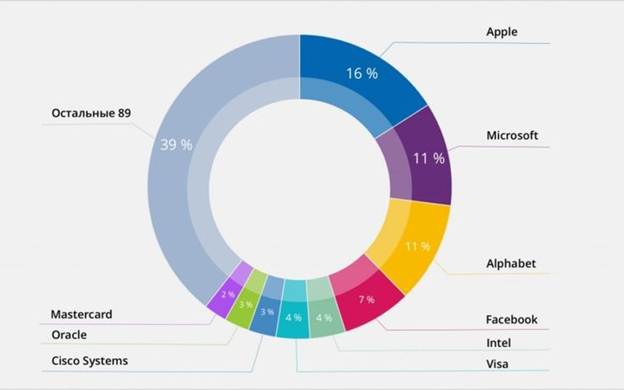

FXIT

Ana ɗaukar FXIT ɗayan kuɗi mafi tsada, wanda ya haɗa da hannun jari na manyan kamfanonin IT. Masu zuba jari za su iya shiga cikin ci gaban hannun jari na manyan kamfanoni masu fasaha: Apple / Microsoft / Intel / Visa / IBM / Cisco / Oracle, da dai sauransu. Fayil na FXIT ya hada da masu ba da kyauta fiye da 80, wanda ke tabbatar da rarraba kadara da rarrabawa. yana rage kasada. Kudaden kula da asusun ba su da yawa.

A kula! Zuba jari a hannun jari sau da yawa “sag”. Matsakaicin matakin samun kudin shiga na shekara-shekara na dogon lokaci zai kasance sama da ƙasa.

An sake saka hannun jarin rabon da aka samu. Idan masu amfani suna sayar da hannun jari ta hanyar amfani da sabis na

dillali na Rasha , mai saka hannun jari na mutum zai kasance ƙarƙashin harajin kuɗin shiga na sirri (13% na bambanci tsakanin farashin siye da farashin siyarwa). Har sai an sayar da hannun jari, ba za a hana harajin ba. Idan kuna son guje wa biyan haraji a lokacin siyarwa, zaku iya siyan hannun jari na FXIT akan IIA

( asusun saka hannun jari ɗaya). A wannan yanayin, ana ba da raguwar haraji.

FinEx FXUS

FinEx FXUS yana ɗaya daga cikin mafi kyawun ETFs a can. Fayil ɗin ya ƙunshi fiye da 85% na kamfanonin Amurka: Amazon/Apple/Coca-Cola/Facebook/Johnson&Johnson/Microsoft/VISA. Solactive AG shine ikon mallakar ƙasa. Masu zuba jari na iya siyar da kaso a kowane lokaci kuma su janye kudaden da aka saka tare da samun kudin shiga. Matsakaicin shigarwa yana da ƙasa. Akwai raguwar haraji:

- IIS raguwa;

- dogon lokaci riba riba.

A kula! Bayan kammala cinikin, za a cire kuɗin daga asusun, kuma za a ba da kuɗin ga sabon mai saka jari.

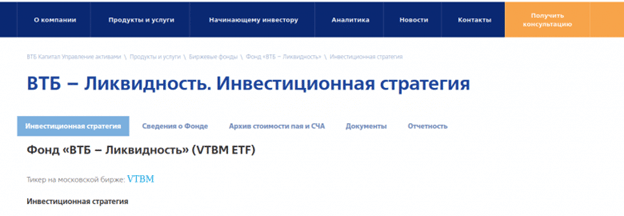

VTB – Liquidity

VTB – Liquidity – asusun da aka yi niyya don sanya kuɗi na ɗan gajeren lokaci da sarrafa kuɗin ruwa. Masu zuba jari na iya sanya kuɗi na tsawon awanni 24. Yawan riba kullum. VTB yana fuskantar kasadar kasada – Liquidity kadan ne. Ana sanya kadarorin asusun a cikin kayan kasuwancin kuɗi. Kudin gudanarwa na shekara-shekara bai wuce 0.49%. Mai saka jari yana biya:

- albashin kamfanin gudanarwa – 0.21%;

- ajiya – 0.18%;

- sauran kashe kudi – 0.1%.

- Intraday liquidity (samuwar yuwuwar siyan / siyar da asusu tare da ƙaramin yaduwa);

- yuwuwar ribar kwatankwacin ajiyar lokaci na manyan cibiyoyin banki;

- ƙananan kasadar kasada.

Abin sha’awa don sani! Matsakaicin dawowar asusun na kowane wata shine +0.28%.

Farashin FXRU

FinEx Tradable Russian Corporate Bonds UCITS ETF (FXRU) ana ɗaukarsa a matsayin asusun da ake nema wanda aka mayar da hankali kan Index na Rukunin Yurobond na Rasha EMRUS (Bloomberg Barclays). Ana samun amintaccen kariya daga saka hannun jari daga rage darajar ruble. Ba a bayar da biyan kuɗi na riba ba. Masu zuba jari za su iya yin amfani da kudin shiga da aka samu. Sake saka hannun jari na riba yana taimakawa wajen haɓaka dawo da saka hannun jari. Ana sayar da asusun ETF akan musayar Moscow a cikin rubles. Wajibi ne a kula a gaba don buɗe asusun ajiyar kuɗi wanda ke ba da damar yin amfani da Musanya ta Moscow. Da zarar an buɗe asusun, nemo ETF ta ticker a cikin tashoshin wayar hannu na dillali / PC. Bayan haka, zaku iya shiga cikin tallace-tallace da sayayya. Fa’idodin FXRU ET sun haɗa da:

- matakin hukumar yarda, wanda shine 0.5%;

- samun dama mai dacewa da mafi ƙarancin shigarwa;

- martabar kasuwanci mara kyau;

- zaɓin haraji da za a bayar lokacin amfani da AI don saka hannun jari;

- m makirci na hadin gwiwa;

- hade da zuba jari tsaro da liquidity.

A kula! Masu zuba jari na iya siyan Eurobond ETFs da yawa saboda ƙarancin shiga.

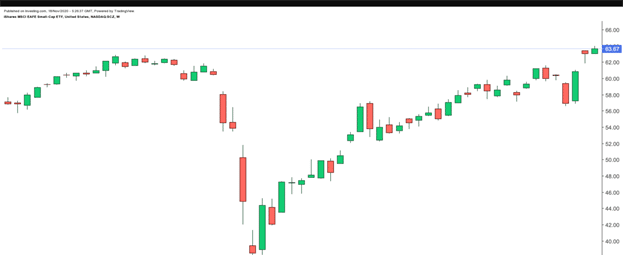

Schwab US Small Cap ETF kasuwar kasuwa

Ana ɗaukar Schwab US Small-Cap ETF a matsayin hanya mai sauƙi, inganci, kuma mai rarrabuwar kawuna don saka hannun jari a cikin ƙananan hannun jari. Fayil ɗin asusun ya ƙunshi sama da hannun jari 1,700 na ƙananan kamfanoni masu tsaka-tsaki. Kar a manta cewa hannun jarin asusun yana da nasaba da tattalin arzikin cikin gida na Amurka. Schwab US Small-Cap ETF ba shi da tsada, wanda ake la’akarin fa’ida mai mahimmanci. Yawan rabon rabon shine 1.2%, kuma adadin farashin bai wuce 0.04%.

FinEx: US REIT UCITS ETF USD

FinEx US REIT UCITS ETF USD sanannen asusu ne wanda ke ba da babban matakin rarrabuwar kawuna (saba hannun jari ba zai dogara da yanayin al’amuran kowane sassa na tattalin arziƙi ba) da kuma yawan kuɗi. Masu zuba jari suna da damar da za su saya / siyar da kadarorin cikin sauri, yayin da suke adana haraji. Kudin kula da asusun shine 0.6%. Ƙarfin FinEx: US REIT UCITS ETF USD sun haɗa da:

- high liquidity;

- ingancin haraji;

- babban bambanci;

- babu farashin gudanarwa.

A kula! Adadin hannun jari akan FinEx US REIT UCITS ETF USD Godiya ga wannan, mai saka jari ya kawar da buƙatar shigar da takardar haraji da kansa.

Farashin FXDE

FXDE ETF wani asusu ne wanda ke ba masu zuba jari damar saka hannun jari cikin riba a hannun jari na Jamus da kuma manyan tattalin arzikin Turai. Fayil ɗin ya ƙunshi hannun jari na manyan kamfanoni: Siemens/SAP/Bayer/Daimler/Allianz/Adidas/Volkswagen/BMW da sauransu.Tallafin ya ƙunshi kashi 85% na kasuwar hannayen jari mafi girma a Turai. Babban kudin FXDE shine Yuro. A cikin yanayin raguwar darajar ruble, mai saka hannun jari zai amfana ta atomatik daga bambancin farashin. Kamfanonin kayan masarufi masu zaɓaɓɓu suna riƙe mafi girman kaso na FXDE. Masana’antar mai ba ta nan gaba daya.

A kula! An sake saka hannun jarin da aka samu kan hannun jarin kamfanoni.

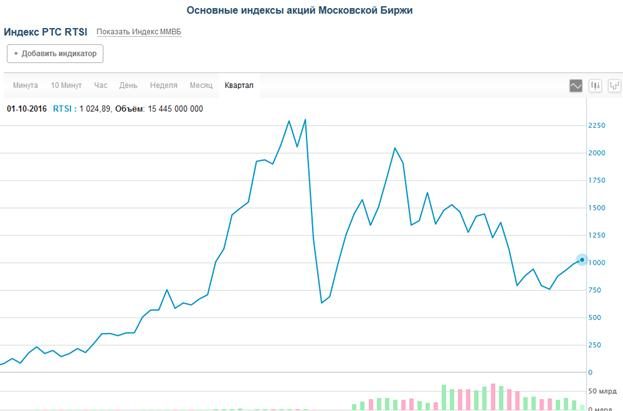

FinEx Russian RTS Equity UCITS ETF tarihin farashi

FinEx Russian RTS Equity UCITS ETF ana ɗaukar mafi girman fayil ɗin saka hannun jari na kishin ƙasa, wanda ya ƙunshi hannun jari na Rasha. Masu zuba jari na iya saka hannun jari a hannun jari na manyan kamfanoni kamar: Gazprom/Lukoil/Sberbank/VTB/Surgutneftegaz/NOVATEK/Magnit/Rosneft da dai sauransu ƙananan ƙofar shiga. RTS Equity UCITS yana saka hannun jari a cikin hannun jari daga ma’aunin RTS, yana maimaita abun da ke ciki da tsarinsa. Duk da haka, yana da daraja tunawa cewa ana ƙididdige ƙididdiga a cikin daloli, ba a cikin rubles ba. An sake saka hannun jarin da aka samu akan hannun jari.

FinEx FXRW ETF Currency Hedge Global Stock hannun jari

FXRW ETF ana ɗaukar shi azaman asusun shinge na ƙima a cikin kasuwar tsaro ta duniya. Fayil ɗin FXRW ETF ta ƙunshi hannun jari na US/Jamus/Japan/ Sinanci/Australian/Rasha. Saboda bambancin farashin ruble / dala, ana ƙara kashi biyu cikin dari zuwa yawan amfanin ƙasa. Ta hanyar siyan hannun jari na 1 ETF, mai saka hannun jari yana karɓar rarrabuwa na duniya. Ana sayar da ETF a Rasha tare da babban rabon rabo, wanda tabbas yana da fa’ida. Farashin hannun jari yana farawa daga $0.02. A cikin FXRW, ana ɗaukar ETFs manyan sassa ta nau’in: Masana’antu / IT / Kuɗi / FMCG / Kula da Lafiya / Kayayyaki / Kaya masu Dorewa. Fayil ɗin FXRW ETF ta haɗa da hannun jari na APPLE/MICROSOFT/ALIBABA/TENCENT/Facebook/Amazon/Toyota da sauransu.Maƙalar shigowa ba ta da yawa. Ana iya siyan takarda FXRW ɗaya akan 1 ruble kawai,

SPDR S&P 500 ETF tarihin farashi

SPDR S&P 500 ETF asusun ne wanda aka kafa a shekara ta 1993. Tare da shi ne masu sarrafa fayil suka saba kwatanta sakamakon nasu, saboda SPDR S&P 500 ETF wani nau’i ne na ma’auni. A cikin lokuta inda aikin ya kasance sama da index, wanda zai iya tabbatar da cewa aikin a cikin shekara ya yi kyau. Idan ƙasa, to, mai saka jari yana da abin da zai yi tunani akai. Babban kasuwar wannan asusu shine dala biliyan 284. Adadin dawowa na shekaru biyar da suka wuce ya wuce 70%. Kudin gudanarwa na shekara shine 0.09%.

Farashin FXRL

Amfani da ingantattun kwafin jiki shine muhimmin fasalin FXRL. Don adadin mukamai daga RTS, babu isassun wadata/buƙata. Abin da FXRL ke yi da su akan musayar yana shafar ƙimar kasuwar su. Wannan shine dalilin da ya sa aka inganta tsarin da aka tsara: ana ƙara yawan hannun jari na manyan masu bayarwa, yayin da ake cire ƙananan ƙananan ruwa. Fayil ɗin FXRL ya haɗa da hannun jari na manyan kamfanoni: Sberbank/Gazprom/Lukoil/Yandex/Rosneft/NOVATEK/Polus/Magnit. Hukumar kudi – 0.9%. Asusun ba ya biya rabo, amma sake zuba jari, wanda ke taimakawa wajen haɓaka darajar hannun jari.

Vanguard FTSE Developed Markets ETF girma

Vanguard FTSE Developed Markets ETF ginshiƙi akan rahoton hada-hadar kudi ta yanar gizo. Fayil ɗin ya ƙunshi fiye da hannun jari 1000 na manyan kamfanoni a Turai, Ostiraliya, Amurka da Japan. Matsakaicin ƙarancin kuɗi na asusun yana da fa’idar tsadar gaske fiye da yawancin masu fafatawa. Farashin gudanarwa shine 0.05%. Yawan amfanin ƙasa a cikin ‘yan shekarun nan ya kasance a cikin kewayon 16.5-16.6%.

iShares MSCI USMV

USMV yana ba da babban fayil na hannun jari na Amurka tare da ƙarancin canji. Fihirisar asusu tana amfani da ingantaccen algorithm don ƙirƙirar fayil tare da ƙaramin bambance-bambancen da ke yin la’akari da alaƙa tsakanin hannun jari, maimakon kawai ɗauke da kwandon ƙananan hannun jari. Don ƙirƙirar fayil ɗin saka hannun jari, ana amfani da babban madadin S&P. Fayil ɗin ya ƙunshi hannun jari na kamfanoni waɗanda ke da ƙarancin canji (misali, PepsiCo/ Merck & Co). Wannan hanyar tana ba da raguwa a cikin girma / raguwa mai kaifi a cikin ambato. Godiya ga wannan, mai saka jari yana karɓar abin dogara da riba mai riba a wurin fita.

JPMorgan US Momentum Factor ETF tarihin farashi

JPMorgan US Momentum Factor ETF (NYSE:JMOM) yana ba masu zuba jari damar saka hannun jari a hannun jari na Amurka. An kafa gidauniyar ne a shekarar 2017. Ya zuwa yau, JPMorgan US yana sarrafa kadarori 273 da darajarsu ta kai dala miliyan 135. Yawan rabon rabon shine 1.15% kuma farashin zuba jari shine 0.12%. Yawancin babban birnin kasar ana zuba jari a fannin fasaha (kimanin 30%). Sashen kiwon lafiya (13.3%) da masana’antu (11.7%) suma an saka hannun jari sosai. Fayil ɗin saka hannun jari ya haɗa da hannun jari na manyan kamfanoni kamar Amazon/Microsoft/Visa/NVIDIA/Apple. Masu bayarwa sun mayar da hankali kan haɓaka kudaden shiga, a cikin dogon lokaci / haɓaka riba da dawowa kan zuba jari.

A kula! A cikin ‘yan shekarun nan, JPMorgan US Momentum Factor ETF (NYSE:JMOM) ya samu kusan kashi 12.5-13% don ya kai ga ko wane lokaci.

Yadda ake zaɓar ETFs akan Musanya ta Moscow a 2022 – yadda ake saka hannun jari, saka hannun jari kuma kar a rasa: https://youtu.be/OgbogdWLsh8 Samun ETFs don fayil ɗin ku ana ɗaukar ra’ayin saka hannun jari mai wayo. Irin waɗannan kuɗaɗen kayan aikin da aka ƙera ne. Duk da haka, a cikin tsarin zaɓi na ETF, yana da mahimmanci kada ku yi kuskure. Ta hanyar ba da fifiko ga kudaden da aka lissafa a sama, mai saka jari zai iya tabbatar da cewa ajiyar kuɗi ba kawai ba za a rasa ba, amma kuma zai ba ku damar samun ƙarin samun kudin shiga mai kyau.