Iimali ze-ETF kwimarike yaseRashiya: uluhlu lwezona zilungileyo zomtyali-mali waseRashiya ezikhoyo ngo-2022. Ubuninzi be-ETF buhlala bubhidanisa. Kunokuba nzima kubaqalayo ukukhetha ukhetho olubafaneleyo, ngaphandle kokuqonda ukuba zeziphi izixhobo eziphantsi kweemali ezithengiswayo kunye nokwenza ipotifoliyo yotyalo-mali. Ngezantsi ungafumana inkcazo yeemali ezilungileyo ze-ETF apho kunenzuzo kubatyali-mali baseRussia ukuba batyale.

- Imali ye-ETF: yintoni

- Imbali yokwenzeka

- Imali ye-ETF: imeko yemarike yaseRashiya

- Kutheni kukho ii-ETF ezimbalwa kwi-MOEKS – zeziphi iimali ezikhoyo kwi-Moscow Exchange?

- Iimali ze-ETF: zisebenza njani

- Umlinganiselo wezona ngxowa-mali ze-ETF zingcono kumtyali-mali waseRashiya ukususela ngo-2022

- I-Sberbank S&P 500 Index SBSP

- VTB Moscow Exchange Index VTBX

- IFXIT

- FinEx FXUS

- VTB – Liquidity

- FXRU

- Schwab US Small Cap ETF

- FinEx: US REIT UCITS ETF USD

- FXDE

- FinEx Russian RTS Equity UCITS ETF

- FinEx FXRW ETF Currency Hedge Global Stocks

- SPDR S&P 500 ETF

- FXRL

- Vanguard FTSE Developed Markets ETF

- iShares MSCI USMV

- JPMorgan US Momentum Factor ETF

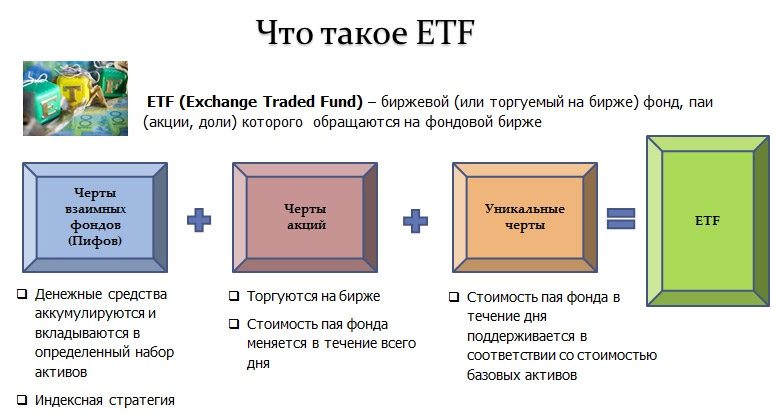

Imali ye-ETF: yintoni

Ii-ETF zibizwa ngokuba yi-exchange traded funds, apho izibambiso ziqokelelwa ngokusekelwe kuzo naziphi na i-indices/amacandelo/impahla. Utyalo-mali kwii-ETF yeyona ndlela ilula yokufikelela kwimarike yemasheya yamazwe ngamazwe. Akukho lwazi lukhethekileyo olufunekayo kutyalomali kule mali.

Ngokuthenga izabelo kwi-ETF, abatyali-mali banokutyala kuzo zonke izibambiso ezibandakanyiweyo kwisalathiso kanye. Ngaloo ndlela,

ukuhlukahluka kuyenyuka kwaye ingozi iyancitshiswa.

Ukuba ingxowa-mali ivaliwe okanye ii-asethi zithengisiwe, umtyali-mali uya kufumana inxalenye elinganayo yexabiso labo ngexesha lokuthengiswa kwengxowa-mali.

Imbali yokwenzeka

Ii-ETF zaqala ukuvela kwimarike ngo-1989. E-US, bafumaneka kuphela kwi-1993, ngelixa kumazwe aseYurophu kwakunokwenzeka ukuthenga izabelo kwiimali ezinjalo kuphela kwi-1999. Kwiinyanga zokugqibela ze-2015, ii-ETF zigqithise ngaphezu kwe-1,800 yeemveliso ezahlukeneyo kumacandelo ahlukeneyo emarike / i-niches / izicwangciso zokuthengisa. Ngombulelo kwesi sikali, abaphathi beemali zotyalo-mali bakwazi ukugcina imali, kuba iindleko zokusebenza zancitshiswa ngenzuzo. NgoDisemba ka-2019, ii-asethi zase-US eziphantsi kolawulo zifikelele kwi-4.4 yeebhiliyoni zeedola. Ukuza kuthi ga namhlanje, ii-ETF zihlala zithandwa.

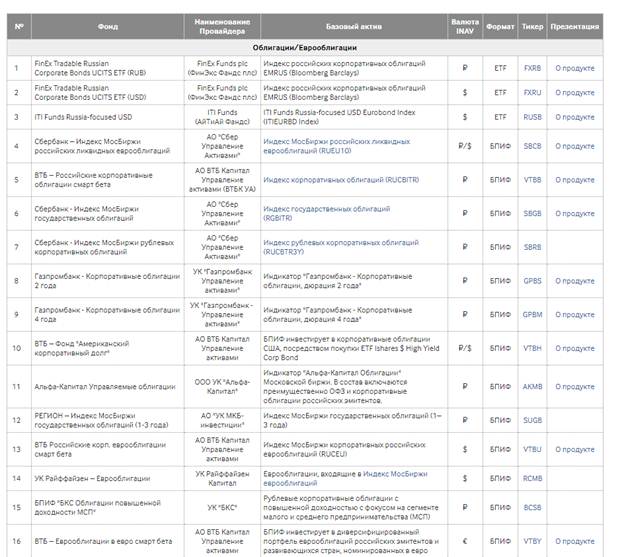

Imali ye-ETF: imeko yemarike yaseRashiya

Kwiminyaka engama-20 edlulileyo, imarike yotyalo-mali edibeneyo kwi-Russian Federation itshintshe ngokukhawuleza. Ukuba ngo-1999 kuphela iimali zotyalo-mali eziye zavunyelwa ukufikelela kuyo, ngoko ekupheleni kuka-2001 kwabakho ulwahlulo lwaba luhlobo lwengxowa-mali oluhlangeneyo kunye noludibeneyo. Ekuqaleni, kuphela

iimali ezihlangeneyo (iimali ezihlangeneyo) zathatha iingcambu kwimarike, kwaye kwiminyaka eyi-7 kuphela edlulileyo iimali ze-ETF zaqala ukufumana ukuthandwa ngokubanzi. https://articles.opexflow.com/investments/fondy-etf.htm

Kutheni kukho ii-ETF ezimbalwa kwi-MOEKS – zeziphi iimali ezikhoyo kwi-Moscow Exchange?

Kukho ii-ETF ezimbalwa kwi-MOEX. Iingcali zikholelwa ukuba oku kungenxa yokungalungi okuthile. Ngotyalo-mali kwingxowa-mali ethengisiweyo, umtyalo-mali akakwazi ukugqwesa imarike, kuba utyalo-mali lwesalathiso lwenzelwe ukubuyisela umndilili.

Uluhlu olupheleleyo luyafumaneka ku- https://www.moex.com/msn/etf

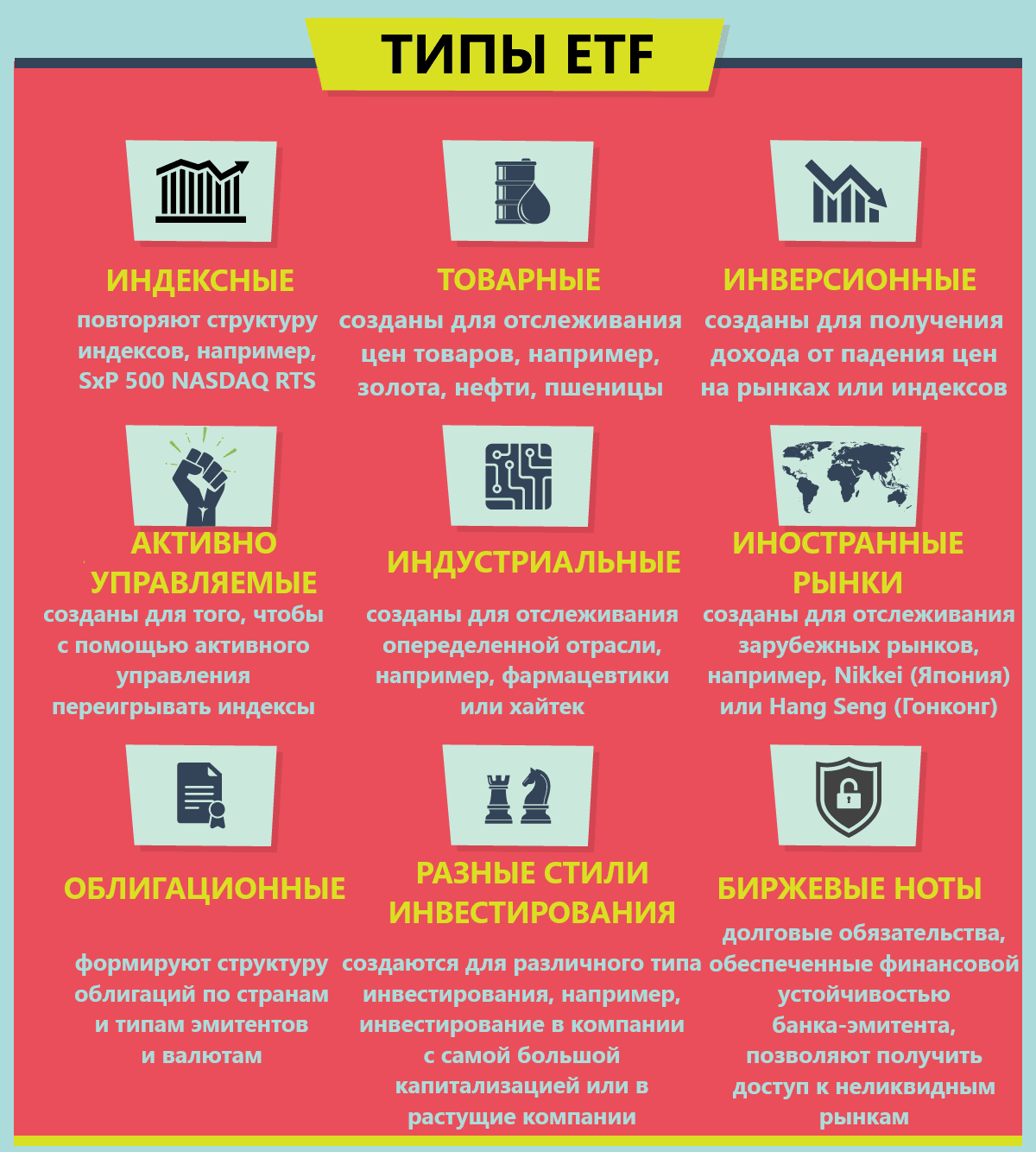

Ipesenti ephambili yee-ETF imelwe ziipotfoliyo eziphinda ubume bezalathisi zesitokhwe ezahlukeneyo (ezikhokelayo/zecandelo). Nangona kunjalo, unokufumana ezinye iimali ezisekwe kulwakhiwo oluntsonkothileyo lwezinto eziphuma kuzo. Iimali ezinjalo azifumaneki kubatyali-mali babucala. Ukurhweba nge-ETF enjalo kubandakanya ingozi enkulu. Ngelo xesha, inzuzo kwimeko xa umtyalo-mali ekwazi ukungahambi kakuhle ngexabiso liya kuba ngamaxesha amaninzi aphezulu.

Iimali ze-ETF: zisebenza njani

Ngokwesicwangciso esichaziweyo, ingxowa-mali ifumana inani elikhulu lee-asethi kwipotfoliyo yayo. Emva koko, i-ETF iqala ukukhupha izabelo zayo. Ungathenga kwaye uzithengise kwi-stock exchange. Kwingxowa-mali enye kunokubakho ngaphezu kwe-100 yesitokhwe kwiinkalo ezahlukeneyo zomsebenzi / iindawo. Izabelo zeenkampani kwingxowa-mali nganye ziboniswa kwisixa esibalwa ngayo isalathiso. Isalathiso sisetyenziselwa iinjongo zokuhlalutya ukuze sikwazi ukuvavanya ukuba ngawaphi amacandelo oqoqosho/iinkampani ezikhula ngexabiso. Yiyo loo nto ukukhula kwexabiso lesabelo kungadityaniswanga nokukhula kwesalathiso.

Umlinganiselo wezona ngxowa-mali ze-ETF zingcono kumtyali-mali waseRashiya ukususela ngo-2022

Iimali ze-ETF sele zifumene ukuthandwa kwimarike yotyalo-mali, ngenxa yokuba abantu banokutshala imali kwiibambiso kunye neendleko ezincinci ukwenzela ukuba benze inzuzo kwixesha elide.

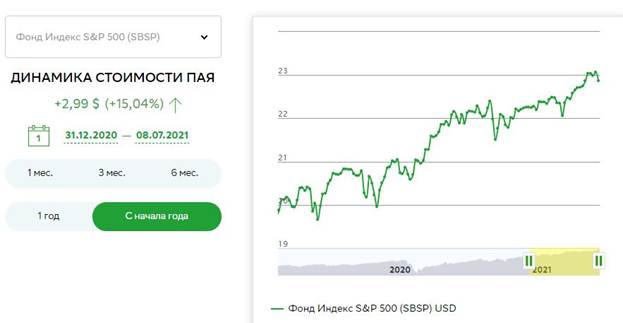

I-Sberbank S&P 500 Index SBSP

I-S & P 500 Index yi-stock index equka i-500 yeenkampani ezinkulu zase-US kwibhaskiti. Inxalenye yenzuzo efunyenwe ngumnini-sabelo iphinda ityalwe njengoko ifumaneka. Ubume bepotfoliyo yotyalo-mali yengxowa-mali iphononongwa xa umboneleli etshintsha ukubunjwa kwesalathiso kunye neeparitha zayo zokubala, okanye ukuba kuyimfuneko. Abatyalomali banokuthenga izabelo kwiidola / iiruble. Iindleko zesabelo esinye siqala ukusuka kwi-ruble ye-1,000. Kufuneka kukhunjulwe ukuba ukuthengwa kwe-ETF ye-ruble kuthathwa njengenzuzo kakhulu. Ubuninzi bekhomishini yonyaka ayidluli kwi-1.04%. Umtyali-mali kufuneka ahlawule umrhumo:

- ulawulo – 0.8%;

- indawo yokugcina – 0.15%;

- ezinye iindleko – 0.05%.

Phawula! Izinto ezi-2 zokugqibela zeendleko azibandakanyi i-VAT, ngoko ke ixabiso lilonke yi-1.04%.

Kwiimeko apho umtyalo-mali enezabelo ngaphezu kweminyaka eyi-3, ukhululiwe kwiirhafu (nge-3 yezigidi ngonyaka ngamnye).

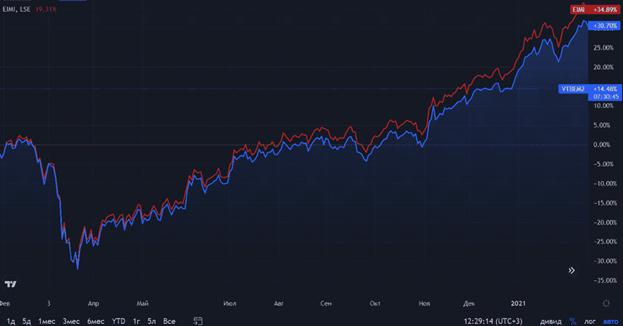

VTB Moscow Exchange Index VTBX

I-VTB “I-Index yaseMoscow Exchange” i-VTBX yingxowa-mali yotyalo-mali ethengiswayo ethengisa kwi-Moscow Exchange (eMoscow Exchange) kwaye ityale izabelo zeenkampani ezivela kwi-Index Exchange yaseMoscow. I-VTB yaseMoscow Exchange Index VTBX ityala imali kwizabelo eziqhelekileyo / ezikhethwayo, kunye

neerisithi zediphozithi zezabelo ezibandakanyiweyo kwi-Moscow Exchange Index. Izahlulo ezifunyenweyo ziphinda zityalwe. Iiyunithi zengxowa-mali yokuthenga zivumela abatyali-mali ukuba batyale imali kwipotifoliyo yesitokhwe esahlukileyo ngexabiso eliphantsi. Iindleko ezipheleleyo kunye nekhomishini ye-VTB Moscow Exchange Index VTBX ayidluli i-0.69% ngonyaka. Xa usenza ukuthenga ngesicelo, awudingi ukuhlawula ikhomishini ye-brokerage.

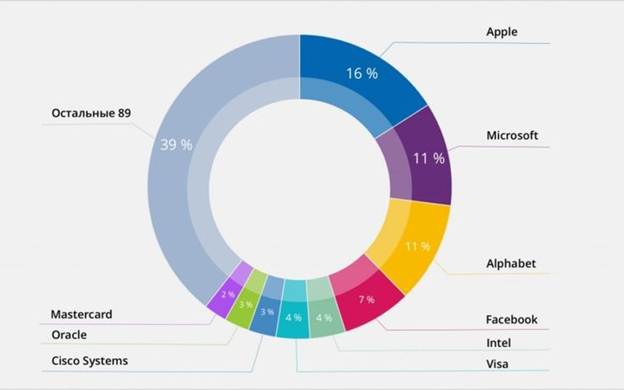

IFXIT

I-FXIT ithathwa njengenye yeemali ezibiza kakhulu, ezibandakanya izabelo zeefemu ezinkulu ze-IT. Abatyalo-mali banokuthatha inxaxheba esebenzayo ekukhuleni kwezabelo zeenkampani ezithandwa kakhulu kwi-high-tech: i-Apple / Microsoft / Intel / Visa / IBM / Cisco / Oracle, njl. kunciphisa iingozi. Imirhumo yolawulo lweNgxowa-mali iphantsi.

Phawula! Utyalo-mali kwizitokhwe luhlala “luhexa”. Umyinge wenqanaba lonyaka lomvuzo kwixesha elide uya kwenziwa ngamahlandinyuka.

Izahlulo ezifunyenweyo ziphinda zityalwe. Ukuba abasebenzisi bathengisa izabelo zengxowa-mali usebenzisa iinkonzo ze

-broker yaseRashiya , umtyalo-mali ngamnye uya kuba phantsi kwerhafu yengeniso yomntu (i-13% yohluko phakathi kwexabiso lokuthenga kunye nexabiso lokuthengisa). Kude kuthengiswe izabelo, irhafu ayiyi kubanjwa. Ukuba ufuna ukuphepha ukuhlawula irhafu ngexesha lokuthengisa, unokuthenga izabelo zeFXIT kwi-IIA

( i- akhawunti yotyalo-mali lomntu ngamnye). Kule meko, kutsalwa irhafu.

FinEx FXUS

I-FinEx FXUS yenye yee-ETF ezilungileyo kakhulu phaya. Ipotfoliyo ibandakanya ngaphezu kwe-85% yeenkampani zase-US: i-Amazon/Apple/Coca-Cola/Facebook/Johnson&Johnson/Microsoft/VISA. ISolactive AG sisalathiso esisisiseko sale ngxowa-mali. Abatyali-mali banokuthengisa isabelo nangaliphi na ixesha kwaye barhoxise imali etyaliwe kunye nengeniso. Umda wokungena uphantsi. Kukho ikhefu lerhafu:

- Ukutsalwa kwe-IIS;

- inzuzo yexesha elide.

Phawula! Emva kokugqitywa kwentengiselwano, imali iya kutsalwa kwi-akhawunti, kwaye isabelo siya kufakwa kumtyalo-mali omtsha.

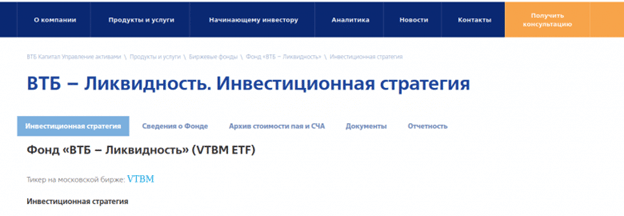

VTB – Liquidity

I-VTB – I-Liquidity – ingxowa-mali ejoliswe ekubekweni kweemali zexesha elifutshane kunye nolawulo lwe-liquidity. Abatyali-mali banokubeka imali ixesha elidlula iiyure ezingama-24. Ukongezeleka kwengeniso yonke imihla. I-VTB ijongene nemingcipheko engaphantsi – Ubukho bemali buncinci. Ii-asethi zengxowa-mali zibekwe kwizixhobo zentengiso yemali. Umrhumo wonyaka wolawulo awugqithi kwi-0.49%. Umtyali-mali uyahlawula:

- Umvuzo wenkampani yolawulo – 0.21%;

- indawo yokugcina – 0.18%;

- ezinye iindleko – 0.1%.

- I-intraday liquidity (ubukho bethuba lokuthenga / ukuthengisa ingxowa-mali ngokusasazwa okuncinci);

- ingeniso enokubakho xa ithelekiswa nexesha elibekiweyo lamaziko amakhulu ebhanki;

- Umngcipheko omncinci osezantsi.

Inika umdla ukwazi! Umyinge wembuyekezo yenyanga yengxowa-mali yi +0.28%.

FXRU

I-FinEx Tradable Russian Corporate Bonds UCITS ETF (FXRU) ithathwa njengengxowa-mali efunwayo egxile kwi-Russian Corporate Eurobond Index EMRUS (Bloomberg Barclays). Utyalo-mali lukhuselwe ngokuthembekileyo ekuthotyweni kwe-ruble. Intlawulo yezahlulo ayibonelelwanga. Abatyali-mali banokwenza ingeniso efunyenweyo. Utyalo-mali ngokutsha lwengeniso kunceda ekwandiseni imbuyekezo kutyalo-mali. Ingxowa-mali ye-ETF ithengiswa kwi-Moscow Exchange kwi-ruble. Kuyimfuneko ukunyamekela kwangaphambili ukuvula i-akhawunti ye-brokerage ebonelela ngokufikelela kwi-Moscow Exchange. Nje ukuba i-akhawunti ivuliwe, fumana i-ETF ngeticker kwi-app yefowuni ye-broker/i-PC terminal. Emva koko, unokuzibandakanya kwiintengiso kunye nokuthenga. Izinto eziluncedo zeFXRU ET ziquka:

- inqanaba lekhomishini eyamkelekileyo, eyi-0.5%;

- ukufumaneka kofikelelo olulula kunye nomyinge omncinci wokungena;

- igama elihle loshishino;

- ukhetho lwerhafu oluya kubonelelwa xa kusetyenziswa i-AI kutyalo-mali;

- isikimu sentsebenziswano elubala;

- indibaniselwano yokhuseleko lotyalo-mali kunye nokuhlawula amatyala.

Phawula! Ii-ETF ze-Eurobond zinokuthengwa kakhulu ngabatyali-mali ngenxa yokungena kumda ophantsi.

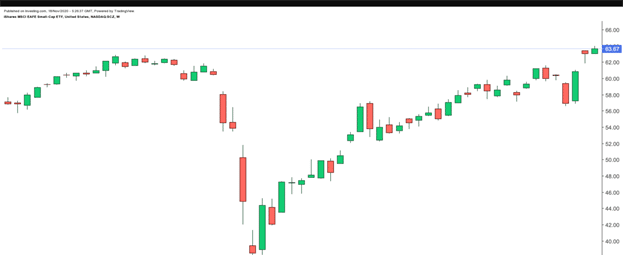

Schwab US Small Cap ETF

I-Schwab US Small-Cap ETF ithathwa njengendlela elula, esebenzayo, kunye neyohlukileyo kakhulu yokutyala imali kwi-stock-cap encinci. Ipotfoliyo yengxowa-mali ibandakanya ngaphezulu kwe-1,700 yezabelo zeenkampani ezincinci/eziphakathi. Ungalibali ukuba izabelo zengxowa-mali zibotshelelwe kuqoqosho lwasekhaya lwase-US. ISchwab US Small-Cap ETF ayibizi, nto leyo ithathwa njengenzuzo ebalulekileyo. Ingeniso ye-dividend yi-1.2%, kwaye ixabiso leendleko alidluli i-0.04%.

FinEx: US REIT UCITS ETF USD

I-FinEx US REIT UCITS ETF USD yingxowa-mali ethandwayo ebonelela ngenqanaba eliphezulu leyantlukwano (utyalo-mali aluyi kuxhomekeka kwimeko yemicimbi yecandelo ngalinye lezoqoqosho) kunye nokungabi namali. Abatyalomali banethuba lokuthenga ngokukhawuleza / ukuthengisa iimpahla, ngelixa begcina kwiirhafu. Umrhumo wokulondolozwa kwengxowa-mali yi-0.6%. Amandla eFinEx: US REIT UCITS ETF USD iquka:

- amandla okuhlawula amatyala aphezulu;

- ukusebenza kakuhle kwerhafu;

- ukwahlukana okuphezulu;

- akukho ndleko zolawulo.

Phawula! Ingeniso iphinde yatyalwa kwiFinEx US REIT UCITS ETF USD. Ndiyabulela kule nto, umtyalo-mali ulahla imfuneko yokufaka irhafu yerhafu ngokwakhe.

FXDE

I-FXDE ETF yingxowa-mali evumela abatyali-mali ukuba batyale imali kwi-stocks yaseJamani kunye noqoqosho oluphambili lwaseYurophu. Ipotifoliyo ibandakanya izabelo zezona nkampani zinkulu: Siemens/SAP/Bayer/Daimler/Allianz/Adidas/Volkswagen/BMW nezinye.Isalathisi sigubungela i-85% yentengiso enkulu yaseYurophu. Eyona mali iphambili yeFXDE yiyuro. Xa kwenzeka ukuhla kwe-ruble, umtyalo-mali uya kuzuza ngokuzenzekelayo kumahluko kwiirhafu. Iinkampani ezikhethiweyo zeempahla zabathengi zibamba esona sabelo sikhulu seFXDE. Ishishini lamafutha alikho kwaphela.

Phawula! Izahlulo ezifunyenwe kwizabelo zeenkampani ziphinda zityalwe.

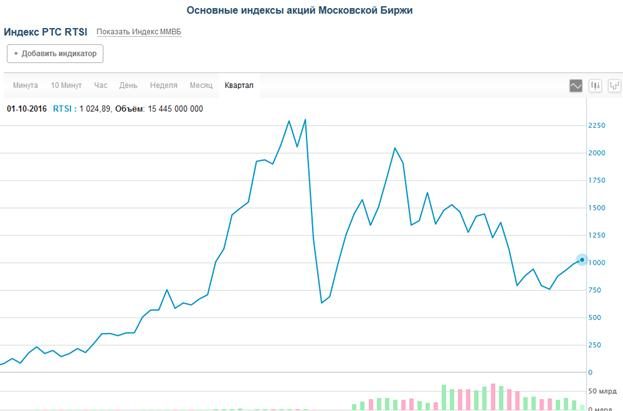

FinEx Russian RTS Equity UCITS ETF

I-FinEx Russian RTS Equity UCITS ETF ithathwa njengeyona portfolio yotyalo-mali yokuthanda ilizwe, equlathe ubukhulu becala isitokhwe saseRashiya. Abatyali-mali banokutyala imali kwizabelo zeenkampani ezinkulu ezifana ne: Gazprom/Lukoil/Sberbank/VTB/Surgutneftegaz/NOVATEK/Magnit/Rosneft, njl njl. I-FinEx Russian RTS Equity UCITS ETF ithathwa njengeneenzuzo ezibalulekileyo: ikhomishini ephantsi, isivuno esiphezulu kunye umda wokungena ophantsi. I-RTS Equity UCITS ityala imali kwizabelo ezivela kwi-RTS index, iphinda ibunjwe kunye nokwakheka kwayo. Nangona kunjalo, kuyafaneleka ukukhumbula ukuba iikowuti zibalwa ngeedola, kungekhona kwiiruble. Izahlulo ezifunyenwe kwizabelo ziphinda zityalwe.

FinEx FXRW ETF Currency Hedge Global Stocks

I-FXRW ETF ithathwa ngokuba yimali efunwayo emva kokuba ihedge fund kwimarike yokhuseleko lwehlabathi. Iphothifoliyo ye-FXRW ETF iquka i-US / iJamani / iJapan / i-Chinese / i-Australia / i-Russian stocks. Ngenxa yomahluko kwiireyithi ze-ruble / zeedola, iipesenti ezimbalwa zongezwa kwisivuno. Ngokuthengwa kwesabelo se-ETF esi-1, umtyali-mali ufumana ukuhlukahluka kwehlabathi. I-ETF ithengiswa eRashiya ngeqhekeza elikhulu lesabelo, ngokuqinisekileyo inzuzo. Ixabiso lesabelo liqala kwi-$0.02. Kwi-FXRW, ii-ETF zijongwa njengamacandelo amakhulu ngohlobo: Ishishini / i-IT / yezeMali / i-FMCG / Ukhathalelo lweMpilo / iMpahla / IiMpahla eziZinzileyo. Iphothifoliyo yeFXRW ETF ibandakanya izabelo ze-APPLE/MICROSOFT/ALIBABA/TENCENT/Facebook/Amazon/Toyota kunye nabanye. Iphepha elinye leFXRW linokuthengwa nge-ruble enye kuphela,

SPDR S&P 500 ETF

ISPDR S&P 500 ETF yingxowa-mali eyasekwa ngo-1993. Kukunye naye apho abaphathi beepotfoliyo bahlala bethelekisa iziphumo zabo, kuba iSPDR S&P 500 ETF luhlobo lwebenchmark. Kwiimeko apho ukusebenza kungaphezulu kwesalathiso, umntu unokuqiniseka ukuba umsebenzi ebudeni bonyaka wenziwe kakuhle. Ukuba iphantsi, ngoko umtyalo-mali unento yokucinga ngayo. I-capitalization yemarike yale ngxowa-mali yi-284 yeebhiliyoni zeedola. Izinga lembuyekezo kule minyaka mihlanu idlulileyo lingaphezulu kwama-70%. Umrhumo wonyaka wolawulo yi-0.09%.

FXRL

Ukusetyenziswa kokuphindaphindwa komzimba okulungiselelweyo yinto ebalulekileyo yeFXRL. Kwinani lezikhundla ezivela kwi-RTS, akukho nikezelo / imfuno eyaneleyo. Yintoni eyenziwa yiFXRL kunye nabo ekutshintshisweni kuchaphazela ixabiso labo lemarike. Yingakho ukubunjwa kulungiselelwe ngokucwangcisiweyo: izabelo zabakhupheli abakhulu zonyuswa, ngelixa zisusa izibambiso eziphantsi kwamanzi. Iphothifoliyo yeFXRL iquka izabelo zeenkampani ezinkulu: Sberbank/Gazprom/Lukoil/Yandex/Rosneft/NOVATEK/Polus/Magnit. Ikhomishini yengxowa-mali – 0.9%. Ingxowa-mali ayihlawuli zabelo, kodwa iphinda ityale imali, nto leyo enegalelo ekunyukeni kwexabiso lezabelo.

Vanguard FTSE Developed Markets ETF

IVanguard FTSE Developed Markets ETF yingxowa-mali eneengcambu zaseYurophu. Ipotfoliyo ibandakanya ngaphezu kwezabelo ze-1000 zeenkampani ezinkulu eYurophu, e-Australia, eMelika naseJapan. Umlinganiselo weendleko eziphantsi kakhulu zengxowa-mali yinzuzo enkulu yeendleko kuninzi lwabakhuphisana nabo. Iindleko zolawulo lweendleko yi-0.05%. Isivuno kwiminyaka yakutshanje siye saba kuluhlu lwe-16.5-16.6%.

iShares MSCI USMV

I-USMV inikezela ngeepotfoliyo ze-US stocks kunye nokuguquguquka okuncinci. Isalathiso sengxowa-mali sisebenzisa i-algorithm yokuphucula ukudala iphothifoliyo enokuhluka okuncinci okuthathela ingqalelo ukulungelelaniswa phakathi kwamasheya, kunokuba iqulethe ibhasikidi yempahla ephantsi yokuthengisa. Ukwenza ipotifoliyo yotyalo-mali, eyona ndlela iphambili ye-S&P isetyenziswa. Ipotfoliyo ibandakanya izabelo zeenkampani ezinokuguquguquka okungephi (umzekelo, iPepsiCo/ Merck & Co). Le ndlela ibonelela ngokuncipha kokukhula / ukuhla okubukhali kwiikowuteshini. Ndiyabulela kule nto, umtyalo-mali ufumana i-asethi ethembekileyo kunye nenzuzo ekuphumeni.

JPMorgan US Momentum Factor ETF

I-JPMorgan US Momentum Factor ETF (NYSE: JMOM) ivumela abatyali-mali ukuba batyale imali kwi-stocks yase-US ephezulu. Isiseko sasekwa ngo-2017. Ukuza kuthi ga ngoku, iJPMorgan US ilawula ii-asethi ze-273 ezixabisa i-135 yezigidi zeedola. Ingeniso yesabelo yi-1.15% kwaye ixabiso lotyalo-mali yi-0.12%. Ubuninzi benkunzi butyalwe kwicandelo lobuchwepheshe (malunga ne-30%). Icandelo lezempilo (13.3%) kunye neshishini (11.7%) nazo zityalwe kakuhle. Ipotifoliyo yotyalo-mali ibandakanya izabelo zeenkampani ezinkulu ezifana neAmazon/Microsoft/Visa/NVIDIA/Apple. Abakhuphi bagxile ekwandiseni ingeniso, kwixesha elide / ukwandisa inzuzo kunye nembuyekezo kutyalo-mali.

Phawula! Kwiminyaka yakutshanje, i-JPMorgan US Momentum Factor ETF (NYSE: JMOM) ifumene malunga ne-12.5-13% ukubetha ixesha elide.

Indlela yokukhetha ii-ETF kwi-Moscow Exchange ngo-2022 – indlela yokutyala imali, utyalo-mali kwaye ungalahleki: https://youtu.be/OgbogdWLsh8 Ukufumana ii-ETF zepotfoliyo yakho kuthathwa njengengcamango yotyalo-mali ehlakaniphile. Iimali ezinjalo zizixhobo ezilungeleleneyo ezenziweyo. Nangona kunjalo, kwinkqubo yokukhetha ye-ETF, kubalulekile ukuba ungenzi mpazamo. Ngokunika ukhetho kwiimali ezidweliswe ngasentla, umtyalo-mali unokuqiniseka ukuba idiphozithi yemali ayiyi kulahleka kuphela, kodwa iya kukuvumela ukuba ufumane ingeniso eyongezelelweyo elungileyo.