Forms and types of investments: classification, choice of instrument, real direct investment, financial portfolio, speculative, choice of investment instrument. In frequent periods of crisis, ordinary people are faced with a shortage and depreciation of money, the loss of a few sources of income, and the rapid washing out of savings, if any. And people who consciously form their income from several sources are faced with the zeroing of some of them. Professionals always, and especially during a crisis, continuously and flexibly monitor the market, predict and choose effective ways of investing and accumulating income based on a broad analysis.

- Essence and mechanisms, investment prerequisites

- Classifications of types of investment

- Forms of investment

- Common types and forms of investments

- Bank deposits

- Stock

- Bonds

- Real estate

- Mutual funds

- Exchange-traded funds

- Cryptocurrencies

- Gold

- Compound interest

- cash currency

- Timing of investment

- Long term investment

- Medium term investments

- Short term investments

Essence and mechanisms, investment prerequisites

Investments are considered to be investments of cash, securities, property, property and other rights in entrepreneurial and business objects to receive income or dividends. Investment objectives are:

- Creation of a second salary or pension, additional and basic income for life, family and travel.

- Secure income and savings from inflation and financial risks.

- Proper money management to create capital and move into a state of financial freedom.

The level of today’s income of the population is reflected in the photo:

- Shares and bonds of reliable companies. Stock market.

- Real estate.

- Precious metals. First of all, gold.

- Cryptocurrencies.

- Business investment.

- Invest in your education: to gain skills and abilities that generate income.

- Exchange and stock trading.

Investments are investments and assets that will help protect funds and receive additional income. Then the crisis becomes a resource and an opportunity to help generate income and dividends. A means to multiply your assets, not a problem. It is important not only how and where to invest correctly, but also how to effectively manage your capital.

Investment capital is material, intellectual and financial means. In the classical sense, capital is all material values, including the means of production. In the investment understanding, the means of producing goods are investment instruments.

For effective capital management, the issue of financial literacy is acute. Knowing about the profitability of investments, without understanding them competently, many get into fraudulent schemes and pyramid schemes, where the key word is always “investment”. During the year, the Russians “gave” 13.5 billion rubles to financial scammers. The current situation with currencies plays in favor of literacy and analysis of financial situations. The decades-old strategy of “sitting on dollars and euros” has ceased to work, these investments have depreciated several times in two months. Unlike President Biden, who predicted the price of a dollar for two hundred rubles, US investment billionaire Ray Dalio calls cash trash and does not recommend keeping savings in cash, especially in times of crisis. https://articles.opexflow.com/trading-training/ray-dalio.

Classifications of types of investment

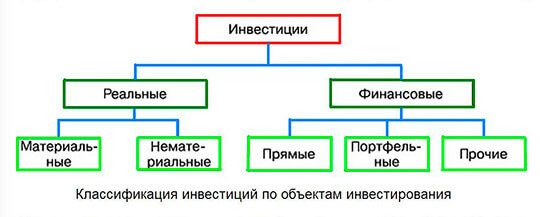

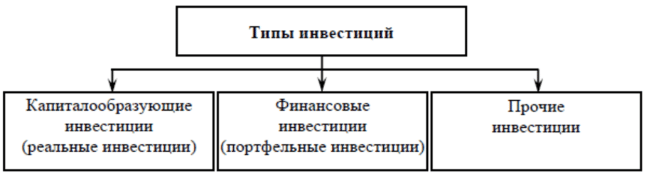

There are several theoretical classifications of investment types. By category of investment objects are:

- Real long-term direct investments of tangible and intangible assets in the form of fixed and working capital, as well as intellectual property. This is how the fixed assets of enterprises are created. They are aimed at expanding, improving and updating production with deferred profits.

- Financial portfolio investments lead to direct receipt of income. These are investments in the form of futures and securities, in the form of stocks, bonds and debt obligations. Also investments in business, financial projects and leasing. The income from such investment objects is made up of regular dividends and price increases in the event of their sale.

- Speculative – investments in currencies and types of precious metals.

- Direct participation of the investor in the selection of the object, contribution to its authorized capital, and participation in the management of the investment object.

- Indirect participation in investments through intermediaries – investment funds, brokers, financial consultants.

Important is the classification of investments according to the terms of investment of assets:

- Long-term investments lasting more than five years.

- Medium-term deposits from one to five years.

- Short-term investments for a period of less than a year.

Another important indicator of investments is the level of their income:

- Investments are considered highly profitable, the income from which exceeds the average return on the investment market.

- Average returns are investments that are comparable to the average return on investments in the market.

- Low -yielding investments are investments that bring income below the market.

- Non -profit investments without planned profit include social, environmental and charitable programs.

An important definition of an investment for an investor is to classify it according to how much investment risk it has:

- Risk -free investment with a 100% guaranteed income. These include deposits in state banks and government bonds.

- Low-risk investments are those whose risk of loss is lower than the market average .

- Medium-risk investments are those that are comparable in risk to others on the market.

- High-risk investments are those whose degree of risk is a multiple of the average market risk. These include investments in speculative projects with the highest possible income.

An equally important characteristic of an investment is its liquidity:

- A highly liquid investment has instruments that can be easily and quickly converted into cash without loss in market price.

- Medium liquid investment refers to objects that can be converted from 30 days to six months, without a significant loss in price.

- A low-liquidity investment may be converted into cash in less than six months. Usually these are little-known or unfinished objects.

- An illiquid investment is one that is not convertible on its own, but only as part of a common object.

According to the method of using the invested assets, an investment can be:

- The primary investment is a new investment of assets.

- Reinvestment is the repeated investment of assets received from the income of the original investment. With competent reinvestment, investors achieve a multiple increase in income in a short time.

- Disinvestment is the extraction of previously placed investments, without reusing them.

According to the form of ownership, investments are private from companies and individuals, and state, as well as mixed of these two forms. The same forms may be foreign, and investments by several states are called joint. There is a separate type of investment – an annuity, the income from which is planned for uniform time intervals. Examples are insurance and pension funds. Most of these classifications are used for terminology and characteristics when considering investment portfolios – a set of investor instruments and types of investments that cover different economic spheres or business sectors.

Forms of investment

Existing forms are different expressions of types of investment. For example, they reflect the interests and motives of investments:

- Mercantile forms are considered to be deposits for maximum profit, without social and other aspects.

- Social investments are non -commercial.

- Associated investments pursue the strategic goals of investors.

The material forms of investment capital are also classified:

- Monetary expression of the form in bank deposits and securities.

- Material forms include types of immovable and movable assets.

- Forms of property and intellectual rights :

- Intellectual rights of authorship, know-how, patent rights.

- The right to use natural resources – water, land, gas and oil, minerals.

- Financial rights form .

There are forms of public investment:

- Providing preferential loans and tax incentives.

- Direct government budget investments.

- Forms of investment from state-owned companies.

- The form of state or stock investments are annuity and rent.

As a result, the forms of investments detail the types of investments in specific manifestations.

Common types and forms of investments

There are many types of investments, and in each type it is necessary to choose reliable investment objects. It is necessary to invest, having the skills of investing, professional consultants, and to navigate in current situations. At the same time, it is important to diversify deposits in different portfolios, because the effectiveness of different investments changes over time.

Examples of the most profitable investments in different years:

- 2001 – high profitability of real estate deposits.

- 2014 – gold and US stock returns.

- 2020 – high returns in Bitcoin and in new buildings.

Bank deposits

Such investments in Russian banks are risk-free, with a state guarantee of the deposit. But the deposit rate does not always cover inflation. This is a reliable way to save money. The most effective term deposits.

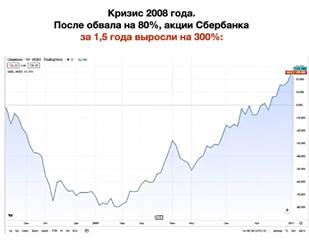

Stock

Now it is one of the most consistently profitable types of investments, but with a high level of expertise. You should choose stocks of reliable companies with growth prospects of up to 30% per year or more. OZON has 100% growth in two years. Polyus Gold shares, Yandex shares, Apple shares have large gains. And for foreign shares, brokerage accounts on the stock exchanges were temporarily frozen. It must be remembered that a crisis is a time of opportunity, and investments are a tool for saving and increasing money. Here is an example of the growth of shares of Sberbank in the crisis of 2008:

Bonds

Bonds from reliable large issuers have higher payouts, but come with risk. Safer than government bonds. They are risk-free, but with low income. Under bonds, the investor becomes a borrower of a company or state for a certain period and for a certain program. These are long-term investments, at the end of the term the invested amount and interest on the deposit are returned. This is a reliable contribution, but at the level of covering inflation.

Real estate

It is believed that it is necessary to invest here during periods of sustainable economic development, because real estate falls in liquidity during crises. This was the case in 2008. But in 2001 and 2020, there was a steady growth in deposit income in Russia.

Mutual funds

Mutual funds collect pools of participants in passive investments in various securities, it is important to make the right choice and control investments, taking into account market trends. Dividends are received as a percentage of the share of the share. https://articles.opexflow.com/investments/birzhevye-paevye-investicionnye-fondy.htm

Exchange-traded funds

These ETFs are suitable for beginners and offer investment portfolios that take into account market indices. These are short-term, high-risk investments with the potential for high returns when prices move throughout the day. You can reduce the risk by choosing wide indexes.

Cryptocurrencies

These short-term investments carry high risks with high returns. Investing money in crypto dollars brings a deposit income of 15%. It is worth remembering that in recent years, Bitcoin has grown by 200% per year. In some countries, there are terminals for converting cryptocurrencies into cash. In crypto trading, investors can earn up to 10% per day.

Gold

You can buy bullion, or you can buy ETF gold. The rise in the value of gold varies from year to year, but it is one of the most stable investments in the history of safe savings. Gold almost always does not provide high returns, but is a guaranteed insurance.

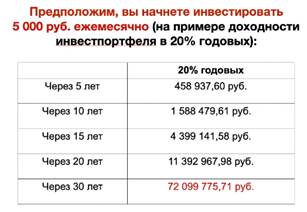

Compound interest

They are often called the secret to getting rich quick. Compound interest is the return on investment on the return on the original investment. Banks have the term “capitalization” for this. In another way, this is called effective and composite interest, or interest on interest, as well as the rate of return, taking into account reinvestment and taking into account capitalization. It is important that compound interest is calculated at certain times not from the primary amount, but from savings for a certain period. It turns out that the generated income is added to the original amount, and also generates additional income. An example is shown in the photo:

cash currency

For a long time, this was a way to both store savings and profitability. Now this method has acquired a high risk of loss. But there remains a game with exchange rates on the stock exchanges, and also with high risk. Ray Dalio said:

Timing of investment

For different periods of investment, there are different investment volumes, and different levels of profitability:

| No. | Evaluation criterion | Long term investment | Medium term investment | Short term investment |

| one | Payback | From 1 year to 5 years or more | Up to a year | Days and months |

| 2 | Yield level | Average | Average | High |

| 3 | Risk | Minimum | Average | High |

| four | Entry threshold | Need big capital | Average | Small |

| 5 | pros | Reliability and stability | Relative reliability and stability | High and fast income |

| 6 | Minuses | Long term and entry threshold, average income | Slow payback | Big risks |

Long term investment

Such investments are designed for long periods, with investment programs up to 25 years. These include:

- Working with stocks and bonds of reliable liquid companies. Opening a brokerage account.

- Investments in production.

- Housing construction, acquisition of real estate for resale and rental.

- Acquisition of machinery and equipment.

- Gold for safekeeping.

- Jewelry, coins.

- Investment own education.

Medium term investments

An example of such deposits is bank deposits, deposits in gold, exchange-traded funds and mutual funds.

Short term investments

These include investments in MFIs, mutual funds, exchange packages, cryptocurrency and foreign exchange transactions. There are many ways and forms of investment, and each works effectively under certain conditions. For their proper use, it is necessary to improve investment education, practice investment portfolio diversification with different investment terms and returns, and practice active investment management. At the same time, to outline a long-term investment planning horizon of up to 10-25 years.